Business confidence as measured by the ANZ Business Outlook Survey has soared to its highest level in a decade in a month in which the Reserve Bank cut interest rates.

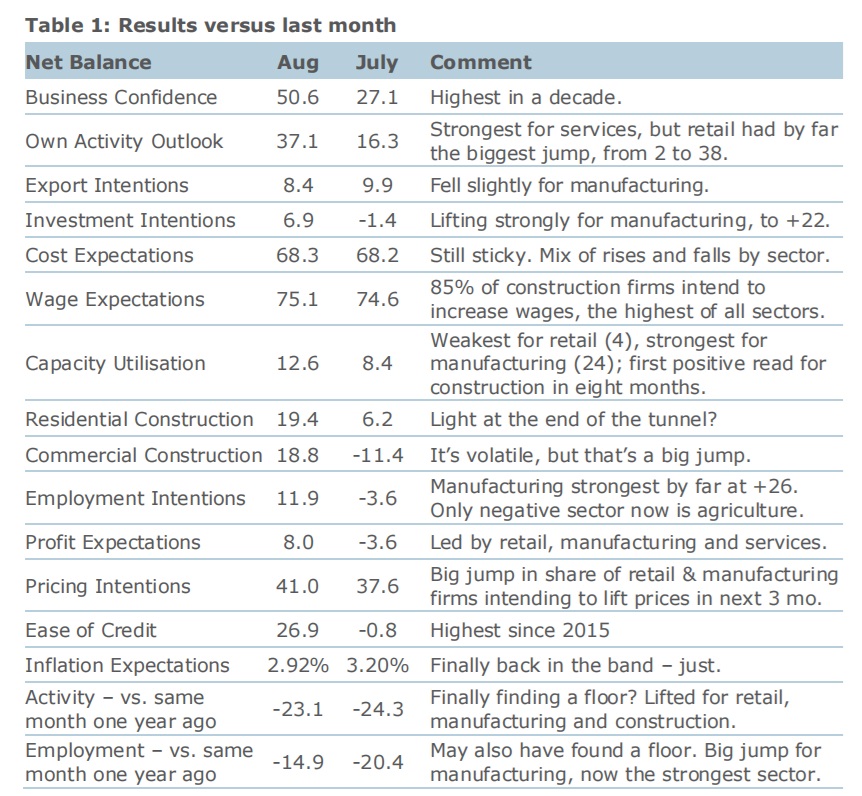

The headline 'confidence' measure in the survey jumped 23 points to a decade-high +51 in August, while the 'expected own activity' measure put on 21 points to +37, a seven-year high.

The August survey was conducted on either side of the RBNZ's Official Cash Rate decision on August 14, so, therefore the soaring confidence was not simply a result of the 25 basis point cut to 5.25% in the OCR. However, wholesale interest rates and indeed bank retail interest rates had been falling meaningfully ahead of the OCR decision. And business confidence had risen in July too.

Finance Minister Nicola Willis issued a media statement in response to the survey, which was headlined: "Business confidence rises under new economic management," and in which she said the survey showed businesses "are feeling a whole lot better about the future".

Difficult conditions are starting to ease, she said, and we are already seeing "the green shoots of recovery" with inflation forecast to be under 3% this quarter.

"It’s early days and there is still more work to do, but our careful and deliberate plan is working. Like businesses, we are optimistic and confident that brighter days are ahead," Willis said.

ANZ chief economist Sharon Zollner said the latest survey "showed a flurry of optimism".

"Forward-looking activity indicators lifted strongly, and this was evident already in the responses that came in at the very beginning of the month," Zollner said, while the "roughly one-third" of responses that came in after the OCR cut "didn’t change the results a great deal".

Zollner said, while she didn't want to be "a killjoy", it remains the case that the hurdle for expecting better times ahead is "very low".

"Reported past activity, which has a good correlation to GDP over its short history, barely lifted, and at -23 remains very weak."

New Zealand has experienced contraction in its GDP in four of the last six quarters - and the RBNZ's picked negative GDP growth both for the June quarter, the results of which have not been reported yet, and the September quarter we are currently in.

Commenting on the survey results, Westpac senior economist Michael Gordon said the Westpac economists wouldn’t suggest that a single OCR cut "could make this degree of difference to the economic outlook".

"Rather, we think this shows how downbeat firms had become earlier in the year. We had noticed a distinct souring in the mood amongst businesses at the prospect that interest rate cuts might be another year or so away, as the RBNZ had been signalling in its February and May forecasts. With the economy having already been effectively flat for the last year and a half, the prospect of having to “survive until ‘25” would have been daunting for many," he said.

"The RBNZ emphasised the recent weakness of high-frequency activity indicators in its decision to cut the OCR in August. And indeed there was a marked deterioration across a range of measures for the June month. However, the updates for July and beyond have generally improved since then. We don’t think this will derail further OCR cuts in the months ahead, but the lift in business confidence along with other measures should see the market scale back the odds of larger 50bp [basis-point] moves," Gordon said.

Zollner said the variation in reported activity between sectors is "stark", with construction the weakest "by quite some margin", followed by retail. Agriculture is the only sector reporting higher activity than a year ago.

The RBNZ will as ever be interested in the responses to questions about inflation, costs and pricing intentions. The RBNZ targets getting inflation between 1% and 3% and its now widely expected that annual inflation, which was 3.3% as of the June quarter, will fall back under 3% in the September quarter.

Inflation expectations in the survey dipped from 3.2% in the last survey to 2.9%, which Zollner said was the first sub-3% reading since July 2021.

She said pricing intentions rose 3 points to a net 41% of firms intending to raise their prices in the next three months, with the average expected increase lifting from 1.4% to 1.6%.

"By sector, retail and manufacturing rose – the latter from 1.8% to 2.7%, the highest read since June 2023. Average expected price changes for the services sector were flat at 1.3%, and agriculture and construction fell, with the latter just 0.5%," she said.

"The net proportion of firms expecting higher costs over the next three months was steady at 68%, with the magnitude of expected average cost increases also unchanged at 2.5%.

"In some good news for firms’ profitability, implied margin squeeze is easing, insofar as the gap between firms’ own expected price and cost changes continues to narrow.

"Reported wage increases versus a year earlier fell from 3.8% to 3.3%, and expectations for firms’ own wage increases over the next 12 months were unchanged."

Things therefore are looking up, albeit from a pretty dark place for many firms, Zollner said.

“So is this burst of (relative) euphoria justified, will it be sustained, and will it actually impact business decisions?

"We will be closely watching indicators such as housing auction clearance rates, job ads, PMI and PSI new orders, and card transactions. And the RBNZ will be too. Just as the pace of monetary tightening varied considerably, the speed with which interest rates come down will also be data dependent," Zollner said.

Business confidence - General

Select chart tabs

78 Comments

Grab that property you've always wanted...you heard it here first. 3...2...1...blast off!!

And to get it, someone has to be selling it.

Why would they be doing that if interest rates are expected to fall and prices to rise? Perhaps because they see it as an opportunity to get out? Property can be a very illiquid market when it wants to be.

Just like The Warehouse shares. The expected ownership changes saw the price zoom up to $1.50. Buyer demand everywhere...until reality set in. Today? $1.10 and looking at the recent lows of 81 cents. And there's.... Fletcher's. Recently, buoyed by low interest rates and the promise of more building. Soared back to $3.50. Today? $2.87, back to a level of 22 years ago, and looking lower. Just imagine if property fell to the lows of 22 years ago. Impossible, right? Markets can be wonderful things.

Fools rush in where Angels fear to tread. (In Riverhead Angels wear Gumboots)

I've just been held up by stop/go guys for 10 mins. on Brigham Creek Road, adjacent to Westgate as another massive subdivision gets under way.

"another massive subdivision". Also known as - more supply.

" According to the scarcity principle, the price for a scarce good should rise...over production of a commodity pushes the price for that commodity down"

LOL! you're saying developing areas drop in price? smh

It's an industrial subdivision, I guess there's none left at West Harbour.

More data centres! :-)

Loving the stop/go along there as well.....

https://www.interest.co.nz/property/129392/residential-construction-tak…

Not so sure this oversupply is going to continue in the short term....

If you've been in a Labour induced deep dark depression for the last 6 years ... even the faint glow from a Gnat's butt is enough to reawaken your hope for the future ...

This survey goes negative as soon as Labour get elected, even if they have the economy humming along. Businesses have a false expectation that National will improve their outlook, not sure how cutting government spending would do that.

Exactly. The business confidence just tells you whether a decent Nat 'bloke like us' is in charge. The level of bias make the results unusable as a predictive tool. Try comparing it to actual business investment. It's a joke.

It’s just a straight up class divide, having attended my fair share of board meetings and had to advise directors—half these guys don’t know what the fuck they’re doing and just have a sense that “workers” are inferior to management who are in turn inferior to owners. It gets them by thanks to middle management shit shielding workers and finding ways around their dipshit decisions.

See: raises budgets less than inflation resulting in highering below your salary budget for new roles and rolling those salary savings into a mid-year “raise” for your new worker just so that you can give his budgeted raise to someone else on the team…

SKF

Inflation to the moon

sarcasm?

Nah, he's just a doomie gloomy who can find the turd in every field of roses.

Yeah the economy is a real field of roses right now.

Perhaps they are growing from the corpses of the freshly unemployed?

Perfect example, this report shows an increase in hiring intentions but you choose to go turd picking.

Pretty much. I think the optimistic folk in this survey may be using a bit of this sarcasm business as well.

Funny how people think you are joking but don’t believe that inflation could rip again anytime over the next 12 months and we see the OCR going back up again. Another price spike in oil is all it will take.

Hmmm, that’s a yeah nah from me…if that were to happen, and it could, that still wouldn’t be demand pull inflation and they would at worst case pause the easing cycle not hike, they have successfully stamped out demand pull by stamping out the economy…we still have another 6 months minimum of lag effect dragging our economy (and inflation) down before there is any chance of these cuts doing anything more than improving sentiment only...but it’s all guesswork eh, and my guess’s might be as sh*t as Adrian’s 🤷🏻♂️😂

Yes clearly the economy has been ‘stamped out’ with a decade high business confidence sentiment.

If sentiment becomes action then maybe, will the sentiment actually realise? People are financially scarred, I’d imagine it is going to be a slow grind before any genuine growth…unless the printers roar, the rates gets slashed & the restrictions on lending get eased…then the wealth effect kicks in and shit goes crazy…but, that is not going to happen according to most punters on here?

And if it does…then there is a fair argument for the spruikers who are getting slammed for saying house prices will rise quickly…sh*t, there would be an inflationary amount of humble pie to be consumed if it is the case 😂

…but again, my crystal ball might be 💩🤷🏻♂️

What an idiot.

All due to a 0.25% drop (both expected and actual) in the OCR?

Wow. Imagine where we'd be if the RBNZ had dropped 0.25% back in November '23.

Golly. We might even had skipped the 3rd recession we're in.

I’d rather just have a decent recession and get it over with. We’ve been trying to avoid this recession for a decade and all we’ve achieved from it is inflation problems, cost of living crisis and an out of control housing market,

Talk to any business owner (myself included) and they will tell you we've already been in a recession for the last two years.

we have had our 2 busiest years out of the last 10 years, I think your right still but not every business sees it.

That is scarcely believable. Well done. What industry are you in if you don't mind me asking?

Manufacturing

You must find this ANZ business confidence survey quite bizarre then right?

Or does your optimism for your business match or differ with this result?

just to clarify i am an employee, but yes i think so, we have hired 2 people recently and advertising for another.

We have been waiting for the downturn but it has come yet, but it may still come.

i suppose its because now they know rates are on the way down the recovery has begun, confidence rise.

Same way banks are prices in the next 2 years ish of interest rates, they are making their assumptions of the future based on information they have.

That's also because recency bias has people believe the same thing will happen again despite the conditions being different. QE has been an anomaly and it has to be unwound eventually.

QE is relatively common, currently we are still squeezing.

You should have a read of Ray Dalio’s ‘Changing World Order’ that covers QE/debt cycles/currencies/empires/international relations. It might help calibrate this comment - QE is no free lunch.

Years ago I used to read books by economic 'experts' and commentators, but gave it up after concluding they were all speculative, wishful-thinking nonsense.

I started reading books on gullibility, manias and crashes. Much more interesting and a real insight into how naive and easily taken in humans really are.

Sounds like you learned what you wanted to from those books you’ve read for your own character development.

I read about suckers on the internet all the time. Comrade Ardern's government was chokka with them .

Ray's Bridgewater Fund hasn't been a winner by the way. He's been losing billions.

Big call IO, could that not be said about everyone, yourself included ?

Indeed wingman is highly successful (he tells us all the time) so he obviously learned a lot reading such books, hence why others should consider doing the same. Unless wingman would prefer others to stay in the dark while he reaps all the rewards of his vast knowledge.

If you're that desperate you need to read books by Ray Dalio, it's time to give the investing game up.

Ok thank you for the sage advice.

QE is relatively common, currently we are still squeezing

An interesting read: https://www.newstatesman.com/business/economics/2024/02/the-qe-theory-of-everything

OCR unchanged for the next review....and for the foreseeable future.

Sarcasm?

????

Why drop rates further if business confidence is high and inflation is at the higher end of the target range.

(something obviously doesn’t add up in all the data we are seeing as it is all very conflicting)

Business confidence is high because of the presumption of an extended cutting cycle back to the neutral rate whereby the economy is no longer being contracted.

Blackbeard: "OCR unchanged for the next review....and for the foreseeable future" = He would like the OCR to remain unchanged.

Sounds like that is all we need then as far as rate cuts go!! The cutting cycle might be over already.

It's not about the small cuts that have occurred in August IO, it's about the new trend down.

What was that I said about sentiment in the housing market like a week ago ? You have got until Christmas to buy a house if you are currently in a financial position to do so and have been looking at doing it anyway.

Or as above. You've got until Christmas to sell a house if you want to, and have been looking at doing it anyway.

The best time to sell anything is when someone else has the financial capacity to pay for it.

What and then it is illegal to buy a house in 2025?

NO you turn into a pumpkin on the 1st of January 2025

The Spruikers have not come up with who I would be selling to come end of 25 if I buy today....

I think there may be more thinking to do around this Spruik.

Like a Q&A for Spruikers People Leader sheet

if you have anything in the 600 to 650K mark i know a couple people.

i agree, personally the best time to buy has only recently past.

people touching up their deposits as much as the can before next year.

I see a LOT of top end places that have been listed for 6months or so now, and more coming across the board by the day. Nobody wants to buy them when they can wait and get a better deal early next year, and likely borrow more should they choose to do so with lower stress test rates.

fair, what about on the low end? i suppose you don't look there much?

Lowe end still moving at 500-650k, less so the higher you go.

Immigration will probably pick up again next year with more people coming over for work. we’ve had 3 years of gloom. The pendulum always swings, and it looks like 2025 could be the year it finally goes the other way.

It will be funny if inflation figures go up later this year because then what will the RB do, as they dropped them before they were in the required band. Previously they were too slow to increase the OCR esulting in rampant inflation after all that money printing. Boom bust cycles are not good for businesses

That business confidence number can only be put down to respondents Prozac ingestion. It would be interesting to see who they do survey. Retail confidence through the roof ? I can't get a retailer to put stock on the shelf without taking on some of the risk. Maybe I just deal with extremely negative people.

I wonder is a fair amount of this anyone who works in property (tradies, real estate, etc). Regardless of whether the property market takes off again, lower interest rates would help developers and increase new builds.

The headline 'confidence' measure in the survey jumped 23 points to a decade-high +51 in August

That is quite astonishing. Sure it's not really in response to the 0.25% OCR cut, but because of the new trend down, but still… a 23 point jump top a decade high ??? Unbelievable!

Like many people on this site (and others), business leaders appear to be under the illusion that a year of cutting the OCR will lead to a resurgent economy and untold profits for everyone. It doesn't work like that!

How does it work?

business leaders appear to be under the illusion that a year of cutting the OCR will lead to a resurgent economy and untold profits for everyone. It doesn't work like that!

We shall find out in 12 - 18 months Jfoe

Would love to see:

- who is surveyed

- the survey methodology

I wonder if it is from a paid online survey

Thanks.

but I am more interested in which firms actually participate

confidential I guess

Pretty un-nuanced survey

How they do it is online.

In a nutshell, people volunteer to answer rather vague and unspecific questions based upon their 'reckons'. Pub-surveying at its best.

if the article said business confidence is at an all time low, you would have the same opinion?

Dead cat bounce result. I suspect optimism will soon be reigned in. We may be at the bottom, but it’s a long road out of this hole.

the cats bounced higher than its fallen so far

Perhaps a closer look at the data might be needed. Have all the adversely affected businesses that normally respond to this survey responded or are they too busy trying to save their business or have gone? What sectors have responded? Have you seen the EV car discounts lately? (I get a specific sector with specific issues but hey data can say a lot of things which a look under the hood really tells you things)

It is still brutal out there regardless of what a survey tells you. Businesses might have hope but consumers are still rolling over mortgages as much higher rates and banks are not cutting fast enough and are still making more margin on the interest rates that what they were in Oct 2023

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.