The dramatic recent 25 basis points (bps) falls in home loan rates have brought similar falls in many term deposit rate offers.

But we are in that in between, transition time where there is an unusually wide range of offers between institutions, from those who've moved rates compared to those who haven't. There is a 40 bps range for six month offers, and 70 bps range for one year offers. This gives savers a 'last chance' opportunity.

And the opportunity is to lock in above 6% rates. They probably won't last long.

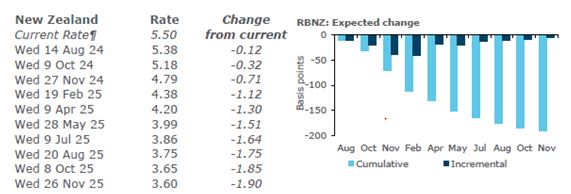

That's because financial markets are signaling interest rates have quite a way to fall yet.

Today's wholesale "what's priced in" suggests up to three 25 bps Official Cash Rate cuts are possible before the end of 2024.

If that happens, term deposit rates will follow that down.

With falling wholesale benchmarks and low and falling loan demand, there's no good commercial reason for banks to hold term deposit offer rates high, as much as some savers 'wish' that to happen. Banks are businesses, not charities.

But right now, there are still good offers to be had.

With Heartland Bank cutting rates this week, the highest offers are now from Rabobank. We have no way of knowing, but savers would be wise to assume their high offers are about to be trimmed too.

Here are the banks still offering 6% or more:

- Bank of China; 6.10% for six and nine months, 6.05% for one year.

- China Construction Bank; 6.00% for one year

- Heartland Bank; 6.15% for six months, 6.10% for nine months, 6.00% for one year.

- ICBC; 6.15% for six and nine months, 6.20% for one year.

- Kiwibank; 6.00% for 6 months.

- Rabobank; 6.15% for six months, 6.20% for nine months, 6.30% for one year, 6.10% for 18 months.

- SBS Bank; 6.05% for six and nine months.

- TSB; 6.00% for one year.

- Westpac; 6.00% for eight months.

The best offer at present for about six months is 6.10% from three banks, all challengers - Heartland, ICBC, and Rabobank.

The best offer for about nine months is Rabobank's 6.20%.

The best rate for about one year is Rabobank's 6.30%. Its 6.10% for 18 months is the only above-6% offer for that term.

Savers should make due diligence enquiry about these rates. When is interest paid out? Is there a PIE option? These details can make a material difference to your after-tax returns.

We should also note that so far no bank has adjusted down their at-call or other savings rates. This is another area due for potential sharp adjustments lower. But there isn't much you can do about these, even for Notice Saver accounts. Steel yourself if you have one of these. We expect announcements will come soon.

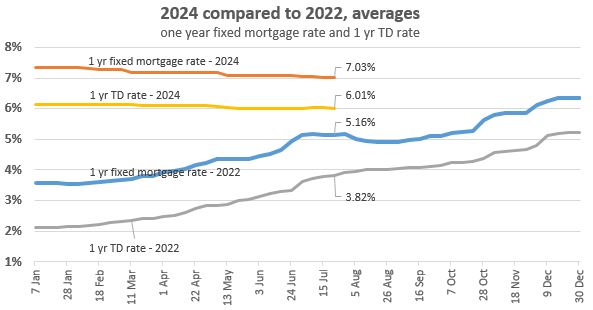

In our last home loan rate review, we contrasted the 2022 tracking of a one year fixed home loan average with the one year swap rate. That showed the 'margin' between them higher in 2024, although in 2022 the volume of housing transactions was substantially more giving space for narrower margins.

In contrast, here is the same comparison with the average one year term deposit rate. It's likely this shows it just before a notable drop:

We should also point out that after-tax returns can be enhanced for some savers with higher tax rates, by the choice of PIE structures. Not all banks offer these, but most of the main banks do. For a nine month bank offer, they can be boosted by about ~30 basis points going this way. In some cases that will make up any difference, or more.

Always ask a bank for a better rate. Many bank staff have discretion to offer more than the advertised rate. (And check your bank's app offers as they too are often enhanced to retain you). But in a falling market with weak loan demand, don't be surprised if you don't get a positive response.

Use the term deposit calculator here, or the one below the table, to calculator your expected net returns.

The latest headline term deposit rate offers are in this table after the recent increases.

| for a $25,000 deposit July 23, 2024 |

Rating | 3/4 mths |

5 / 6 / 7 mths |

8 - 11 mths |

1 yr | 18mth | 2 yrs | 3 yrs |

| Main banks | ||||||||

| ANZ | AA- | 4.30 | 5.75 | 5.75 | 5.70 | 5.60 | 5.35 | 5.10 |

|

AA- | 4.40 | 5.75 -0.15 |

5.75 -0.25 |

5.60 -0.30 |

5.40 -0.30 |

5.10 -0.30 |

5.00 -0.20 |

|

AA- | 4.30 | 5.95 | 5.90 | 5.80 | 5.60 | 5.40 | 5.20 |

|

A | 5.00 | 6.00 -0.05 |

5.90 -0.10 |

5.80 -0.10 |

5.45 -0.15 |

5.10 -0.15 |

|

|

AA- | 4.30 | 5.80 | 6.00 | 5.80 | 5.70 | 5.50 | 5.30 |

| Other banks | ||||||||

| Bank of China | A | 5.50 | 6.10 -0.10 |

6.10 -0.10 |

6.05 -0.10 |

5.95 | 5.70 | 5.35 |

| China Constr. Bank | A | 5.50 | 5.80 | 5.90 | 6.00 | 5.85 | 5.65 | 5.40 |

| Co-operative Bank | BBB | 4.30 | 5.85 | 5.80 | 5.80 | 5.60 | 5.35 | 5.15 |

| Heartland Bank | BBB | 5.50 | 6.15 -0.10 |

6.10 -0.15 |

6.00 -0.20 |

5.90 -0.10 |

5.70 -0.20 |

5.35 -0.45 |

| ICBC | A | 5.40 | 6.15 | 6.15 | 6.20 | 5.95 | 5.70 | 5.40 |

| Kookmin Bank | A | 4.40 | 5.80 | 5.90 | 6.00 | 5.00 | 4.60 | |

|

A | 5.05 | 6.15 | 6.20 | 6.30 | 6.10 | 5.90 | 5.60 |

|

BBB | 4.20 | 6.05 | 6.05 | 5.95 | 5.80 | 5.50 | 5.30 |

|

A- | 4.25 | 5.80 -0.10 |

5.80 -0.10 |

6.00 -0.10 |

5.60 -0.20 |

5.40 -0.10 |

5.20 -0.10 |

Term deposit rates

Select chart tabs

Daily swap rates

Select chart tabs

Term deposit calculator

53 Comments

Be quick ⏰

I have one with Rabo @ 6.3% maturing in Dec. I expect options available then will begin with a 5. If we decide to reinvest, this is an attractive return given the times.

Likely won’t if rates come down more, banks are cunning. Plus after you get taxed on the interest it’s a very average investment. Stock market or indexed funds will serve you much better.

Please tell me that you're not about to follow me around the threads like some lost puppy.

Even if everything turned to custard out there and we got zero percent return, we'd still be doing just fine - thanks ✅

Are you insecure?

No ones following you mate. I hope you’re okay. We all know the type of people that “invest” in TDs, enough said.

Hi - long term stock market investor here and I am buying TDs while they return more than inflation after tax. Stock market valuations are too high currently that the 12-year return is forecast to be -6% (before inflation).

Good for you, I’m not trying to brag here - made 50% on a retirement village stock yesterday so I’m pretty happy about that. Yes it was a buy out, but you make your own luck. I’ll pick value stocks over TDs any day of the week.

It’s a pity retired poppy has to take things personally and resort to childish comments instead of having a robust conversation.

You seem arrogant and aggressive Iceman. Why? Rather than criticising RPs investment decisions try and shed some evidence base on alternatives. Do you know his financial goals? No. Do you know his risk profile? No.

I’m with you Retired Poppy. Happy with my split between property, TDs and ETFs.

Retired, enjoying life and stringing together 4min/kms.

I’m def not being aggressive. “Criticise” is probably how one feels if they have a closed mindset. My initial comment hardly wreaks of criticism, why do I even need to spell that out.

Read some of his other comments on other articles and you’ll realise who is arrogant. Cue his comment here about shoe shiners. He probably took a while to google that one.

Just accept that you're overly insecure and your aggressive stance is just a way to compensate for your fragility. You do this on the internet where you're safe behind a computer screen.

Iceman's modus operandi:

- Find someone commenting with some form of positive achievement or outcome (not necessarily bragging)

- Engage in tall poppy syndrome, hold an aggressive contrarian viewpoint. Argue, flame and whittle away the victim into nothing,

- Win a prize on the internet

Mate, that was a well constructed essay, hope you didn’t spend too much time on that.

Your idiotic comment doesn’t even deserve a further response.

Need a hug?

Also, you call it an essay (at 77 words) yet your reply further down at 2:51pm (littered with laughing emojis) has 93 words.

While you're clicking like on all your own comments, can you send a few my way too? Thx babe.

I see Retired Poppy called his over 50 squad for back up.

You counted the words…Jesus. I feel for your family ( if you’re lucky enough to have one)

I stand by my original constructive comment that TDs are very very poor investment especially after you’re taxed on interest received. You guys continue with that though, save your way to retirement. Closed mindset is typical of boomers anyway. It’s funny how you lot got twisted over my ONE comment!

Copy + paste into Microsoft word = word count. Something an over 50 would unlikely know how to do, but good try with the lazy attempt at Ad Hom.

It's not even about TDs, a few of us are just pointing out an e-thug when we see one. The Interest.co's very own Nelson Muntz.

Good on you mate, it’s literally the most childish thing to copy paste and get a word count. Everything that’s wrong with people like you on this forum. Grow up old man!

Almost as childish as liking your own comments or putting in emojis.

Or....thugging people on a financial news website for having Term Deposits LOL.

What actually makes you think I’m liking my own comments? Seriously you’ve got issues, go have a drink if you’re having a bad day and act your age mate.

I added my opinion and some of you got your panties twisted in a bunch. Grow up insecure man. You’ve just embarrassed yourself even more - don’t be that upset that TD rates are dropping mate. I suspect you’re not educated or brave enough to put your money in more diverse investments. Its okay… Just don’t jump on here and come across as a total word counting moron.

Won’t be replying to your nonsense anymore.

The Iceman is getting roasted. Nothing but a puddle on the floor now.

Just another individual who unfortunately spends their life on these types of forums with their incessant postings. Constantly checking the thread for responses . Aggressive and immature comments , all very revealing. Where is a moderator when one is needed ?

Childish yourself iceman. What was the wisecrack you made about "types" of people who use TDs then.

I love reading the passive aggressive mockery between the two of you. It really helps me make financial decisions.

🤣😆👍 My personal favorite quote from history is "The time to sell is when you are getting stock tips from the shoeshine boy”

Was that supposed to insult me? Classic sign of a fragile dented ego.

You bio says that you’re in your 50s and you def sound like it. Stubborn, Mr I know it all booked. (Hence the TD investments, I should have known!! 😂) Sounds like you still rent too, so I can understand your tall poppy.

As you were, enjoy the 5% less tax returns because you’ve got this all sorted. Enjoy saving your way to retirement. You’re probably still dreaming of the 20% plus rates from the last century I bet. 😂

"(Hence the TD investments, I should have known!! 😂)"

It's your mockery makes you seem arrogant.

It’s called returning fire…if they’re prepared to dish it out - be prepared to receive it too. Or are they too sensitive?

It's called being an insecure bozo LOL.

You are aren’t you? Took time out of your day to bother commenting here on a conversation between two other people. Grow up lad, typical keyboard warrior.

You’re all getting tiring now. Maybe swap emails and go have some private mud slinging sessions and keep the uninformed tossing of shit out of the comments section. I come here for reasoned and informed debate on finance and economics, not child’s play or taking the piss out of someone for their investment risk tolerance.

Iceman,

"We all know the type of people that “invest” in TDs, enough said". As i am one of them, I can't wait to find out what 'type of person' I am.

You should perhaps know more about people before slagging them off. I am primarily a stockmarket investor and have been for many decades, but as I approach 80, I have become more conservative and now have both government and local bonds in my portfolio, as well as TDs. As rates fall-which will benefit my sons more than it will negatively affect me- I will tweak that, but will always want to have cash available at short notice.

In my book, only idiots don't.

Average long run return on a balanced fund is ~5-6%, taxable.

What was the CPI rate in 2007? About 2.4%.

What was the 12-month Term Deposit Rate that year, +7%. (Variable Rate mortgages were ~8.75%)

It's not solely about the CPI. If any number of other economic variable 'surprise', then who knows where T/D & Mortgage Rates will go. And if we reckon the World is a more predictable place today than ~15 years ago, then by all means act accordingly. (Perhaps those 9 banks are...)

https://media.anz.com/posts/2007/11/anz-changes-deposit-and-lending-rat…-

https://www.macrotrends.net/global-metrics/countries/NZL/new-zealand/in…

I can guarantee you that most of the time, term deposit rates are likely to be lower than the real rate of inflation.

Japan went through a period when cash in the bank at close to 0% was holding its value better than in the Anglosphere - 1999-2014.

Maybe.

But it's not the 'most of the time' that does the damage. It's the exceptional unexpected, as it was after 2007 when the GFC toddled down the road. And as I suggested, today we are in a more unpredictable World than we have been for many a decade.

(PS: It was similar when I arrived in NZ some time back. It was incomprehensible that CPI was, I think, 4% at the time, yet 12mth T/D was 8.9%. And an Approved Issue Levy tax rate of 2% to boot. But who was I to argue!)

I hear you. But the CPI is not inflation. You have to unlearn this. The quicker the better.

Question, the 1 year mortgage is 6.89%, and 1 year TD is 6%, will you choose to pay towards mortgage, or will you put it in a TD?

which one will make you better off?

Flexibility, is as good an answer as any. Pay off that mortgage and if things get sticky, just try re-borrowing from your friendly banker again ("Look we'd like to help but...."). But if you have the know access to a maturing T/D to tide you over, that may be the answer.

so what you are saying is, better to have some spare cash for rainy days, so that we don't end up defaulting loans?

Revolving credit mortgage.

Its always a balance. I always paid off the mortgage first but held some cash for a sudden loss of employment. Problem is you don't want to hold a lot or WINZ pings you. At one point $5K was the max or that had to come down before they started paying you so no point holding over $5K. The other problem is their "Rules" keep changing all the time so it was better to have cash in a box than cash in the bank if you suddenly lost your job.

At what point does the banks or Winz suspect you might be using your childs account as Mule account for your own rainy day fund?

Well its basic math, they don't even pay you enough each week to cover the mortgage so how in hell do they expect you to survive without getting extra money from somewhere ? The whole thing is like a CIA funded black op's mission, they know but they don't want to know.

The word is “maths”

Answer, what is your marginal tax rate?

Your mortgage is paid out of after tax income & your TD has tax to pay. You will almost always be better off paying down the mortgage (at zero risk) than investing.

Definitely keep an emergency an accessible emergency fund. After that, extra mortgage payments save you a guaranteed 6.89%. A 6% TD gives you 4.32% after PIE tax at 28%.

I focused on grinding the various mortgages down, and it has really worked for me. It was a priority.

The exponential curve, is a marvelous thing. With mortgages it's a down curve, then a near cliff.

I see a lot of stress on here about high interest rates. But high interest rates are not their problem. It's the high debt.

Here's an option somewhere in between. Some banks (definitely ANZ and maybe others) have an on-call account available that has no fees charged to it if you maintain a minimum average balance of $5,000.00 over the calendar month. Naturally I can't speak for others but when I had a mortgage I calculated that the fees avoided each month were slightly higher than the interest charged to me on that $5,000 still on my mortgage (and that wasn't including net interest paid to me on that $5k). It also meant I had $5k available immediately if needed.

It does depend on individual situations as some of us attract more fees than others and $5k is unlikely to go far if someone loses their job, but it is an option.

I'm not sure why anyone pays bank fees anymore? I don't think any of the main bank on call savings accounts have fees attached?

But the answer to rainy day fund depends on your level of discipline. For disciplined ones, pop it in your revolving credit or offset. If less so, put it in some sort of bonus saver with monthly or quarterly withdraw window. Not financial advice, just an observation on human nature.

Yeah, I had a look after posting and noticed that fees don't seem to be a thing on my account anymore. They were definitely significant and draconian for a while though.

I did contemplate getting a revolving credit mortgage at the time but again, fees were charged after about the fifth transaction of the month, on each transaction (EFTPOS, withdrawls, transfers). I was confident my discipline wouldn't be up to it at the time (I still managed to comfortably pay off my mortgage though).

LOWER MUCH FASTER

🍿🍿🍿🍿🍿

SORRY POPPY

Why are you apologizing?

Hopefully not faster than the FED. Can't imagine where the NZD would be heading to...

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.