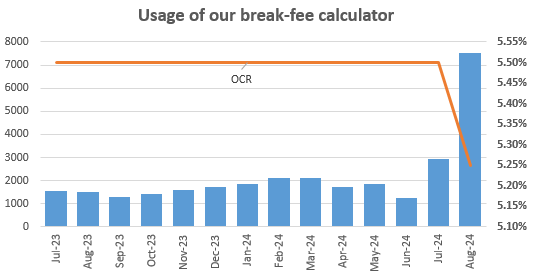

The number of people accessing interest.co.nz's mortgage break fee calculator spiked last month as banks cut mortgage rates and the Reserve Bank reduced the Official Cash Rate (OCR).

Break fee calculator views jumped during August to 7533 amid record overall traffic, way ahead of the 2924 in July, which was comfortably the most for any 2024 month up to that point. (See the chart at the foot of this story).

This came as the Reserve Bank cut the OCR by 25 basis points to 5.25% on August 14, in what's expected to be the first of several cuts. Banks had already been cutting mortgage rates ahead of this as wholesale interest rates fell, and have continued doing so since.

As of August 30, the average carded, or advertised, bank two-year mortgage rate was 5.997%. That's down from 6.717% on July 19. The average one-year rate was 6.501% on August 30 versus 7.034% on July 19.

A falling interest rate environment can lead to borrowers with a significant period left to run on fixed-term loans look into options to lower the interest rates they're paying.

However, if customers borrowing at a fixed interest rate for a set term repay their loan early, banks are allowed to recoup lost earnings by applying an early repayment charge, or a break fee. This must be included in the terms and conditions of the loan contract. Under the Credit Contracts and Consumer Finance Act, lenders are allowed to recover their costs. (There's more from the Banking Ombudsman Scheme on this here).

Loan Market mortgage adviser Bruce Patten says he's not currently seeing people wanting to break loans.

"Because anyone due in the last 12 months has been fixing short term on the expectation rates were going to start falling soon," Patten says.

"People seem to think the banks have been waiving break fees when in actual fact they just haven't had any. Because someone selling and not re-buying or making a lump sum [payment] was doing so on a rate much lower than the current rates, so they didn't have to pay anything."

Patten says cash incentives offered by banks are running at about 0.80% to 0.90% of the amount borrowed, so if someone was breaking a mortgage they could use such a cash contribution from a new lender to offset the cost of the break fee.

The latest Reserve Bank data shows about 28%, or $89.921 billion, of the $323.897 billion total value of home lending on fixed-terms - as of the end of July - was fixed for more than one year.

Fixed mortgage rates

Select chart tabs

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

3 Comments

People seem to think the banks have been waiving break fees when in actual fact they just haven't had any.

Generally, if there is no break fee, it's because swap rates have increased since your loan was fixed. Where there is a fee it is amortised based on the remaining contract duration.

I have never heard of banks offering a cash incentive towards this fee however. Why would they? They already have your business and you would have to pay to refinance. Even if you accepted that feeling you would be tied to that bank for several years henceforth.

The cash incentive is from the bank to transfer your loan too. Some will also cover the legal costs/have their tame legal firm do the work if discharging a mortgage and registering a new one.

Just broke with my same bank 4 months left into a 6m term, saved 1.1% on my rate at carded, will save $4,500 interest after break fees in 4 months. Have been 6m fixing for the last 18 months.

In December my 4 year cash incentive claw back will be up and I can change banks after Feb OCR given serviceability testing levels get down to where I need it.

Don't wait for your fixed term to be up people, get relief now!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.