Here's my blogroll for the week, detailing the blogosphere's reaction to the government's election year budget released yesterday. Have a good weekend all.

Read of the week is Eric Crampton's Budget overview. He makes a good point on a potential looming problem if KiwiSavers invest in the privatised SOEs.

From the Left

1. Where's the plan? Eddie at The Standard thinks the field is wide open for Opposition parties and ACT to show they have real ideas for the future following the budget. The left do have a chance here.

The government wants the public sector to cut NZ$1 billion in spending, but it's up to respective departments to choose what they spend on and what they cut.

Isn't it a Cabinet Minister's job to decide what initiatives and schemes the government would like to focus on, and therefore have the say on where money is spent and where it's cut?

And who gets the blame if decisions turn bad? Not the Government Minister - they didn't make the decisions....

4% wage growth will be below inflation once the Kiwisaver clawbacks get you. An extra 1% of your gross income will go into Kiwisaver to replace what the government is no longer contributing. And your employer’s contribution may go up to 3% from 2% but now you will be paying tax on it, which you don’t now, so you’ll actually only get 2-2.7% net from your employer. Oh, and your employer is allowed to make that Kiwisaver increase part of your pay rise.

Working for Families will be killed off slowly by eliminating the inflation-adjustments so the real value of the payments shrinks and rising nominal incomes mean you’re no longer eligible.

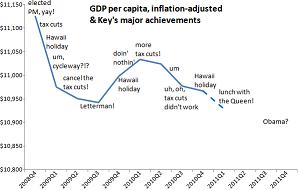

National says that jobs will come but they have pinned their hopes on Christchurch rebuilding itself, and claiming the credit for themselves. Personally, I don’t see it happening. Every Budget, National has promised the recovery is coming, and it simply hasn’t happened. Anyway, even National’s projections don’t get unemployment back under 4% like it was under Labour.

Oh, and their projections assume asset sales. The way they’ve planned things, there will be no money for new capital expenditure – schools, hospitals etc – unless they privatise assets.

2. Smoke and mirrors. No Right Turn says those supposedly in line for higher Working for Families payments will actually be receiving cuts, plus the KiwiSaver changes aren't too good for workers either.

Their carefully chosen examples, which show lower-income people receiving higher payments, do that because they're counting the inflation-adjustment, not because they've actually made the scheme more generous. In real terms, their entitlements have been cut. On the second, the government has just legislated you a 1% pay cut from 2013, plus another 1% if (like many) your employer rips KiwiSaver payments directly out of your wages. Plus, they're cutting their contribution, while sticking a stealth tax on your employers (meaning, in fact, that you will be no better off due to their increase). And if you're planning an education, you're not going to be allowed to do it part-time unless you meet your course-related costs. Which makes it far more difficult for those already in the workforce to better themselves.

In addition, we have health cuts, thanks to a sub-inflation increase, education cuts, thanks to the Ministry of Education having to meet superannuation costs out of its own budget, andselling the family silver. And all of this so the government can reach surplus one year earlier (if everything goes right). I remember when government's delivered surpluses without these sorts of cuts. But that was back when we were governed by competent people, rather than self-interested looters.

But don't worry! Good times are just around the corner! Treasury says so, so it must be true! Oddly, though, they're projecting record 4% wage growth [PDF; Table A3.1], while at the same time sticking the screws on public servants through the requirement to internally fund superannuation. So who is going to get these supposed wage increases? Un-unionised wage-slaves on 90 day contracts? Somehow I don't think so.

3. Where will the jobs come from? Labour MP Stuart Nash asks on Red Alert where those 170,000 jobs the government is promising will come from. High commodity prices don't necessarily mean more jobs in the tradable sector, Nash says. He also points to the massive debt still saddling the rural sector.

It seems to me the government's medium term jobs plan relies on the Rugby World Cup (ends in October) and the Christchurch rebuild (which the government is projecting may need 12,500 workers). Other than those two events, the government says it's done its job by cutting taxes and reforming the RMA, so it's up to the private sector to create jobs in the productive sector.

Oh, and the government will be cutting public service jobs, freeing up workers for the productive sector. Ha. Can you imagine a bunch of B.A. wielding policy analysts who have just been chucked out of Te Puni Kokiri going to work on the farm? Cue Tui ad.

Here's Nash:

Bill English and John Key have promised 170,000 jobs will be created by 2015 - but from where? When pressed on TV this morning, Bill said that record commodity prices will create more jobs in these sectors.

Record commodity prices does not equal more jobs. Products are commodities because we have failed to add any (or very little) value in NZ. So the reality is the opposite is happening. For example, in the forest industry record log prices have meant job losses as forest owners are selling more unprocessed logs overseas and domestic processors are struggling to afford the sharp increases in prices. We have already seen three mills close in the past 6 months.

Farm prices, whilst high, are not the panacea to all problems. The sector is still saddled with massive debt ($42b) which it must address before any expansion is considered. Besides, how will record wool, meat and dairy prices create jobs? The works may stay open a few months longer, but I certainly haven’t seen any plans for new processing plants.

The public sector is being asked to find saving of $1b, and we all know that will mean staff cuts, so no new jobs there.

Sure, Chch reconstruction will create employment, but I hope the govt isn’t counting on Chch to pull it out of recession. That’s simply not sustainable growth.

So where are these 170,000 jobs coming from Mr English?

To me the most telling thing about this budget is English’s decision to tax employer contributions to Kiwisaver. Why is the Finance Minister increasing taxation on savings when the ongoing crisis crippling our economy is our private debt and inability to save?

Maybe he has some technical, policy-based or even ideological reason, but I’m pretty confident it’s simply because he desperately, desperately needs the cash and this is a nice, covert way to extract it without anyone noticing. He could just raise income taxes or corporate taxes a fraction – but then the opposition would make fun of him, and Dr Brash might write him an angry letter. So instead we get fiscal policies complicating the taxation and savings regimes, purely because the Finance Minister won’t swallow his pride.

From the right

5. Astute, but needs to look at savings more. David Farrar at Kiwiblog says the government can't just sit on its hands and expect everything to work out now it's delivered the budget with surpluses forecast in 2014/15. His challenge to the government is to work to turn the forecast NZ$700 million deficit forecast in 2013/14 into a surplus.

This budget reminds me of the 2009 budget – both were shaped primarily by external forces. There isn’t a lot you would sensibly do different. The 2010 budget remains for me the bold budget where some risks were taken and big changes made.

The budget is politically astute – it gets NZ back into surplus earlier and minimises the impact on most people. But it has not dealt with many of the issues raised by the Savings Working Group, such as the excellent idea to tax people only on their real returns from investments, not their nominal returns. The Minister said the idea is not yet ruled out, but is complex. Hopefully they might be saving that for their election manifesto.

Farmers do not pay their fair share of tax. It doesn't matter how you spin it. Looking at their gross income isn't the issue. Looking at their leveraging and how that swallows up deductions, is where the action is at.

Tomorrow I imagine there will be screeds of reactionary comment from the likes of Fongterror and Federated F*%kwits. All of it spin designed to show you how poor farmers are and how hard they have had it. The deflection will be grand to watch.

You know farmers are the backbone of the community bla bla. In reality they contribute4.6% of GDP (agriculture), 7% employment (agriculture) and around 25% of exports. Yet you would think the way they carry on they carried 100% of all. They get special treatment. Fongterror's special made regulatory benefits see to that.

Today we have already had this spin. No farmers pay $28,000 in tax! Oh so that's better. Income of hundreds of thousand of dollars and stuff all profit all in the name of what sort of business model? Millions of dollars of leveraging all for capital gains.

It depends on how you define hard but would a family of three really struggle on $85,000 a year? That’s well above the average income and if they need the extra $2.55 a week, they do have options.

One or both parents could do more paid work or they could look at their budget, give up some luxuries and reassess what’s necessary.

That’s what the government is having to do because previous administrations have given money to people in want rather than need.

A couple of tradesmen called in last night, they brought up the this topic and neither had any sympathy at all for the families who will be losing a little bit of their WFF payments.

They’d both brought up their children on incomes well under $85,000 and without any government assistance. Like me they didn’t mind paying tax to help people in need but neither approved of paying for people in want.

We reckon that the big flaw in the budget is that it is a plan for the best and hope like frikking hell the worst doesn't happen. Whereas we have always believed in the business planning maxim of plan for the worst - hope for the best.

The only people who ever consistently base their future on the "plan for the best" approach are gamblers.

So while we think that the budget offers up some good bits, it doesnt do enough hard enough and fast enough for us. Leaving most of the changes to the next year and using the election as a mandating approach is fraught and again a gamble.

So to our PM - heres our song for you - courtesy of our favourite country crooner - Kenny Rogers - The Gambler. F**k we hope ya got it right mate - otherwise we will be joining the PIGS at the trough of economic despair.

Economics blogs

9. Hard to find upside risks, quake bond a good idea (but 4% might be a bit low), KiwiSaver SOE dividend problem down the track. Economist Eric Crampton has a great overview of the budget on Offsetting behaviour. I've picked out what I think are the best bits

Using a dedicated bond issue to partially fund Canterbury reconstruction is a good idea (previously noted here). Not sure how many folks will take bonds paying 4% nominal interest when inflation's set to run reasonably high; hope sufficient numbers of investors will go for it.

I'm not at all averse to the government's selling off partial stakes in SOEs to raise money. The efficiency gains of partial privatization aren't strong relative to full privatization, but it's not particularly bad. But this bit of Key's speech worries me:

KiwiSaver funds are well placed to participate in the Mixed Ownership Model, which I will come to shortly.

Where State-owned Enterprises raise outside equity, New Zealand investors will be at the front of the queue to invest. We expect KiwiSaver funds to become substantial long-term holders of these investments.

I don't like partial privatization where KiwiSaver providers are leaned on to invest in the SOEs. Why? Imagine that, 30 years from now, Solid Energy is 51% government owned, 49% owned by the retirement funds. Changes in Solid Energy dividend flows then become of strong public interest as they affect retirement incomes. I worry that political pressure to maintain dividend flows over investment and maintenance could distort SOE decisions over the long term.

Looming risks. Here's some of Treasury's list of risks, generally unquantified, that might affect revenue and expenditure projections: AMI Support Package (earthquake); Kyoto obligations (hopefully we'll just ignore it like everyone else); Leaky home assistance (risk exceeding the billion already provided for); Rugby World Cup (unquantifiable contingent liability).... It's harder to find plausible upside risks.

Video

10. What else this week...Peter Dunne. Great video and good to see he has a sense of humour.

7 Comments

look out phil NASH could be making a dash at your bash.

I've discovered a new rort...it's as easy as calling yourselves Treasure Divers...bashing out a few hours of edited rubbish mostly of three old farts playing at diving for treasure on a boat ...lots of blathering garbage some pics of 9crt gold chains and highly polished silver coins....throw in a chart or three with the dirty finger pointing at where the treasure can not be found...and then find yourself a stupid Sky Tv buyer to flog the lot to....

Oh and don't forget the underwater shots of one old coot finding nothing but sand and murkey water.

Best of all is to let one old fart stuff up by saying the air pressure in the tank goes up as you get deeper and can cause the 'bends'.....utter rubbish.

They sure suckered the sky programme buyer.....

It's bullshit tor lawn....pure crap. For starters the area they are diving in consists of coral and coral sand reefs which in the three hundred years plus since the wrecks went down, have grown metres in height over the top of the wrecks...deep enough to be out of range of a mag system other than something the US Navy would use. What they have there is a fanciful programme of pretty shots and heaps of jabber.

As for the stupid comment about the pressure of the air in the tanks...that's gotta be a hoot ...

Somebody got paid a pile of dosh for a pile of crap.

Perhaps the answer to where the growth will come from can be found in the porridge that lies between the ears of all the KiwiKevs out there who will believe the Treasury numbers come what may...a bit like the fools currently waiting for that idiot's end of the world prediction to come true....

Remember...the first victim in a recession set to last a decade minimum...is the truth.

"While deeming the sign " tacky, unoriginal and embarrassing" members have pushed each other to email Wellington Airport directly" stuff

Let's see how long it takes for some enterprising team to add an Esssss at the start and flip the doubleyou.........

Either that or torch the bloody thing on Nov 5th....

Imagine having to look across the harbour....at that piece of shite on the hillside....

"Children are set to be the key focus of any future Labour government, says deputy leader Annette King at the party conference today.

She announced that a Labour government would introduce a Minister for Children with the aim of targeting the country's alarming rate of child abuse." tvnz

King had 9 long years in which she managed to do next to nothing about this problem...

I think the heading should have been..." votes are set to be the main focus......"

and at the same time Labour if elected will sell the children's futures into debt slavery...

thanks Labour

regards

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.