The Government says it has found $4 billion in cost savings to spend on core services, cost of living support, and cyclone recovery in Budget 2023, without adding to debt.

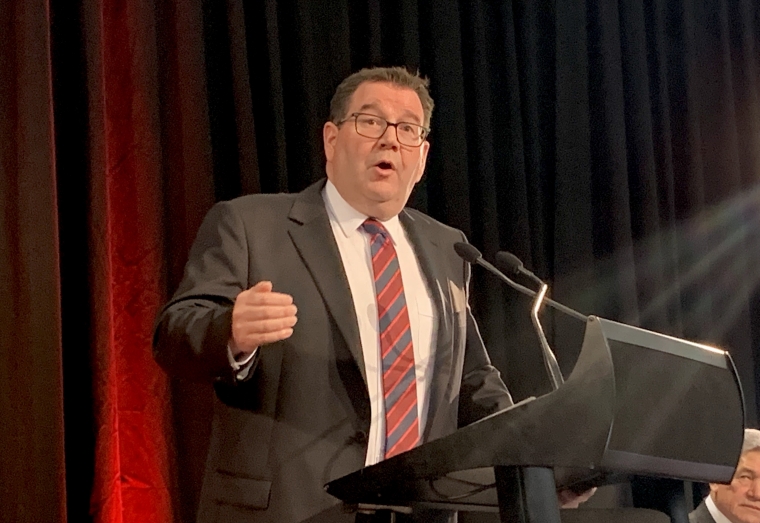

In a speech to the Wellington Chamber of Commerce on Thursday, Finance Minister Grant Robertson said the Budget would focus on returning to “a more sustainable fiscal position” after big spending during the pandemic.

The four themes contained in the Budget would be: cost of living support, delivering core services, economic resilience and recovery, and fiscal sustainability.

Government net debt sits at about 19% of gross domestic product (GDP), which is below the self-imposed limit of 30% which Robertson set himself in the 2022 Budget.

However, having room to respond to future crises is essential and the Labour government wants to bring its spending back to pre-Covid levels, or about 30% of GDP.

This won’t happen in this budget alone, Robertson said, as it would require cutting services to “austerity levels” but will happen across the next couple of years.

Government Ministers were told that if they wanted to fund new initiatives, they would have to find cost savings within existing budgets.

Funding set aside for job vacancies has been pulled, underspend budgets have been clawed back, contingencies have been closed, and forecasts have been reassessed.

This apparently adds up to $4 billion once combined with scrapped policies such as the public media merger, and the clean car upgrade.

Robertson said the Government had to cut back, like New Zealand households are, in order to fund its priorities—cost of living, resilience, and core services—without exacerbating inflation.

“Despite the welcome news that inflation appears to have peaked, there is no doubt it remains too high, and we are committed to playing our part in bringing it down, including by reducing our spending as a percentage of the economy over the coming years,” he said.

“We will be making targeted investments to support these goals, while continuing to manage the books carefully”.

Bermuda Triangle

Robertson took a jab at the opposition in his speech, by saying he was being honest about the trade-offs required when managing government finances.

“I don’t go around telling people that spending on public services will go up, public debt will go down and taxes will be cut, all at the same time,” he said.

“That fiscal Bermuda Triangle is the domain of the Opposition, and I don’t believe it is either realistic or credible”.

Economists don’t expect a budget surplus to be delivered until Budget 2025 and even then, only if future governments are willing to steer clear of big spending or tax cuts.

ANZ economists Miles Workman and David Croy said running fiscal deficits and adding macroeconomic stimulus to an already out-of-balance economy could be problematic.

“New Zealand’s record-wide current account deficit, a near record-low unemployment rate, and CPI [consumer price index] inflation near a multi-decade high are all good reasons to consolidate the fiscal position faster than otherwise, but it’s not clear that Budget 2023 will deliver that”.

Sovereign credit rating agencies and overseas investors will be watching more closely than usual and will want to see a “clear and credible strategy towards eventual fiscal consolidation”.

The Government had no choice other than to help communities affected by the cyclone to recover, they said, but this could have been funded with a dedicated levy or increased taxes.

Treasury’s half-year forecast predicted net debt would peak at 21.4% of GDP in the year to June 2024, leaving quite a bit of blue sky below the self-imposed debt ceiling.

“To put some perspective around the recent increase in debt, this measure was sitting at 1.8% of GDP in 2019, suggesting a ‘breach’ of the ceiling could be only one significant economic shock away,” Workman and Croy said.

Robertson wants to reload the fiscal cannon for future crises, but is unwilling to cut services or raise taxes to get there. Instead, he will rely on economic growth and small surpluses in future budgets to chip away at the debt.

37 Comments

Will the fifth theme be the nuclear moment that is climate change?

Totally lacking in imagination & creativity. Just another "status quo" budget coming to appease the primary voting block. We're doomed to sink further down the mediocrity scale.

Funding set aside for job vacancies has been pulled, underspend budgets have been clawed back, contingencies have been closed, and forecasts have been reassessed.

None of that sounds like a savings from what is currently being spent though. They're just promising not to spend more, and calling it a 'saving'.

Cannot wait for National to get in and open the books to reveal how financially mismanaged this country has been for the last six years.

And then do what about it? Blame labour for next X amount of years they're in Govt...

I doubt they would do that Nifty1; that is a Labour response.

A telling stat in this article was that debt was only 1.9% the year after Labour came in- reflecting Nationals management of the economy and ability to balance the books and reduce debt -- before Labours policy disasters began to take effect - without that debt would be 50% or more by now

National inherited a bankrupt economy with a huge structural deficit and debt -- and they had similar unexpected challenges that Labour have had to deal with -- 2008 GFC, christchurch quake -- there are always unexpected crisis to manage every government will have to face these

Not sticking up for the current government at all, but saying that National balanced the books and reduced debt only tells part of the story. I mean our household savings would have been up +$20k a few years back if we hadn't replaced the tired and leaking roof...

What do you mean the Christchurch earthquake?

The Reserve Bank currently estimates the total construction cost of the rebuild to be about $40 billion (in 2015 dollars), comprised of slightly more than $16 billion each for residential and commercial construction and around $7 billion for infrastructure.

As at 30 September 2015, insurers had paid out $26 billion.

So by 2015, $14b was left to be "settled". Yet somehow our Government debt increased from $10b to $60b over that same period?

https://www.rbnz.govt.nz/-/media/project/sites/rbnz/files/publications/…

"found $4bn in cost savings".....pull the other Grant. How do they even get away with this stuff.

He found 1.9 bill that he promised to spend on mental health but only spent 50mil on a working group.... there, sorted. He is a total clownshow, Cullen was a pro, this guy is a clown.

These guys are not worker supporting unionists.

These guys are not radical transformers like Douglas.

I understood the old labour of Chris Trotters day trying to improve things for the working man.

This lot are lost in the wilderness amateur ideologists and Maori radicals.

It’s a total circus, run by clowns. Where did you find this info? I have been wondering for some time where the mental health funding has gone as I can only see mental health issues getting worse in my job with no extra support.

I was planning to buy a new car next year, but I can no longer afford it. Hey, I just saved $40K that I can spend on rent and food instead!

Grant is our new Oracle of advanced monetary policy. He has found a way to rob Peter to pay Paul so they both believe they have done well!!

Until after the election anyway.

If Labour hadn't done the 'big spending during the pandemic' (a lot of which had no proper control or direction) and Adrian Orr had not decided that super cheap money was the answer even before he knew what a pandemic world would look like, then I doubt we would have inflation to the extent that we do in NZ. After all, it's much lower over in Australia.

Jacinda's "transformational" government has been transformational all right. It has delivered a health system that now cannot cope, community crime like we have never seen before, an education system that now falls short of almost all reasonable expectations, ministries that rarely get things right and huge sections of our society that just simply don't care (census uptake failure, vaccination rates, etc.). The high cost of living and mortgage stress levels for many young families may be less of a priority for voters than Grant Robertson thinks but let's see what tricks he can pull from the budget hat.

If shortage of staff is the problem facing many sectors of the economy as we hear, then that may only get worse with a growing exodus to Australia of those that are both skilled and mobile; i.e. the young.

I will personally never do a census form on time under a Labour again, I will wait until 2 months after the due date, and do one to get the free Warriors tickets and food voucher. CLOWNS

Glad I’m not the only planning to do that.

Yep, CLOWNS summarises it adequately!

Dan highlighted a couple of days ago that revenue is falling - and likely to fall further despite the bracket creep we have

So Chippy's message of a focus on bread and butter issues is over statement as usual - there will be no butter, not even margarine and the bread will be value plus and stale

You can't trust this man. Sorry, person.

"....cost of living support...." but somehow this doesn't include putting more money into the hands of those who actually need it to counter inflation.

Great stuff. Lets add a CGT to this 4 billion and spend that windfall on paying our teachers, nurses, police staff etc more as well as making the first $25k tax free. Courtesy of the big earners at the top end of the wealth conveyor belt. We can use the conveyor belt to return 33% of that untaxed income back to the bottom end to keep the pile of gold at the same level.

nothing delivered. hospitals, chaos. trains and buses, chaos, housing, oh well, never was their problem.

dig a hole first, then fix the hole, and call it victory.

Anybody sèe an issue with this...

"Government net debt sits at about 19% of gross domestic product (GDP), which is below the self-imposed limit of 30% which Robertson set himself in the 2022 Budget.

However, having room to respond to future crises is essential and the Labour government wants to bring its spending back to pre-Covid levels, or about 30% of GDP.

This won’t happen in this budget alone, Robertson said, as it would require cutting services to “austerity levels” but will happen across the next couple of years. "

I find it's odd that the Government seems intent on using underspends, cancelled projects and reprioritisation to fund new spending while it continues to borrow for its current spending. Reports in recent days state the tax take has been down and the overall difference between income and outgoings is widening.

If there's any loose change found around the place, the most prudent approach would be using it to plug the Government's operating deficit.

Robertson has organised a complete disaster. Because he looks down on the rest of us he is incapable of understanding that.

They have been bagging the 319 richest and their supposedly low tax rate.

But the 319 pay two and a half million tax each. I think that's enough.

(As an aside, as pointed out by others here, 319 is an odd number as cutoff point. I guess that was carefully selected to best show the point they already decided to make.)

Superb summary

Anybody can manipulate any stats to suit their politics.

Reality - 100 % of beneficiaries are tax takers.

Myth. " I pay tax on my benefit"

Sure, they pay $2.5m each. But who is being sacrificed in order for them to generate the sort of income that results in $2.5m of tax being paid?

"Boss, can we have a pay rise?" "No, there's not enough money in the kitty"

That night on Facebook/Interest.co.nz

"Man I pay so much tax, unlike these good for nothing bottom 50% losers who receive all sorts of tax credits".

I actually looked into this the other day, I keep seeing people bringing up "50% of New Zealander's aren't net taxpayers" but people seem to forget that part of those 50% percent are people on superannuation. It's talked about as if 50 percent of workers are contributing nothing but considering there are 842,000 over 65's who will be the ones collecting the vast majority of those "transfers".

Then another big chunk would be WFF, and accommodation supplement which is basically a landlord subsidy, then the classic jobseeker which is $3b out of a $50b budget. There aren't as many working-age people just sitting around doing nothing as it seems to be framed from looking at the data.

The info for that is all in the below link showing what the transfers actually are and what groups are getting what. That data is also a bit out of date as it's from 2018.

https://taxworkinggroup.govt.nz/sites/default/files/2018-09/twg-bg-distributional-analysis.pdf

I reckon what we do, is legislate a reduction in rents to a point where WFF & AS can be scrapped. Say the average WFF/AS = $150 per week, so we introduce rent caps that are $150 per week below the current averages.

"Shock horror, you can't do that?!". The only people that would disagree is overleveraged landlords, who ironically are probably the ones making the most noise about the "non-net taxpayers". Then we start looking at that $17b per year (and growing) old person's benefit regardless of need or employment status.

“Grant Robertson said the Budget would focus on returning to “a more sustainable fiscal position” after big spending during the pandemic. “

= still not sustainable.

“ Robertson took a jab at the opposition in his speech, by saying he was being honest …”

= I am not usually honest

"found $4 billion in cost savings to spend". Last time I looked if you spend a saving, it's not a saving. I've always said that Grant Robertson is the most useless and the most intellectually bereft Minister of Finance this country has ever had. There are blobs of formless goo around that would have higher IQ's.

is it showing imagination and creativity to reward those defaulters that failed to complete a census form?maybe they could come up with a better reward than tickets to the warriors to lure them into filling it out.

He's such a tool. I can't even watch his speeches anymore.

Does it believe it’s own BS?

The $4bn is a complete illusion. It wasn't real money last FY and isn't this year. No different than me allocating $100k that I could have borrowed last year to spend this year but decided not to.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.