On a global scale New Zealand has in recent years had among the biggest house prices rises - along with one of the highest rates of population growth and one of the biggest falls in mortgage interest rates.

These are some of the findings of research undertaken by the Reserve Bank (RBNZ) to better understand the sustainability of house prices in New Zealand. RBNZ chief economist Paul Conway gave a speech on Thursday that summarised some of the research.

In a paper called: How do we stack up? The New Zealand housing market in the international context, the RBNZ's Hamish Fitchett and Punnoose Jacob have looked at NZ's housing market in comparison with 12 other developed nations between 1991 and 2021.

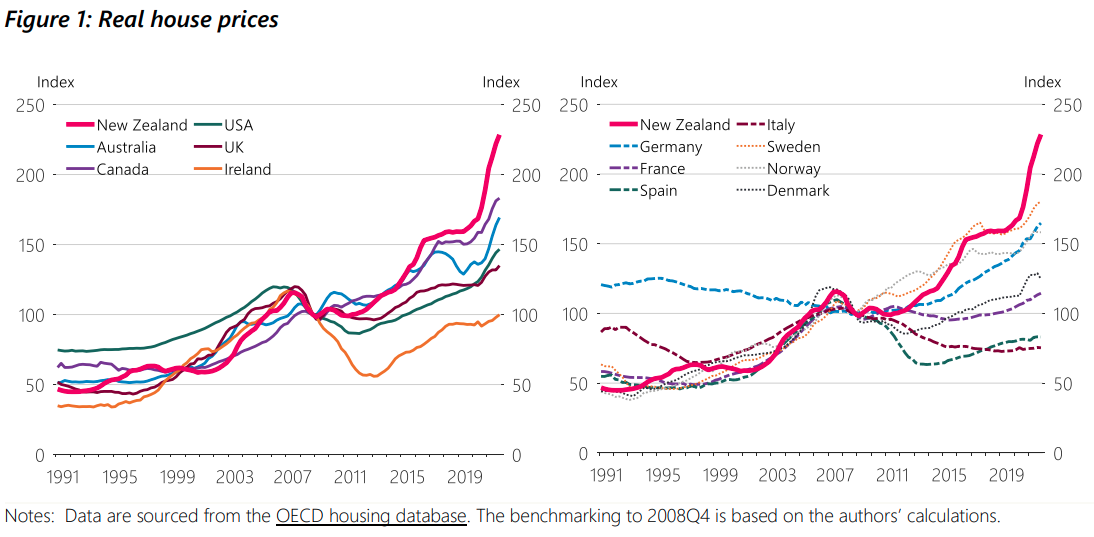

They say that until the Global Financial Crisis in 2008, the progression of New Zealand house prices was broadly in line with those in most other countries; but the pattern changed after the GFC.

"Real house prices in New Zealand flattened for a few years following the GFC, before undergoing a rapid escalation.

"The rise in New Zealand house prices since 2008 exceeds that of all other economies in our sample," the report's authors say.

"The upward surge in New Zealand house prices has also pushed New Zealand to the upper end of the cross-country spectrum with regard to two other key indicators of the housing market; the price-to-rent-ratio and the price-to-income ratio."

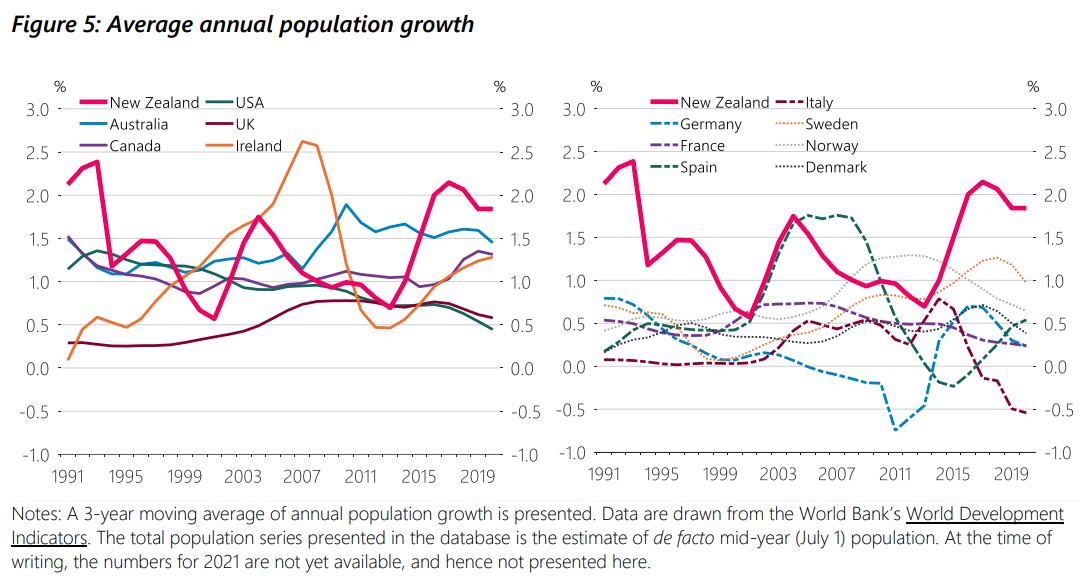

The authors note that demand for housing strengthens as the population increases and the interest rate costs of mortgages decline.

"Figure 5 examines population growth rates in our sample. New Zealand has been at the upper end of the range for much of the past three decades when it comes to population growth. Albeit from low levels by world standards, New Zealand’s population, buoyed by high immigration, has grown rapidly," they say.

Fitchett and Jacob say that even though net immigration fell in the immediate aftermath of the GFC, it started rising after 2011, and kept strengthening till early 2016 and remained at high levels.

"Population growth in other economies has been relatively weaker, and even negative in Germany, France and Italy during several episodes in the last 15 years."

On mortgage rates, the authors say that comparing rates across countries is difficult because the types of mortgage contracts that are relevant vary across economies and possibly also over different periods.

"With this caveat in mind, Figure 6 illustrates the persistent fall in selected mortgage rates for most of the economies in our sample, after the GFC.

"The New Zealand mortgage rate started at a higher level than those in other economies in 2008.

"Between mid-2008 to mid-2009, the [Reserve] Bank eased the Official Cash Rate by 575 basis points.

"This in turn reduced the interest rate cost of mortgage debt to, what was at the time, historically low levels. After increasing mildly till about 2014, the mortgage rate declined continuously.

"By 2021, the New Zealand rate appears to have fallen the most in our sample; about 500 basis points."

The authors then present 'Figure 7', which presents scatter plots that compare the changes in population (left panel) and mortgage rates (right panel) since 2008 to the change in real house prices over the same period.

"Two key messages emerge from the figure," the report authors say.

"Firstly, it suggests that house price increases after the GFC correlate stronger with population increases across countries while the corresponding correlation with declines in mortgage rates is weaker.

"Secondly, not merely has New Zealand experienced the strongest house price increase since the GFC, it has also been accompanied by almost the steepest increase in population and the strongest decline in mortgage rates across our sample economies."

Fitchett and Jacob say residential construction in New Zealand has progressed at a rapid pace after the Global Financial Crisis, in fact, more rapidly than in most other economies.

"However, New Zealand’s population has also grown at an increasing rate, again almost the highest in our sample.

"This mismatch has constrained the availability of dwellings; the number of dwellings available per inhabitant steadily declined over most the 2010-2020 period, and was the lowest among all the economies we consider."

The authors say the relatively weak supply of housing in New Zealand was accompanied by construction cost inflation that was high by international standards.

"On the other hand, the demand-side of the New Zealand housing market was buoyed by robust population growth, and mortgage rates that experienced the strongest post-GFC decline among the economies we considered."

The lower interest rate cost of mortgage debt along with robust population growth are likely to have supported an increase in the demand for houses. The combination of strong demand and limited supply generated an escalation of house prices in New Zealand, more so than in other economies, Fitchett and Jacob say.

"To sum up, the combination of relatively stronger demand-side factors and the relatively constrained supply-side factors pushed New Zealand house price inflation to the upper end of the cross-country spectrum."

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

85 Comments

Well I guess that settles the argument: is it the government's fault or the Reserve bank's. The answer is both

i dont get why any of this is surprising, needs graphs or economists. RBNZ probably concocted the perfect receipe for a pefectly tuned house market bubble and waay better than average crash..

for best crash results: 1. give people access to tons of free money, 2. let them leverage that money with the bank for more free money (2b.minimise your control over how much they can borrow of course). 3. tell them to invest in houses because they always rise in value (practice saying ' the nz economy is nothing like ireland, we have 'sustainability' on our side) then 4. flood the place with more people to create a big shortage of houses (4b. oh yes, also an important ingredient is to make it really bloody hard and expensive to build any new ones). 5. as an experiment drop the interest rates lower than everyone else , 6. print a ton of cash to really ramp it up 7. if asked deny always that there is a bubble or recession coming (simple tip - when people do realise it has to happen now, act really shocked and say that it was always the obvious outcome.. dont ever actually apologise for anything) 8, do nothing to support other industries and encourage everyone into building, development, trades or buying investment properties... 9. put everything into the economic oven for about 8 to 10 years with a pandemic and populist goverbment then wait... a long time.. in fact for best results we recommend to prolong cooking of house prices as long as possible doing everything to delay the 'pop' for a bigger and more dramatic CRASH

I am not sure there are many ways the RBNZ and Government could have done it better? scratching my head to sport missed opportunities to hike prices more to be honest.

Looking forward to future article:

"RBNZ research shows declining population & larger increases in mortgage rates in NZ than most comparable countries, and the biggest drop in house prices"

Stands to reason!

You jest! but i feel certain the joke will be on us in 4 years when said article is published.

Head scratching stuff! It’s mind boggling to me that a residential property market has been allowed to over inflate this badly. I guess people react to signals from the authorities right… tax free capital gains for all!

Not that simple really. Capital gains tax on second properties, whether they be investment or holiday properties, is fine but everyone has to have a residence to live in. So slamming a capital gains tax on each and every property sale when someone is selling then buying in the same property market is unfair.

I guess the statement by these RBNZ guys shows they are now fessing up to the fact that slashing interest rates two years ago and offering near to free money without any restrictions by either RBNZ or the government on just what that money was used for has resulted this mess. The RBNZ don't have a lot of wriggle room and some first home buyers are going to feel real pain from all this.

"So slamming a capital gains tax on each and every property sale when someone is selling then buying in the same property market is unfair."

Why is it unfair?

If we follow the pre-2008 trend line, it looks like we could be in for a correction to 2015 price levels, unless the immigration tap is turned back on.

Didn't we assume the hundred thousand-plus temporary migrants who received PR, i.e. became eligible to buy homes in NZ, were going to save the market from falling off a cliff?

New arrivals this year will gain PR by mid to late-2023; a correction of some sort will have long happened by then.

Its almost as though adding demand by people volume and ability to pay more might have an impact on prices. Who would have thunk it

Haha exactly.

only what we have been talking about on this website for many years…

clowns

Nononononono, it's all about the cost of materials. Housing is diffrunt, and speshal. Interest rate increases have reduced borrowing power by 30% in the last 12 months, but people were never borrowing to their limits so they will just wear that 30% to satisfy the vendors.

Also, apparently there's returning expats with suitcases full of cash looking to buy property.

We don't need the top-ranked universities, high pay, great career prospects, good living standards and quality infrastructure to snatch those cashed up expats from the likes of the US, Canada, Australia and the UK.

Why wouldn't someone be willing to pay Melbourne median house prices to live in Manukau city or Titahi Bay.

I read some article the other day that the Roe Wade decision led to a spike in "live in nz" searches on the internet. This will save us.

Rocket science!

Not!

I love a not joke.

What these comparisons miss is that a 'house' is not a homogenous product.

In NZ, a house has generally meant a ~400m2 section and a standalone house. In most other developed countries it is a terraced property / flat / apartment with limited land.

I think the main lever that will change affordability in NZ will be increasingly efficient use of land as properties in NZ increasingly move from the former to the latter.

I'm not saying that current properties are not overpriced, I just think anyone expecting a 'reversion to the mean' over the next few years is likely to be disappointed.

I think we will see a pretty significant drop in prices, circa 35%. I agree that we will see a change in the properties we are building (I am betting on this with my own money) both from the necessity of intensification but also in regards to the changing cultural mix of our population. A lot of our recent immigrants will have grown up in apartment living and a lot prefer it. They are more focused on friends and family, the lack of maintenance tasks enables more time for this.

There's already been a 30% drop in borrowing power over the last 12 months due to interest rates rises. It's happened so fast, that it's barely had a chance to fully filter through, although recent REINZ HPI figures suggest Auckland and Wellington are halfway there already.

Agree on the apartment living but it's not just maintenance tasks. It's being able to have services within a 15 minute walking distance. You can get your entertainment, retail, grocery, libraries, sports, gyms, cinemas, everything all within a walkable distance, it's friggin' awesome and even better for kids.

Ironically the people that are most set to benefit from the change are retirees who are the most vocal in opposing these changes. Both my grandma's ended up being stranded in big houses with lovely gardens away from any services. Their mental health deteriorated badly until they moved into apartments in town. Once they were able to get out the house and go for a coffee with friends and local activities they both recovered. We're social animals and we seek human company, houses on section in the suburbs are barriers to this. The negative mental health effects of suburban living are well documented.

Bi-partisan population policy needed, yesterday.

Limited to 0.5% a year, you have my vote.

Shambolic economic policy over these last two decades or so. Reliance on sugar rushes rather than rewarding productive enterprise.

Rick! What is going on here?? Am I actually agreeing with you?? ;)

I will say, having worked in the DIA (Immigration), that this problem will be hard to manage. The teams that held the gates (Hodor!) when I was there have all retired and in any regard times have moved on and our new more progressive cultural position means this is a mine-field.

Although I hold out hope for Dr's and Nurses, it will not surprise me (at all) to see a continued majority of immigrants falling into the "Retail Manager" and "Tradesmen" categories.

Am I actually agreeing with you?? ;)

Can't be too surprising :-) I voted for John Key twice because of his campaigning on fixing the productivity problem (us lagging and falling behind) and the housing crisis. All I really want is some politicians who actually want to reward hard productive work rather than speculation, ultimately. And economic policy focused on this, not sugar rush fakery.

I know, it's a hard road finding an honest politician prepared to make good, solid policy calls haha.

What is hard productive work? Why doesn't the market value this already rather than "asset" values?

What's the difference between the serfs of old performing the hard productive work for their barons and landlords, and the essential workers, factory workers, cleaners etc of today?

When many industries already demand 10 and 12 hour days from their workers, where does the extra productivity come from?

Where's the balance between unvalued productivity - ie maintaining home and family, community interests, individual health and wellbeing - and valued productivity?

The productivity narrative being pushed is BS. For what their paid how productive is the productivity commission and how do they add anything to "the economy"? How productive is the FIRE industry? What are these new productive enterprises? More rocket labs, more xero's, more farms? It all sounds like those in power, in high positions just demanding more from others and not willing to lead by example.

Maybe productivity isn't the answer but a paradigm shift in values is. Does policy just reflect an embedded belief system?

Alternatively, if there is already enough for everyone what use is producing more?

We tax productive work heavily while not taxing asset value increases, thus have seen a dearth of capital for business and over investment in land speculation. Fundamentally.

Also see Milton Friedman on this.

There may not be purpose to producing more, ultimately, but incentivising sitting on land rather than contributing through work hasn't done NZ much good. Certainly hasn't improved living standards or equipped us economically to support the dependent elderly population or all Kiwis' healthcare needs.

Milton Friedman was a shitty economist who completely denied the concept of unearned income, aka rentseeking. His economic recommendations and the dominance of chicago economics is what has produced the hyper financialized economy.

All the classical economists from the Physiocrats, Adam Smith, Ricardo, Marx, Fredrich List, Thorstein Veblen etc spoke of the "Free Market" as in free from rent seeking. Simon Patton, the first economist for the Wharton School, spoke and wrote extensively about this. You want to reduce rentseeking using the force of the state to enable productive labour.

Half the reason our economy is so uncompetitive is that the rentseeking behaviour through landlording, financial interest etc drives up the costs of production enormously. High land prices and high housing prices, created by intentional policy decisions of the RBNZ and facilitated by the economic planning of the big four banks, makes us unproductive. When 40% or more of your income has to go to rent, how on earth do you save money or invest in productivity or compete?

The paradox here is that the state should intervene to drive down housing/land prices and any other rent seeking behaviour in order to lower the costs of production for all other industries. Yet this conclusion is impossible to reach without acknowledging the concept of unearned income, which Milton Friedman did not acknowledge at all.

However, Milton Friedman had it right when he advocated for taxing the unimproved value of land rather than productive work. Which would precisely target tax avoidance, rent seeking, and unearned income accruing to land through societal betterment.

Put LVT on the unimproved value of land up and push tax on income from productive work right down and we'll get far more investment in productive enterprise rather than just sitting on land. Liberalise zoning to match, and you'll get far more maximising of land.

The main issue with LVT is that it requires the land to first be zoned to give it a potential 'betterment value' on which to create a value to be taxed. IE it is driven by policy rather than the free market. is just another form of rent-seeking. And now the private and public sector developers are fighting over the capture of this artificially created value.

The most rapid infill housing is now taking place in Cities like Houston because they never forced high-density housing in the first place, so any that is taking place is on land that is low density and cheap and is driven purely by what the market wants, not some ideological planner forcing density onto people with the corresponding high price that comes with such ideologies.

Productive enterprise-no tax. FIRE sector-taxed.

Meh: Productivity means firms investing in software, plant and machinery ( eg fruit picking and sorting machines, CAD, prefab factories etc ) and investing in their workers. Many owners don’t want to do that, preferring to just lobby government to let in more low paid workers.

Oh so you're in the know then. How does a Government actually enforce reductions in migration numbers?

My gut feel is that Labour's election promise was never going to come to fruition because the DIA and other government agencies are on their own little mission. They got the memo, but gave the middle finger. Maybe bonuses/KPI's are tied to numbers processed?

Well things will have moved on since I was there, but the way it was done was actually to set specific targets in consultation (light) with industry for specific roles. Those visa's were then published and applications were taken only in line with the numbers sought.

The barriers were a little higher as well, I remember the language requirement being lowered (still required but no longer level 4) while I was there.

NZ has been built on immigration so our culture was pretty open to very high (by international standards) immigration as a percentage of population. What we did not learn from the lessons of the UK in the 80's (where immigration from previous colonies such as Pakistan, India and the Caribbean was very significant) was that all immigration needed to be directly reflected in the planning for not just schools (which is where NZ gave up) but also hospitals, housing, roading, water, sewerage... (you get the idea).

As a result of a lack of clear understanding about the net impact of a new NZ'r we have been absolutely hammered by a lack of infrastructure.

Your comments are less authoritative when you realise DIA hasn't done immigration for over 20 years.

I thought I was pretty clear about it being a long time ago but I am relaxed the processes will be similar. Happy to hear from you if you have relevant experience to share?

Well according to Dale Smith, you don't need to plan anything. The markets will sort it out. Spoken like a true developer.

I have never you don't need to plan anything.

You need fewer plans that are the right ones, as opposed to the current plans which are many and are the wrong ones.

That is what a truly free market is about and you don't have to take my word for it, all you need to do is read a bit of Adam Smith, Alan Evans, and Alain Bertaud.

And unlike yourself, I have worked in overseas markets that were 3x median income and still are. And in NZ where they were 3x median income and they are now not.

And since I am for housing that is more affordable, and you are against me for wanting that, why do you want housing to be unaffordable?

Absolutely, and from BOTH Labour and National.

100% and a big part of where our money earned from income flows (into productive enterprises or speculative assets) is centred around our tax system (which needs to be completely overhauled) and RBNZ enforced bank lending policies.

Neither party wanted to fix either, so the acceleration of the status quo it has been, until now.

In other news global warming has accelerated as whale slaughter declined

Can you imagine the amount of methane a whale gives off?

'Thar she(they) blows.'

What was the alternative. Not drop interest rates like the rest of the world and watch our dollar go through the roof.

Allow investors to take the hit and give owner-occupiers a soft-landing with a structured climb-down on housing values.

All the benefits of ending up with a lower house price after the fact with a plan in place to stop people's lives being ruined.

Investors would not have taken a hit as they would have simply been in market.

Investors are not to blame for house price appreciation, a lack of a capital gains tax, appropriate LVR's, a lack of appropriate loan targeting regulation (residential housing is the least risky loan to make for a bank), and finally low interest rates are.

Investors have built as many houses as any other population group, in all likelihood more.

Investors in parliament and their voters kind of are to blame.

Normal service is resumed :).

I'm sure if yarning over beer we'd have far more in common than not haha. I'm just suitably jaded.

I read somewhere that it was a very high percentage of FHBers that got their deposit from mum and dad. I suspect are very high percentage will be going back to mum and dad to get through this.

Presumably the ability for mums and dads to provide deposit assistance will be reduced as their own property values tank?

Yep, having to live with your parents, and explain what happened to the money they lent you. Could be a lifetime of chores and going to bed early.

Flabbergasted and astonished!

That type of report is so Generalized, it is like asking a General Practitioner about Brain Surgery.

Looking at the USA for example as one homogenous group is misleading. The States, which have different laws, especially relating to tax, land, and house policies, are like different countries when it comes to making comparisons.

So California has many housing law similarities with NZ, ie restrictive land-use policies and thus expensive housing, while Texas has less restrictive land-use policies and very affordable housing.

And this is in spite of them having approx. the same issues that the article is claiming are the reason for NZ's high house prices, namely high immigration, and low-interest rates.

Immigration and low-interest rates (and other stimulants) act as accelerants when the supply of land is restricted, ie housing in the fuel, the restrictions are the ignition source, and the stimulates are the accelerants.

If you don't light the fuel by having restrictions to supply, like in Texas, the stimulates do not act as accelerants and therefore have very little effect on house prices.

And that is why Texas has affordable housing in spite of high immigration and low-interest rates, and NZ and California don't.

Texas has very different property taxation too, which I would suggest might be as influential if not more so than their land use regulation.

Tax is important but it is not as important as getting the right land-use policies in place, otherwise, tax just becomes another accelerant type used to control the wrong land policies. ie it is a solution to a problem that needn't have been a problem in the first place.

It is a truism that if you don't get the land (policies right) then everything else is wrong. Because the epiphany of seeing how the right land policies are key will automatically make you adjust every other input like taxes, infrastructure, consenting, etc., correctly. The end result is housing affordability which will be a lot closer to 3x median income than the present 10x median income.

The underlying principle of Texas land policies is a presumptive right to build, with very few restrictions, what Adam Smith would have called the 'Invisible hand,'. this allows supply to meet demand in almost developer real-time.

Californias and NZ approach is a presumptive right NOT to build with many restrictions to supply, and if Adam Smith had coined a term for it, it might have been the 'highly visible hand' (maybe holding a hammer, with a sickle not too far behind).

True, NZ would not have a housing crisis without decades of councils preventing building on much land, coupled then with tax advantage pushing all money into land speculation rather than business...and followed lastly with govt and central bank welfarism for property as soon as hard times hit.

You keep peddling this. It's rubbish. You have to plan for the infrastructure, the physical and social infrastructure. Focussing on the very narrow idea that allowing free land use policy (sprawl) is just somehow going to reduce land prices is just nonsense. And even if it did reduce house prices it pushes up prices of a whole bunch of other stuff like travel costs and social costs like mental health issues from lack of social cohesion.

You need to do some basic reading on land economics, and then look at how it works in practice.

As I said mentioned in a previous comment of yours read some Adam Smith, Alan Evans, and Alan Bertaud, to name a few, plus the NZ Productivity Report on Housing. I know it seems counterintuitive at first, but have a read and then look at the evidence in front of you.

The theory matches the evidence, and there are just as many mental health studies that point out issues of inner-city living, especially with both inner city and the suburbs being unaffordable in NZ.

And while you are thinking about it, NZ used to historically be 3x median income up until the early 1990s, and are now 10x. and yet other jurisdictions that were and still are 3x median income have had all the same issues that some people put forward for NZ unaffordability, namely high immigration and low-interest rates.

It's an easy enough exercise to do to show that almost all NZ house prices are 50% higher than they need to be, and most of that is due to our land-use policies.

So what, the completely denied, lied about narrative that immigration drove housing prices, is completely obvious and true? Almost like the media spent years lying about it and pretending it wasn't what it is.

The media run state sure loves the plantation economy of importing more wageslaves to buoy the bubble economy. What an utter joke.

Just a bunch of folk enjoying short term looting of the economy without regard for the country they leave for following generations...

If the housing market is following the NZX we are back to 2019 which reflects my share portfolio.

That's around 160000 people or 4% of the population purchased houses at over inflated prices. Most were probably National supporters so who cares.

lol not many people around here that is for sure. Of course the social impact of this on those people essentially disappearing from the consumer economy gives you a good view of where our economic measures are heading.

felt like a spruiker style headline -- maybe try New Zealand blew a bigger Ponzi bubble than anyone else - so sit tight and watch the most spectacular of implosions here in good old Aotearoa!

"The combination of strong demand and limited supply generated an escalation of house prices in New Zealand, more so than in other economies, Fitchett and Jacob say."

REINZ was spot on.

Be quick....to loose your deposit and or equity.

Election year next year. The majority of non speculative investors in NZ want the asset reset. Yes some banks will get kicked in the nads, and yes some speculative investors will get wiped out. We just need politicians to get some stones and do what they campaign on.

Stop lower quality immigration, introduce 3x Dti, promote and allow the asset reset, with policy to support FHBers only. And really crack down on gang related meth trade activity.

It's lose not loose...sorry got to be 'that guy' with this awful yet common mistake.

OK, I get that annoys but there no is education going on here. It will clearly be a mistake so what is the point?

..there no is education..?!?

It could be helpful to be made aware of the mistake. In a resume it wouldn't look good. It was once my life mission to stamp it out but I fear it is a lost cause. It may even become the correct spelling one day.

Typos do not mean that someone doesn't know the correct spelling. My phone auto corrects to the wrong spelling all the time.

Besides, language evolves and the rule around spelling are not as rigid and pendants would have you believe.

It's not a typo. The same typo we see every day in the comment threads? It seems like you have been in a coma these last ten years.

* I just read a long discussion about this topic and there are actually people, you may be one of them, who don't really notice this misspelling. Others are hypersensitive about it. It's the reading equivalent of slipping on a banana peel. To us it's incomprehensible and disturbing. On the spectrum probably.

We all wish the Banks to get toe-punted out of the room on this.

Politicians doing what they were elected to do would be a first in my experience so not likely I would suggest. This time Labour got lucky with the timing of a recession, in truth although they were in charge during the most expansive house price period in our history, they will also be the first since the last Labour government to have seen a reduction in house prices.

Interesting to see the immigration levels in Ireland and Spain spike before the GFC. Looks like we're the only ones that had another good spike in more recent times.

Ireland is busy celebrating population growth.

https://www.bbc.com/news/uk-northern-ireland-61910927

https://www.globalpropertyguide.com/Europe/Ireland/Price-History

Their house prices doubled over the last 10 years, which reinforces the claim that house prices double every 10 years.

Just ignore the 70% fall that preceded it. Or the fact that prices are still well off their 2007 peak.

Gee! I wish I could get a highly paid job to state the obvious. Any openings perchance?

Not to worry as whatever fall had to happen has more or less happened as per :

https://i.stuff.co.nz/life-style/homed/real-estate/129123898/slower-hou…

No crash means will not fall beyond 20% and market is already down 10% to 20%> So chill as worst is over is the message in a subtle way despite looming recession and OCR going up by another 65% to 100% - Just chill.

But will it ? Sure the OCR should still be going up but will the RBNZ actually do it ? What happens from now until the end of this year will be very interesting.

$NZD to $USD = $0.62.

Aside from March 2020 (pandemic season) the last time it was this low was 2009. A month ago it was $0.66.

To me the real culprits where Governments that did nothing to plan for the housing or infrastructure that immigration would require. I have no issues with high levels of immigration but it creates a massive up-front cost for society that necessitated a rapid and sustained build-out of housing and infrastructure.

Well this is a bit late, after thousands of FHB were suckered into buying a house in the most over- inflated market in the world. Why wasn’t this information, plus information about previous booms and busts provided as the bubble started to inflate. Am I misremembering, but did the RB actually actively encourage people to go out and buy houses from 2019 - 2020?

Also what about the commentators who argued that the government would never let house prices drop? Where are they now?

I wonder if there is any scope for a class action? I would be pretty pissed if I were a FHB. They are the collateral damage in all this.

Investors and speculators are expected to and should know the risks. Kiwis have been chasing the easy dollar ever since NZs whaling and sealing days, maybe earlier. Then we chased gold and gum, and land. More recently forestry, kiwifruit, the stockmarket, finance companies, dairy farming. Boom and bust. It just goes on and on.

Banks are also expected to know the risks, hence billion dollar profits, because alongside that there is the expectation that they can provide a sound financial service. Yet somehow these billion dollar per year organisations had no clue that their lending rates would increase from 2.5% to 5.5% in one year?

No different to an electrician or plumber, you pay good money and they provide the product/service and carry risk if something goes wrong.

The information has been given widely and often, the IMF was banging on about it since at least 2010, people ignored it because NuSuland is duffrunt

RBNZ’s research paper from 2018:

The estimates further suggest population change may be ‘hyper- expansionary’ as the residential construction demand associated with an additional person is higher than the output they produce. In these circumstances, population increases raise the demand for labour and create pressure for additional inward migration, potentially explaining why migration-fueled boom-bust cycles may occur.

“.The authors note that demand for housing strengthens as the population increases and the interest rate costs of mortgages decline” Now there’s a radical thought. They got paid to conclude that?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.