Household living costs are coming down, but they are still markedly higher than 'official' inflation as recognised by the Consumers Price Index (CPI)

Statistics NZ has released its latest household living-costs price indexes (HLPIs), which show a 3.8% rise in the cost of living for the average New Zealand household in the year to September.

This contrasts quite sharply with the recent release - also by Stats NZ - of the CPI for the September quarter, which showed annual inflation at just 2.2%.

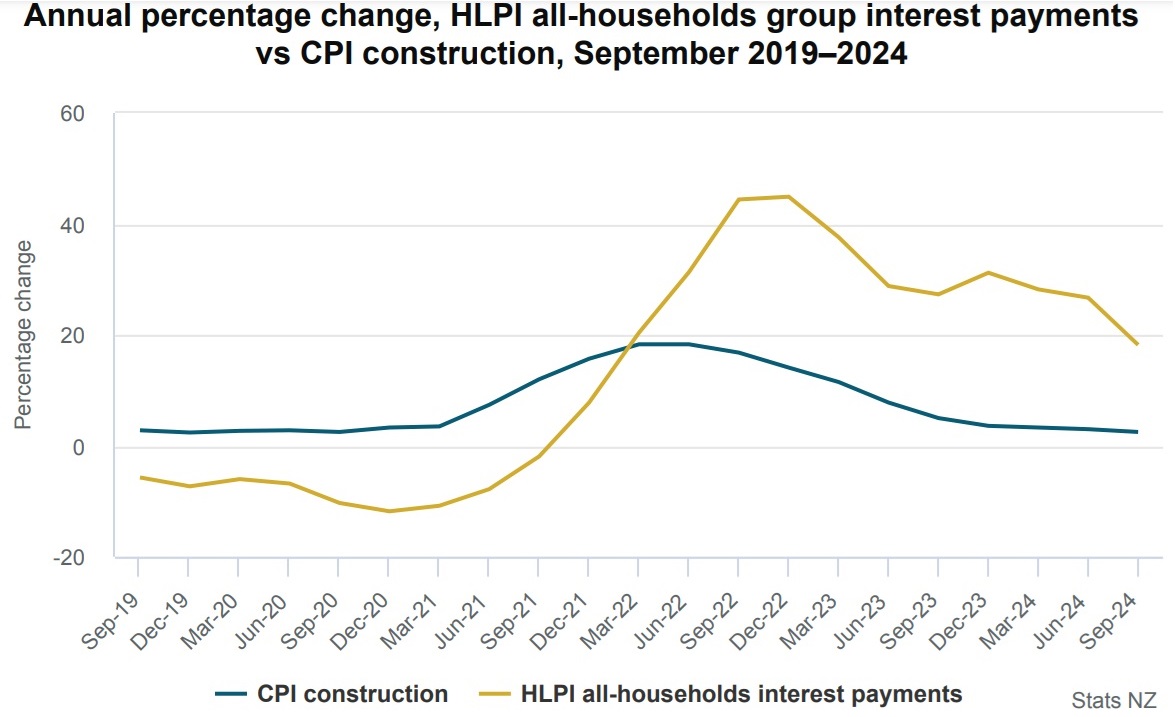

The marked difference between the two measures comes largely from the fact that the HLPIs include interest costs for houses, while the CPI does not - it includes instead the cost of building a new house.

Stats NZ said the 3.8% increase, measured by the HLPIs follows a 5.4% increase in the 12 months to the June 2024 quarter. The most recent high was 8.2% recorded in the 12 months to the December 2022 quarter.

Perhaps its no coincidence that the high of 8.2% was recorded during the period that saw the biggest impact from the soaring interest rates. During the 2022 calendar year, according to the HLPIs, the average cost of interest payments rose 44.9%.

The impact of the high interest rates has gradually lessened, by was still significant over the past 12 months to September.

Stats NZ said interest payments increased 18.2% in the 12 months to September while the cost of building a new home (which was included in the CPI) increased 2.5% in the same period. In the 12 months to June mortgage interest costs had actually risen 26.7%

In the three years since September 2021, interest payments have increased 117%. Over the same period, the CPI increased 15.7% and the HLPI all-groups increased 20.3%.

“Mortgage interest payments remain high and continue to contribute significantly to living costs for many households,” Stats NZ consumer prices manager Nicola Growden said.

Apart from mortgage interest payments, the biggest rises average households faced in the 12 months were insurance, up 16.4% and rent, up 4,8%.

Stats NZ offers the following explanation as to the HLPIs and differences with the CPI:

Each quarter, the HLPIs measure how inflation affects 13 different household groups, plus an all-households group (an average household). In contrast, the CPI measures how inflation affects New Zealand as a whole.

The two measures of inflation are typically used for different purposes. A key use of the CPI in New Zealand is monetary policy, while the HLPIs provide insight into the cost of living for different household groups. HLPIs include interest payments, while the CPI includes the cost of building a new home.

6 Comments

Many people believe the major reason why we get inflation is because wage increases drive up supplier costs so the suppler must increases prices. (This isn't usually the initial trigger, btw.) But once inflation gets established the wage/price spiral certainly can become a significant sustaining force.

So look again at the graph above showing how CPI vs. HLPI 'all-HH interest payments' differ. Note how the HLPI lags the CPI? And how it goes higher? (Back in the 'good old days' our inflation rate was the base all-household's HLPI !!!) And even now it is 3.8% while the RBNZ's CPI is down to 2.2%.

Thus, even after the RBNZ's CPI starts to decrease, what people are really seeing in terms of actual living costs just keeps trucking upwards, and worse, it goes far higher than the RBNZ's CPI. Thus, the pressure on employers to keep raising wages, and therefore prices, remains. This effect almost certainly means inflation will last longer than otherwise.

And, of course, the major difference is the RBNZ's CPI doesn't include interest rates whereas the all-household's HLPI does !!!

Which is yet another reason why the RBNZ should have started easing the OCR back in November 2023 ... almost a year ago!

(Have I mentioned the OCR is a pretty crappy tool? Add the widely quoted, and supposedly representative, CPI to that list!)

Edit: Is there a better tool than the OCR? Consider the US. They have 30-year fixed rate mortgages. When their central bank increases their equivalent of our OCR it primarily affects the creation of new credit and those on floating rates.)

Yes, wages tracked just beneath the HLCPI over the last few years (having grown in real terms for years before). RBNZ's attempt to suppress wages by hiking rates has the opposite effect - at least for the first year or so. Medieval monetarism is such a joke. See also adding billions to business costs to persuade businesses to reduce prices. Just crazy.

Nice graph. Perfectly proves my point. Thanks. Also shows the supply shock that triggered inflation receded quickly but rising living costs - probably due to RBNZ policy - kept it up.

Chances of the RBNZ recognizing how poor they are at Monetary Policy? ZERO to near-zero !!!

Chances of voters realizing the same? Almost ZERO. (many interest.co readers are likely to be among the few.)

You could argue that inflation was initially (and usually) driven by businesses raising prices - well before wages changed.

As a business owner, 2022 felt like a classic ‘lolly-grab’ to soak up the extra liquidity in the economy from post-lockdown QE, combined with limited supply due to demand restrictions.

This allowed for substantial price hikes well above normal inflation, often justified by real or exaggerated supply chain disruptions etc.

These excessive price hikes were good for business—until the OCR came in to curb what was then termed demand-driven inflation.

The thing with wages, is they never make up 100% of the cost of goods. Let's say you have an item that sells for $100 and you could measure the Labour cost across the whole supply chain/manufacture of that item at $40 (including logistics and manufacturing), $40 for materials and $20 for profit (20% GP)

If the Labour cost goes up 20%, then it becomes $50 of Labour, $40 materials, and $22.50 profit (20% GP). Your sell price as a ratio of Labour cost goes from 2.5x to 2.25x ($100 / $40 -> $112.50 / $50). That would however rely on businesses just maintaining their profit margin, so the price will likely rise back to 2.5x of the wage earner because that's what the market can afford.

Back in the 'good ole days' land was included in the CPI until it was reclassified as an "investment".

Proper thinking would suggest that once dwellings, structures etc are constructed, the land has been "consumed". Or is my thinking off?

Have we been misled by financial thinking? Land prices are one of the main drivers of inflation?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.