By Amanda Morrall

Singular or shared, this country's largest ever lottery jackpot which has snowballed to NZ$34 million will make instant millionaires on Saturday night.

While most of us spend our working lives daydreaming of such a moment scripting the office farewell and luxuriating in the feeling of burying the mortgage with the stroke of a pen, the reality of 'sudden money' raises tough questions and decisions that often escape the Hollywood fantasies that play out.

How much to spend up front? How much to save? Where to invest? Which friends, family members and charities to share the spoils with? Who and how to trust? Whilst they might seem trivial and trifling in the face of NZ$34 million, the emotional can be just as challenging as the financial.

For interest sake and guidance, interest.co.nz sought the advice of three financial experts who were asked how a family with two young children and a NZ$200k mortgage should spend their theoretical winnings.

Here's what they said:

Janine Starks, Fund Manager LionTamer.

Q) Your advice for the lucky winner?

A) "Well, given it has got to be won, it could go to 7-8 different people so that NZ$34 million might end up being only a few million. I sort of believe a millionaire these days is somebody with NZ$5-$10 million so if you only win a million dollars you shouldn’t give a penny of it away because all that is really is a basic retirement fund."

Q) Is a million really worth so little?

A) In 20 years time it would be devalued by at least 35% and would only be worth NZ$600,000 and you can barely buy a house in a good area for that. I just think if you only win a small amount like a million, it might sound miserable but don’t give anyone anything and invest the lot.

Q)What about debt?

A) Goes without saying; repay the debt and invest the rest as a retirement fund. When it gets up to the decent amounts, like NZ$5 and NZ$10 million, then you've really got to invest half it.

Q)What are the biggest risks to capital?

A)Probably the two factors that really destroy lotto wealth are stupidity and inflation. They’re the two things lurking in the cupboard waiting for new young winners. You can’t change your intelligence level but the inflation aspect is just so important which is why I say you have to invest at least half of it.

Q) Is there no room for spending?

A) Sure, if it was NZ$30 million but if you look at NZ$10 million and thought the average couple could easily chew through a couple of million by buying a fancy new house, a car, having a travel fund and withall that, that couple million would be gone very quickly. So then if you put $3 million into fixed interest, if you invest at 4% net, and look at the longer term dates, after tax you’d be lucky to generate NZ$125,000 from that.

And if you don’t inflation proof half your money and have something around for the future that’s where you end up like these hard cases in the U.K. where there's nothing left after a 5-10 year period because they didn't invest it correctly.

Q) Is inflation that high a risk to a multi-millionaire?

A) If you look at the Reserve Bank website they chart a 35% decrease in the purchasing power of your money between 1990 and 2010. So if you take 35% off, your winnings drop considerably in a value. It makes you realise that in another 20 years after that -- if you have to prepare for the next 40 -- your money can easily be halved maybe even reduced by 60% in terms of purchasing power. So it’s really, really important to look into the effects of inflation and don’t go thinking that you’ve got that rich that you can sit back and leave the money sitting in a low interest earning account and just use it up over your life.

Q) What's the best allocation then?

A) I think the investment should be spread nicely among stock, shares, bonds, property. Property would be an element but I wouldn’t rate it any more highly than anything else. I just think half should be professionally invested and properly diversified among all the asset classes.

Q) Anything else?

A) Yes, get the best trust lawyers you can and the best is not necessary from the biggest firm. At least by doing that, by getting that money into a trust account, you can separate yourself from the money and create a legal structure around it with other trustees that will help you think more clearly and they’ll stop you from being preyed upon.

Because I think worst thing with lotto winners is that everyone comes out of the wood work wanting money, not only from your own family but all sorts or charitable cases in the community. Setting up that legal structure and having a big name firm of accountants and very good trust lawyers who can act as professional trustees for you as well and help you set that up would be very wise. Perhaps, after the first year, go to the philanthropy conference.

Liz Koh, Authorised Financial Adviser, MoneyMax

Q) What should a family of four do?

A) The first thing that needs thinking about even before hand, is whether you want to share the proceeds among your wider family because of gift duty. Although it is expected to be abolished in October if you give away anything more than NZ$27,000, it's subject to the duty. The easy way around that is to say you’ve got a syndicate; a group of people sharing it therefore the winners are going to split the money.

Q) Then what?

A) Then of course you pay off your debt. And following that you put it in a safe place until you think about what you want to do. This is where it gets interesting because it really makes you think about what is important to your in life. It forces you to think about what money does for you in life, what purpose you have for this money. Because money is not there to stockpile and count, it’s there to enable to you enjoy your life or help other people enjoy their life.

Q) Is there a recommended minimum amount of time to ponder these bigger questions?

A) Probably six months to a year. Maybe take part of it and have a splash about. Get new car, new house or whatever, but beyond that you want to park it for awhile because having a big win like that is quite an emotional experience and with that deep emotion you don’t really think straight.

It's the same way if somebody loses a partner, in an highly emotional state they’ll feel like wanting to sell their house and go move somewhere else and then a year later realise that actually that's not what they really wanted or needed afterall.

You have to get yourself back to an even keel emotionally because you want to make really good decisions with your money.

Q) A year later, then what?

A) Get some good financial advice with what you want to do with it.

Q) Any specific investment advice given current conditions?

A) It doesn’t matter what the markets are doing you need to diversity with your investments. Property usually comes high on the list for Kiwis but there are some down sides to property. It’s not very liquid and you can have problems finding tenants. There are still risks with property. The key thing is not to put all your eggs in one basket, to spread it around and make sure that whatever you are putting it into is reasonably liquid. The two key things to keep in mind are liquidity and diversification.

With this money stuff, it’s about getting the balance right.

Q) So how do you strike the right balance?

A) The way I look at it, you need to ask yourself three questions:

1) What can I spend in my lifetime?

2) What am I going to do with the left over amount?

3) With the stuff that I can spend in my lifetime, when do I want to spend it? Now, later or a lot later because if you win $32 million, you’d have to have a pretty crazy life style to get through that in your life.

Q) What if your win is smaller in size?

A) Same advice, NZ$1 million doesn’t go a long way. If you want to have a good income off it, you need more than NZ$1 million to give up your day job.

James Smith, Authorised Financial Adviser Bradley Nuttall Ltd.

Q) $34 million, what's your advice?

A) Paying off the mortgage then go into a decision-free zone. Try to keep you life as much as it was before. Don't quit your job.

Q) How do you keep your life normal with $34 million in the bank?

A) For starters by not talking about it for awhile. Keep the circle as tight as you possibly can because obviously news gets out and your life is going to change in a big way. I’d be thinking of confiding in a lawyer or financial adviser or someone with a duty of care not to share that information.

There are lots of of case studies about people who come into money, who later confide about having felt a lot more comfortable with the lifestyle they previously had. So what ends up happening is they burn through their capital at a massive rate because they felt they didn't deserve it or didn't earn it or fritter it away till they back to where they were.

Q) Any remedy for financial recklessness?

A) You could hire a financial psychologist, they're popular overseas. I think if I came into money I’d go down that route. They can help people understand a bit more about themselves and their goals. As financial advisers we find ourselves in that position but we're not trained psychologists and therapists. It's a mind boggling amount of money for someone who is accustomed to being a slave to their mortgage living hand to mouth to get used to.

Q) Will couch time, help you make better financial decisions?

A) It would help to address underlying philosophical issues that get brushed aside amid the euphoria. Would they be happier? That’s the question. Studies of lotto winners tend to find a lot of people are no less happier than they were before because once you get used to the money, the same fundamental human issues remain. You still have to get up and brush your teeth and put your clothes and just live.

Q) How about retail therapy?

A) Some people suggest you allocate an amount that you can just blow but I'm not so sure. It probably makes sense to go on a holiday, get out of town and get some mental clarity so you can figure out what you're going to do. I’d probably invest my money fairly quickly. I’d allocate some to family and friends, charity, debt and spending needs and then put it somewhere it can grow over the medium term.

69 Comments

Amanda

Excellent stuff.

I love the suggestions about using a financial psychologist. We need one of those on staff.

And the one about not quitting your job.

Hoping to see you on Monday...

cheers

Bernard

Meanwhile Bayley's suggests buying property and a fast car.

Here's their suggestion:

Among the dream properties throughout New Zealand that Bayleys has listed on its books are:

- A wild west themed township near National Park in the Central North Island – complete with bank, blacksmith, saloon, bathhouse and corral... a bargain at $4.5million.

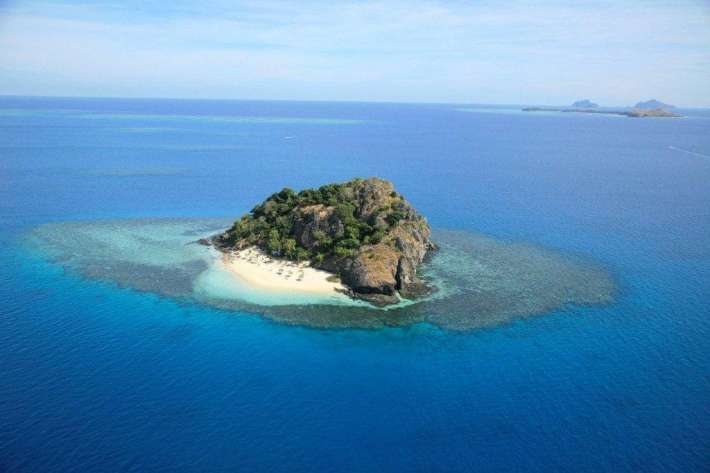

- An uninhabited tropical island in Fiji, aptly named the romantic Honeymoon Island – complete with gold sand beach and swaying palm trees… available with a price tag of $1.88million.

- One of Central Otago’s original pinot noir producing wineries…. the award-winning Black Ridge Vineyard, ripe for the picking with negotiations over $1.95million.

- One of Auckland’s most expensive homes – 533 square metres of luxury living, with five bedrooms/five bathrooms, temperature-controlled wine cellar, pool and sauna complex…. all for just $7.5million.

- or even….

- A former church in Invercargill – suitable for conversion into a character-filled home – complete with bell tower and pews up for sale at an incredible $65,000.

And even with all of these pieces of real estate added to the personal portfolio, there would still be cash in the bank for the latest 2011 Lamborghini Aventador (top speed 350kmh with a V-12 engine) at a mere $675,000 through Independent Prestige LMVD; a six carat princess-cut diamond set in platinum for $259,000 from Partridge Jewellers in Auckland... and even a corporate hospitality package (including Champagne and canapés) to the Rugby World Cup semi-finals and finals with category-A seats at Eden Park – a snip at just $10,995.

Wordsonthweb replies via twitter: I'd make a $17m donation to Chch earthquake relief for a start.

BMR789 replies via twitter: Guns, Gold and Stocks.

Guns yes, but can't eat gold or stocks. A couple of cows, chickens and a large greenhouse/vegetable patch surrounded by razor wire and security gadgets.

I'd get one of those big money bins , 'like Uncle Scrooge McDuck had in the Disney comics ..... And a diving board ........ And fill that sucker with yummy Gummy Bears ...... Hoo hahhhhhhhhhhh ! .... weeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeee ......

Mr Westminster

Any suggestions of which types of prime commercial real estate and where?

Hastings perhaps? Maybe a few packing sheds?

Only 50% gearing? Why not a bit more?

More profit that way?

cheers

Bernard

Mr Westminster

Many thanks.

Gearing not really my thing. Would love to live a debt-free life.

First thing I'd do is pay off my little mortgage (less than 1/3 of value of house we live in). 50% plus gearing sounds not all that conservative.

I'd keep my job!

Actually I'd probably invest a bit more in this little business we have going here. Growing fast already in a debt-free and profitable way, but there's so much more we could do.

We'd love to employ a few more journalists, technologists and analysts here to keep the bastards honest.

And to have lots of fun talking about monetary policy, tax policy, investing theory, property markets, property markets and interest rates all day long.

And I'd put an awful lot in the bank. I wouldn't put much in property.

And I'd even buy you a coffee Mr Westminster...

And a big bag of gummy bears for GBH

And a new pushbike for Powerdownkiwi

And a punching bag for Wolly...

Ah the fun I could have...

Need to buy a blinking ticket now...

cheers

Bernard

Thanks , big guy ........ And if I win , I'll get a hair-stylist for you , to rid you of the Ken Barlow look .

Hey Bernard ....what about my camel...? have I not been a good and faithful servant...?

Well that's just bloody great..!

Thanks PDK your a solid gold friend.....I just got to find out shipping and quarentine costs and hey ho ...The Revolution is back on.

I'm throwing out my oil lamp as we speak as a gesture of good something or other...!

I can just see you bedouin down for the evening.

Humming quietly "Ahab a dreammmm....."

I'm told some of them kept polishing their......lamps, hoping someone would send Aladdin.

They'd have likely been dissappointed - bet he was a fakir. We need turban that kind of thing.

I'm keeping that one PDK a beautiful piece.......and please ...no more visualising me bedding down.

aw shucks, Bernard, that's nice.

But a push-bike would need gearing, and we couldn't go there.......

And I just counted up, there are more than 20 here already.

Nice thought though.....

Time honored old jewish advise:

1/3 Gold

1/3 Real Estate

1/3 Cash

1/2 gold

1/3 real estate

1/4 cash

olly olla - !!

me think you meant 1/4 real estate... (if not, not sure where you got that extra 1/12th from!).

methinks Kunst should by a calculator with some of that NZ$34 million. Could buy quite a few. I'd recommend the old Sharp FX 82

cheers

Bernard

Methinks you should " by " a spell-checker ....... methinks !

And juice wat is that sapposd to meen..........Big B 'S NEEEWSPAPER MAN. he nose wots swot.

Surely Bernard means the casio fx 82.

http://www.casionz.co.nz/default.asp?ObjectID=271&StockCode=FX82

And at the RRP of $33.95 you could even buy a million of them and almost enough left for that Invercargill church Bayleys has on offer - somewhere for Bernard's flock to gather? Looks a bit of an earthquake risk though, so may be hard to get insurance on, although AMI should be able to help with that.

Bernard - another bloody thing imported from China - no thanks. I stick to my old, colourfull abacus.

1/2 gold / 1/3 real estate and 1/4 cash = 125% GST incl. minus bail out of AMI and Goff resignation as party leader makes in total 98.5%.

These abacuses are so much more flexible.

Err........... I hate to point it out to you Walter but the Abacus was invented by the Chinese!

Wolly - I thought this is coming, but that was back 100's of years, when China was a nice, friendly nation.

Errr...no Walter, it was back thousands of years and they wasn't your friendly types back then.

noooooooooo - you mean they counted us on their abacus - the lean ones for lunch - the chunky ones for dinner - zzzhhh.

Do be a millionaire I would invest my money to get rid of abacus in China then.

Wolly.....errr...I hate to point out the Abacus was actually invented by Arabs, by the Sumerer back in Babylon (today Iraq). The Arabs also invented Algebra and the Zero, which is quite a fascinating subject.

A hilarious blog today, considering some funny details. Most enjoyable math from Kunst including GST!

I cannot believe Wolly is wrong - shame on you - more Malborogh Sav then.

Walter's extra 1/12th is a consequence of his belief that inflation has taken off .

ohh, I just relize it was Elly the French Lady who calculated me right not the Lady from Germany Gertraud - sorry - how is your boss Bernascoli doing with his court case ? Everything is so much more complicated now in Europe with the Euro, Portugal, the UK and the Germans.

Yep Kunst, I'm the Frenchie......not Italian (I think you are referring to Berlusconi). That said Sarkozy and Carla have generated their fair share of gossip too. I don't closely follow current affairs over there anyway, there's more than enough to keep me entertained here!

I thought Sarky is from Portugal ?

Nah, as far as I know he was born and bred in Paris. According to Wiki his father was Hungarian and his mother of French and Greek jewish origin though.

I do like your creative maths as explained above :)

He's a little bit like me then - I don't know exactually where I’m originated from, but obviously that happen quite often with leaders of nations.

Gertraud t. ...time honored old Christov advice........tell the wife your just popping out to buy some cigarettes........

I'd build my swimming-pool, invest some for the kids/ourselves and give the rest away. Definitely won't give up working or I'll go nuts. And definitely don't see the need for 34 millions, it's kinda obscene for just one person/family. Although on second-thought a housekeeper, nanny, personal cook and masseur do sound good :)

"...In 20 years time it would be devalued by at least 35%'.....bloody rubbish....it will have lost at least 65% and more likely nearer 75%. For that you can thank the govt and the RBNZ.

An idiot would invest it in bonds and bank deposits.

But really, is there any point enjoying our temporary wealth when the world economy is about to crash, a global currency installed, global warming/erratic weather, peak oil, spreading islamic threats/influence, one-world govt socialism, western bankruptcy, rising interest rates, falling house prices, earthquakes, nuclear risk, anxiety, fear increasing etc? .....

mortgage belt - there is another way of looking at 'enjoying', and 'wealth'.

It's just a matter of looking at things as they ARE, rather than following the rabble, and it's the rabble who thing of 'winning lotto' and being 'rich'. What these folk don't tell you, is that all 'investments' from here on, will dwindle. 'Investment' assumes a 'return', and that return will be expected to be swappable for goods and/or services. These, in turn, require energy to produce. Peak energy, peak return available.

Purchasing items you think will be in future demand, might make better sense. So does being counter-cyclical (but of course, that option is limited to less than 50%!)

We bought our 60 acres when it dipped to $1000/acre, use unwanted technology to supply ALL our energy needs, built a new house for under $400 a sq/m by thinking outside the square. The result is that at 56/48, we are semi-retired. Even during the process, we could take a full calendar year out, travelling with the kids. I look at most of my comtemporaries, and they don't look any 'wealthier', despite 'working' full-time all that time. The phrase used to be 'pound foolish'.

It's never how much you have, it's how smart you were/weren't with what you've had. One of the biggest problems is often insecurity - folk need houses, cars, toys, which they think make them look more important in the eyes of others.Only folk with similar problems, are going to be impressed.......who wants friends like that?

FYI Davebrownz says on twitter: Jackpot? Fund a housing cooperative in Christchurch to enable those in the Eastern suburbs to rent new homes at 20% of wage.

So I need $5m to class myself as a millionaire.

Sod it, I will just have to keep chasing rainbows. Still from experience I can truthfully say that I would only get a marginal boost after the first $2m. Having been brought up prior to yuppydom I find it hard to spend $100 without questioning the need. Guess I am just a miserable old fart.

I do have one ticket and will report back if it comes up.......promise!

this via twitter from sovereign path: I find it depressing how little the experts think of $1Million Vs how long the avg. NZ would have to work for that amount.

Well I have always said.....that if I won lotto....and once again i looked around me to see all the poverty.....the unfairness...the unkindness.....the truly wretched.....

I'd move so far away I'd never have to look at it again.

Back to Milligan, Christov.

"Money doesn't buy you happiness, but you can be miserable in comfort"

and

"Money doesn't buy you friends, but you get a better class of enemy".

So true PDK....so true......When we were first married in the Puritanical Church we were so poor that in the abscence of furniture I had to sit on a spike.......when a friend inquired where my wife sat....she replied "I sit on Christov as two spikes would be an extravagance."

obviously she spike too soon

She certainly spake before she was spoke in two.

did you then 'forever hold your piece'?

only before I had to give her a spoking to.

We'll be getting round to Spucking soon - you didn't marry Patricia Bartlett, did you?

The biggest NZ collector of illicit material - and the right to decry it?

Or nun of the above?

It seems very odd that in this day and age $1 million is barely enough to retire on, but he's right. Inflation is the real worry long term.

I would follow that well worn advice; never keep all your eggs in one basket. Since I have a few years to go before retirement age if I won $1miilon I would like to keep working, but I might take a year off in the first instance and then look for something a little more relaxed or possibly part-time to do.

If I won the full $32 million, I'd look to spend around $2-3M on a new house, and the balance I would invest across a range of asset classes (but not residential investment property).

$34,000,000.............16 odd tupperwaka's.....that will keep the tourists happy

Right....no ..now I've got it.....I'd use 10mill to set up a bonafide looking investment company/ insurance......use another say 4 to buy off strategic Media mouthpieces to boost my credibility.....a further 10mill to make sure John Boy.(6mill)... Billy Bob(2mill)....the Fat Man...(1mil.999,950.00) Bolly...$50.00 were all in the pocket when the residual was leveraged to eternity and back......................mismanage the whole thing so all my debts were socialized cop a huge bail out at the taxpayers expense...take my parachute fund 100mill and presto.....

When Giving advice it is always best to keep it simple so even the most stupid can understand and articulate the plan.

$ 10 mill

Invest 50%

Spend 25%

Gift 25%

Investing $ 5mill assuming 5.5% after tax and fees will comfortably give a 44 year old $300k per annum until 65

Spend 2.5 mill on house car holiday boat and batch, Any more and Kiwi's will snear

2.5 gifting to family charity etc.

Ask one who has $34m already.

Maybe John Key

Then again, could I be that stoopid?

Which bank would you invest the money in. Would you give it all to one bank or spread it around. If it was me the bulk would be with Kiwibank (like to keep my money invested in NZ) with the rest spread with the aussie banks just to make them beg for the rest of my money. Could be a lot of fun just doing that..........

Also I might give up my day job just to blog on interest.co.nz or maybe do something else.

Inflation would be right, once again everyone is more than happy to screw over savers, then act so amazed that people don't save in this country, such a mystery.

Well helped a few people with windfalls through the dot com bubble, these were people flicking off companies and coming out with 10-15 million US for their shares. Through this I was introduced to their peers..was interesting times. For anyone without wealth already I would seek out a good financial psychologist, you would have to go overseas to seek a good one out.... that is the best advice you will ever buy especially looking at how most people act with a windfall. It is amazing how peoples expectations and spending profile change without iron force discipline and people having a true grasp of who they are and what is important to them. Nearly in every case they were put in a worse position by their financail advsiors which recommended leverage which subsequently backfired. Most are now asset rich and cash poor or worse... and all have been on a hell of a ride inbetween.

Personally 34 million would allow me to give away the clients that do my head in and allow me to focus on the non profits I'm involved with but help them with more than advice :-)

Interesting read speckles......Ta

I could not possibly comment....However, it seems a common complaint that the powers that be, can spend faster than you can save and invest.

Good advice speckles. I sold my farm in the dairy boom fortunately i already had a home on 250 acres and didnt need to shift the family. I also had run my own business since I was 25 and also had an importing business for a while out of Eastern Europe, it wasn't a success but taught me a lot. Also I have some very wealthy friends and family who put it all in perspective, I dont feel at all 'well off' around them. Its very hard to refocus and you get out of balance if you stop working, without a plan. I was only 45 at the time.

I did not enjoy the first year at all, kept looking for something to get stuck into but wanted assets without too muck risk and reasonable return, still looking. Im having to read alot to keep up with the world but my outlook has changed and although I earn more than I ever did my day to day life is very similar to before (without the cap in hand to the bank manager when the tax is due). My children have been bought up on the farm with chores and we had high expectations, they are all enjoying fantastic opportunities, unfortunately for us outside NZ.

Also I inherired most of my land and expect to pass my inheritence down to my children, something I take very seriuosly. Earning capital today is very nigh impossible for most, Capital is a blessing that gives us so much freedom my children don't have to chase money and can follow their dreams. In my old business it was about hands on skills and stockmanship, I had to get the basics right and the only mud in the job was on my boots, it was an honest living and how I made money was plain to see, today its appears gray and murky sharks everywhere. Cash is dangerous in a world were politicians are trying to keep a huge ponzi scheme alive. I take advise but never act on anyones elses advice only what I learn myself.

At least Andrew you have the time and finances to visit your children and see them pursue their dreams. It is very hard to see them struggle in life and if it occurs you can help them in a measured way :-)

It may be frustrating but you do need to have confidence and understand of the advice you receive before you can act. At the time these clients were using the top private financiers in Europe and US and it allowed me to gain an appreciation of how high net worth private bank works and what to look out for. Most mismatched investments with clients when the ideal investment for them was left on the shelf!!! Now I have the understand... I just need the net worth LOL

Great opportunities are out there but you have to spend a lifetime to know who you can trust and the real risks and the dynamics of the investments.

Gold, oil and drugs = GOD is good! Show me the $$$$$$$

Mary Holm reakons you should give most of it away, makes you happier.

I dont doubt the research is right, but boy would that be a hard thing to do...

I gave away a parking voucher today. Made me happy ;-)

"Don't quit your job"

QUIT YOUR JOB!

I'd set up an investment vehicle and head off to the US/Asia and come back in 20 years with $20 Billion. Look out Graeme Hart!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.