I suspect we'll get away with it. This time.

The fact is, however, there are a number of worrying and unsatisfactory aspects to the current situation with "the New Zealand economy" - by which I mean our houses and mortgages.

For me, the Reserve Bank's latest, six monthly, Financial Stability Report (FSR), was a bit like a delayed-action bomb. The report carried more impact than it first appeared to.

The more I think about it, the more I think I'm pretty perturbed by the thought that around a quarter of our outstanding mortgages by value (about $87 billion-worth) were taken up by homeowners buying into the white-hot housing market of late-2020 to late-2021.

Add in to this state of unease the admission from RBNZ officials, after a fair bit of (surprisingly well-focused) probing from MPs, that the $87 billion-worth was not subjected to stress testing at interest rates now prevailing, and we've got quite a queasy-making sandwich.

Now, there's two not-good factors in play here. First up is that about $87 billion of mortgage money has been splashed on houses that are now worth less than was paid for them. Remember, according to REINZ figures house prices nationwide are down 17.5% from the November 2021 peak.

Secondly the ability of the people to service those mortgages has not been tested at current interest rates. So, while it's true to say that nobody will be facing interest costs 'much' more than they were tested for, the ability of at least some to pay and to manage is an unknown quantity.

The Reserve Bank is playing this down. But of course it would. It has caused the current situation with such a rapid rise in interest rates.

Essentially what we've had here is our central bank (along with others everywhere) being surprised at firstly the magnitude, then secondly the persistence, of inflation. That's necessitated hiking interest rates faster and further than originally intended. The speed with which interest rates have been increased has been unprecedented. And that was from historically low levels. It was always going to be a problematic situation.

All the current evidence is that people are managing - for now. There's no doubt a lot of people were able to save money during the pandemic (getting shut in your house for weeks on end will do that) and many people have been ahead of mortgage payments, largely due to how amazingly low interest rates were till late 2021.

The other hugely helpful factor is the almost non-existent unemployment, at just 3.4%. Even if a mortgage holder does get 'under water', with their mortgage exceeding the value of their house, as long as they can keep servicing the debt they are 'okay'. Albeit that it's not a situation I would wish on my worst enemy.

I'll make no predictions here about the immediate direction of house prices, other than to note two things:

One - inbound migration is soaring again (and people need places to live).

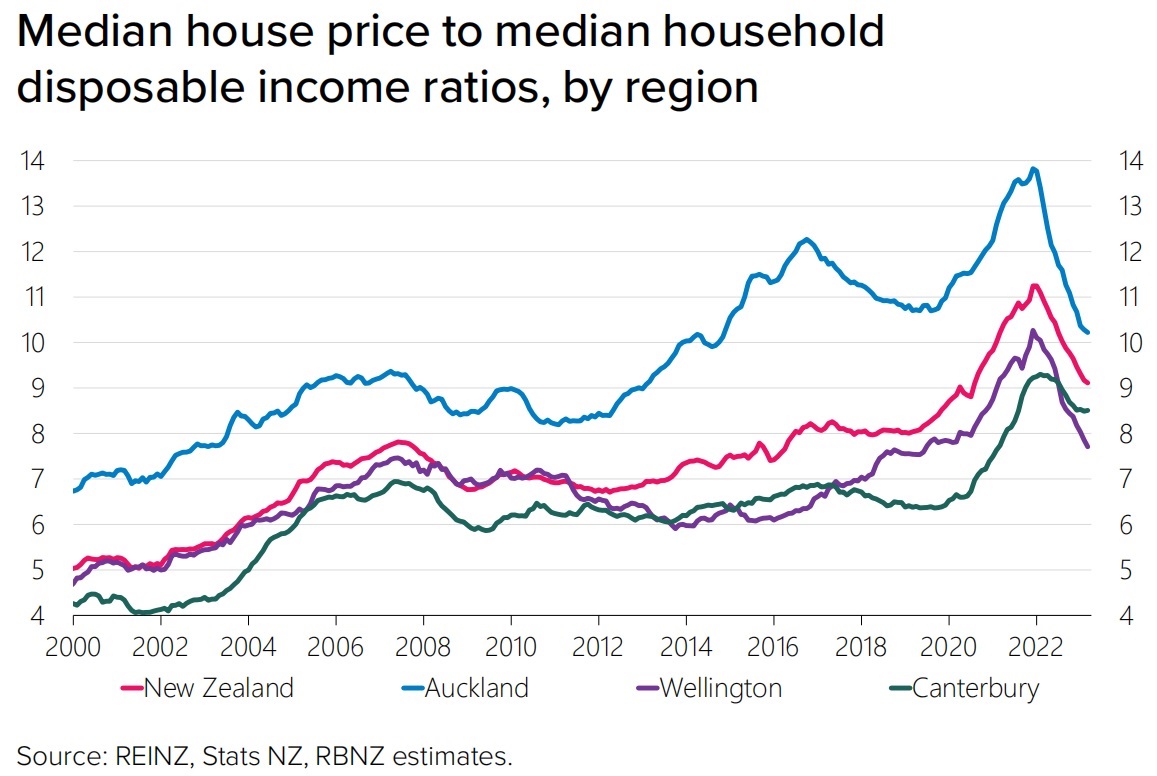

Two - data with that latest FSR from the RBNZ shows - to my surprise - that 'affordability' in Auckland as measured by how many times the house price exceeds household disposable income was as of March 2023 at its most favourable (IE lowest) level since all the way back in November 2014. That's right, by this measure Auckland houses are now the most 'affordable' they've been in nearly nine years.

Look, I don't think paying 10.2-times disposable income (which is what it was in Auckland as of March) is in any way 'cheap', but there may be a few people out there soon who start to think so. And Auckland always leads the NZ housing market. Watch this space.

All things considered then, I reckon we are (mostly) going to be 'okay' with our current housing and mortgage issues. We are going to get through. We are going to 'get away with it'. But that's probably going to be down to good luck rather than good judgement. That 40% pandemic-induced house price surge may not prove to be as damaging as it could have been.

I would say there need to be some extra safeguards in place for the future. It may well be that next year could finally see introduction of debt-to-income restrictions, a macro-prudential tool the RBNZ has been hankering after since 2016. These would obviously be a helpful backstop.

Earlier the RBNZ had looked at setting a 'test interest rate floor' for the banks, but ultimately decided against this. Well, actually, I don't see why we can't have both DTIs and 'test interest rate floors'.

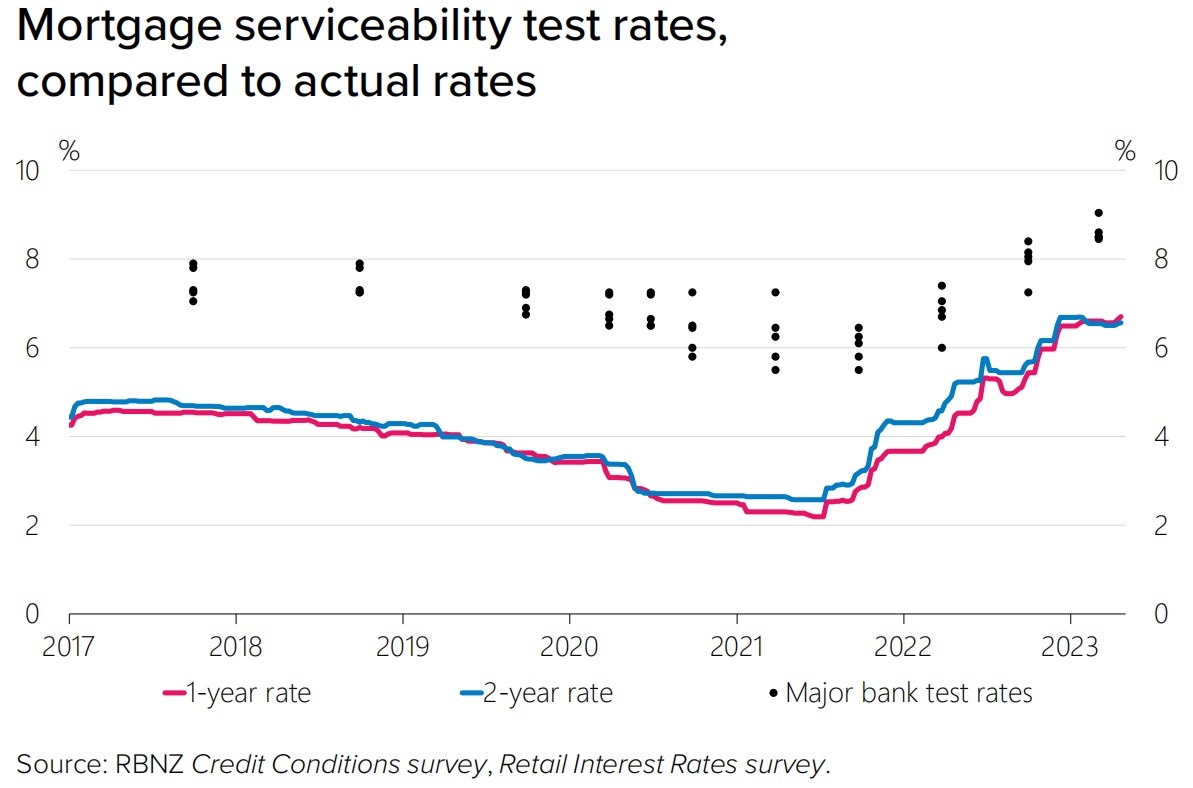

Remember, it is the fact that the setting of test interest rate levels (or stress-testing levels if you prefer) has been left to each of the banks' individual discretion that has led to the situation where 25% of the outstanding mortgage stock hasn't been stress tested at current interest rate levels.

Yes, as explained above our central bank along with all others around the world got caught out by inflation and has ramped up interest rates to an extent that was not anticipated in such a short period. But maybe the lesson is we need better safeguards around if the RBNZ has to move rates in such a precipitous manner again.

The latest RBNZ FSR document detailed the stress testing levels employed over recent years by the big five banks. And these have been very variable. For the record, this link outlines the situation as of last month.

A close look at the data that went into the graph above shows that at times the difference between the highest test rate and lowest test rate applied among those five banks has been as much as 1.8 percentage points. That's quite a difference. In March 2021 (when the housing market was ragingly hot) one of the big five banks (and the RBNZ doesn't disclose who is who) was testing customers on a rate of 5.5%, while another was testing customers at 7.3%.

The significance of that is that customers of the bank that tested at 5.5% are now facing rates well over a percentage point higher than they were tested on, while customers that were tested at 7.3% are below current rates - well, the 'special' rates anyway.

The test rates offered by individual banks have over time varied from anywhere between just 1.9 percentage points over current 'special' mortgage rates and 4.7 percentage points over. Big variance.

So, what about a uniform standard - and one that provides plenty of leeway for rising rates? I know the RBNZ has previously ruled it out, but reckon they should reconsider. And I reckon banks should have to test at least 4 percentage points over the current rates.

Then what about interest rates themselves, and what happens when they start coming down again? I here again put in a plug for the idea in recent RBNZ research about the central bank increasing interest rates to prevent house prices getting as out of whack as they have previously in this country.

These are just some ideas.

We really do need to be thinking about how we avoid large numbers of Kiwis putting themselves financially at risk in future. And we need to be thinking about that BEFORE the house market takes off again.

*This article was first published in our email for paying subscribers early on Thursday morning. See here for more details and how to subscribe.

140 Comments

How could there be another boom? Surely the current environment is a permanent change for all time.

It is kinda difficult, our institutions want to create compromise level mediums to offer security and stability. So benchmarks get set, and everything gravitates around those. But as we all should have learnt, everything's on a knife edge and can change at any point. There's a tendency for rates to be around a certain level, but they could be 0%, 5%, or 20%.

My prediction: our overlords will be expending most of their energy just holding things together through this period, and no significant lasting change will be sought or instigated.

Wevbought houses, to live in or as a bach, in 1999, 2002, 2008, and 2013. All were bought during downturns at well less than CV or previous sale prices. There are always busts, there are always booms.

Lol - I wouldn't classify any of the periods you list above as property downturns or busts.

We've essentially had 30 years of booming property prices (and falling interest rates) without experiencing a significant correction or crash (even during the GFC NZ managed to avoid significant falls).

The rate at which our house prices has risen without correction or crash is HIGHLY unusual. But confirmation and recency bias has caused people to think the last 30 years are 'normal' and not an anomaly.

I consider those times to be downturns... ( thou , I'm not sure about 2013 ) Sometimes aggregate statistics do not tell the full story.

When u look at our house price history, and consider Population growth, Monetary devaluation , our urban planning policies, and our pre-disposition for housing .... then I dont see the long term price trend as unusual...

I u look at city like Wanganui.... which was once prosperous...and then for years had population decline .... and now population growth... the trend has been different.

I'd say that the price for a house has probably been a better proxy for NZ monetary devaluation ... than the CPI has been..

Having said that.... When u consider that we are a debtor Nation and not ,at all , that wealthy.... there have been some really bad policy decisions, over a long period of time, that have lead us down this path to expensive housing relative to the average income.

( I'd suggest that one of the policies has been the the "inflation targeting policy framework" )

just my view.

Also... I share the same view as Ray Dalio, in that because of wealth inequality we kinda have 2 economies.... which aggregate statistics dont properly measure.. https://www.cnbc.com/2017/11/07/billionaire-ray-dalio-for-many-in-the-u…

boom, bust, boom, bust, boom, bubble, superimposed bubble, crash, pause, crash, stagnate, trepidation

How could there be another boom? Surely the current environment is a permanent change for all time

🤣😂🤣

Warren Buffet comes to mind buy when people are selling sell when people are buying.

Hard to believe that some banks are starting to believe that the housing market may have found a bottom. Perhaps they are ready to join the spruiker brigade?

It's unbridled self interest. If prices continue to fall much further the banks will be in trouble. We can't have that now can we?

It's ok.... Orr said the banks would divert their super profits to paper over the cracks to maintain their "social responsibility".

Tui billboard in the making...

Hard to believe that some banks are starting to believe that the housing market may have found a bottom. Perhaps they are ready to join the spruiker brigade?

says a DGM spruiker...

House price falls were pretty much universal in Western countries. The US has bottomed out apparently, as will everywhere else. There’ll be a boom, there’ll be a bust.

Brave call saying this is the bottom:

S&P/Case-Shiller U.S. National Home Price Index (CSUSHPINSA) | FRED | St. Louis Fed (stlouisfed.org)

Of course, you could be correct, but I wouldn't bet a mortgage or future financial well-being on it.

What these so called experts don't realise is it wasn't a boom, it was one of the biggest housing bubbles in the world. History shows that once bubbles pop it takes a long time (decades) to get anywhere near back to where it was (another bubble). House prices will stabilise at some point but will take many years before we see a recovery. 18 months ago all these experts were forecasting a 3% decline with a flat period of two to three years before another so called boom. The bubble has well and truly popped.

To me, that spike in 2022 in the price to income graph represents incredibly stupid behaviour where the bank of mum and dad and other undesirable sources of funding was used for deposits.

So I see that any correction now to affordability, is just going back to what it should have been in the last few years.

Not that that is necessarily a good affordability level.

Agreed. Debt based on fear and accessibility, all unsupported by income, is not reality. The distance back to yield making sense on most is a long way.

It's all been about tax free gain and income tax minimization. Without either, the stark reality and scale of this scam is startling. Exploitation of other kiwis for exceptional bank profit.

Blackrock and Vanguard, according to ChatGPT, are big share holders in Aussie banks and each other. They must be laughing at our stupidity.

It's all been about tax free gain and income tax minimization.

That's been present but that's not what it's all been about. People want to park or grow money somewhere. Savings accounts pay terribly and who can really trust listed companies? You can go start a business and potentially make a lot better return, but most people don't have the time or inclination for that.

For FHBs it's always the case that paying rent is dead money.

So those FHBs watching prices drop double the cost of their rent each week are making poor financial decisions?

No, they're wearing the consequences of a down market. If in 30 years time renters come out better off for not owning a house, then you could seem it a bad decision.

Especially in the short term, there are few guarantees.

Rather than paying relatively high amounts of interest to the bank (a.k.a. dead money) on an asset that is falling in price every month, I'd prefer raking in a neat amount of monthly interest on a comfortable deposit while paying pretty low rent (considering the monthly mortgage amount that the owner has to pay!). Paying rent at the moment gives us a really sweet deal.

Exactly, no one believes its a bubble at the time - as there are far too many vested interests pumping a narrative in MSM of why it’s going to keep going up

It’s not until after it pops that people look back and say "Maybe those tulips weren’t such a great idea as a store of value”

Have you seen the Miguel Index?

Turns out those green shoots the spruikers can see are just NZ fast approaching Ireland for falls

It wasn't that long ago that people would ridicule and laugh at anyone who suggested we 'could' repeat what happened in the US during the GFC.

I warned about this one many occasions, because having lived through that property crash, I could see the similarities unfolding here in NZ (actually it was in some respects much worse in NZ when you factor in the 2020-2021 insanity).

The most common responses when warning about such a risk were:

- you are a just a negative person aka a doom gloom merchant.

- you have no credibility because you've been talking about this risk for a few years and it hasn't happened yet (i.e. because you were wrong up to a certain point, this means you will always be wrong in the future).

And yet here we are - with around 2/3rds of the falls of the US during the GFC in nominal terms (and in inflation adjusted terms we've already crashed (similar/worse than US during the GFC) - people just don't know it yet)

Interestingly, we haven't even entered the recession bit yet when unemployment starts rising - and often in a bubble, this is when prices fall the most (while interest rates start dropping - even this often isn't enough to turn the momentum once it becomes full blooded fear of over paying and this because the common narrative within society).

FYI, house prices around the world that took a long time to recover to previous peak prices (if at all)

1) Japan - peaked in 1991 - still not recovered by 2022 https://fred.stlouisfed.org/series/QJPN628BIS

2) Bulgaria - peaked in 2008 - still not recovered in 2022.

https://tradingeconomics.com/bulgaria/housing-index

3) Croatia - peaked in 2008, recovered 12 years later in 2020

https://tradingeconomics.com/croatia/housing-index

4) Cyrpus - peaked in 2008 - still not recovered in 2022

https://tradingeconomics.com/cyprus/housing-index

5) Denmark - peaked in 2008, recovered in 2017 - 9 years later

https://tradingeconomics.com/denmark/housing-index

6) Estonia - peaked in 2008, recovered in 2017 / 2018

https://tradingeconomics.com/estonia/housing-index

7) Euro area - peaked in 2008 - recovered in 2017/2018

https://tradingeconomics.com/euro-area/housing-index

8) France - peaked in 2012 - recoevered in 2018

https://tradingeconomics.com/france/housing-index

9) Greece - peaked in 2009 - still way below in 2022

https://tradingeconomics.com/greece/housing-index

10) Hungary - peaked in 2008 - recovered in 2014

https://tradingeconomics.com/hungary/housing-index

11) Iceland - peaked in 2008 - recovered by 2013

https://tradingeconomics.com/iceland/housing-index

12) Ireland - peaked in 2007 - still not yet fully recovered by 2022

https://tradingeconomics.com/ireland/housing-index

13) Italy - peaked in 2011 - still under water in 2022

https://tradingeconomics.com/italy/housing-index

14) Latvia - peaked in 2008 - recovered 12 years later in 2020

https://tradingeconomics.com/latvia/housing-index

15) Lithuania - peaked in 2008 - recovered in 2019

https://tradingeconomics.com/lithuania/housing-index

16) Macedonia - peaked in 2009 - recovered in 2021

https://tradingeconomics.com/macedonia/housing-index

17) Montenegro - peaked in 2009 - still below peak in 2022

https://tradingeconomics.com/montenegro/housing-index

18) Netherlands - peaked in 2008 - recovered by 2018

https://tradingeconomics.com/netherlands/housing-index

19) Poland - peaked in 2011 - recovered by 2017

https://tradingeconomics.com/poland/housing-index

20) Portugal - peaked in 2011 - recovered by 2017

https://tradingeconomics.com/portugal/housing-index

21) Romania - peaked in 2009 - recovered in 2021

https://tradingeconomics.com/romania/housing-index

22) Slovakia - peaked in 2008 - recovered in 2018

https://tradingeconomics.com/slovakia/housing-index

23) Slovenia - peaked in 2008 - recovered in 2019

https://tradingeconomics.com/slovenia/housing-index

24) Spain - peaked in 2008 - still not recovered by 2022

https://tradingeconomics.com/spain/housing-index

25) Switzerland - peaked in 1990 - recovered 20 years later by 2010

https://tradingeconomics.com/switzerland/housing-index

26) United Kingdom - peaked in 2008 - recovered by 2015

https://tradingeconomics.com/united-kingdom/housing-index

27) United Kingdom - look at 1990 - 1999 period

28) Hong Kong - 1998 peak to recovery in 2011

https://tradingeconomics.com/hong-kong/housing-index

29) Singapore - peak in 2007 and recovered by 2010

https://tradingeconomics.com/singapore/housing-index

30) South Korea - 1990 peak and recovery in 2002

https://tradingeconomics.com/south-korea/housing-index

31) United States - peaked in 2007 - recovery by 2017

https://tradingeconomics.com/united-states/housing-index

The only potential difference from the above is that these are in nominal terms and that their bubbles didn't burst from a point of 0% central bank rates (but stand to be corrected)

Ireland has lost 15% to inflation (and accelerating) since 2008

Thanks so much for posting this, CN. Very valuable information.

Brilliant intel - thanks for posting

Looks like it there is plenty of precedent of crashes in economies far stronger than ours

And what was the interest rate falls in all those countries over that time? While the house prices may have 'recovered', is it that they rose again as interest rates dropped further? Where are they vs incomes?

Yes and the fact the US 10 year yield has reversed out of a 40 year downward trend recently, means that dropping interest rates to prevent a housing collapse may not be a viable option going forward for many nations around the world.

It was previously because the US 10 year yield was always trending down which was beneficial for assets/prices. Unless the US gets inflation under control, our housing market (and economy) could be facing years of headwinds. Who knows, we may now have 40 years of rising inflation/interest rates (similar to the 1940s - 1980's period).

Most of the assertion that we are nearing the bottom/green shoots are appearing/the next boom is coming soon are based on extrapolating today's data forward - a strategy that has worked well for the last 20 years. Right now we still have good employment and high spending. If this changes over the next 6-12 months then the picture will look very different.

Once unemployment starts increasing and number of jobs starts falling, immigration will also fall as very few will want to move to a country where you can't find work. Add in rising costs forever (driven by resource scarcity and climate impacts) and we as a nation will get poorer over time due to our trade deficit.

I can't see NZ prices getting above the previous peak in real terms for generations, if ever.

Surely the days of boom bust cycles are over? Surely Surely Surely!! It would make the RBNZ job way easier if everything was more linear and predictable. Use the DTI, it's a proven tool for preventing these erratic swings.

DTI, CGT and why the heck didnt they raise earlier if their target was higher unrmployment?

Evidence suggest otherwise It's a proven tool to not really do much.

If we can make covid an emergency money go round, we probably should get a lot more serious about actually solving housing supply.

First stop, focus on the action of supplying as much housing as is needed, not peripheral stuff.

Highlighting $87 billion of likely exposed and under pressure borrowing. The moment approaches.

Kaaaaaarrrkkkk.

That seems like a lot of money 💰 🤑

Think about how many properties that are used as mortgage security for that $87 billion.

Rather than permanent 'test rates', David, how about a "maximum initial term" that can't be more than 20 years? Of course the banks would hate it as they'd collect less interest but overall, kiwis would get wealthier, quicker, as a result.

Yes the increase in mortgage terms over the years has been another factor in house price increases. So has the increase in women with careers.

I can't see either of these being rolled back!

Will 7 houses luxon allow banks to offer 35, 40, hell even 50 year mortgages?...plus an advance on future kiwisaver to help hardworking first home buyers put a bigger deposit onto a house? Who would bet against that happening.

Why bother ever paying the principle? Just interest only forever and pass it on to your children then we can all be rich.

Hello Author, how much housing debt do you have on your balance sheet?

In this article, are you trying to convince yourself or others who took unreasonable amount of mortgage just because of their greed?

The housing market in NZ is no way sensible. No one should have to pay more than 10 times their income to buy a house. We need healthy family life in the country to have a better society. If all parents can do, is to worry about how to manage their mortgage on their highly leveraged houses and keep paying all their money to make the banks rich, then something is really wrong with it.

And your article trying to normalise this behaviour by saying that we will be alright is short-sighted.

This high income to debt ratio in a small country like ours is not good for long healthy run of society.

Right on the money - house prices have caused massive issues around the world and it was totally foreseeable. I remember discussing this with a finance person who shall rename nameless (but is extremely qualified) who was saying this bubble is really bad……about 5 years ago. It’s come a long way since then. At the time there were 950 quadrillion in derivatives around the world, adding to the problem. This could get really bad in nz, far worse then what even the most pessimistic person thinks…..as tends to happen with crashes.

One - inbound migration is soaring again (and people need places to live).

Amazing to see this same old water-cooler trope still being repeated.

People needing places to live does not affect house prices, unless those people are actively participating in the market and bidding those prices up. There are already plenty of people who need places to live in this country, but they're not contributing to our house price bubble by sleeping in their cars.

The second part of this argument usually goes that even if they aren't buying, they'll be renting, which will drive up rents and make property an attractive proposition for investors. But investors don't buy property for rental income. They buy for capital gains. Nobody is going to be investing in property for the rental income if there are no capital gains to be had.

If we do get another property boom after this one - which is far from guaranteed in any of our lifetimes - it'll be for the same reason we got this one; cheap credit, tax incentives, and loose monetary policy.

cheap credit, tax incentives, and loose monetary policy

Logical. Unfortunately greed is not.

I’ve been searching my financial history books, one on bubbles has an article which mirrors many of the articles I have read in NZ about immigration, lack of land blah blah and why houses only go up in value..…at the end of the article the date…..it was late 1800s from memory….just prior to a massive crash. When I get time I will find it, it could be published today and many people would nod in agreement.

The great Australian property crash of 1891?

It crops up frequently when the risks to the Australian financial system are talked about. A few major bank failures and Australians will suffer much more than they know e.g. pension fund balances take a haircut. Could this happen again? Absolutely. And in NZ? Absolutely.

The GFC was kicked off by 'sub-prime mortgages' being rolled up as prime and then sold as 'good safe investments'. The US banks and others pretended they had no idea how fragile these 'safe' assets were. Sorry, that's total b.s. All the insiders knew a slump in property prices - either instigated by the Fed raising i-rates, or a energy shock, or a government debt default, etc would cause the 'safety' of these assets to evaporate. But nobody said anything because the answer was always the same ... House price crashes wouldn't occur in the modern banking environment. Actually, it wasn't quite nobody that said anything. Buffet was crystal clear in his views. Why? He'd done the maths and run a few far-less-than-black-swan what-ifs and the numbers were clear. "Safe as houses"? Dumbest saying ever!

Has anyone run the numbers on the big NZ banks if house prices crash by 30%? 40%? 50%? In Australia they've started number crunching and the answers are far from pretty. This is one of my reasons to think the OCR will not go much higher and why it'll come down more quickly than many believe.

https://www.afr.com/wealth/the-great-australian-property-crash-of-1891-…

Well put and thank you for saving me the time.

you are quite correct about owning rental properties for the capital gain. We were talking to a friend the other day who has had a rental 12 years (it was inherited so no mortgage and hence interest) - he has rented it just below average market rent, did a renovation 2 years ago (new carpet, upgraded kitchen, new tiles in the bathroom) so he could charge above market rent. He banks the proceeds from the rent

He currently has a total of $70 000 in the bank from the property after tax. A total of $6000 a year on a $1 million property or a 0.6% return. He said if it wasn't for capital gains he would have sold it a long long time ago,

Well that has to be one of the most reality blind comments I've read for a while. Massive immigration isn't a driving force for property prices? Try firing up a property bubble with declining population.

Massive immigration is certainly a factor, but as I have said before the wealth characteristics of the immigrants is very important in terms of how significant a factor it is.

20 years ago our immigrants were generally much wealthier than they are today. And our house prices were much lower. Hence, immigration had much greater impact 20 years ago than it does today.

NZs population increased 25% (+1M) over the last 20 years.

The no of dwellings increased 33%.

https://figure.nz/chart/bOXOzYWW8RyIotwx

Indeed. A increase in population that was not campaigned on, or ever voted on. Aka no electoral mandate.

"Try firing up a property bubble with declining population"

Closed borders in 2020-2021 and yet 40% property price increase.

(but agree immigration is a factor in our property price increases in the longer term - but the most significant factor is ease of credit creation - our house prices have turned in near perfect inverted correlation to interest rate falls/rises).

Immigration is only a factor insofar as those people are bringing money with them to buy houses, or are able to access credit in order to do so. Population increase in and of itself is not a determining factor for house prices.

Well, interestingly, NZ's astounding 2020-2021 housing bubble formed while we had our slowest population growth in 30 years. This link is behind a pay wall, but the title says enough.

Sure it can be done.

1) stop building houses 2) drop interest rates to zero 3) watch house prices balloon, older people hold on to property due to value/income streams while the young must borrow many multiples to purchase (sound familiar?).

Try firing up a property bubble with massive immigration and tight lending conditions. Hell try having massive immigration if nobody can borrow to build houses to indirectly accommodate these new residents. Remember, these people need a roof before they can come over?

I think to say we “are going to be alright” is very premature. RBNZ have stated publicly they need unemployment to rise, we have had almost 20% house price declines with record low unemployment. What happens when the RBNZ get their wish?

Think everyone at rbnz would have their money om a messy outcome. But nobody is going to state that publically.

Best case houses drop just 50% but our country becomes even more unlivable from poor immigrants (needed to prop up prices but living 3 families to a rented house), brain drain to australia anf more cuts to already underfunded infrastructure and piblic services.

Bank profit drops...a lot, over leveraged specuvestors get wound up, and most of NZ rejoices at the fact houses and thus rent is much cheaper.

albert 2020..........'RBNZ have stated publicly they need unemployment to rise'

How about quoting your source! Employment is now required to be taken into account by RBNZ along with Inflation when setting the cash rate.

You have probably been listening to the likes of the big-bank economists who have no scruples about welcoming the emergence of higher unemployment as a reason for the RBNZ to lower the cash rate. Capitalism is predicated upon the fear of unemployment.....it is a necessary inclusion in the economists' tool box. The unemployed are the modern-day equivalents of those who were sacrificied in stone-age religious rituals. Human nature doesn't change. How can economists sleep at night?

The obvious answer is longer fixed terms, right? That puts the onus on banks to hedge rate risk, and they should be better at that than individuals. Theoretically. Expecting households to carry that risk seems quite mad, really - it’s Kiwi exceptionalism.

If housing isnt used to grow credit (for grow it must) what then is to be inflated?

Wages.

With what collateral?

HW2 will love this article. It will give him hope after experiencing the pain he is currently suffering as his house value (if he in fact has one) continues to drop.

As poor as a church mouse mate, not as lucky as your goodself having an e-bike. I make do with legs 11 to carry my valuable belongings between bridge lodgings

When I'm not here people miss me.... ahhh that's nice.

had to go check that this was not sponsored content -- lowest house sales in forever -- market dropping faster than other major world C shhh dotn say it - inflation rampant and showing no signs of significant drops -- interest rates their highest in 15 years and more raises to come

but here we are -- promoting the next housing boom -- Be Quick

Next Boom incoming , get on before youre left behind, be quick!

There will be a boom for sure - Prices will drop just 50% from their peak BUT THEN in the next 10 years they will go up a whopping 100% from the bottom (ìn marketer speak... 'the boom is almost upon us'!).

Ps.. math can do awesome things for marketers.

Now, there's two not-good factors in play here. First up is that about $87 billion of mortgage money has been splashed on houses that are now worth less than was paid for them. Remember, according to REINZ figures house prices nationwide are down 17.5% from the November 2021 peak. Secondly the ability of the people to service those mortgages has not been tested at current interest rates.

The ponzi based "wealth effect" racket promoted by the RBNZ

The Reserve Bank is playing this down. But of course it would. It has caused the current situation with such a rapid rise in interest rates.

Or could the problem have been the RBNZ dropping rates to the floor and giving the banks unnecessary funding with no directive as to where it should go?

We all read between the lines. They've s**t the bed and now they're having to clean it up in public for all to see. Shame the still deny they did anything wrong on a mass scale, otherwise Orr would be forced to leave

Where is IT GUY today

Is he awake yet. Or maybe still at the WAKE

After the 1987 crash then property 89-93 things where very restrained for quite some time, the banks really got burnt, BNZ needed two rescues.

And do you think the banks might have learned from their mistakes. Mistakes on the way up in mid 80s and the way down after 87.

They're now profiting more which is why they are in business.

"And do you think the banks might have learned from their mistakes. Mistakes on the way up in mid 80s and the way down after 87."

FYI, a bank that was founded in 1856 did not seem to learn from their mistakes over the last 166 years of business. The bank effectively got into trouble and the shareholder and debt holders were holding securities that were worth very little. The name of that bank is Credit Suisse.

All well said. Good opinion piece.

Can anyone advise how the test rates work?

Presumably it’s something like:

- assume current incomes

- input all household costs and outgoings

- calculate the mortgage at test rate

- see if income exceeds outgoings

What is the sensitivity on the final point? If income does not exceed outgoings at the higher test rate, does that mean a ‘no’ in terms of mortgage approval? Or is it more nuanced?

Just keen to understand better how the test rate works in practice.

There are recent changes to how it works

Government has another go at tweaking CCCFA - Good Returns

https://www.goodreturns.co.nz/article/976521584/government-has-another-…

Find a good broker

Thanks.

But my key question remains - what’s the sensitivity of income versus outgoings when the stress test is applied? Ie. The stress test is failed if outgoings exceed income? Or if outgoings exceed income by at least 10%? Etc etc

I imagine it's binary for most, it's either green or red. If they wanted a buffer, that would only apply to one side, in which case they may as well apply the buffer directly to the stress rate and that defeats the purpose. They _may_ have some sort of "10% of applicants within ~5% of stress rate at mortgages < 2DTI" or rather.

At some point they're making a call, yes or no. If they were to add 10% to income to cover expenses to make it work, it's easier to lower the stress rate on the other side of the equation. Suddenly, stress tests lower than long term averages. Mind boggling stuff.

Thx

Oh, is that why some of the banks were foolishly testing at 5.8% in 2021, and less than 12 months later you couldn't find a rate below 6%?

I have given up trying to understand banks, there used to be a clear formula to calculate servicing depending on risk appetite. Now banks apply in-house rules which they dont like to discuss with me as I am not at the coal face. I have had the most luck by using a decent broker

There are a lot of current borrowers including myself who would not qualify for mortgages. My view is that its easier to stay on the ladder than to try getting back on.

Hold up.

You have calculated your net position, gone to the bank and been declined? And yet still believed the market will magically turn around each successive month for the last 18months??

You dont understand how mortgage finance works though you're still opinionated on which direction the market is headed. Good luck with that

How many properties do you own

I have given up trying to understand banks

The number one driver for house prices right now is availability of credit, not my opinion. There are other factors, sure, but availability of credit is the leading one. My point is that you, with all of your investment properties and supposed hedging and equity, got declined credit as per your previous post.

So I am asking you, who can get credit? Where is the money coming from to turn this around? Where is the credit? The immigrant nurses? Engineers? Teachers? Bus drivers??

Show me the money and I'll believe you.

This just goes in circles and gets boring imo. You didn't answer my question, how many properties do you own.

You're right, we all are doomed to live in rentals

OTY

lot of current borrowers including myself who would not qualify for mortgages

If your banks is not talking to you and giving a clear indication of their thinking, then you are most likely either, don't owe them enough, or, they have you in the "we don't really want this customer" bracket. You show clear self realisation with your statement, yet based on the theme of all your posting you cannot see the down side possibility of ongoing inflation driving further rate increases. Increases that will ultimately end up with debt needing to be supported by income at those ever higher interest rates.

And what that means for price... Wow.

Yep - anyone who thinks the market is about to turn upwards should go to their bank and try and borrow money for an investment property

They will soon realise why prices are falling

I’m in the Bagrie camp - the falls don’t stop until investors return

And even if the bank would let you borrow today the numbers and risk return simply doesn’t stack up when you can get probably up to twice the level of return in a TD… that potentially is going to go even higher.

Think about it logically - if someone gave you $1m today would you really go out and put that down as a deposit on a rental?

The mortgage we borrowed on a major asset is now half of the original principal (note the correct spelling) amount. LVR of 11 percent of market capital value. Based on the original purchase price 13 years ago the yield is 25 percent return pa

Probably not as good as your numbers but good enough for me

even if the bank would let you borrow today.

Today. Not last decade. Or any other historical reference e.

"There are a lot of current borrowers including myself who would not qualify for mortgages"

But the market is fairly priced and will start climbing again very soon says wealthy landlord property investor.

Sounds like a tui billboard or headline to a satire article from The Onion.

One says wealthy landlord property investor, another questions whether or not said person owns a house.

Tui billboard

Interest rate increased are not linear but exponential. The impact of an increase from 2% to 6% is much less than the impact from 6% to 10%.

???

Mortgage repayments increase more when the mortgage rate changes from 6% to 10%, as compared to the same debt going from 2% to 6%.

The difference is significant but not huge.

Someones been asked not to write so many negative (realistic) articles about coming cluster ####!

Yes was thinking this when reading it. Comments have become almost entirely pessimistic of late, but that is to be expected at this stage of what appears to be unfolding.

I think you're in danger of doing in reverse what you accused others of doing in 2020 - 2021

According to you the market is only going in one direction DOWN

by HW2 | 12th May 23, 9:38am 1683841090

I think you're in danger of doing in reverse what you accused others of doing in 2020 - 2021

According to you the market is only going in one direction DOWN

Here is a test of your consistent criticism towards me HW2.

- I (Independent_Observer) agree that it is a POSSIBILITY that house prices COULD rise again in the next few years. Home ownership is a good thing and getting mortgage free before retirement is a critical thing to do for your financial security and well-being. Everyone should aspire to own their own home.

But do you have the ability to admit the opposite, equally true, statement? (that highlights the risk of buying leveraged property as opposed to the benefits).

- I (HW2) say it is a POSSIBILITY that house prices COULD continue to fall for the next few years. Buying at the wrong time could be very bad for your financial well being. History shows that property bubbles do appear around the world and when they deflate, they can have devastating consequences on individuals and the nations finances.

Both statements are factually true and I acknowledge both to be true.

And here's the problem - you only acknowledge one side to be factually true. And the other to be a lie.

Why? Because you have a financial vested interest which creates a bias that limits your thinking.

How can you ever see things clearly, and your thinking and views to be well rounded, if you chose only to see one side of two opposing, yet both factually true, positions? You can't. You have to accept that both are true. I accept that both of the statements above are true - do you think you can try to do the same?

I am happy for you to believe whatever you believe. There is a huge inconsistency in what you tell the 'other team' which I wanted to point out.

OTY

All you need to do HW2 is copy and paste this and your bias will magically disappear....it is a true statement so surely that can be so hard?

"I (HW2) say it is a POSSIBILITY that house prices COULD continue to fall for the next few years. Buying at the wrong time could be very bad for your financial well being. History shows that property bubbles do appear around the world and when they deflate, they can have devastating consequences on individuals and the nations finances"

And I will repeat for fairness and open and honest debate, that I believe property ownership is a very positive thing (for many reasons) and that house prices will eventually rise again.

Your turn HW2 to acknowledge that there is risk involved in leveraged property please to show your openness and fairness in this debate - and acknowledgement of factual statements.

I think his walkie talkie ran out of batteries.

Over And Out.

by HW2 | 12th May 23, 9:38am 1683841090

I think you're in danger of doing in reverse what you accused others of doing in 2020 - 2021

According to you the market is only going in one direction DOWN

The opposite being that I'm providing sage and prudent advice in a period of financial unknown, as opposed to promoting a risky asset bubble for my own financial gain?

Time for some positivity! The good coming from ‘the bad’:

- over the next 12-18 months there will be some buying opportunities for FHBs. Interest rates will be the main barrier however for many. But at some point they will lower

- some rebalancing of the economy. The key question is whether some of this rebalancing will last, or whether we will return to the same old nonsense. Maybe somewhere in between (probably hopium from me)

- a positive culture shock: property prices can fall in little ole NZ. A good lesson

- a platform for the next building surge (it won’t be a boom) is being established. Savvy developers will be buying sites at heavily reduced prices. Construction costs will subside over the next 12 months as construction slumps. There will be opportunities to restart a little development surge (much less than the recent boom) from perhaps early 2025, especially if interest rates drop by then. The big planning changes in Auckland should be finalised by then too which will also help

Your point around a culture shock is fairly sound imo. Slowly but surely the integrity of property influencers such as AC and TA is draining away, and people are beginning to see the advice for what it's worth; a paycheck. I follow along with their content purely to guage comments and responses. TA is getting an absolute battering on socials at the minute. People in this country do not understand the influences on property prices, and for a long time they relied on "experts", who are now looking just a little silly after being so consistently wrong for over a year.

I find this latest spout of "those waiting should stop waiting and pounce!" hilarious. It's like telling broke NZers to just buy more food if they're hungry. This is not a choice for a large portion of our population, prices are too high and incomes are too low. So back to fundamentals we head where things are easier to understand: we've gone for broke and lost.

I personally think FHB may still struggle due to the house price falls, not just the interest rate requirements.

I cannot see how it would be a good investment for a bank to lend money on a property that is declining more than principal payments, per year.

Anyone who hasn't paid at least 12% off their mortgage in the last year has gone backwards (in terms of paper equity for older mortgages, real equity for newer ones).

A real fix for this conundrum would be to legislate against longer mortgages. The real winners from longer mortgages are the banks. Sitting with a fixed monthly repayment, I compared a 15 year term to a 30 year term: doubling the length of the mortgage resulted in a ~33% increase in purchasing power, whilst generating 400% future interest payments to the bank (200% increase for twice as long).

Shorter loan terms, and higher interest rates would negate the need for a DTI (which is an ambulance-at-the-bottom-of-the-cliff).

Seems to me the only decent thing the Gov should do is help those buyers out and limit interest rates to 5% for the term of the mortgage.

They were very quick to throw all sorts of money at Contractors during covid and all happily accepted. Most say that was their best earning period ever. Additionally like I have said before, the covid bail out money that went to businesses continued to flow even when those businesses were far exceeding expected profits.

Whenever I bring this up people moan that they would not be bailed out if their investments tanked. That is fair, and such arrangements should not apply to those who purchased property as investments during this time. But please remember for a lot of these people a home is not an investment, it is a place to live, and they got shafted by the Government response and RBNZ's incompetence.

If you don't think we should help these people then I certainly hope you are not someone who benefitted from Covid bail out money...

Do you include property investors in this position?

No - read the post, I clearly exclude them

Apologies - my mistake.

F -- off!!!!

Feel free to donate personally yourself. I can direct you to some mortgage holders if you like.

I, just like most other Kiwis, donated to pay thousands into the bank accounts of business people, contractors and consultants through the covid relief fund. Even when they didn't need it.

How is it any different?

Test rate at 10% minimum, essentially removes the need for a DTI.

It would be interesting to see a breakdown of the immigration numbers. How many of these are students? or "low skill" workers. Are there really that many that would be in a position to buy an overpriced NZ home at these interest rates?

Roughly as many people leaving as they are arriving through our border, the difference in migration statistics is purely an "intention" to leave/stay. The status for long term emigrants is not known until they're gone for over a year, so the statistics are a mix of guesses and assumptions until they're over a year old and no longer immediately relevant. Great for spruiking though!

The answer to your question is ‘no’.

Apart from students, most of the immigrants are on low-middle or middle incomes. You can see the occupations in tables on the Stats NZ website.

For many, if they had homes in their home country (who knows what % of recent immigrants did), they won’t necessarily have much cash in hand, especially once they have paid relocation costs.

I have heard some horror stories of the crazy low prices that South Africans are having to sell their homes for before coming here.

I'd suggest there's a bank that has had their warning lights flashing for over a year now but they haven't been able to see them because the lights are the same colour as their branding.

Which bank had the highest DTI stats, lowest stress rates, an inquiry into risky lending standards last year and is only now stockpiling provisions for a rainy day?

Which Won I Wonder

This one? Sounds like Tupac but....

If monetary policy in terms of loan to income ratios, minimum deposit %, and/or unrealisticly low interest rates mean that taking on debt to gamble on increasing housing prices is a strategy that out performs any other form of investment, then why should we be surprised when people gravitate to this form of investment.

You cant complain about the effects while convienently ignoring the causes.

"You cant complain about the effects while convienently ignoring the causes"

We don't get to ignore the consequences though. And if they get bad enough, people will be fighting for change.

Might be a case of having to learn via personal/collective pain, as opposed to learning from the mistakes of other nations throughout history (which has been a large part of the point of my posts on here for a number of years).

As many commentators will know, I'm an advocate of the median multiple to give a snapshot as to how affordability or not a market is, or to put it another way, how dysfunctional or not it is.

But when you look at the multiple, you need to know a little about how it works, and what 'sins' it can hide.

1) Is that it is based on total household income, which used to be one income earner. Now it is two income earners per household or more. This distorts the multiple in favour of a lower multiple compared to past years, but in the present things are getting worse.

And 2), which is part of what the present stats. also show, is that many people are being forced into smaller and smaller homes, just to make them more affordable. This tends to also artificially lower or keep the multiple from rising as much as it should compared to past years and disguises the fact that the amenity value is falling.

The trend is still to 'shoe box in the middle o' road.' Or at least a tiny home.

As interest rates return to equilibrium, affordability will improve. Or more likely HPI will increase and offset the improvements.

You know where equilibrium is for the OCR, right? When it's above the CPI level.

Even if they get it back to 3% - in the target band - that leaves next to no room for mortgage rates to fall from here if, as this article suggest, we prepare for the future. And if the CPI goes back below 3% that's looming Deflation territory, and that will hammer the asset prices more than the servicing cost of the debt underpinning it.

"it's true to say that nobody will be facing interest costs 'much' more than they were tested for".

I'm not sure that's true and I'm not sure rates have peaked.

A couple of things.

"...our central bank along with all others around the world got caught out by inflation..." - this is an extremely poor characterisation of what happened. They decided to willingly ignore inflation for over a year, using each others "transitory" statements as their own justification for not raising. Call this what it is - they abrogated their responsibilities and completely mishandled the situation in what should be described as a shambolic decision leading us to the edge of financial disaster. This is very different from being "caught out" and it's past time we stopped describing it as such.

"But that's probably going to be down to good luck rather than good judgement" - correct. But the last word should read "management" rather than "judgement". And again it should read more like "But that's probably down to good luck, that the utter mismanagement of inflation by central banks as inflation started to rise, hasn't led us to financial calamity - yet. Though the ongoing banking crises in the US and others around the world could tip us over."

Unless.....what we have today was always part of The Plan?

Let's not forget 'they' spent a decade and more trying to create Inflation, to no avail. We didn't get negative German Bond yields for any other reason. Then the opportunity of the century came along - a probable bad flu season, and the rest fell conveniently in to place. Terrorised societies across the globe, kept from starvation and rioting by the creation of massive public debt, that went easily into the places where a lifetime of conditioning ensured where it went - asset prices, that 'always go up' and required higher incomes to service the Debt required to purchase them.

A bit like the Democrats getting Biden in ( "Who runs the US if Joe dies in the next term?"), the reality of what they'd done is only just playing out, and whatever trick they come up with next, let's hope it's not the Ultimate Solution (which is looking more likely as every newscast airs) - War.

Were your ears burning, just referenced something you said below lol

Agree with every part except where they chose to ignore inflation for over a year.

The remit is maintaining inflation within a target band, and they chose to exclude HPI from that figure and focus purely on CPI since forever ago.

I believe it was bw who commented within the last few days that inflation has been with us this whole time. Nobody cared because it made our houses look like a million bucks.

The reliable dependable broad property cycle tells us that the downside has 15 odd years to go in real money terms

But the biggest bust will occur when people finally realize that the climate crises is existential. When it is evident that we must scramble for survival - assets are valueless. "It won't happen" I hear. OK atmospheric CO2 is rising and worse CH3 is inexplicably rising and the ocean temp is accelerating and an El Nino is developing.

Just thinking out loud here- if you print money the amount of money available increases.(The value of money decreases at this point but is not obvious straight away) Things to buy do not increase in number so their value eventually increases. This "new" money enters the system by being "borrowed". Low interest rates in the years preceding lull the unexpecting into a false sense of security. This "new" money was drawn down by New Zealanders for, more or less, uncontrolled spending. Controlling what this "new" money was spent on was the crucial, all important step that was missed. The lending (the entry of this newly created money) should have been strictly controlled and channelled into productive expenditure first and foremost. By missing this step the RBNZ and the NZG took their hands off the steering wheel. We now have "inflation". Of course we do! To my way of thinking some control needs to come in NOW. Laws controlling borrowing/spending as opposed to using interest rate rises to do it. Channel money away from house buying etc and into productive assets/incentives but not by raising interest rates which snuffs out not just discretionary spending but necessary spending and hamstrings businesses / necessary productivity- but by laws governing what borrowed money can be spent on. This will stabilise things. People will be forced to delay their house buying etc and encouraged to save and buy in a more durable fashion. Those that have mortgages will be reprieved and given time to consolidate. Money will be diverted into productivity. Societies focus will shift from the individual to getting NZ on a firmer footing. My family and I farmed though the 80's, 90s and beyond. We were up to our eyeballs in debt. For decades the Bank Manager would make his yearly visit and say "we'll give you one more year". It was very stressful and I always felt a bit sorry for our kids. "Christmas is going to be a small this year."...they always remind me of this! However! As a result of these years they all quietly resolved to resist debt and today none of them have debt. They all have their own businesses. If I told you the name of one of them you would know it. So the hard times taught them some valuable lessons.

The problem is that we do have regulations to control debt, and those regulations work in favour of lending for housing because of the low risk associated with it.

Those stories of “small Christmas this year”, will be told in years to come by parents desperate to maintain a roof over their heads through the 20s.

I imagine many FHB watching this play out will be cautious of overloading in debt now and into the future. There is no longer a guarantee of capital gains, so load debt within your means.

I completely agree that we could turn this nation around by better planning around money allocation. That would likely require many more smaller banks lending to productive industries for risk of failure. To move forward, we need an actual risk to the bank.

Yes. That really is one of the main points- "To move forward, we need an actual risk to the bank."

Good post. Yes, regulation and laws could be used but you'd have a lot - sponsored by the richest - saying you were impinging on their "freedoms". Another option - perhaps more palatable - would be have different OCRs for different asset classes. That's been done before with varying degrees of success. E.g. China does this to some extent and their growth has been nothing short of exceptional.

Many rich people- especially if they are self made- have lived by the kind of regulations and laws I'm thinking of. This type of regulation is second nature to them.... they have become rich by working conscientiously, living within their means, delaying gratification, saving, investing and giving. They know the folly of borrowing for the fun stuff etc They never liked this sort of "freedom". Our poor younger population haven't been taught the fundamentals of money management. A responsible government should have firm guidelines in place making it difficult to be stupid. I imagine the rich would applaud this.

That graph certainly proves all the Labour liars wrong, who always try to blame high house prices on the nats.

Labour normally spend like made and cause conditions for house prices to go ballistic, just general bad management of the economy whenever they are in power.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.