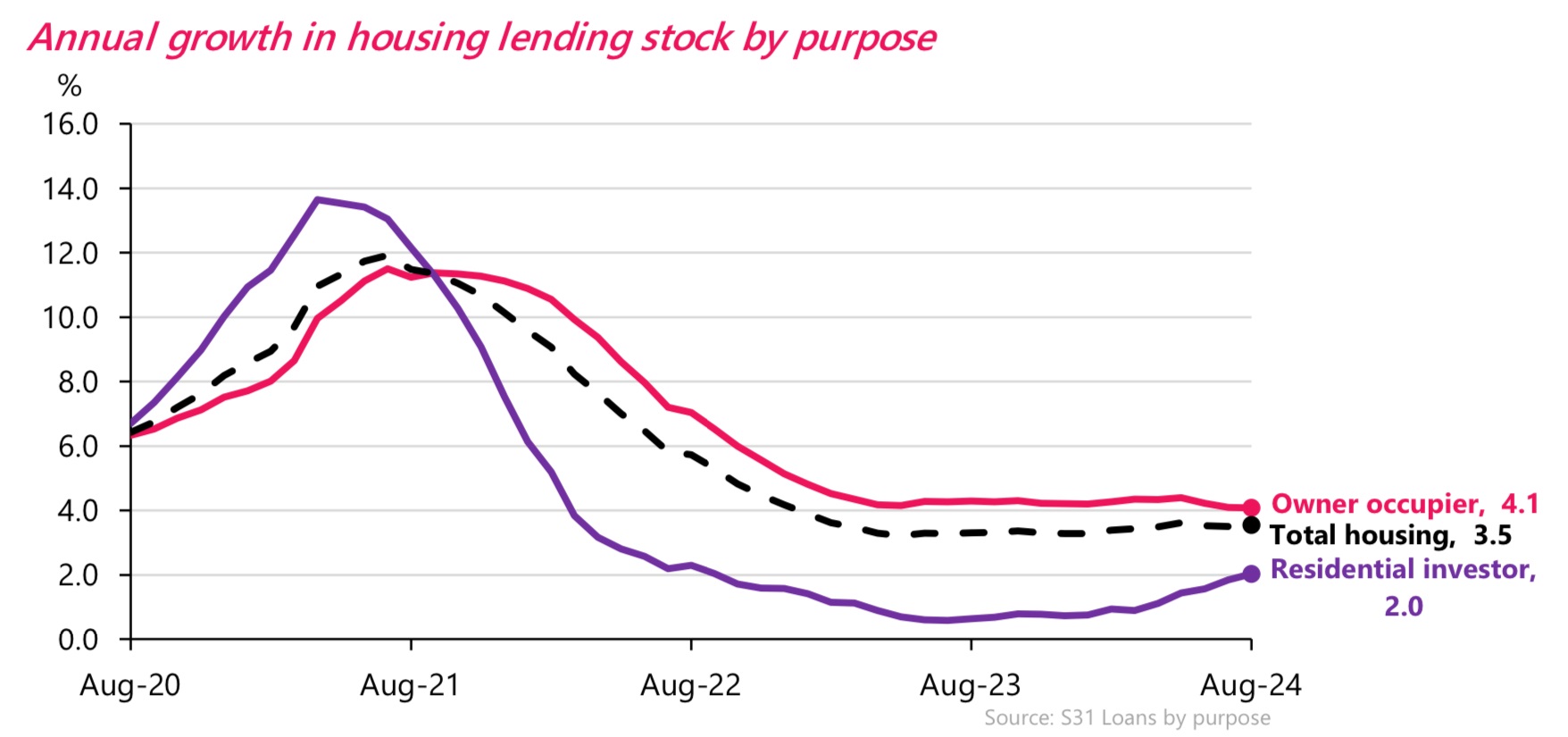

The housing investors' mortgage pile grew by its largest amount in over three years during August, according to latest Reserve Bank figures.

During August the amount of outstanding mortgages to investors rose by $335 million to $91.837 billion.

Now, that's not a huge increase - certainly not when compared with the $1.266 billion of growth the investor mortgage pile experienced in the super-hot month of March 2021 - but it's further evidence that the long dormant investor grouping may have opened at least half an eye to what's going on in the market.

The $335 million increase in the investor mortgage pile in August is the biggest increase since May 2021 and follows a 215 million rise in July 2024. In fact the amount of outstanding investor mortgages has risen by nearly $1 billion since April of this year, while for the whole of 2023 it grew by just $345 million. In 2022 it increased by $1.4 billion.

The latest investor figures follow on from last week's separately released RBNZ data on mortgages by buyer type, which showed investors gaining a bigger share of mortgage monies advanced in August than first home buyers. It was the first time that had happened for two-and-a-half years. Now, that particular data series includes mortgages that have been swapped between banks - so, not all new. Therefore its a bit dangerous to draw conclusions just based on those figures about increased house buying interest and what borrowing is or it not 'new'.

But the now just released figures that show the existing mortgage pile and how much it has grown by, or not grown, give a rather more definitive picture as to whether certain groupings are buying houses or not.

The fact is that the investors have been notable by their absence in the housing market during the past three years after a period of rapid-fire activity that coincided with the pandemic and the RBNZ's (insert your own adjective) decision to temporarily remove loan to value ratio (LVR) limits. Between April 2020 and April 2021 the investor grouping added over $10 billion to their stock of existing mortgages.

Since that feast there's been a famine. In fact, there's actually been more than the odd month in which the investor mortgage pile has actually shrunk.

But of course the investors were hit with reintroduction of tough LVR limits, while on the Government front there were measures such as the removal of interest deductibility for investors and the extension of the timeframe covering the so-called bright-line test (to be read as 'capital gains tax that dare not say its name'). And the housing market went from white-hot to perhaps not bitterly cold, but certainly chilly.

More recently the RBNZ has somewhat relaxed the LVR limits for investors - although it has in tandem introduced new debt to income measures. More crucially, the current Coalition Government has reversed the interest deductibility and bright-line moves.

With interest rates now coming down, it would be surprising if existing and wannabe housing investors didn't at least have another look at the market. The extent to which this 'having a look' crystalises into actual investment will be a key factor for the housing market over the next 12 months. It will definitely be something to watch.

Elsewhere, and perhaps in another sign of stability for the housing market, the RBNZ's bank loans by asset quality figures showed that in August the amount of non-performing housing loans dropped by $26 million to $2.022 billion. This had followed a sudden $141 million jump in non-performing loans in July, taking the overall non-performing total up to an 11-year high and to levels not seen since the aftermath of the Global Financial Crisis.

However, apart from that jump in July, the figures actually appear to have been levelling off in recent months.

Between April 2023 and April 2024 the non-performing housing loan total had risen by nearly $800 million to over $1.9 billion. But since then, apart from the big rise in July, it's been reasonably static.

Now with interest rates on the way down, it will be interesting to see what happens to these figures and whether stressed mortgage holders are able to get themselves back on an even keel.

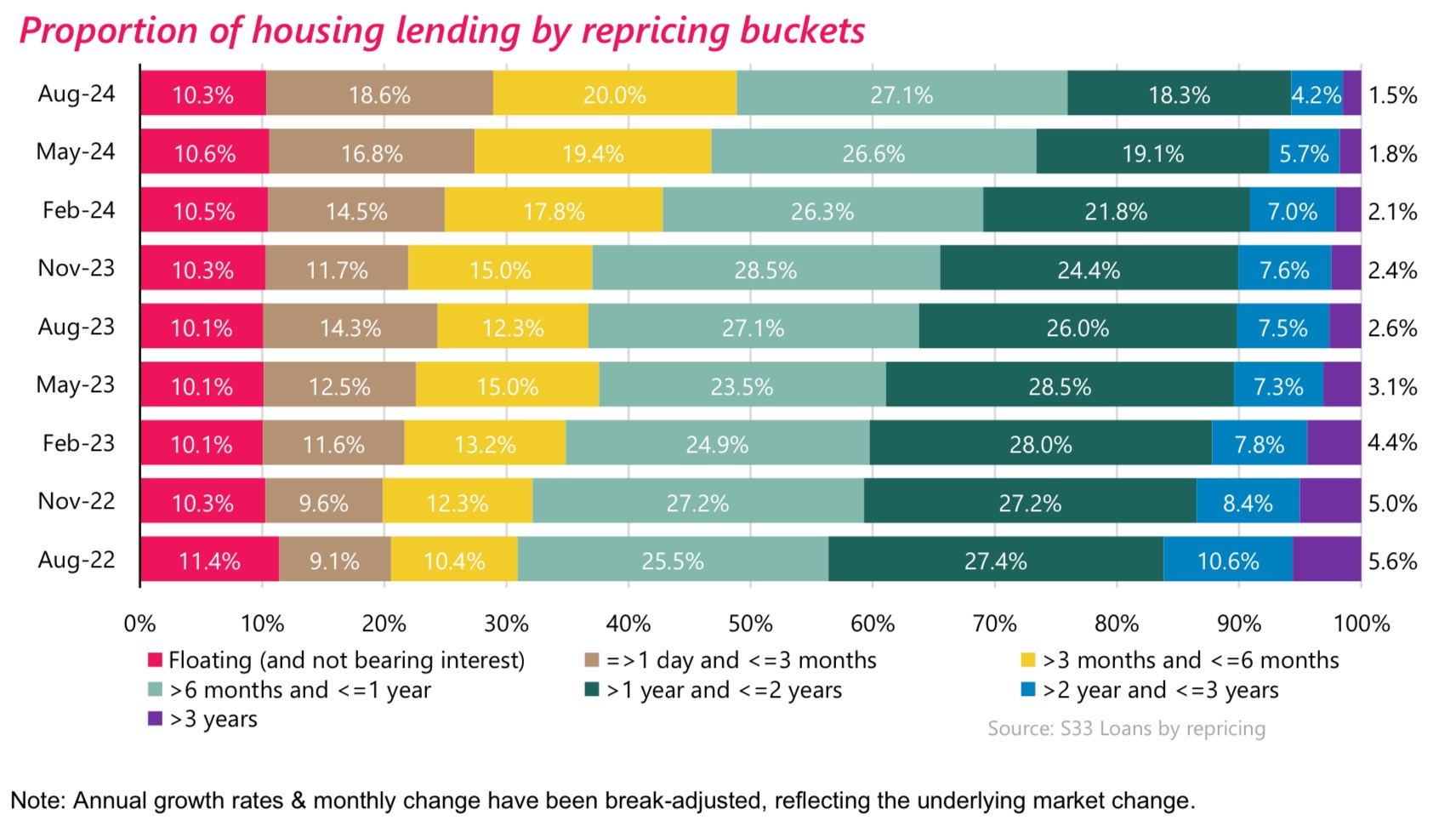

Of course, the mortgage holders - and many of them will be on fixed term rates - will need to wait till the next reset of their mortgage till they can get the benefit of lower rates.

But the reality is that the Kiwi mortgage holders have been more than ready and waiting for the start of rate reductions. I have previously highlighted the extent to which homeowners have been 'going short' with their fixed terms since the start of this year.

Two years years ago, in August 2022, well over 40% of outstanding mortgage money was on a fixed term of over a year.

But the RBNZ's repricing data shows just how much that has turned around. As of August 2024, a whopping 76% of the total $363 billion mortgage pile was either on floating rates or fixed for durations of a year or less. So, in other words 76% of the mortgage money will be getting lower rates on it within a year. And in fact, if we look at durations of six months and less, they account for just under 50% of all the outstanding mortgage money. (The RBNZ's summary that includes the above graph is here.)

So, relief is on the way for many - quite soon.

What this all does for the housing market over the course of the next 12 months, well, we'll find out. Plenty to see here.

41 Comments

Yes, they are back. Record levels of rental inventory meaning increased choice and bargaining power for tenants. Rents are now falling. NACTNZ delivering for the tenants of NZ, unlike Labour which forced tens of thousands of previously privately housed tenants into social housing ghetttos.

Can you explain what you mean by "NACTNZ delivering for the tenants of NZ". What have they done specifically to help tenants? I know they've put a handbrake on KO building and this is bad for tenants as far as I see.

I wouldn't say this govt did it, however the last govt got the ball rolling with the landlord tax - effectively making adding a dampener to house prices and thus assisting tenants to become home owners.

The last government set the cat among the pigeons by expanding housing density rules with the NPS/UD & MDRS. This one? Not much thus far.

Where are you getting your information from?Labours own data shows the net no: of KO new builds since Oct 2017 is only 2601 houses. Labours actually demolished or sold 4,700 houses in the last 5yrs, contrary to their claims they would stop the "State house sell-off".

Labours bought 1,400 houses in the last 5yrs & added them to the State house stock. These arent new houses being built by the Labour, theyre private homes converted into state homes.

4,000 of Labours "10,000 new houses" are redirects, where community housing providers lease properties from private LLs, then house a social housing tenant using a gov subsidy, again these are not new builds.

Labour cannot spin its way out of NZs housing crisis. Labours been abysmally slow at building new social houses. Labours decieved voterbase refused to hold account for the largest rise in homeless, rents, & prices, now form the largest problem in Nz. Try again.

"Rents are now falling?"

National median rent up $30 a week in June year | interest.co.nz (14 August 2024)

Mate you're dreaming!

There are some red numbers in the quarterly figures, Auckland,Wellington and Dunners.

Yes he is dreaming.

Here's rent prices from his KW's same data source (scroll to bottom for raw year v year numbers).

https://johnbutt.substack.com/p/reference-price-charts?open=false#%C2%A…

Great tenants have more choice though, but similar to house sales market, more choice isn't translating into falling prices we simply are comparing stock levels of both rentals and housing inventory to an EXTREME period in time where we stuff people into motels and cars.

I follow PN market specifically. Post GFC until around 2014 there was 700+ houses for sale, that's over a 5+ year time span. Fairly well balanced market at that level with prices flat lining during that time (I bought as many as possible during this period). Then post 2014 inventory fell sharply, getting to as low as 150 houses for sale on the market and sub 20 days to sell by early 2021. Now sitting at 400 - so on my scale using a longer time-line, 400 for Palmerston North (where population has increased maybe 10-15k since GFC) is still on the tight side - hence prices have been flat now for about 2 years as FHB and house movers churn through the stock. Add investors back in the mix and unfortunately 2 things happen - prices show hints of upward movement, competition is visually seen at open homes, FOMO comes back, people with multiple properties decide not to sell as prices go up, all factors brining inventory DOWN (and it has started already PN hit 500 listings at peak, now 400 12 months later, once it gets under 300 then I am sorry buy buyers market will be over - and they've had plenty of time now to make the most of it so only themselves to blame if they don't.

Why ever would rents fall, when every other cost is either still rising or still high?

Why should tenants be the only ones to have reduced costs during a cost of living crisis?

Mate your dreaming! Tenants costs will be the last costs to reduce.

Queenstown bound.

Yes, everyone should probably take a look at the C33 data (New residential mortgage lending by purpose) before reading too much into the investor story. The only significant increase was for changes in loan provider and nominally less was borrowed for property purchases than last year. The most simplistic explanation is more investors switched banks.

If you look at S31 increases in bank lending to investors is tiny compared to Owner Occupier over the last year, as well. August was just more treading water for the housing market.

Is this another bull-trap for residential property 'investors'?

I think it's quite possible.

I suspect many are factoring in the excessive capital gains over the last 20 years and aren't savvy enough to release they won't be repeated for at least another 20 years.

Ho. Hum. I guess they won't lose in nominal terms. But they will lose heaps when compared to other asset classes. And it'll be a terrible waste of capital that could be used to actually create stuff.

What other asset classes? Fixed interest? Shares?

Create what? Invest your money with some shonky outfit that goes bust and leaves hundreds of unfortunate 'investors' high and dry?

How about investing in agriculture?

https://www.farmersweekly.co.nz/news/shortfall-of-8m-as-nz-wagyu-goes-b…

Was about to post the same, have you tried making stuff in this country ? Way too hard. The people making heaps of money were buying up houses, fixing them up themselves and flicking them on and up to a couple of year ago this was zero risk and guaranteed profits.

"have you tried making stuff in this country ?"

Yes. As a matter of fact I have. Software. Doing either 'hard stuff', or 'it can't be done" stuff, or low-level stuff at the bleeding edge, or re-engineering slow crap into fast solid stuff.

Just quietly, both the two comments above simply re-enforce my view that Kiwis are financially pretty illiterate. I blame our education system which, like sex, believes financial competence should be taught at home.

Wingman there are a number of software companies currently on the NZX such as Gentrack and Blackpearl Group where the shareholders are sitting on large gains that make property investing look very ordinary. I retired in my fifties after 30 years of investing in equities and commercial property. Investing in equities does require an element of intelligence.

I've been investing in equities for a lot longer.

It requires a very strong stomach and lots of luck, which makes me think your post was in your imagination.

I am now in my 40th year of investing. You don’t need luck. You do need some intelligence though. My broker who is one of many in NZ has numerous clients who over a number of decades invested small regular amounts in worldwide equities. These people were on average at best incomes. Today they hold equity portfolios in the $5-10m range. The only issue they have is how do they spend their income each year. Overseas travel is generally their answer.

Over that timeframe yes, it’s not really about luck, except that you started in the 1980s before property really took off

There was a colossal crash in NZ in 1987, the world's worst. I suppose the resident 'expert' will tell us he was unaffected.

Actually I was unaffected. My wife at that time earned more than me. We had saved about $45k which was tagged for our second home. The sale and purchase agreements were unconditional with settlement to come. My broker told me to get the funds out of equities as it was house money and he felt the market was over bought. I listened and sold them and the rest is history. I was bloody lucky. If we had to borrow that $45k it was not cheap. One thing you have to remember is very few people lost everything unless they were fools. Eventually the market recovered as it always does and more. I am not an expert. I have made mistakes and have learnt from them. From the sounds of it you have never made a financial mistake Wingman. We need you as our RB governor.

Software is not really making stuff. We don't build the stuff that matters in this country its all imported.

Tell that to the shareholders of the companies currently on the NZX which are creating software in NZX and selling it to overseas clients in big revenue numbers that are increasing quickly. I include Xero in this category even though it’s on the ASX. $A150 per share today.

If you haven't noticed already - software is taking over the world. Even tech companies that "make stuff" are all moving to software as much as possible because that's where the high margins are. Perfect for a country that is at the end of the world with good internet connections.

We had the right idea in 2001 with the knowledge wave conference but we did nothing with it. I think of what could have been if the government had setup a new computer science school with extra fee subsidies to our smartest kids.

I was often interested in your comments Chris. This one is difficult. Your las para re financial literacy rings very true. But “re-engineering” isn’t building anything. It’s a wank word for fixing something.

If schools taught financial education just as they do sex it'd be even more nonsense & waffle;

- teaching there's no difference at all between men & woman, that one can be both a man & a woman at the same time whilst also simultaneously being neither, that men can have periods, give birth & breast feed, that certain biological reproductive parts doesn't make one a woman but apparantly wearing lipstick, putting on high highs & carrying a handbag somehow does

- We absolutely do not want schools to be even remotely a part of attempting to try teach financial literacy. The curriculum would muck up even the very basics of financial literacy. They'd teach more maxist socialists mantras like let's all tax our way to financial prosperity, or to penalize anyone that has more than oneself as one must somehow be a victim. No way.

Other asset classes? As in crypto? So volatile it's been known multiple times to lose over half it's value in a single day. How many times has the housing market lost over halfnits value in a single day? This is the largest decrease in property prices since the 1980s, and yet property prices have fallen just 20% accross the country, and took several years to do so. This was after a 94% increase in property prices accrosd the country in just 5 of the 6 years under the previous government due to their constant meddling. So actually, it's not 20% drops on property, it's 74% increased on prices from 6 years ago. What other investment could return such gains with such little volatility? Almost none that most investors would be willing to entertain.

Looks like all those Govt/RBNZ policy changes in July may now be feeding through in the data...

One drop in rates and its already started, just wait until we get another 100bps drop.

You'll be waiting a while for that!

100bps in one drop won't happen anytime soon. (I hope, the economy would be completely in the poo for that to happen)

But 100bps over two to four MPC meetings is very likely. Could be halfway there in 8 days. Four 25bps drops by early April isn't that far away.

Another 100bps before February 2025.

Great news for aspiring FHB. Potentially lower rents enabling them to shave a month or 2 off the time to save for a deposit, and increased choice in the places to live while they slog away.

I don't think there is anything of note here as if house prices are increasing at 2% a year then it would make sense that investors are borrowing 2% more but still purchasing the same low number of houses.

Also the numbers don't work for investors

Also for existing loans isn't the average interest rates on total mortgages still increasing as remaining low fixed rates roll off, but you don't hear much about this

"Also the numbers don't work for investors". The numbers may not work right now but investors are looking at what's happening in the future, not right now. Right now is starting to look like the time to buy, they don't wait for all the signs to be positive because by then its too late.

Interest rates falling

prices falling

both

will help the numbers work

but if prices fall you will be holding losseS

If the value of your investment properties was depressed by the cost of borrowing limiting the pool of potential borrowers/buyers. Could you borrow against some properties with equity available. Put those funds on deposit and use them to cover the rental income shortfall you have on other properties. Until interest rates are cut and additional buyers can enter the market to stabilise/improve prices. Then you can rebalance your portfolio without making capital losses.

That would be a bit absurd.

The problem is that the interest paid on borrowed money is always higher than the interest received from deposited money. Therefore borrowing money so that you can deposit it in order to earn interest is not something that any rational person/investor is going to do. Unless the numbers change somehow.

We have a huge proportion of our housing stock owned by investors already, at the very top end of the OECD. National want to grow rental supply, they seem to have no interest in growing home ownership. Do we need more investors? I'd suggest it's the opposite. We are literally living out a real-life game of Monopoly in this country.

Where are you getting your information from? Statistics.co shows that just 6% of home owners are investors, and that 80% of that own just 1 rental property. Clearly listening to too many far fetched left wing fabricated envy stories about 100s of investors with 100s of property.

Considering Labour:

failed to build its 100,000 kiwibuild homes for sale to FHBs,demolished more old State homes than they built, primarily built new state homes for renters, not owners, increases rent up by 60% under their 6 years reign with rents having risen over 2.5x faster than the previous National government, and home ownership became at an all time 70 year low under their reign.

It is much more likely that you have been decieved by labour, who claimed to advocate for the people, but did everything but that. Labour has shown over their 6 year stint to have grown the rental supply by all timr historic highs. Labours taxing, penalizing, restricting housing policies were the direct cause of the fastest rising rents & house prices in this countries history. Not to mention the 548% increase of homeless on the government's emergancy social housing wait list under their 6 years. When National took over just under a year ago there were over 25,000 families on this list waiting an average of 5 years. This shows clearly that the government cannot house half the country that rent, they can't even house 25,000 families. Absolutely the country requires private investors to step in.

And you think Nationals 10 months has caused damage? Lol Wake up. Any damage they could cause would be an improvement on Labours 6 years. It will take much much longer than just 10 months to undo 6 years of damage causes by Labour. The fact that one clearly has been taught through cheesy socialist mantras to dislike National is irrelevant. Facts over feelings.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.