New Zealand's major banks should be able to maintain return on equity over the next couple of years without needing to take "undue risks" such as pricing aggressively, S&P Global Ratings says.

The comments come in S&P’s 2025 global bank outlook commentary.

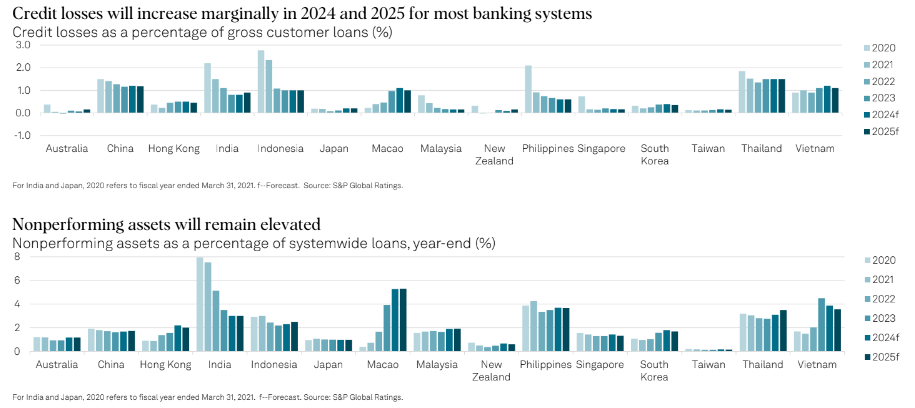

"New Zealand banks' credit losses will likely remain low over the next two years. We estimate they will rise to about 15 basis points in fiscal 2025, before falling to the long-term average of 10 basis points in fiscal 2026. Most borrowers should be able to absorb the pressures from high, albeit falling, interest rates and a sluggish economy with low unemployment," S&P says.

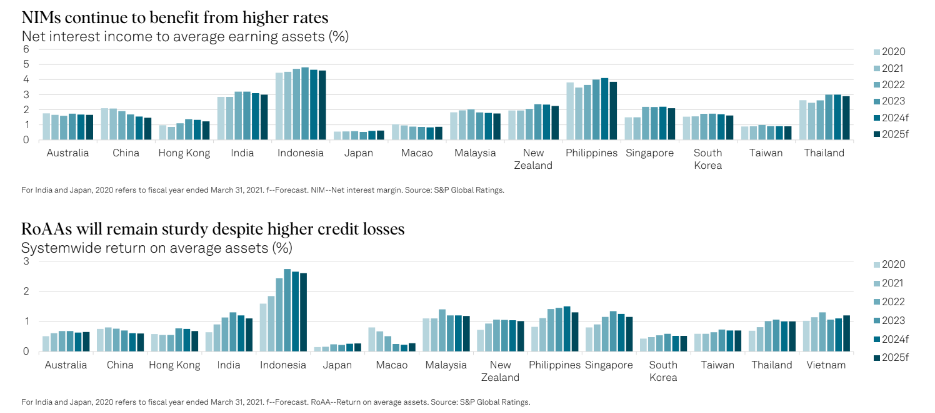

"New Zealand banks should be able to maintain their return on equity at 11% to 12% over the next two years without any need to take undue risk, including aggressive pricing. This is off the back of lower growth and net interest margins and higher credit costs. We project private sector credit growth to increase slightly over the next two years reaching 4.0% in fiscal 2026, up from 2.8% in fiscal 2024 as interest rates continue to fall."

S&P also suggests house prices "should continue to rise slowly." After a decline of about 10% in the June 2023 year, house prices finished the June 2024 year flat.

"Falling interest rates and ongoing immigration inflows will support modest house price growth over the next two years, in our view. This is notwithstanding falls in property prices in recent months following a recovery in early 2024," S&P says.

"Under our base case, we project house prices will increase by 3% to 4% in fiscal 2025. Ongoing easing of interest rates, high net migration, continuing supply shortages, and a slight loosening of macroprudential lending restrictions should support property price growth in New Zealand."

"After finishing fiscal 2024 at -0.2% growth, real GDP growth will increase to 1.7% in fiscal 2025 and 2.5% in fiscal 2026, according to our forecasts. We expect inflation to fall to within the Reserve Bank of New Zealand's 1% to 3% target band in fiscal 2025 where it will remain for the next two years. While unemployment rose to 4.6% in the quarter ended June 30, 2024, we expect it to increase modestly through fiscal 2025 but remain below 5.0%. Annual population growth of 1.0% to 1.5% will further support economic growth," says S&P.

The credit rating agency says, if they needed it, NZ's big four banks remain highly likely to receive timely financial support from their Australian parent banks.

"We envisage no change in the strategic importance of the four major New Zealand bank subsidiaries to their Australian parents. This will support the credit quality of the New Zealand major banks, which account for more than 90% of New Zealand banking assets," S&P says.

S&P has long-term AA- ratings on all of ANZ NZ, ASB, BNZ and Westpac NZ, all with stable outlooks, which is the same as ratings on their Australian parents. See credit ratings explained here.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.