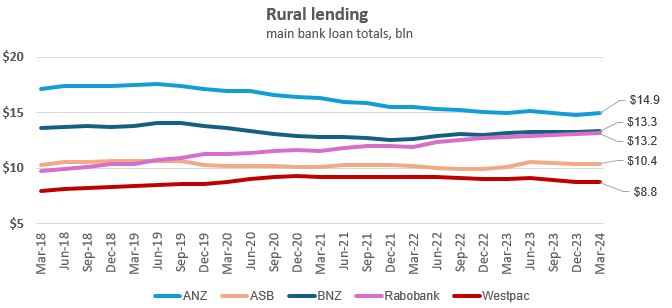

Across New Zealand's five key agriculture lenders it was a case of three up, two down on whether they grew or shrank lending over the March year.

The latest quarterly update of the Reserve Bank's Bank Financial Strength Dashboard also shows four of the five saw both non-performing agriculture loans and provisions rise, with falls at the fifth bank.

ANZ remains the country's biggest rural lender. However, its rural lending dropped $86 million to $14.944 billion over the year to March 31.

BNZ is the second biggest, just. Its rural lending rose $164 million to $13.330 billion.

Next is Rabobank, which grew lending $369 million to $13.159 billion.

ASB is fourth, having increased rural lending $329 million to $10.428 billion.

At fifth, Westpac reduced rural lending $333 million to $8.755 billion.

In terms of non-performing loans, which are impaired loans plus loans at least 90 days past due, ANZ, ASB, BNZ and Rabobank all recorded increases in the March year, with Westpac seeing a drop.

ANZ's non-performing agriculture loans rose $22.7 million to $58.9 million, with its non-performing loan ratio rising to 0.4% from 0.2%. ASB's increased $19.2 million to $112.4 million, with its non-performing loan ratio up to 1.1% from 0.9%. BNZ's climbed $16.8 million to $219.8 million, with its ratio rising to 1.6% from 1.5%. Rabobank's jumped $340.4 million to $584 million with its ratio surging to 4.4% from 1.9%.

Meanwhile, Westpac's non-performing rural lending fell $28.9 million to $76.5 million, with its non-performing loan ratio dropping to 0.9% from 1.2%.

In terms of total agriculture loan provisions, ANZ's rose $33.9 million to $136.6 million, ASB's lifted $47.9 million to $118.3 million, BNZ's gained $41.7 million to $201.6 million, and Rabobank's rose $4 million to $28.9 million. Westpac's fell $18.7 million to $95 million.

*The chart below shows movements in the big five rural lenders' books over the last six years, based on dashboard data.

*This article was first published in our email for paying subscribers early on Thursday morning. See here for more details and how to subscribe.

4 Comments

In the good/bad old days depending on your perspective, banks were farmer friendly and allowed farmers to capitalise interest. So I think the above additions will be for new debt

Good luck to those dairy farmers making a farm move today and all the best for the new season

Back in the day banks hated farmers... stock and station agents and lawyers funded farmers.

Not sure what your smoking? Green Shoots?

Puff whew

I looked this up to confirm. National bank bought rural bank in 1988, it was previously owned by govt and fletcher's had it in between. Would now be assimilated into ANZ after they bought National

The Rural bank was pretty big and has therefore made anz the largest rural lender

Puff puff, what are you puffing

Been out and about over the weekend, including in the Waikato and totally amazed to not have seen a single vehicle piled with chairs tables garden furniture etc. Maybe just missed them but that would seem pretty unusual. Infact very few stock trucks even.

Happy to have not been moving, it's costly and stressfull, but good luck to those that have .

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.