By David Chaston

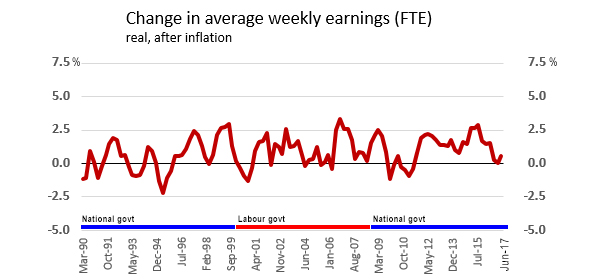

After Wednesday's low wage change data, the question becomes how does that stack up on an after-inflation basis?

And how does it stack up compared with the longer term?

In the five years to June 2017, we are ending a period of the strongest real wage gains since 1989 when the current data series began.

That will surprise many readers (and analysts like me).

| Straight | Overtime | Total | change | CPI | Real | |

| year to ... | $ | $ | $ | 5yr% | av%pa | av%pa |

| June 1992 | 541 | 29 | 568 | +15.9 | +7.4 | +0.2 |

| June 1997 | 611 | 24 | 635 | +11.4 | +2.1 | +0.1 |

| June 2002 | 698 | 21 | 718 | +14.2 | +1.6 | +1.1 |

| June 2007 | 846 | 23 | 869 | +20.0 | +2.6 | +1.1 |

| June 2012 | 1,013 | 25 | 1,038 | +18.9 | +2.9 | +0.8 |

| June 2017 | 1,142 | 26 | 1,168 | +12.5 | +0.9 | +1.5 |

The bounce this quarter from a period when pay gains have slowed keeps going a period of real gains that started in September 2011.

It is true that nominal wage gains have been higher in the past quarter of a century, but inflation was even higher for much of that period, so those gains were illusory.

The data is important because the claim of "low wages" and "low wage growth" will be part of the election rhetoric.

It seems clear that inflation, which has been historically low, is about to get even lower. Monetary policy officials don't seem to know how to raise it with their traditional tools.

If we have real wage gains, the question can be asked about what is the problem with low inflation and why should the Reserve Bank try to lean against the trend.

Rising real incomes should be enough, you might think.

The Reserve Bank however may want higher inflation and higher interest rates in "the good times" so that it has some traditional firepower should the economy need some stimulus. If rates are very low when the economic cycle turns down, they are left contemplating the use of "unconventional" tools, like money printing ("quantitative easing").

Low inflation makes pay packets go further.

In New Zealand, there is no evidence yet that many people are being hurt by prices that don't change higher. It is more a policy issue for the Reserve Bank than the rest of us.

Low interest rates in response to low inflation has had the perverse effect of driving up asset prices, especially for land. (But recent housing data maybe unstitching that idea a little.) It has also fuelled our housing debt, and twisted out debt levels toward more housing exposure.

But back to wages. Any gains higher than inflation add to people's purchasing power.

To get a fair share of the economic pie, these real gains should be as much as the economy grows in real terms.

Here is the same data with the real GDP growth data added.

So the argument should not be that workers' pay packets are not making gains. The real argument is that they are not gaining as fast as the economy has been growing.

That is true now.

But it seems to have been the case for much of the time over the past 25 years as well. Pay has kept up as well in the past five years as in any previous period. But it has not kept its share of the economic growth all the same.

Data for this story has been sourced from Statistics NZ's Infoshare resource, QES (Table: Average Weekly Earnings (FTEs) by Industry (ANZSIC06) and Sex (Qrtly-Mar/Jun/Sep/Dec)) for the wage data, and from the RBNZ for the real GDP growth series (M5).

40 Comments

Minimum wages grew from $13.50/hour to $15.75/hour in 5 years. That's 16.7% increase and way above CPI for these 5 years. So despite common "noise" minimum wage earners are better off today than 5 years ago

Which would be about 3% annualised? Cost of living hasn't moved in line with CPI inflation either unfortunately.

Except what about house price inflation and building cost inflation? Why are house prices not included in inflation figures?

Enjoyed the article and analysis. I'm just a layman but I was left wondering if there isn't a better alternative to OCR to drive inflation that would prevent the distortions we've seen (both in housing and elsewhere) and possibly a better way to measure inflation that could more broadly account for cost of living.

Stats NZ collects about 100,000 prices from about 2,800 retail outlets and 2,300 other businesses and landlords for the CPI survey, each 90 days. The details are here (see Tables in MSExcel workbook). I would be interested to know what items are missing to account for the cost of living?

Adding house prices doesn't count. They are not a cost of living element. But rents are (and they are included), and mortgage interest is (and that is included). The cost of houses is not included for the same reason the cost of a car is not, nor the cost of a boat, nor the cost of shares, or any other capital item.

CPI is a 'flow' measure, as is "the cost of living". Houses are a 'stock' measure.

"Low inflation makes pay packets go further." No it doesn't, it means the rate of loss of spending power is reduced.

Low inflation allows workers and employers to negotiate smaller pay increases to maintain relativity with costs of living, but many workers pay increases over the years have not kept pace with the rate of inflation, or with the things that drain the bank balance but are not measured in the CPI, so it could be argued that a period of low inflation is an opportunity to make up for lost ground if the business is doing well.

We are a low wage/cost economy said Bill English with a smile on his face at this great achievement. However the low income people are struggling, could be to the detriment of the National Party in this election, if the struggling sector come out to vote. People have had enough.They need more money in their pocket to have a better life and to save something. Maybe even buy a house. Immigration is having a huge effect on wages.

I met a grower who supplies a major supermarket chain over the weekend , and he was frank about the wage rates in NZ which he says are way too high for the agricultural sector

So by "way to high" he's suggesting the minimum wage is too high?

If that's the case perhaps you could have suggested he get out there and harvest the crops himself ?

Well, a classic reaction to unacceptable cost increases is automation. Chiefio has a dissertation here: https://chiefio.wordpress.com/2017/05/11/why-robot-labor-is-disruptive-…

And the money shot, as far as Ag work is concerned:

In the ’70s, Cezar Chavez “organized farm labor” with a focus on grape pickers. Now there are mechanical grape pickers, largely a result of his efforts raising the price of labor and, more importantly, making it unreliable at harvest time. A strike at harvest time is simply not an acceptable risk. That was when the last major tranche of farm labor left the fields.

Plus ya gotta do the math and look at the effect on profits when costs increase: if cost X is say 30% of total opex, and profits are say 10% of sales (i.e. opex is 90% of sales), then a moment's calculation will yield the perhaps surprising result that a 5% increase in X will cause a drop of 13.5% in profit (it is now 86.5% of pre-X-increase rate). And businesses routinely decide product mix, location, staff levels and much else, on relative profitability......

Careful wotcha wish for....

Very true waymad.

Mechanisation is the biggest factor in raising productivity and living standards; its a good thing. Surplus labour and low wages lead to reduced incentives for productivity gains through improved methods and machinery. It's why they still build roads with human labour in India and why they have one of the lowest productivty and standards of living in the world. The post war labour shortages stimulated one of the biggest leaps in living standards - certainly here in NZ.

Importing cheap labour is a race to the bottom.

Leveraging energy resources is what lifts living standards - mechanisation certainly helps achieves this... It creates an energy surplus in the system. But the kicker is to invest in the mechanisation you need viable "consumers" downstream to load & service the upfront debt ... in other words you need growth in resource (energy) per capita to keep those debt servicing payments coming... This is ultimately where India has been kneecapped.

Now the entire West is on the same path ... chasing cheaper labour because of debt & energy/resource limits.

Under National the grower should be smiling. This massive immigration we are experiencing is designed to keep wages down and profits up.

Interesting comment Boatman. Perhaps its the supermarkets that are screwing him that's really the problem because agricultural workers are among the lowest paid and hardest working. There is also claimed to be a recruitment problem which would tend to indicate that the wages aren't high enough. Something not right there.

The figures in the article are for average wages and, as we've seen, the median wages are falling well below the average. Wonder how things are in median land. It does seem highly unlikely that we'll be seeing any decent wage growth outside of the top 10 or 20% with "our" governments cunning plan to access workers from the billions of third worlders.

which is a classic example of diminishing returns at play ... to a point where the grower cant afford to pay the workers enough to afford the grower's output...

So are these average or median wages and is 'shrinkflation' a factor?

"If we have real wage gains, the question can be asked about what is the problem with low inflation.."

Diminishing returns right across the economy in terms of resource "use" and the one off use of non-renewable resources. Economically we pick the easy fruit first, making (real) growth continually more difficult. This is reflected in the need for ever lower interest rates to manage debt burdens ... until you hit an interest rate floor.

Then what?

David, I wonder what these numbers would look like if we treated the wages gains as marginal and thus attracting marginal tax rates.

With bracket creep I suspect would be a lower figure ?

Anyone with data on this perspective ?

Eco 101 - Think at the margin !!

More than offset by the raising of the bottom 2 tax thresholds.

Potential permanent residents are known to over report wages and under report hours. Has this been taken into account? My local restaurant was prosecuted for paying $3 per hour for 90 hour weeks. Would the numbers involved be too insignificant to distort these stats? Are there separate figures for long term resident immigrants and native Kiwis against the various non-resident employees on work visas?

Labour did nothing for working peoples wages during 9 good economic years, electing instead to give hand outs thinking this would mean the recipients would have to continue voting Labour. They didn't count on the Nats saying that they wouldn't be out bid in this area. The net result is the govt is subsidising employers by propping up otherwise unacceptably low wages.

Measuring wage growth against the CPI is too one dimensional given that house price growth is not in the CPI

Cost of living is what you pay to live. So includes mortgage (rates are low) and rents (going up). Changes in the value of the property you live in does not change your cost of living - but it might make you more free and easy in spending and/or stop saving.

That is fine if you own. But if you don't own, assuming house prices rise quickly and the necessary deposit % remains roughly constant, then you could easily be paying much more today for a house than you would have 5 years ago. You will be paying more in total and you will be paying more on a weeky basis.

It may be a matter of interpretation. For myself I own the house my family lives in so whether its price goes up or down is little concern to me (I would prefer to leave more money when I die but not looking forward to the event).

On the other hand I have an adult child who has all those CPI expenses (transport, rent, food, etc) but you could say she has one more expense which is the savings she makes every payday towards eventual purchase of a home. Clearly the more house prices go up the more her pay packet fails to cover the things she would like to buy - say holiday, her child's sports, new clothes.

As a retired bystander trying to be impartial I certainly think everything is harder for young people than when I was that age. Maybe I will vote for TOP's young person's UBI - the argument on their website is persuasive.

We need the tenants to pay enough so that we can pay the mortgages, rates and maintain the properties properly including paying for their lawn mowing and water charges. If there is enough left I might even install a heat-pump to keep them warm!

If I were one of your neighbours in the DGZ I would be embarrassed to acknowledge you. Most of these people have more than likely made their money through sound commercial decisions not the exploitation of their fellow citizens and are quite philanthropic. You sound foolish

Agreed. I wonder what CPI would be if housing was included, actually I do know,, it would be shocking!

My guess is that the lion's share of wage gains are going to the top quartile of wage earners. The highly skilled are capturing 10%+ pay increases while the bottom quartile tracking inflation.

"guess" is the keyword here.

This would be far more realistic if it was taken on median rather than average wage, as that is a better representation of what is going on for most people

Quote from a Statistics NZ talking head on radio NZ "most of the low CPI is the result of calculations for improvements in technology" so your iphone goes from $500 to $1500 but it triples in utility so it's price in the CPI model doesn't change. Go eat your phone. That is why the CPI doesn't seem to match reality because it doesn't.

Yes.

And many higher end or luxury products have gone down in price, which pulls the CPI down.

But that means little to the strugglers who are paying 3-5% extra for groceries.

It's a flawed and one dimensional tool.

It has it's place but needs to be applied and interpreted with caution.

Is shrinking food package sizes taken into account with the inflation figures. eg when manufactures reduce the size of the packet, rather than putting the price up? eg Butter used to be 500gm, now it is 400gms. I remember when bags of potato chips were 200-220gms in size, now most have shrunk down to 140-150gms.

And toilet rolls will be not much wider than party streamers before too much longer. Shrinkflation they call it.

My understanding is yes, however there is also the double whammy of using cheaper ingredients as well as downsizing not sure if that is captured.

This is why I like the $ per kg labelling so much 110g of Camembert is more expensive than 125g and you can see it easily and instantly.

Lack of inflation is not a good sign

http://www.credoeconomics.com/approaching-a-global-deflationary-crisis/

Indeed...this is what it looked like in the late 1920s and that didnt end well.

Lets get rid of the kiwi mindset of low incomes. We should aim for profitable business and better wages both. When I was in Hong Kong and China in the early 90s incomes were doubling every three or four years. Think what that might do to your headspace over a decade when it happened for everybody.

Put New Zealanders in first place and lift the lot of us.

Doing that requires business growth, which requires lower taxes, which requires lower handouts, which no one wants to do.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.