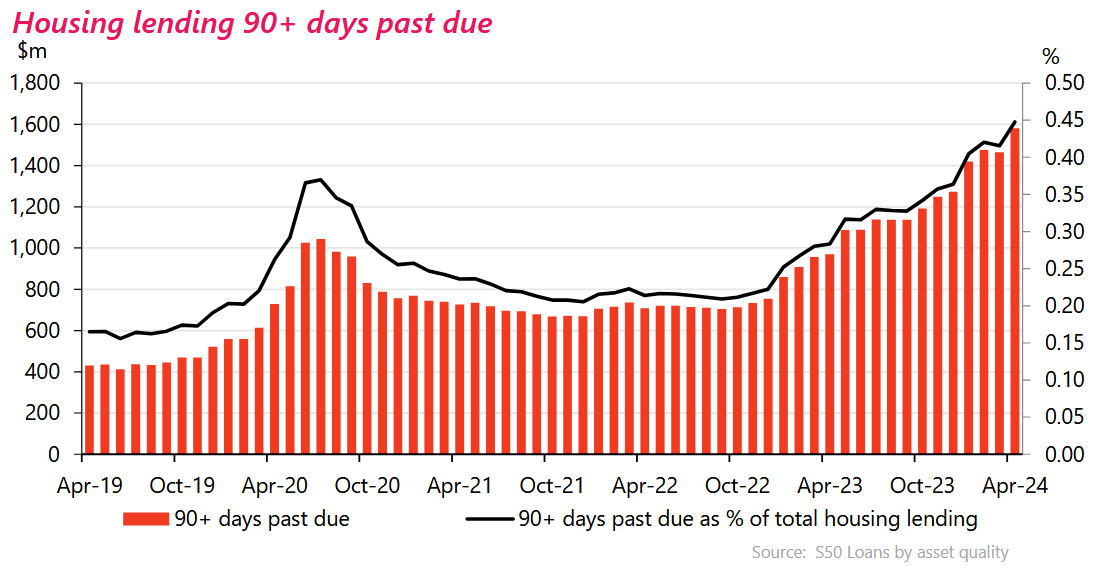

Non-performing housing loans had a renewed surge in the month of April, rising by 7.7% to just over $1.9 billion, according to the latest Reserve Bank loans by asset quality figures.

In recent months the pace of rising loan non-performance had appeared to be slowing.

However, the $136 million rise in April 2024 was the second largest monthly rise since June 2020 at the height of the pandemic, beaten only by a $161 million jump between December 2023 and January 2024.

Since the start of this year the non-performing housing loans total has risen by $384 million, or 25.3%, while in the past 12 months the total has risen by $796 million, or 72%.

Non-performing loans are impaired loans plus loans at least 90 days past due but not impaired.

The latest monthly rise sees the percentage of non-performing loans rise from 0.5% as of March to 0.54%, which is a new peak during this current period of rising loan stress. The 0.54% non-performing loans ratio is the highest in around 10 years.

It is, however, still well down on the sorts of levels seen in the aftermath of the Global Financial Crisis, with the rate frequently hitting 1.2% between 2009 and 2011.

While the non-performing loans ratio has risen from a low level and it still not at an exceptionally high level on a historical basis, it has nevertheless kept steadily increasing as the higher mortgage interest rates prevailing since the second half of 2021 have started to take a toll.

In April 2023 the non-performing loans ratio was 0.32%. This rose to 0.43% by the end of 2023. And in the first four months of this year it has risen to 0.54%.

In looking at the finer detail of the latest figures, impaired loans rose by $20 million during April to $320 million. The impaired loans total is up $75 million, or 30.6% so far this calendar year and $185 million, or 137% higher for the past 12 months.

Loans that are 90 days past due but not impaired have pushed through the $1.5 billion mark, surging by $116 million, or 7.9%, to $1.581 billion in April 2023.

The 90 days past due total has increased by $309 million, or 24.3% so far this calendar year, while it is up $611 million, or 63%, in the past 12 months.

One of the factors that was seen as being helpful for home owners during this spike in interest rates (with, for example, average one-year fixed rates rising from 2.3% to 7.2% in the past three years) was the very low rates of unemployment.

However, unemployment rates are now starting to climb quite quickly, with the figure, according to Statistics NZ, having risen from 3.4% as of the March quarter 2023 to 4.3% as at March quarter 2024. And the RBNZ is forecasting that the unemployment rate will hit 4.6% by the end of the current (June) quarter.

Obviously rising unemployment rates are one significant factor that could lead to increases in non-performing loans.

Thus far the non-performing loans ratios are within the boundaries expected by the country's banks. According to the RBNZ's May 2024 Financial Stability Report (page 14) the banks expect the ratio to rise to about 0.7% by the end of this calendar year, and still well below those levels seen after the GFC.

But another major factor potentially in any future rises in mortgage stress is just how long the interest rates stay at around current levels (notwithstanding some marketing tweaks by the banks to their rates).

RBNZ monthly figures showing what terms people are refixing their mortgages for show that most are now fixing their interest rates now for 12 months or less. There's a clear expectation that rates will be coming down sooner rather than later.

The financial markets had till recently been heavily pricing in the potential for rate cuts in the latter part of this year. But the RBNZ, which is still seeing domestically-sourced inflation as being too high, has poured iced water over such expectations. And its latest set of forecasts don't have the Official Cash Rate (which has now been on 5.5% since May 2023) being cut till the second half of 2025.

So, homeowners expecting mortgage rate cuts within the next 12 months could yet be disappointed, although those ever-hopeful financial markets are still - regardless of what the RBNZ says - pricing in the first OCR cut in November.

Still, with the general flat state of the economy (GDP has contracted in four of the past five quarters - and that's despite a big rise in the population), rising unemployment and with interest rates not falling any time soon, it will be worth keeping eyes on how these non-performing loans do track.

Clearly, if the economy fares rather worse than currently expected, this could lead to further mortgage stress. Watch this space.

83 Comments

I’m sure this will continue in earnest over the rest of the year.

Well that came out of nowhere. Probably nothing.

Side Eye Chloe moment......

You just need to take a "look through" approach to this data.

0.45% of loans. stay calm and carry on

Yes. Anyway, I saw and posted about this y'day. Could be just an Aussie issue.

Journo Michael Janda chats with ABC News Daily on Australia's hidden mortgage hardship crisis. Fresh research from ASIC Moneysmart today showing 2 in 5 Aussies with debt say they are likely to have trouble making repayments over the next 12 months (that's 5.8 million people).

https://www.abc.net.au/listen/programs/abc-news-daily/australias-hidden…

This is fine, everything is fine.

... Until it's not.

Slowly, then all of a sudden......

Interesting but does'nt tell me a likely outcome if all > 90 day plus all those already impaired default will have on bank solvency. I realise its not quite that simple but surely the exercise needs to be done on a a bank by bank basis where the bank has to cough up capital to cover losses.

RBNZ is across it, which is why they started cranking up bank capital adequacy requirements about 5 years ago. Of course the banks all pushed back and moaned, said it was unnecessary and would cost consumers a lot of money, but it was clearly the prudent thing to do and they are now better able to weather this than they otherwise would have been

At the moment it is fine, its less than a major bank's yearly profit. The question is how much worse will it get, and that depends on where interest rates end up.

According to one ignorant individual, on the grounds they've not posted their stories on here, holders of 1.5 Billion of stressed mortgage debt, harbor no buyers remorse or regrets having purchased. These are potentially people that either have or are close to exhausting avenues of Landlord Bank assistance. Not a good place/space to find oneself in.

Yes, when compared to the entire mortgage market the percentage in difficulties is historically small however, considering we are not near the worst of the downturn (unemployment peak) and interest rate effect lag, I think to would be foolish to rule out this being equal to GFC. If we are subject to a Global shock then we could indeed find ourselves in territory testing the RBNZ previously run scenario of stress testing limits. Things are looking more vulnerable with each passing day.

Overnight, $517 billion in unrealized losses hit the US banking system and the FDIC says 63 lenders are on the brink of insolvency.

The number of problem banks represented 1.4 percent of total banks, which was within the normal range for non-crisis periods of one to two percent of all banks. Total assets held by problem banks increased $15.8 billion to $82.1 billion during the quarter.

https://www.fdic.gov/news/speeches/fdic-quarterly-banking-profile-first…

Wouldn't mind betting you're a goldbug. They're always posting about the imminent collapse of the US banking system and USD. They have done for decades.

FDIC insures the banks.

FDIC insures the banks.

Not exactly and you're obviously oblivious to what happed in last year's banking crisis. If all deposits weren’t covered, then a bank run would start. Any large depositor with a non-'Too Big to Fail' bank would instantly transfer money to a TBTF bank, which have full government guarantee of all deposits. Subsequently, thousands of banks would go under across the country.

Rather than suffer at the ballot box, those in charge essentially now guarantee all deposits in the US banking system. That is a stealth addition of $6.7 trillion, as this is the amount of uninsured deposits as reported by the St Louis https://fred.stlouisfed.org/series/BOGZ1FL763139105Q

This leads to money printing because the FDIC’s insurance fund doesn’t have $6.7 trillion. Once the fund is exhausted, the FDIC will borrow money from the Fed, which will print money to satisfy the loan.

If there was lots of money printing, there'd be lots of inflation....and there isn't. The US economy's in pretty good shape, the USD Index has been going up since 2008.

If there was lots of money printing, there'd be lots of inflation

What does 'lots of inflation' mean? Base money, broad money?

The inflation in the USA is 3.4%, I hear from goldbugs and others that the USA's printing money like there's no tomorrow.

Money printing causes inflation, and one of the the most extreme examples was the German meltdown after WW1 when people used a wheelbarrow to carry the cash for a loaf of bread.

Why does everyone love the USD?

The inflation in the USA is 3.4%

No. That's a CPI reading.

Yes it is

Where's there evidence? You're a goldbug, I can smell them, even over the internet.

The USD buys 20% less gold than this time a year ago.

Just sayin'

Yeah, I thought so - gold's one of the worst bets out there, huge buy/sell margins, illiquid and no dividend. Ever met a rich goldbug?

I haven't.

How's gold doing against the US stock market?

My ex brother in law in Sydney has held large amounts of gold bullion for years. Also has been in and out of Bitcoin and lately has been buying silver. He has made some big gains, millions. He is one of many worldwide. It pays to be diversified. It’s not just about property especially right now.

Because they have the biggest economy in the world. Their dollars are real unlike our Mexican ones.

The US has the biggest economy in the world only when adding FIRE (finance, insurance real estate) activity numbers into overall GDP and using a strictly USD perspective (i.e. with no adjustment for on the ground purchasing power). China has the far largest economy in the world in PPP terms, and especially in terms of industrial and manufacturing output. In those terms the Chinese economy absolutely dwarfs the USA. Eg. latest World Bank data GDP (PPP) has China at US$31.8 trillion and the USA at US$25.4 trillion. It's not even close.

If there was lots of money printing, there'd be lots of inflation

Where do you think asset price inflation comes from if not from "money" printing? Where do you think all the excess money in the financial asset industry comes from if not from "money" printing?

Since the invention of fractional reserve banking, the removal of the gold standard, removal of land from cpi, deregulation of the banking system, the fixation on property prices, and QE, all we have had is excess "money" printing for two decades plus. Whether it shows up in consumer prices or asset prices is moot. The only difference is us believing that one makes us rich and one makes us poor, but it is still inflation and it reduces the purchasing value of our money either way. The alleged "good" inflation might make many institutions and a few individuals rich, but it is making us collectively poorer. Supply and demand is merely a narrative to justify flawed economics and false beliefs, as both are regularly manipulated in a variety of ways.

Very few understand what you said and its true.

They're always posting about the imminent collapse of the US banking system and USD. They have done for decades.

The US has done this to itself by weaponizing the USD and their financial system, including SWIFT, against anyone any everyone that they dislike. Hence even close US allies like Saudi Arabia are starting to trade in local currencies instead of the USD and also using alternative financial structures eg non-western insurance underwriters.

Am I right in saying they have $1.8 billion of debt that is past due, but most of that is backed up by a house and a deposit, so only a small amount of that (probably < 10%) would be a loss at current house prices? So it really needs to escalate a hell of a lot more before the banks are in any real danger. But I'm not saying it wont happen...

Banks borrow money from numerous sources ... and if those sources get spooked ... Well ... It get's way worse, real fast.

Of course. But when your impaired loans are a tiny fraction of your yearly profit, we are a long way from anyone being spooked.

Hmm, you can see it that way, but it all comes down to market confidence. Once undermined things can spiral down quickly, hence banks have a massive interest in not spooking the property market. Bought an apartment last month (I realise it’s not ideal time to buy but family circumstances) from a vendor who had less than a week before Westpac foreclosure. There will be more of this as banks are quietly getting tougher but bank took a haircut to avoid “mortgagee sale” headlines.

the negative equity debacle of the 90's in the UK demonstrated that a liquidity crisis accompanies a deep recession and the only buyers are those with cash who set prices and the value of assets goes **** !

The trend is your friend and the trend of imapired loans and unemployment are both up, still its different in NZ - untiol it isn't and that may be closer than you think.

Increasing default. No surprise. How long can the banks continue to ignore financial reality, especially when its a growing problem...?

Banks to Orr: "We did as you asked and agreed to DTIs. Now drop the OCR!"

Orr: "When I'm ready."

Banks: "We want to continue our record profits!!!"

Tail wagging dog

I would be extremely surprised if there was not a 25 bps cut to the OCR in November, a cut which is needed considering how things are evolving.

Hike in OCR later this year. Inflating must be clubbed.

Once down, it must be clubbed again.

CPI last quarter was 0.6% or 2.4% annualized. Inflation has already been defeated.

Many people (myself included) were saying the same thing last year.

Will; be too little too late.

There will be more than just a few people wishing they had not listened to their parents, friends, work mates, agents and brokers who told them that property prices only rise. Some of them borrowed more than they should have in hindsight. But they wanted that bigger home in a great location. The trouble is that their “advisors” other than some parents will not offer to help them.

As someone who almost borrowed 7 figures to buy a first home in AUK during the second half of 2021, I vividly recall the pressure to 'buy buy buy or be left behind forever'. It came from everywhere and was absolutely relentless.

I probably would have caved if it weren't for some of the contributors to this site regularly offering contrarian perspectives. "Helping you made financial decisions" - indeed!

You always have bush lawyers who think they know it all. Well done. When you eventually buy you will have a smaller loan compared to what you would have borrowed in 2021. I believe we will see steady falls in house prices until core inflation from food, energy, rates and insurance slows down and interest rates fall back. Even then you will not see big interest rates reductions as the RB will not want inflation to go back upwards. Paying rent is peanuts compared to what you will eventually save because you wisely did not buy in 2021. Remember Banks are not our friends.

Yip, I agree with what you say. House prices will be flat or having small decreases till 2028 (except for some regions, as there are always outliers such as Queenstown), and it will be so boring that everyone will be asleep, and then "all of a sudden" people will start buying again, and there will be another bubble.

Well done. Informing yourself then trusting your gut goes a long way.

"As someone who almost borrowed 7 figures to buy a first home in AUK during the second half of 2021, I vividly recall the pressure to 'buy buy buy or be left behind forever'. It came from everywhere and was absolutely relentless."

Good that you avoided that potential financial landmine.

There are many property promoters with their vested financial interests at work. Some were on interest.co.nz telling people to buy. Those that chose to follow that advice might be facing cashflow stress and mental stress now.

Here is one such potential example:

https://www.realestate.co.nz/42575379/residential/sale/72-compass-point…

Well-done on holding out against the nefarious Property Ponzi Pumpers. Some lurk on these channels.....giving really bad and selfish vested interest advice.....much the same as the garden variety REAs.

Keep saving and look to buy when the yields are back in the 6 to 8% range and don't overdo the DTI. Youve saved yourself 2 to 4 hundred K already.

This market is mid-reset downwards and these resets take on average worldwide, 6 years to play out, so just halfway down the great reset slope.

"Youve saved yourself 2 to 4 hundred K already."

This is something most people do not realise. The property promoters with their vested financial self interests won't tell you this.

Peaker vs Buyer Today

How does this compare with a Peaker and a Buyer Today (BT) in NZ?

1) Peaker

a) Nov 2021

The median house price at the peak for Auckland was $1,300,000

With an 80% LVR, this is a mortgage of $1,040,000

The 20% equity is $260,000

b) Feb 2024

REINZ median House price for Auckland: $975,000 (-25.0%)

Mortgage: $1,040,000 (assumed to be interest only for comparison purposes)

Equity: NEGATIVE $65,000 (-125%) (i.e negative equity)

2) Buyer Today ("BT")

The current REINZ median house price for Auckland is $975,000

For a buyer who waited, and used the same $260,000 equity used above, the mortgage at this price would be $715,000 (an LVR of 73%)

The Peaker has a mortgage which is higher by $325,000 (mortgage of $1,040,000 for Peaker vs $715,000 for BT)

As a result of that additional borrowing, at a 6.8% mortgage interest rates over 30 years, Peaker is paying $770,000 more over the 30 years than BT (30 years x $25,667).

Assuming same incomes, and same living costs (food, travel, etc except mortgage), BT can save the $770,000 in payments that Peaker is paying.

The annual payment on the additional mortgage of $325,000 is $25,667 per year.

1) Peaker pays $25,667 more per year than BT.

2) BT instead saves that same $25,667 per year. At a deposit interest rate of 5.8% (after 33% tax is 3.9% p.a). Saving $25,667 per year and earning 3.9% per year in net interest after tax for 30 years comes to a total of $1,415,685.

$1,415,685 - this is money that BT has available for retirement after 30 years that Peaker will not have.

Remember that at the end of 30 years, the house price will be exactly the same for Peaker and BT.

BT will have more money available for retirement than Peaker.

And think how much better it could be again if BT (Buy Today) was to be BT (Buy Tomorrow), or BTM (Buy the Next Month), or BTY (Buy the Next Year).

I did buy a few months ago, as other factors (young kids being the big one) meant we had held out as long as we could.

But by that point we had saved hundreds of thousands on the purchase price, and had a deposit almost $100k healthier, negotiated ruthlessly, and bought at a sleep-compatible 50% LVR and 2.5 DTI

I agree with you though, and fully expect the slide to continue. I’ve told my wife to steer clear of the valuation websites for the next couple of years!

Hey I have seen up and downs in property prices over the last 40 years. The main thing is you avoided buying in late 2021. Agents were selling the same day a property listed. You could sell a garden shed as long as it was well located. It was simply nuts. FOMO got the better of many. Some will pay by losing their homes.

"But by that point we had saved hundreds of thousands on the purchase price, and had a deposit almost $100k healthier, negotiated ruthlessly, and bought at a sleep-compatible 50% LVR and 2.5 DTI"

Good for you. 2.5 DTI is a manageable level of debt relative to many purchasers of 2020 - 2022 who took on DTI's of over 5 who may be facing cashflow stress and mental stress.

If you choose to pay down more than the minimum payment, you'll pay down the principal faster, resulting in reduced total interest to the lender. The reduction in total interest puts more money in your pocket for retirement.

After the mortgage is fully paid off, if you choose to maintain those payments from your income and deposit into a savings or investment account, it increases the probability that you will have a nice nest egg for your retirement.

Best of luck to you.

A reminder from May 2021

The latest RBNZ figures show that for the month of March, 2021 some 53.3% of mortgage money borrowed by FHBs nationwide was at a DTI of over five. That's up from 48.7% as at the end of December 2020. A year earlier in December 2019 under 40% of FHB mortgage money was borrowed at DTIs over five.

According to the RBNZ data some 43.3% of owner-occupier mortgage money was on an over-five DTI at of March 2021. That was up from 41.1% in December 2020, and up from 32.8% in December 2019.

By December this figure had blown out to 69.1% of DTIs of over five for investors.

Then in January (possibly as investors rushed to get in before LVR restrictions were reintroduced) this ratio of high DTI mortgage money blew out even further to 71%. Then for both February and March, it slipped back a little to be 67.6% for both months.

https://www.interest.co.nz/property/110261/new-figures-rbnz-show-71-mon…

DP

Could I ask what level of salary/salaries you had to be able to borrow 7 figures and what field you work in? (I'm looking to retrain (half joking), but only reply if you'd like to)

check out "Coming flood of US Treasury issuance unsettles some investors after blazing rally"

Coming flood of US Treasury issuance unsettles some investors after blazing rally | Reuters

Hopefully we don't caught up in the forthcoming

I would say the bank of mum and dad are looking very impaired, though inheritance will fix that....

BMD definitely has highest rates of NPLs! (Though probably true in good times as well)

We all know its worse than this, The Reserve Bank is stupid allowing trading banks to report understated and un audited non performing loans - Please don't let us down again Reserve Bank - these figures are lies

Of course they're going to let us down - they've being doing so for 20 something years. They are the banks' bank for a reason.

Maybe it's not fully their fault though - our own ignorance is just as much to blame.

"our own ignorance is just as much to blame."

Many borrowers chose to take on debt levels which has subsequently proven to be too high. At the time of signing the loan documents they didn't know this.

So Economics History should be taught at high schools?

Yes. I'd agree.

“So Economics History should be taught at high schools?”

People definitely need to recognise that they need to become financially literate.

Parent's need to instil this into their kids, as early as possible ideally. However many aren't financially literate themselves, or see the level of importance in such crucial life skills as financial literacy in their kids, and the impact it will have on their future.

Yep, ignorance is bliss...untill it isn't.

Yes fully agree, the Big Banks are hiding these thousands of bad loan skeletons in the closet and then reporting "nothing to see here"......

Lots of Chicken Little's here predicting ruin in the property market. Who knows what'll happen? Anyone who thinks they can predict the future should be rich.

You can take your punt now while the property market's down, or keep paying those extortionate rents for the next few years.

"Anyone who thinks they can predict the future should be rich. "

One only needs to get their predictions right, more often than wrong, to get and stay ahead.

The problem is, virtually no one gets it right. Picking the bottom of any market is by guess and by God.

It doesn’t matter if you buy a bit off the bottom. It matters if you buy and it keeps dropping. Paying interest to the Bank is the same as rent and it’s an expensive rent currently. Paying rent to your landlord is cheap compared to Auckland house prices which are consistently dropping by tens of thousands currently. Some dropping by six figures. With the stock coming on the market currently in Auckland prices are not going to go up. Too much gravity.

Yep, many would not care about paying an extra few thousand in rent for a year compared to saving tens of thousands on their house purchase and the long term decrease in interest they would pay to the bank. Double savings woohoo!!

It would seem we are only ever trying to pick the bottom, or top, in the property or financial markets. Makes sense in the financial markets given it is the equivalent of a casino.

Where is the bottom of the market when we are buying food, clothing and other basic needs.

Maybe turning homes into financial speculation was not the most intelligent of ideas.

My rent is $700 per week.

Mortgage for an equivalent property ($950,000) is currently $970 per week plus fixed wastewater, rates, insurance and maintenance.

Have $300,000 in a term deposit for the next 6 months earning me $6,750 after tax. I'm also saving approx $3000 a month.

If the price comes down by another $50k over the next 6 months, that same mortgage is only going to be costing me $858 per week.

What possible reason is there to buy now? Prices trending down and at best going to remain flat. I'll wait another 6 months if unemployment still heading upwards and no rate cuts by November.

Why are you trying to exaggerate rent costs to talk up an objectively bad financial decision.. what's in it for you?

Great analysis harlow, your situation is like a few friends and colleagues I know who are sitting tight but moving into a better position to strike when the time is right. One advised he talks to the RE at the open homes fishing for information on the vendors situation hoping to find signs of distress to push for a bargain.

And that's why it is now illegal (subject to a Real Estate Agency ethics violation) for the Real Estate Sales Agent to offer up an answer to that question unless the Agent has the Vendor's signed permission to provide that information to a customer.

Those extortionate rents are because of the property market.

If people were able to have an affordable home (whether owning or renting), without being in debt servitude or consuming large portions of their income, would the property market be in ruins. Maybe the banking market would have to adapt to truly serve its customers rather than being the predator.

If people were not paying extortionate rents and mortgages there would be more discretionary and disposable income to save, most likely improving our capital markets, investment in productive enterprises, long term savings, and homes would not have to be financial assets or the predominant savings and nest egg vehicle.

‘While the property market’s down”….it’s down a bit from where it was but it remains one of the most overpriced in the world. There’s further down to go yet…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.