A lot still rides on the next set of inflation figures to be released in the coming week.

And yes, that's the case even though the Reserve Bank (RBNZ) effectively declared victory against the inflation beast when making a double-cut to the Official Cash Rate (OCR) on Wednesday, October 9.

The RBNZ did all this of course before being in receipt of the latest official inflation figures. The figures for the September quarter, as measured by the Consumers Price Index (CPI), are due to be released by Statistics NZ on Wednesday, October 9.

As we might imagine from the RBNZ's confidence, the CPI figures are expected to be 'good'. But how good? More to the point - will they be 'good enough' in the fine detail for the RBNZ? It's some of the detail in the figures that could yet have a significant impact on the future path of the OCR and particularly the speed of future cuts.

And so while the RBNZ has now started to reduce interest rates, in the expectation that inflation has been 'tamed', our central bank will nevertheless want to see the firm evidence that inflation really is on the run. In some aspects, I certainly think there's still more evidence needed, particularly in regard to the sustainability of low rates of inflation.

To some extent the RBNZ has arguably claimed victory in expectation of inflation drops - rather than necessarily seeing the hard details. The figures coming out on Wednesday are the first official CPI figures since the RBNZ began cutting the OCR, with the previous CPI figures for the June quarter having been released in July.

So far the RBNZ has already, since August, dropped the OCR by 75 basis points from the 5.50% peak to 4.75% currently.

The market wants action

The 'market' wants to see the OCR cut very quickly from its recent highs and is egging the RBNZ on - but if the actual rate of inflation disappoints, then the RBNZ may yet not move rates in quite the way the market anticipates. And the market could be disappointed.

Following the October 9 OCR cuts the financial markets were fully pricing in another 50 bps of cuts in the final OCR review for the year on November 27, while there's seen as a 50-50 chance that the first OCR decision of 2025 in late February will also be a double-cut.

So, those inflation figures...

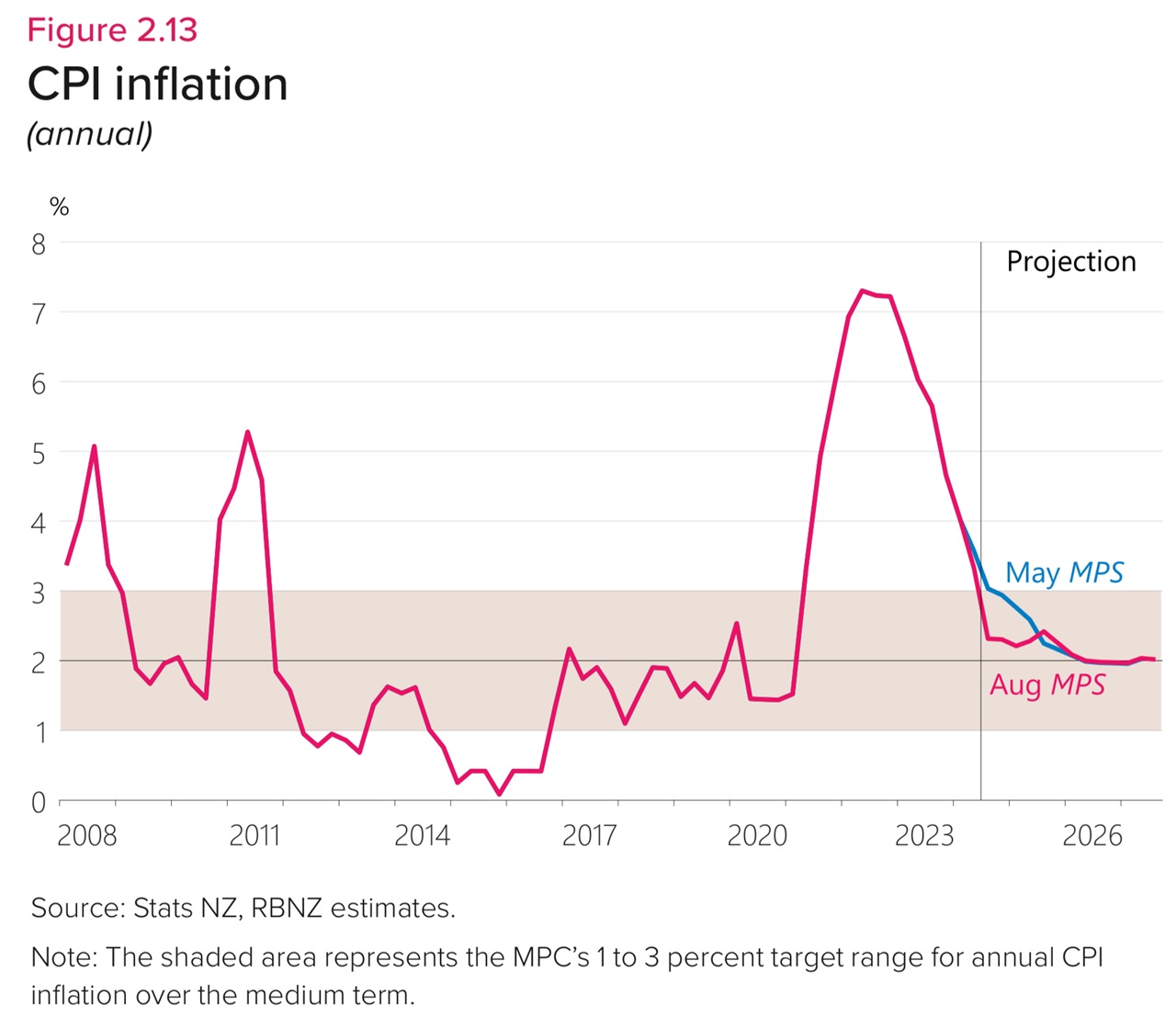

The June quarter 2024 CPI figures, released in July, showed the rate of annual inflation slowing to 3.3% from 4.0% in the March quarter.

It's universally expected that the September quarter figures are going to show an annual inflation figure of under 3%.

This means that we'll have an inflation rate inside the 1% to 3% target for the first time since the March quarter of 2021. It's been a long time. Remember that in June 2022 the annual inflation rate actually got as high as 7.3% and it made its way back down only slowly at first. (The graphs with this article are sourced from the RBNZ's August Monetary Policy Statement).

In its August Monetary Policy Statement (MPS) the RBNZ forecast that the September quarter CPI would show annual inflation falling to 2.3%.

Recent second-tier economic data, including the monthly Selected Price Indexes containing items that make up about 45% of the CPI, have suggested that 2.3% could indeed be about where the CPI reading will land, and maybe even lower. If the actual figure does come in at that level it means we won't be far off getting to the 2.0% figure the RBNZ explicitly targets achieving within that 1% to 3% range.

So does this mean it is all go for more OCR cuts then?

Well, yes. But the pace of the cuts could still be affected.

There's three ways this can all go when the CPI figures are released on Wednesday:

1. The CPI figures are about what was expected so the RBNZ proceeds with cutting the OCR at its own pace - which likely will indeed include at least one more 50 basis point cut, in the final OCR review for the year late next month.

2. The CPI figures are lower than expected, opening up the prospect for even more rapid-fire OCR cuts. The financial markets are ALL FOR this scenario, in which perhaps we could see the OCR chopped back to just 3.75% by February 2025.

3. The CPI figures 'surprise on the upside'. This would be the proverbial spanner in the works. It's not the expected scenario. But then, spanners in the works are never expected.

The composition of the inflation figures will be important.

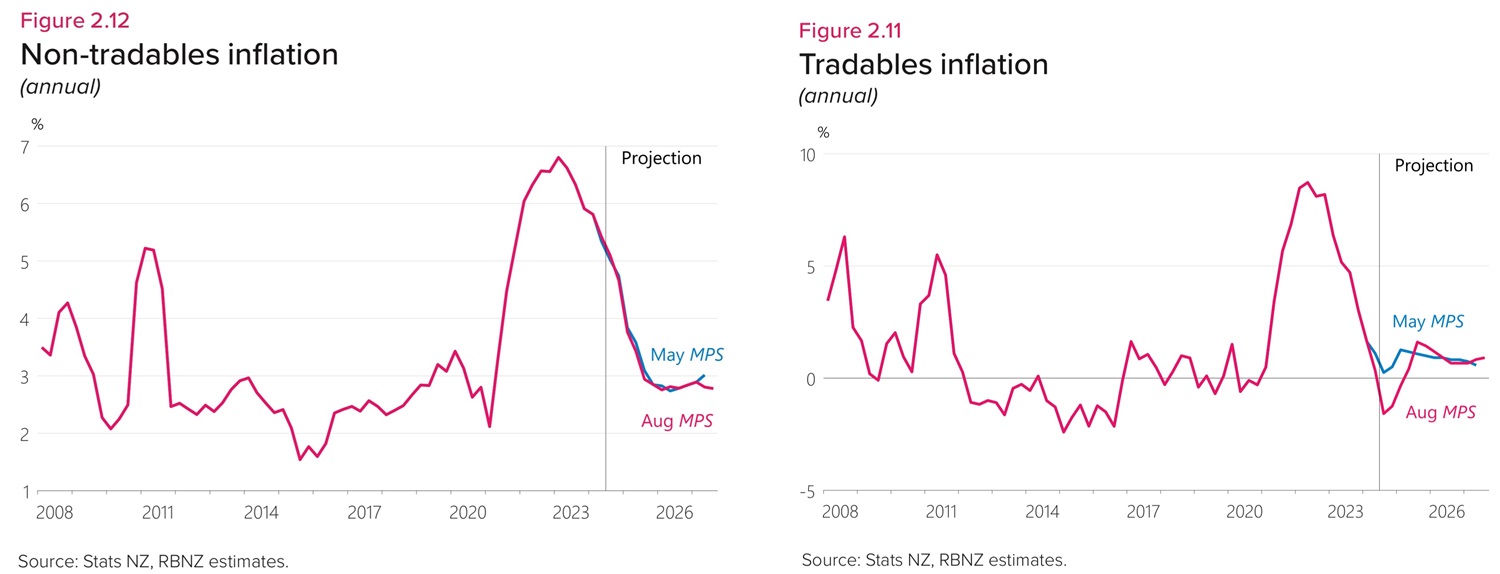

In its August MPS forecasts the RBNZ was picking that the annual rate of overseas-generated, so-called 'tradables' inflation (think things like oil prices) would be -1.6%. So, we are expected to be getting a great helping hand from reductions in the cost of overseas goods. This is actually not so untypical of what we saw at times in the pre-Covid period, when we were often importing DEFLATION. Very handy.

However, we do know that domestically-generated, so-called 'non-tradables' inflation has been much slower to fall. And this is the one that the RBNZ worries about - because this is the figure it can do something to influence through its use of the OCR.

So, the RBNZ's pick for the annual rate of non-tradables inflation as of the September quarter was 5.1%, down from 5.4% in the June quarter. The figure's expected to be still elevated, but finally coming down.

The RBNZ's obviously getting comfort from the fact that falling overseas-sourced inflation is dropping so much. But it DOES need to see definitive evidence that domestic inflation pressures are easing.

It's fair to say there's a lot of anecdotal evidence to suggest that domestic inflation is about to collapse, but it's not yet made its way into the official figures - which is why this coming Wednesday's figures are so important.

On the anecdotal evidence side, two much-watched business opinion surveys came out recently.

The NZIER Quarterly Survey of Business Opinion showed weak pricing pressures among Kiwi businesses. But it's worth mentioning, very worth mentioning, that the pricing intentions measure is just for three months ahead.

ANZ's latest Business Outlook Survey, which likewise painted a gloomy picture of the here and now did show a blip up in expectations of the future - in a 12-month timeframe.

As long as inflation still returns...

As ANZ chief economist Sharon Zollner commented at the time, there is a risk that the economy’s response to lower interest rates could be "more vigorous" than is generally expected. She said that would be good news - as long as inflation still returns sustainably to target.

Yes, that's right. As long as inflation still returns sustainably to target.

What's the ideal scenario for the RBNZ from the inflation figures out in this coming week, then?

Well, a 'headline' annual inflation rate as close to the targeted 2% 'midpoint' of the 1% to 3% range as possible would be very encouraging. And if that's combined with a 'non-tradables' annual inflation rate of lower than the 5.1% the RBNZ predicted then the CPI figures will indeed be a win-win for the the central bank.

That's all eminently possible.

And if it does pan out like that then we can expect to see the RBNZ continue to aggressively take the OCR down to what's considered a more 'neutral' level, which these days bank economists reckon could be anywhere between about 3% and 4% depending how you calculate 'neutral' and over what timeframe.

What the RBNZ will definitely not want to risk, having put us through a recession in order to tame inflation, is seeing some still-glowing embers of inflation reignite again.

Consumer prices index

Select chart tabs

*This article was first published in our email for paying subscribers early on Friday morning. See here for more details and how to subscribe.

97 Comments

Government ain't spending so no risk/harm in cutting.

The Govt continues to spend far too much & ignores the trajectory

https://www.stuff.co.nz/politics/350448464/damien-grant-nicola-willis-n…

Govt deficit spending at $19bn last year, net bank lending at $14bn. This was *required* because our current account deficit blew out to nearly $30bn (and the aussie banks have to make billions of profit). Here's how the money tree shook down.

We're not importing more stuff, but the price of the goods and services we import has gone up a lot. Compare 2019Q1 to 2024Q2:

- imported goods prices are up 25%

- oil price is up 35% so NZ diesel is up 35% (both have come down a bit in Q4)

- imported services prices are up a whopping 40% (tech, software, travel, business services etc)

The fact that our CPI has gone up 25% over the same period should hardly be a surprise. NZ is adjusting to a new global price level. We're just making a drama out of it.

Our economy is on its knees because Govt deficit spending + net bank lending are not currently high enough to overcome the current account deficit and bank profits. Something has to give. I don't know about you, but I would rather we had a plan other than (a) hope the housing ponzi kicks off, and, if not, (b) crash the economy.

Expressed with such charity. Much thanks yet again Jfoe.

All well and true, but Im all ears about what plan you suggest will sit comfortably between

- More Govt deficit spending is needed

- Govt spending is too high (as per linked article above)

The reality is we are living beyond our means. What will give is our living standard.

Looking increasingly like the posters here that were predicting tanking property prices until 2030 are gonna be eating humble pie.

The correction has 30% to go

Lol, and I'm the virgin Mary.

Humble pie is off the menu, except maybe, for Winging It property Gamblers.

The NZ PROPERTY MARKET IS NOW DROPPED OVER -40% in real terms, in many large cities, and this Crash Rate, is now spreading these major falls, into the regions.

We will see -45 to -60 Falls nationwide.........and more for soggy swamplands.

Inflation to ReFlare bigtime in 2025 (Deglobalization/Reshoring, New and Forever wars, High Energy costs) and that goes with more mortgage rates rises.,.....

Looking forward to the next .5% interest rate review on Nov 27th?

According to Opes Partners, Auckland property prices appear to be 9.3% undervalued.

I think its almost guaranteed Wingman but my prediction of 100bps by Feb still stands but it could be complete by November. The housing market is already picking up again.

"Opes Partners is a New Zealand-based property investment and advisory firm. They specialise in helping Kiwis build wealth through property investments."

No vested self interests there eh Wingman?

Most of Opes Partners' post is fact....what's happened to the market. They base their prediction on the fact that Auckland is down the most.

ALL the major banks in NZ are predicting higher property prices in NZ next year.....do they have vested interests? The banks are going to look pretty stupid if they've all got it wrong.

"ALL the major banks in NZ are predicting higher property prices in NZ next year.....do they have vested interests?"

Do you even think about what you post? Its not like banks make significant revenue from mortgage lending is it? SMH.....

Of course I do.

What will happen at management level if all these predictions by major banks are wrong? They don't pull numbers out of a hat you know.

by wingman | 13th Oct 24, 10:30am 1728768633

What will happen at management level if all these predictions by major banks are wrong? They don't pull numbers out of a hat you know.

I feel like old man yells at clouds is in full effect here.....

Banks make bank off mortgages - higher prices mean more debt, more interest, more cash for them. Of course they’re predicting a rise, it’s in their best interest. And if they’re wrong? They’ve already locked people in.

You're a full-on conspiracy theorist, you probably even 'stack' gold bars.

The notion that all the major banks here and in Australia are predicting higher property prices so they can benefit from mortgage sales is very, very eccentric.

Conspiracy? Banks do profit from mortgages plain and simple it’s not eccentric, it’s reality. They push the narrative that suits them. If you think they’re only driven by public service you are a special man indeed.

I hope you get the help you need.....

Every bank is predicting higher property prices next year, but a poster with a history of getting it wrong reckons on this occasion he's got it right.

Latest bank NZ property forecasts for 2025...

ASB +10.9%, BNZ +6.9%, Westpac +6.4%, RBNZ +4.8%, ANZ +4.5%.

Median +6.4%, Average +6.7%

Auckland house prices bounced back last month. Dream on about the great kiwi property crash, smart people have bought in the last year.

"Auckland's average property prices are re-approaching the $1 million mark after dropping below it for the first time in four years in August."

https://www.1news.co.nz/2024/10/08/property-prices-bounced-back-last-mo…

Conveniently you've snipped the one sentence out of the article that omits any mention of "asking" prices, which was what the whole article is about.

The average asking price for a property nationally in September was $823,550 — a 0.6% increase from August and the first time since March prices saw a month-on-month increase.

Although, give you credit. REINZ HPI has AKL up 1% on the month which effectively unwinds the 1% down on the past 3 months. Rodney is up 0.2% after being down 3.4% for 3 months.

The complete conspiracy theorist, a man who is scared of his own shadow calling someone a full on conspiracy theorist. That’s the pot calling the kettle black.

From one property investor to another, banks are only out for themselves and their shareholders. You have surprisingly naïve views

Do you still believe in Santa?

Haha do the banks have a vested interest? - gee sometimes you surprise me with your naivety.

@wingman - "The banks are going to look pretty stupid if they've all got it wrong. "

Do you mean like a couple of years ago when they were all telling us that low interest rates are here to stay, era of the "New normal" etc.?

Moral of that statement - never go "all in" on what the banks (or anyone for that matter) predict. Things can spectacularly turn around, especially in today's precarious world with a very real possibility of escalating wars or other inflation-causing events.

The banks were looking pretty stupid when they had to ratchet their test rates from < 6% all the way to over 9% within 6 months, resulting in a bunch of their new mortgages refixing 12 months later at rates higher than they were tested at.

Yes they would say that as a property sprucking pair of charlatans - inreply to Wingman

@NZG, another 5-10% in real terms on house prices is a fair maybe, will take a few months for sentiment to turn into activity.

The "reflare"...I'm not so sold on what you've said, and if it is the case then I'm not sure that mortgage rate rises will be the fix to global issues assuming our domestic economy is only fumbling along? I think they could try to look through some of that, maybe if oil totally shits the bed could be different.

However...domestic inflation could go gang busters in a few years after they've slashed mortgage rates and removed lending restrictions in a desperate play to ignite our economy with the one trusty fix they know will quickly give NZ Inc a hit...wealth effect via house prices 🤔...then I'll share a beer with you and we'll agree that they'll need to raise rates again! 😂

As soon as the house sales pick back up, the prices will too. There is a feedback loop here of course, but FOMO is going to drive sales numbers and prices up over the next 12 months despite the depressed economy. The same happened in 2009 - house prices rose with unemployment, then a little fallback, then the whole ponzi was back on. You can see this really clearly here...

Maybe.

But while Prince Key & Co tinkered with planning rules during his reign, no substantial changes were made. Ergo, houses still got built, including far too many McMansions, but little got built where it was needed (although renovators in these areas coined lovely un-taxed capital gains), all of which drove averages up.

I see the post-2016 world looking quite different as it facilitates the building of less expensive dwellings in areas where people want to live, which will keep averages down.

fingers crossed

‘While Prince Key & Co tinkered with planning rules’

In fact, they mandated the Auckland Unitary Plan through legislation, oversaw its process, and submitted heavily on it through their agencies, on the lame and insufficient version prepared and notified by Auckland Council in 2013.

The Key government thus initiated and realised arguably the largest urban planning transformation in this country’s history.

They also introduced the NPS-UDC in 2016, a major step forward in terms of urban planning.

There are many things I didn’t like about Key and his governments, but he most certainly undertook huge initiatives on urban planning.

Compare that to Helen Clark’s government who did zilch wrt planning rules from 1999-2008, despite the fact that it was becoming obvious by 2003/2004 that planning was a major part of NZ’s housing problem.

Read this earlier, thought you might be interested...

https://www.ucl.ac.uk/bartlett/public-purpose/publications/2024/oct/dem…

Thanks, looks good and will have a read

edit: just had a quick skim. Who would have thought - demand side measures are just as important if not more so than supply side measures!

Hence why some people are vocal in their support of reforming of our woeful tax system. ;-)

and in addition to that, some people also advocate for an immigration pause/reduction to reduce demand.

Did you read the paper JFoe posted? (Josh, the author, is no fool. He's written a few books that are well worth a read.)

I'm not sure that such changes to immigration settings would stop residential property from remaining an investment class for 'investors' and a huge source of profits for the financial industry.

I'm not sure that such changes to immigration settings would stop residential property from remaining an investment class for 'investors' and a huge source of profits for the financial industry.

I agree - which is why I never said anything like it. What I did point out is another way to reduce demand and therefore pressures on house prices and rents.

I read the Exec Summary and took particular pleasure in these couple of points as I've advocated for them previously so I must be in good company by your high praise of the author:

Housing has two economic functions. It is a consumption good – it provides shelter – but also an investment.

An annual property tax could be introduced, replacing Council Tax and Stamp Duty, that would considerably reduce investor demand for housing and free up potentially hundreds of thousands of properties to better meet housing needs.

Indeed. The trouble with the whole supply and demand analysis is that it misses a critical varable - time. In NZ, the housing market is not allowed to stabilise because RBNZ keep fiddling with the cost of credit, which means demand peaks and troughs. So, some quarters we have 15,000 house sales and some quarters we have 35,000! Have a look.

So, what level of supply would be needed to satiate the needs of this pulsing mess of a market when it is in full flow? You get similar effects in rental markets of course - student changeover month is a classic in many student cities.

Agreed. Our RBNZ's interventions are far too heavy handed, and seldom pre-emptive. But they're only part of the problem!

jfoe,

I have saved it and will read it later. The market must have changed since I left 21 years ago. I spent my life in the financial world-primarily with pension schemes-and I didn't know many people who were involved in property as an investment. As a broad generalisation, clients and friends were more comfortable in the stockmarket than property, while here, I found it to be the reverse. As you will know, the UK has a long-established CGT and has stamp duty, while also operating an Inheritance Tax.

HM, You've presented that Auckland Council revisionist history previously. And I have responded. Suffice to say, the conservative Ex-National MP Mayor, John Banks was tossed out in 2010 and the Council composition has moved from Conservative to Progressive ever since (up until recently). With regards the NPS-UD, most of the work for the NPS-UD was performed by the 2010 ACT party inspired Productivity Commission (copied from the Australian one, and now dead thanks to this government). The progressives among all political parties picked this up, likewise did the progressives within Local government and academia who contributed to the Productivity Commission's work. (The government of the day largely sat on their work until the last minute.) I agrees that Clark's government didn't do anything like enough. But to suggest "planning was a major part of NZ’s housing problem" was only "becoming obvious by 2003/2004" is more revisionist history as these problems go way back, e.g. when central government was forced to step in in the 70s, and before. Local Governments become infested with conservatives protecting their patch, and it's always been that way.

Re: JFoe, Private Balance sheets where very different back they and high property prices were accompanied with 8% mortgage rates. Lots of drives but some are a bit different now.

The bounce back in 2009 was when OCR was about 2.5% and household debt was at around 90% of GDP (same as now). The bounce back was imho was caused by pent up demand and FOMO.

It's not so much prices as it is product. In Auckland especially most new stock will be apartments and town houses. They're getting more efficient at delivering these. The prices of the housing unit will follow usual factors of supply, demand, and a abilty to pay. But people will mostly be purchasing a box, and house with land will be a big premium.

Don't get me wrong, I've happily lived in some well built apartments in my life.

RBNZ has stuffed the economy much more severely than it realises. And there are still people today fixing their mortgages at high, constrictionary rates. So, the problem is worse than they know, and still getting worse.

They are going to have to cut rates by more than they think.

Question is, would the RB have cut by 50 last Wednesday if they weren't 99% certain inflation will come in well within range this week?

Cutting by 50 suggests to me that they're now concerned that low inflation might become a problem.

Or.....

Did they cut by 0.5% last week because they know that it was going to be the last chance they would get, to lower rates, before they have to start raising them again?

Across the World, we see the same remedy to what ails us - print more Debt. We know how that ends - tear away price rises for the necessities of Life. And the same remedy that we've just had a glimpse of, higher % rates, is the consequence.

eg: "China will “significantly increase” government debt...Finance Minister Lan Fo’an said there was “more room” for the central government to issue additional debt and signalled there would be further “counter-cyclical measures” later this year." (AFR, this morning)

"(UK Chancellor) Rachel Reeves should ignore dogmas around debt..." (Telegraph, this morning)

"America’s avalanche of public debt is putting the nation at a fiscal tipping point..The national debt will only continue to grow "

https://www.barrons.com/articles/national-debt-trump-harris-deficit-5b6…

Exhibit A: gold price doubled last 5 years

And where did it close against the NZ$ on Friday night? Yep. Another all time high.

Gold's a terrible long-term bet.

It has its moments followed by tremendous implosions. A dud with no dividend, extortionate buy/sell premiums and storage and insurance costs. That's if you can insure it.

Across millennia, it has two enduring qualities, (1) it's portable and (2) even in times of crisis there is always an immediate buyer - the opposite of assets that are tethered to one place and one set of market participants. It's not about 'making money' as such. It's the ultimate insurance policy. And its price rising tells us that a lot of insurance is being taken out against something, unexpected.

eg: When a trillion Zimbabwe dollars couldn't buy you a loaf of bread because no one wanted the worthless paper Debt, bakers would take gold scrapings for that loaf.

The fact that it's portable is irrelevant in 2024. It's easily located by sniffer dogs and X-rays at borders.

When there's a financial crisis, the last thing people need is a chunk of gold - they need a roof over their head, clean water, food, transport and security. During WW2, the most destructive conflict in history, gold declined in inflation-adjusted terms.

Goldbugs always wheel out the 'Zimbabwe scenario', but NZ isn't Zimbabwe. The monetary crisis in Zimbabwe was caused by economic and political vandalism, US dollars would have been a better bet, more liquid and easily transportable.

Zimbabwe had plenty of gold, they still do but its doesn't matter what you have when you have massive corruption, only a few get rich.

"NZ isn't Zimbabwe". No. Neither was Zimbabwe. It was one of the wealthiest places on the planet pre Independence. "Southern Rhodesia experienced a degree of economic expansion and industrialisation unrivalled in Africa. Its natural abundance of mineral wealth contributed to the high rate of economic growth."

they need a roof over their head, clean water, food, transport and security

Spot on, I'd even say that is the case at all times. I just wish there was a political party that would have this as their reason for existence.

Couldn’t agree with you less on this wingman . Gold is a speculation asset , if your holding gold long term i would say it would be a small percentage of your total assets or you just can’t be bothered figuring out when to buy and when to sell.

we have lost around 25% of purchasing power in nz in the last 4-5 years ,any currency that loses this amount will decline against gold . The disinflation period is the best time for gold( we are still in that period) , as soon as your purchasing power starts to return that’s the sell time in my opinion . You don’t want to hold gold through a deflationary or liquidity crises period .

Why would I own a gold bar when there's a multitude of other liquid ways of owning it like through ETF's for example? Very liquid, I can buy or sell instantly over the internet. And if I was worried about the NZD I'd buy US dollars.

Simple.

Why would I own a gold bar when there's a multitude of other liquid ways of owning it like through ETF's for example?

Yes Wingy. But you wouldn't own a gold ETF. Against your principles and belief systems. So doesn't really matter.

Gold is the money of kings, silver is the money of gentlemen, barter is the money of peasants – but debt is the money of slaves.

Actually I have owned a gold ETF, it was a short - betting against the gold price.

Debt is how you get rich. Stick with your non-income-producing gold bars.

Since 1980, the DJIA is up 74,768% (excluding re-invested dividends).

Gold is up 13,587%.

Actually I have owned a gold ETF, it was a short - betting against the gold price.

Did you Wingy? Did you own ProShares UltraShort Gold (GLL) aiming for 2x/3x inverse performance?

How did you get on? It doesn't really make any sense for non-expert traders to short gold without relatively large positions.

Since 1980, the DJIA is up 74,768% (excluding re-invested dividends).

No it hasn't Wingy. Since Jan 1980, the DJIA has appreciated 4,612% (ex div).

I humbly apologise...

since 1980, gold is up 337%, the DJIA (excluding re-invested dividends) is up 4,839%.

More accurate Wingy but your numeracy could do with some work, which makes we reckon you're not trading options on gold.

1980 is an important starting point because in the previous decade:

XAUUSD increases by approx 2,300% while DJIA increased by approx 5% with significant declines, notably losing nearly 50% of its value at one point.

So you would have been better off investing in equities since 1980 rather than housing and that excludes dividends also. The 87 crash was a mere blip.

I've invested in housing because I'm in control of it, not some faceless bureaucrat.

It's been very interesting, I've built 5, renovated the rest of them and owned 2 factories, one of them for about 35 years. I bought one house for $30,000 at a mortgagee sale, I made a fortune out of it.

I have punted on a few equities over the years and one occasion I bet my own house on them. But there's nothing like being in control of your own destiny and property is one way of doing it.

It's risky, borrowing large amounts of money isn't for everyone.

BTW, the '87 crash in NZ was the worst on the planet, because the market was so overheated.

Still up 4800 per cent. That’s why I retired in my mid fifties and that’s why you are still trying to make a bob or two.

Well, Wingman - doesn't this all depend on the time frame and which index and stock market you look at?

From January 1971 (when the dollar became unlinked from gold) to December 2019, gold had average annual returns of 10.6%. Over the same period, global stocks returned 11.3%.

We also need to remember that after the Wall Street crash in 1929, the DJIA hit its lowest point on July 8, 1932, 89% below its September 1929 peak. The market cap didn't return to its 1929 high until 1954 - basically for an entire generation.

This time around the disastrous underlying fundamentals and asset bubbles make the market of the 1920s look like a Sunday school picnic compared to what we witness now.

We also need to remember that the recent highs of the gold market don't mean that gold has risen in value - rather it signals the plummeting purchasing power of fiat currencies.

The historical average lifespan of ALL fiat currencies, before they reach zero value, is 35 years. All currencies effectively became fiat when Nixon removed the US dollar from the gold standard in 1971 - it has survived for 53 years and so is already 18 years overdue to cease to exist.

Mind you when I said 'survived', I should have qualified that by saying barely survived - in fact, it has already lost more than 98.2%* of its purchasing power since 1971.

* (Average closing price in 2024 = US $2312.70 - Average in 1971 = $40.80 - $2312.70 minus $40.80 = $2271.90 = that's a percentage loss of 98.2%!!!!)

If you think that is grim then take a look at the British fiat currency - it has lost a mind-numbing 99.77% of its value - a gold sovereign used to be able to be purchased for £1 - now it will set you back £450 - it has retained ~0.03%of its purchasing power.

Meanwhile, gold still purchases almost exactly the same amount of goods and services as it did 5000 years ago.

What seems to escape the Wingmans of this world is that Gold is money and everything else, including fiat currency, ETFs, cryptos (that's all 2.5 million of them!) are credit - IOW merely obligations that carry massive counterparty risk. They are credit tokens, with only implied value - they rely solely on their credibility, having ZERO intrinsic value - less inherent value even than tulips!

So Wingman, I would politely suggest that before you write off gold as little more than an inconvenient rock relic, you take the time to reflect on the fact that the Basel III Accord recently redesignated physical gold as a Tier-1 balance sheet asset.

In doing so they effectively began the process of throwing ALL fiat currencies under the bus. This all came into being on 1 January 2023, and it meant that the process of de-dollarisation and divestment out of government treasuries would begin in earnest.

At that same time, it meant that the orchestrated central bank habit of blatant paper manipulation of the physical gold price was abandoned - leaving only the idiotic Fed to continue to bet against gold.

Most of the central banks of the world, with the notable exceptions of the US, Canada, and NZ now realise that the fiat system is so utterly broken that they need to hold a degree of physical assets on their balance sheets, rather than exposing themselves to the growing risk of holding only man-made paper assets as reserves.

Obviously, this has not been shouted from the rooftops as the central banks are still very busy gold stacking while the global paper price suppression casino plays out in its final death throes.

The Fed has diverged from the 62 BIS member banks and continued to bet against gold. Along with their massive leasing and rehypothecation of their claimed reserves (8133 tons) it is looking increasingly likely that in reality, they own a significant negative tonnage of physical bullion. The Fed and the US Treasury have been disastrously wrong-footed.

This global central bank move appears to coincide with the US deliberate wrecking of the entire German economy and as such the entire EU as well. It is also a desperate last-minute attempt to save their own currency/s and balance sheets.

IMO it is far too late for that now - they are already being sucked into the debt death trap vortex, worse even than the US. They will cling to a Western-centric financial 'solution' (sic) and bypass the BRICS model which around 90% of the global population wants to join.

A PENDING GOLD REVALUATION

At any stage BRICS could announce a physical buy price for gold at the Moscow and Shanghai exchanges, which would immediately revalue gold globally - on that day, paper manipulation would become little more than a quaint historical notion.

The physical gold price would break out and head for the hills into a new organic market price discovery paradigm - $3,000/oz, $5000, $50,000 - who knows - when the fiats crash, the currency reference becomes completely meaningless, just as it did historically in the Weimar Republic and Zimbabwe.

Of course, this has zero to do with a change in the value of gold - it would simply be the unmasking of the dismal plummetting purchasing power of fiat currencies - including the one that amounts to little more than counterfeited portraits of dead presidents printed on fancy paper.

Regards

Colin Maxwell

Gold is for the mistress — silver for the maid —

Copper for the craftsman cunning at his trade.

"Good!" said the Baron, sitting in his hall,

"But Iron — Cold Iron — is master of them all." ........

Rudyard Kipling

You don’t want to hold gold through a deflationary or liquidity crises period .

Depends.

XAUJPY has appreciated approximately 2,288% since 1990 but the Nikkei is basically flat.

So owning gold through a deflationary period can be very good.

There's the nub though, when do you expect our purchasing power to return?

How exactly does restarting the debt pyramid and house price inflation achieve that?

"Did they cut by 0.5% last week because they know that it was going to be the last chance they would get, to lower rates, before they have to start raising them again?"

bw, it's time for you to see matters as they are, rather than as you'd like them or imagine them to be.

Mike, I agree, this bump in oil might save them from deflation next year maybe

Cost of living is 'out the door' ....inflation might be under new management but its riding on the back of some hefty YOY rises . lol

Indeed, I sure wouldn't be claiming 'victory' (stupid use of the word at that) when all I've done is stop further large increases being locked in. They've got a cease fire, but they've still lost a whole lot of ground they once held...

Yes and there are essential costs in NZ that will continue to increase - rates, power and insurance.

Owning a house in NZ as a rule of thumb will cost you 3 sets of $5k

$5k rates, $5k insurance, $5k power.

Then you pay your mortgage.....

Inflation will be within target of 1% - 3% in the September quarter and interest rates will continue to tumble. But, in the medium turn, I expect a resurgence in inflation later in 2025. That's when the RBNZ will truly be between a rock and a hard place, because the NZ economy will still be on its knees and the RB won't be able to raise the OCR significantly.

Sounds alarming plausible. I hope your wrong but wouldn't put money on it.

Could be. But what is the intended purpose of manipulation in the cost of Debt/Money? Answer: To change behavioural spending/borrowing patterns.

When rates rise, there is little choice but to pull your head in; lenders stop lending and borrowers stop spending; stop taking on more Debt. But when rates fall, no one can be compelled to spend or borrow if they don't want to. And that's going to be the problem. We've all just witnessed, and now remember, what too much Debt and unanticipated higher % rates can do to our personal balance sheets.

That Rock and a Hard Place may not be as daunting for the RBNZ as it could be. Because right now we aren't spending. We are rebuilding our personal balance sheets by paying down Debt and reducing unnecessary spending. And if the RBNZ wants to maintain that it can do it all so easily, by reducing DTI's for a start.

The choice is simple Yvil, people want the economy to get better, more jobs and house prices rising. I don't see a problem, plenty of room left to cut rates. Things will all turn to shit one day but I don't see it being as early as next year.

What do you see causing the resurgence in inflation? Much lower interest rates, or something else?

The whole world is at the tailend of an adjustment to the price level. Our tiny little island nation has been along for the ride. Think about it. Between 2019Q1 and 2023Q3, the price of the goods and services we import has changed as follows:

- imported goods prices up about 20%

- oil price / NZ diesel up 35% (both have come down a bit in Q4)

- imported services prices are up a whopping 40% (tech, software, travel, business services etc)

The fact that our CPI has gone up about 25% over the same period should hardly be a surprise. We import a third of what we consume - did we think we could just insulate ourselves from the change? What were we supposed to, reduce wages, rents, local govt rates, insurance costs etc to offset the price of more expensive imported goods so that we could hold our precious CPI figure static!?!?

Incredibly, we are still reading articles about taming inflation, and what RBNZ could have done / should do next to tame the beast. What a lot of drama over nothing. Small island exceptionalism gone mad.

We might be along for the ride but we could've built a sturdier boat.

Instead we pissed it up against the wall on cheap imports and believing that being landlords and bidding up property prices would make us wealthy.

What's Plan B?

What were we supposed to, reduce wages, rents, local govt rates, insurance costs etc

In the case of rents, yes!

By how much? In Auckland I'd say about $300 per week i.e. about the same amount they are jacked up by the accommodation supplement.

Make no mistake, our policy has been to contribute to rental inflation over many years with the accommodation supplement. Perfect time to reverse that mistake would have been when other [uncontrollable] costs were rising. Oh, and that would come with a side of more affordable housing.

I'm all for shock therapy on rents Murray! The UK did that in the 70s. House prices plummeted, landlords couldn't make it work, so they sold up to councils who added the stock to their social housing rosters. Somehow I can't see the Govt here doing that

I wasn't aware of what you said had been done in the UK Joe. I wonder if Kate is...there could be some lessons from that 'event' for what might play out with her proposal to reduce rents. To me high rents combined with lack of security of tenure (the original policy that attracted me to TOP) are more of a killer than high house prices.

Since Australia and the US seem to be in no rush to lower rates, it may pay to get as much money offshore as possible before Orr tanks the NZ$. If you need to order any goods/services from overseas, now is the time to do it (well, 2 weeks ago was the time to do it, but better late than never).

Yes USA Govt bond rates are rising again - and their much revered 30 year mortgage rate, is surging higher again.......breaking its recent minor downtrend.

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

https://www.freddiemac.com/pmms

Get that SuperCheap, Briscoes discount, Costco cutting, Warehouse bargain DDDebt money now NZ.....the sales will all be cancelled come 2025.

- The current NZ crowd on the predominant short mortgage fixes, could be in for a real biatch of a time!

Once again, it is important to understand that the RBNZ's CPI is really for the RBNZ's purposes alone.

Why? The CPI is (supposedly) constructed to remove the effects of the RBNZ's playing with interest rates ... (yeah, right.)

A better measure for how all members of NZ Inc. are fairing is the HLPI or Household Living-costs Price Index.

As an aside, crying shame that our ignorant politicians felt indexing so much stuff to the CPI was a good idea, ay? Or did they knowingly do this?

The current 0.5% cut will help those floating, which includes many businesses. While banks are slow to pass on the full cut, the reduction in working capital costs for businesses (and those floating) will help to keep inflation down. But the OCR is still contractionary, and NZ Inc will continue to contract without further cuts.

Two big questions remain:

1) what will happen to the billions locked up in cash and near cash investments? Current interest rates are probably sufficient so see these rolled over at this time. But some will flow into the economy.

2) what's happening in the real world, as measured by the HLPI? Lots of good stuff that's we'll not see for six months plus - from an inflation point of view anyway. Perhaps not much otherwise.

I have absolutely no doubt the RBNZ will spin the inflation numbers to 'surprise on the upside' next MPS.

They have too.

It is the only thing they can do to stay even remotely credible.

I am not expecting a mea culpa of any sort from this lot.

Another -50 in November RB overshot the hikes and it knows it.

Did you mean "too high"? Or "for too long"? Or both?

My view - not that anyone cares (or should) - is they went high enough but stayed there for far too long.

After being too slow to raise rates (transitory inflation..) and knew it.

If the Ponzi fires up again due to oversized OCR cuts - The RBNZ must take full credit for it, and for the damage it does to NZ Inc.

.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.