Financial advisory firm National Capital says women in New Zealand could be facing a KiwiSaver retirement shortfall of up to $61 billion compared to men.

National Capital’s latest Value for Money report for the January to March quarter reveals there were significant differences between the fund levels of women’s and men’s KiwiSaver funds which could lead to large disparities in savings by retirement at age 65.

The firm analysed data from the Financial Markets Authority’s 2023 KiwiSaver report and the Retirement Commission’s KiwiSaver balances.

National Capital was founded in 2018 and currently advises on over $130 million of KiwiSaver investments.

The financial advisory firm said women usually earn 25% less on average than men when it comes to salary, and are more likely to choose less risk-averse investments than men.

“Because of this, the difference in retirement savings between men and women could grow to $61 billion.”

National Capital’s report findings support similar research from the Retirement Commission in April, which found men contribute 36% more to KiwiSaver each year than women, even though both contribute the same percentage of their salaries on average.

That 36% gap in KiwiSaver contributions was mainly due to the gender pay gap, according to the Commission, which said women were missing out on KiwiSaver returns because they earned less, not because they contributed less.

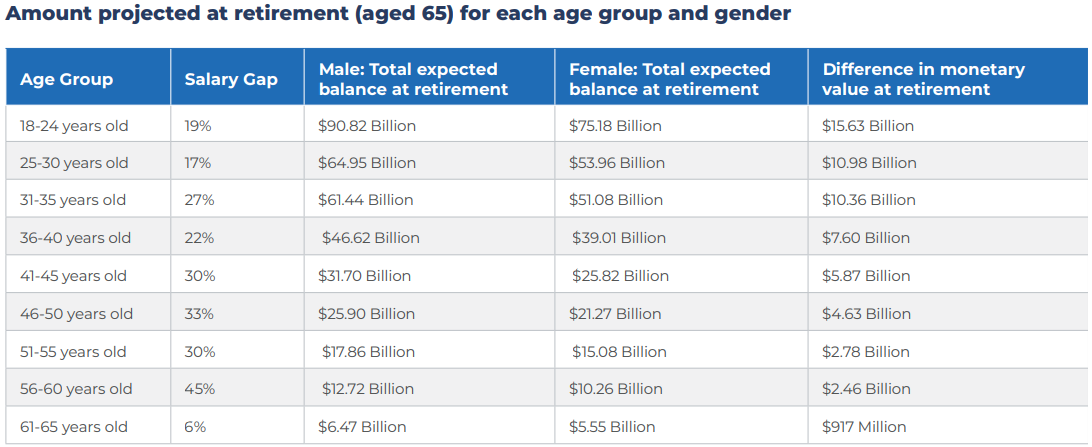

National Capital provided a breakdown of expected retirement funds for men and women aged 18-65 and their differences at retirement across different age categories.

The largest difference in KiwiSaver fund amounts was between men and women aged 18-24, with a 19% salary gap. This could mean a $15.63 billion difference in KiwiSaver funds for women and men by retirement age.

The smallest difference was between women and men aged 61-65, with a 6% salary gap. This could result in a $917 million gap between them by retirement age.

In the January to March quarter, National Capital said the typical cash reserves in KiwiSaver Growth funds decreased from 7.70% to 7.57%. The firm said this suggested managers seized some investment opportunities.

The report also noted most KiwiSaver funds had slightly boosted their bond investments in the quarter, with the increase being funded by reduced equity allocation.

On the fees front, Simplicity kept its position with the lowest fees across growth, balanced, and conservative categories, National Capital said.

Fees varied widely, with high growth having the highest at 1.12%, and conservative the lowest at 0.61%. The Milford Cash Fund had the lowest fees at 0.20%.

National Capital said although some providers are eliminating fixed monthly membership fees, 12 out of 24 still mention charging them.

The Milford Cash Fund had fees of 0.20%, making it the lowest fee KiwiSaver fund if we include the cash category.

Research firm Morningstar reported KiwiSaver funds under management rose by $4.6 billion in the March 2024 quarter, while the gap between the two biggest KiwiSaver funds closed in.

KiwiSaver assets under management are now at $108.6 billion, up from $104 billion in December.

19 Comments

Kiwisaver is not a replacement for an actual pension scheme, (like those available to government department employees) and in most cases it is set up to heavily discriminates against many sectors of the population and provides less investment informed choice, less reporting to users and much more investment risk then desired for the needs during different life and economic events. Any other managed fund is literally better for fees management, risk management and reporting.

If any person or government actually relied on kiwisaver to pay for retirement for everyone or to enable them to stay alive to retirement age then they are bigger fools then even our current crop of primary school kids.

even 8% of nothing is still nothing. In today's day an age only one person may be guaranteed an income even with support and even then that is not a firm guarantee with many physically unable to work also unable to access the benefit so whole families can be income-less and homeless with no access to KO wait lists due to bureaucracy. It is just how the NZ systems are designed. That those who most need pension support will be the most likely with no access to Kiwisaver government contributions. Bit of a chicken and egg situation. We pay billions to those with no need of kiwisaver benefits or indeed any benefit at all while those who truly are destitute and needing benefit support to survive are the most likely to be denied enough to live on and can be homeless without the government housing subsidies paid out to those over 65.

Go figure. No wonder we are wasting billions, trying to pinch pennies from those at the bottom to pay for the waste at the top and still coming up short.

If you are able pull funds from KS and invest them in more diversified and better managed funds. It is far better to be able to actually plan for retirement and have the option should you need it to pay to survive to retirement age.

Our financial advisors hate KiwiSaver as it does not give them income, nor can they benefit from churn.

Beware their "advice" on that one.

Not exactly - have a search for "kiwisaver adviser" and many show up. That's not even including many life & mortgage advisers who build that into their conversation.

However, the bigger issue is actually Kiwisaver was far too ineffective to make a tangible difference long term. Should have had a minimum of 8% from day 1 with mandatory employer contribution too. It's also too rigid only being allowed to be withdrawn at 65 which deters many from contributing more than the 3% minimum.

In Australia, the average balance for workers is far larger and makes a tangible difference to peoples retirements. In Singapore, their CPF is incredibly powerful - makes up a large chunk of their pay but they can use it for more than just retirement etc.

Kiwisaver is long due an overhaul.

I would like to see a list of all the assumptions made behind this "data".

Additionally I would like to see a comment about this assuming that everyone is single.

And I would also like a comment upon how the lifespan difference between genders affects things.

And how the balance differences are negated in divorce.

I know several divorced women renting in retirement. Maybe 10. I know of only one man and he has a drinking problem.

That's pretty funny, I suppose not a single one of those 10 women have any "Problems"?

They got 99 problems but a husband ain't 1.

My wife's pay works out to be close to our monthly mortgage payments so all her money goes on the mortgage. My pay is used for living off and Kiwisaver and other retirement investments. She puts in enough to get the free government rebate every year but I am putting in the most I can, now 10%. Skews the numbers a bit. When we retire it is our retirement funds, not his and hers.

Poor planning by you. She should be getting the 3% employer contribution by also contributing 3%, it's worth way more than $500 from the government.

She did when she was working but retired now (early). All other investments in her name while I still have income coming in.

TRT?

National Superannuation cannot last. We need to replace it with a muscular KiwiSaver for everybody.

So it will cost people now. Better than starving later.

There is no reason to suppose that women as a group will ever match the income of men, and even less reason to suppose that men may one day take as much time away from work to have babies as women.

KiwiSaver, and every other investment scheme, are mere nice-to-haves for those who can afford to save.

NZ Superannuation remains the universal answer to providing for retirement for everyone, male or female. It isn't enough: it needs to be doubled. And to ensure it goes to those who need it rather than those who don't, everyone who applies for it should be on a punitive tax rate for all income - restoring a form of the surtax or surcharge National and Labour recklessly colluded to abolish in 1998.

How to pay for an enhanced NZ Superannuation? By increasing taxation on those who can afford to pay: it is the state that should be investing in its own KiwiSaver to provide for the futures of us all. Individual savings are the icing on the cake for those with ample surplus income to tuck away for their 'golden years'.

How to pay for an enhanced NZ Superannuation?

There's an obvious answer that would go a long way towards this. Recognise state superannuation for what it is - a benefit. Treat it like any other benefit payment with the exception being that there is no obligation to look for work.

Superannuation should be mandatory. Australia isn't wealthier than us because of taxes, its because of savings and investment.

Yep. KiwiSaver is a dud. Average balance is 15K. It’s been going for how long. A lot of difference that is going to make to people’s retirement.

Pretty sure their natural resources have something to do with it too...

Employer 3% contributions should be paid to all workers as currently 1.0 million out of 3.2m kiwisaver holders contribute nothing so miss out on the employer contribution and govt grant.

Also we need to make a start on emulating the Australian scheme which is 11%

We could start off at 4% in 2026

5% in 2027

6% in 2028 etc

I'm surprised there hasn't been any discussion about this in the media, retirement commission or financial commentators

Oh, but the poor employers having to endure this cost. Where's your humanity?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.