In a preview of this year written towards the end of 2023, I styled 2024 as the Year of Finding Out.

That particular title was, as much as anything, a reference to inflation. But I also included GDP/the economy and the labour market/unemployment in the mix. So, specifically, I reckoned we would find out if the efforts of the Reserve Bank (RBNZ) to tame the inflation monster were going to work. We would find out too if the economy might drop off the proverbial cliff. And we would find out how many people would lose jobs.

As we reach the halfway point of 2024 (yes, where did those six months go?) it is - frustratingly - not possible to say we've 'found out' everything we needed yet. I think we still will - but it's going to take the second half of the year for us to get there. Maybe not all the answers will be good.

On those three key things mentioned above, inflation - with big caveats attached - is heading the right way. But we can't definitively say it is under control. Not yet. I had actually hoped we might have a clearer picture by now - but we don't. It's still mixed.

Unemployment is rising as it was meant to - but with signs that's beginning to happen faster than was expected and/or desirable.

The economy. Now that's a big worry for me. A big worry. The optimist will look at the June 20 announcement of a 0.2% rise in GDP in the March quarter, which technically lifted us out of recession, as a sign that things are looking up. I tend to side with the observer who said that GDP figure "may well prove to be a dead cat bounce". Never mind the figures. Does it feel to you like our economy is growing?

Before I go on, context is important. Remember that in mid-2022 our annual rate of inflation peaked at 7.3%. Bad. The RBNZ is tasked with keeping inflation between 1% and 3%. Its weapon of choice if inflation is out of control is the Official Cash Rate - through which it influences the interest rates we pay. Through this the RBNZ can take the heat out of the economy by making us spend less. The Official Cash Rate was hiked, rapidly, from 0.25% as of October 2021 to 5.5% as of May 2023. Then the RBNZ hit the pause button.

The trouble is the OCR is a very blunt instrument. The lead times for the impact of increases in it are long. Only about a third of people have a mortgage - and they are a major first line of attack for OCR moves. But it means two thirds of the population, arguably, are not immediately directly affected.

What all this means is that potentially the RBNZ could 'overcook' the OCR hikes and it would be some time before that was clearly apparent.

Okay, so, at this point I'll go through some of the key economic data, including some that goes back into 2023, but was not released till either very late in that year or in the first part of 2024.

The December quarter Consumers Price Index (CPI) released in January 2024 showed annual inflation slowing to 4.7% from 5.6% and then the March quarter CPI showed a further reduction to 4.0%. Frustratingly for the RBNZ though, the so-called non-tradables, domestically-sourced, inflation slowed only slightly from 5.9% to 5.8% - way above the RBNZ's forecast of 5.3%. And it's that non-tradables figure that matters for the RBNZ, with RBNZ Governor admitting to being "annoyed" that the home grown inflation component had "barely budged".

We don't get interest rate relief till we've got low inflation

An annoyed Governor is not a Governor about to cut interest rates.

So, halfway through 2024 we don't have a clear picture of when there will be some easing of the high interest rates.

Unemployment was as low as 3.2% in 2022, but had just ticked up a little to 3.4% at the start of 2023. Then by December 2023 it was 4.0%. Then, in figures released on May 1 this year, we learned that the unemployment rate as at the March quarter 2024 had risen to 4.3% - ahead of the RBNZ's forecast of 4.2%.

What of GDP? I have to say I think the lack of timeliness of our GDP figures is a worry. We need to be able to get a faster, at least snapshot, of how the economy is performing.

At the time I wrote my previews for 2024 (in late November), it was in the belief that we had managed to completely avoid a recession last year. How wrong that was. This was before the September quarter GDP figures turned up - they were not released till December 14, 2023. And they were a huge game-changer. The RBNZ at that time was not forecasting any future recession. And it had forecast 0.3% growth for the September quarter. Instead. BANG. The figure was MINUS 0.3%.

It was worse than that, however. There were substantial downward revisions to earlier quarters, producing a kind of posthumous 'recession' (two consecutive negative quarters) earlier in 2023 that nobody knew we had even had.

When the December quarter 2023 GDP figures finally saw the light of day in late March 2024 they also had a 'minus' sign in front of them - meaning that between September's contraction and another drop in GDP for the December quarter we had gone into recession again. A double dip!

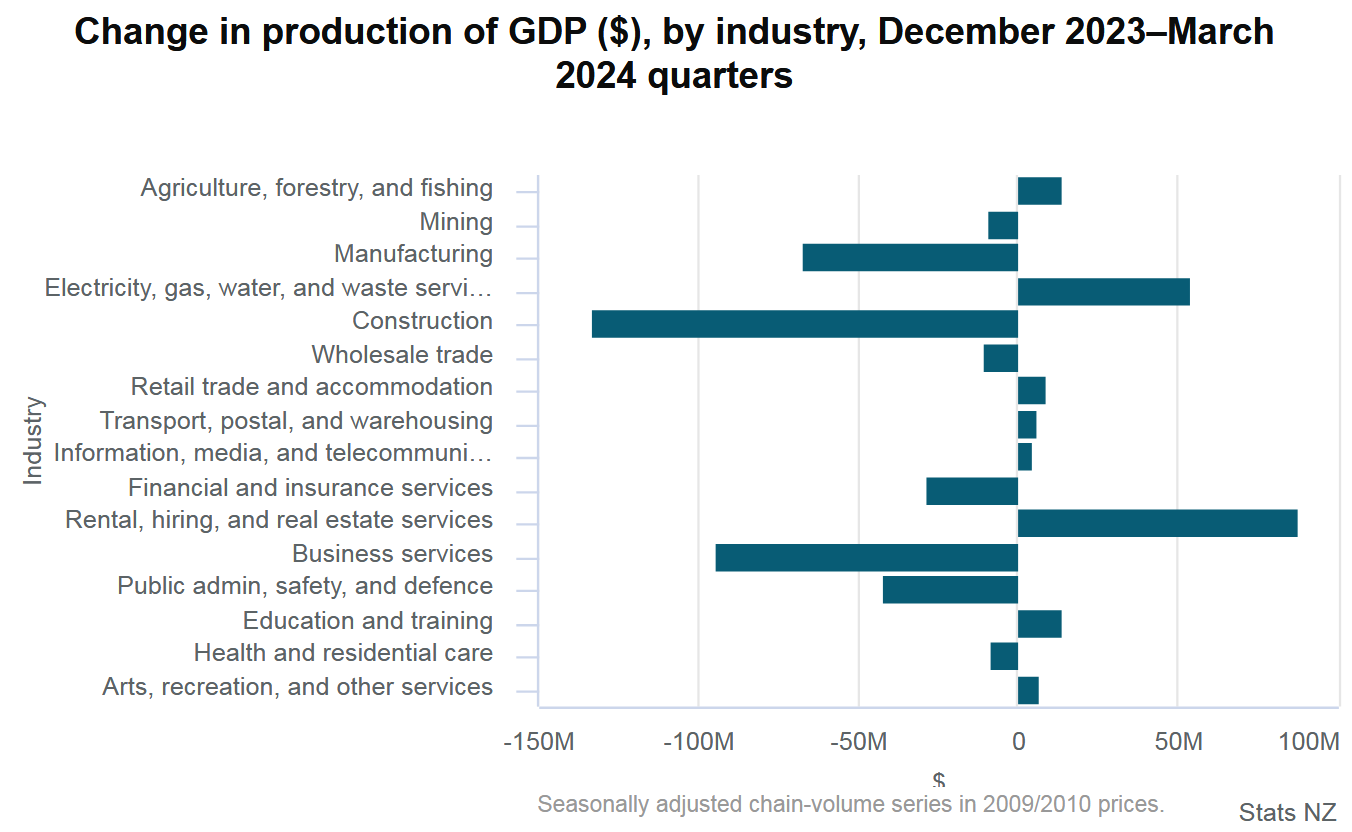

Of course, the March quarter GDP figures released on June 20, 2024 showed that in the quarter our economy grew by 0.2%. Recession over! Apparently. But have a look at the details:

Sorry, but that's not a picture of an overall economy in good shape.

Remember also that, according to Statistics NZ estimates, in the year to March 2024 our population grew by about 130,000, or 2.5% - largely on the back of a massive surge in immigration. This immigration surge soaked up the previous slack in the labour market. Additionally the extra bodies in the economy - what they were producing and what they were consuming - helped to mask the fact that the underlying economy was declining.

The March quarter 2024 GDP figures showed that on a per capita basis our economy actually contracted for the sixth consecutive quarter, by 0.3%.

This doesn't look like an economy in recovery mode

This means that since late 2022 our economy, on a per capita basis, has shrunk by 4.3%. Now that's a BIGGER fall than the 4.2% per capita fall we saw in the wake of the Global Financial Crisis.

I've just highlighted some of the 'key' economic data. As I said above, a lot of this stuff is not particularly timely. The GDP figures were just up to March. What's happened since?

Well, that's where I think some of the more second-level economic information released just very recently has been of concern.

I think some of this data is suggesting an economy that, far from being in recovery, is now beginning to really roll over in a very significant and not-at-all-good way.

For example:

Electronic card transaction data for May showed the fourth consecutive monthly drop in retail sales - and this was the biggest drop of the four. The wallets have been put away. Businesses that have been doing it tough are finding it's suddenly getting even tougher.

According to the latest BNZ-SEEK job ads report job ads fell 4.8% in May. This follows a similar sized drop in April, taking job ads’ annual decline to 30.5%. Aside from Covid lockdown periods, job ads are at their lowest level since February 2016. This is a clear sign of continued contraction in the labour market.

The BNZ – BusinessNZ Performance of Services Index (PSI), which has been going since 2007, recorded the lowest level of activity for a non-COVID lockdown month since the survey began. The services sector accounts for about two-thirds of GDP. If it is sagging the economy is sagging. Big time. The earlier released Performance of Manufacturing Index was "soft" as well. BNZ economists suggest that between these two indexes it all "points to GDP falling by more than many might care to believe" in the June quarter that's about to end.

This is not looking like an economy in recovery. It looks like an economy still on the way down.

Gloom has returned to the housing market

House prices are going backwards again, with the median price falling 2.5% in May, according to the Real Estate Institute of NZ (REINZ), and dropping 1.2% after seasonal adjustment. And there's a glut of available houses.

The house price news will hurt. I don't think you can overstate how much of a psychological impact the housing market has on Kiwis. We are hugely invested in the housing market both financially and emotionally. When house prices go up, the mood of the nation goes up. When they go down, or are even just in the doldrums, the mood goes down.

And I think that's about where we are now as we get to the halfway point in the year. House prices starting to fall again are the over-ripe cherry on top of an increasingly soggy cake.

How to explain all this?

It was always my concern that through this high interest rate period there would be an outward picture of everybody carrying on with life as if things were okay and then, 'suddenly', everything would all drop in a heap.

Of course, what we are seeing is not really sudden. It's the cumulative rolling impact.

It all looked better than it was

I mentioned above that only about a third of the population have a mortgage. The OCR hikes had a very direct impact on them. But not immediately. For a start, most people are on fixed rate mortgages, so, there's a delayed impact when interest rates go up.

During the pandemic period a lot of people were able to salt away a good deal of rainy day money. Many people with mortgages took advantage of the super low interest rates to get well ahead with their mortgage payments.

New Zealanders are a phlegmatic bunch, who mind their own business and get on with things. It was never going to be apparent on the face of things when savings buffers were starting to run out and when the leeway that had been established on the mortgage payments was starting to be used up. Until suddenly. Here we go.

And once the struggles start to become apparent, this mood becomes contagious. People who don't have a mortgage and to all intents and purposes are doing 'fine' suddenly decide they too should stop spending money, well, because, it's grim out there. Better save.

And the economy grinds to a halt…

Halfway through 2024, this is where we appear to be - in grimace-and bear-it mode.

Where to from here?

Stay tuned, because this is going to be a 'two-parter'. I will have a go at looking forward at the next six months and the things I’ll be watching out for. That will be coming up soon. In the meantime, take it easy. It’s cold out there.

*This article was first published in our email for paying subscribers early on Friday morning. See here for more details and how to subscribe.

168 Comments

It amazes me how few comments the ComCom article received yet it is at the heart of many issues.

It could be a shining light for the year if it gets an overhaul.

Like property market reform and improving per capita output, the ComCom thing is just another issue that gets talked about every now and then but little action seems to take place. If NZ was serious about enforcing real competition, we would have something similar to anti-trust legislation that the US has. Until that happens, little will change.

Even in the US anti-trust legislation is no longer used. If it was, the Big Tech companies would be broken up by now, instead they are allowed to dominate not only their existing market, but all the new tech that comes along as well (look and see who owns all the AI companies now!). They are allowed to do this because they funnel billions of dollars into the pockets of politicians at election times along with having complete control of political advertising.

During the pandemic period a lot of people were able to salt away a good deal of rainy day money

straight after lockdowns were stopped plenty were buying that new car, boat upsizing the house they were in as they could not go for a holiday overseas, which juiced up our local economy more than it should have

now some of those decisions are ending up in the papers as wo is me stories

Fairly obvious that in a startled response to covid the OCR was crash dived too low. If the mantra of encourage to borrow to spend was planned as part of that then that was one of the worst about faces NZ has ever witnessed given the well recorded and justified lamentations of previous Finance Ministers and RBNZ governors that NZr’s evidence one of the worst savings performances in the world. There are undoubtedly very many now rueing taking part in that daft 180.The point that two thirds of the population are out of OCR affect by being mortgage free must be tempered by those that are tenants and mortgage hikes obviously will increase rent. The thing is though even when the first OCR cut eventuates it will be 0.25% and further reductions will be hesitant, rather than flowing Therefore people envisaging that as being a salvation are going to be disappointed to find how little it actually assists in the short term.

It not only went too low, it went on too long. The RBNZ continued its emergency lending progamme well beyond the point it became clear that there wasnt any emergency, ending it only in Dec 2022. Whereas the RBA quickly canned theirs in June 2021, a whole 18 months earlier then NZ.

True. And the powers that be. Ardern, Robertson, Hipkins & Co all sure made hay while the sun shone didn’t they. Outright plunder and squandering of the public purse. That sun went out and so then, did they.

The NZ economy is in a vulnerable state and we are one global shock away from some real carnage setting in. Given the vast amount of risks in the global economy and geopolitical situation right now, we will be very lucky to get a smooth ride out of this current downturn.

Housing is the biggest drag on the economy.. people are so indebted, there is no spare money for anything else.. we top the charts for highest rents..

Yes, obviously. What I am saying though is that given how vulnerable NZ is right now, all it will take is a global shock to really cause major pain for us.

One example would be if China blockades Taiwan or something similar. You can imagine the economic troubles that will cause NZ.

Or like, most everyone.

That shock is very close and its a world food shortage/crisis thanks to adverse weather/Ukraine war -( 30+ % of grain producer) increased freight costs and delays courtesy of the Suez and Panama canal issues and widespread anger in Europe especially of farmers protesting with tractor convoys and manure spreading not on fields but Govt offices. The anger evident in much of the world is emerging - at worst two European Prime Ministers shot in assasination attempts, political upheaval in France and Germany and UK in July and the growing threat to illegal migrants (Invaders in locals eyes) with some countries now looking at forcible repatriation. Such widepsread anger bordering hate is close ot becoming irreversible and if higher for longer interest rates create mortgagee sales in volume those perceived to be responsible will be targets, Orr should very carefully weigh up the tipping point.

Great article. The Reserve Bank knows there is a lag time of 12 to 18 months interest rate hikestake affect. I see businesses closing on a weekly basis in news articles and 4 locally in a small town close to myself. My wallet is shut and have over $15,000 on a credit card to survive the cost of living. Everywhere I turn there are parasites taking more of me for lessor services. What is this bulldust about people having saved during Covid and then afterwards buy a boat or new car. Maybe the 1% as they are known by. Good on them for taking risks and doing well from it.

It is probably brutal for some - hopefully the long term effect will be good for NZ in that people will learn how economic cycles work and the need to save in the boom times for the next bust. For people and businesses.. it applies to choice of business, career, investments, where we choose to live and much more.

I suspect most the moderately wealthy people in NZ are low risk investors, who have stable careers, work hard and save a lot (in the US they used to say most millionaires drive toyota corollas). Not those that gamble in property and buy expensive stuff.

The RBNZ remit is inflation not non tradables inflation. It IS under control - the last 2 prints have been 0.5 and 0.6. Extrapolate that puts you comfortably in the band. What’s NOT under control is the almost 1 year old 1.1 and 1.7 quarterly numbers waiting to drop out. Our real rates are now bumping 3% which is incredibly high given the timely data you mention is capitulating. Whether or not you believe monetary policy is actually relevent, it is now unquestionable the RBNZ will allow the economy to suffer a severe recession. The risk behind this is that our currency could get hit. Hard. I just hope that they see sense soon and start easing. It’s not just a question of lowering the interest rate to get things running again once you have jobs gone and business going broke.

Agree, they have done enough now, we have enough evidence that inflation is under control. They need to get down to “neutral rate” levels fairly quickly.

The old saying around the time of 2008. The RB arrives too late, does too much and stays too long still resonates doesn’t it. In consideration of that, whatever the plan is or isn’t, find it difficult to imagine any deviation until it’s too late and then it will be an overreaction that is carried on at length. In other words a repetition of that old saying around the time of 2008.

It’s probably already too late. If we undershoot 2% CPI that will be very embarrassing for them.

most people just want inflation to fall... as the cost of living (for basics) is simply too high. i dont think many will care if we overshoot.

I think they might care if the price of inflation falling was them losing their job, because that is what they are trying to do, right?

It depends, ardern/robbers son increased wellington bureacraps by 18,000 of which 416 have been made redundant so there is much scope for savings on wages and office costs when the rest are made redundant excluding any if there any who have actually made a constribution of value to NZ, if any are found they should be retained. A hidden benefit even if small is some of the redundant through necessity may joing the productive workforce or even create something new that has value, I estimate that outcome at 18,000 to 1.

My version is the RBNZ does too much too soon then too little too late and Orr has demonstarted he has no intention of spoiling his consistent record of being wrong. Disappointing that National have failed to at least signal to Orr that retirement would a good personal option for him - now!

Dug out my comment on the 2024 preview. The recession will continue until bank net lending and Govt net spending (residual cash influence) significantly exceed domestic and offshore private sector saving (offshore saving is basically our current accout deficit). It's that simple.

Jfoe | 3rd Dec 23, 9:15am

So, that surge of migrant workers. What happened? Between November 2022 and May 23 we saw a 40,000 jump in jobs as migrants filled the roles that kiwis couldn't / wouldn't do. Most of these jobs were low paid - care home staff, bus and van drivers, warehouse staff, early years education centres, hospital cleaners, and bit of construction. We also saw some growth in nursing, ICT staff etc.

What happened after May 23? Job growth slowed markedly despite big increases in net migration, and the number of people on benefits started to pick-up as job opportunities disappeared. Basically the economy had enough people doing stuff to meet current demand in May 2023, and total demand is now falling. So jobs will fall too (and unemployment is already picking up quickly).

But, migrants add to demand don't they - creating jobs etc? That's the 20 billion dollar question! Did migrants turn up with a stack of savings that they have converted to NZD to spend into the economy? Because with Govt net spending stalled and about to be cut further, and the housing ponzi on a temporary pause (banks are only printing about $1bn net per month), where is the extra money coming from that will allow new arrivals to accumulate NZD and increase demand?

It's a recipe for a deep recession. The idea that we are on for a soft landing is a fantasy.

The idea that we are on for a soft landing is a fantasy.

This is one of many falsehoods sold to us by the central authorities to make us feel like things are under control.

Then when things get really bad, they can say they had good intentions.

Or that labour did it.

yes we are not going to avoid the unpleasant fallout, but more importantly what is the powers that be plan to address it?

It would appear unlikely a resurgent RE market or net migration gains are an option on this occasion.

Lower (and lower) for longer?

I would put money on them opening up the RE market to foreign buyers again before the end of 2024

National campaigned on this but Winnie said no.....

Foreign buyer ban: National expects foreigners to snap up one-in-two high-priced luxury homes

National finance spokeswoman Nicola Willis with highlights of their tax plan announced today. ...

Foreign buyers will need to spend about $5 billion buying Kiwi property each year - the equivalent of snapping up almost half of all the $2m-plus homes that sold last year - for the National Party to generate $740m in promised tax income.

National yesterday said that, if elected, it will allow foreign buyers to buy any Kiwi home at $2m or more so long as the buyer pays a 15 per cent tax on the sale price.

It predicts the policy will raise $740m each year. At a 15 per cent tax rate that will require $4.9b worth of annual sales to foreign buyers.

Last year, the overall sale of $2m-plus homes in New Zealand totalled $11.5b, while in 2021 such sales totalled a record high $17.2b, according to property analysts Valocity.

That suggests foreign buyers will need to each year buy between 30 and 50 per cent of all high-end homes for sales to meet National’s goals.

But before the Government banned foreign buyers in 2018, they typically only took part in less than 3 per cent of all house sales across New Zealand.

Brad Olsen, principal economist at Infometrics, said National’s numbers sound optimistic but it’s hard to judge because it hasn’t released details about how it came up with them.

“It’s plausible but whether or not they are likely to come to fruition is the next question,” he said.

National’s plan to allow foreign buyers back into New Zealand, along with other property-investor friendly tax cuts it has proposed, threaten to put housing issues back into the limelight ahead of October’s election.

The party said it has had the foreign buyer tax plan is independently costed and downplayed concerns by suggesting increased foreign demand will only affect the upper end of the housing market and not push prices up for the entire market.

Yep and Winnie will change his mind

The only practical way to reduce our account deficit! Selling of more assets to overseas interests until we are tennants in our own country.

The more assets we sell, the more we increase our future current account deficit. The flows of 'rent' offshore will just get bigger and bigger.

But that's a future govts problem!

Are you kidding... do you mean it's our future generations problems..

I didn't think I needed a sarcasm tag, but maybe I did

They're up for it any which way:

- bill for the continued status quo

- bill for some serious deficit spending with no certainty of any net gain

We think we have some formula for prosperity, bit of infra spend here, some tax rebates there, more education round there, and wah lah, x amount of productivity or growth.

But that's based mostly on what's been previously observed. Western nations grew into this over a century or so (or you can go back further if you'd like). Then the same model got ported elsewhere (and with it the jobs), and was managed faster, because the model had already been worked out.

That next step, is much harder, the returns often diminish fast. Harder still, in a global market with significant parity and uniformity in approach.

Real improvement requires some serious innovation in approach, unless you inherit some fairly lucky circumstances. And the nature of innovation, is often fairly unpopular.

Selling property to overseas investors does not reduce our current account deficit. In the short term it funds it, in the medium to long term it increases it via primary income account outlows.

There is another solution - reduce spending/obstructionist legislation & bureacrats and encourage increased productivity, how likely - not very - how possible - quite possible if GOvt National and local spent more time on efficiently deliver what Kiwis needs on time at lower cost - will it happen - unlikely whiolst Luxflakes concentrates on Maorification and Gender issues. Heres a tip Chris - if you have a Y chromosone you are male if you dont you are female and science hasn't found a Q version.

If the RE market is unattractive to local investors in the current state of the economy why would it be any more attractive to an offshore investor who has the additional currency risk?.....the ability of our economy to support serviceability of RE values has been played out.

Offshore investors will be looking for assets that generate rent - with yields preferably locked-in to the deal. So, yes, Chris, we can build 1000 build to rent apartments for you, and some wider and wider highways... all you need to do is underwite our returns so we are not taking any risks. Oh, you want some lines drawing on your shiny new roads? Sorry mate, that wasn't in the deal... that will be $500m please, and, no, you can't do it yourself because you might damage the road surface that we are contracted to maintain in tip top condition.

Point taken....currency risk still remains (unless that is also underwritten)....and a losing proposition for the financial well being of the country, not to mention political risk for the party accepting such a proposition (not that that has stopped them before)

We would be better served by the state borrowing directly and funding the construction of said BtR developments....obviously.

Previously, it was attractive to offshore investors as a money laundering scheme. AML-CFT changed all that.

No capital gains tax.

I have had this view for a year now, we are actually ahead of most of the world, who will follow us down.

All I am spending money on right now is food, rates , power and insurance.

I suspect many are in the same boat and some people are in sinking boats.

Easy capital gains are gone and people are looking at what they have to save for retirement.

Even if interest rates were to come down a bit from their current levels over the next 18 months, it will take time before the economy rebalances to it and households feel confident enough to begin spending again.

I do hope we don't waste this crisis and learn to live within our means as a country. If we want better things, why not improve our means first.

That would start with improving relations and connectivity with the largest market, military and economic power in the Pacific, China. But unfortunately we are part of the western set against China trying to protect American supremacy so none of that will be happening.

Can't you think of a single country that sucked up to China in the last couple of decades and came out strong economically.

Chinese state-owned companies follow neo-imperialistic ideals and try to vertically integrate their supply chains in host nations.

If we let the the Chinese have their way in NZ, they will likely buy out all the farms here plus the processing and logistics companies, then replace local workers with cheaper Chinese labour and spread CPC propaganda around NZ.

Like it or not, the US is the lesser of 2 evils by a long shot.

Hey if you want to hang out with uncompetitive market losers instead of the winning market leaders, why not. I doubt you'll find any benefits there. As for "letting the Chinese have their way" economically that's up to our business and political leaders to set a course in our national interests - instead of hiding under Uncle Sam's sabre-rattling umbrella.

Both China and USA have economic issues, Chinas is bigger due to population size and low birht rates and adverse demographics. At least NZ produces much more food than it consumes so will continue to have a commodity that is not optional so buyers will be there, consumer durables not so much.

I understand your point but I suggest that it is already outdated to a degree. Absolutely massive modernised dairy farms are coming online in South America, India and Russia. African farmers who previously worked the land by hand are now benefiting from mechanisation and fleets of inexpensive farm machinery imported from China. In my view China is going to far prefer buying its food and commodities from friendly BRICS aligned nations trading in local currencies rather than somewhat hostile US bloc nations trading in the USD.

Yes - No mortgage, cash in Bank , paid down mortgage when rates were low and sold property when demand was high, still working at 80 and enjoying being able to chooseto spend or not.

It will be a massive job to 'significantly exceed domestic and offshore private sector saving (offshore saving is basically our current accout deficit)' given the current level of our account deficit. I don't see that happen in the short and mid term future of New Zealand.

Yes, that has been my point for the last two years and why I have been so confident that we were heading for a recession (and then sustaining it).

I am keeping an eye on the car market. The depreciation on some cars especially electric ones is amazing and they are still not selling. Retail is equally slow according to my best mate who manages an appliance store. Wallets are shut except for food.

The electric car depreciation is over and above the impacts of the slowing economy. Some models falling up to 60% in the first year.

I was looking at prices for second hand Mitsubishi ASX and was shocked at how they retained their value. A fairly mundane two litre small SUV that is a bit of a gas guzzler at almost 8L/100KM. Made me think a brand new one was a pretty good buy at 28k.

Been looking at 5 year old Subaru Outbacks - still somewhere around 27-30k. Not sure who would be picking those up. Seems after houses it'll be car dealers needing to meet the market.

Used Outbacks (at least from dealers) have been "strangely" priced cars for a while now. I feel like it's one of those cars where, at least up until now, it has made more sense if you want a relatively late model example to just buy a new one. I'd rather spend $45k on a base spec brand new one and care for it from day dot, than spend $30k on an import with tens of thousands of kms and no history but will almost certainly have lived a hard life, and the used example is a generation older at this point.

If you don't need the ground clearance and don't mind going another generation earlier around 2013/2014 when they got the better safety systems) a Legacy wagon is the better buy. Nicer to drive and for less than half the price, sometimes more like a third of the price. You can score a top spec, excellent condition one for about $12k and it will be less likely to have gone off road if a fresh import.

Of course more difficult if you need the extra ride height, but our Legacy has never failed to make it up a ski access road or got stuck anywhere in 5 years and 80,000kms of driving. Best car we've ever owned in terms of value for money and capability, by a country mile. I'll be distraught when it goes.

To your point, however, I think there are going to be a bunch of car dealers and private car sellers needing to meet the market and some normality may be restored. Already seeing it in pricing for modern classic performance cars, which had become absurd but seems to be normalising rapidly.

Thanks for the notsodumbthoughts!

It'll be an Outback over a Legacy for me as the additional clearance works for me, and I've also had a really good experience with my 2005 outback (ofcourse tagged as a Legacy!). I'd go a little older, but they went through a very ugly period. Will wait and watch.

Anyway, I best not turn this into a secondhand car subreddit. Cheers

Yeah best not to get sidetracked on the pros and cons of various Subaru models.

I just wish they'd hurry up and do a decent hybrid Outback (just nick the engine from the RAV4 as Subaru and Toyota share parts/platforms on other models anyway). There is nothing else so good as a Subaru Outback/Legacy for the money IMO, but they are getting a bit pricey on the fuel these days.

My sons friend bought a Honda CRV with all the bells, 4wd, roofrack, towbar etc for $300 no bs. Genuine seller, bought it and drove home from coromandel town to Hamilton

Only problem the rego has been cancelled, has rust

No reg and rust. Scrap value only.

Missed the point, drove from Coromandel

Paint, re-rego, flick. There again scrap could be 1500

It's the re-rego that could be the sticking point.

No. Strip underside, repair rust either by paying someone or supervised by repair certifier, recoat underside, fix any other issues (like a wof but 100 times harder) pay lots of money.

There’s a reason it was $300. If the reg hadn’t been canceled it would have been a different story.

Park anywhere, let the parking, speed camera and toll road charges stack up, no details of the owner. Then sell for scrap

Take to Northland. Wof and reg are optional up there.

You can make a profit by simply selling to the wreckers. They actually pay more than you would expect.

It a depends on if you can sell it. Friend has a low mileage 2.5 ltr Subaru..can't give it away.

Electric car inventories in China and USA stored outside of dealerships can been seen from space.

The caravan, motorbike, portable spa and jet ski market are also worth keeping an eye on. Lots of people are going to be liquidating what assets they can very shortly.

I find it laughable that we wait for the 'new normal' which really just says the previous overcooked high costs and charges havent gone away rather we have just normalised and slowed their upward pace somewhat by strangling availability to access cheap credit. Yet once the situation sets we will 'go back Jack ' do it again ,wheel turnin' 'round and round'.... (Steely Dan)... oh the humanity of it all!...lol

My banking app reckons I have lost 275k since the beginning of the year. That's quite significant. For the first time in a long while I have distant family members without work and struggling to find new employment.

I've started drying out paper towels that are not too yucky and have taped up my worn out sheepskin boots to get through the winter cold indoors. Not joking but I enjoy that sort of thing as my interests are more cerebral.

For about 10 years I've geared my living standards to survive off minimum wage if need be. If things dry up and stay bad long enough, I'll just divert my time from active commerce to full time homesteading. A big part of me eagerly longs for such conditions.

Hang in there. Haven’t even got to August. Worst month of all. Cold grey, mostly sodden, lifeless vegetation. Living in the USA everybody hated August too. Overheated, dusty, burned off vegetation. Let’s ban August.

Take up Skiing, a week a year is worth looking forward to...

Gloomy on here today & now you recommend going downhill.

Too funny.

Yes, the employment situation is worse than current statistics are portraying. The slowdown in the NZ economy is very real and it is starting to worry me. We must have a slow but steady downward progression of interest rates, starting from November. Starting cuts only in mid 2025 (as forecast by the RBNZ) would be too late, and it would introduce a significant risk of a seriously deep fall in economy activity.

I fear that Orr is going to repeat the same mistake that he made during Covid, when he kept interest rates too low for too long while ignoring clear market signals - now he risks doing the same by keeping interest rates too high for too long, unless he starts acting in November.

Feeling a bit Blue today

Dominant

Given the % of a years profit retailers make over Xmas, this coming one is going to break a lot of small NZ Retail. I also expect a lot of larger retailers shutting less profitable, or loss making locations.

Indeed. One only has to look at recent share price performance of The Warehouse, Rymans, Oceania and Fletchers to get an idea of where retail and construction are headed.

This little piggy bought Ryman and this little piggy The Warehouse, But this little piggy had TDs all the way home

But then Briscoes and K Mart are heading the other way.

The stats used in the article shows clearly to me that the 'negative' bars are much bigger that the positive ones. So how can the GDP has been growing or is it what I believe 'Chris of no fame's suggestionthat the number could be rigged just to prevent our collective mindset from going into a depression.

Here you go - the biggest contributor to GDP last quarter was 'unallocated', which Stats do not include on their graphs! This looks to be a problem Stats are having with *when* to allocate some of the unknowns. The 'unallocated' contribution weighed negatively on GDP in 2023 and then suddenly swung round to do all the heavy lifting in Q1 2024! It does average out overtime though.

Discussion about these issues have been on going in this forum for the last 12 months. And now we're seeing it in the official numbers.

The manufacturing and services data are particularly worrying. What concerns me is that we enter 2025 and little has improved or things are even getting worse. Assuming the RB has made little movement in the cash rate by then, we could be in for an even worse ride next year.

We will need to see some radicle reform, ACT will be up for it, not sure Winnie will be.... not sure National have the vision

A radical shift is required, the last decade has shown tinkering will not change the direction, if Luxflakes continues his obsession with Maorification, Climate change and Gender issues, National will either dethrone him or accept Nationals future in Govt will be a junior partner to ACT.

I concur with David Hargreaves about the New Zealand economy in the first half of 2024. Hargreaves argues that the economic situation is worse than it appears, despite a recent GDP figure showing positive growth.

He cites several pieces of evidence to support his claim, including stagnant wages, rising unemployment, and a decline in retail spending.

Hargreaves warns that the worst may be yet to come, and that the economy could be headed for a severe recession.

The problem with New Zealand in my opinion is that we actually don't produce anything.

We have all our eggs in Agriculture and Tourism.

Take the difference between us and Singapore for example.

I certainly don't see anything changing soon because the demographic voting base seems intent on suffering with a political culture that is not only stagnant but too conservative and not forward thinking or innovative enough.

We have seen two possible contenders rise, Gaming and movie production, but Offshore provide better tax breaks so they leave. Gaming revenues could be a massive earner. Given the scale of asset correction to new interest rates, and reduction in of tax revenues, I think we are in for a once in a generation correction. It may well be that we are simply the canary in the coal mine.

IMHO which ever way China goes, we go with it.

IT GUY has good observations below.

We are reliant on agri/forest/hort/fish. One can't pick up the land/water resources and relocate to another land mass.

IMO Kiwis are smart in innovation, digital and other tech. But (again IMO) once the find their success, they are bought out by an offshore player. We just don't seem to keep them here and capture the long term benefits.

How do we get them to stay pit in NZ?

Entrepreneurs and developers what would it take to persuade you not to cash out to offshore, and grow your initiatives here in NZ?

By the time a Google, MSFT or AMZN swoops in to acquire a startup a lot of the decision-making power is often already out of the hands of the entrepreneur-founder and in the hands of a first and second round investor crowd. To them selling out to Google for $50M and walking away with an instant 200% gain is short-sighted but also a no brainer.

Incorrect the first round are looking for 15-20 baggers, as many of there investments go to zero. As soon as you do these rounds you buy into their exit strategy, which is selling out, or further rounds at higher valuations, then possibly a listing exit.

Regardless the final outcome you listed is the same - the company is sold out into (probably) foreign ownership.

Comment of the day. Well said.

Crikey thats a bit harsh. When the chips are down food is what always sells. And we sell plenty. Or we did. All those pine trees are making inroads.

It is 'simple'! New Zealand allows the forming of mono- and duopolies by the way it has set up economic regulations because the influence of certain lobby groups was higher than 'economic common sense'. Just an example: In The Netherlands when they 'liberated' the electricity market, the law was very specific on that the generators could not own retailers. And this applies also for a number of other EU countries.

Domestic inflation come from somewhere! Economic laws should be designed to reign domestic inflation in.

RBNZ under Adrian Orr doesn’t know the meaning of the word “moderation”.

They seem to think the OCR needs to be either full throttle or brakes slammed. First they stuff the economy up in one direction, then they stuff it up in the other. Good work guys.

There has been there, a massive increase in staff. That will include a bevy of ego justifiers, promoters and insulators of good internal feelings and screening out bad news, respectively. That way, to them what you are saying, will be nothing less than a heretical falsehood. Call it the ivory tower syndrome if you like.

I think it's much harder for the RBNZ to navigate an economy that's been suffering from a serious case of productivity anemia for some considerable time. All appeared good on the surface whilst many naive folk partied hard with the growing herd using money that wasn't even theirs to begin with. Now that the much overdue reset is upon us, many are awakening to the true cost of folly (edit) Some have found themselves better positioned than others.

As house prices resume falling, the rest of the world watches on to see how our housing centric economy lands.......

Yup. All said and done, real GDP per worker us still stuck at 2011 levels in NZ. Hundreds of billions borrowed from the future and wasted away on artificially boosting consumption and asset values.

To make matters worse, the government of the day wants to practice mild austerity by pulling back on infrastructure spending and industry support to fund tax cuts for landlords, pushing productivity growth further into the ground.

It lands short of the runway.....

the hangover is here, and the fact that we got pissed on the credit card means the party will have to be paid for over then next 20 years..... unless people default.

Only 1/3 of people have a mortgage.

Many others have term deposits and are very happy.

Many older people have some savings, investments and air travel is booming - we are using it before we can’t. If your in an all in bet on housing well good luck - understand for FH buyers you have no choice but we were all there once.

95% of people are employed. It appears you can move to Australia for higher wages - how lucky is NZ to have an open door to one of the wealthiest countries in the world at present.

Its tough for some, will get tougher for some but many are going ok and enjoying life.

Life is not fair and some get advantages but many have worked hard to get there plus made choices along the way.

TD 5.95% at WP on Fri. Pushed for 6.0% but declined by branch manager. 12 months, QTR interest. I’m comfortable but not happy. Prefer inflation to be 3% with these rates.

Number of employed is only 2.9m of 5m = 58%, or roughly every 3 workers are supporting 5 people in the population.

In terms of unemployment, the unemployment rate is 4.3% but the underutilization rate is about 11%, so roughly only 90% fully employed.

Let's break this down a bit...

Net bank lending (new loans minus loan repayments) is currently running at around 3% of GDP. It has only been that low during one period in the last 30 years - in 2009/10. At the moment, Govt deficit spending (including capital investment) is running at about 6% of GDP for the Govt fiscal year. So we have a net flow of new money into the economy of 3% + 6% = 9% of GDP. Some of that money flow is far from stimulatory - eg interest payments on Govt bonds and bank reserve balances that goes straight into the 'saving' pot.

Our current account deficit means that 7% of GDP is being saved offshore and domestic savers are also busily stashing cash in their term deposits etc. So the stimulatory flow of new money is currently being balanced (cancelled) out by offshore and onshore savings. So GDP is flat. You can't create a 'surplus' without a net positive flow of cash in and through the economy (unless people start spending their savings like it's the end of the world).

Now, here's the kicker. Govt's latest budget is aiming for deficit spending to reduce from 6% of GDP this year to around 1% of GDP next fiscal year (July 24 - June 25) before dropping to 0% in 2025/26. If that happens and net bank lending is still limping along at 3% of GDP, the wheels are going to really come off. This is poorly understood by central bank economists because their models of the economy are simply wrong. This year we will find out how wrong.

Now, it might be that the Govt think that their private financing deals for infra will save the day. Private finance deals are (after all) basically just massive bank loans. But, how realistic is it that these deals will be set-up and stimulating the economy in the next 12 months - to the tune of, say, 5% of GDP? That's $20bn a year of new bank credit. Really?

As you say...IF.

" But, how realistic is it that these deals will be set-up and stimulating the economy in the next 12 months - to the tune of, say, 5% of GDP? That's $20bn a year of new bank credit. Really?"

With no new shovel ready infrastructure development on the books any timeframe for significant 'stimulus' can be measured in years....meanwhile?

Stimulating far too much when it wasn’t needed (say post Covid period) and potentially now unable (or politically unwilling) to stimulate when it really is needed. Could exasperate the severity of the boom and the following bust.

Dan Brunskill mentioned in his piece the other day that ..."New Zealand’s economy is at the bottom of a wide U-shape GDP recession. While it may have passed the lowest point, the slope ahead is still shallow and treacherous."

With no apparent mechanism to underwrite any growth that would suggest the recession will be L shaped rather than U.

I think it will be a *shi* (Japanese hiragana) shaped recovery

Is "shi" Japanese for Claytons?

Down and back up, but never to reach the lofty up heights once again.

Yes, that double-up of monetary and fiscal stimulus in 2021 was a real banger. If Govt manage to slam on the fiscal brakes next year, our mishandling of this inflation episode will be drawing gasps of disbelief in econ lectures for many years. It will be catastrophic.

I expect though that Govt will be forced to deficit spend by much more than they are planning - not least because the benefit forecasts in the budget already look very, very optimistic. Main benefit recipients are around 10,000 higher than the forecast Govt made a couple of months ago! Accommodation Supplement also flying up as people face cuts in their hours etc.

Which when all added up suggests a considerable decline in the value of the NZD.....and imported inflation (at least initially). We may then begin to address the BoT, though we did not last time the NZD value crashed.

The biggest driver of our currency value is capital flows, which completely outweigh the impact of BoT. So, the relative value of NZD is determined primarily by the relative attractiveness of Bonds etc that are denominated in NZD. The appetite for NZ Bonds is huge so I don't think we will see much of a drop in currency value unless Govt does something completely ridiculous.

Good point.

An overvalued Kiwi is bad for our economy overall. Exports become expensive and makes imports cheaper than producing here.

Our companies did rather well selling their offerings to Aussie back before 2013 when NZD lingered around AU80c.

Those capital flows are predicated on comparative risks/returns....both of which are tied to (relative) economic performance.

"The appetite for NZ Bonds is huge so I don't think we will see much of a drop in currency value unless Govt does something completely ridiculous."

Something ridiculous like committing us to guaranteed above market returns to overpriced infrastructure projects for the next 30 plus years?

Fair point. Ultimately though bond markets will happily buy NZ bonds as long they know that Govt are good for the interest payments, and Govt is still printing $140bn a year (gross) - sp, what's another $10bn or so especially when NZ is one of the few countries in the world with a net positive financial worth.

Anyway, we will be back to near zero per cent rates in a couple of years time - once the Fed has stopped holding the world to ransom. Countries like the UK, Sweden, Canada, Aus, NZ etc with high levels of private debt held on short-term fixed rates can't survive rates of more than 3% or 4%.

Indeed Jfoe, I fully agree with you.

Don’t get me started on accomodation supplement! As it increases, we are increasing welfare for landlords to bailout their poor business/investment decision making Ie they have purchased assets/a business with poor cash flows that doesn’t justify the amount they have paid for it - yet the rest of the country are expected to pay for their poor decision making - what a rort!

Accomodation supplement should be frozen immediately to force the rental market to correct back sustainability fundamenta levels - ie where our productivity/incomes can justify the amount required in rent required each week (this will follow through with a reduction in property prices to justify the cash flows the asset can generate in relation to the productivity of our workers/economy - as opposed to an asset that is artificially boosted with external inputs like accommodation supplement).

it is a government subsidy and not for the people whom rent, it helps force rent pricing up which in turn forces houses prices up as that couple with other policies ie tax refunds on interest expense on the business against personal income (no other business can do that ) banks weighting investors more favorably than owner occupiers, and banks lending to investing housing and not treating the same as any other business (if they did the interest rates would be higher).

the simple answer is that the parties on the right don't want state supplied housing and that is why we have so many incentives for people to invest in rental stock, ironically, they always bring up singapore which runs completely opposite to their ideology

Behind the Design of Singapore's Low-Cost Housing - Bloomberg

Question. What would happen if the Big Four Banks stopped printing mortgages for 6 months or so? And maybe the only exception is downsizing a mortgage?

Would that help the non tradeable to track lower?

Just a thought because I'm no 'expert'.

J Powell doesn't want to be that guy. Volcker taking his foot off the pedal to soon.

"Harder, Higher for Longer baby!"👶

The most predictable consequence is that the entire real estate market will collapse as the vast majority of sale and purchases would no longer have finance.

I had to chuckle that the KiwiRail CEO said he would happily take his family on a ferry tomorrow.

If it has to be said, its probably an issue.

Personally, If I need to use ferries it will be Blue Bridge. I have sailed my own yacht offshore, I do not like the Inter Islanders safety record, first a total power loss, then this....

The Bluebridge has been the only choice for me for a couple of years. I will only sail in good weather now. There is no chance of rescue in bad weather.

OCR cuts will occur by December. The negative comments here about how things will be much worse in 2025, only encourage my view that we will reach bottom 3-6 months from now. Buy shares now ad make money for the next 3-5 years.

Shares are as overpriced as they have ever been - eg some levels as 1929/2000 booms relative to fundamentals/risk free returns.

Rubber money makes for depressing distortions not just here in NZ. It has been stretching for a very long time in the world’s biggest economy. Check out https://wtfhappenedin1971.com/ and then to keep your chi in balance listen to Ian Dury and The Blockheads - Reasons To Be Cheerful, Pt. 3 (Official Lyrics Video)

I read recently median S&P P/E is only 15. No where near the recent booms. It's just a few companies with very high valuations.

True but have a look at what the current yield of the S&P 500 is and compare this to the current risk free rate. Generally when the risk free is multiples of the share market yield, a period of poor market performance follows. Why buy shares that return 1% yield when you can buy a bond that pays 4-5%? (if you are speculating over future capital gains, sure go for it! If you are investing and want the best return vs risk - why would you buy the current market?)

(edited typos)

Growth companies dont pay divvies

It's about four companies driving up the entire US market. AAPL, MSFT, AMZN, NVDA. Question is, does this mean that this massive market rally is built on a base of matchsticks or does this mean the market rally has real legs to run as the rest of the companies catch up to the leaders? The spruikers have one perspective on which way it will go, I tend to have the other,

What changes in our economy are required to cause a sustained bounce and growth.... China our biggest trading partner seems to want to buy raw products off us, as its more cost effective for secondary processing of milk power to food, logs to timber, fish etc offshore.

Fonterra is selling its secondary production companies, says it all really, we cannot compete economically. This has been the case for a long time, but we have managed to mask the lack of productivity in our economy by the wealth created from the housing market, now the music has stopped and there are many holding the debt, that will not receive any reward.

The UK back in 1990 had a more diversified economy then NZ currently has, they still suffered a substantial housing slump with considerable negative equity. We will now see the same thing. We need to work out how to get through the current crisis as well as how we reform our economy to bounce out of recession, as I keep saying ..... the existing debt is not going away, and the service cost is going to constrain any investment in new growth initiatives.

https://www.newstatesman.com/thestaggers/2022/09/housing-crisis-negativ…

Those arguing we shouldn’t be too worried about a negative equity crisis now because we survived it in the early 1990s should consider how different the housing landscape is today. For a start, homes are much more expensive versus incomes than they were in the housing boom of the late 1980s. At the 1988 peak London homes cost an average of 5.5 times the average salary. At the moment it’s 11 times salary, meaning the relative amount of negative equity is much harder to pay off with wages or consumer debt.

The government was also encouraging lending with deposits of just 5 per cent until as recently as last year, leaving homeowners – especially young people who have only recently got on the housing ladder – with only tiny amounts of equity before they are wiped out and trapped. The rise of shared ownership schemes similarly locks people into their mortgages. We are staring a full-blown crisis for owners in the face.

Not sure about buying shares just yet, but yes agree we are probably near the bottom. I feel like the RBNZ have overshot again and we’ll see the OCR frantically lowered and another unsustainable boom coming. That is just one of the possible scenarios from here.

There have been a few commentators saying that the govt should counter cyclical spending. The Labour govt were doing it in part with Housing NZ build program. Now that the build program has been suspended the building contractors are moaning and also what will happen to the tradies who were possibly benefiting as well. I'd suggest that those who are involved from engineers to architects and the main building contractors saw an ideal opportunity to get their hands on lucrative govt contracts under Labour. Now that those builds in progress and the associated contracts are being examined in more detail the relevant parties are squealing.

This would be the right time for counter cyclical building. Unfortunately Labour had to do it at the worst possible time after the previous National government sat on their arse

Labour government housing spend timing was completely wrong. They we competing when resources were scare and driving up prices. There are numerous examples of this.

Hard to go cold turkey off the stimulus isn't it? Look at how many comments there are on every RBNZ announcement hoping they promise to just give us a little hit for Christmas...or maybe early next year. We just need to get through, just need to manage the economic withdrawal symptoms.

Our economy has for many decades run on net govt or bank stimulus of around 5% of GDP, which allows some wealth accumulation / savings, and GDP growth of 2% - 3%. So what does adjusting to no stimulus look like? It looks like a complete collapse because our economy is geared to move money to the rich rentiers as quickly as possible. But when the stimulus money isn't flowing into the economy, everything falls apart. The poor and the workers hand all their money to rentiers and then they riot.

I have a worker currently exploiting the system. Ongoing concussion symptoms. Continues to live an active lifestyle and trains at a semi pro level in his sport daily. Very hard to prove he is lying and no doctor would be willing on sending him back to a moderately physical job in case he falls off a ladder. Normally I’d be irate but I have no work for him when he returns. Just another example of the real level of unemployment going on in this country.

This is what I find so hilarious is people so ignorant of brain injuries they do not comprehend they happen to the brain and not to the rest of the body. Its like they are the ones severely incapable because brain injury is kinda in the name. Protip someone with a TBI & post concussion can still walk and do exercise, however they might often forget where they were every 10mins, have severe headaches, panic attacks, visual occlusions, could frequently pass out, and lose the ability to read and write for many years. I know several that lost the ability even to remember their own birth date, address or even how to spell their own name and that of family members. There are also significant effects if a person has had repeated concussions as it is well known that significant long term damage can occur with repeated concussion events and they take longer to recover from (this is also often very detectable in post mortems as well).

Also it is well known that ACC often denies the long term rehabilitation necessary for brain injury treatment and recovery. So many have to take more time to recover from effects as they are often doing it without the minimum medical support available in other countries (often doing it alone). Brain injury & severe concussion patients can still do usual exercise, eat and sleep to help general health but for the brain to repair connections and damage it often takes a longer time then bones to heal and is a much more gradual process. One dude took 3 years to recall the names of objects in a home & to be able to write for an hour. His hands would shake a lot in that time, he could not hold a spatula let alone the small drills or paint brushes he often previously would use. ACC provided zero rehabilitation support, just a short psych interview to assess the damage every 3 months (e.g. the whole remember 5 objects test, how to fit shapes together etc, which the dude frequently failed even 2 years later even though they started as a practical engineer & part time engineering lecturer).

That's a lot of 'reckons with not a lot of evidence.

You fink?

Your hearts in the right place, if this was the case with other staff members I would give them the benefit of the doubt. He's all over social media attending events, not competing but as support crew for athletes, under bright lights and with loud crowds. Continues to train at semi pro level. He’s clearly taking the piss and telling doctors what they want to hear.

Life sucks. Been on holiday in Europe for 4 weeks. All paid for.

Your point?

I think he's trying to make a singular counter point to the many negative comments. I know positive comments are not welcome on this site, but I guess he's entitled to share his experience as well, even if it's a positive one.

I wonder what type of chemistry he does?

Chemical sales.

It could be taken that he's been holiday having the time of his life for 4 weeks in sophisticated Europe not having to worry about money. But now has returned to winter in NZ and has to pay his own bills again, therefore "Life sucks"

Not a holiday of a lifetime. Plan to do more in the coming years.

You're such a weirdo if you think the way he has phrased it is positive ...

It is. I am mortgage free and have money to spend without borrowing. It can be done.

Maia Vieregg, a 26-year-old geologist, graduated university last year and struggled to find work in Wellington or elsewhere in the country. And when several conservative parties displaced New Zealand’s former progressive government at the last election, she felt “cynical and hopeless” about New Zealand’s future.

Well this is consistent with the reasons the young qualified engineers and data scientist leaving my industry have given.

https://www.theguardian.com/world/article/2024/jun/21/it-felt-like-bad-…

“And when several conservative parties displaced New Zealand’s former progressive government at the last election, she felt “cynical and hopeless” about New Zealand’s future.” - I knew this would happen!

Unless we put in place better controls to make housing affordable I expect both of my kids to live overseas and I guess at some point I’d go too.

This problem is going to take a long time to unwind if it’s even possible.

Wind Dti to 3x. Make specuvestment require tax paid cash...alot of it.

Where would they go though? Property is unaffordable everywhere across the anglosphere. All that you and the kids might end up doing is uprooting yourselves from your current home (NZ) unnecessarily.

Asia is the new economic and professional centre of the world.

I read that article this morning, and it did make me smile when I read their comment blaming our conservative government, before then mentioning that they'd taken a job at a mining company.

So she then takes up a job in the mining industry... sure she was for the "progressive" govt, nah she was in it for her own interest and work. If we had the mining jobs here that she could be employed in she would be in NZ. Her morals and ethics were nothing to do with the level of progressiveness in politics and more to do with where she could get the best wage for work (after all we still have an open casting call for the low wage work in elderly care support, hospitality, supermarket checkouts and agriculture she could easily have picked up work in at any time).

Well not all mining is un-"progressive". But sure, you keep gaslighting. I think we've had a decent insight into the type of person you are based on your 'if you go on a pilgrimage to Mecca and die due to extreme heat you deserved to die".

The Coalition is visionless and incompetent and is driving NZ into the ground in 2024.

They need to go.

You do realise that the momentum of the economy is driven by policy settings anywhere from 12 to 24 months previous due to lag time? So if you feel that the NZ economy is nosediving right now, you know who to blame. Unless you are being partisan about it, of course.

It's pretty clear the RBNZ got things terribly wrong through covid and up to now.

But why? Why has an organization that has been entrusted with vast powers that affect every New Zealander got it so wrong?

My view ...

- Trust in models based on unrepresentative data. I think they're using economic models that include data from 20+ years ago. You know, models that include periods where greater than 50% of households had mortgages, and large mortgages relative to income, which pollutes the results of the models. (That's just one example. There are many others. E.g. what those with no mortgages are doing with their savings and how banks are using them.)

- Trend analysis. Like the point above, I believe they are completely misreading how fast NZ Inc can adjust to many things it faces. Likewise, some things we are now adjusting to more slowly. Modern communications technologies have changed both what data we get, the mix, and it's frequency. (An example of this is the employer mindset change we've had due to the new government policies around employment matters. Anyone wanna bet we'll see unemployment rising far faster, and going higher, than the RBNZ anticipates?)

- Biased (i.e. political) economic theory. There appears to be a significant oversimplification in how inflation takes hold and how it should be quashed. And how quickly it needs to quashed. Their constant references to labor markets massively overstates it's influence. While their ignoring the effects of greedflation speaks volumes.

- Complete absence of 'what is different this time?' thinking. Covid responses both in NZ and around the world threw many new factors into the traditional mix. Alas, I see zero evidence that any of these new factors (e.g. household cash buffers, broken supply chain, etc.) have been understood by the RBNZ, or indeed factored into their thinking and/or planning.

- Fear of inflation. They're terrified of it. They failed by making it far worse with lax monetary policy. Now they overreact. Further, when current economic conditions fully justify loosening policy, they stay with it. Are they worried that the NZD will fall and we'll see more imported inflation? As Jfoe points out above - and most don't seem to know - capital flows have a far greater impact on NZ's FX rates. So long as there is demand for NZ's triple 'A' rated debt, our NZD won't be going down as much as many believe should monetary policy ease. (That said, it won't stay triple 'A' rated for long as the economy collapses and tax revenues plummet.) One should note that a flexible exchange rate can be a boon when fundamental economic adjustments must be made.

- They're taking being politically neutral to extremes. It is right and proper that a central bank presents its views on what effects government policy - and business behaviors, e.g. greedflation - will have and how a central is likely to respond. Likewise, it is right and proper for organizations to challenge what a central bank is doing, and especially, ask if there isn't a better way.

- Moribund thinking with no searching or discussion of new tools and their effects.

- Poor communication. Too many glib statements and too many poorly thought out presentations.

IMO It is hard not to conclude the recent actions of our central bank will go down in history in any terms except outright ridicule.

If you're a Reserve Banker your job is presumably secure and well paid with very little skin in the game. Unemployment, downsizing and business downturns are problems for everyone else.

Monetary policy is set by the Monetary Policy Committee (MPC) which has a few reserve bankers (too many?) as you say but there are also external members.

See: https://www.rbnz.govt.nz/about-us/our-people/monetary-policy-committee

The MPC is bound to provide a united front and individuals can not speak out if disagreements arise. I personally think that's sucky and would like to see detailed minutes even if the comments from individuals were anonymised. I'd also like to see far fewer reserve bankers on the MPC in favor of more (younger?) external members. (Having so many reserve bankers means 'group think' becomes far more likely and their roles should be as 'presenters of information' rather than as decision makers.) I also think the MPC needs more members, and from a broader sectional view of NZ.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.