Falling headline inflation won’t be the main focus for Reserve Bank (RBNZ) policymakers heading into their first committee meeting of 2024 on Monday (February 19).

Rather, the central bank will zoom in on core inflation measures and other data points that signal where headline inflation might track in the next 18 months.

The RBNZ has forecast annual inflation, as measured by the Consumers Price Index, will be back in the target range by the end of September this year.

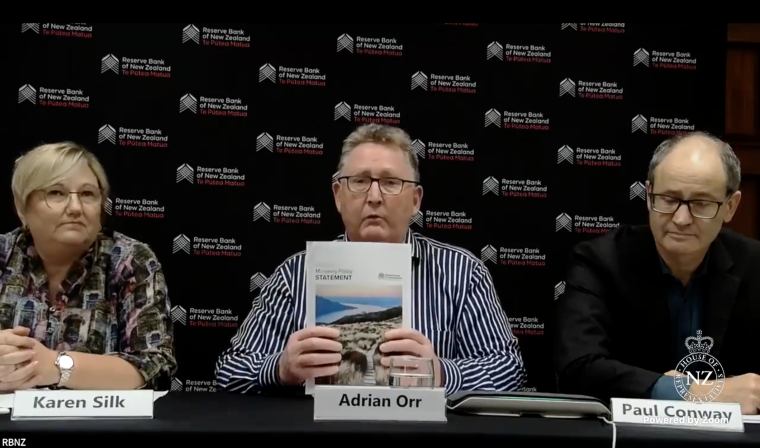

But that is not the job done. Governor Adrian Orr said, in a speech to Waikato University’s economics forum, the goal remains getting annual inflation to the midpoint of 2%.

Paul Conway, the central bank’s Chief Economist, reinforced this message in an interview.

“We’ve always had a focus on the midpoint in legislation. If you keep inflation at 2%, then shocks are less likely to put you outside of the band,” Conway said.

There has been some talk, notably from BNZ Head of Research Stephen Toplis, about whether the RBNZ should be shifting to a higher target to account for structural inflation pressure.

Orr’s speech on Friday morning could be seen as a rebuttal of this argument, as well as a possibility the coalition Government could seek to put a time limit on the inflation target.

It was impossible to ensure inflation hit 2% on any particular day and attempting to do so would result in volatile policy settings and economic outcomes.

Allowing the central bank to hit the target in “the medium-term” gives the RBNZ's Monetary Policy Committee space to respond carefully to noisy data, he said.

Static in statistics

But this shouldn’t be interpreted as a signal the committee would be willing to tolerate much noise in the current data they are looking at over the next nine days.

“Of course, if you are sitting in a period of high inflation and rising inflation expectations [then] our ability, or our appetite, to look through temporary price shocks is significantly reduced — and that has been the case over recent quarters,” Orr said.

The Governor explicitly said the central bank was targeting core inflation, which has been falling more slowly than headline inflation. Core inflation, the RBNZ says, is the estimated measures of inflation that's persistent and broad-based.

Monthly price indexes released by Statistics NZ this week showed inflation was still in decline but largely due to imported prices.

ANZ economists, who have predicted the Official Cash Rate will rise to 6% from 5.50%, said there was nothing in the data that would “materially change” the inflation outlook.

“The RBNZ needs to see more progress on non-tradables inflation to be confident overall inflation is returning to target in a sustainable timeframe,” they wrote in a note on Friday.

Paul Conway said there was very little difference between core and total inflation when you look a few years ahead. In essence, core inflation becomes the headline number over time.

“So, effectively given that we're forward looking, the difference between core inflation and headline inflation is pretty semantic. They all collapse into the same thing,” he said.

Headline inflation was 4.7% in the December quarter, down from a peak of 7.3% last year.

Different measures put core inflation between 3.9% and 5.9%, which were down from peaks between 5.7% and 6.8%.

Orr said these figures were moving in the right direction but there was still work to be done “tackling the tail end of these persistent inflation pressures”.

Fool me once

The RBNZ’s key core inflation measures, called factor models, are estimates that are calculated based on the quarterly consumer price index data.

This makes them subject to regular revisions and means they are not always an entirely accurate picture of inflation pressures in the real economy.

In his speech, Orr said real-time estimates of core inflation were “relatively subdued” in mid-2021 at around 2.2% or 2.3%.

“However, with the benefit of more data, these estimates now measure core inflation at 3% in the second quarter of 2021, the upper limit of our target”.

Sharon Zollner, chief economist at ANZ NZ, said this had contributed to the RBNZ underestimating emerging persistent inflation pressures.

“It serves as a reminder to markets, and other observers, that any one measure of core inflation will have its strengths and weaknesses rather than being the ultimate ‘truth’”.

She also noted the Governor’s speech was not intended to provide any guidance about future policy settings and there had been no market reaction.

Mark Smith, a senior economist at ASB, said the speech didn’t suggest any “imminent hurry to either raise or lower” interest rates.

There was a strong emphasis on hitting the midpoint of the target, as well as there being no perfect time frame to get there — which could be seen as providing wriggle room.

“It suggests that OCR hikes are not imminent but that the RBNZ will need to see concerted progress is being made in lowering core inflation before cutting the OCR”.

The seven-person Monetary Policy Committee begins its February meeting on Monday and will announce its new policy settings on Wednesday, February 28, the following week.

53 Comments

"Key data is also released with a significant lag. That means we are prone to large revisions, we're prone to the use of estimates," Orr said.

This is a quote from another article I just read. Everything communicated from the RB is a narrative and not necessarily an intention. All the more reason to make your own assessment about where the economy and monetary policy are headed.

Much of inflation is well outside of central banks' control, and their inflation narrative a smokescreen. They want destruction and financial reinvention.

Core inflation seems to be driven by fiscal policy at this stage. RBNZ have moved their needle.

Could you elaborate why you believe 'core inflation seems to be driven by fiscal policy'?

Reserve banks should have competent leadership. Thanks labour.

Labour are not in office.

They are all talking a good game, but I think they stay unchanged OCR, but they will talk a higher forever narrative. As ANZ said previously, deny deny deny cut.

Or as they said recently: Raise, raise!!!

Orr has a great opportunity to get revenge on the Nat's, and I suspect he'll take it.

They (rightly) questioned his competence.

He can go HFL, torch the economy, and do it with a narrative of following the new mandate RBNZ has been given.

I don't think the public understood the implications of the mandate change, but he'll ensure they do!

The new mandate was given by National. Your argument that Orr wants revenge on National is nonsensical.

I think it’s quite possible. National publicly embarrassed Orr then handed him a revenge opportunity.

Structural inflation. The circular current of greed to bail out the overleveraged and banks. Will Orr capitulate to global banking interests or look after average kiwis...?

Which average kiwi are you wanting to look after?

Those struggling to reach the security of home ownership. Otherwise we are swaping another good tax payer for rwturning 501s.

If security in NZ means owning an asset worth $750,000, then something is wrong. Not everybody can afford that. If it means the middle class can be secure while the lower class must live an unsecure life that's no solution to anything.

450k homes would be delightful

Agreed. Dti will close dow debt farming by forcing reasonable equity. The debt to the moon interest only and hold for inflation model will not be effective. Prices down.

Ya had me till you said prices down. It'll just exacerbate our current undersupply of houses, and have people bidding up the limited existing stock.

To get the prices down, you need to make older houses less attractive.

Trouble is lots of "average kiwi" took out $3/4m loans to buy average (very) homes.

I totally agree with you but our totally unsustainable debt based system means lots of average kiwi lose either way. Like it or not we are snookered by the banks . Personally I hope it ends really badly for the financial parasites but I'm sick of waiting for change for the good.

How does this help to make new houses affordable... affordable shouldn't mean "smaller shoebox, further out". We probably need more competitive building companies and developers along with serious deflation to bring about lower build costs. It won't happen overnight

Japan is one of the only developed nations to have an environment conducive to affordable homes, and they've done that by having far less regulation than the rest of us. While also ironically having some of the lowest borrowing rates.

Methinks you're overlooking a more likely factor ... https://en.wikipedia.org/wiki/Demographics_of_Japan

Pretty aware of Japan's demographics. Tokyo is growing though, yet has more affordable housing than most developed metros.

What they don't have, is much nimbyism, zoning laws, etc. Just build stuff.

In the past half century, by investing in transit and allowing development, the city has added more housing units than the total number of units in New York City. It has remained affordable by becoming the world’s largest city. It has become the world’s largest city by remaining affordable.

https://www.nytimes.com/2023/09/11/opinion/editorials/tokyo-housing.html

The irony is the faster Japan urbanises Tokyo, the quicker they'll accelerate depopulation (urbanisation being the prime driver of lower birth rates).

So the subject is Tokyo. Your o.p. was about Japan.

Compare the recent population growth rates of Tokyo to Auckland.

https://en.wikipedia.org/wiki/Tokyo

https://en.wikipedia.org/wiki/Auckland

Not very similar, huh? I'd also point out that Tokyo is a mature and massive metropolis, with vastly sophisticated infrastructure, while Auckland still has a long way to go.

You say, "urbanisation being the prime driver of lower birth rates." I've not heard that.

I have read that better education (especially for women), the reduced influence of religion (especially on educated women), more varied employment options (especially for women), and raised standards of living have been playing a major role all over the world. The urban environment enables those things but isn't thought to be a cause, just a correlation, as the same happens in non-urban areas.

So the subject is Tokyo. Your o.p. was about Japan.

The country that's managed affordable housing in growing metro areas is Japan. The city cited as doing that is Tokyo, in response to your claim the affordability was driven by depopulation.

Auckland has a land use policy that's more weighted towards suburbia than Tokyo, and Tokyo's much higher density makes that improved infrastructure more viable. And NZs high building costs aren't unique to Auckland, so it's definitely not just a case of which city is growing fastest.

We made new dwelling generation too costly in NZ and subsequently we drive up prices of houses because the increased costs lends itself to lower supply.

If the question is why high house costs then root cause analysis cannot ignore this

You say, "urbanisation being the prime driver of lower birth rates." I've not heard that.

It's not overly new information. Women in cities have higher rates of tertiary education and improved careers that delays or negates Child birth, and children are greater liabilities in cities.

If we're talking specifically about Japan, Tokyo's birth rate is lower than more rural prefectures. Half of some areas:

https://www.statista.com/statistics/1233526/japan-total-fertility-rate-…

If we want to split hairs, I guess we can say something like "if you want the lowest birth rate possible, urbanise your population".

Very good points

re ... "in response to your claim the affordability was driven by depopulation."

I made no such claim.

You cited demographics as the response to why new housing is cheaper in Japan (or more expensive in NZ). In the absence of more words on your behalf, that's a fairly reasonable understanding of your post.

You said, "Japan is one of the only developed nations to have an environment conducive to affordable homes, and they've done that by having far less regulation than the rest of us."

You never mentioned, nor recognized, that demand factors were completely different.

Instead you made up the cause which you said was down to Japan having less regulation.

This is a classic example of an argumentum ad odium.

re .. "If we want to split hairs, I guess we can say something like "if you want the lowest birth rate possible, urbanise your population"."

There is no "we" to split hairs. When you surface something that supports your claim that urbanisation is the prime driver of lower birth rates I'll take notice. Until then, I'll put it into the pa1nter bucket of stuff they made up.

"We" are having a conversation, and "you" are getting fairly pedantic about phrasing and wording.

Birth rate divide between rural and urban populations is a fairly common trend.

For someone who needs to label anyone debating things with you as intellectually inferior, you don't make a good case for yourself being a better arbiter of information.

Like I said above, when you surface something that supports your claim that urbanisation is the prime driver of lower birth rates I'll take notice.

Until then, forgive me if I ignore your argumentum ad hominem responses.

To get more competitive building companies we need more competitive building suppliers and manufacturers. Building material costs are still going up, gib just increased 5.5%, cement due to go up in March along with aggregates. Looks like 'core' inflation us going to be around for a lot longer.

Building material costs are still going up, gib just increased 5.5%

If the price of gibs gone up heaps

But the manufacturer of gib still lost the best part of a couple hundred million dollars

Why would having more competition have someone prepared to lose more to offer it cheaper?

THE HFL or in fact Higher Forever interest rates, is still not reported by the property interest linked Media (most of NZ media are in cahoots with the banks and REA industry stooges)

Thye are all telling the tens of thousands of overleveraged to hold on "help is on its way" Sorry, its a heavy freight train and not the light and relief they have been falsely promised.

INTEREST, is one of the last bastions of objectivity and Independance. They have not been bought and paid for, like Granny Herald has been.

Welldone INTEREST team!

What is currently playing out in the catastrophic Commercial Real Estate market crash in the USA, has a big warning and a "get ready" message for NZ! That is if you care to look deeply yourself, as The Establishment Media seek to burying this very unhelpful news 6 feet deep under heavy wet clay. Their owners and clients (the Bankers and REA collective) set the news narrative - shame on them!

We have our current housing market sales rates still clogged and constipated, as stressed sellers are indeed holding out for a break even or just a small loss on the sales price.........just as occurred in the USA with CRE.

So once the capitulations occur in coming months in larger volumes, the NZ Resi housing market here will see real price discovery and a lower price.

Be very careful buying today as the prices are artificially held up and high.......only the higher volumes coming will see the lower reality be seen.

Once NZ housing is indeed "Marked to an honest Market" in higher liquid turnover, the results will be shocking and not even the Vested Interest Owoofie or Granny Herald could contain it!

Commercial Real Estate Market Plunge Has Lenders Facing a Brutal Reality - Bloomberg

From the Bloomie article (Yes I pay the Subs, as many articles are gold and insightful and help me with decisons based on the best facts! NZ media does not serve NZers well)

IT IS A HARBINGER FOR NZ 100% so:

"Since the Covid-19 pandemic upended the use of real estate around the world, lenders have had little incentive to get tough on borrowers squeezed by soaring interest rates and take on loans that had lost value. Transactions ground to a halt as potential sellers were unwilling to unload buildings at distressed prices — an outcome that allowed them to pretend that nothing had fundamentally changed"

"For many, the time to wait it out is nearing its end."

Across the country, deals are starting to pick up, revealing just how far real estate prices have fallen. That’s spurring widespread concern about losses that can ripple across the global financial system — as underscored by the recent turmoil unleashed by New York Community Bancorp, Japan’s Aozora Bank Ltd. and Germany’s Deutsche Pfandbriefbank AG as they took steps to brace for bad loans.

"In Manhattan, brokers have started to market debt backed by a Blackstone Inc.-owned office building at a roughly 50% discount. A prime office tower in Los Angeles sold in December for about 45% less than its purchase price a decade ago. Around the same time, the Federal Deposit Insurance Corp. took a 40% discount on about $15 billion in loans it sold backed by New York City apartment buildings."

Assets unsupported by income. Is tje decades long wave of speculation without income finally nearing its true end.

Reset.

NZ Banks do not have massive exposure to commercial realestate vs US, in NZ the big guys like Precinct Properties carry lots of risk, the 2nd tier ex eng lang school buildings are a risk for their owners for sure.

I think the only way we build cheaper in NZ is take GST off new builds for FHBers, and try to reduce developer contribs if built up and near transport links. if you do a calc, what price do you need investment res to fall to become cash flow positive.... its no wonder the industry wants to sell the possibility of cap gains... if you take them away you have to deal with the fundament overvaluation of the industry...

Yes the NZ banks are not much worried about the CRE side in NZ or US.......but way, way exposed to the Resi market.

What about the NZ superfunds/Kiwisaver ?? - I bet the massive crash of CRE in the US, will have an impact on the Superfunds industry here.

Thats why they are all talking up the cap gains, as you say, the divi/yeilds are abhorrent - on all measures.

So they must hang their hat and hook in the mindless plebs to buy the only story going and then go about constructing a "non-stop media narrative about housing going to get good 5 to 10%" - gains this year.

Its obscene and this obvious market collusion, all to keep the NZ housing Ponzi up in the air, built on pork crackling and dry, dry straw.

The embers of an all consuming fire and it collapsing are well established now!

They are all smoking the Hopium pipe and those gains are not happening this year.

You would think 10%Tony A, would have learned valuable lessons after his last sets (yes many) of predictions fell completely flat and he looked akin to the schoolboy class clown.

Neither the pumpers or the doomers have been very good at calling this market.

Although outside of the "high interest rates will cause house prices to plummet" narrative, everything is stacked against housing going cheaper. You'll need the entire economy to crater first. Or a significant change in housing policy, and we're far closer to the former than the latter.

I’m trying to find the light at the end of the tunnel for the former here in NZ. Gut feeling is we’ve started entering the tunnel, and it may be a while before things are feeling good again.

My guess is National backtracking on the austerity plan somewhat, which they’ve already revised.

Re housing, neither here nor there

All I can really see is the same gradual slide of the last few decades picking up steam as the labour market struggles to fund increasing state costs, and central bank financial reinvention has diminishing returns.

Well we know that our favoured asset class has a heavy central bank resistance about 20-25% above current "prices" in real terms, and it took a number of policy mistakes during a worldwide black swan event to get us there. Conversely, as you say, political will power will keep the subsidies and incentives for speculation - so dimishing returns until the collective wakes up to the real losses. I would put money on 2021 being the best year to sell a house in NZ ever if wanting cash.

I guess if we never see as favourable lending conditions again, you could well be right.

I'm also not just talking about housing, the entire economic model we've subscribed to is geared for marginalisation, and for money to flow one way.

By the time there's significant political will for substantive change, we'll vote in even worse sorts.

On the subject of commercial property

I tried to find out how much commercial property Fletchers owns.Must be a fair few sites?Does anyone know?

At some point companies are going to get whacked if the market crashes, not just investors??

On the subject of commercial property

I tried to find out how much commercial property Fletchers owns.Must be a fair few sites?Does anyone know?

At some point companies results are going to get whacked if the market crashes, not just investors??

I was switched on to the CRE black swan quite some time ago NZG. Except it wasn't really a black swan. Water coolers of NZ suggesting it has nothing to do with us. But it does. They just haven't spent the time to work out why.

Do you deliver water bottles?

Do you deliver water bottles?

Not directly but Indirectly kind of. My client handles bottling and delivery for Coca Cola across China and have moved into ASEAN. Nestle Waters does much in the space, depending on the market.

So Nestle will have the best water cooler goss then?

My pick: RBNZ holds next week and talks a massive game about raising. Zollner is further disgraced and calls come for her to step down at ANZ. Then bang - .25 cut in April.

Next GDP release is scheduled for 21 March 2024. April would seem about right given re-acting to old news is very much their thing.

RBNZ was the first central bank since covid to start raising. No one should be surprised if they're the first to start cutting.

Yes, I agree. 3 out of the last 4 quarters see contracting GDP. Unemployment surging now, particularly in Wellington. I can't see any inflation anywhere in our bills for the past 6 months, except insurance (which is almost certainly because of a lack of competition).

The inflation figure reporting is heavily influenced by what happened 6-18 months ago and that data is used going forwards. Unemployment data is 3-6 months old if not more. So we set policy for the future based on whats happened a while ago, not what's happening now. The delay to the reporting etc means the RBNZ will over correct both ways, swinging wildly, so won't drop rates now like they should be based on whats happening now. As that data filters through, then they will start acting (too late, again).

(which is almost certainly because of a lack of competition).

They've been taking some big losses paying out for events, and are now clawing back. Whether you have a handful of players or 50, the end result is the same.

In California, a much more competitive environment, insurers in general are pulling out of reinsurance. The numbers don't stack up.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.