The New Zealand home loan market is large and growing quickly. No news there, but the nature of the expansion in 2020 shows some interesting twists.

By the end of 2020 home owners owed $296.7 billion to banks, according to the RBNZ residential mortgage reconciliation (C35). Additional, although minor, amounts are owed to non-bank lenders, and there are other non-residential mortgages as well.

That will take the total mortgage debt to well over $300 bln by the end of 2020, and by the end of March 2021 it is our estimate that it will have swelled to $311 bln. In turn, that makes it about 95% of annual economic activity (GDP) and its highest proportion ever. It was 87% at the end of 2019 and 86% at the end of 2016.

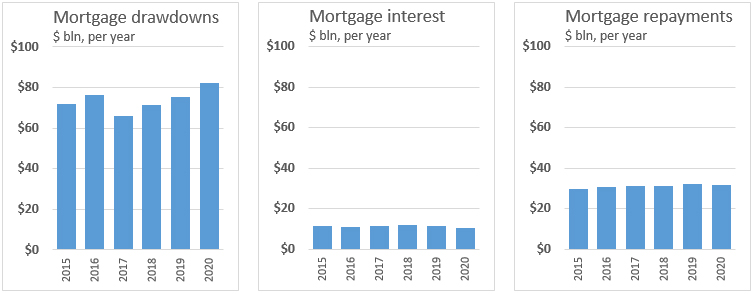

The 2020 rise in mortgage debt was equivalent to 7% of 2020 GDP, and it hasn't been this high since the 2015/2016 "housing boom." But of course the amounts involved are larger now, exceeding +$22 bln in 2020.

That quickening growth however, is not reflected in the amounts being paid to banks for interest.

| as at end of December |

Opening position |

+ New loan drawdowns |

+ Interest charged |

- Scheduled & extra repayments |

- Repayments in full |

+ Adjustments |

= Ending position |

| $ bln | $ bln | $ bln | $ bln | $ bln | $ bln | $ bln | |

| 2015 | 195.2 | 71.8 | 11.7 | 29.6 | 38.6 | 0.4 | 210.9 |

| 2016 | 210.9 | 76.5 | 11.2 | 30.8 | 38.1 | 0.0 | 229.7 |

| 2017 | 229.7 | 66.1 | 11.6 | 31.1 | 33.4 | 0.1 | 243.2 |

| 2018 | 243.2 | 71.2 | 11.8 | 31.4 | 37.1 | -0.6 | 257.0 |

| 2019 | 257.0 | 75.5 | 11.7 | 32.1 | 37.7 | 0.1 | 274.4 |

| 2020 | 274.4 | 82.1 | 10.6 | 31.9 | 38.9 | 0.3 | 296.7 |

Even though the amounts owed rose +8.1% in 2020, the amount borrowers paid in interest fell by a remarkable -9.5% saving them more than $1.1 bln over what was paid in 2019. That should give both borrowers and public policy makers pause because that is what it could rise to if interest rates move back to 2019 levels. Actually it would be more because the base has risen so much.

Despite the falling interest rates, borrowers are not taking advantage of this by paying down what they owe faster. In fact borrowers reduced the absolute amount of repayments in 2020 from 2019. In fact, this is part of a longer term trend; in 2015 they repaid 15.2% of what they owed via scheduled repayments. By 2020 this had fallen to just 11.6% in the year, and it has been in consistent decline in between.

Cheaper funding reduces the impulse to repay debt, rather than create an opportunity to pay it down faster. It also seems to encourage taking on larger debt loads.

41 Comments

"Cheaper funding reduces the impulse to repay debt, rather than create an opportunity to pay it down faster. It also seems to encourage taking on larger debt loads"

Bingo!.

Those who suggest that debt is more affordable because the cost of financing it has been artificially lowered are blind to the reality of life = there are no free lunches. One way or another, debt will have to be repaid; the bigger it is, the harder it will be.

Not as long as there's a bigger sucker waiting , along with a ever longer term.

Quite right.

And with every sucker, the debt rolls over ever bigger, and our national situation deteriorates; our capacity to repay (the only input to a lending equation that matters) falls.

The days of 'just import a million more suckers' may be over with COVID-19. It's just we don't want to believe they are.

"One way or another, debt will have to be repaid; the bigger it is, the harder it will be."

We shall tell renters that they just need to work much harder to repay our debt.

We shall tell renters that they just need to work much harder to repay our debt.

Yes. And among all renters, you have 100% of the disenfranchised. These are the people who carry the economic hope for NZ. Everyone is queueing and bidding up the price of houses to provide a service to these people.

Doesn't really make much sense does it. In a feudal society, you only had a small proportion of landlords and the majority were serfs and peasants.

You do an affordability analysis on an individual basis, how do the above figures sit on a national basis? Can we afford to pay back principal or an increased interest rate?

Edit

Or is it fair to assume that the banking system does that automatically like a parasite sucking just enough to not kill the host.

That update is coming next week. But this issue has long ago twisted to more related to how feasible it is to save the initial deposit.

From a personal perspective I disagree. Saving the deposit is more feasible than bag holding a million odd dollars of debt for the next few decades of unknown interest rates.

Anecdotally speaking, a lot of people I talk to seem to think the low interest rate environment is a good opportunity to borrow more - rather than pay down existing debt - since they believe in two falsehoods:

1) That the Government and Reserve Bank have complete control over interest rates (and for that matter, house prices), and simply manipulate them according to their will

2) That the Government and Reserve Bank will not - nay, *cannot* - allow interest rates to rise, or house prices to fall, since doing so would unleash a wave of defaults on all the debt we've now accumulated, and that would be an unacceptable situation

These people believe that homeowners have won, that financial authorities are hamstrung and have no choice but to let property continue to be a one-way bet, and it's just tough luck for those who missed out.

Debt always involves risk. The more debt you have, the more risk you assume. Artificially low interest rates to not change this fact, and if and when markets are suddenly forced to acknowledge that there is risk in the world again, interest rates will rise as a result.

This will serve as a harsh reminder that affordability is about much more than just the ability to service debt. The inability to pay down the principle in a reasonable timeframe means you may end up stuck with it in an environment of rising interest rates instead.

chebbo... and the other side of that is that a rate rise has the opposite effect ie will not only take money from the economy through increased mortgage payments but more importantly will cause people to try to pay down debt faster thus reducing spending. This is the big worry if rates rise as it may have devastating and unavoidable consequences.

And yes, high debt or huge leveraging has worked fantastically in the NZ property market over the last 40 years. (it served me brilliantly). Leveraging through borrowing always magnifies the results of an investment but when things have only moved one way (in the timespan of most peoples memory) we run the extreme risk of not comprehending how destructive that very same high debt (and leverage) can be. Just ask any trader who was leveraged during any market recession. But "the evidence of the last 40 years" (LOL) shows us it cannot ever happen to NZ property right?

Why are they falsehoods ? That's pretty much exactly how its panning out and people are going "All in" because of it.

Carlos67... (plz read above). They are not falsehoods but with the property market having an incredibly unusually positive run over the last 40 years it becomes difficult for people to relate to the fact that high debt and leverage works equally as powerfully both ways. The results of the last 40 years (together with pornography such as One Roof and Landlords Inc) can almost solely be blamed for such unrealistic inaccurate (and frankly downright dangerous) pie in the sky risk assessment by the masses.

Why should one repay when have no fear of default as govetnmrnt and rbnz are their to worry for you and cover you.

Borrowers specially in housing market, have been assured by Jacinda Arden through her policy and Mr Orr that borrow and help the country.

Quite absurd from her really - the Ardern "put".

Why should one repay when have no fear of default as govetnmrnt and rbnz are their to worry for you and cover you.

The ruling elite thought that the Greenspan era was when the world had worked it all out and the wealth generation machine could provide perpetually. The ruling elite was wrong. So was Greenspan. And he even admitted it.

Thinking that the NZ govt and RBNZ are the master controllers of economic destiny does not match the historical reality that most bubbles fail drastically. I know that NZers are myopic and seem to think they live in an alternate universe, but I suspect they're acutely unaware how exposed they are.

But this time is different?!?!

“But... but... but.... CUPPUHTOOL GUNZ!!!!!!”

C'mon David: 'house prices and mortgage debt growing faster than our economy..' Which part that you've missed? Most of the NZ highest academia already label it the past 10 years as: F.I.RE economy. House prices & mortgage debt are the NZ Economy, hence the faster growth index of it. - This is a good news! - If they not? then Why govt (both sides), RBNZ & Banks are all supporting it? - We're talking a collective brilliant minds here.

Tell me which one/a member from of those above institutions that talking the opposite F.I.RE must be put down?

A career path using an economics degree usually means that you have to bend to the status quo. If you believe in the status quo, that isn't so much a problem. If you believe that it is broken, then your days will be filled with torment simply to get a paycheck. A soul destroying existence.

I agree. And why would we listen to our ‘celebrity’ economists when 99.99% either work for banks or work indirectly for banks / property industry / NZ business community i.e they don’t bite the hands that feeds, they are the instruments of vested interests.

So, if I've got this right, our economy needs people to keep spending on 'stuff'-keep the treadmill turning-and many mortgage holders are doing just that by reducing their payments as interest rates have fallen instead of paying off debt more quickly.

Now, despite what some think neither the RB nor the government has the power to stop interest rates rising indefinitely-the bond market is much more powerful than either of them. Remember James Carville's remark about coming back as the bond market as then you could inttimidate everybody.

So, when the proverbial hits the fan, these mortgage owners are going to find themselves with all these depreciating 'assets'-cars, boats etc on which they will be paying interest for decades, while having to find more money to service their mortgages. Actually, to compare them to hamsters on a treadmill is to insult the intelligence of hamsters.

I couldn't get my own mortgage paid off fast enough-at 53 from a small inheritance-and I still remember the satisfaction of getting my hands on the title deeds. Now, 76, I have never been in debt since. This will end badly.

Sheesh. I'm paying down my debt as quickly as I can. Every refinance I'm reducing the payment schedule. Started off on a 25 year, 2 years later reduced to 13 year, and this year I'll likely opt for 10 year. And this is with a household DTI of only 1.5.

Used debt all my life - and remorselessly drove it as soon as I could.

End result has been wonderful.

KH...me too but that was then and this is now. I has a 500K+ mortgage in 1990 at age 24 and tried to borrow another 500K (and was laughed out of the bank managers office). But I think Dan is very wise to be doing what he is in todays economic climate. If somebody came to me with exactly the same property portfolio strategy that I used very profitably and successfully in the early 90s and asked for advice, I would strongly recommend against it based on (what I perceive to be) excessive risk. It is so hard to know what the future will bring so I will just say what it is extremely unlikely to bring.

In the next 40 years, the future of NZ property is very very unlikely to bring results that even slightly resemble the results of the last 40 years.

I thought it was too risky three or four years ago to have too much debt and took steps to reduce it. The government was going to ring fence tax on rental properties, new healthy homes laws coming etc. I wanted to be positively geared as retirement approaches. Huge mistake in hindsight. And I don't know if you recall that commenter Andrew the farmer mentioned last year once or twice or thrice that a mate of his who owned many properties was selling up because he was certain there was nothing left in the property market.

So you certainly missed out on some gain Zachery.

But gain ain't the only objective. Having equity reduces risk. And being debtfree provides a lot of options, indeed power.

I certainly felt a lot more secure at the beginning of COVID. My wagons were circled and my powder was dry. Since then I've become a bit annoyed that so many people haven't worked on becoming more resilient but have instead taken on more debt and risk.

Nothing wrong with carrying no debt at the moment, especially if you can't afford losses. I still forsee a crisis of sorts, either a crash or an inflationary blow out. Either way a non leveraged portfolio consisting of shares, property or other real assets is your safest bet against all senarios IMHO. Just get your money out of fiat while you can

We all miss the point, this govt is changing the demography, by kicking out new generation Kiwis from NZ in next few years. That is going to happen believe it or not, as housing is second most essential commodity after food to survive. If it is unaffordable (which it is already), kids will leave this country and i can see it happening, how people start making plans to go across the ditch .

Govt want to tax working class and giving free hand to investors by throwing away cheap money. This is the perfect antidote for making a country less productive/innovative and push to the path of deterioration.

I recall JA asked CEOs to take a pay cut but specuvestors she wants them to take all the unearned gains they like

One need to be .......not lucky

Mort gage from old French "death pledge".

Kiwis voted Lab to stop this being the death of the country and economy. To date they are saving the banks the stupidly in debt (the risk takers), while crushing the poor (renters) and the conservative (savers).

Winny lied about stopping immigration and where is he now? Perhaps Jacinda already has her UN job...

That is it takes people longer to pay off the loan

Just what banks want

If banks did not keep approving ever higher loans then house prices could not rise

But no one will stop them

We now have economies run on increasing debt rather than productive activity. Bit like cause of obesity?

Slightly off topic but the lending is a problem IMO. Little data from RBNZ yet. Its at least 9-10 weeks since the breach occurred and 6 weeks since the RBNZ knew about it. https://www.rbnz.govt.nz/our-response-to-data-breach .... "Some files contained lists of information such as personal email addresses, dates of birth, or credit information".... This statement is of concern. What is it that RBNZ require that it needs this level of detail about individuals. Surely the main stream banks and financial institutions agglomerate this data into categories required by RBNZ? No doubt Grant Robinson doesn't want to get his hands dirty in this minutae and Orr couldn't care less or leaves it to one of his lower mortals who inflates his position and insists on this level of detail

Seems like people don't understand the difference between a good and bad debt.

Mortgages are good debts unless you can't afford it at the first place.

Is that why property investors use interest only because they can't afford the debt in the first place? (and they also need the accommodation supplement as well to pay the 'good debt').

NZ land of the long dark drop, every subsidy/stimulus were all directed to prop the big corporations:

https://www.stuff.co.nz/business/opinion-analysis/300251702/where-did-t…

In the whole scheme of things, what does that mean or what effect will the imbalance have when mortgage debt exceeds GDP?

Concerning.

I exited a residential investment property I held for several years (earlier than planned but longer than the bright line). We paid down debt and transferred the payments to our own mortgage at lower interest rates. Even though I might miss a little top side gain, I'm more worried about what happens when the wheels fall off.

At some stage, governments and central banks have to stop printing money. Equities will drop precipitously once interest rates rise, you can see the edginess of the market now. Everyone talks about old rules, new times, but if no one will lend, what do we do then?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.