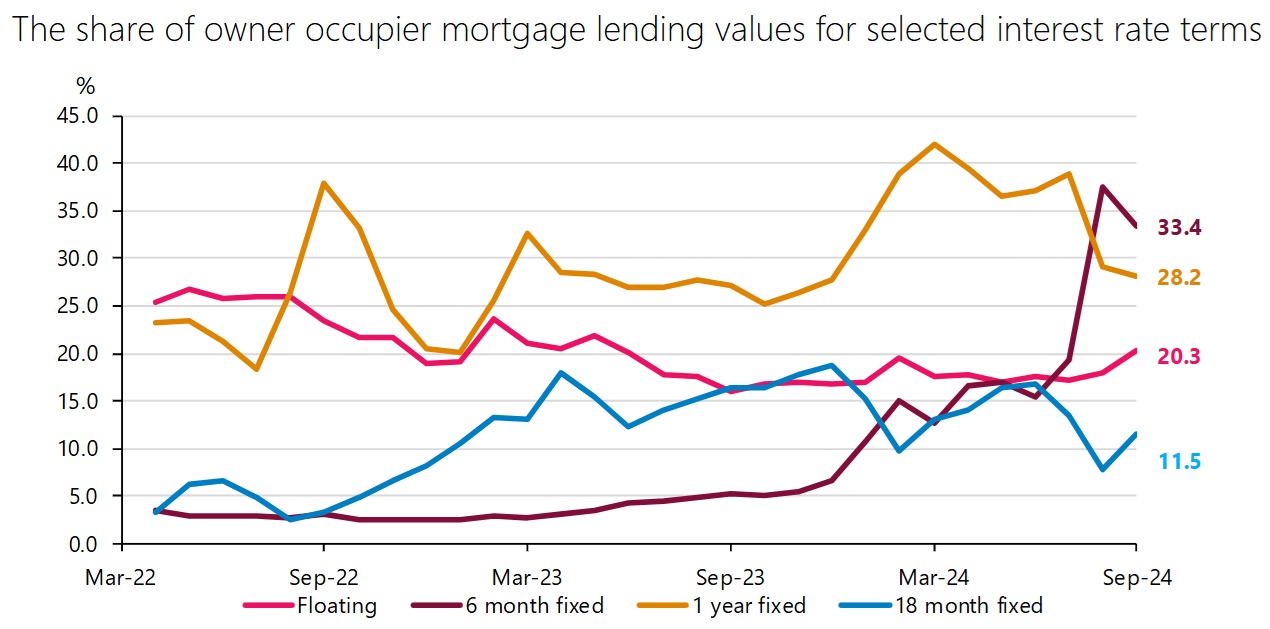

Short is still good for the country's owner-occupier mortgage holders when it comes to choosing a term to fix their interest rates for.

The Reserve Bank, in its latest monthly figures says 33.4% of the $4.638 billion worth of new mortgages taken up by owner-occupiers during September were for a six month term. This replicates the recently discovered 'flavour of the month' status for six month terms that saw that term hit a record high for popularity in August with a 37.6% share of the mortgage money.

Consider for a moment, that a year ago in September 2023, the six-month terms attracted just 5.3% of the new mortgage money. Different times call for different approaches and clearly people are still looking for more interest rate falls in coming months.

But there are in the latest figures some signs of more diversity in the strategy of the mortgage holders, perhaps.

The 18-month terms that recently lost their lustre saw something of a return to favour, with the share for the owner-occupiers picking up to 11.5% from just 7.8% - although a year ago the figure was 16.4%.

That might suggest a few people are thinking of going 'slightly longer'. But on the other hand, there was a bit of a blip up in the shortest of short terms - floating. And that's despite floating rates still being quite a bit higher.

The share for owner-occupiers on floating rates went up to 20.3% in September from 18.1% in August and 17.1% in July. In September a year ago it was 16%.

The once seemingly ever-popular two-year terms continue to languish, up very slightly to a 3.9% share from 3.5% in August. In September last year the share was 23.5%.

In its summary of the latest figures, the Reserve Bank says new residential investor mortgage lending remained at $1.8 billion in September. Of this, six-month fixed terms were still the most preferable at 35.1% of new lending, down from 43.8% in August.

The share of new residential investor lending increased on the one-year, 18-month, two-year and four- year terms. The three-year term decreased slightly, and the five-year remained at the same level for the third month in a row.

The mortgage holders are likely to get further fuel for thought from the RBNZ coming up on November 27 with the last Official Cash Rate review of 2024. At the moment the OCR is on 4.75%, having been cut twice from the 5.5% it was on at the start of August.

The general expectation is that the OCR will be cut by at least another 50 points on November 27 and the financial markets are still giving a reasonable chance that it may be as much as 75 points.

3 Comments

Yup. Short fixes are better for borrowers at this juncture.

But let's be clear ...

They are also massively, exceptionally and spectacularly great for banks given their extremely fat margins that our banking oligarchy enables.

Sucks to a kiwi.

Banks are in business to make money 💵 - not friends.

TTP

2 Billion a year would be classed as excessive profit for a country of our size.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.