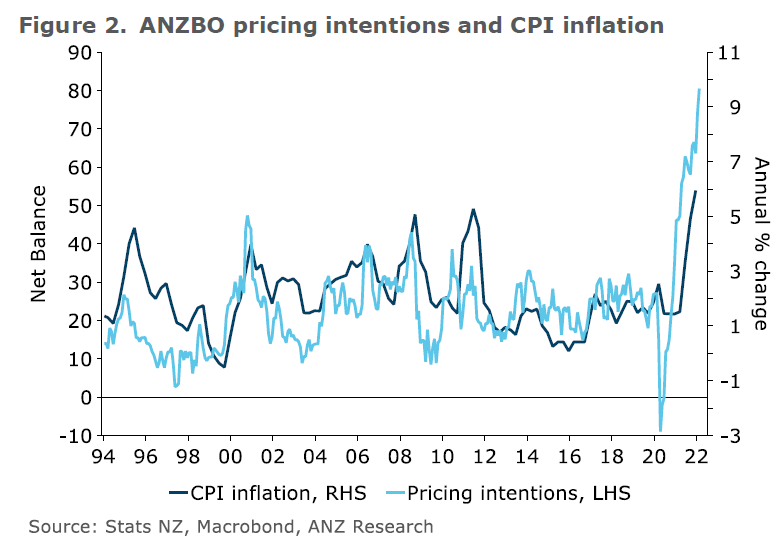

The pricing intentions of Kiwi businesses suggest inflation is "moon bound", according to the March ANZ Business Outlook Survey.

ANZ's NZ chief economist Sharon Zollner said inflation pressures had continued to lift, with the commodity price impact of Russia’s invasion of Ukraine "giving pressures fresh impetus".

"Inflation expectations rose to a new record high of 5.5% and pricing intentions took yet another meaningful leg higher to a net 81%. Indeed, the latter suggests CPI inflation is moon-bound," she said.

"A remarkable net 96% of firms report that they expect higher costs. Can’t get much more broad based inflation pressure than that."

But the news "gets even worse", Zollner said, if you split the sample of survey respondents into the early and the later part of the month.

"Amongst the 29% of firms who responded after the reminder email went out on 21st March, a net 99% expected higher costs in the next three months, and 1-year-ahead inflation expectations were a startling 5.9%, nearly three times the RBNZ’s [Reserve Bank's] 2% target midpoint."

Both the business confidence and 'own activity' measures in the survey recovered a little in March compared with February, but both remain considerably lower than at the end of last year, Zollner said. In fact most activity indicators bounced back a little, "perhaps as the worst fears about the impact of Omicron waned".

However, Zollner said there was "a wariness evident" across the that doesn’t seem likely to be entirely due to the current Omicron outbreak.

"Overall, the themes are consistent with the themes outlined in our recent forecast update and OCR [Official Cash Rate] call change; the housing market and the outlook for speculative construction is weakening quite rapidly; households are facing increasing headwinds and budgetary pressures, and are reducing their discretionary spending; firms’ margins are getting squeezed; inflation pressures are extremely broad-based and still intensifying.

"It’s not a very pleasant mix, and the near-term growth outlook is clouded. But with inflation pressures now so extreme, and the RBNZ’s inflation-targeting credibility on the line, it’s full steam ahead for rate hikes – we’re forecasting 50bp hikes in both April and May.

"It could well be a rough ride, but maintaining medium-term price stability is the best contribution monetary policy can make to New Zealand’s big-picture economic prospects from this very difficult starting point."

Zollner said given the overwhelming consensus about cost and price escalation, ANZ "tweaked" the questions to ask businesses how much they think these variables will change over the next three months. All sectors are anticipating more margin pressure ahead.

“We now also ask by how much businesses think wages changed in the last year and are expected to change in the next 12 months. The strongest wage pressure is in agriculture, followed by construction. There’s little evidence of a wage price spiral here, insofar as most firms are anticipating similar wage lifts next year as those delivered in the past 12 months.”

The March survey includes the quarterly questions about problems firms are facing, and investment intentions.

"Finding skilled labour remains firms’ biggest problems, though it isn’t getting worse, while non-wage cost inflation and high rates of pay are growing as problems. Traditional recession-type problems such as cashflow/debtors and low turnover remain well down the list.

"In terms of what’s driving investment decisions, interest rates are not yet a significant factor for either firms intending to invest, or those not. Concern about the domestic economic outlook is rising, and is the top factor constraining investment by quite some way.

"For those intending to invest more, labour costs are an increasing driver, but the domestic economic outlook and skilled labour shortages remain considerably more important."

Business confidence - General

Select chart tabs

67 Comments

"most firms are anticipating similar wage lifts next year as those delivered in the past 12 months.”

It was widely reported last year that while most in finance roles felt they'd done enough to earn a significant catch-up on living costs, only 3% of firms or so were planning on offering pay rates over 3%. So if the previous 12 month trend is set to repeat itself, I'm guessing workers will either feel more compelled to seek other opportunities or risk falling even further behind.

The great resignation rolls on.

Or just view it as central bank controlled financial repression of the masses to pay for the insane market intervention in 2020 - now to prevent deflation and asset price falls.

Yup. I think we got a 2% bump last year. Inflation was 5.9% last year. If that repeats this year, and inflation is also 5.9% year on year, then that's an effective pay decrease of around 7%.

I, like a lot of people I imagine, are sick of constantly having to suck it up for the 'good of the economy.' First it was 'lets blow out house prices, for the good of the economy!' Now it's 'we can't have wage increases despite rampant CPI inflation, for the good of the economy!'

And yet oddly central banks can act swiftly, with determination and certainty, at the smallest possibility of deflation......because it might pop out massive debt bubbles...but inflation...well another story.

Perhaps the inflation target band should be simply set to anything greater than zero and any insane method is perfectly fine to achieve that mandate regardless of asset bubbles and wealth inequality and social stability.

If it's any consolation, about 70% of jobs are nonsense, but nothing works if only 30% of people are employed.

How in any conceivable way could this snark be construed as 'consolation'

I got a 2.7% raise last year so already went backwards. Another 2.7% raise will definitely encourage me...to look elsewhere.

FWIW my pay rise the year before was 0.0%.

My employer made record-breaking profits, yet again.

You dont have to name the employer but can you tell us what industry?

My guess is, it’s a bank?

If it is, I would stay there as you're probably recession proof.

Cashflow is king.

A bank's operations and profits are recession proof.

Your position as an employee of the bank is not as secure.

That's exactly why I started my own business. I was sick of the greed, fat cats at the top mentality. My team all got 5% and Christmas bonuses.

A quite amazing chart in pricing intentions - from deflation to out of control inflation.

In all honesty, you could not have created a more inflationary environment if you had tried

Shock and awe ZIRP and QE, close the borders, close down large swathes of the global supply chain, sanction one of the largest energy and wheat suppliers, adopt energy policies that abandon energy independence and put wholesale reliance on renewables that provide a fraction of that required (globally).

Light the fuse and stand back.

It'll be a miracle if we come out of this any way other than disaster. What's less clear is which flavour of disaster.

Net Zero was an inflationary bomb ticking away before Covid and the Central Banks piled in.

Glum in our extended family. Two professionals, married six years. Up graded house to max $800k mortgage two years ago, due next year. Not long after on “cheap” loan money, for something to do, two jet skis, trailer & Ranger to tow. Just woken up to likely mortgage payments next year, and gulp & gulp again. Talked to bank about interest only but no show. Trying to sell the toys, going to take a hit, but at least reduces outgo. Very much looks like will have to downsize house to as before. Cannot imagine this couple’s predicament is unique, far from it would wager, but unfortunately these two are pretty angry, and that won’t be unique either. NZ is not looking like a happy place for a lot of New Zealanders in the not too distant future.

I'm curious to understand who or what they are angry at?

If they're anything like my bother and his wife(they went for a boat rather than jetskis. Same ute) the answer is "Jacinta".

Whilst I'm not insensitive. People like this Only got themselves to blame. I'm sure these types would have had zero problems Locking in cap gains if the party kept going and No doubt would have called it smart investing, you DGM just don't get it etc.

I feel MUCH more sorry for the families I see at Pak'n'Save, struggling to feed their kids on cheap bread and noodles.

Exactly.

and being charged gst on those basic food items while property investors have had tax free capital gains for decades. Not very Labourey.

Of course GST should be charged on houses. It is the exceptions to GST that cause the problems - chicken zero rated and half chickens having GST because they are 'prepared', etc. Everyone knows capital gains taxes seem to hit the middle class but rarely the wealthy but GST is simple.

GST impacts people with lower income more, because a bigger portion of their income goes on necessities that fetch GST. It is a tax on the poor, relatively speaking. I support removal of GST from necessities and a higher rate on luxuries, there are other countries that run this model.

That's a myth, because there is no GST on rent.

Can you explain how that makes it a myth? Is GST charged on interest payments? Doesn't change the underlying fact that GST impacts lower income earners more, that is well understood, and probably why National lifted the rate from 12 to 15%

That’s a revealing typo.

good question. no good answer. have not had any contact since my comment something like you reap what you sow. I am not young but I have never failed to own my own mistakes, rueful yes but not angry. could put it down to a generation gap but that would not be pc.

Its not a generational gap, there are people in every generation who don't wish to 'own' their mistakes. If what we are seeing continues and interest rates rise further there will be blood in the streets. So many families are in up to their eyes balls in debt, just to afford a roof over theirs and their children's heads. Prior to leaving NZ a year ago I remember standing in line in Pack n Save in Glenfield (Auckland) and every ailse was full of the cheapest, most unhealthy foodstuffs. One can only guess this was because people were already struggling then. That same crap food probably cost 25% more. People have to be hurting now.

What's the quote....

" A man can make many mistakes but he isn't a failure until he blames someone else".

Not long before it turns into a back and forth of :

"I told you we shouldn't have gotten those bloody jet skis you stupid idiot"

"but you said this, if only you had done that"

"blah blah you arsehole"

Judgement aside, this is why interest rates will not rise to the level currently priced in or expected. Like having a dental nurse drilling kids at school, interest rate rises to tackle supply side inflation should be a thing of the past.

I do have some sympathy for them (many here won't), it was only 18 months ago the RBNZ governor was encouraging people to get out and spend and flooding the economy with cheap cash and liquidity. This is how National get elected.

I don't think The Fed cares about a few stretched professionals in NZ having to sell their toys. Rates will need to go up to save the currency. Letting housing take a hit is the path of least regret in this case.

Side note - I have a few friends in this situation too, now selling toys and excess rental properties to ease the pressure of their debt.

What do you mean save the currency? On a trade-weighted basis our currency is actually over-valued, currently at 74.63 vs a post float average of 66.87. We need it weaker and be damned with inflation whic, as long as we do not get wage inflation, will pass through via a reduction in our standard of living.

I'm pretty having our imported goods even more expensive and no offsetting wage increases to help with it is not a stunning idea, given the perilous state many Kiwis are already in. The historic average TWI has almost no relevance when it comes to defraying costs across a low wage economy where the basics like food, fuel and accommodation costs are already soaring.

Is it a case where at this point it doesn't matter what long term or ideal is. Any drop in nzd means higher inflation?

There are no free lunches in life.

People like this ain't thinking of future generations when they enjoy thier giant ICE toys and locking kids out of the housing market.

0 sympathy. You take a bet, end up reading it wrong, that's on you big boy.

Also. For all my criticism of the rbnz, andrian did, very clearly, publicly warn people not to over extend.

Actions speak louder than words. If you want people out of one side of your mouth but continue to pour fuel on the fire when no one is looking, then guess what happens

Alongside that TK. Just need to recall the parade of Finance Ministers, Cullen and before and after, endlessly bemoaning the self evident abysmal status of savings by NZr’s. And then come covid, interest rates slashed and the government is saying borrow and spend and save our economy. What goes round comes round, and here it is now.

I'm not in the big price fall camp, simply not going to happen. I mean, land has to fall a lot just to offset inflation in trade labour and building supplies. Most likely scenario is that discretionary spending and investment hit's a brick wall. You can start talking house price falls when the stock market starts tanking and unemployment starts rising.

If they can't afford repayments of $50k/yr out of what must be a $200k/yr combined income, there is something badly wrong with their money management.

Wait, I thought net-zero was what the labour party had achieved in government since 2017 ? What am I missing ?

Well said

It is the time when I least trust CPI figures rolled out by RBNZ coming month. These figures are fudged so bad from the last 2 announcements as a cover-up, that even a layman can say it is a form of corruption.

The ground reality is scary getting a small piece of work cost you arms and legs. The inflation is crazy and our govt is sleeping as always.

I wont be surprised if the CPI number comes out with .9%...

AJ

Stats NZ produce the CPI data - RBNZ have nothing to do in producing CPI data.

Democratic Corruption.

Time for change.

We will look back at lots of the graphs from this era and see a single heartbeat shape - with a plummet in early 2020, a surge upwards in late 2021, and then a quick return back to the groove in mid-2022 (albeit with a sustained increase in some prices due to less efficient supply chains, increased inventories etc). We can already see the downside of the surge in rent figures, wage growth, house price growth, consumer spending, fiscal stimulus etc etc.

What will the central bank response be when we become deflationary again in the next 12-24 months?

At this point I think they would be happy to have that problem.

- Ensure the supply of credit to things that will support increased productivity, enterprise and sustainability - including direct investment for public infrastructure projects as needed.

- Regulating the financial sector more tightly to restrict the flow of easy credit into speculation, and reducing the flow of profits overseas

So the opposite of what they did when avoiding deflation in 2020? (but with the same people in charge?)

Sorry, I defaulted to answering on what they 'should do' - but you asked what they 'will do'!

I agree with your points on merit/principle but not in reality of what I've just witnessed the last few years.

Art as prophecy: it's time to suggest the Buzz Lightyear meme, as in 'to infinity and beyond', to these all-too-sober dissections of entrails....

The path of least regrets has not lived up to it's name.

New Zealand is buggered.

You're in for a bit of a shock once you realise the world's mostly in worse shape.

Except for a sliver of land on the East Coast of Australia, that is. Where the grass is green and the girls are pretty.

Worse? Nah. That's just uninformed nonsense.

The girls have a lot of lip filler. But are still prettier than the average swamp donkey in Aotearoa / New Zealand.

This is a financial news site, keep your gutter comments to your incel platform.

Well said Te Kooti. Misogynistic comments have no place in a financial discussion group, or anywhere else for that matter.

I didn't bring up the subject.

But looking forward to you keeping your racism to yourself from now on.

And that bloated Bank that tweaks CPI,

Whereunder crawling coop't we rent and die,

Lift not thy hands to It for help -- for It

Rolls impotently on as Thou or I.

With many tricks and housing market greed,

Of coming recession they sow'd the Seed:

Yea, reckless pumping of housing costs wrote

What the Last Dawn of Reckoning shall Read.

(apologies the Edward FitzGerald)

The Labour Govt / CB cartel has got it horribly wrong. Over-hyped it. Over cooked it. Then over engineered it, so that it cost a fortune. In an already extreme world, the current poliflops have gone ultra-extreme. It was indeed a very hard labour. She gave birth to twins. One cost a million dollars. The other one was broke.

Just an aside :- is Dalts the most successful beneficiary we have ever seen?

Yep

It did make me wonder if the all blacks will still play tests in Nz after the silver lake deal

or do they become like the Harlem globetrotters

maybe if grant had not lost 5 bill betting otn eh market against his treasury advice -- he coudl have forked out 50 mill more to dalt - personal if all benificiarys delivered the spectacle prestige and financial boom of hosting the cup - i am all for it

Hardly surprising is it? Rising commodity prices have given inflation a huge boost from an already above target level. RBNZ hasn't been willing to use policy to contain inflation at any reasonable level.

There's the possibility that Zero Covid policy could cripple China as well.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.