Kiwibank cut its 2 year fixed mortgage rate by 10 basis points to 6.59% 5.59% on Thursday, taking it at least 6 basis points below its major competitors in an attempt to spice up demand in a quiet spring housing market.

ASB's two year rate is 6.7%, ANZ/National is on 6.69%, BNZ is on 6.65% and Westpac's was 6.69%.

The move sparked an almost immediate response from TSB, which cut its 2 year rate by 10 basis points to 6.58%. And late on Friday, Westpac said it was dropping its two-year rate by 10 basis points to 6.59%, effective from 8.30am Saturday November 20, matching Kiwibank's move.

And on Monday evening SBS Bank also cut, reducing its 2 year mortgage rate by 11 basis points to 6.59% from 6.70% effective from Tuesday, November 23. On Tuesday, HBS Bank, formerly the Hastings Building Society and now part of SBS Bank, said it was cutting its two-year home loan rate to 6.59% from 6.70%. And PSIS said it was dropping its one and two-year home loan rates. PSIS cut its one year rate to 6.40% from 6.45% and its two year to 6.60% from 6.70%.

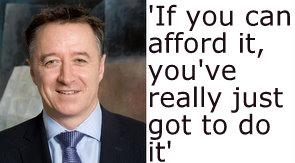

Last month Kiwibank's new CEO Paul Brock told interest.co.nz that now was the time for first home buyers to take the plunge.

Brock, who recently replaced Sam Knowles as Kiwibank’s CEO, said then he would be concerned if people were being put off home ownership. He noted the overall housing market had slowed down “quite a lot” and, although he didn’t have the data at his fingertips, there was a feeling that first home buyers might be stepping out of the market.

“That’s a bit of a concern really for New Zealand. From my point of view home ownership is really good,” said Brock.

“It’s one of those things that’s both good for the individual to get started towards financial security, I think it’s good for the country and it’s also good for the community that people are owning their own homes.”

“In a way it’s almost that rite of passage for New Zealanders, the opportunity to get started and in many cases it is the first step towards financial security,” Brock added.

“Making that step is really, really important. So I would be concerned if people are being put off by views on property prices, or views on interest rates.”

Mortgage rates

Select chart tabs

(Updates add Westpac, TSB, SBS, HBS and PSIS moves).

50 Comments

Remember that Bismarck tune?

We gotta bring the customers in and sell em lots of debt

we have to win them over cos our profits depend on that

so tell em it's time again...... to have a splurge or two

We gotta bring the customers in and sell em lots of debt.

who can add to this?

I will play the game:) Does this sound the like the right tune?

The year was twenty ten and one, the second dip had just begun

The bankers had the biggest debt based on negative equity The ASB lead a non sterling field in inadequate depositry With her balance sheets all to hell but no drop in salariesAsking this dude if you need a mortgage is about as smart as asking your hairdresser if you need a haircut.

The "Just do it " unthinking attitude described here has got us into this crap.

Maybe prices are too high - ever crossed his mind ?

Median US house prices are US $180,000 - what does that tell us about NZ house prices - labelled as grossly overvalued by The Economist.

The desperation is evident....it will not stop the trend for families to deleverage and run like hell from debt....twenty years I reckon and a whole new generation before these memories and new found habits of frugal prudent behaviour, are washed away.

English speaks of reduced retail spending and declining demand for new building as though it will quickly revert to the way things were pre 07. Not friggin likely. This is the new normal level of market activity. He had better plan on revenue, at best remaining where it is.

We need to realise these bank bosses gorge themselves on bloated salaries and have no idea what so ever of life on a low income.....they probably believe their own hype is the truth.

Bernard

I will take up some serious dosh at 5.59%.

Are you trying to scare the rest of the market - I am sure you mean 6.59%

Yes, our error. It should have read 6.59% in the first sentence. Apologies to both readers and Kiwibank.

My apologies to everyone and Kiwibank. Had it right in the headline earlier, but yes it was wrong in the body of the story. My v, bad.

Bernard

I also think it is meant to read 6.59, otherwise i would be a very happy man. Lets see what the others do i guess.

I picked this last month lol

No one jump in yet, coz ASB are traditionally the last and the best (esp with there new stupid ads I dont understand)

A 2 year less than 6.45% and anywhere near 6.25 is great value and a 3 year rate less than 6.75% is also a slim possibility

Roll on interest rate wars. Game on Small Kev :)

Spot on, 28/29 y.o. ! 'No one jump in yet...coz'...prices are going to get much cheaper. That's both financing prices and purchase prices. Why try to pick the bottom, and see it go way further than anyone expects? Better to stand back ,and buy on the way back up ( that way you're buying an appreciating asset!).....but sadly...that time is way, way off.

Only a fool would buy now, because prices are obviously going to fall for years to come.

Oi, I also picked this last month!! Alright, maybe the month before, but yeah, "we told you so"!

It is the game alright. Now is the time to buy, but certainly not the BEST time to buy because the BEST time has already been and gone. The vendors of those good quality houses dont have to and wont drop their prices...

But wait, there could be more rate drops still to come, but I'm not going to make that call this time as the 2 year rate is already low enough for people to comfortably budget with.

For those who are in the position to buy and have survived 9%+ interest rates 2 years ago, this is what they've been waiting for.

“Making that step is really, really important. So I would be concerned if people are being put off by views on property prices, or views on interest rates.”

What an ignorant and stupid comment to make!

Here's what he's really saying: "It's REALLY IMPORTANT that you allow banks to profit off YOUR debt regardless of your views or our interest rates"

I will tell YOU something Paul Brock. I have alot of money in KB. Make such ridiculous statements like this again and I will pull the plug on my accounts Got it? You will notice believe me

The real estate market is like an old engine, slowly dieing with real estate agents and mortgage brokers / banks firing engine start at it and coating it in CRC. Not much is left in the can though.

Kiwibank's move is a good marketing strategy that strengthens the country.

In the absence of attractive long-term fixed-rate mortgages, homeowners are caught in a cycle that requires them to shop for value every few years anyway. Banks know when a mortgage is transferred to another bank, consumer debt follows along. By breaking the gridlock imposed on Kiwis by the Australian banks (majority owned by New York banks anyway) we can disconnect from Australian Central Bank policy and retain some degree of sovereignty.

Given the unfolding of the property market in Australia that is just beginning, Kiwi customers will undoubtedly be forced, through coming rate increases, to subsidize the balance sheets of Aussie banks, like Westpac, with a preponderance of their assets in residential mortgages.

Fractional reserve banking is heading towards a cliff. When it collapses we will need a sovereign infrastructure that enables people to trade and exchange. I would rather that institution be a New Zealand one.

Jeez Doug....let's not worry about the minor details of banking and just believe in Kiwibank saving the nation of splurgers and other financially braindead fools....How can the property ponzi bubble over here remain intact when the aussie one implodes?

Where will the hundreds of billions in credit needed to fund all this new mortgage lending by Kiwibank come from?.....please don't say it will be borrowed from the aussie banks!

You are right about the approaching wall that fractional bullshit banking will run into, but then it all goes pear shaped. "When it collapses"...Kiwibank will be squashed underneath because it too operates on the bullshit principle.

Good call on Westpac. Their woman boss ran St Georges, then quit to move into Westpac, then Westpac took over St Georges.. I wonder what they're hiding? hmm something about west Sydney 100% mortgagees for people that will never remain above water in a declining market. uh oh.

5.59% is worth considering for 2 years...in normal circumstances....this isnt nornmal of course...but

So the Q is are the lying buggers doing this as they see 2 years flat or worse? but are saying the opposite?

IF you are inflationist (not me) how can you resist this rate?

Even a deflationist like me is wondering if its worth a punt just for that small chance....

regards

"Even a deflationist like me is wondering if its worth a punt just for that small chance"....err well that would be a "no" steven......see in a deflation environment prices are falling....now why would you want to buy property ?

AS an inflationist you should resist because you know bloody well rates are set to shoot higher because you will have done your homework and applied yourself to your studies of econ 101.

Seems there must be another leg to this....there it is....ask yourself.... "why would brock be telling me I have really just got to do it"............easy isn't it!

Wolly, you have mis-read me....not to buy "new" but to swap from floating to a 2 year fixed term.

Im not an inflationist...not for years anyway and certianly not in 2....the point is not to cut your nose off to spite your face. How much lower could the floating I am on go compared to 5.59% v the 6.19% I am paying now....balanced against what I see is an unlikely but there risk of inflation.....

Sorry but your economy 101 class is the neo-classical school....and its basic theory...and its broken, we are in a liquidity trap and not a std recovery.

Inflation happens when the Govn prints into an already low employment market with a booming economy, have a look at this scenraio and compare it to us today.....a classic modren example is Japan....they are still buggered 20+ years later....

Im not interested in paying a higher fixed 2 year than the floating that would be silly.....

Interestingly of course is I am assuming that the bank is seeing very few sales, ie its a reflection on the buggered house sales scam.......backs up the stats.

regards

As you say ..mis read you...but playing the floating or fixed is only going to mean a few bucks one way or other.....

Inflation is already on the up. Look at China. Don't look at govt released data...they are lying. The US stats are as corrupt as the pollys. Even the Beijing data is a fraud.

Liquidity trap yes....a new normal instead of a 'standard recovery'....true enough.....dependence on the buyers of 'our' product at high prices....even then unable to pay down the 250 billion in debt.....that's the hammer blow the public are not being allowed to learn about...there is no bloody light at the end of this tunnel!....at least not for those in debt they cannot pay down....but if the debts end up being really really friggin big...we will have our version of a taxpayer bailout of the 'too big to fail banks' because that is what the RB and the govt will do....Currently English is doing his best to make the debts larger and the braindead are being encouraged to borrow more and leap into the bubble.....

Ask Labour and you will be told this had nothing to do with them and they have the answers...all you need to do is vote for goofy.

China is different, to NZ and the USA. China, now that's a case of inflation, they have a boom and they have too much money, I totally agree.....that fits the economics model 101.

Beijing data....the interesting thing is Beijing says it wants something and sets a policy, then the provinces give the expected answer....if its as expected no one asks anything more....so the data is not only fraud its "double" fraud....Beijing manipulates tha data thats already been manipulated....or based on fantasy...

If the 250billion in debt cant be paid off then its bankruptcy and fire sale time, but thats not all bad...Ppl in the 1930s that had cash could and did buy out companies at firesale prices and made money....cash has an opportunity factor that with deflation/depression is very useful IMHO....

I dont know that BE etc is having much joy with the brain dead if the house sales are anything to go by, there are few such ppl.

regards

When mid term rates start to drop, and longer term dont, what generally happens mid way thru the mid term rates jump up before their term is up.

Bank still make enough profit even thu their margin does lower, but they do have that customers a/c on their books.

Banks are not stupid..just look at their balance sheets...and to achieve that they know very well what is going to happen in 18 months or 5 yrs time...espec on a market that is below the long term ave.

One could argue they didnt predict the drop in interest rates....thats fine, they have/had more than 1/2 of customers on above ave long term loans, and could recover costs if customers wanted to bail out.

As I have mentioned in the previous articles on bank rate changes...Its all about marketing, increasing customer base, and from that we can start to predict when interest rates will start to climb again. Its a bit early to call, and will depend on what banks do with the long term rates over the next few weeks/months, but at this stage with long term static, interest rates start climbing in about 14/18 months time.

FYI updated with TSB cutting its 2 year rate mortgage rate in response by 10 bps to 6.58%.

cheers

Bernard

well done - undercut already by a rival bank, may they be undercut too...

10 basis point cut on a $250k loan is...$250 per annum...<70 cents a day. Enough to tempt one into a commitment of >$350,000 ? But on the flip side; I guess my rent will be falling that $5 per week, as imput costs are falling? Right.....

Your applied mathematical skills are simply outstanding!

From the article in the NZ Herald this morning, I wouldn't be expecting rents to be falling anytime soon in Auckland. A large number of people may stay renters for the rest of there life! Not a good place to end up when you retire. (renting that is)

Renting is the only place to be when you retire, Gavin! It's great! We get to move about at will; town to town; city to city; country to country. If you want to live in the same place for the last 50 odd years....that's for you, but not me.

Its human nature, property is still people's favourite, otherwise people wouldn't get so sensitive about it.

Leave the capital gain out of the equation, owning and paying off your home will give you half a chance. Tough luck will there be no more capital gain ever again, but you own the damn place and probably have paid it off or a large part of it.

But IF the market takes off again big time and if you happens to be renting......

I reckon owning your own home(or owning something) will be better when you retire.

You dont have to be renting to be able to move from city to city, town to town.

For me it is better to own a house here and there, city to city and maybe one day country to country, and when i m not there, i can choose to rent the house out for money, this is me now and the next 50+ odd years.

"I reckon owning your own home .. will be better when you retire."...now I guess you mean better owning in retirement than not...instead of 'owning will somehow be better in retirement than before retirement'!....

I was thinking about all those retired people north of Auckland who are now facing a 4 lane motorway through their land or near enough to be a bugger....

Or the poor sods who are in Auckland and having a road widened, using their property which is no longer their's.....

For the likes of us small kev, with the dosh to dabble, we can have the cheapy place in the city and the batch on the Coast with the Whitebait stream and the large camper bus to do the commute. Others are all wrapped up in having the biggest squat with the most rooms on the best plot inside the biggest city where they waste away!

For the likes of us small kev, with the dosh to dabble, we can have the cheapy place in the city and the batch on the Coast with the Whitebait stream and the large camper bus to do the commute.

Just what NZ really needs: even more fat geriatrics sipping on cups of tea as they drive their road maggots at 60kph down the centre line, belching huge clouds of black diesel smoke all over the 2km queue of traffic backed up behind them.

I look forward to parking my windchime-covered housebus on their immaculate front lawns and cooking hedgehogs over open fires while they're conveniently away in their other houses. Could probably tap into the electricity too.

Yes you're right Malarkey...it's what we need more of...peasants on the move...enjoying the country and giving that coro street shit the bums rush. Most move at 80 to 90 because 90 is the limit imposed by some pointy head in wgtn...so don't friggin blame the drivers. We know of so many special places to park up for the night...we have sat tv and cold beer, hot showers and hot grub....your black smoke BS applies to council buses and Remuera taxis.

If only they would do 90 kph! And stay in their own lane! And keep left! And move over to allow the rest of us to pass!

Instead they take their mobile trophy homes straight down the centre line as slowly as they can, while gawking at the scenery, completely oblivious of other traffic.

Not that they care about other road users.

It's hilarious to see these fat people waddling around inside these oversized monstrosities, with fridges and microwaves and Sky dishes, while congratulating themselves on how nice it is to "get away from it all".

Just like people who live and work in the city driving 4WDs, especially the ones with bull bars, spotties, snorkels and winches, all trying to pretend they aren't really accountants and office managers, but are really Rugged Individuals.

The LTSA should ban the bloody things, along with 4WD vehicles, unless you can prove a genuine need to have and drive one. (Skiing once a year and/or driving through a puddle every now and then doesn't count.)

Whaddaya mean stay in their own lane....is that all you ever drive on ...4 lane motorways..hahaha...thing is Malarkey you need something called training....before you start telling other how to drive 4 and 5 ton buses or campers, try improving your own skills.

Best for you would be to hire one for a weekend and see how bloody good you are at staying left when a foot too far means going arse over tit into a ditch or bog or sand or gravel or off the bloody cliff just so a silly little fart behind can pretend to be Stirling bloody Moss in his pissant Jap crap.

Most Kiwi 'camper' drivers stay as far left as the shitty roads allow...and it's a dam sight safer moving left into one of the very rare areas where a safe patch exists to allow a 40 ton truck and trailer unit to shoot by at 120kph, if the camper is doing just 80 max. Think about that Malarkey....if the big bussy thing is doing just 60kph....the fart driver like you should have no bloody trouble getting passed...that is if you are capable of passing!

Oh and while you do your training..take it up to 90kph on a 'normal' Kiwi road...any stretch of highway one...good bloody luck to you if you can keep it at 90ks and guess what malarkey....have a gork in the rear view mirror...yes that's you right up your own rear end pissed off that the bussy thing is doing only 90ks.....suck on that for a trip and you will know what truck drivers think about bloody little farts buzzing to get passed and rush like hell to be right up the bum of the next truck or bus.

Best campervan rant ever.

"I love the smell of hit nerves in the morning."

We aim to please and entertain Kakapo.

I'm holding up a placard with 9.0 on it. It would have been a 10 but you didn't call anybody a doucheweasel.

Why do we dig the NZground and import most everything and don’t NZmanufacture NZcampervans and NZbuses NZpublic transport – NZtailor- made 100% NZpure ? Why does that package not come with NZdrivers 100%NZ pure – a new NZmentality/ NZculture making us NZproud as a nation ? Why does our NZeconomy not go 100% pure setting an example for the world making NZBillions in all NZsectors of NZindustries exporting 100% NZpure ?

Do we need all that shit in our economy/ life’s ?

What's about a fresh NZinspiration - making a real difference for us and the next generation !!

But IF the market takes off again big time and if you happens to be renting......

The only way the market can take off again "big time" is if banks begin lending the way they did between 2003 and 2008.

You know, those 105% mortgages to all comers?

That was the only thing which permitted prices to rise.

It wasn't incomes, because those haven't increased in real terms for a long time.

And it wasn't that property was in any way "undervalued" before 2003, because it wasn't.

The myth about waves of rich immigrants falling upon our shores and buying up everything in sight has been thoroughly dispelled.

No, only another bout of property-mania that is fuelled by insane bank lending policy could possibly save your bubble.

What are the odds?

Or you could have a couple of million in the bank and live wherever you want i.e. the tropics.

The two assumptions you are making are,

1) the house value has increased....all else being equal (removing effects like inflation etc)

2) You can realise that capital as part of your retirement...

If it has not increased or even decreased then you are worse off than if you had rented, evcen before you can figure out how to get an income via it.

The biggest thing to take away from today is the next twenty years will not be like the last twenty...

regards

Currently looking for a new place to live, I find it funny how all the agents that you deal with look down on you because you're renting, cracks me up because they are all up the creek and the only reason I rent is to allocate my assets properly, not into one lol

Heheh, yes.

They are desperately praying for the property bubble to reinflate so that they can flick off some of the houses on which they owe a fortune, while surviving day-to-day on credit cards and an OD.

But tenants with plenty of liquid assets and no debt are "losers" and "scum"!

HAHA!

It's nice to be able to fly under the radar like that.

I would prefer that people assume that I'm poor. Keeps the idiots and scam artists out of my hair.

Check out Public Trust's 2 year rate at 6.45%. We have two loans with them and find their rates (floating and fixed) are usually just a bit lower than the big banks.

What I love about this is BNZs' adverts talking about their 2yr rate "being the lowest". No longer is. Time for a new TV ad? DOH!

FYI, this story has been updated again with the latest moves.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.