Here's my Top 10 links from around the Internet at 1 pm today in association with NZ Mint.

We welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read today is #2 from Andy Xie on China's structural flaws. The New Zealand and Australian economies are not going to get a leave pass again on the current global downturn.

1. Too much investment - The most important variable in New Zealand's economic outlook is what happens to China's economic growth rate and whether it can repeat the extraordinary investment surge of 2008 and 2009 that helped cushion the blow to the Australian and New Zealand economies of the Lehman crisis.

The biggest issue is whether China has the capacity to do another investment surge like that.

Many inside and outside China say it needs to rebalance away from (over) investment to consumption to make its economy sustainable.

Some say this is already happening.

The Institute for Economic Thinking questions the logic that the shift is happening in this post.

The investment levels are astonishingly high, as the chart below shows.

If we look at consumption, rebalancing is not happen yet either. It is not growing fast enough. CLSA asserted that despite the fact that consumption’s share of GDP is quite low China’s consumption is already strong and that the rebalancing of Chinese economy is already underway. To support their position, CLSA shows that retail sales growth is faster than GDP growth. However, they made at least five mistakes here. First, retail sales growth is a nominal figure while GDP growth is real. If we deduct the price difference, retail sales growth is not faster than GDP growth.

Second, retail sales cannot represent household consumption in China. Lots of the sales are government purchases and some of the components are investment-related goods, like jewelry and home appliance.

Third, even if we pretend that retail sales data is a good indicator for household consumption, it still does not mean rebalancing is taking place. Why? Because if rebalancing is really taking place, not only does retail sales growth become faster than GDP growth, but investment growth has to be slower than GDP growth. Unfortunately investment growth is still much faster than GDP growth.

Fourth, consumption growth is unlikely to surge if household disposable income increases slowly and household income has been lagging GDP growth for many years. Last, as economic growth decelerates, retail sales growth is slowing down too, which makes it very difficult to say that rebalancing is happening.

2. Serious systemic flaws - Andy Xie writes at Caixin that serious systemic flaws in China's growth model are now being laid bare. This is today's must-read.

Around the country, I see numerous property developments that are in the middle of nowhere and may never be sold. When the last property bubble burst in the mid-1990s, numerous buildings stood unfinished. The scale of unfinished buildings will be much bigger this time. Out of 4.5 billion square meters being built, 20 percent may never be finished.

Most tier-three cities have not seen significant population growth in the past decade. Yet, they are building properties equivalent to 20 to 30 percent of the existing stock. Many developments are far from the urban center. How would such developments be sold?

Obviously, the book losses, especially to the banking system, could be enormous. That will translate into pressure on the central government to stimulate speculation again. Only a massive bubble could allow such useless properties to be sold.

3. Bankers and the neuroscience of greed - Ian Robertson writes at The Guardian in a fascinating way about the neuroscience of the investment bankers of London and Manhattan.

Holding power changes brains by boosting testosterone, which in turn increases the chemical messenger dopamine in the brain's reward systems. Extraordinary power causes extraordinary brain changes, which in their extreme form manifest themselves in personality distortions, such as those seen in dictators like Muammar Gaddafi.

The "masters of the universe" who have arisen out of a deregulated world financial system were given unprecedented power that inevitably must have caused major changes to their brains. While power in moderate doses can make people smarter, more strategic in their thinking, bolder and less depressed, in too-large doses it can make them egocentric and un-empathic, greedy for rewards – financial, sexual, interpersonal, material – likely to treat others as objects, and with a dulled perception of risk.

This power-primed boldness and forward-looking focus on rewards arises from a neural "approach mode" that biases attention, memory, action and emotions towards thoughts and feelings linked to success and conquest. Low power, on the other hand, tends to trigger a neural "avoidance mode", where mood is low and anxiety high because of worries about threats and future uncontrollable events. These approach and avoidance modes are linked to different networks in the right and left sides of the brain respectively, and to different chemical messenger systems. The wild oscillations of financial markets are partly the result of traders' brains lurching between these two modes: it is a characteristic of being in one mode that it is hard to think in terms of the other – a bit like finding it hard to imagine a sunny day in the middle of a bleak, dark winter day, or vice versa.

4. Chinese overspending on Australian iron ore projects - This is a cracking piece from Henry Sender at FT.com about how much money Chinese state-owned firms have pumped into holes in the ground in Australia.

I hope a bunch of New Zealanders working there have got their hands on some of this money.

The world’s second-biggest economy had hoped it would more easily control its economic destiny by taking huge mineral stakes, robbing companies such as BHP Billiton, Vale and Rio Tinto of the ability to dictate commodity prices.

But the Sino Iron project, far from being a showcase for China’s might, has become instead a cautionary tale of the difficulties Chinese enterprises face as they seek to expand abroad. When it was first conceived in 2006, the total cost was estimated at under $2bn. By now, it has already cost Citic Pacific $7.1bn. Analysts at Citigroup calculate the bill could swell to a possible $9.3bn, while others say they expect the ultimate bill will be closer to $10bn. The mine is at least two years behind schedule.

“This is no longer about commercial goals,” says a senior executive at one leading Asian trading company with extensive sourcing operations in Australia. “It is about Chinese machismo. They have plonked down too much money to pull out now.”

They’re the worst drivers—and we’re too scared to tell them so. If we don’t push back, they’ll steal our benefits and bankrupt the country.

The economics blogger Steve Randy Waldman memorably and bitterly articulated the meaning of these grim facts. The long slump has revealed the preferences of the aging polities of the Western world. “Their overwhelming priority is to protect the purchasing power of incumbent creditors. That’s it. That’s everything. All other considerations are secondary”—-including economic recovery.

We could jump-start the economy with a massive jolt of monetary and fiscal stimulus, but such a policy would risk inflation and pose a threat to retirement savings. So we don’t do it. We could borrow money to finance infrastructure programs that would set people to work now and enrich society over the long haul—but that borrowing would have to be serviced by taxes to which older Americans fiercely object. So we don’t do that either.

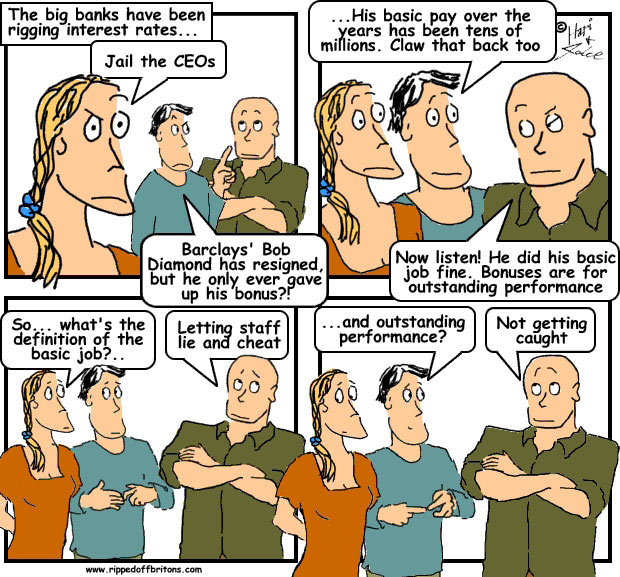

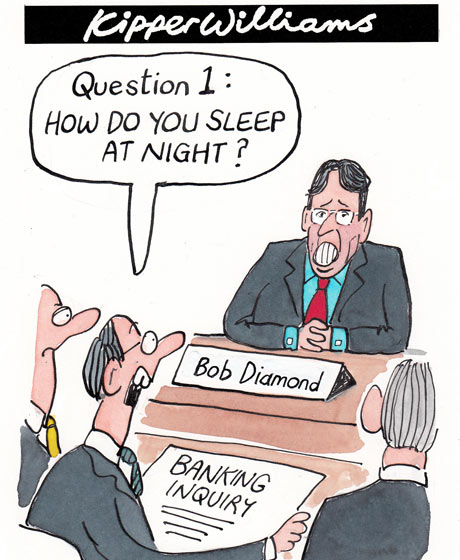

6. The real cost of the LIBOR scandal - Here's the New Statesman with its view.

Libor (and its counterpart Euribor) are the starting points for setting the interest rate for, well, pretty much everything. To give you an idea of the size of the possible distortion, the FSA notes that the notional amount of financial instruments, derivatives and contracts which depend on Libor “in the first half of 2011 has been estimated at 554 trillion US dollars”. The World’s GDP for the same period was roughly 35 trillion US dollars. The manipulation of this interest rate by a tiny one-tenth of a percent can result in a distortion the size of the entire Eurozone rescue fund.

Here is a fallacy which has emerged over the last few days: there were winners and there were losers. When the rate was manipulated up borrowers lost out, but savers gained. When the rate was manipulated down, the converse happened. This is a perfect example of the simplistic masquerading as complex. It ignores the biggest and most dangerous impact.

Interest rates are all about the assessment of risk. The discovery that the basic Libor rate on which most such assessments are based was arrived at by collusion and was essentially fictional makes it unreliable. This creates extra risk. No prizes for guessing who will absorb this extra risk. Next time any lender sets its variable mortgage rate, they will be adding a little bit of fat, in case the Libor rate has been massaged down. Next time the decision is made on what interest to award to a pension fund, it will be made a little meaner, in case the Libor rate has been artificially boosted.

Rendering the Libor rate unreliable, is like removing the bottom block from an enormous financial Jenga tower. It is causing the entire construct to teeter and become more unstable at every level. Importantly, it makes it more susceptible to the next crisis. It may steady itself or it may collapse.

7. OMG - Here's the famed George Monbiot saying at The Guardian he was wrong about Peak Oil.

That should be good for at least 50 comments...

There is enough oil in the ground to deep-fry the lot of us, and no obvious means to prevail upon governments and industry to leave it in the ground. Twenty years of efforts to prevent climate breakdown through moral persuasion have failed, with the collapse of the multilateral process at Rio de Janeiro last month. The world's most powerful nation is again becoming an oil state, and if the political transformation of its northern neighbour is anything to go by, the results will not be pretty.

Humanity seems to be like the girl in Guillermo del Toro's masterpiece Pan's Labyrinth: she knows that if she eats the exquisite feast laid out in front of her, she too will be consumed, but she cannot help herself. I don't like raising problems when I cannot see a solution. But right now I'm not sure how I can look my children in the eyes.

8. The Oil Drum responds - For the sake of balance and completeness, here is a detailed take-down on the Harvard report (I linked to a few days ago) that Monbiot based his volte-face on.

A large chunk of the Harvard report is based on the idea that Iraqi production can get going again.

Here's the The Oil Drum's response with a useful chart below.

I understand that one ought to show some optimism at some point over Iraq, but it has yet to reach the levels of production that it achieved before the Iran/Iraq War, and that was over some time ago. The EIA has shown that it is possible to get a total of over 13 mbd of production, but it requires investment and time, and some degree of political stability in the country. That is still somewhat lacking. Prior to that war, Iraq was producing at 3.5 mbd, the production curve since then has not been encouraging:

9. The reaction is starting - Australians are getting grumpy about all these New Zealanders arriving for jobs and all the Australian jobs being outsourced across the Tasman to NZ (Heinz factory/Newspaper sub-editing).

Here's (expat Kiwi) Bernard Lagan writing in the Global Mail about the growing grumpiness in Australia. HT Toby Manhire at The Listener.

In Girgarre, a hamlet in Victoria's lush north, some people no longer buy much of anything made in New Zealand — Australia's near neighbour.

"I don't care to buy it," says Jan Smith, a member of Girgarre's development board, who has stayed in the town, seeking new ways to keep Girgarre alive while its jobs have leached away, most recently to New Zealand.

10. Totally The Daily Show's correspondents explaining the banks and economists and Wall St.

77 Comments

Steven are you there ?

Speak the same language, godammit.

A Guardian commenter makes the unsensational point that 'Peak Oil' has a specific meaning that Monbiot is not quite using.

Same all over the blogosphere - what do we mean by 'growth', 'inflation', integrity (oops, maybe we know what that one is, it's just not used often).

#2. Wow we got that in common

Serious systemic flaws,

I drive around NZ and see a lot of dairy farms producing milk the world doesn't need.

At least China runs surpluses, we haven't got that in common.

Can history repeat itself? Will China turn the taps off?

extract from 2007 at the beginning of the GFC

the wool boom - episode 1

During the 1960's Australia and New Zealand enjoyed one of the greatest wool booms.

Cant find any documentation on the Australian effect but this on New Zealand Wool Boom

In 1972 and 1978 the oil shocks arrived. Oil went to $80pb. Petroleum based synthetic fibres became more expensive than natural fibres, which led to the next Australian and New Zealand wool boom, which continued into the early 1980's.

In the period 1985-1995 oil fell back to $10 pb with an inevitable collapse in wool demand.

Australia and NZ ended the 1980's early 1990's with massive wool stockpiles.

Extract from http://www.abc.net.au/landline/stories/s342945.htm (paragraph 13)

China, a new economic tiger, fuelled the market. Then in 1988 it withdrew totally. By 1991, seventy per cent of all wool produced was passed in at auction and bought by the AWC. The wool boom burst, inevitably and traumatically.

With this one act China discovered the enormous power it had, and how to exercise it to its advantage.

Extract from http://www.sirca.org.au/Papers/1998026.pdf

During 1980-1990 the Australian Wool Reserve Price Scheme continued to purchase virtually the entire Australian wool clip and nearly all private stockholdings world-wide at prices far higher than any foreign buyer or consumer was willing to pay. Eventually, the Australian Government walked away from it, realising there were limits to the extent that tax payers were willing to pay to bail out such stupidity. Today, Australia still has a huge unwanted wool stockpile.

.

Now that the LIBOR has been proved false and under control of cartel, what about the 'wholesale rate' on which the home lending floating rates are set ? Any cartel behind that too ?

@#7

I think the largest fallacy of peak oil as always been conflating “discoveries” with “production”. There are thousands of wells around the world the sit idle and are not even used for production. Just because someone discovers a source doesn’t mean it’s immediately drilled, tapped, and sucked dry. I have made the argument many times on this blog that most of the US oil is sitting on uncapped wells because the price is just too cheap to bother. Why use the water in the lake around back when it’s cheaper to buy bottled water from the guy down the road for a fraction of the price.

The world is awash in oil right now and factoring in both inflation and USD deflation it’s just a cheap today as it was in the early 2000’s. I told many readers here that the US would be an net exporter of oil this year and oil would be $80 again very soon and here we are. So now all those wells that were uncapped and tapped will be recapped and the supply will tighten.

So lets make this clear, the price you think is good to get the US fantasy oil out of the ground is a price that the world's economy cant run at even if it existed....

Oil is at $80 and I expect it to follow the last drop....way way down, under $50 seems a sure thing as we fall into a global depression.

As far as existance goes you argue for a behaviour never ever seen in the USA, keep it in the ground, en-mass rather than exploit it ASAPP...frankly its loopy. It suggests a mass conspiracy from the behaviour over multiple decades from numerous small bit players.

Even if say the US could get to say 12mbpd, that at 2% per annum world demand growth is 3 or 4 years.....

So I think you are making absolutely no sense what so ever.

Oil is $80 because of the fear of a depression, being right for the unknown reason is a guess. Peak oil is an event like no other and just how the world responds is unknown........further its pretty safe to say that we wont ever see oil at $200 (inflation adjusted) for long aanyway, what we will see is a series of seesaw events like the second we are into....so a peak followed by a through and that will repeat and repeat....

Given marginal fields are indeed at $90, yes these will be sat on or maybe capped.....it makes no sense to get oil at more than it can sell for....but we cant afford to pay it.

Saudi wil aim to tighten, it needs the income at >$80.....but Iran is being taken off the market, 3mbpd bye bye.....so Saudi may not have to do a thing.

regards

Steven

If oil drops to $50 you can bet it will also bounce up higher, peak oil was always going to be heralded by a period of instability, there are two things I find intriguing about this all

1. The process of cherry picking data to extrapolate on, things have changed for example a lot more wells are horizontal and though they produce faster they water out faster, so the pundits pick the production side, Shale 'oil' is poor quality and the wells decline at an eye watering rate, again the 'experts' pick the upside.

2. Measuring the oil price is $, the oil consumption / global GDP correlation is very close and the global money supply releated to GDP, so you cannot measure one against the other, to measure something against another requires no releationship, the best way we measure oil is oil used in oil production.

Neven

George Monbiot seems to have lost the plot. Peak Oil is an impossible concept to pin down. You can’t predict when it will occur or even if it will occur because it’s dependent upon too many variables. Assuming a steady growth rate, before demand exceeds supply, market forces boost the price and the dynamics of exploration change.

We will never run out. Price will increase until we’re sucking on empty and you pay $1000s per barrel. By then alternatives have become viable.

Thomas Friedman and others had the right idea. The prices of oil, gas and coal should have a rising floor, if the price falls you whack a tax on it to bring it back to its previous highest level. The tax takings go into alternative energy research.

Amongst the many advantages:

- That gives the alternative energy guys an even playing field. Presently, oil goes up and they get funding. Oil goes down again and the funding evaporates.

- We avoid transferring ever more wealth to states funding terrorism, corruption, and oppression.

- There's the small matter of saving the planet.

Woah there buddy!!! Your suggestions are far too sensible to enact! I can hear the people now; "how dare you make us take short-term pain for the long-term gain!!!! rabble rabble rabble...."

Remember, the USA is NOT an exporter of oil.

Currently the US consumes around 18.6 million barrels/day and produces 9-10 million barrels/day. The recent media hype that the USA is now an oil exporter is rubbish. The USA is a net exporter of petroleum products, not oil, please note the distinction.

Here is a graph of US production over time. (Note that the much heralded oil boom from the unconventional sources hasn't yet come close to restoring production to the 1970's peak).

Yes, there's a current kerfuffle about Iran finding a massive 6 billion barrels. Sounds a lot, but it's only 300 days of US consumption and about 75 days for the whole planet.

George “the reverse Cassandra” Monbiot has been sucked in by the US- centric shale oil bonanza hype. Simple as that

David Strachan sums up the reality of "peakonomics" here..

"Slower oil production combined with intensifying competition among consumers may soon produce oil prices so high they kill all prospect of sustained economic growth. The outlook is for repeated oil price spikes alternating with deep recessions, regardless of when global output actually peaks. Welcome to the last oil shock."

If Monbiot had researched a little more thoroughly he would have discovered the issues which are at the heart of the peak oil debate

First is that the rapid depletion of older existing oil fields is what is driving the oil price upward. As a result of depletion an IMF paper predicts prices to double by 2020

Second the so-called shale oil "bonanza" is not backed up by hard data. The IMF team expects total oil production (including shale and tarsands) to grow at no more than 0.9% per year for the next decade, way below the historical average of 1.5%-2%, and therefore insufficient to sustain economic growth.

Third ... non-OECD oil consumption has risen around 4.8 million barrels per day since 2008, while OECD consumption has fallen by almost exactly the same amount. “China is bidding away the OECD oil supply” says oil analyst Mr Steve Kopits quoted in in the Strachan article, “and recessions are the mechanism by which that oil is being transferred from weaker economies to faster growing economies”.

Fourth ...major oil producers such as Russia and Saudi Arabia are canabalising their own supply to meet soaring internal demand, leaving less and less for export. Saudi Arabia will be a net importer by 2038 if current trends continue.

MED industry-supplied data shows NZ domestic production has already begun a steep decline and will be near zero by 2020. This will force NZ to be ever more dependent on ever more expensive oil imports at the worst possible time in the next decade. Even if we found a super field tomorrow it would take a decade to bring it to full prodcustion and we would still pay the international oil price. Meanwhile China and India are already taking an ever larger slice of available net world exports. How exactly is NZ going to secure a share of this diminishing market? Send a frigate?

Finally Monbiot glosses over the recession-inducing impact of even $US80-$90 a barrel oil. Economic peak oil is the point at which the cost of supply exceeds the price economies can pay without destroying growth at a given point in time. For mature economies such as in the OECD that unaffordable price and trigger point for recessions is around $US80 - $US90 a barrel, or historically when 4% – 5 % of GDP is spent on oil. 10 of the last 11 global recessions are linked to oil supply/ price shocks ( US economist James Hamilton ) and the current recession and that in 2008 have oily fingerpints all over them.

Monboit is an idiot IMHO.

regards

Calling someone an idiot does not sound very humble.

Have a nice day...

pretty much sums up "modern" peak oil economics I think.

regards

Do you have a link for the NZ domestic production? I would be interested. Being able to refine our own production is one of the 'action points' cited by Nicole Foss during her talk here in Christchurch. Securing oil from other places is going to be difficult, particularly when countries like South Korea are signing up 99 year supply contracts.

... and yes we can send a frigate, but only as long as the sea isn't too rough. ;-)

@#9

It’s getting very personal. These are the same arguments you hear right wing nut jobs expounding in bars in the US about Mexicans. Protectionism and the “It’s their fault” argument are sure signs of a serious underlying issue in the economy. I'm calling a top to the Aus economy the bust is here.

Its just hype but it is brewing - http://au.news.yahoo.com/thewest/a/-/breaking/14080834/kiwis-ready-to-pay-fly-in-fly-out-fares/

They don't want us in Aussie taking there jobs and they don't want the jobs going to NZ. Yet the Aussies are happy for Gina to import essentially slave labour into the mines (english language requirements are relaxed and they are not paid what an Aussie would be).

Its just a shame the jobs going to NZ are low wage, typically manufacturing while the Kiwi's leaving NZ are for high wage mining or professional jobs. NZ is the one losing in this relationship. Just like the wetbacks, and just like the drain from Northern Ireland to mainland Britain.

But don't worry we can use Aussie money to sell houses back and forth to each other.

What the average Australian doesn't have the economic wit to understand is that they're all creaming it at the New Zealand taxpayer's expense.

The average Kiwi in Australia earns more than the average Aussie or any other ethnic group, therefore pays considerably more tax, Kiwis paid for their education, and we're paying for most of their parents' retirements.

If they sent 'em all back here it'd be a major blow to their economy and we'd kick the arse out of all their league teams.

:)

When a Kiwi works in Australia, they take the place of an Australian employee. So as a whole it's worse for the Australian worker. The Kiwi will work for less than the Australian, so the employing company in Australia is better off. Just another example of the rich getting richer, poor getting poorer.

Are you kidding? That's just flat-out not true.

500,000 Kiwis create Australian jobs! They're consumers, they're educators, politicians and public servants, they're movers and shakers. They form a disproportionately high percentage of the people who create jobs and who get things done.

If it wasn't for 50 years of abject failure of government policy here, and the resultant decline from the top 3 GDP per capita in the world to 50th and falling, those people, and a bunch of Aussies, would be here making us richer.

To clarify, I think it depends on how the movement of labour affects the unemployed. If the Kiwi takes the job and that results in an unemployed Australian, then I think what I said is true. If there is no change in unemployment and instead more jobs are created, I think what you say is true.

This gets back to the start of the thread which is talking about the situation in the US where unemployment is very high. In such a situation the jobs are going to cheap foreign labour instead of local expensive labour. Good for the companies balance sheet, bad for the American employee, or not?

Using that logic, every time a Kiwi goes to Australia it should create another job for the few of us remaining here. We'd all be better off if we paid for their tickets and got rid of another 500,000.

Across the whole spectrum of Australian Kiwis, they don't work for less than Aussies. They work for more. Ask their tax man.

People found it very funny when economic genius Robert Muldoon said that "New Zealanders who emigrate to Australia raise the IQ of both countries."

We've been quoting his drivel smugly ever since when in fact all along exactly the reverse has been true. Just as with every great migration the best and brightest leave.

Go and visit Scotland where it's been going on for a couple of centuries. Scotland had a disproportionate number of great scientists and engineers who helped to create the industrial revolution. But a lot of them did it in England and in North America. Now it's a basket case. Anyone with any "get up and go," has got up and gone. The lowest common denominator are left behind.

5.000,000 Scots in Scotland. 20,000,000 plus of largely Scots descent in the USA. There's a lesson there.

Unless we're rescued by climate change doing them more damage than us, we're headed for th same Third world status that Scotland are nudging. North Sea oil is all that's stopped them from becoming European Mexicans.

Most of my ancestors came from Scotland, I served 4 years there during naval training, and I've spent a lot of time there in the intervening 50 years. I love Scotland. But the people have been intelectually and spiritually diluted.

That's where we're headed.

The saddest part, the best and brightest of Maori are flocking to Aussie too. My feeling is that it's in a greater proportion than for pakeha. Just what Maoridom and New Zealand in general need.

And no, Key, English, Clarke, et al, they aren't coming back. Ask my friends who grieve for their grandchildren.

It depends what the Kiwi was doing here in NZ and their prospects in NZ. If they're not contributing to society here and they can go somewhere where they can contribute, they benefit personally and NZ benefits too because it doesn't have to support that person. A win win situation.

The deeper issue however is why that person is not contributing or has no prospects. If the person is highly skilled yet there is no demand in NZ because they have been themselves outsourced to cheaper foreign labour, and they leave for Australia, then that tells me there is something wrong with the system.

The main thing that's wrong is that we put all our eggs in the Farming and Tourism baskets. Our biggest industries by far and totally dominated by low-wage jobs. It's not that we don't need them, it's that they're pushed to the detriment of more lucrative pursuits.

Not enough innovation. Not enough science and technology. Not enough understanding of entrepreneurism so that when we do have a good idea it goes offshore.

Sir Paul Callaghan understood it, our mealy-mouthed leaders made him New Zealander of the year last year but totally ignored his message. If you haven't heard his presentation "Beyond the Theme Park and the Farm Gate, you I BEG YOU to watch it right here. It's inspirational and inarguably correct. It's about 4 years old but everything still applies except the stats. They've got worse.

So sad that Paul is gone. We needed him.

Thank you for the link. I see it's almost an hour and a half so I've bookmarked it for later.

Indeed, it seems we're very good at taking the short term payoff in favour of the long term income. Build up a promising company then flick it off to someone overseas. A couple of people take the profit and the company goes off shore. Future revenue for NZ, nada.

Looking at it the other way, what is it about people in other countries that make them see value in holding onto a company and taking the regular income?

Tourism has a very shaking footing in a likely future financial depression, so we're left with farming. Hmm.

About half that video is questions from the audience. The presentation is only about 40 minutes I think. Sir Paul was a very good speaker, so it's an entertaining watch as well as disturbing and provocative.

I saw his presentation in person here in WangaVegas and it pretty much set me on a different road in retirement. His research into where we're going wrong was triggered when he bought "The Undercover Economist" to read on the plane. Opened his eyes to our folly and he resolved to do something about it. He, in turn inspired me - a retired marine engineer and IT geek with an interest in science - to seek to understand more about economics.

That led to me discovering that everything I thought I knew about politics, money, debt, and who runs the world was total bollocks.

I'm so disappointed and angry that I wasted 40 years thinking that our leaders were trying to do what was best. I'm now trying to fix that by preparing my mokopuna for a future where the only certainty is uncertainty. So here I lurk. :)

Sorry, rant over.

Alan,

As a card carrying member of the economic and political counter-culture for the past 20+ years, I would like to welcome you as a full member.

I want a card too.

:)

It’s in the mail to the 'usual" address. ;)

First rule of economic club is: There is no spoon!

Didn't get that. Google put me right.

i think John Key draws his substance from that spoon.

"Tourism has a very shaking footing in a likely future financial depression, so we're left with farming. Hmm."

Yes indeed. If we're hocking off the family silver Air New Zealand should be first on the block. Airlines are a very risky investment and will get more so, no matter how well run. It seems likely that at some point 5 or 10 years down the road long distance air travel will become prohibitively expensive and considered anti-social.

We'll be reliant on Australian and domestic tourism. Not such a bad thing.

I've been waiting for someone to start building sailing ships for freight. It's going to come.

In this era of modern technology I can assure you that this is very feasible. It’s not difficult to build a wing/sail vessel large enough to carry cargo. You could also design specialized containers to take advantage of solar energy while at sea. The entire ship would be completely sustainable and green.

At present and for years designers have been hung up on sail as an optional extra on diesel ships. I'm mystified as to why nobody has gone further.

By far the biggest cost for shipping (cargo ships, at least) is fuel. So I'd expect sail to be viable. Surely there would be people prepared to pay even if sail were more expensive. Just consider extortionately expensive organic produce, people in Germany and elswhere can't get enough of it last I heard.

The continued uncertainty among decision makers on future oil prices may be a hindrance. Time will fix that and maybe fairly soon.

Unfortunately perishable goods need to get to market asap, dry goods can take their time. I read somewhere that ships have already slowed down to save fuel. Sails are certainly an option and designs I've seen more resemble venetian blinds and are very maneuverable.

Ship yards are not getting the orders they need to flourish so there is very likely a surplus of vessels. This would suggest to me that sailing ships are some time off and it will need a major fuel crisis to bring this change.

Containerisation means that most perishable goods are able to be shipped over a long time span. For instance, bananas are difficult to keep in or out of the fridge, but if they're stored at exactly 15 deg C (I think, maybe 14) they will keep for a very long time without ripening or discolouring. That's why we once had "banana boats" (maybe still do?) they had holds set at that precise temperature. Individual temperature controlled containers killed the need for most such specialised vessels.

Even today, the really sensitive stuff is air freighted. Time is money, but only as long as other costs don't trump it. Fuel is the biggie, crew costs a distant second. The role of capital expenditure is distorted by ship building subsidies.

I remember paying $30 a ton for better grades of heavy fuel oil. Now it's $600 and rising. Even then it was constant pressure on Chief Engineers to keep fuel consumption down in the face of Masters wanting to wind the throttle wide open.

You're correct about the glut of shipping, it's affecting tanker rates too. And your "major fuel crisis" is coming right up. It may not happen overnight, but it will happen.

:)

I watched the video. Indeed, inspiring stuff. Amazing to see how much each employee generates in the way of revenue for the high tech companies like Samsung, compared to low tech ones. I think it's also true that there is a mentality that 'we don't do that here' - a bit like a self esteem issue almost. Thanks for the link.

For all those hoping that China will crash I have some bad news. It wont.

China is following the same path as all the other Asian tigers. The only difference is that China is so huge.

The direction is clear, onwards and upwards.

I find the writings of the right wingers such as yourself strange, ppl say things such as china is going to implode and you came back with those ppl want to see that....yet never, never ever as far as I can see has anyone said any such thing.

Maybe you could show some specific lines?

regards

Don't make much diffo what their political slant. If they think exponential growth goes forever, they're wrong. End story, really.

I was reading between the lines. Hoping for the worst, thinking that things can't get better seems to be a human failing that people fall into, especially among some lefties.

Well I think things can get better -- all we need is some left wing government; not the reactionary crony fact free government we suffer from now.

Some lefties think we are running out of resources, that there isn't enough food, that there are too many people, that we will go hungry. Rather than believing that things can get better they believe in the great leap backwards.

Is it only "some lefties" who think Malthusian? and understand the power and implications of expotential growth, and understand what cluster f**** climate change is going to be? Or are you using "lefties" as your code for anyone who disagrees with me?

I didn't start using left wing/right wing labels, however some have decided its useful to continue bringing up these terms. Chill

Kiwi...correct me if I'm wrong , but I'm sure your the one who continually extols the virtues of cosying up to Communist China as our new best freinds......

How does that regime see itself...? not left surely...? but then I guess some folk are left of left.

BTW ...correct me if I'm wrong........ was rhetorical.....I'm not.

Aleksandr Solzhenitsyn had a lot of time to be bitter at the communists after being sent to his gulag by the soviet authorities, however instead he came up with :-

“Gradually it was disclosed to me that the line separating good and evil passes not through states, nor between classes, nor between political parties either -- but right through every human heart -- and through all human hearts. This line shifts. Inside us, it oscillates with the years. And even within hearts overwhelmed by evil, one small bridgehead of good is retained. And even in the best of all hearts, there remains ... an unuprooted small corner of evil. Since then I have come to understand the truth of all the religions of the world: They struggle with the evil inside a human being (inside every human being). It is impossible to expel evil from the world in its entirety, but it is possible to constrict it within each person.”

I hope that the Chinese would

- outlaw all forced abortions

- Let families grow as big as they want.

- change their political system so that leaders are elected by the people, not because they descend from a princeling.

Now, If a pessimist convinces everyone that something bad is going to happen and instead something good happens, will the pessimist be happy or sad?

Let families grow as big as they want.................?

Geesus...! says it all for me, you shouldn't have bothered....no I mean really, you shouldn't have.

qhi-xhi gettin' to you christov?

We'll be seeing a Kiwi-Hu-Phlung-Dung next.

Yes iconoclast...........this one raaks me up a little more than I should allow mysaelf to be.......but propoganda is as propoganda does......and it just annoys the s*#t outta me.

Good on you Bernard, for the 'balance'.

Monbiot is a common kind - heart in the right place but no grasp of the exponential function, or math generally. We were always going to fry. If the symptoms are there before you are 1/2 way through the culprit resource, and there are lag-times and trigger-points, them mathematically you are stuffed.

Going into the last half doesn't save you - it was never going to.

No mention of EROEI, the export/import issue, or the fact that doubling your available resource gives you a few years grace at best....

Apropos of what you were saying the other day PDK about PV I made some enquiries about the cost to install it for my home where I currently use 10854 kwh pa. I would like to use about 16,000 kwh pa. Then I would be warm This is what they said.

3.2kw solar pv system - this has the potential of generating up to 6000kwh in a year - total cost inc gst $13,500.00

4.6kw solar pv system - this has the potential of generating up to 7000kwh in a year - total cost inc gst $19,570.00

5.0kw solar pv system - this has the potential of generating up to 9000kwh in a year - total cost inc gst $21,630.00

Not included in the price is the cost of a building permit (if required) or a structural engineers report (if required).

Certainly outside my league

Patricia

What are you running? A boarding house?

While I wouldnt consider myself representative, but the following might help. I am the sole occupant of a 200 sqm house, lots of glass, all electric, central heating, 7kw/hour air-conditioner, run a network of 3 computers all day long, router, modem. Water heating is gas, and central heating is gas (for heat) and electricity (for distribution of heat). Heats the whole house. No choice.

I have a 1.2 kw PV system.

Since installation 30 months ago, meter readings today are

Total drawdown from the grid is 4000 kws

Total unused power sent to grid is 2200 kws.

Maybe it is me not understanding this PV thing. I live alone and my house was built in 1974. It is concrete on the outside - sort of sprayed on concrete is what they did back then. Three bedrooms two bathrooms. I bought it in 1995 and did a lot of alterations - Including underfloor heating. Electricity wasn't so dear back then. My garage is under neath the living room which has a cathedral ceiling. I have done everything - well nearly. Fan to push the heat down. Insulation in the walks, ceiling and under the floors. Only two rooms left to double glaze and two bedrooms left to have internal walls insulated. Because I do not have a concrete floor the underfloor heating is really just an electric blanket under the tiles and carpet and that is only in the living room, kitchen and hall. It is too expensive to run the underfloor heating even twelve hours a day. If I did my bill would be around $600pm. Meridian said I had used 10,854 kwh in the last year. Is that a lot? The price the instaler quoted wouldn't help me much at all but am i reading it wrongly? I am old, when you are old you feel the cold much much more. I am home all day so I want to be able to use the heating in this cold Christchurch winter. Everything is electric - there is no alternative here.

Insulation.

Hmmm. 1974 huh. Difficult. Houses built around that era with cathedral ceilings (usually) didn't have much of a gap between the outer roofing and the inner lining so you should check to see if there is (a) any insulation barrier between the two, or (b) anything that could be done. If the inside beams are exposed you could insert some form of polystyrene barrier and re-line the ceilings over the polystyrene. Depends.

Is the garage a cantilevered open carport or an enclosed garage? Is the ceiling of the garage sealed with a ceiling or is it exposed joists. If lined, is there any insulation between the floorboards and the garage ceiling. Is the garage door draft-proof? or do strong winds pressurise the garage.

Power Usage.

Often the greatest users of electricity are (a) the hot water cylinder, and (b) the fridge. An older fridge that is defective can be constantly running and may need to be regassed. If the hot-water cylinder is an internal cylinder with an overflow pipe running down through the floor and is the original 1974 model you should check the pressure relief valve. If it is defective the overflow pipe would constantly leak hot water out under the house. The unit would be constantly running and using a lot of power. Try turning it off for a day if you can go without hot water for that long and take readings of your power meter for one day while on, and then one day while off. If you ever go away for a week, turn your hot-water off.

You can buy a cheap electric power device meter and set about measuring the amount of power each of your electrical devices are using. You need to start discovering what is using the power. When I got interested in PV I was like a little sand-boy checking the two-way meter every day, and soon discovered that when turning every electrical device off at the wall instead of leaving them on stand-by (ie computers, TV, VCR, etc etc) power useage dropped dramatically. When I go to bed at night the only thing left on is the fridge. PS: 16,000 kw pa is a lot of power use for one person.

Here is another thought. PDK has discussed on a several occasions his use of (thick) ex-container insulated polystyrene panels in his house. They're economical. If you have access to under your house you could attach those to the underside of the floor-joists. Pretty cheap. Do one bedroom and see if it makes a difference. Check the pros and cons and costs with PDK.

10,854 kWh sounds about right to me. While you have increased insulation a lot by the sounds of it, the glaring remaining problem is that you're using resistive electric heating. If you were to use a heat pump instead you could cut the amount you spend on space heating in half (easily I reckon). During winter space heating is the largest component of power consumption.

The amount of power you're using is similar to what we use, also in Christchurch, similar age house. We don't have all the insulation yet, but are working on it. We do have a heat pump and it runs all the time. 17C at night, up to 22 during the day, with heat transfer (fan ducting) throughout the house. We also use additional resistive electric heating in work rooms as we both work from home.

Try to ignore people who say they spend only a pittance a month on electricity in Christchurch. Closer investigation reveals they have gas space heating or a pellet burner and gas hot water. I know someone who spends a few hundred each winter just on pellets.

PDK has insulation levels way beyond what our houses will ever achieve, alas. He also doesn't heat with electricity! (has to go outside and bring in a tree to burn).

If you are set on PV, then you need to get your electric heating (both space and water) onto something else like gas, pellet burner. Then you will find you only need a small PV array, certainly much smaller than what you have been quoted on.

I never asked, but what is your goal? If it's just to reduce your power bill then get a heat pump. If it's to become resilient from the grid, then you need to look at the alternative heating methods to electricity.

BTW, I'm just interested in this stuff as a hobby, advice worth what you paid for it etc.

Martinv thank you. You live in Christchurch so you know what it is like. I only have my water heating on two nights a week - Monday and Thursday. That lasts me. My latest thought, because I could not afford that PV and anyway I use more kwh than it can provide (and I want to use more) is a heat pump. I know everybody has them but they look so ugly sitting on a wall. Walls are for paintings not heat pumps. Anyway it sounds you are using what I had in mind. I thought I could have the heat pump in the garage (which is under the living room) have the heat ducted up to the house and come out through vents. Is that what you have and how many heat pumps do you have? (When I got up this morning the temperature guage inside said 12. Last week it was 8! Your 17 sounds like heaven.) Is it necessary to have vents in each room? My goal ? It is to have an affordable warm house. That will give a very happy old age........ I have gone off saving the planet. You youngsters will have to do that.

An alternative to the stuck on the inside wall heat pump might be a ducted heat pump system. They will be less visible inside the house. You still need the outside unit, but inside the house you would just have vents in the ceilings of rooms, the 'inside' unit is typically hidden in the roof space. Unfortunately from what I've seen such systems are more expensive than a regular heat pump, and sometimes there just isn't anywhere to fit them in.

12 degrees is simply too cold! Not knowing your house it's difficult to give recommendations. We've been in our house for two winters now and I'm still learning what works and what doesn't (mainly in regarding to the ducting I'm playing with). If you go for a regular, wall-mounted type of heat pump I'd put it where you spend most of your time, and low down works better than high up on the wall for heating.

We have a single heat pump in the kitchen/dining that was in the house when we bought it. I duct heat from that room to other rooms in the house. This works, but the ducted air loses heat (even with highly insulated ducting) the further it goes and so the kitchen/dining is warmer than the other rooms. Ideally (for the shape of our particular home) we would have a separate heat pump for the bedrooms. Then we would have more control over the bedroom temperatures and could raise the temperatures there above what's in the kitchen/dining without resorting to exta electric resistive heaters.

Your idea of mounting a system in your garage (a ducted heat pump - not just a regular heat pump of course) and venting to relevant rooms should work well. Access will be easy. Particularly as warm air rises, vents in the floors of rooms above would work well. Remember that the air needs to cycle around back to the heat pump to be heated again, so when the air is ducted into a room it has to have a way back to the heat pump whether that is via an open door through the house to another room, or another duct in the same room.

Thank you so much Martinv. You have given me much food for thought. I will contact a supplier tomorrow and see what they say.

Addendum

You can get the energymatters weekly newsletter free, here

They have a good forum that traverses nearly every possible question you can ask

http://forums.energymatters.com.au/

And here is a thread by a guy who is not too far from me, but he uses electricity for water heating. Only two of them in the house and they are asleep during the day, away at work at night, so dont need to use much power. It appears electric hot water heating is the big user.

But oh-boy his power bills are huge - read the thread

http://forums.energymatters.com.au/energy-efficiency/topic3609.html

Those are the type of problems that need to be attended to

He comes across as capable of grasping, but its pretty clear Monboit doesnt want to IMHO....I assume with small children he just cant go there......

regards

Ohh steven, you're back. You were gone for hours and we all feared the boss had uncovered your browsing history. Don't do that again, you know we would wandering in the darkness without your many, many illuminating comments on every post. Be still ,my beating heart.

From total economic ignorance, in a few months I've learned a lot by following these pages and the comments from learned folk. Let me see if I've got this right:

- If world economic growth continues at a respectable enough pace to avoid economic melt-down, we then consume finite resources at an unsustainable rate;

- before too long we're stuffed.

- If economic growth doesn't continue at a respectable rate, the whole financial system comes crashing down because the our debt-based economies can't survive without said growth;

- and before too long we're stuffed.

- China's even worse off than most because she requires growth of say, above 6% to keep paying the bills.

- So before too long China's stuffed.

- If China's stuffed, before too long Australia's stuffed.

- If Australia's stuffed, we're stuffed in spades.

So we're stuffed.

Right?

Got it in 8.

http://www.energybulletin.net/stories/2012-07-02/peak-denial

We'er going to get hit with a lot of noisy spin from here on. It will parallel the 'church vs Darwin' effort, which hasn't gone away, and for the same reason: Those who hold power in the current paradigm, never want the paradigm to go away.

"Those who hold power in the current paradigm, never want the paradigm to go away."

Damn right. I can't remember whether Exxon's CEO's incredible rant this week has been mentioned here.

It's terrifying stuff. Don't worry about climate change or energy security, our engineers can fix it and nobody else understands the science.

Burn baby, burn. God's on our side.

Yes, except for the tense of the first one......we have consumed resources at an unsustainable rate already....just about all the cheap stuff is gone.....

China's "normal" growth rate is 10%, that means its economy doubles every 7 years. So the easy point to consider is, where in the next 7 years do they sell a double amount to? and where do they get the resources from to do it? So for all those who think its going to just carry on, I ask how......

Peak oil was 2006.....condensates have held or pushed that up slightly...so the only way china can get the energy is to take it off someone(s) else.....that can only be achieved via price.....

I think we can step back and say the last doubling was started 7 years ago and to keep them going they have been doing make believe work....property speculation etc that looks to explode/implode.....

So best case I suppose we could say we have another 7 years....cant see it myself.

Stuffed, yes......in terms of a BAU economy in terms of morfing into something else I think NZ can and will....

regards

Welcome to the club. Yes, we're stuffed.

Not much that will be done though, so best just to sit back and watch. People will adapt. Useful people will do relatively well. Life will go on for many.

Perhaps you're right.

But unless there's a big wakeup and a total rehash of our economic system, it could be very nasty. It's not just oil we're running out of. Topsoil, fresh water, land, some metals, fish stocks, you could go on forever.

Without a radical rethink it's going to get nasty.

People may covet your stuff.

:(

YES, Much like all ponzi schemes when they have reached peak sucker capacity

Yes , she is Hugh P......in trouble with a capital T that rhymes with P that stands for Poor.

The impoverished members of the union know if they have nothing they have numbers, a constitutional menace....the French pretend to whistle on the fence while the figure a way back into the game on a bluff...and all the while Merkels Turkels wonder why they are at the table when their's is the only ante on the table, potentialy capable of providing the losers with a grub stake.

Nein Madame, es wird nicht schweben...!

For all the doomsters, the classic blog is of course James Howard Kunstler....the books are all good intentions if wooden plots (sorry).

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.