The last few weeks of the election campaign were always going to be a roller-coaster.

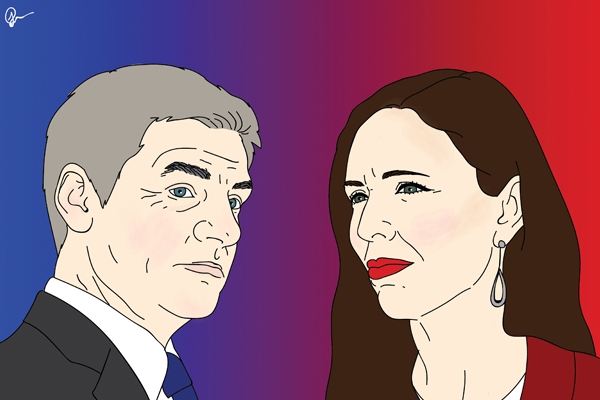

The latest Newshub Reid Research poll has thrown out another curve-ball, showing National and Bill English strengthening to a position to be able to govern alone and Labour's momentum perhaps hitting its buffers.

National was up four points to 47.3%, giving it 61 seats in a 121-seat Parliament. Labour was 10 points behind on 37.8%, down 1.6 points. New Zealand First was down 0.6 at 6.0%, and the Greens down 1.2 at 4.9% - missing out on Parliament so boosting the wasted vote and allowing National to govern alone. Jacinda Ardern told Newshub that Labour's numbers showed the Greens slightly stronger.

TOP was down 0.3 at 1.6%, the Maori Party up 0.1 at 1.1%, and ACT no change at 0.6%.

The poll was conducted between 6 and 11 September - so encompassed Steven Joyce's fiscal hole claims, and the many rebuttals. The margin of error was 3.1%.

That margin of error might help explain National's strength - Bill English said the polling they were getting showed the two parties more neck-and-neck, with National slightly lower than what the poll indicated.

Bill English strengthened his standing as preferred Prime Minister, at 33.1%. So did Ardern, up slightly to 31.7%.

The poll contrasts greatly with the recent 1 News Colmar Brunton, which had Labour ahead of National and in a position to choose between governing with either the Greens and Maori Party, or New Zealand First.

333 Comments

Its still going to be down to Winston

Yes, at 4.9% the Greens are closer to the 5% threshold, than not - which takes it back to the need for a coalition government. Hopefully, we'll have another poll of polls calculation done soon.

Tax is the lefts achilles heel .........you would have though that Labour would have learnt by now that while Kiwis are willing to pay tax , they are streetwise enough to avoid voting for a situation where they get shaken down.

Kiwis also inherently dont trust politicians , so they are even more wary of secretiveness and a lack of openness and transparency around something as important as taxation

They've had 9 years to consult with whoever they want, or just go off nationals tax working groups findings, the reason they haven't is because both land tax and capital gains taxes will be suggested and it's clear Taxinda wants a property crash but knows saying as much is political suicide.

She's reckless and unlike John key and English doesn't have a deep understanding of the complexities of the NZ economy.

House prices are already falling - vote labour and they will crash, along with farming, and trade as she naively attempts to renegotiate with china and south korea.

Read the demographia studies going back over 10 years (you'll see Bill English actively wrote the intro for the 2013 one he knows the issue well), the problem with property prices is clear, and its down to the RMA. National are the only ones attempting to address this and they know a plateau is needed NOT a crash that will see banks forcing many families to sell their pride and joy. Vote labour and more people will get hurt just so kids get free tertiary education - even though they all can get the same education already, heaven forbid they pay tax payers back from their 100k plus salaries.

National have not resolved the RMA issue in three terms. But for some reason you still believe they will this time around?

Pretty sure that is because both labour and the greens have stopped them!!!! They only just scrapped through with parliamentary support by making some concessions to the Maori party last year, but it was significantly watered down. But you're right, unless nats get a clear majority the same political bs will hamper any real changes.

Also amazed that nationals 100,000 children out of poverty in 2 years compared to Labour's goal or 25,000 fell on death ears. Jacindas life in a bubble of privilege only ever being a well paid politician, and mixing with NZ socialites (her partners one) means she thinks free tertiary ed etc will make her popular; she will find out that as wrong as she is about what drives the economy and puts dollars in kiwis pockets has nothing to do with what her and her kiwi celeb mates think are important.

Pretty sure that is because both labour and the greens have stopped them!!!!

That's just plain wrong.

National have had the majority with which to pass reform in the last nine years. But they have not. They don't need Labour or the Greens to vote with them to pass laws.

You can't blame everything on Labour. At some point, National has the responsibility to legislate when they are in power.

Exactly. And what amendments they have made have made in many cases have introduced more complexity. The as yet unknown impact of the last round of changes that is of future interest are the Mana Whakahono a Rohe provisions;

http://www.mfe.govt.nz/sites/default/files/media/fact-sheet-3-%20change…

The issue of the Mana Whakahono a Rohe provisions is more about undermining the democratic process than increased complexity. The provisions give undemocratically appointed stakeholders (Iwi leaders) the ability to develop policies and rules before other stakeholders. One country, two sets of rules is no way to build a prosperous, unified NZ and is the one thing that'll stop me supporting National. So disappointed they've gone down that rabbit hole.

as she naively attempts to renegotiate with china and south korea.

It is only the South Korean FTA that needs to be renegotiated on the issue that would allow NZ to implement a ban on non-NZ residents buying residential RE. And, the South Koreans have that provision/sovereign choice to do that in their side of that FTA - the NZ delegates (whether by design or omission) simply failed to mirror it on our side.

Remember this is the Reid Research Poll, the one we lefties hoped against hope for the last 2 elections would turn up the goods, but no, its the Colmar Brunton one that got it all right. I will wait for the next one of those. And until such times as these pollsters start using cellphones more and landlines less they will continue to fail to accurately assess the thoughts of the younger demographic

Yes, totally agree. Don't know about Reid, but Colmar Brunton's adoption of relevant technology for polling is woeful. Furthermore, most research companies are still overly focused on random sampling, but in this day and age, a non-probability sampling frame is probably a better option, however there would need to be quite a bit modelling necessary for it to be representative.

From CB:

Nationwide random digit dialling of landline telephones using stratified probability sampling to ensure the sample includes the correct proportion of people in urban and rural areas. Interviewers ask to speak to the person in each household aged 18 years or over with the next birthday. When required, multiple calls are made to reach that person. Voting eligibility is determined at the first question.

YouGov in the UK has a panel-based methodology and I believe is done entirely via mobile.

https://yougov.co.uk/news/2017/05/31/how-yougov-model-2017-general-elec…

Hoping against hope is something you lefties are good at - I will give you that.

Trouble is it is the only thing you are any good at - pretty much the summary of the whole "philosophy".

Forget about polls , they are often wrong , what is true however is that Labour have for the past 3 elections cocked up their tax and spend strategy, which has seen them lose the elections.

Tax is a funny thing , I dont mind paying my money in tax as long as its spent as carefully as I would spend my money AND I know how much I am going to pay

NZ is unlike other countries where a small minority pay tax and the majority vote for a Government that milks them .

In NZ we all pay tax from the first Dollar we earn , so tax is important to voters .

Kiwis simply dont want to pay more tax if the Government is going to spend it on on pet projects and nonsense

Oh come on. In NZ, the lower income group may be taxed on the first dollar but they get it back with WFF. The result is the same.

Minus the costs of collection and redistribution.

It's nutty that we have a government who claims to be capitalist and ranted against WFF as "communism by stealth" but who is increasing the redistribution through this and the accommodation supplement out of necessity because they have failed to address the housing crisis. Just nuts.

Such an economically inefficient approach. And all seemingly to protect a core speculator voter bloc's tax-free wealth gains.

Agreed. They've admitted defeat.

lol, .... Simple things really please Simple minds !! ...

as if holding the balance of a whole country's finances and interests were as SIMPLE as you put it ....

Aren't these polls like rating agencies ?

Perhaps Jacinda will turn out to be New Zealand's version of Joan of Arc?

I'm thinking more like Hillary Clinton.

vs. Trump and the effect of "alternative facts"...an apt comparison given Joyce's carry-on.

Hope national get in.I couldn't be f....d paying loads more tax!!!

Six more taxes per term, based on the track record. And some of these explicitly broken promises.

Are you trolling or are you so dense you truly believe that?

I couldn't be f...d with better health, education, housing affordability, environment, less imigration

I assume these can be ignored by many voters because as long as you have private health insurance and a house, they don't affect them. Poor people should've worked harder to be born into better circumstances.

Just part of the "Eff you lot, I've got mine" generation.

I was trying to show the cognitive dissonance of this stance.

The effects can only be ignored in the short term. Somethings will get worse pretty quick though like traffic with an extra 100,000 cars in Auckland over the next 3 years based on the current immigration level and lack of investment in infrastructure. Also expect to pay more in services costs than you would have done in taxes as companies have to pay extra to keep staff in Auckland.

Oops, sorry mate - I wrote my comment badly. I did not mean it to sound like I was describing you, but rather to echo the point you were making.

no worries Rick, I know you care for the plight of your fellow Kiwis

Hugo Chavez comes to mind.

Anyone who believes that political polls, published by the media, are an accurate representation of the election outcome is a fool. One only has to look at the last American election to see how wrong they can be.

Actually, only the UK Brexit vote involved flawed polling. The US polls called the vote accurately, just not their Electoral College (a uniquely US intervention between the voters and the result).

Polls in Holland, Austria, Germany, France, Italy, Australia, etc etc etc all since the US election have all been remarkably accurate. (Which is why political parties use polls and adjust their messages based on them. If they didn't work, parties wouldn't bother. But they know they do.)

Still, plenty of time yet for more twists and turns here. Polls record what was, not what will be.

Actually, YouGov was pretty much on the money with Brexit considering MoE.

https://yougov.co.uk/news/2016/06/28/online-polls-were-right/

...within their margins of error

Polls in France... remarkably accurate.

Picking on this one example - no, they were not. Macron beat Le Pen in the second round by 66% to 34%. A 32 point margin.

Polls in the lead up to the second round were showing 61% to 39% - a 22 point margin, or 10 points away from the actual result. That's not a polling success - that's a massive polling failure.

Put it another way: imagine a world where Macron polls over Le Pen by +5 points, and then the election result is Le Pen over Macron by +5.

That's exactly the same sized polling error as the actual election. You can be damn sure that, in the alternative scenario, the media would be calling for the heads of pollsters on spikes, and decrying the death of the polling industry. Instead, because the binary winner was correct, the media don't care.

I guess at the end of the day we need to keep two things in mind.

1) Polling was always, is now and always will be, hard.

2) the average journalist and member of the public doesn't have a f---ing clue about how to understand data and statistics.

People coming to their senses at last. All this nasty talk from you young townies about farmers while you continue to pump shit directly into the sea.

Ironically the reason that occurs is because we aren't taxed enough for the economic benefits we receive.

Its the same argument for polluting farmers or water drawing farmers.

The honeymoon is over for Jacinderella ; the "vision" thing turned into a pumpkin already. Her best chance now lies with the oldest of the "old dinosaurs" Winston - this should make for some interesting conversations in Ardern household.

It looks like every voter is being swayed by the negatives. Negative against National for nine years in power, stale, complacent out of touch with the everyday man on the street voter. Now negative against Labour, nine years of ineffectual & useless opposition in parliament. New broom, but no detail, especially on tax which looks more and more stealthy every day. Negative against the Greens for obvious and self inflicted reasons. Negative against NZF, same old populist, same old story. To my mind there is a rather dismal similarity to PM English and government to that of PM Bolger in his last election campaign. Maybe, just maybe, this time the worm has now turned the other way. Unfortunately hard to say if that is positive or negative, such is the state of political play in our country. The calibre of our MP's across all parties is low, very low, and we suffer the results accordingly. Perhaps Winston is the best vote, if only by culling 30 or so of them, things might be made to improve.

Maybe Stephen Joyce's dog whistle is working, yeah. Doesn't matter what's true, Joyce just needs to keep tooting.

Bitter ?

The question is whether this is signals a trend or is the poll an outlier. However, the trend is clear that the Greens are probably out.

I would say they are balancing on the brink ; pretty impossible to tell which way it will play out at this point - although some of their supporters will be looking to vote Labor tactically now.

That would be a hard call. The Greens without parliamentary representation might be done for good so core Greens may see opposition as the lesser of two evils.

I am wondering how that will play out. There's two outcomes that I can foresee. Either Greens supporters rally behind the party in order to get them over the 5% threshold, or they jump ship in droves in order to not be a wasted vote. It's really interesting to see how it will play out.

Getting into anyone's head is a challenge ; getting into the head of a Green supporter - forget it.

The Greens were on 10.7% in the last election. Larger than NZ First on 8.66%.

I'm no Greens supporter (because of the red flesh under the green skin), but this highlights how undemocratic our MMP system is. There is no reason for there to be any threshold to have a truly proportional system. Anyone guess why Labour and Nats are opposed to lowering the 5% threshold? Democracy my ass

Yep, it would be great if Labour came out and stated that they would implement the recommendations of the Electoral Commission in full. That would be an indication that they really do place importance on listening to experts on various matters.

Even better go right back to the Royal Commission that stated categorically that the introduction of MMP would not require any increase in the number of MP's. David Lange is on record as stating that parliament's decision to contradict that, was probably the most reprehensible parliamentary outcome he ever witnessed.

MMP was a copy-pasta from Germany. In Germany the reasoning for the 5% is basically that they don't want another Nazi party. Look where Germany is today, full of violent male criminals, it looks like they'll get another Nazi party anyway

it shows that a young generation is knocking on door and prehaps an opportunity for national and labours younger people to step forward and demand to be seen more often and to have there voice present on the national stage. Jacinda has shown where the next generation is coming from and now prehaps we will see more of Nikki Kaye!!!

It does show that stoking intergenerational war will likely have some...varied outcomes. Something we'll all pay to be wary of.

Time for a NZ Youth Party, you think ? Membership and Leadership restricted to those between 16 and 35.

Other party members welcome to renounce their affiliation and join NZ Youth Party...

I've a strong feeling that Jacinda's honeymoon is drawing to a close.

People are now reflecting more on her lack of experience - and her enthusiasm for populist policies such as capital gains tax. Many are nervous about her secretive approach to taxation.

Let alone the attitude ... she started talking and passing laws as if she was the PM .. what a show of hollow arrogance .... and yes, that lack of experience ( and anything goes attitude e.g. Korean Trade Agreement ! ) will make people think what kind of " on the Hoof " leader could be put in the beehive if not careful ...

The fact that she keeps hiding the TAX details despite everything make some of us believe that she is taking NZ for a ride ... started splashing the money everywhere ..lol

The Greens are equally infected with the same Glory Viral disease ...lol, they started splashing money too ...where mostly needed !!

Yes, so the property speculators have been telling us ad nauseam.

But really, there is no secret approach - from everything said, they look likely to do whatever is recommended that will serve to crackdown on property speculation for tax free gains (both offshore and onshore) to get more NZers into their own homes - simple.

Funny thing is, I suspect given the already announced:

- 5 year bright line test

- ban of non-resident purchasers

- ring-fencing of losses

- improved rental terms for tenants

So much of the shine will have gone off speculating for tax free capital gains that no full blown CGT for non-owner occupied dwellings will be needed.

What they might need to do is adopt National's increased subsidy for FHBers - such that existing tenants are able to take advantage of the sell down on existing rental properties.

I do feel for you Kate, the polls are not making your spinning job any easier ....

Keep repeating the same Glorious Achievements which we would drastically lose if Labour was NOT elected .. keep up the Emotional Blackmail which people are fed up of it

Keep repeating the expired term "Speculators" which are going to suck the housing market dry and leave nothing to the FHBs (although we dont know how many they are yet) ...

Carry on Kate, we have another 12 days to read more of this nonsense-- not that long !!

Oh, BTW .. I am just curious, what is the size of the Mansion you live in atm?? the one you pay $4000pa rates .. ?? ... must be worth few mils eh?

Don't worry about me, never deterred when working for what I'm passionate about.

As I see it, property speculators, that is, non-owner occupiers with residential properties in Auckland (be they onshore or offshore), who believe that the capital gains on their properties should not be taxed in the same manner as my (and everyone else's) wages are taxed have ruined Auckland.

It has become a place where the average family is unable to get ahead. Poverty and homelessness are growing and frustration and inconvenience abounds.

Our largest city deserves better than this. And yeah, I don't want all of NZ to follow in Auckland's footsteps.

So, no, I'm hardly discouraged - quite the opposite, I'm hopeful that we are on the cusp of change.

If Auckland was that bad people wouldn't be queuing up to get in. What's wrong with Invercargill if you are homeless? You can buy a house down there for about $100 a week. People are living there now and no doubt loving it. Evidently some people think it's better to live in a car in Auckland then a house in Invercargill. This is a decision they are making. I know which option I would choose.

Average families in Auckland are driving around in new SUVs and clogging the malls every weekend.

Evidently some people think it's better to live in a car in Auckland then a house in Invercargill. This is a decision they are making. I know which option I would choose.

Problem for many I assume is that they stay in Auckland because they have jobs - as explained here;

And behind these children [living in cars and boarding houses] are parents, often with at least one in work, who are unable to source adequate housing. No one should be living like this, particularly children in a wealthy developed country with a 'rock star economy'.

http://www.radionz.co.nz/news/on-the-inside/338989/kids-living-in-vans-…

Average families in Auckland are driving around in new SUVs and clogging the malls every weekend.

Your median personal income in AKL is $29,600;

http://www.localcouncils.govt.nz/lgip.nsf/wpg_URL/Profiles-Councils-Auc…

There are a whole lotta people/families who can't afford to own a new SUV and if they are at the mall it's likely for groceries. But hey, don't let reality for some get in the way of a good joke.

"If Auckland was that bad people wouldn't be queuing up to get in."

As someone wise pointed out, Auckland (and NZ generally) could get a whole lot worse and still be an attractive destination relative to where many new arrivals are coming from.

People queuing to get into Auckland. Depends who you are. There is no queue with waiting New Zealanders. It seems New Zealanders choose to leave Auckland. ( More leave than come in) or maybe it's about even.

The queue is international. Auckland is great for them, especially if you come from Mumbai or Yangshuo.

I do really admire your passion ... it seeps through your well articulated expressions ..

BUT, you are wrong Kate, as always, or maybe brain washed ..

Auckland is NOT ruined - it has actually flourished in the past years and is becoming an international city ( you obviously don't live in Auckland and just believe everything your rockstar leader tells you)... True, Auckland has become more challenging .. but people can still get ahead in it if they wanted.... the ones who won't are those who do not want to walk the hard yards ...

Wrong again, in assuming that this is about CGT ...as you guys like to fool and confuse people with this issue .... 2 years vs 5 years is no big deal to anyone ... and I think everyone would welcome changing it to 5 years ... the problem is in what you are HIDING !!!

It is the Land Tax, Inheritance Tax, Water Tax, Carbon Tax Fart tax, Petrol Tax in Auckland that are being dodged -- it is the unfairness to be given a MANDATE TO GOVERN then fool us with a Tax Working Group smoke screen which you want ( as Grant said today) to design as you please -- hand picking your most eccentric mates to produce what you want !!

It is the free ATM that you want to tap in to fund ill studied projects and on the hoof promises not to mention the silly ones dished in a hurry to harvest votes in the last few days ...

IT is about your LEADER who is NOT telling the truth ( by repeating that Labour have been clear and transparent) everytime asked about money and tax ....

It is about the attitude, your people started talking like Dictators already !! that alone is disgusting .. it all about Jacinda, everyone else is either locked up or muzzled.

So dont take it personally Kate, we do understand passion ... but we have had enough BS and dodging and being treated like Toddlers .. Because we are NOT!! .. well most of us at least !

Kiwis will be waking up to all of the above and vote with their feet - if they don't, they will get what they deserve ...

I think Kate once admitted to living in Palmerston North.

Yes, via Chicago.

Kiwis deserve affordable housing. Lets vote for it.

Affordable housing can be found in many places in NZ.

What did that doco on TV3 say last night? Tauranga, yes our Tauranga, is the 9th most expensive city on the planet! It's not the nominal price of the houses down there, but the wages. And that....is what makes 'many places in NZ' unaffordable. The value attributed to their jobs market.

Yet, when we received estimates for exterior work on our property, mostly semi skilled labour, the charge out rate was so high that I know what I will be doing this Summer. This entitled male pale stale baby boomer will be on the end of a shovel.

It will only get worse as service companies need to pay enough for people to afford houses. Ironically, this extra cost to everything would be more than the extra tax over time.

ten dollar Tauranga - I guess it's $15.75 now

"hand picking" well that would be Mr now Sir Cullen if the jungle drums are accurate. Like you Eco, could only see the left hand being used.

You do not know any of this Kate - you are speculating as they would not tell us what their plan is . Your guess is as good ( or bad ) as anybodies.

It's not a guess - it's plain as day in Labour's policy - see their heading;

Crackdown on speculators

lol, indeed ... they are gone, didn't you hear??

Gotta love the housing crisis here... I put my address into the interactive housing map found on the link above from Kate. Going through the the various pages of proclamations of housing crises, I find that the median house price is at the unaffordable level of $346k locally. Rent went up 0.4% for the past year, with the following tagline "The housing crisis is putting the squeeze on renting families – we need to do something about this." I'm trying to figure out how the 27% of homes are rented in my local area is cause for a crisis.

Auckland is not the entirety of New Zealand.

Much of the cause of Aucklands ills can be placed at their councils lack of foresight.

I find that the median house price is at the unaffordable level of $346k locally.

What matters is how that compares to the median personal income in the area.

Yes, Auckland is not the rest of NZ but those of us not living there don't want to ignore its unique problems. Of the studies I've read, the Super City has been detrimental - none of the agglomeration benefits have been realised (yet) and the cost of governance (bureaucracy) per capita has increased. On the central government side, immigration numbers are much higher in AKL as a percentage of population to total migrants and similarly, the region experiences a higher percentage of foreign ownership (bar that in the Q-L district). And it's top of the leader board in crime stats as well;

http://www.newshub.co.nz/home/new-zealand/2016/05/nzs-most-violent-city…

From my perspective, we need to get on top of Auckland's problems before it deteriorates further. Its decline is beginning to remind me a lot of a number of cities in the US that I'm familiar with.

lol,... Jesus Kate.!!..

" From my perspective, we need to get on top of Auckland's problems before it deteriorates further " :)

if you are that upset with Auckland problems ( while not living there) then don't read these stupid reports about the super city because you will open a can of worms for yourself.

....The supercity has been controlled by Labour and lefties since its inception ... they were sleeping at the wheel and cheering their mates and dragging the chain for a very long time .. They woke up after late and after getting a kick in the bum last year by the impatient central Gov ... so please stop worring about us ...we dont need your concerns, sympathy, and crocodile tears!!

Political ideology makes not one iota of difference where local government in NZ is concerned as they (local government) are a "creature of statute" (their function could be removed via a simple majority of Parliament). For example, I understand Goff has been wanting to introduce congestion charging or local fuel tax or some other such tool - but that has been prevented by statute, and an unwillingness of central government to permit such.

Median household income across NZ is $74k. Median property price is $640k. That's a ratio of 8.8. Sure, there will always be places with lower prices but, overall, this country's housing affordability is a mess. It just seems like houses are affordable when comparing them to Auckland.

I'd suggest looking at the median values for both property and income for each location individually, as the total median values get skewed by places such as Auckland, Queenstown and Wanaka. Hawkes Bay had a median household income of $53k as of the 2013 census ref: https://figure.nz/chart/8fxE9N6MfmLhOZyH-1J3kkYbNBviNXeBP This median income value has likely climbed towards the $70k+ range as incomes have been increasing rather quickly locally in the past few years due to the booming local economy. That would be a ratio of closer to 5 locally, which isn't that bad from an affordability perspective considering the current interest rates available.

It is not what is there ( a collection of slogans mostly .. ) - it what is not there. You claim to know what they will and will not do around CGT - you have no such knowledge.

Polls or no polls.

This time Jacinda Government !

It is good as now labour will be more alert n will help them

Nine years warming the benches yet cannot answer the one question people want answered.

3 MORE YEARS.

This is why I don't think people should vote early. Wait for election day. Who knows what will happen?

Yes, put it off everyone. National needs voter turnout to be low.. Do it later...

Hi Zachary,

Agree - wait until election day.

Vote early and vote twice.

how do you vote twice?

Lax ID checks and you know a few who will not bother to turn up? That or you could sabotage a few making a single vote count for more. NZ is not really a 'voting is sacrosanct' type of country, we are too lowbrow for that.

Isn't that illegal? I know we have lax laws in this country, but come on, have some integrity...

Party vote and electorate vote.

If you're smart, you'll give both your votes to National.

We all need to avoid a Labour Govt running amuck with its populist policies. (We've seen enough with the likes of Brexit and Trump.)

The hilariously ironic thing is that both of those populist movements are primarily right wing in nature (or at least the faces of them are) Farage & Trump.

A man and his daughter saw a homeless person in the park. She said "I want to help this poor man" That's beautiful, the dad replied, you'll make a great Labour supporter one day.

Maybe you can make and sell lemonade or help someone gardening for the day, then give the money you earned to the homeless person so he can eat, he proposed. She stared at him with a puzzled look and said; "Why doesn't that man do these things himself ?"

You'll make a great National supporter one day.

One of the more sadly trite and simplistic posts to come out of the Young Nats, that one. Albeit abbreviated here.

I can appreciate there are those who latch on to this quite sincerely...perhaps when I was younger and had seen less of the world I did too.

The obvious question with this anecdote, and one it's shocking that espoused capitalists should miss: Where does the homeless man get the lemons and resources with which to make the lemonade to sell?

Whoops.

Rick - people with this mindset have quite a strong 'victim' identity I find. 'I worked hard to get where I am so bugger anyone else, including the vulnerable'. 'My life has been so hard and look at that lazy homeless person - why should I help them because my life has been so hard'.

Isn't simplicity beautiful, things become so easy to understand

Ignorance is bliss, as the saying goes, yes.

Talking from experience I am sure ; keep enjoying yours.

Disappointing comeback.

How about answering my question above re the anecdote: Where does the homeless man get the lemons and resources with which to make and sell lemonade?

From a lemon tree RickStrauss

From a lemon tree RickStrauss

Ahh...so through the assistance in the form of resources from someone else in society in order to get the homeless fellow on his feet, huh? (I assume you're not condoning theft as a way out of welfare dependence.)

You'll make a fine Labour supporter one day, Yvil.

Thats quite sad if your stating that as a reason to vote National. Im a capitalist pig at the end of the day, I want to make money, travel and do a lot of things.

But one thing I have is empathy. At the end of the day, I can look after myself no matter who gets in. There are accountants to make the best out of whatever situation my business requires.

But there are a few things National should be ashamed of themselves, and thats homelessness, people living in cars and garages.

Its not the NZ I grew up in, kind of makes me ashamed.

Waitakere man is a smart dude who knows when the media is pushing a change of government on him. He is uneasy about secret committees deciding how the tax system will work. His granny is in a rest home and hopes that one day when she passes, his life will become a bit easier. Cindy's confirmation that the state will loot part of his inheritance has unsettled him. He was thinking we needed new blood to run the country but now wonders what Labours true agenda really is. It's called trust. And his has been eroded.

They're not pushing a change of government, they're reporting on a movement for change.

lol,

so secretly you are voting for Bill ? after all first non CPI increase in benefits for 40 years ,rise in accommodation supplement - Whanau Ora, raising the tax thresholds for lowest income earners -

Bill represents a change from JK's fiscal conservatism to a social conservative model - and well at least he has costed it !

My favourite comment on that question of National's tax/welfare plan is this;

National campaigned on income ‘tax cuts’ in 2008 and then, when elected offset that with a rise in GST, getting everybody to pay for the wealthiest earners gains. Jacinda Adern’s main stated goal, if elected, is to get rid of child poverty in NZ and it’s shameful that a NZ politician has to campaign on this issue. Will tax go up to achieve this goal? Well yes probably, is this a bad thing? Only if you have no soul or conscience. Every nappy, pair of shoes, loaf of bread pays for the wealthiest tax cuts. F... that.

its too close to call, it will come down to who can mobilize their voters, last election a third did note vote, and that is made up mostly of young and poor.

i have no doubt national are gaining traction on tax, and labour have allowed them to make up what they like as taxes by not setting out and making publicly clear the parameters of review.

the way i look at it is even if labour lose this time they will walk in next time as national will just carry with denial and make homelessness, inequality and services worse

Have doubts as this election is for change and change it will be

"and make homelessness, inequality and services worse" and even harder and more expensive to fix

Sharetrader. Immigrants are the other significant group of non voters. A recent study showed that a majority of the non voters would tend to be more right than left. But if just one segment of the non voters was more motivated to vote than the other segments, eg the young, that could alter the skew to more left leaning.

Arderns big risk now is the greens falling below 5% . With no electorate MPs that means all those votes are not counted.

i will be voting early and have heard the same from many people so i will be watching with interest to see if it improves the amount of voters.

as a swinging voting, who has voted different parties time after time, i have made my mind up early this time as for me it was quite simple this time after this weekends announcements

i had 3 main things i wanted to see and only one party that will have the power to do something has ticked those boxes on all 3.

Here's to voting early and deciding on policy.

I could have voted National if they reduced immigration and stopped foreign buyers of NZ property.

But there are a couple of things that I genuinely dislike about National, one of the things is really small, but BE called most of our youth, druggies.

If you have no belief in the young of your country and you import workers to take their place, you have no right to call yourself prime minister of the country you are trying to run. You should be helping your countrymen out, not creating generational problems.

Joyce is right, Labour has spent everything on its student loan election ploy, and won't have enough in the kitty to meet the round of demands from its base if it gets in - and then we'll be the ATM.

Only if you believe that a government cannot lift productivity. We have only been running our public services at deficits because this governments economic strategy is based around immigration/population growth. And that looks to have had a negative impact on productivity growth - whilst at the same time increasing the need for tax transfers and government handouts.

If a government chooses to end property speculation, lift productivity and wages, curb immigration to reduce the pressures on government services, improve educational outcomes and employment opportunity for its existing citizens - government revenue takes care of itself.

National has been reluctant in all those areas. They have over-egged immigration, depressed wages and under-funded services.

lol, BTW.. when you have some time to get out of the cave you are living in and listen to what is happening in the world.. you will hear economists and others talking about THE PROBLEMS HIGHER PRODUCTIVITY WILL BRING in the near future!! .... the Fourth Industrial Revolution that is happening NOW involving smarter higher technologies replacing people increases productivity - the need will be to re-train the people who will become UNEMPLOYED and lose their jobs as a result of higher productivity ...which is bringing in arguments about UBIs .... Maybe that would be a great Labour policy for 2020

so you might like to be a bit careful about the terms Productivity and 4 % unemployment going forward ..because that will become another stupid claim soon ...

In the UK they already started talking about robots to farm the land from sowing to harvest ... Go figure, and be careful what you wish for !!

Kate - I don't know what the reason or answer is for the low productivity, but one thing is pretty clear from research into the subject, low productivity is a global problem.

http://www.focus-economics.com/blog/why-is-productivity-growth-so-low-2…

Since there seems to be no commonality in the reasoning for it, let alone many managing to lift their levels accordingly, I seriously doubt that the Labour team has any answers either, other than using it as a stick to beat one of the multitude of Govts that haven't found the answer, ours.

My owns thoughts on the low productivity are that it all stems from management's inability to understand the reaction to the company policy.

1. Company pays per hour - worker works more hours to earn more. Productivity is irrelevant.

2. Company pays salary - worker expands work to fit minimum hours. Productivity is irrelevant.

3. Company incentivises annual profit - worker focuses on cost cutting, rather than investment.

4. Ticket clipping - good ideas get devalued as everyone jumps on board to try and get a piece of the pie

5. Training and investment in staff - spend Xmillion on system, but Xhundred on training and development.

6. "ism"s/RIght person for the right job - employed as a "good company fit" (i.e. nepotism/favourtism/racsism/etc...) rather than actual ability to do the job.

Our performance over many years is worse than most;

https://croakingcassandra.com/2017/09/04/consistently-dismal-relative-p…

What I'd like is a government that listens to its own experts and our country's most experienced business people. For example, the Law Commission, the Productivity Commission, Parliamentary Commissioner for the Environment, the Children's Commissioner etc. etc.

National has this habit of 'cherry picking' recommendations from these expert advisers - just as it did with the Land & Water Forum output.

And we have an NGO/business sector that is motivated, innovative and over flowing with good ideas/advice, e.g.,

http://pureadvantage.org/news/2016/04/22/our-forest-future/

https://nzinitiative.org.nz/insights/reports/in-the-zone-creating-a-too…

http://www.eds.org.nz/our-work/publications/books/last-line-of-defence/

We're a small economy - much more nimble, much easier to pass legislation under and in my opinion, therefore, we should be much easier to turn around than most.

Kate, and anyone else concerned about NZ's level of immigration. This was posted on one of Reddell's blogs about Labour's immigration policy:

"Their policy, if implemented, won’t materially alter the net inflow over time. And I heard this morning an extended interview with Jacinda Ardern on Radio New Zealand in which she declared that she would have no problem at all with a net 70000 migration inflow per annum if only the houses were there, and actively endorsed some recent strongly pro-immigration comments made by Helen Clark. Labour, like National, is still a “big New Zealand” party – despite the economic damage that strategy has been doing over decades (remember how bad our productivity record has been) and will continue to do (ever more people and a heightened priority on improving water quality and meeting climate change targets is a recipe for severely undermining our productivity prospects.)"

Yes, thanks Doris, I always read him. And in comparison, National are recommending no change.

I suspect the biggest inroad into reducing net inflow, particularly into Auckland, will come from Labour's proposed changes to;

Require courses for international students to be high-quality, remove the ability to work for international students in low-level courses except where the work is approved as part of their study, and remove the ability to get a work visa without a job for those who have completed study below university level.

But, yes, more analysis and more work is needed, as there is so much unqualified propaganda put out on this subject.

As Michael has pointed out, the statistical data on immigration is getting worse, not better;

https://croakingcassandra.com/2017/09/01/whats-happening-to-immigration…

You have to wonder whether dumbing down the efficacy of that data is intentional.

A bit like the intent not to collate and make publicly available data on non-resident land/RE asset ownership in NZ.

Yes Doris. Labour and National both are in favour of bigger is better in terms of population. I personally think bigger is worse, and see growth advocacy as a poverty of actual ideas of how to improve the lot of New Zealanders.

It is Time for CHANGE ...

I would call upon every wise kiwi to vote for a change from The last 4 weeks of BS polluting our ears and noses... ad nauseam

I would call to reject the past and future fraudsters and their supporters including any one who thinks they can loot hard earned savings and assets built over the years by hard working kiwis .... We don't need new Robin Hoods disguised as Santa Claus - Father Christmas ...

VOTE NATIONAL and let's get on with life !! enough is lost already ...!

"Don't tax my wealth gains, tax those who work a 9-to-5 job!"

Exactly.

What if you happen to have wealth gains and a 9-5 job?

Income is income - why treat either differently?

BS, all income is taxed .. asset appreciation is NOT INCOME .. only in looter's books like GM

"Income" means different things to different people. We should clean up the definition. All realised gains should be taxed, equally. (It is those pesky definitions that allow some to avoid paying their share.)

To an extent. Housing is a different kettle of fish.

Taxes do not lower a price.

Stamp Duty

Impact on FHB. A FHB has $100k deposit, at 20% that equals a $500k house. Wrong it equals a $450k house with 10% stamp duty. So FHB now has less money to compete for the same quantity of housing.

Impact on Ladder buyer (i.e. FHB moving up the rungs). They sell house for $450k, Say they keep all of that money and don't want another mortgage, well the next house they buy can only be worth $405k, as they need to keep the 10% aside for the Stamp duty on their next purchase.

CGT

Impact on a FHB - zero, as they are buying not selling.

Impact on a Ladder buyer - They bought their house before kids, they now sell for 100k more, they lose say 20%. Problem is they are buying in the same market. So technically can not afford to buy their own house back, let alone a bigger one.

Stamp duty and CGT

Impact on FHB - same as just stamp duty.

Impact on Ladder buyer? - lets just say they are screwed. They must buy and sell in the same marker, yet have 30% less to buy with compared to what they sold.

Conclusion.

You just have to look at OZ/Canada to see the results.

Auckland levels of un-affordability across all state capitals, and larger cities.

Massive FHB grants to "refund" the stamp duty.

Ladder buyers losing money due to having to sell then buy in the same market. SO end up staying in sub standard housing, as they can't afford to upgrade.

FOregin buyers come in with excess cash (stamp duty is easily paid), and house is never sold so CGT is irrelevant.

We have all the same problems but without the taxes. Imagine the carnage if we threw them in as well.

Tax wont fix anything...Supply/Demand changes need to be implemented.

1. Exclude foreign buyers from the residential market.

2. Radically lower the costs to build (i.e. remove the dodgy duopoly, red tape, and ticket clipping)

3. Invest in infrastructure to make new developments functional and desirable.

"Don't tax me, don't tax you, tax the man behind the tree"

It's not losing your savings and assets that you are worried about, Eco Bird - you are worried about losing the tax free status of the gains made on those assets (the gains, or interest made on your cash savings are already taxed).

If I'm wrong, tell me what else other than the tax free gains it is that you might stand to lose.

Excuse my cynicism, but the more people you keep down and financially dependent for longer through the status quo, the greater the opportunity for those on the right side of the ledger to get ahead. This appears to be a mindset that has gripped a segment of middle NZ and pandered implicitly by the govt.

Japan and Germany took a much different approach post-WWII and inclusion of all people was a pillar of their rise to the industrial titans that they became.

@Kate. I think CGT is fine for me but from economic sense at end of day the capital (taxed or non taxed) will still be invested in the economy (build more home, invest to business, or even donate to the charity etc), everyone in the country benefits from them.

Possibly. Some of those gains might be reinvested onshore, others might go offshore.

At the moment we tax all income from labour but not all income from capital. Hence, the question to be answered is whether or not this results in over investment of excess capital in the real estate asset class; and if so, whether that has impacted negatively on those asset prices and on productivity.

This is the point being made by The Opportunities Party;

http://www.top.org.nz/top1

It's a very important question and one which I'm sure would benefit from further consideration.

Kate, I have answered this in a post above ,...your horse trading technique is impressive - look like you live in Cambridge !!

but will repeat it to emphasis the point ..maybe other cheerleaders could learn something and to address your envy and jealousy problems ...

you are Wrong , in assuming that this is about CGT ...as you guys like to fool and confuse people with this issue .... 2 years vs 5 years is no big deal to anyone ... and I think everyone would welcome changing it to 5 years ... the problem is in what you are HIDING !!!

It is the Land Tax, Inheritance Tax, Water Tax, Carbon Tax Fart tax, Petrol Tax in Auckland that are being dodged -- it is the unfairness to be given a MANDATE TO GOVERN then fool us with a Tax Working Group smoke screen which you want ( as Grant said today) to design as you please -- hand picking your most eccentric mates to produce what you want !!

It is the free ATM that you want to tap in to fund ill studied projects and on the hoof promises not to mention the silly ones dished in a hurry to harvest votes in the last few days ...

IT is about your LEADER who is NOT telling the truth ( by repeating that Labour have been clear and transparent) everytime asked about money and tax ....

It is about the attitude, your people started talking like Dictators already !! that alone is disgusting .. it all about Jacinda, everyone else is either locked up or muzzled.

I have nothing to lose, I do not intend to sell my investments ( they are housing a lot of people) ... but do not entertain the idea of being looted in plain daylight on a highway !!

In other words, you have nothing to lose but the tax free gains on your property investments.

Great, we've agreed on something!!!!!

haha, Nice Try .... It is what we DO NOT agree on, that is causing this friction in opinions !! ...

I do not want to pay unnecessary taxes - today, tomorrow, or in 20 years time ..neither do most NZers ... imposing taxes without mandate is LOOTING ... not so hard to understand , is it?

imposing taxes without mandate is LOOTING

I never got to vote on whether or not I wanted to pay more tax on my ciggies, that's for sure!!!! So, yes, you could say I got looted... but I wouldn't say that.

Governments do what governments do and taxation is just one of the things they do for all sorts of different reasons.

Labour knows damn well that it will lose the election if they come clean on the TAX issue, just like they did last time ..... they think they are smarter this time to fool NZers and hide behind a future TWG

Smooth spin Kate - Bravo !! however, ciggie tax was set years ago under labour and was mandated (no objections) over more than 3 elections -- There is a world of difference between ciggies tax and property or Land TAXes..lol ...please do not disappoint me with such a wild drawn comparison ... !!

"Governments do what governments do and taxation is just one of the things they do for all sorts of different reasons". .. Indeed, with knowledge, mandate, and approval, Not a carte blanche or smoke and mirrors, hiding behind TWG. .... else it becomes arrogance and daytime robbery ...

Nope, not a Labour government initiative. There was always an excise tax on tobacco, but nothing like the regime of rises implemented by National/Maori Party - here's the timeline;

In April 2010, Parliament enacted the Excise and Excise-equivalent Duties Table (Tobacco Products)

Amendment Act, which provided for 3 step-increases in tobacco excise:

• a 10% increase in excise on manufactured cigarettes, and a 25.4% increase in excise on loose

tobacco (to equalise rates by weight with the new rate for manufactured cigarettes)

• a 10% increase in addition to the annual CPI-based increase on 1 January 2011

• a 10% increase in addition to the annual CPI-based increase on 1 January 2012

http://www.treasury.govt.nz/publications/informationreleases/ris/pdfs/r…

And then In February 2011, in response to recommendations of the Maori Affairs Select Committee Inquiry Into "The Tobacco Industry And Consequences Of Tobacco Use For Maori", the Government adopted the

aspirational goal of making New Zealand essentially a smoke-free nation by 2025

No mandate sought on that.

TSY advice after that time was;

On the narrow fiscal grounds of covering the costs smokers impose on government, further increases in tobacco excise may not be justified. At over $1.3 billion per year, tobacco excise revenues may already exceed the direct health system costs of smoking.

But, they are still at it;

Budget 2016 will increase the tax on tobacco by 10 per cent on 1 January each year for the next four years, Associate Health Minister Peseta Sam Lotu-Iiga and Māori Party Co-leader Marama Fox say.

http://www.maoriparty.org/tobacco_excise_to_rise_10_per_cent_per_annum

We are of course seeing some unintended consequences (increased crime/black market sales) and as the cessation targets aren't being met, the price increases keep coming (making the product more attractive to criminals). How it all ends, who knows.

Did you know that maximising cigarette consumption is actually better for governments?

Smoking related diseases tend to kill quickly as people hit the end of their productive lives in their 60's and save huge amounts of pension and elderly care costs, while also seeing children inherit just as they need money to set up and care for families of their own. Bumping up smoking taxes is done to improve peoples lives, not improve the govt's fiscal position.

Bumping up smoking taxes is done to improve peoples lives, not improve the govt's fiscal position.

Rubbish - punitive taxes do not improve people's lives. Tobacco is (I have heard) the second most addictive natural product on the planet. Hence, the kind of crippling punitive taxes that this government has gone for only serve to impoverish the addicted - and the addicted are percentage-wise greater among the already impoverished.

A better way to make NZ smoke free would be to raise the age at which one can legally purchase tobacco products each year and introduce sentences for those found to be supplying the under-aged. That way, eventually all your addicted population simply die off (whether of smoking or not related causes) and the younger generation never starts.

Need change from National policies : Denial, Lie and Manipulation.

Irrespective of todays poll am clear that this election is for change.

As far as labour is concerned have spelled out their intent of all taxes BUT the only chance National has is by using fear psychology but can they fool all the people all the time has to be seen.

People who are worried of losing are more afraid of changing than anyone else. I too have few investements but am not worried as my investments are for long term and not for speculation nor is funded from overseas nor money laundering.

Like it or not this election is for change.

I could agree with you, but then we'd both be wrong. Bring on the only poll that counts, that on the 23rd. So far it's looking like recent All Black games in that the opposition peaks too early.

A good sporting analogy always goes down well. You are right of course the only poll that counts is the big one. I wonder if early voting affects Exit Polling?

Yes - National is the safest bet.

A vote for any other party is a vote for instability.

And a vote for National is a vote for entrenched generational inequality.

worsening inequality. There will be another 150,000 immigrants into Auckland over the next 3 years under National along with abut 30,000 houses built.

Kate. I invest in businesses for capital gain. Under your proposal that this gain should be taxed in addition to the dividends earned on that original investment plus on the subsequent gain, the total return I would require must increase. So the cost of capital for that business would rise. My risk models would also need to become more conservative and therefore my appetite to invest more constrained.

Increasing tax on the owners of capital and distributing this to individuals reduces the supply of enterprise capital and the creation of jobs. The net effect, even after factoring in increased retail consumption, is dilutive on business expansion. Untaxed capital gain may be viewed as 'unfair' but it is an important driver of investment risk appetite. Note that I'm not including assets such as housing where returns have become delinked from the capital value due to excessive speculation over a long period - intervention may be necessary, especially where there is a social need aspect to the asset class.

Note that I'm not including assets such as housing where returns have become delinked from the capital value due to excessive speculation over a long period

And of course, that's the only capital asset class that is the subject of Labour's concerns because of that very excessive speculation over a long period of time and the effect it has had on prices.

No it is Not the " ONLY capital asset class that is the subject of Labour's concerns" ... you could be a smooth talker , but nobody's fool here!!

Capital tax can be extended to include any asset that could be similar to an investment property, it could well be extended to capital gain on business, plants, or farms ..any capital gain anywhere... as long as Labour does not rule these out and is leaving it to a TWG .. then there is a misleading action and argument ..hence cannot be trusted !!

Simple and legitimate suspicion that you guys have created yourselves !!

Kate. You've hit the nail. You say housing is the only asset class Labour is concerned about but you don't know that. Neither does the electorate. Taxinda just won't come clean about what the shadowy committees are secretly plotting.

Kate. I invest in businesses for capital gain. Under your proposal that this gain should be taxed in addition to the dividends earned on that original investment plus on the subsequent gain, the total return I would require must increase. So the cost of capital for that business would rise. My risk models would also need to become more conservative and therefore my appetite to invest more constrained.

Do you not invest in equities because of taxation? Do you think that capital gains on equities should not be taxed?

J.C. No I don't think the capital gains themselves should be taxed, because dividends on the capital gain portion are already taxed so the state over time receives its share of that gain. But a case can be made that where dividends are artificially suppressed in perpetuity, a deemed rate of return for taxation purposes is justified (and that is the system for over seas equities). Another is housing where social needs must be considered if capital values become delinked from dividends (rental income)due to excessive speculation. But taxing the capital gain is not the way to do this as it is expensive to collect, distorts investment in housing types and drives widespread evasion. Micro measures such as bright line tests, regulating expense deductions etc are more effective.

I don't invest in equities 'because of' taxation but tax efficiency is definitely a factor. It's why NZ shares remain attractive. But if Labour slaps a capital gains tax on NZ shares, that immediately tilts the field in favour of offshore shares because of their currency hedge benefit and that they already have a form of

CGT on them. If they do this I will rebalance my portfolio more away from NZ.

If you don't tax capital gains, then companies can avoid paying tax by paying out smaller dividends

Rubbish - you have not got a clue do you ? Company profits are taxed in NZ is a way that makes retaining them or paying them out as dividend tax - neutral. It is the basics ..

As a company owner and investor, I do know how it works. As the owner of capital, it is better to invest in growth than income and take the gain tax-free rather than pay 28%. Another tax loophole that needs closing.

Then as a business owner you will know that eventually you will earn a dividend on the accumulated capital gain and that will be taxed... tax now on a lower dividend because you've been ploughing back into the business, or tax later on a higher dividend. Eventually your capital gain will be taxed - unless you liquidate and immediately spend it all or give it away. But few do that.

On-sell the business and bank the tax-free capital gain. Standard technology start-up model.

New Zealand is the envy of the world as we don't have an envy tax. We treat people fairly. Labour = Smiling Mafia

perfectly put

New Zealand is the envy of the world as we don't have an envy tax. We treat people fairly. Labour = Smiling Mafia

They're only mafia because you're afraid of them.

That's a nice irrigated dairy farm you have there. Be a shame if something happened to it. #Letsdothis

But the commissar and cadre who come to cut off your water will do it transparently. You'll be allowed to watch them do it.

nz has a growing inequality because people are no longer getting treated fairly, those of us that were born at the right time, so got education paid for and were able to buy our houses for a low percentage of our income, and have our super paid no matter how much we have accumulated are doing very nicely thanks to the last two labour and national goverments

Share trader. NZ does not have growing inequality. The trend has flatlined for a decade.

http://www.stats.govt.nz/browse_for_stats/snapshots-of-nz/nz-social-ind… of living/income-inequality.aspx

Boo! Hiss! don't say that, it messes with the Social Justice Narrative. Of course you are right, inequality hasn't changed much for 20 years despite media hysteria, though people have been getting wealthier (GDP/capita has more than doubled during that period, so in reality genuine poverty is drastically reducing) - the tide is raising all boats. Our Gini coefficient is about 0.33, slightly above OECD average.

http://socialreport.msd.govt.nz/content/images/figure-ec2-2-RGB.png

Ha, 'genuine poverty'. Whatever that nebulous term means.

Yes my boat has risen along with yours but it is intrinsically unfair that you have a bigger one. Just not right.

To be fair, the term 'increased poverty' is also rarely defined when used.

That's party politics for you.

Doesn't help when the government decides poverty is simply too hard to measure so best not to try.

nor is it particularly enlightening when the much trumpeted child poverty is defined as child living in a family having an income below 60% of median income - so if you doubled everyone's income we would have identical number of children in 'poverty'

Sort of correct, but actually it is simply too high.

We treat people fairly?? OMG you blokes are so brainwashed by the GDP and rockstar economy lines.

From my perpective it depends weather you have any sort of social conscience. The prevailing attitude of people with money is... "Its mine and i want MORE" MINE MINE MINE...

Our social statistics are appalling, absolutely appalling if you cant be arsed paying a bit more tax, or dont like to share (remember the sand pit at kindy?) then vote national, Its just plain greed to me.

Perhaps the public have heard the same "we will end child poverty" type rhetoric before only to find two years down the track that child poverty statistics haven't improved and millions wasted employing highly paid Civil Servants and Consultants instead of going to those in need.

Poverty in a modern society is a disgrace and I would happily pay higher taxes to health, education and social services but first I need a Govt to show me the exactly how each dollar is spent and for that Minister in charge to be 100% accountable for the outcomes and be sacked if they don't show results.

I need a Govt to show me the exactly how each dollar is spent and for that Minister in charge to be 100% accountable for the outcomes and be sacked if they don't show results.

You'll get that with Labour as they intend to legislate for it;

Introduce legislation to set a child poverty reduction target and to change the Public Finance Act so the Budget reports progress on reducing child poverty

It's one of the first 100 day policies;

http://www.labour.org.nz/100days

Every one of those intended actions goes directly toward solving the seemingly intractable problems that National either don't want to address or don't know how to address.

"Our social statistics are appalling"

Perhaps you could be more specific and state compared to what. For example child mortality rates in NZ are not worse than Southern Sudan, (an extreme example that shows an incompleteness to your statement).

Hiya, i meant things like suicide rates, mental health issues and the lack of services, inadequate services for drug and alcohol rehab, poor teachers pay, overburden on health services in part due to rampant immigration, incarceration rates are appalling, (prison = university for crims) homeless rates, the growing inequality, very low wages... national has done a reasonable job for sure but they are asleep at the wheel half the time....

I was going to vote Winston because I want immigration cut right back.

I am now worried that a vote for Winston could help Labour get in as he won't say who he supports.

Labour won't say what their tax policy is although they have had years to think about it.

All this uncertainty is swinging me towards National.

Steven J as minister - No way.

Need change.

If they win means people support lies and have been carried away by national fear psychology. That will be a shame. If national lies work their will be no stopping of the same for next 3 years.

Are you trying to convince Northland Hippy to vote your way? If so look at your post's wording. It reads like a zealot rant.

After watching 'Who Owns NZ now?' on TV3 last night I am changing my vote. I want to do the right thing. I want to reduce homelessness in Auckland. I want every Kiwi family to at least own a home instead of living in the car-parks. #LetsDoThis

I agree that was a very good documentary on our woeful housing situation, highly recommend watching.

However I seriously doubt dgz would want any change to the status quo.

Just trolling again...are we?

Every Kiwi family deserves to own a home in Auckland?

Every Kiwi family deserves to own a home in Ponsonby

DGZ, so who are you changing your vote for ??? who do you think will decrease homelessness ?

I have not decided but at least JA will have a good look at it. Also I like the Green's policy on planting 1.2 billion trees around the country. I am all for more green and more oxygen.

I like trees ; I just do not think money grows on them.

Where do you get 1.2 billion tree seedlings?

From all the nurseries up and down the country. If not we can always import them from China provided they have been sprayed for diseases properly.

It's taken 100 years to plant 1.6 million ha so you are going to plant 1.2 million ha there need to be a bit more than sound bites and the vision thing.

...and a stray 1.2 million ha. I guess seasonal labour can be imported to plant them.

It doesn't really matter - planting trees is about the only good policy i have seen so far.

Who Owns NZ now?' on TV3 last night.

Interesting that the Herald said that the doco "should never have been made" . Bias anyone?

Why? - this is where it gets really hilarious. Because accurate housing records have never been kept.

Who knew?

As per the doco's findings in other countries and what most people assume here it is because no one wanted the information known as it would be too hard to digest.

A total co-incidence that this 'doco' is released a week before the election. After all, housing has only recently emerged as as issue.

Yeah - good point, National have been in govt for 9 years and they along with every one else never knew there was an issue - just some ne'er do wells bitching as usual in Sth AKL.

Agree. Classic way to get rid of a problem. The right did it for CC, lets not launch satellites that provide data on global warming, then there is no evidence its changing seems to be their logic.

ie rinse and repeat for any subject you dont want to address.

The likelihood now is that Winnie will hold hands with National to form the next Government.

The problem for Labour is that it hasn't been able to find a good leader. Goff, Shearer, Cunliffe and Little all failed. Now Jacinda is following in their footsteps and rapidly going downhill too......

It's her failure to be open and up-front with the electorate that's putting people off - in droves. And after just 6 weeks of being Labour leader. That hardly augurs well for her future.

People loathe Jacinda's secrecy over her tax proposals. The reality is clear - Labour hasn't actually thought through its tax (and other) policies. That's appalling given the central position of tax policy in its campaign!

Jacinda's inexperience and Labour's obvious incompetence have become hallmarks of the 2017 election.

Remember, Jacinda's never been in government - and her parliamentary career lacks distinction. Is she equipped to be Prime Minister? Not at all.

ttp, I disagree with you, Jacinda has charisma (nice smile & speaks well) and that's (sadly) all you need to get votes. Just look at the shift of support for Labour when she took over from Little. Labour's policies haven't changed that much since she took over. What's hurting Labour is their unwillingness to say what they will tax until after the election. It leaves the door to taxing wide open and too many people are not ready to hand over a blank cheque to Labour (or to any party for that matter)

Well worked for JK....

Correct... I agree with that ... the Labour team almost wrote itself off before JA, that is why they couldn't bother planning anythings but moaning and cursing Nats... however , and active Jockey cannot revive a dead horse alone .. no matter how well spoken she is .... you need Substance and Trust ... i fear that both are not there in sufficient amounts ATM

the more i hear from Winnie it seems to me he has already picked to go with national.

that is the problem with NZF you dont know which way he will jump, and i voted for him last time to stir up the government , wont be this time as he might be part of a government either way which will hamper him

it is going to be strange if he does go with national as they are polls apart on immigration and super and foreign national buying our houses.

Polls apart perhaps but not necessarily poles apart. Winston is ex National after all. A National NZF alliance seems more comfortable than a Labour NZF alliance especially when you see their support base.

Winston wants a major overhaul to taxation in New Zealand as well;

To replace the existing tax system with a fair and equitable system based on people's capacity to pay, so that people and businesses who benefit from the higher incomes made possible by New Zealand’s economic potential will bear a greater portion of the tax burden than those with lower incomes.

To replace the existing tax system with one which is clear and easily understandable, thus minimising confusion and costs.

To ensure that the tax system is effective, raising only sufficient revenue to enable effective and efficient government programmes to be paid for without excessively burdening taxpayers and handicapping the economy.

Exceptionally crafty move by National.

I am in absolute awe at the level of planning, however, I'm not sure if it will achieve the momentum shift that they're aiming for.

Looks like Labour will loose again because of the same thing as last election TAX !

Why are you people so hung up on largely inconsequential tax cuts?

By the same token that you want to know where the money is coming from for infrastructure investment - think about where the money is coming from for tax cuts.

It's almost American isn't it, John Steinbeck said it best - "Socialism never took root in America because the poor see themselves not as an exploited proletariat but as temporarily embarrassed millionaires."

You have people who vote themselves a $500 a year tax cut, and think that's great. The thing is that $500 a year tax cut for them is ten times that for the 1%. People don't want to enact these taxes as they somehow think they're going to get there - fact is 99% of them are not, no matter what they do, no matter how hard they try, but they still won't vote for taxes that would benefit society in the long run, as one day that guy might be this guy.

Other thing is the massive economic illiteracy when it comes to taxes - you see people roll out the I don't want to pay 39% tax line, not understanding that that's the top rate tax and is only payable on the portion of income earned over and above that top rate. So if a new top rate of 39% came in on $150k+ per year, I'd end up paying roughly $50 a week more tax

It's crazy when you factor in the expected personal costs arising from ever decreasing taxes.

A decrease in public healthcare spending = increase in private healthcare costs.

Decrease in education spending = increase in private education costs.

Foregoing transportation planning = increase in personal costs of congestion.

Foregoing debt paydown = increased borrowing costs.

The list goes on and on.

For me, I think $1k per year is a bargain when we consider all of these factors.

Reducing tax burden makes sense only in a situation where the marginal benefit of taxation is declining - i.e. net social welfare is maximised through reducing the tax take. In the case of NZ I highly doubt this is the case. We have no scale, poor capital formation, poor productivity. The list goes on.

Except every election year we think we can expect tax cut cherries in the face of this. Essentially for some retarded reason we think we can supplement flat wage growth with cuts to essential services.

It's time we wake up to the fact that we are very fast approaching (or have reached) a minimum tax threshold. Any further tax reductions are going to significantly impact our way of life and those that continually advocate for them are going to be (as always) the relatively largest beneficiaries of them.

It's completely insane, to give a western example, under the conservative government the UK went under a mass privatization of assets - Railway being a biggie, the tax payers in the UK are subsidizing these companies to help them turn a profit to repatriate overseas. http://neweconomics.org/2017/01/railways-failed-next/

Following Brexit the NHS could be partially dismantled if a trade deal with the US is enacted (not saying it will but there will be an appetite for it) https://www.economist.com/news/britain/21716662-question-what-firm-woul…

The right tend to cut budgets for services, announce they're not working and then introduce a private contractor to "give more competition" or to "maximize return on investment" - they then prop those up with taxes whilst the private company invariably performs significantly worse, all the while profiteering from essential services - I give you Serco and the prison debarcle here as an example.

yes and the voter lets them get away with it again, and again and again mostly because they get their 30 pieces of silver.

You have it the wrong way around. its actually I want,

a) private healthcare = who cares about public healthcare, I dont use it, ergo give me more money so I can get a better private policy.

b) repeat for education.

How do I form this opinion? because I listen to ppl around me who take these vary lines.

It all comes down to me, me, me and short termism for a big enough % of NZers that this is what dictates an election result.

Solidname@9.07. If you are earning $100K+ you are in the 9% of the population group already paying 42% of all income tax. If the top tax rate increases to 39c, the imbalance increases. The suggestion that top earners will continue aspiring and risk taking if the top rate is further increased and they will lose 40%, is flawed. Avoidance is incentivised, social divides entrench and the economic 'balance' that redistribution is supposed to deliver, becomes more elusive. There is a point at which increasing marginal rates become unfair. We are there now. Even Taxinda seems to have realised this by forbidding her secret tax quangos from going there.

And yet the top tax rate in the US is 39.6%

yet no one, or few actually pay the top rate. Many high earners actually only pay 10~15%

This is my point. A high income tax rate does not hinder the highest earners as they shift their earnings to capital gains. You would need to close the capital gains loophole to ensure the wealthy paid more tax.

So you're telling me that people will stop earning to avoid taxes, so they'll eschew 61% of that money because they'll be taxed 39% of it? No I don't want that $61k because I'll have to pay $39k tax? They already should be paying $33k in tax on it anyway, it's $6k more on a $100k! Hypothetically a top rate tax kicks in at $150k, someone earning $250k per year would pay $6k more in tax.

That's a bit like cutting your nose off to spite your face isn't it? I'm certainly not going to stop earning because I'll be taxed a bit more. In an ideal world I'd prefer that the top 0.1% paid their due instead of avoiding taxes that are due (Gareth Morgan I'm looking at you) and multi-nationals paid their taxes, add religions in there as well for good measure.

No we are not there now as a) few in the top few % actually pay that top rate anyway. b) historically we had tax rates far higher yet economies did perfectly fine in those periods.