BNZ's chief economist Mike Jones doesn't reckon we will immediately see rising house prices as interest rates start to fall, but he's sticking with his pick of 7% house price rises in 2025.

In his latest Property Pulse publication Jones says he sees the recent falls in mortgage rates as "more about preventing a deeper correction in house prices than providing the fuel for an immediate lurch higher".

"We do expect housing demand and sales activity to lift from here. But rather than squeezing house prices higher this extra demand will, in the first instance, be directed more towards working off the excess inventory overhanging the market.

"Reflecting these dynamics, our best guess is that house prices will continue to drift broadly sideways in the short- term. From around the end of the year we expect to see a modest upswing in house prices develop. After a dead flat 2024, we’re forecasting a 7% lift through calendar 2025."

He cautions, however, that "as with any house price forecast", there is significant uncertainty surrounding this view.

Jones does say that following the recent wave of mortgage rate reductions "anecdotal evidence" points to a lift in prospective buyer enquiry and confidence.

"No doubt some of this reflects borrowing capacity estimates getting a small uplift and people being able to draw a line under prior concerns that interest rates may yet go higher."

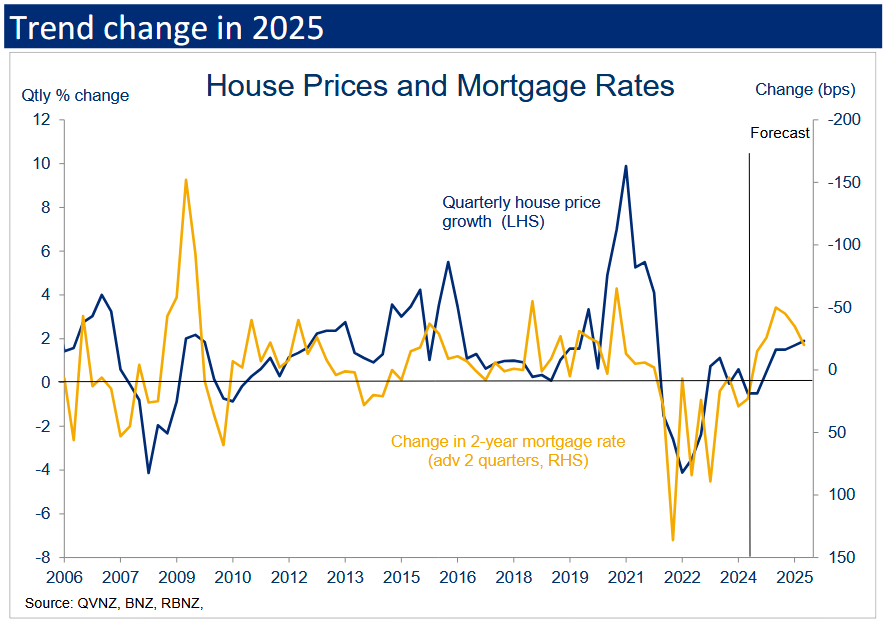

He says the BNZ economists' "rough rule of thumb" suggests changes in mortgage rates can take six months or so to feed through to house prices (chart below). "It’s far from an exact science but provides a reasonable directional steer."

"We thus remain of the view that a sustained upswing in house prices is a story for late 2024/early 2025. Our forecasts for 2025 consequently remain exactly as they were in our last Property Pulse."

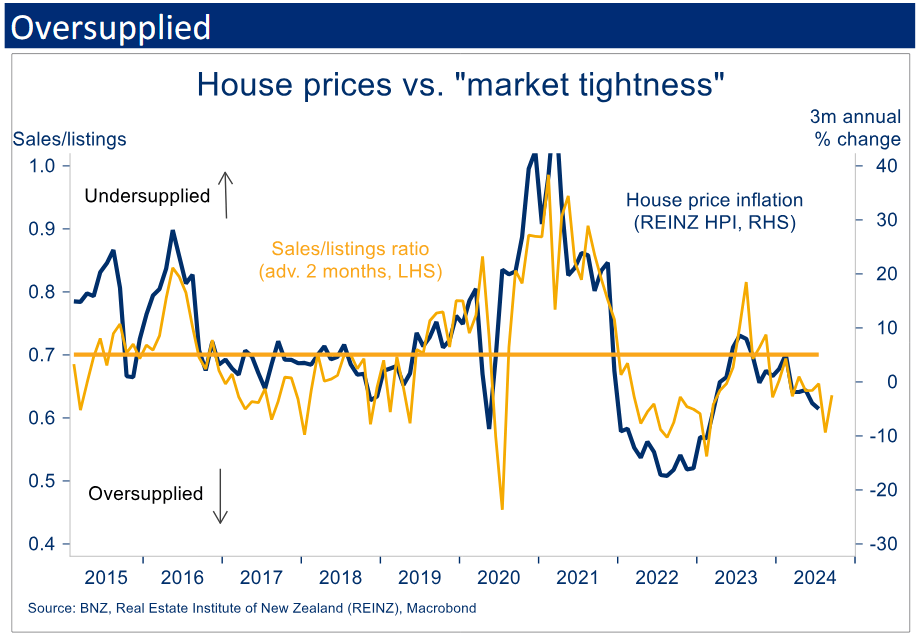

Jones say the immediate issue confronting the housing market is that it is oversupplied.

"Unsold inventory has continued to climb since our last update. There are 32,000-odd listings currently on the market – a nine-year high equivalent to around six months’ worth of sales (all figures seasonally-adjusted)."

He says that "contrary to some of the commentary", this is not a reflection of surging supply.

"Yes, new listings have lifted from the 2023 lows. But they’re still only running at about an average pace. Undershooting demand explains more of inventory lift. Smoothing through the monthly ups and downs, the pace of monthly house sales is still tracking 20- 25% below the 2015-2021 average."

Around the turn of the year Jones sees an "average" sort of upturn taking hold as lower mortgage rates and a more supportive policy backdrop bolster demand.

69 Comments

Ok but have we now found a floor in this correction? I am thinking we might be very close.

well, interest rate has peaked and started to drop, inflation is to normal range. at least we can say, market has stabilized.

the only issue is, the economy is still weak while unemployment is still on the rise.

What's this guys prediction record looking like........ ah magic 8 ball

and a low confidence magic 8 ball.... that he has low confidence in.

I reckon Renaissance Technologies may have more advanced models then BNZ.

Generally most asset price falls occur after the yield curve normalises from an inversion. We are now approaching a yield curve normalisation after one of the longest and deepest inversions in the past 100 years - only comparable in duration with what occurred just prior to the 1929 crash and following depression. I’m not saying that this is going to happen now, but it would be bold to say ‘hey the bottom is definitely in’ when historically the yield curve would suggest this market down cycle may only just be getting started. Ie the bottom could just as likely be another 12-24 (or even 36) months away.

Interesting. However, isn't that without factoring all the market intervention from the government to reverse the house price collapse in NZ? Reinstating interest deductibility on investment property, high net migration, choking out public housing, etc.

Edit: This lot running the country with all their so-called business expertise believe spending billions of current and future taxpayer dollars on pushing up house prices is a sound macroeconomic plan. Worse, restarting the housing economy will ensure more young Kiwis continue leaving for greener pastures and reduce future Crown revenue.

Until private debt vs gdp comes down, NZ is going to be on struggle street if interest rates stay flat or rise over the coming decades. Our explosion of high private debt vs GDP over the past 20 odd years has only worked because interest rates kept dropping while wages kept rising. If rates don’t drop, the mode no longer works - I think we are going to have to see significant deficit spending by the government to get us out if the whole we are digging ourselves into. But that could be quite inflationary meaning rates may be in the rise again over the long term.

Until private debt vs gdp comes down, NZ is going to be on struggle street if interest rates stay flat or rise over the coming decades. Our explosion of high private debt vs GDP over the past 20 odd years has only worked because interest rates kept dropping while wages kept rising.

As of early 2024, the total value of New Zealand's housing stock was approximately NZD 1.63 trillion. Given New Zealand's GDP was approximately NZD 274.5 billion in 2023, the housing stock value to GDP ratio is 5.93.

Anyway, here's a Reddit post that suggests that Aotearoa rules the Anglosphere on this metric. Take it with a grain of salt.

https://www.reddit.com/r/australia/comments/145i7ax/au_nz_have_the_high…

Yeah must be similar to Japan before it all went tis up there 30 years ago. Quick google and this article comes up regarding Aussie being comparable with Japan in terms of value vs GDP.

https://www.news.com.au/finance/economy/australian-economy/australian-r…

What worries me as much is how leveraged our agriculture ventures are, and once again, all back by land valuation and tax free capital gains.

Yeah must be similar to Japan before it all went tis up there 30 years ago.

From memory, Japan's ratio was only approx 3.5 during their stupendous bubble. CRE was actually far worse.

"CRE was actually far worse. " Far, far, far worse.

Ordinary people's houses were largely unaffected. Their pensions took a hit though.

Japan's CRE 'specuvestors' (many were not Japanese) have much to answer for. (The ones that were sacked for gross incompetence became NZ property 'investors'. Too harsh? Nah. Same mindsets.)

"Given New Zealand's GDP was approximately NZD 274.5 billion in 2023"

That number is in USD. Numbers in NZD here:

https://www.rbnz.govt.nz/en/statistics/series/economic-indicators/gross…

Cheers.

And is your argument that the government should always prop up the housing market - ie debt free tax payers should always bailout the investments of those who took on too much risk/debt?

Where/when would this perverse behaviour end?

Hell no. Irks the crap out of me to see the quantum of political effort that gets spent in this country on propping up house prices. Meanwhile, we have massive infrastructure gaps and public service deficits dragging down prosperity that gets overlooked during anything short of a crisis.

I would like to see house prices moderate for a while, so that fiscal and monetary authorities are forced to repair and rebuild our economy instead of resorting to the age-old trickle-down economics.

- the asset price has dropped significantly, more so taken into consideration of inflation.

- asset prices are linked with money supplies, hence linked to interest rates and debt creation.

though I agree, it's really hard to predict things, and it is almost certain prices change will be out of syn with interests change.

Don’t be surprised if house prices fall for 24 months in correlation with interest rate drops.

My experience living in the US during the GFC was that interest rates and house prices can an do fall in tandem at times (especially after periods of speculation/exuberance in a housing market). It may take 12-24 months (or more) for the impact of thee rate cuts to flow though to the house market but prices could be down another 25% before a bottom is found (not a prediction, just a possibility that should be considered).

Different market. Different time. Let's check back in 24 months.

Sorry forgot Nz housing market is different to everywhere else in the world!

Immune from any future possible weakness despite how terrible the economy looks!

Besides, much of the debt required to sustain high house prices in NZ comes from abroad, exposing the market to global financial risks.

Immune from any future possible weakness despite how terrible the economy looks!

I didn't say that.

Sorry forgot Nz housing market is different to everywhere else in the world!

I didn't say that either. But it is clearly different to the US market, as evidenced by the GFC that you referred to.

you forgot

Residential investment property valuation re establishes a link with achievable yields.... and how capital gains factor in.

Its like a tech startup, its all blue sky until a profit is made and suddenly the valuation does not live up to the actual profits.

Crash, not correction.

Spring will be here shortly and that will ensure renewed activity, spurred on by interest rates on the way down, much faster than expected.

The huge property crash, predicted by many here hasn't eventuated, and in some areas prices have increased.

2 areas I monitor, Coatesville and Riverhead are amongst them.

I predicted house prices to start rising by the end of this year, and the article states.."We remain of the view that a sustained upswing in house prices is a story for late 2024/early 2025."

https://homes.co.nz/map/riverhead/riverhead?lid=3a66j3amweil&utm_source…

Spring will be here shortly with a renewed zest for dumping property while people still can.

There, fixed it for you.

People get rich buying in slumps.

People also get poor by buying in incorrectly identified slumps.

And peaks.

I've been poor, I know what it's like, so I make damned sure I make decisions that won't make me poor again.

Yes and sometimes people are wealthier when they have less than too much money (they are much nicer to be around).

As the most important prophet in the western world said to avoid chasing treasures on earth where moth and dust corrupts - but instead seek treasures within your moral compass (call it heaven if you wish) where moth and dust does not corrupt.

The speculative market we’ve experienced in the anglosphere the past few decades appears to have left many with much less, despite having a net worth of much more.

I like having money, it makes me super happy.

The notion that being rich doesn't make you happy is the most absurd piece of socialist propaganda on the planet.

Rich doesn't automatically make you happy, its all about your personality and the way you handle it. Being rich has certainly killed a few people over the years. Happiness is all in your head at the end of the day, its an emotion you can still be happy with nothing. Do I think most rich people are happy ? probably not because they don't know when enough is enough and to leave what's still left on the table for others.

It's true that rich people often kill themselves in expensive toys they're ill-equipped to manage, there's any number of instances of that I can think of.

Aircraft are one of them.

But creating something unique like a new house is hugely exciting, and can often be very profitable. You omitted to mention that many people are hopeless with money, you could give them heaps of it and it'd be gone in a flash.

If you took all the money off everybody and we all had to start from scratch, the rich people would get rich again and the poor people would remain poor. You can see it every day in NZ. Teenagers pumping out kids, dole bludgers, drugs, crime, no education or trade - NZ's chokka with them.

At the peak, residential real estate in New Zealand was valued at $1.76 TRILLION

Since the peak, residential real estate values in NZ have declined $295 billion (over 70% of GDP). This is more than the entire market capitalisation of the New Zealand stock market.

Another interesting datapoint that people do not know. For the 12 month period from the peak, the REINZ house price index for NZ fell 13.76%. On an inflation adjusted basis, this is a fall of 19.6%. When was the last time that house prices fell 19.6% in inflation adjusted terms in NZ?

If we look at Figure 5 (page 8), it has been almost 80 years (last time in the mid 1940's). Very few people in NZ have experienced that firsthand or are even aware of it. Most people unaware of the very rare situation in the residential real estate market in NZ in 2021.

Bulletin Volume 71 No. 2, June 2008 (rbnz.govt.nz)

"People get rich buying in slumps. "

Can I correct that for you, wingman?

People get rich buying before prices rise.

Housing 'slumps' can last 10, 20 and even 30 years (and even longer if demand and supply remain in balance).

But the slumps haven't lasted that long, the average recession is a smidgeon over 2 years.

It'll also depend on your location, if it's prime, you're going to be a winner...right? Apparently we're in a slump right now...go and have a look around Westgate shopping centre. Housing, industrial and massive stores under construction.

funny core logic say in Sydney people are trying to list now and sell IN FRONT of the spring selling rush

not waiting until frustrated buyers just offer anything to secure some pooperty?

does not sound very spruiky

Trying to realise those paper gains before the downhill leg of the cycle starts

"Renewed activity" the number of houses for sale currently (40k+) suggest activity is at peak levels.

I'm guessing you are suggesting that listings will increase to 60k+ in the spring?

The lower rates go, the pickier lenders are going to be about to whom and how much they lend.

They've just had a real time experience of what happens when interest rates inevitably rise. (no one knows if that's tomorrow or in 5 years time - interest rates are dynamic and respond to many variables, as we can see today). Those on new lower rates find themselves struggling with more repayments to make when rates rise from any level. Sure, more will 'qualify' at lower rate assessment levels, but it's what happens after that, that matters.

The lower rates go this time, the less lending there should be.

I think you'll find the opposite at the moment, the banks are keen to lend & less picky. Bank test rates eased, CCCFA relaxed, LVR restrictions eased... along with this banks are fighting for the new business that's out there.

If you were a Lender, wouldn't you be fighting to get "the best stuff" from your competitors to lessen your overall exposure risk? That's probably what the fight is for. Not those who haven't made the cut before.

And given what the lenders have, and are, going through today - stressed borrowers at the margin because of 'unexpectedly' high mortgage rates (they were promised that the OCR wasn't going to rise for years, remember?), their VAR (Value at Risk) calculations for property lending should change. At some stage, their figures will say, "That's it. We're up to maximum Risk level" - which is another way of saying (as we all should) "How much can we afford to lose if we are wrong?"

Doesn’t it seem strange that banks are willing to lend more (if what you suggest is true) when the income generating economy is getting weaker! (Ie our ability to repay that debt is getting worse). Banks should be lending less to avoid future defaults, until a point where the economy is stronger - and stress test rates should not go down during a recession! Ie hey because the economy is getting worse, we are going to make it even easier for you to load up with debt (how counter intuitive and against wise behaviour that might promote financial stability).

But for our economy to be stronger, we need a lower level of private debt vs GDP..but the banks don’t want that because they are in the business of selling private debt - so then you realise the banks are the cause of our problem and not the solution.

I very much doubt we will see a return of high house price inflation anytime soon and that is a good thing. Houses should only keep up with general income inflation unless there are other factors at play such as changing location desirability.

For example Hamilton and surrounding towns became more desirable as it was seen as more affordable and transport links to Auckland were improved.. Auckland became recognised as a Beta level global city with high immigration. Consequently even less desirable suburbs became sought after. Tauranga became a retirees paradise. Add into the mix high immigration from UK, India, China and the Philippines and recent high house price inflation was quite understandable all across New Zealand.

‘I very much doubt we will see a return of high house price inflation anytime soon and that is a good thing. Houses should only keep up with general income inflation unless there are other factors at play such as changing location desirability’

And this was true for the 100+ years prior to around 1990..then we saw house price appreciation of 7+ % which was at times 2x wage growth! Hence why I was saying in here we probably were living in a housing bubble in inflation adjusted terms (to which much abuse occurred about being envious and a DGM).

If we are to get back to something that resembles a historical norm, house prices either need to stay flat for another significant period (might be 10+ years) while wages rise, or prices need to fall significantly more in nominal terms if wages do not rise (ie we are in a recession with high unemployment and low wage growth). Dropping rates again does nothing to solve the problem we have.

"...house prices either need to stay flat for another significant period (might be 10+ years)..."

Which they will ... for reasons I've mentioned ad nauseum.

Agreed.

The landbankers have not been affected yet. There is still approx. 1/3 to 1/2 that could come of all landbanked property if land supply was allowed to meet demand, at any level.

None of the Govt. policy that were electioned on to allow this have been implemented yet.

I think we are in a state of flux, where the 'outside of our control ' bust has happened, and now it's just a matter of controlled policy between income growth and allowing land supply to be opened up so prices remain stable, ie not increase as interest rates drop, and trending to a lowering of the median income multiple.

Plucked 7% out of the air and provides no basis for this.

So are we getting another covid type stimulus package?

Are they about to tax us again with inflation?

Be nice to know.

Well put.

"Thanks to recency bias, we assume what worked in the recent past will keep working. As a result, there is no incentive to look for alternative policies. Rather, there are powerful financial and emotional incentives to paper over signs of diminishing returns as threats to an emboldened status quo that has boosted everyone's prospects and hopes.

This is how the status quo ends up doing more of what's now failing. If loosening credit greased the remarkable expansion, then the solution to a slowdown is to loosen credit even more. If subsidies and stimulus boosted growth, then the solution is to expand subsidies and stimulus.

The problem is that once the mighty machine has reaped all the easy gains, throwing gasoline on the embers no longer creates growth, it generates systemic risks, as loose credit and subsidies encourage the moral hazard of high-risk investments gushing into marginal projects that soon become tottering dominoes in the financial system. "

Yes exactly what happened in 2020-2021. It doesn’t fix the underlying problems we have in NZ. Too much private debt vs productivity..until that is resolved, NZ is going to continue to battle serious headwinds.

It's worth adjusting those house price indices for wages. What drives house prices in a permanently supply-constrained + favourable-tax regime environment is how much people can spend and the interest rate they can borrow at. My view is that unemployment is not that relevant - it is young people and renters that lose their jobs in recessions. This pulls down on real rents but house prices are relatively well-protected (with some geographical variations). You also get markets within markets - for example, now is the chance for many families to move to an area with a better primary school. First home buyers are also waiting nervously in the wings.

If you look at mortgage money creation and real houses prices (wage-adjusted) you can see that post-GFC we did get a dead cat bounce in house prices as buyers moved at the perceived bottom of the market. However, to trigger this bounce, RBNZ crashed rates from 8.25% to 2.5% and that is almost certainly what will will be required to fire up the old ponzi this time. Look at mortgage affordability now - we need OCR at 3% or house prices down another 20% - 30% or so to get back in the zone.

Before anyone starts, no I don't think that firing up the housing ponzi is a good idea.

Such a corrupt way to do things. Inflate the wealth of those that own the assets by stripping the little wealth that non asset owners have.

If they try this again, bring out the pitchforks. Its theft.

Young/poor lose jobs (or can't start their careers so get behind) - those who've already got assets & dollars can swoop in and pick up more at a discounted price. Not necessarily the massively over-leveraged investors of recent years, but those who've been in the game for a longer period of time or who have big incomes to support topping up rent in exchange for buying future gains at a discount.

Only a few guarantees in life ... death, taxes, mother in law issues, and the rich getting richer.

Et tu, JFoe?

It's not all about i-rates. Past supply constraints have played a major part.

Yes, i think that conditionality is in there?

So what is a desperate NAct trying to grasp hold of power going to do to get credit following again... its think Ponzi or Think big or Think Green (massive solar?)

If they removed most council planning restrictions (Urban plan et etc) it would cause an lotof project and construction, it would cause land prices to fall , but lots of construction work, is it the lever they have to pull to get re elected? its sort of half ponzi half land use reform, I think they have no alternative.

NZ is well setup to quickly fire off this type of change. It would instantly cause C Bishop -16-25%, maybe its been modelled already.

Yeah a good point.

If land prices dropped I for one would be looking at a new build. So much of the housing stock is overpriced rubbish.

High land prices are snuffling out this potential area of economic activity.

It is. But isn't front and center, and in big bold print. This time is different.

Well if there is anything I have learned on here, its the economists have always been wrong. Its not going to take until 2025 for a sharp turn around, all it takes is a few more rate drops. At this point its all dependant on how much and how fast the RBNZ drops rates, its as simple as that.

I agree with you on not trusting economists except on the quicker bounce back - it will take much longer.

Social media's "Property Investor" forums are awash with "This is the time to buy !!!" sentiment.

(Just quietly - far too many posters on these forums seem woefully equipped to be lent money.)

Cases in point:

"At this point its [sic] all dependant [sic] on how much and how fast the RBNZ drops rates, its [sic] as simple as that."

"... in exchange for buying future gains at a discount."

" in exchange for buying future gains at a discount"

FYI, future growth rates used in calculations.

Friggin' clowns! (Not once do they question, nor explain, why! Or put a better way - if you don't know why prices are going up, down, or nowhere, then you're basically gambling.)

And if Trump wins it likely paints a very different outlook ....lol

My money is still on Harris. The USA is so divided they are screwed either way. Too busy squabbling over the scraps that remain, too few over there have all the money and the poor that are left are just fighting one another looking for someone to blame.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.