For many years now some of us have been banging on about the fundamental policy bias that has led to an over-investment in property.

Still on the political front nothing material has been done to deal to this cancer because of fear by politicians of the personal political cost to them.

While there is a generation of new economists and financial sector commentators banging the drum on the housing market disequilibrium, the messages are very similar to ones I and others started sending back in the 1980’s – when the ratio of the median house price to median income first started lifting beyond the 2 to 3 times range (note that 3 times is the international benchmark for “affordable”).

Now they are up around 6 nationwide, and over 9 in Auckland.

With National and Labour both denying house prices need to come down, that means even if we keep house prices constant we face decades of unaffordable housing while incomes catch up with house prices.

The problem in this market is demand not supply – although of course if demand keeps growing then slow supply growth will exacerbate the problem as will boosts in supply alleviate it – for a while.

But fundamentally what has and continues to happen, is that demand grows to levels totally unrelated to the demand for accommodation.

Unlike successful economies like Germany that have prevented this type of entrenched disequilibrium from distorting investment patterns in its economy, New Zealand’s property market is absolutely a slow train wreck. And I mean slow – we’re talking decades, not just the latest cyclical extremes.

To recap there have been two persistent policy settings that have generated to artificial elevation of demand. They are:

- The Reserve Bank instructs the commercial banks to treat property as a lower risk form of lending than all other types. So naturally those banks do not need the same amount of capital to grow their mortgage lending as they do any other form of lending. This practice originates in what has been convention from the Bank of International Settlements (BIS) standards. Anyone versed in economics knows that if you create a market distortion like this, which amounts to manufacturing a profit opportunity, then the market will respond. In fact the market will respond until the day that it ensures the contrivance no longer holds. That is until the day when the last cargo cult investor wakes up to the reality that no asset class is necessarily less risk prone than others, that there is no “natural” law that says its so. Every asset class has limits that turn it from moderate to extreme risk – markets continually are searching out those limits. The Reserve Bank appears to be waking up to this problem with the restrictions it is now putting in place (loan to value ratios and possibly debt to income also) but it is too little, too late.

- The second policy-induced distortion to the property market is the lack of tax on the full return that property owners enjoy. Yes they are taxed if they rent their property out. But they are not taxed on the benefit they get from enjoying the use of the property themselves – and that is a massive benefit that becomes even more massive if part of it manifests in long-term (also tax free) capital gain. The Government Statistician recognises (as all Government Statisticians do) that the benefit you enjoy from owning your own property is income – as much as income you enjoy from earning interest on a bank account is income. The latter is taxed, the former is not. Which is why some of us have been pushing for the imputed rent on owner occupied assets to be taxed – each and every year.

Now some countries try to deal to the second issue by having wealth, stamp duty, property or capital gains taxes. None of these are done well actually but some have been more or less effective. New Zealand is noticeable in having none of these. In combination, the two policy-induced distortions to the property market are totally toxic and are what’s driving decade after decade rise in the ratio of house prices to income.

I have argued with too many Reserve Bank Governors and Finance Ministers on these issues than I care to remember, but the answer from the incumbents is always the same. The Governors say they’re doing no less than what other RB Governors do as per BIS so they don’t take responsibility – and of course the Finance Ministers all say they have their political careers to think of. I know of no other country that boasts the combined policy negligence in this area to the extent New Zealand can.

So it’s nobody’s fault apparently.

The intergenerational damage and the unnecessary exacerbation of inequality not to mention the lost opportunity from misallocating investment to generation of income as opposed to generation of redistribution is just inexcusable.

A plague on both their houses.

Gareth Morgan is a New Zealand economist and commentator on public policy who in previous lives has been in business as an economic consultant, funds manager, and professional company director. This content was first published here and is used with permission.

78 Comments

Oh well to late now. Just sit back and grab the popcorn.

Well actually it's not too late and there is a way to easily dampen down house prices starting with Auckland.

Now lets think; when did property prices in Auckland actually drop? Have we forgotten so quickly? From October 2015 to January this year Auckland property prices fell by -8 to -10 % that's a big drop for three months. And once Auckland's property prices drop so will the rest of NZ.

Why did this happen? it was a direct result of Non-resident Investors being temporarily locked out of our housing market due to the new IRD regulations and they had to process new IRD numbers for them.

So the simplest answer to reduce house prices here is to restrict Non-resident Investors in to our property market. Their funds can still be utilised but in a more useful form in helping to support new building projects, rather than forcing our young kiwis in to economic slaver.

Well all know that this type of non-resident investment has had a devastating affect on our housing market and has continued to push out resident property investors in to the provinces and our FTB's have been largely excluded from the market unless they have had massive support form their Parents.

Australia is already restricting Non-resident Investors so why can't we? And don't say we can't due to our trade agreements we all know that's a pathetic excuse.

I agree non-residents need to be restricted to new property only, effective immediately. The new RBNZ rules restrict NZ citizens' ability to invest while foreigners who have probably borrowed offshore can continue to plunder our real estate unhindered. National and Key are being unpatriotic by their non-action in this respect. Surely they aren't just plain stupid?

I see Winston is reported today in the media with some pretty strong comments. He needs to get to be a lot more visible in this space.

I think it needs to go further, no non resident should be able to own rentals, at all, NONE, not even new houses, they could rent out the ONE they would be allowed to own! That would of course mean reversing the 2011 amendment to the investor category for prospective immigrants to allow them to include residential property investment. That was probably what has pushed the property market over the cliff, everything else took it to the edge.

The globalist (New World Order) agenda is the breaking down of national borders and the opening up of markets to overseas speculation and ownership. The Key government is a globalist (New World Order) government, and will therefore continue to promote what is good for globalists ahead of what is in the national interest.....until they can't. Sometimes promoting globalist agendas requires active measures, and sometimes it requires sitting on hands and doing nothing.

Needless to say, the globalist narrative is unravelling rather quickly, now that both Russia and China (along with a significant number of smaller nations) have dug their heel in and won't comply with edicts issued from Washington.

Don't be surprised is it gets very messy on the international scene from here on. And don't be surprised if the stampede to the perceived safety of NZ increases dramatically.

That's what Trump is against.Globalisation.

Also why Brecht happened people are starting to say enough with globalisation if it disadvantage the local population

I'm not sure on the specifics of an 'imputed rent' type tax, but it seems like it would be complicated and have to have all kinds of rebates. Also, as the article infers, an unlikely election winner. So, it seems like a very remote option and something that could only be introduced after a Communist revolution and total market crash.

Lots of things have contributed to ever increasing house prices, but a reduction in demand and an increase in supply, could have been all that was necessary to keep a good equilibrium. Considering how much time and warning we have had, it is unlikely anything radical will happen, until it absolutely must.

Good points, but there is no mention that NZ is joined to the rest of the world, specifically the NIRP reality of free money. Investors (and I don't mean the many traders and speculators) are chasing a combination of security and yield in a world where an acceptable combination is getting hard to find.

What we are seeing is hyperinflation of real estate and it's not only in NZ if you look around.

Back in the 1980's - before Douglas and Co's liberalization, housing credit was severely rationed in our controlled economy. We now have an open economy which has resulted in an avalanche of credit availability, naturally much of it flowing into real estate given its blue-chip security status for banks.

I don't think there is a solution unless that involves making property unattractive as an investment by regulating and taxing it to death. It is unlikely alternative investments with the same security and yield will become a realistic alternative. That is something Gareth may be able to discover.

What was NOT rationed, was the supply of land for urban development! In fact, wasn't Roger Douglas himself responsible for NZ housing supply hitting record annual highs, even compared to the great suburban explosion of the 1960's? Something like 50% higher than currently, in the face of lower population?

We cannot dispute what Gareth says but intergenerational damage perpetrated by politicians and their accomplices over the past three decades extends far beyond housing affordability and into practically every aspect of life. The majority of young people have never had worse prospects than now. They face collapse of the global energy system, collapse of the global environment and collapse of the financial system over the coming decade or so (perhaps over the coming few years).

I am no fan of Donald Trump but am consoled by the fact that he is speaking unmentionable truths that have been covered up for decades in America: "Again, I will tell you the plain facts that have been edited out of your nightly news and your morning newspaper: Nearly Four in 10 African-American children are living in poverty, while 58% of African American youth are not employed. 2 million more Latinos are in poverty today than when the President took his oath of office less than eight years ago. Another 14 million people have left the workforce entirely.

Household incomes are down more than $4,000 since the year 2000. Our manufacturing trade deficit has reached an all-time high – nearly $800 billion in a single year. The budget is no better.

President Obama has doubled our national debt to more than $19 trillion, and growing. Yet, what do we have to show for it? Our roads and bridges are falling apart, our airports are in Third World condition, and forty-three million Americans are on food stamps."

Trump will not be able to undo the damage done, of course, and many of his policies are simply insane. However, his popularity is symptomatic of how rotten and dysfunctional the system has become.

Here in NZ 'we' could stop making matters rapidly worse for young people. Unfortunately, 'we' won't. The 'Money God' won't allow it..

GM says the current housing wreck, or wreck to come is created by 1. RBNZ' preference for lending to housing and 2. lack of taxation on gains property investors are making.

Economists are very good and forecasting, irrespective of whether their forcasting comes out actually happening or not. Mind you they always have a bob each way- as there is ALWAYS a 50% chance it will or will not happen. Either way, if they win, they come out thumping the table-'I HAVE BEEN SAYING THIS ALL ALONG BUT NOBODY LISTENS" and if they come out wrong, they will still come out with a decent explanation- this is economics. Remember the forecast of VERH HIGH inflation with a follow up interest rates coming in 2009-2011.

Getting back to (1) above--economists say too much investment in housing because of RBNZ's inclination/thinking houses are safer. I wonder is that why banks dont like lending to buy shares. After all shares have performed extremely well lately. I would rather borrow to buy bricks and mortar then to buy shares. Nothing wrong with shares, but keep that argument for another day.

As for (2) above- "lack of taxation on housing"- no different to shares--you trade, as a trader does, you pay taxes on gains, whether residential investment or stock market investment. You trade, not as a trader in either, you keep your gains. At least with housing you pay a bit from any positive rental income. Both investors invests in stock, one is housing stock and one in companies engaged in businesses. For some reason, the economists believes its better to invest in NZX company like FBU (which undoubtedly is an excellent original NZ Company) selling all sorts of building related stuff but somehow its not so good in investing in what ends leaves FBU factories and becomes the end product- Housing stock and the associated employment created.

Sure we might have over invested in one and neglected the other- its called choice. Think for a moment why you are likely to be shown the door if you get in to borrow to buy shares. Housing is a cycle like cycles in all other investments. Those that are sensible will continue, those that arent will have some issues. Surely, just because some are overindulging does not mean this form of preferred investment is better than the other. Like a good Chardonnay, have a few, feels good, have a few more it may or may not make you feel better and may crash with a hangover. But surely, there will be some who will say we are overindulging and should put some controls in availability of this good Chardonnay.

Remember in 2011, we were told this removal of depreciation on housing investment thing was going to sort out the then housing problem. They did not consider the consequences of investors slowing a bit. Exactly the opposite of the intensions of removal of depreciation happened. It did not take much for the property gurus to come out and say "housing investments would slow"--exactly this happened which culminated in housing shortage and when the demand came back (dont indulge too much into why the demand came in- whether it was from immigration, chineese buyers or John Key whoever you might want to blame), it just came as they always do. What else did we expect to happen apart from a distortion in supply and demand.

So to housing investors, you are a help rather than a burden--just be careful like everything else. Hope they dont totaly ban you from investing in housing.

Let's just for a moment assume the latest polls are correct. What would that say about NZ society? I don't believe the poll, but you just can't rule it out can you? Things are drastically changing in NZ and around the world. You gotta wonder

The only poll that matters is the one on election day. As the world has seen in the past month - the markets were confident that Brexit would fail (and the bookies) - and we now know how that turned out.....

National winning, Brexit winning and Trump winning are all on the same dimension of reality in my opinion. If there was a landslide to Labour/Green then that would be the anomaly in the current political environment.

As usual you miss the point. The market believed that Brexit would fail in the week preceding the vote. The last poll (the Norhtland byelection) National lost and the only thing Trump has won so far is the Republican candidacy for President,

You do realize that Trump is an isolationist and Brexit has strong isolationist undertones (both could be considered anti immigration) and yet National have a strong pro-immigration policy. Talk about confused. You seem to pick bits that you like and ignore the rest.

Yes and on that theme I would expect WP to have a really strong showing next election as his party taps into the anti immigration vote

yes FTSE up 400 points, unemployment at an 11 yr low and the drop in the pound welcomed by business finally making exports competitive - 11 major economies approaching the UK looking for free trade agreements - including 2 that are each bigger than the entire EU .....

the anti national rhetoric on here is reaching the same levels it did prior to the last election - but the silent majority will have their say in the same way .

its not just housing - and every homeowner int he country who are happy - tourism at all time highs - so hotels/ food establishments/ tours/ ski fields/ then there is kiwifruit - wine, recovery in lamb exports - film industry - and unemployment is really low - if you want a job there are several to chose from - anfd finally builders, tradies, architects, engineers - all working 50+ hours a week more if they want and about 10 years work at this level ahead of them -

53% seems about right

yes FTSE up 400 points, unemployment at an 11 yr low and the drop in the pound welcomed by business finally making exports competitive - 11 major economies approaching the UK looking for free trade agreements - including 2 that are each bigger than the entire EU .....

The silent majority, as you put it, in the UK are in reality being eaten alive.

Not since the 1860s have the UK worker experienced falling real earnings over a ten-year period. Such dramatic change obviously does something to the so-called social contract people have been tricked into. People no longer believe in a brighter future and there is nothing more detrimental to a human being than that. No longer vested in the status quo, people opt for radical change, hence; Brexit, Trump, Le Pen, Lega Nord, 5MS. Old rules does not apply anymore. Read more

they have been getting stuffed for a lot longer than 10 years - and BREXIT was them having their say and starting the fight back -- its a message that says either start to look after ordinary people in our country - or we will stuff you at the poles! the status quo is perpetuated by a tiny elite - on all sides of the political divide - which is why the radicals are starting to win -

Do you REALLY think there is a future for tourism, eating out, ski fields, the film industry etc. when the bulk of the world is up to its eyeballs in debt, the global oil supply is on the cusp of severe decline and abrupt climate change is underway?

The fact that 90+% of the populace isn't paying attention to anything they should be paying attention to does not alter the reality of the predicament.

Like all Ponzi schemes, the current one will be at its absolute peak immediately before it collapses.

Yeah, the market got it wrong alright, but....the polls on Brexit were at one point 5% for leaving....so they were not too far off.

It's becoming fashionable to be self-centered and greedy, while at the same time smiling warmly in selfies and making donations to give-a-little so as to appear publicly that you're a very generous and caring person.

Look closely at society and individual characters who are popular (John Key, Donald Trump, NZ's policy towards housing) - it's happening and it's very real....

We don't want the people running Auckland to be running the country.

The people controlling what happens in AKL are the NIMBY grey rinse brigade regardless of what hopeless Len thinks he does. Crush these and the supply side issue is over. Mind you I believe it is actually a demand problem caused by JK,s relentkess immigration policy to artificially increase GDP that is the main problem.

So you want to crush NIMBY's?

Why? They are only trying to preserve the status quo.

That's their right.

But i do agree with you that immigration is a problem.

To steal from Steve Jobs, property is not fond of rules and has no respect for the status quo.

If you have driven on the motorways or been in one of our Akl hospitals, or seen the abundance of Chinese takeaway and 2$ shops springing up you will the the status quo in Akl is always about 1 week old.

In reality defending the status quo is impossible - it changes so rapidly these days. Hopefully the greybeards trying to support some Utopian dream will eventually realise the dead end path that Jk has lead them down and be either rated out of town or finally turn on Jk and his mad immigration policies.

You are right. Defending the status quo is impossible once a country sells its land. Something N.Z. should have thought about earlier.

But N.Z. got lazy, sucked into the housing vortex.

There once was a time when having a house for the family was enough, and working for a living was an honourable thing to do.

All this property trading is rubbish.

A sideshow.

Why? They are only trying to preserve the status quo.

The status quo is not preservable so long as you have changing fundamentals, specifically population (and in fact any real GDP growth above zero). It just isn't, by definition.

That's their right.

It might be their right to selfishly try, but given the above, they must not succeed because they can only do so at someone else's expense.

Australia seems to have a housing boom as well, as does most of North America. If Gareth Morgan thinks those are also due to NZ tax settings, more power to him.

How about a different theory, we don't control the world and we need to make the best of what happens.

How many foreign buyers do you think are snapping up houses in Vancouver, main Australian cities and Auckland. How many of those do you think have Chinese sounding names? Have you viewed what people with Chinese sounding names have done to the Shangai Stock Exchange twice in the last 10 years?

These people with Chinese sounding names are throwing money into these markets. Mum and Dad investors in NZ don't want to miss out on the capital gains gravy train, so they're borrowing up to their eyes in debt to get a seat on-board the National line. Yet those people with Chinese sounding names could well pull their money from the market as quickly as they've put it in if market sentiment changes. Heck if the SSE is anything to go by, it's either all in, or its all out.

But of course, we could never stop foreigners buying into our market and we could never control tax rules to disincentive property speculation. That would be much too difficult wouldn't it?..

It is a very difficult situation.

One that perhaps now, is past the point of an easy resolution.

The focus on house prices has become the west's downfall.

And when voters can't see beyond their house price, not much left is there?

I have interesting considerations with Chinese friends about investing, there main criteria is amount of people, ie if I get in first there are heaps more behind me so I will make money. When I explain how a pymiad scheme works and that is what they are explaining they don't understand my point. As far as they are concerned they are always more people coming to invest. I can see why they go bubble bust in their share market, then commodities and now Shanghai property is up over 50% for the year. The scary part is we don't know how many brought here to live or just for capital gain

I'm guessing some to live, all to gain

naively I am hoping most to live but many conversations I have tell me the opposite. I will feel sorry if it does correct, not from a personal connection as I am MF so makes no difference but for all those that have taken on a mountain of debt to buy there home.

I hope they can ride it out and use the drop in interest rates that would follow a correction as an opportunity to pay down their mortgage

Bring on the market correction.

I have argued with too many Reserve Bank Governors and Finance Ministers on these issues than I care to remember, but the answer from the incumbents is always the same. The Governors say they’re doing no less than what other RB Governors do as per BIS so they don’t take responsibility – and of course the Finance Ministers all say they have their political careers to think of. I know of no other country that boasts the combined policy negligence in this area to the extent New Zealand can.

Hmmmm...

As noted yesterday, the bond market is making this act of willful blindness that much more impossible especially in light of the comparison to the 1930’s; yet central bankers carry on because they can. They can play themselves into fools in public and in private, but it doesn’t matter because they are still politically insulated. They have called a depression a recovery for years on end, but there are no repercussions for having done so; indeed, their dutiful media still reports everything they say as fact and everything they do as “stimulus.” Read more

Interesting. Open home across the road at 2.00 pm today. Decent tidy deceased estate fresh on the market. In the past we have had bus loads cruising our street looking at property. Today the only ones who turned up were the neighbours. Quiet as.

As always, a muted and selective article pushing one and only agenda and lacking real constructive and practical elements of debate .... GM oversights the other anomalies which have created the booms in 1994, 2000, and 2007 and 2013 which caused property market surges albeit a bit milder than today... and that is increased number of immigration and returning NZs. the other one is the accumulated effect of ineffective planning in Auckland where the ACC will be held accountable for its lack of leadership and out of date way of thinking.

Increase in property asset class prices is an international phenomena as is inequality. We cannot compare the last decade with the previous one, the world has changed since 2008 just as it did in 1987. So we need to think dynamically in today's world instead of taking out the old yard stick from last decade's drawer.

Yes, income to loan ratio and affordability are important indeed but they are governed by different factors ... GM should know better than others that we don't live in a small village where there is a perfect economical balance and there is almost a finite amount of money that goes around , we live in an world with almost no boarders and full of TPPs and other trade agreements and "mutual benefits and back-scratching"...

Even in a Village, when a big investor drops in and buys 20-30 cheap properties from willing sellers, the FHBs there will suffer and cry wolf as available STOCK decreases. So restricting finance and taxing some of the locals ( as well as punishing the whole village for the sake of few speculators which are already taxed ) will never solve the issue, that will just accommodate the new investors in town and encourage them to buy more while the house prices are "falling".How clever is that!

So instead of just blaming part of the normal economical processes which work fine in normal balanced markets, we better remember and focus on minimising the consequences of the money tsunami (world wide QE aftermaths, which is still flourishing) and the Shortsighted Planners in ACC who contributed heavily in this crises during the same decade GM mentioned above .. and get on addressing the issue in totality rather than shunting out a slice of the society and taxing everyone we can get hold of.. ... Few constructive ideas were mentioned above by several commentators.

GM should know that taxing investment properties or CGT has proved worldwide that it is not the answer and has never lowered prices effectively ... and that will not make the low income people and the working class any better because there will be several black holes waiting for that money to be wasted on ( so anyone who thinks that that tax will build more/enough cheap houses is out of touch with the markets, and it will not improve incomes, it will just hurt the economy at large, so that GM's " new generation of economists" will then go ...oops, and go bush for a while).

We are part of the western capitalist world and the OECD , not part of the Socialist or Communist systems where everyone must be equal ... this system encourages lower income people to look up to those who are in a better state, not bringing them down!!.. and we pride ourselves to have free market forces which should not be tampered with (either way).

Auckland City Council represent Aucklanders. They don't want their roads flooded with immigrants and then tolled. They don't want there wages kept breadline due to competition for jobs. They don't want to pay higher rates to pay for infrastructure for Immigrants. Auckland City Council did not ask for uncontrolled population growth. So stop blaming ACC for not making land available for uncontrolled growth. They are the only NZ organization actively resisting John Keys crazy immigration policies.

THAT should see the poor feeling much, much better (not)

First of all the German situation. is based on a lack of immigration and an aging population. Secondly the nonsense of income to house price from the 70s is not valid anymore. Husbands and wives in most cases work now so any price to income ratio is far different now. In Wellington the average wage in the city is 83k. So a typical household income is 166k in the city. Times that by 4 and it's a house price of circa of over 650k which is easily attainable.

your second point is wrong the average combined income in wellington is not double tha average wage but much lower

You are right about immigration, Germany is not much fun as a foreigner

...Sprechen sie Deutch?

[ I hope that was intended as irony. But it fell flat, and turned out as offensive. Don't try that again. Ed. ]

The way to fix the housing market is to require the banks to source their funding from within New Zealand...

What about foreign buyers?

AKL suffers the same affordability issues as all the major cities in the world. Sad but that is the way it is...for now anyway.

http://www.bbc.com/news/business-36866975

Auckland a "major" city? Like Jacksonville, Salt Lake City, Calgary, Glasgow, Lille and Hannover are routinely mentioned as among the ranks of "major cities" globally. The Kiwi Walter Mitty syndrome is in evidence here.

Of course, Auckland is nowhere near a 'major city.' However, being by far NZ's biggest city, and commercial centre, and being the main international gateway, it does have some gravitas that other cities around the 1.5 million mark might not have.

For example, Adelaide - nice city that it is - is nearly as big as Auckland, but its CBD is nowhere near as intense, its airport nowhere near as busy.

Yeah, but the NZ economy is Kansas in the South Pacific, without the advantage of being part of a continental mass with millions of people to whom you can ship your produce by truck. It is still too easy to over-rate Auckland. It would not surprise me if Kansas City and Nashville actually had more Asians moving in, as part of their overall in-migration that is around twice the intensity of Auckland's. The high-growth US cities have Latinos that we don't, and they also have New Yorkers and Californians bailing out of their anti-growth, anti-opportunity States.

I also reckon that cities like Nashville and Kansas City have just as much or more, "financial services", high-tech manufacturing, and all the other sxxy stuff that Auckland has a modest amount of; nothing particularly special, actually.

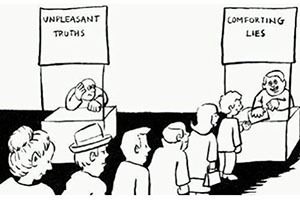

The comforting lies will continue thru to the next election, thats a given.

I agree with Gareth, this and previous government have turned a blind eye to this mess... what would have only required minor tweaks, now requires major surgery.

Gareth is right on the money. Time for this country to focus on national income instead of clocking up national debt. It's been a down hill slide since current account surpluses ended over forty years ago. We're too much of a 'yes' country readily adopting recommendations from international organisations (read BIS).

Time to think for ourselves.

Gareth says:

'The problem in this market is demand not supply – although of course if demand keeps growing then slow supply growth will exacerbate the problem as will boosts in supply alleviate it – for a while.'

Gareth is very very wrong on this point, and typifies the second rate economics profession in this country. He should read up properly on urban land economics.

One of the key reasons speculative demand is so high is because Auckland has not supplied anywhere near enough houses in the last 15 years. Because of that, house prices have risen and risen and that has made housing investment a 'safe bet'. That is basically the fault of the various Auckland Councils over the past 15 years, who in the face of high population growth did 'bugger all' in terms of the zoning changes required.

As Mayor and Deputy Mayor of Manukau City Council and Waitakere City respectively, and now Auckland Council, Brown and Hulse can take a big part of the blame for that pathetic inaction. Although I think they were very poorly served by their planning advisors, who were driven by ideology rather than a 'real world' understanding of development and urban land economics.

How is he wrong? If there was no demand or "high population growth" we wouldnt need the supply.... Its the cart before the horse.

Of course it works both ways. It's bi-directional. But he essentially dismisses the supply side which is plain wrong. He's as wrong as those who say it's all about supply.

Actually, there are cities in the UK, like Liverpool, where urban planning and strangled supply has kept house prices up in unaffordable territory (median multiple above 7) even though its loss of industry and population over the decades, matches Detroit. Detroit has a more realistic median multiple of around 2.5, for an economic disaster city.

Utopian, rationed-supply urban planning merely enables a kind of vampire squid racket in property, so that the property "rentier" class (and the financiers) are sucking the lifeblood out of the local economy and society even when there is little there to suck.

The entire economics profession all over the world is stuffing around with theories that do not match reality, and almost no-one is bothered about this. Gareth Morgan is just one of the herd. There are very few who get much right on this issue. Arthur Grimes is ahead of most of them in the world, but he has not only been ignored, but insulted by the arrogant, god-playing, planners and politicians.

Another is jim rogers. You tube him. Many excellent videos and common sense approaches.

Yawn....off to get a coffee...

Imputed rent? Really? Well ive never heard of that before. It seems unfair. If you apply that to houses, why dont yiu apply it to cars too.. where would it end. That penalizes someone who works hard to be mortgage free. Rates and insurance and maintenance are bad enough dont ya think? Thats a real weekly cost. And if house prices fall, gee lets record that as a capital loss and offset that against income. Imputed rent sounds like a mad tax grabbing policy to me. Let me guess, the beurocrats in Europe dreamt up that idea didnt they?

Seriously, it is a bit rich Gareth commenting about property investors not paying sufficient tax on the full returns of property ownership isn't it!

Did Mr Morgan pay any tax on the mega millions that he received from the sale of TradeMe????

He often comments about bringing in a capital gains tax!

As we know there has always been one.

Secondly bringing in his envy tax will not reduce house prices one iota.

Name a product that has reduced in price due to having a heavier tax put on it?

Yes, and the corollary: advocates of CGT's to "keep house prices affordable" need to be asked to name any city anywhere in the world where a CGT has produced median multiples of 3 in the absence of unconstrained land supply.

http://m.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10639…

Yep the Morgan's already said that isn't right six years ago and as I understand it set up the morgan foundation as their way of giving back. I wonder how many others will be as generous with their capital gains....

One of the hard lessons of life is that if you have made a mistake or something is wrong, the best thing to do is stop and address it immediately. The longer you leave it, the harder it is to reverse the mistake and the costs compound, sometimes exponentially.

This housing mess has been bubbling away for decades as you say Gareth, but it really started becoming a concern to me in the last term or two of the last labour Government. Correspondence with them revealed that they were happy to let it run, I assume because they believed it would help their electoral chances. As it transpired they still lost and we went into the GFC, prices stabilised and may have retreated a bit. Throughout this period the Government and every other commentator anticipated that a lift in house prices was something to be looked forward to and encouraged as a sign that we were "recovering". I believe that this was the period when government should have addressed all the problems that we have been talking about, facilitated better land availability, higher building productivity, with the objective of a period of increased house construction. This would have stimulated the economy in a far more meaningful way than the property price ponzie we are experiencing.

Having set off down the mindset track that increasing house prices is the way to boost the economy and their popularity it seems that Key and co have inevitably become more captive than the hapless investors that have been sucked into immigration/house price ponzie so that now, even if they wished to address the problem and reverse their mistakes, they cannot because the carnage will be directly laid at their feet. Unfortunately they cannot escape this fate because the bubble will burst at some stage anyway and blame will fall on them anyway. A classic example of not recognising and addressing a problem as soon as possible.

You would think that Key would be aware of this trap because it is a very similar situation to the currency traders who go rogue and keep ploughing other peoples hard earned money into a bad situation in the gamble that they will somehow win big and get out of the mess. On reflection this situation is worse and has less chance of a happy resolution.

Even sadder: John Key was talking, in 2007, about the correct reforms to restore housing affordability: the median multiple in Auckland then already being over 6 - double what it should be. Watch and listen to this,

2 min 40 sec in …

https://www.youtube.com/watch?v=qEcmkmaD3ro

Who got to him after that?

By 2008, the prices had already topped out at the end of the property cycle, reform could have been done to manage them back down again, and the pain could have been blamed on the Helen Clark government, their LGA2002 and their brothers in arms in urban planning running cities like Auckland.

Now the median-multiple-9-plus housing bubble is definitely John Key's bubble, and even if it bursts on the watch of a Labour government in the future, it will be a walk in the park to blame you-know-who. But the government of the future is going to have to cope with a LOT more pain for its citizens and businesses than what Key could have been courageous about in 2008.

Ireland's highest median multiple in 2007 was 6.5 in Dublin - other cities were in the 5's and 4's. Sure they had oversupply, or perhaps "supply of the wrong type in the wrong locations", which is slightly different. But the way the issue is being "progressed" in NZ, I reckon we too could have oversupply to accompany our median multiple of 9, perhaps 12 by the time it bursts. Bubble momentum is NOT nicely gradually ameliorated by an incrementally ramping up housing supply, still strictly gamed by the land bankers at every staged increment under "plans" telegraphed years ahead.

I think I don't want to be in NZ at all when the time comes.

Interesting watching that Phil. All sounds great but it never came to anything. They have been in government 8 years now so they have had plenty of opportunity to deliver on their promises. Clearly it was just an early example of the disingenuous lies and spin from John Key that has become standard behaviour for him.

DP?

Where does anyone get this 3 times multiple from?

Just because it may have been this 50 years ago doesn't make it law does it.

Land values and building costs and people's desire to live in NZ have altered dramatically.

Prices of everything has changed. Milk was 4cents a pint at one stage so why is it so dear now.

House prices are socalled unaffordable in all desirable places.

Surfers Paradise that has a continually growing population is not affordable for first home buyers over there that work for low pay and are generally only casual workers.

There are still many opportunities to own your own home in NZ but moaning about it will get you no where.

The moaners have made it harder on themselves by now having to front up,with a 20 per cent deposit rather than 10 per cent.

Life is what you make it.

"The moaners have made it harder on themselves by now having to front up,with a 20 per cent deposit rather than 10 per cent.

Life is what you make it."

Could not agree with this more. As my wife said the other day, moaner keeps moaning and media keeps talking about it every single day, no wonder house price goes up and up. If no one talks about house price at all then perhaps price wouldn't go up this fast.

The "3 times" median multiple was a historical norm for decades in NZ and most of the first world. The UK was the main exception, for the simple reason they had growth-containment urban planning since 1947. They only had a brief period of affordable automobile-based urban sprawl in the 1930's, and the homes built then are sought-after today for their size and quality.

Prior to automobile based development and the median multiple of 3, you had exactly the same kind of chronic and intractable conditions in housing and housing costs, that you do in most developing countries today. Average home sizes of 100 square feet, median multiples of 10+, and half the population in illegal slums and tenements. Marxism - "nationalise everything" - accordingly became quite appealing in many countries.

Anyone who sneers at the evolutionary processes in transport and urban development that produced median multiples of 3, democratisation of ownership of decent homes, a massive improvement in home size and amenities, a massive improvement in housing-related health indicators, ended the systematic wealth transfers to the rentier class, and eliminated a central justification for Marxism; is a moral monster.

Phil best,

Just for the record, when I bought my first house in Scotland in 1969, the maximum loan was based on 3 times my income,with no allowance for my wife's income.

I have read the last paragraph de real times and still can't make sense of it.

This week passed hundreds of empty newly finished 25 story apartment blocks around shanghai, plenty of rentals there. from nantong to ningbo not even one single solar panel to be seen plenty of coal fired power stations. i was told its not allowed. In a city ten time bigger than New Zealand, many of the young freindly english speakers talk quietly of there dream of moving to Australia. Americians, English or Chinese they will come to our little isles so we either stop them or build hundreds of 25 story apartment blocks its really that simple.

yeah sure, we build hundreds of 25 story apartment blocks to fit these people in, then what? do we give them the dole? We don't owe the world a place to live or an income.

Give it up guys the housing market is what it is, time to move on and talk about something else. Buy a house or keep renting and whinging about house prices. Plenty of people working hard, paying a mortgage and just getting on with life. Time to talk about more important issues like the disintegration of Europe into chaos and probable civil war in the backlash against immigration. Still gets pretty hard to discuss this when the truth gets censored. The rest of the world is turning to custard, your problems in little old NZ are relative, there are no bombs dropping on your head. Too many keyboard warriors here and people who think hashtags are going to save the world.

Carlos, you might have a back up plan, you might be wealthy, you probably are a lot more worldly than most of us Kiwis. For a lot of us, NZ is our history, our ancestry and our children's future. We love our country and are stricken to witness what is happening to NZ on our watch.

We won't give up writing posts, the sinking of the Rainbow Warrior by the French military taught us that the power of protest is without measure. If one post is success full in raising awareness, it was worth writing.

Yes things are bad in Europe. The best thing we can do for Europe is not support USA aggressive foreign policy. Their attack on Iraq and Syria has led to the current situation, just one more reason we need a new leader and a new path. Our current leadership wants to hang out with the school bully. We need a new leader.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.