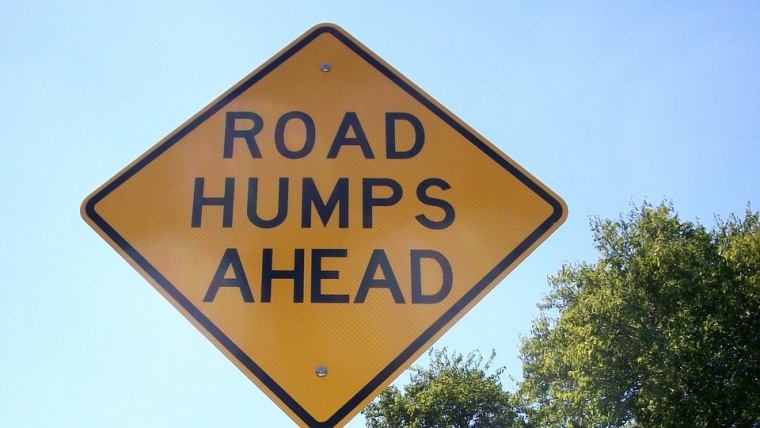

Well, there's a bump in the road that we are about to hit in terms of inflation - but the road ahead looks set to give us a period of very weak inflation, economists say.

We will get a handle on how inflation has been tracking recently when Statistics New Zealand releases the September quarterly Consumer Price Index figures on Friday (October 23).

In short the figures are likely to show quite a sharp rise following the big fall-off in the June quarter - but it's going to be a one-off. In the June quarter prices fell 0.5%, dropping the annual rate of inflation down to 1.5%.

ANZ economists are picking a 1.1% rise in the September quarter, bringing annual inflation up to 1.8%. (Remember, the Reserve Bank has a 1%-3% target for inflation, with an explicit target of the midpoint of that range -IE 2%.)

ANZ senior economist Liz Kendall says the quarterly bounce in CPI is expected to be particularly strong on the 'tradable' side (+1.4% quarter-on-quarter; 0.7% year-on-year), reflecting post-lockdown rebounds across clothing, durable goods and petrol prices. Non-tradable inflation she says is expected to lift 0.9% q/q (2.9% y/y).

Cloudy data

"The data will be clouded by collection difficulties, methodological challenges, effects of Covid-19 disruption on prices, and volatility – along with a CPI re-weighting to boot. Policymakers will down-weight this data and look through the bumps, focusing instead on the road ahead where the outlook for inflation remains weak," she says.

Kendall says Stats NZ are updating household expenditure weights (last done in 2017). "While weights are slow moving, this will affect how price movements are aggregated, adding to uncertainty about [the] outturn."

In its most recent forecast, made in August, the RBNZ also picked a bounce of 1.1% for the September quarter.

Kendall says at that time the RBNZ projections showed inflation weakening considerably over their forecast horizon, "reaching a nadir of just 0.3% y/y in late 2021 – weaker than our own medium-term forecasts, which feature a trough of 0.7% y/y".

"Based on this subdued outlook, with unemployment also elevated and downside risks salient, the RBNZ has been putting pedal to the medal with monetary stimulus. At this stage, we (and the RBNZ) won’t know where the inflation pulse is settling until next year – potentially later if renewed Covid-19 restrictions are needed in future. Price movements will remain difficult to interpret and glean signal from, let alone forecast."

ASB senior economist Mark Smith is picking a 0.9% third-quarter rise in inflation.

Balanced risks

"The Q3 outturn reflects an element of recoil from the very weak Q2 print, seasonality, and our expectation that pricing pressures are not entirely dormant in some key pockets, notably housing. Risks are broadly balanced, but we admit a greater degree of uncertainty than usual around our CPI pick given the impacts of Covid-19 and the CPI rebase being introduced in the Q3 data.

"Looking ahead, we expect annual headline inflation to dip at the start of next year but for annual CPI deflation to be avoided. The NZ economy has proved to be more resilient than we expected, the housing market is booming, and some of the downside risks for the economy and medium-term inflation look to have dissipated.

"Nevertheless, uncertainty is pronounced, and economic headwinds posed by Covid-19 remain sizeable. Policymakers in NZ and abroad have pulled out all the stops and will maintain highly stimulatory settings until they are confident economic activity has turned the corner. This will mean tolerating higher inflation if need be."

Westpac senior economist Michael Gordon is also expecting a 0.9% increase in inflation for the quarter. Noting the 1.1% the RBNZ was expecting, he said a "modest downside surprise" in the rate of inflation in the latest quarter probably wouldn’t sway the RBNZ, which is already braced for weaker inflation over the next couple of years as the Covid-19 shock weighs on economic activity. However, "an upside surprise would be more significant for monetary policy, challenging the need for the further easing measures that the RBNZ is developing".

Local rates

He says the main contributor to inflation for the quarter is likely to be the annual increase in local body rates, "which we peg at around 4% on average this year, compared to an almost 5% increase last year".

"The other significant contribution to the quarter was an estimated 3.5% rise in petrol prices, following a steep fall in the previous quarter. Fuel excise duty was increased at the start of the quarter, and prices at the pump have been fairly steady since then. Petrol also accounts for most of the expected rise in the annual inflation rate, as prices fell slightly in the same quarter last year."

Gordon says the impact of Covid-19 on consumer prices is as yet unclear.

"We think that it will prove to be a disinflationary shock over time, requiring ongoing stimulus from the Reserve Bank in order to meet its inflation target. However, the impact on prices won’t be all one-way, especially in the near term."

Consumer prices index

Select chart tabs

23 Comments

Good Discussion/ perspective on QE, Fed Action on Inflation but is actually Deflationary and future

It is also true that real impact of lockdown / panademic on Economy has not yet begun and will be felt in time to come.

To understand more on inflation and deflationand it affect can watch video above.

Is FED too worried that comming out with statement and predection to motivate people to borrow more though knowing that with law of diminishing return are soon running out of ideas and will have to invent new desperate ideas or tools.

David, you are a busy person but if have time to watch video, will like to hear your feedback on what is been said on the discussion in video.

People don't have time to watch every YT video posted on forums. Make a case to give others a reason to watch it. Who, what, why is usually a good start.

JC one has to watch a video to understand and judge for themselves. Also to watch or not watch is indivuduals call so Chill.

I think you introduced it well, but if you at least put a name to the people behind the content, then it helps. For ex, if you say "On Mark Moss' channel,......", I for one would at least might click on the link. Just a suggestion. I think people should quote their sources better.

The last thing interest dot co needs is a string of links to YT.

Economists, at ths late stage in the unfolding planetary narrative, are flying blind.

They have never experienced the multiple, systemic, cascading collection of impacts, forcings and overshoots we are entering.

So why even ask them? It's akin to reading tea-leaves to see when to initiate D Day - much better we follow the equivalent of meteorologists.

That's unfair :-) - economists are incredibly helpful with predictions - if we use the Sir Bob Jones method of applied economist predictions. Much like economists' unanimous predictions of house price drops, if they're now predicting falling price inflation, it should soon race up to 10%.

That's unfair, economists are incredibly helpful with predictions - if we use the Sir Bob Jones method of applied economist predictions. Much like economists' unanimous predictions of house price drops, if they're now predicting falling price inflation, it should soon race up to 10%.

That's just Bob Jones explaining why people need to think independently. Economists can be helpful and useful, but they can also be dogmatic and little more than puppets for their employers. The more you understand the person, the more you can attribute value to what they say.

I seem to remember a reputable study was done between economists predictions and that of taxi drivers. I think results showed almost no difference in accuracy. Muppets are puppets, aren't they?

Agree, JC, and added a :-) to clarify mild sarcasm, I think economists are very helpful, and certainly needs independent thought.

Economists usually get it wrong in even the most predictable of times

Still waiting for "interest rates to return to normal", as predicted by pretty much every economist for years post GFC? Although there is noticeable silence about "normal" more recently. Economics requires short memory, if to be taken seriously.

On that one I think they're right, the only question is when. I remember posting a couple of links to charts here a while back, one showing last 670 odd years & the other going back a few thousand, showing interest rates. This period of ultra-low rates is the only time like this, ever.

No, they're wrong, increasingly so with time.

I've put this piece up before - read it slowly, sans prejudice, sans assumptions.

https://www.sciencedirect.com/science/article/pii/S0921800919310067

"We think that it will prove to be a disinflationary shock over time, requiring ongoing stimulus from the Reserve Bank in order to meet its inflation target. However, the impact on prices won’t be all one-way, especially in the near term."

Where's the evidence?

Again, it’s not really about just inflation. Even taking out each of the recessionary declines, QE’s – particularly QQE – come up short in every possible respect: graphic evidence

To put this into context, real GDP in Japan during Q3 2019 – despite all the QE’s and inflation targets – was just 6.4% more than it had been in Q1 2008 at the prior peak. Six point four total, not per year.

Seasoned eurodollar observers will notice how in the second half of the quote above all of the reasons given for this shortfall sound exactly like what a eurodollar squeeze produces: declines in oil, unexpected of course; economic growth, or output gap, coming up short, unexpectedly; and the ubiquitous negative shocks always associated with global downturns produced by any Euro$ #n.

Central bankers can see, but don’t yet know, we live in the eurodollar’s world.

In short, there is absolutely nothing legitimate upon which to base the Fed’s late 2020 more optimistic inflationary forecasts. Nothing. It’s all smoke and mirrors, a tired puppet show increasingly lacking the slightest originality. The entire monetary toolkit consists of uncritical stories written up in Bloomberg and for CNBC. That’s all it ever was.

The “yeah, but we won’t screw up like the Japanese did” excuse doesn’t even fly anymore – since everything has turned out the same way anyway. Link

"We think that it will prove to be a disinflationary shock over time, requiring ongoing stimulus from the Reserve Bank in order to meet its inflation target."

Seriously? Even some in the Fed (Kashkari & a few others by recollection) have realised that the belief that QE/low rates should boost price inflation hasn't worked out that way. The already low rates environment simply boost asset prices instead. Doesn't RBNZ look outside to see what's actually happening?

"Doesn't RBNZ look outside to see what's actually happening?" The evidence of their actions would suggest not.

But the frightening alternative is that "Yes they do" and either they, as the local arm of the Collective of Central Bank Debt Creators, are just following Global Orders or, worse, they haven't a clue as to what to do about it - probably a mix of both.

We know what the answer is, and more debt isn't it.

Yip I think the central banks know what is happening and how badly they're backed into a corner. But this was set in motion over a period of decades, so those in the seat now are just dealing with the decisions made by those before them. They may assume they just do their best and know they'll be out of the seat in a couple of years and someone else will have to deal with it (hence each person in the role appears to like the kick the can down the road approach as opposed to how do we make this better for the future, not worse).

'The already low rates environment simply boost asset prices instead. Doesn't RBNZ look outside to see what's actually happening?'

They do look around and are aware AND boosting asset price is their mission as have no control on anything else BUT can only hope that rising asset helps and also that asset price keeps on going up ...and have been successful till now, will they be able to pull it off, sure as they have unlimited power to print and distribute money and can also extend moratge holiday by another or two or...who knows but possible as now they have no choice but to ensure come what may that the ponzi continues.

I think this is a pretty good summary of where we are at from a macro (US based) view:

https://www.youtube.com/watch?v=kLgDMfuihDI

Obviously what happens in the US is likely to be highly correlated to what happens here.

When I said 'diversify, diversify, diversify' I think I underestimated. And thinking about the real cost of debt increasing leading to increased risk of bond holders selling off certainly freaks me out. The summary of 'there are 5 types of wars and we're in 4 of them' is pretty accurate - so long as we discount the skirmishes on the side.

"highly correlated to what happens here" ... if we keep going the way we're going, yes. Personally I think we need to have our fourth industrial revolution sooner than others. Bubble with Singapore?

Inflation everywhere I look, but how the numbers come together seem to be very picky.

It's ok, the experts have always told me that inflation is controlled directly via the OCR.

Inflation of land & house prices is hidden from CPI, they liked an invincible bait carrots for the donkey that pull the carriage. We all can smell it, thus makes us keep on moving. But to some we're just getting hungry, tired and nothing else left - the natural stop working by all donkeys/banded services together is the next natural things that will follow to open up the authority eyes due to higher/prohibitive living cost, more healthcare professionals burn out then strike, farmers/growers/fisheries/bakers/truckies etc. would like to charge more.. just to cover forever increases of housing cost (rental, rates, $ loan etc) - hidden inflations eventually will trickle up into the real CPI inflation figures - The 'separation' is to delay the causation - delay=buying more time=more $ movement in theory try to find adjustment. Sadly, there'll be winner & looser. Except? the winner usually can plan more elaborate way to sustain their place, distort the game.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.