By Alex Tarrant

The New Zealand government ran an operating deficit before gains and losses (OBEGAL) of NZ$10.167 billion in the nine months ended March 31, almost 15% worse than forecast in December, as earthquake costs and a weaker than expected economic recovery hit the government's books.

Also, Treasury said GST receipts were lower than expected and the impact of income tax cuts were not flowing through as expected. Treasury announced last week it would borrow NZ$20 billion this year or 10% of GDP. See our earlier article.

The latest accounts to March are the last to be released before the government's budget on May 19, which is expected to include no additional spending from the previous budget. The government has signalled its intention is to get its books back to a "meaningful surplus" in 2015/16 to begin paying down debt, by tightening spending on schemes like KiwiSaver and Working for Families.

Treasury's Debt Management Office is set to borrow NZ$20 billion in the year to June to cover an expected government OBEGAL deficit of NZ$16 billion for the year, and to cover half of next year's expected NZ$8 billion deficit. The government faces a potential credit rating downgrade from Standard and Poor's unless it can convince the credit rating agency that it can control its deficit and spending. The Crown's net debt was NZ$39.4 billion, or 20.2% of GDP at March 31.

Finance Minister Bill English this morning said the deficit could hit NZ$17 billion.

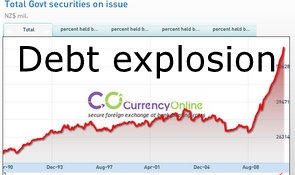

See our interactive chart showing NZ government debt on issue.

Tax package not delivering yet?

Core Crown tax revenue in the nine months to March was 0.1%, or NZ$19 million, above forecast, Treasury said. However, the government's tax package introduced on October 1, where it raised GST to cover for income tax cuts, does not seem to have been as successful as forecast.

"Revenue from source deductions was NZ$242 million (1.6%) higher than forecast because it appears the impact of the October 2010 income tax rate cuts has not been as large as anticipated," Treasury said in its commentary in the financial statements.

This was offset by GST revenue at NZ$263 million (2.6%) below forecast.

"This [GST] result reflected underlying weakness in private consumption and residential investment, contributed to by reduced household spending and the delay of rebuilding activity in Christchurch due to the earthquake on 22 February." Treasury said.

Expenses down

Meanwhile, core Crown expenses were NZ$422 million lower than forecast over the nine months to March, Treasury said.

"This was mainly due to underspends across a number of areas, partly offset by a NZ$331 million revision in the estimate of recoveries relating to the deposit guarantee scheme which was not forecast," Treasury said in relation to losses stemming from South Canterbury Finance related party loans last month.

Meranwhile the Earthquake Commission’s (EQC’s) estimated net costs for the 22 February earthquake of NZ$1.5 billion were unforecast in December and had adversely impacted the operating balance before gains and losses deficit, which was NZ$1.3, or 14.8%, billion higher than forecast, Treasury said.

"However, when unforecast gains are included, the operating balance deficit was NZ$3.8 billion lower than expected at NZ$3.3 billion. These unforecast gains primarily related to equity investments in the NZS Fund and ACC and actuarial gains on ACC and GSF liabilities," Treasury said.

The government's gross debt was NZ$2.5 billion higher than forecast at NZ$66.7 billion (34.3% of GDP) at March 31.

"March was a record month for bond issuance with NZ$2.8 billion of bonds sold, taking the year‐to‐date issuance total to NZ$13.9 billion. In response to strong demand from investors, on 30 March the NZDMO increased the 2010/11 bond programme by NZ$1.5 billion (to NZ$15 billion) to allow for continued issuance over the fiscal year," Treasury said.

"Net debt was NZ$174 million lower than forecast at NZ$39.4 billion, or 20.2% of GDP. Despite the higher than expected increase in gross debt, net debt was similar to forecast because the proceeds from the bond issuances were largely invested in financial assets," Treasury said.

Corporate tax receipts half a billion below forecast

The core Crown residual cash deficit was close to forecast at NZ$12.4 billion, with the two main features being corporate tax receipts NZ$488 million lower than expected; offset by purchases of physical assets NZ$435 million lower than forecast, due mainly to delays in defence and education capital projects (NZ$175 million and NZ$71 million respectively), Treasury said.

The financial impact of the AMI support package was not yet included in the government's financial statements, Treasury said.

Deficit could be NZ$17 billion

Following the release of the statements, Finance Minister Bill English said the operating deficit before gains and losses would "be somewhere around NZ$16 to NZ$17 billion, which will be the largest deficit New Zealand’s had".

"That...will be contributed to by the way we account for the earthquake costs. And that why it’s important that the budget shows a track back to surplus, because that NZ$16 billion means we are effectively borrowing over NZ$300 million a week, and we need to get that down,” English told media in Parliament.

“ACC and New Zealand Super investment returns have been pretty strong in the last 12 months. They haven’t yet clawed back the losses from the earlier financial crisis, so that’s the business of being in investments sometimes – it can drop fast," English said.

"In the long run though we believe those returns will come back to normal,” he said.

When government returned its books to surplus it would resume making contributions to the Super Fund.

Asked what year the government was looking to return to surplus, English replied: “You’ll have to wait for the Budget. It’s a bit of a challenge, managing the government’s books, particularly with the extra costs of the earthquake of around five-and-a-half billion."

(Updates with comment on cash deficit, corporate tax revenue, chart, Bill English comments.)

No chart with that title exists.

55 Comments

Quick John, better open your "Finance for Dummies" book, see what it says..

Or double the analysts budget and resource up a bit more?

Here's the chapter the govt has been looking at.

New Zealand's Currency as Much as 20% Overvalued, IMF Says

Well on that I quite agree with them OMG......but for that imbalance this country would be in Gasoline hell.

or decrease spending and start mining more.

The problem with NZ is that we always think of increasing taxes, never cut spending.

Yup, that's about it in a nutshell .. the plan is falling slowly into place ..

-- Borrow today

-- Print tomorrow

-- Default very soon after that

-- Austerity party to welcome the IMF

Yep just got to connect all the dots of what look like unconnected events and the AGENDA is right on track.

huh? just where is the Govn saying increase taxes? actually all I hear is cut spending....cut spending....increasing taxes isnt on National's agenda.....and its barely if any on Labour's....

The next Q on from that is where to cut......then of course things get vague.....do you really think National wouldnt cut if it could? I dont.....

regards

I think they should just put the taxes back where they were and reverse all of these unaffordable tax cuts we have got over the last few years. Does anyone really feel that much richer from the tax cuts, other than the rich?

The rich can afford to employ tax professionals to dodge tax so putting it back makes no real change but yes its better than nothing......so no I wouldnt want to put the changes back but rather go for a land tax to try and make sure those who should be paying 33% are actually paying 33%...

regards

Or bump the trust rate up to 39% as well this time which would make it harder to dodge

An S&P downgrade must be all but certain. English & Key know this, hence why they have been filling their boots with debt issues while they can.

Concerning they state the tax cuts arn't working. Is the proposal to increase the top tax rate again - very dangerous. Intrdocuce a land tax - simple and reliable tax base. Land does not move, the tax is progressive and captures non-resident landowners. And show some courage and cut the unsustainable government spending and destructive welfare state.

How is a land tax fair? Why should land get a special tax when other assets don't?

Quite right, jimbo! Best you sell that asset before the next owner realises that they are in for 'that special' tax! But maybe, just maybe, that next buyer already knows what's coming.......

Unfortunately I need land to live on.

Rent it, jimbo! Whatever it is you do to create' income' from it ( even if it's income foregone, as an occupier) it's cheaper than the cost of ownership...and is about to become more so! I see insurance rate are tipped to go up 50%. Whatever can be next! And what did I also see on the telly? IMF says NZ has room to ...drop interest rates...now there's another sign we're in real strife....

PAYE get a special tax and others dont....why is that fair?

So you need to look at all aspects of an economy and where money is earned and try and make the tax even such that ppl dont invest in say land because of low tax reasons what you want is ppl investing in a sector because it produces a good....and especially an export good.

Once a balance is determined than vary that a bit to encourage investment in the export sector which is what makes a Nation rich....

So the idea of a land tax is it broadens the tax base and levels the playing field.

regards

But it surely has to be regressive. Everyone has to either own a piece of land to live on or they have to rent a piece of land from someone who will pass on the land tax. I could have a billion dollars in non land assets and only pay land tax on the land that my mansion is on, and another person could have pretty much nothing and be paying almost as much in land tax. It is just as unfair as PAYE is, possibly worse.

The idea is the land is then used productively.....

regards

I suppose you have to get away from whats good or bad for "me" and look at whats good or bad for society / NZ overall...

So the idea is that mal-investments made because there is virtually no tax in a sector get balanced out / removed.

regards

Go easy on poor old John & Bill. They are following "Making the rich richer 101 for dummies", as required by their American overlords.

So Keynesian trickle down is failing us; best we try that Hayek trickle up, then. According to that rap video...Round 2 to F.A. 'Highexplosives'...and debt repayment; austerity and asset taxes.

That little bit about 'investments' is illuminating too: by and large, they've got to reduce over time.

Status - mining your way to 'wealth' is for dummies.

What then?

At the end of the slag-heap, what will your 'wealth' buy? And don't think that's '100's of years away', exponential growth (via greed) always shortens the timeframe. Exponentially, as it happens.

Again - what then?

I would not mind being a dummy like Aussie then:) We always hear about Peak Oil so we well as mine as we would not be able to afford going to the S4 land to look at as petrol prices will be too high and visitors will not be able to fly here. I have seen heaps of old mines in USA that are good viewing, mines do not mean slag heaps.

Reduce spending, this is what we need to do, increasing taxes will bring in a lot less than this. Have a zero increase in welfare payments, even negative rates for 3 years, reckon this will incentivse a few to get back to work and slappers in South Auckland to keep their legs shut.

Will the budget turn the Titanic from a course set to slam into the debtberg.....nope....more bullshit and spin...jelly beans and gummy bears....hope and pray...

The plain truth is, thanks to the banks being in control of the economy along with bad govt in the past and weak govt today we have compounded the problem of having an electorate that cannot understand what the bloody hell is wrong.. and why voters shouldn't vote for the liar who promises the most pork..and why punters shouldn't bloat themselves on mortgage debt to chase the ponzi scheme profits..so the budget will be all about pork.....and the mountain of debt will not go away.....

Wolly - there we agree.

I just keep looking at this graph (even if he's wrong by a decade, and the descent is half as flat, it says Sayonara):

then you hear these guys saying "less than forecast" and you think "by whom"?

"less than forecast" its getting repetitive.....the UK was the same, USA etc....in each case the finance/Pollie ppl were expecting growth that quite frankly even right wing-ish talking heads/economists questioned as likely/possible.....and guess what, it has not happened.....same here, JK said he was expecting a 6% growth at the level of stimulus and we got about zilch......

Defination of madness, doing the same thing time and time again and expecting a different answer/outcome....

So it seems most of this current crop of Pollies have "growth" so ingrained as a mantra that they cannot change even when the failure is obvious....and repeated....and in their face....Simmons I think is right its going to take 3 or 4 oil shocks for it to sink into the populace if not the pollies and we are just entering the second......so 2 years maybe.....hopefully before the 2014 election so at least we start to do something even though its too late....

regards

One way or another Wally ...........Johnny Rotten's gotta go..!..n Billy Bob..n..Bolly Bib...n the fat man too.............Financial Hub..?....Financial Hubris...more like.

And the smug little bast$%d's got a finger in the air saying sorry Nu Zuland looks like your stuck for choices.

Wolly - you are right.

The fact is that NZ'ers have enjoyed years of living beyond their means and what the electorate don;t realise is that their desire for more and more lollies is turning them into serfs. They will become tenants in their own land - slaves to those who they owe the debt.

JimboJones - a land tax is as fair as rates. Those who reside in an area and enjoy core services should pay for them. I propose a land tax to cover core services which citizens of NZ enjoy - such as defence, law and order and central government running costs.

A high % of the populace who have signifcant land assets, enjoy government services but pay limited or no tax. The tax burden is borne by PAYE slaves who invested time and effort in getting skilled and educated. How is that fair?

I am not proposing to replace all income tax with a land tax, just to broaden the tax base away from being too reliant on a small % of highly mobile PAYE taxppayers.

I prefer a land tax over a capital gains tax because it is simple to introduce and administer and difficult to avoid (just add it to rates). Also, unlike capital gains it is very stable (rates don;t go up and down much with movements in the markets). Capital gains would not net much tax in the current environment.

Agree.......

regards

So we already pay a land tax called rates, why do we need another? It is pretty easy to avoid your fair share of land tax just by owning very little land. To me it seems more regressive than GST, so why not just bump up GST?

Because GST is highly regressive on different ppl...ie hammers low income PAYE's again....the idea is move to effectively tax the areas where little tax is paid in comparison to other areas.

regards

Why are you always on about PAYE getting hammered? The personal tax rates are the same for everyone, regardless of whether they earn their income as a PAYE earner, self-employed or whatever.

As for GST, it doesn't "hammer low income PAYE". It hammers everybody in the same way. In fact, you choose how much you want to get hammered yourself. If you consume a lot, you pay a lot of GST. If you don't, then you don't pay much GST either. Can't get much fairer than that, can it?

No, GST is regressive, it hammers the poorly paid worse than the well paid because the poorly paid dont have disposable/spare income....

The point on PAYE is that those on middle incomes pay a very big proportion of the tax burden while those on higher incomes often pay less tax and in some cases so much less they can claim WFF.....that should not be the case. Hence a land tax seems difficult to "dodge" and easy to collect, (its just added to rates).

Whatever, its really simple, at some stage taxes have to go up or some major part of the Govn system has to go......say education, or health or something....and when thats provided privately that costs way more....so you pay really its just a Q of whom you pay.

regards

Not convinced by your argument. As you say, the poorly paid have less disposable/spare income so they consume less hence they pay less GST.

As for the fact that middle incomes pay a very big proportion of the tax burden, I thought it was the high income earners who did (isn't the figure often quoted "the top 10% pay 90% of the tax take"? Can't remember now).

Although I don't know that many people in NZ, most of those I know who have a 2nd property and/or a trust that they use to claim losses against their income, get WFF etc are PAYE earners. They seem just as apt at gaming the system as anyone else... So I'm not sure about the validity of the "poor PAYE earners" argument.

The government's gross debt was NZ$2.5 billion higher than forecast at NZ$66.7 billion (34.3% of GDP) at March 31.

"Net debt was NZ$174 million lower than forecast at NZ$39.4 billion, or 20.2% of GDP. Despite the higher than expected increase in gross debt, net debt was similar to forecast because the proceeds from the bond issuances were largely invested in financial assets," Treasury said.

Other than depositing several plus billions with the RBNZ resulting in a ~3.00% carry loss and lending interest free to students at the cost of issuance - ~5.81%, what are the other so called financial assets?

The net borrowing number release increasingly represents a circular loss making deceit.

When has Treasury been within a bulls roar of being correct in their forecasts?

They always get it right when they forecast their salary increases CO....!

The fact we continually borrow to pay for our standard of living surely is an idictment on our socioty.

The shell be right mentallity, well sort it out later is irresponsible. The reality is the longer we leave it the harder its going to get.

Cutting services well eventually lead further into poverty and disfunctional socioty.

Yes - government import most everything and therefore lives with the fact of exporting “Brain Power” plus creating more red tape – no wonder !!!

What are you people expecting ?

Where are the decent jobs for the wider NZpopulation ? Only more diversity and a stronger, solid production sector (Green industries/ manufacturing) will long term succeed and reverse the trend.

I seriously think the nation needs external help - PM send them a letter urgently - invite a delegation - I do the translation for you - without charge and lemonsine or helichopper transport - I bike :

http://www.youtube.com/watch?v=QUWB7x9jhEc&feature=player_embedded

---

By the way: It is going to rain down a bit for the next few days - broom time.

....you all know national's solution to this spiralling debt - sell assets. I'm thinking this is just delaying the inevitable. At some point they will have to take the IMFs advice to broaden the tax base e.g. land taxes. They will also need to re-structure spending. The longer they leave it the more painful this adjustment will have to be - the bigger our debt the bigger interest bill. The less income we have (because assets have been sold) the harder to pay that big bill...coming adjustment likely to be a hard landing me thinks.

John Key acknowledged at a Dairy Conference recently the paying down of debt by farmers, then went on to say 'I hope you start spending soon'. If this govt is expecting consumer spending to be increased through farmers spending their money on twat, then he is backing the wrong horse.

Hmm.

Did Bill just say that returns from ACC are helping out. I thought ACC was broken and could only be fixed by privatisation. Not sure how a privatised ACC would have helped us out of this mess.

I also recall that the reason given for ACC being broken was because it was in the red, although little mention was given to the situation being the result of weak (poor) investment. Yet here we have BIll saying that ups and downs are 'the business of being in investments sometimes.'

Have they just had their cake AND eaten it. Almost. But I guess not until they finally hand out the juicy bits of ACC to trustworthy and sensible finance companies, hang up the politician's boxing gloves, and take up those board positions on said finance companies.

Jono

Yes lets stop selling and take ownership of our NZ, bite the bullet now and financially contract from the CEOs down, spread the wealth evenly and take care of people.

Re align those capable unproductive resources into overseas income earning activities of benefit in a measured way.

Have productive fullfulled lives with balanced lifestyle to enjoy the true beauty of NZ.

Take back our Aotearoa and control our own destiny.

A great ideology I know; but where does one start and how do we do it?

Why don't we have a tax rebate on the MORTGAGE INTEREST that is paid by a household .... if PI's can claim against their mortgage interest repayments, why not ?

We all know the problem with NZ Inc is that most of the working population have very little disposable income. This will put more money back into their pockets, which to spend in the marketplace and grow business.

Who loses ... no one. The government may have a reduced tax take but this will be put back in the economy anyway ie GST

Might sound crazy at first (that why they call me CRAZY HORSE ! ) but if everyone in the higher income echelons are getting tax breaks, why not the middle and lower income earners ?

In fact before all you PI's say WHAT ! they do this in the USA already ......

" crazy at first (that why they call me CRAZY HORSE ! ) but if everyone in the higher income echelons are getting tax breaks, why not the middle and lower income earners ? "

CH dont forget that if you have 2 kids and earn $48000 then you dont pay any income tax.You only pay gst some of which is offset with community services card,winz accomm help etc.....

as someone who sits on the borderline for any govt$ I would say that low income earners already get a pretty good tax break

as for a mortgage rebate...are you serious????

...yeah lets give people who borrowed too much on an overvalued house some more money....which im sure they will spend on an even bigger mortgage on an even larger overvalued house!

if you are having trouble meeting the mortgage then sell your house or cut your lifestyle.Dont expect thosed who saved and delayed consumption to pay for it.

You are not crazy, you are a Clever Horse!

I'll support any suggestion to reduce tax; the less tax we pay the better off we are!...

A land tax would always be far more effective than capital gains tax.

Why? Because you pay it every year, year in, year out (keeps the payers eye on the ball) while capital gains is not only a once per deal tax but it has to have some form of allowance for inflation.

A concession for personal occupancy would be necessary but the land tax rate could be set high and if income is earned by the asset , then an offset of income tax payable could be allowed. It would pay to make your land (or indeed any other asset) earn its keep.

Also no concessions for overseas ownership.

Basel, agree with you on land tax: But I reckon no concessions for owner/occupied houses in the name of a trust. SO how would you treat a family home, Husband, Wife, 3 children, where it has been transferred into a family trust, with the family members all equal beneficiaries. The Husband is the only income earner. The trust does not earn any income. The Land Registry Title is in the name of the Family Trust. Is the "annual exemption/credit entitlement for a family residence apportioned equally, or, to the income earner, or not at all?

Really this is simple for me anyway, the Govn has an expenditure it has to meet but its doesnt have enough income. No normal family home should be in a trust. So the trust has to pay the land tax on its land it owns....if it cant it goes bankrupt, I sont know the ins and outs but I would assume the trust is charging a rent to the family. If there is no income the trust is disbanded or the asset is sold to pay for the debt and I assume the remainder is passed to the beneficieries. I see no problem with that....or something similar

In "compensation" the sole earner sees no PAYE increase....to meet the present Govn debt.

regards

Why would a personal concession be necessary? I dont see why.....only as a pork barrel thing...When you do concessions ppl legally or otherwise get around it, so like GST keep it simple with few if any excemptions....

For instance for a land tax on a rental, does the PI get the exception? or the renter? it just gets messy IMHO....simpler to add to the rates.....compensate elsewhere say the tax rate, drop it to 29% or something....

regards

Open the immigration floodgates - that would be the best thing to help all our problems.

Limit it to wealthier immigrants, they will come here and boost the economy with their spending, tax revenue goes up. They will help push the housing market up again, which as we all know is the only think that keeps the useless NZ domestic economy afloat.

Nah MattA start from within the ground up, the cultural difference would only complicate matters, this problem has to be dealt with in a NZ and our way.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.