With all the trade war talk, we all ask the obvious question: Who will win? President Trump says the US will win. Chinese business leaders say no, we will win. Free-traders on both sides say no one will win. Few stop to ask, “What does a ‘win’ look like?”

This makes discussion difficult. People are chasing after a condition they can’t even define. Victory will remain elusive until they know what they want. Regardless, you can score me on the “no one wins” side. I believe, and I think a lot of evidence proves, that free trade between nations is the best way to maximize long-run prosperity for everyone.

However…

As Keynes famously said, we’re all dead in the long run. Trade war may end with no winners, but the parties will be better and worse off at various times as it progresses. So we have to distinguish between “winning” and “holding a temporary lead.”

On that basis, I think the US will have the upper hand initially, and could hold it for a year or two. This is because, for now, our economy is relatively strong and we can better withstand any Chinese retaliation. Beyond that point I think our current policies will begin to backfire, maybe spectacularly.

Remember, too, China has growing trade surpluses with much of the world. One Chinese insider told me that within four years China can replace lost US exports via increased trading with the rest of the world. I can’t verify that but looking at general statistics it certainly seems plausible. That doesn’t mean lost US trade won’t be felt, but China is not entirely helpless.

When watching a fight, we ask metaphorically, “Who will blink first?” In this case, that’s the wrong question. Neither side will blink but one may eventually fall to the floor, unconscious. So the better question might be, “Who will faint first?”

Next week we will deal with the tariff situation, as I get that question a lot. But let me state right here: I hope President Trump is engaged in a trade bluff and not a trade war. The market seems to think so. My Asian sources believe that it will be resolved by the end of this year. But make no mistake, an actual trade war along the lines being threatened will impact both economies negatively. Enough to throw the US into recession? Enough to cut Chinese growth in half? No one actually knows, which is a big part of the problem.

Empire of debt

I described in my last two letters the many good things happening in China. Businesses are prospering while living standards rise as well. The country’s vast interior is still quite poor but life is improving (with the notable exception of the Uighurs, a Muslim minority in Western China).

We didn’t talk about how they are financing this progress. The answer is, “with a lot of debt.” You often hear about China’s government and corporate debt, but less about households. So let’s start there.

Back in 2015, I wrote about China’s insanely leveraged farmers and others who bought stocks with borrowed money. Most regretted it, some sooner and more intensely than others. But that period seemed to convince the government to keep tighter control over consumer credit.

But note, controlling credit isn’t the same as eliminating credit, or even reducing it. Beijing wants consumers to borrow in sustainable, productive ways, as Beijing defines them. So overall household debt growth has not slowed.

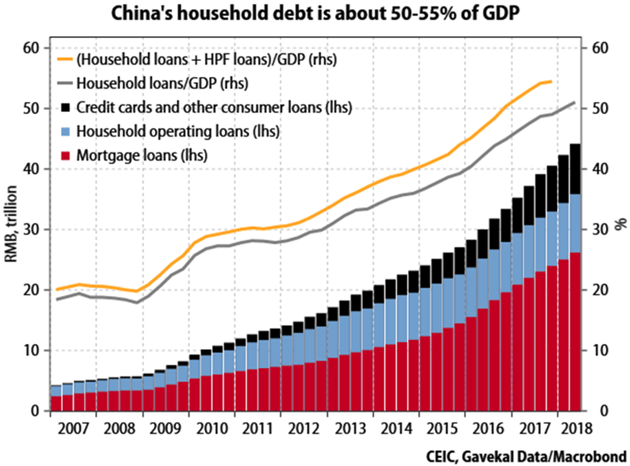

Source: Gavekal

Chinese consumer debt is growing quite a bit faster than Chinese GDP. This means that consumer debt is a growing percentage of the economy. It’s not a big problem now but at this rate will become one soon.

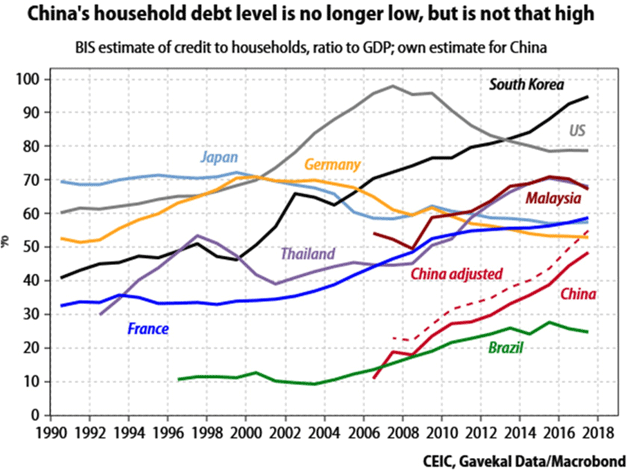

This chart shows how Chinese household debt is growing compared to other economies.

Source: Gavekal

Household debt relative to GDP is near-flat or declining in the US, Japan, Germany, and France. In China, it’s grown from 40% to 50% of GDP in just two years. Yes, those developed countries have higher absolute debt levels, but they also have higher household incomes. So this trend, if it continues, will get more worrisome.

Now, what happens when these indebted Chinese consumers find living costs rising due to a trade war with the US?

One possibility is “not much” because they don’t really need our goods. They have plenty of domestic alternatives in most categories. Nevertheless, removing or limiting US competition could raise prices in some categories.

But the bigger problem is that a trade war will mean lower exports, probably affecting the jobs of some indebted consumers. How many is unclear. China has both domestic demand and other countries it can trade with, should the US decide to raise barriers. Domestic demand might weaken if exporters have to reduce employment and the government doesn’t step in with some kind of stimulus.

The problem here is that any stimulus would probably increase government debt, a problem we haven’t even discussed yet. Not to mention corporate debt rising as companies try to keep operating with lower revenue.

Debt in pictures

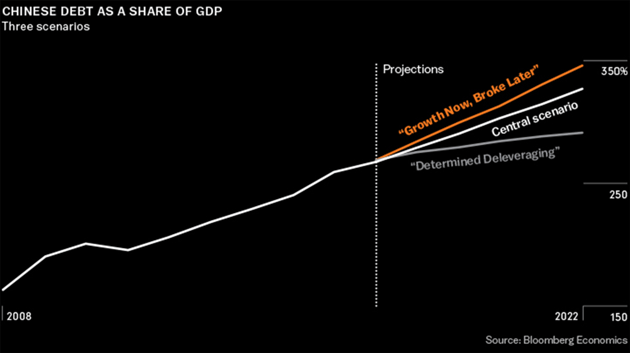

Like everything else about China, its debt is hard to visualize. There’s a lot of it. Here is a chart from Bloomberg that projects three scenarios out to 2022.

Source: Bloomberg

Bloomberg’s base case shows Chinese debt-to-GDP reaching 330% by 2022, which would place it behind only Japan among major economies. It might be “only” 290% if GDP growth stays high.

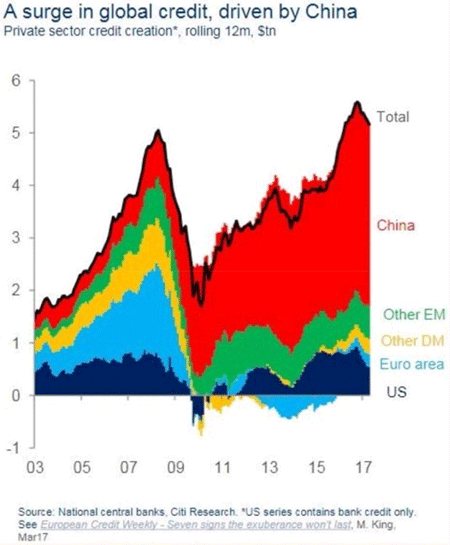

Here’s another look from Citi Research (via my friend Steve Blumenthal). This is private sector credit creation. The US series is only bank credit, by the way, so this isn’t an apples-to-apples comparison. But then much of Chinese debt is bank credit. The “shadow banks” are relatively new. Xi seems to be trying to reduce their influence. However you look at it, China has huge private debt.

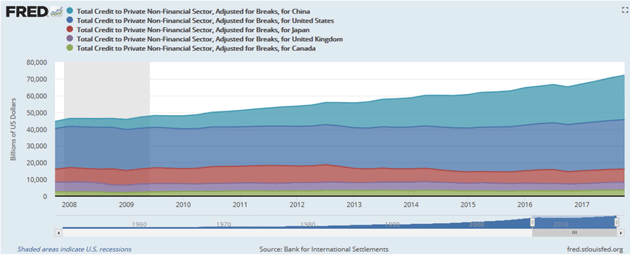

Finally, here’s a “Total Credit to Private Non-Financial Sector” graph we made on FRED using Bank for International Settlements data. That means it excludes bank debt. The US has the most such debt at $29.5T as of year-end 2017, but China is not that far behind with $26.5T. China’s debt of this type was quite a bit more than Japan, the UK, and Canada combined.

Source: St. Louis Federal Reserve Bank

Even so, Chinese growth has been largely funded by debt. Make no mistake, loans have fueled almost everything. You can argue those loans have funded a great deal of useful infrastructure and housing, with a stimulative effect. But that debt will eventually have to be repaid, and debt is future consumption brought forward. That means at some point Chinese growth is going to slow down. Maybe not for a decade or so, but they have to pay the piper.

Like the US, China also has off-the-books debt that may not show up in the totals. For instance, its social security plan is underfunded amid an aging population and shrinking prime-age workforce. The 29% payroll tax (yes, you read that right) that should be funding it often goes uncollected and the debt goes higher still. One analyst estimated strict enforcement would cut corporate profits by 2.5% and shave 0.6 percentage points off nominal GDP growth. With the Chinese government now making aggressive efforts to collect the tax, which it clearly needs, growth could falter.

Any way you look at it, China has a staggering amount of debt. Maintaining it will grow more difficult if the economy turns down. The same is true for the US, of course. Which country is better equipped to survive a trade and currency conflict?

Wargaming the trade war

This week President Trump ordered more tariffs on an expanded list of Chinese imports. The rate will be 10% starting next week and rise to 25% at the beginning of 2019, unless China agrees to new trade policies before then. (Notably, he excluded consumer electronics products like smartphones, which shows the administration is not entirely tone deaf to the impact tariffs have on US consumers.)

Let me be very clear on one thing: I totally agree with the president that China has taken unfair advantage of global trade rules. Its requirements for foreign companies to disclose intellectual property (that then finds its way to Chinese state-owned enterprises) is outrageous. That must stop and we need to resolve assorted other differences. The question is how to accomplish it.

I had hopes Trump’s business negotiation skills would enable more productive trade negotiations. It doesn’t seem to be happening that way. To me, the best strategy would have been to assemble a united front of other top economies and demand China change its ways. We are not the only major country that has a trade problem with China. Then I would have pivoted to seeking better terms with Canada, Mexico, the EU, and others. Instead, he has aggravated allies and made working with them difficult, at best.

Part of negotiating is to have realistic demands. You will never succeed by demanding your adversary cut his own throat. Xi Jinping can be flexible on many things but he still presides over a Communist government and a command economy. That leopard is not going to change its spots. They are never going to abandon their technology goals embodied in their “Made in China 2025” program, nor would any other country.

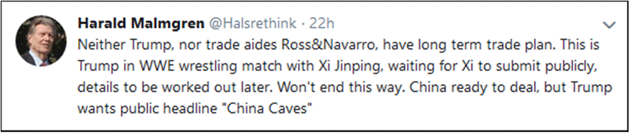

I am not the only one who thinks this. Check out this unusually blunt tweet from former trade diplomat Harald Malmgren, who literally wrote the book on US trade policy, serving under presidents starting with JFK. He’s retired now but remains “plugged in” to global finance better than almost anyone I know.

Source: Twitter

Now, it may be that the White House team is less talented than they think. Peter Navarro’s continued presence, and the president’s apparent confidence in him, is not reassuring. I said when his name was first mentioned that Navarro understands neither economics nor trade. He has done nothing to change my opinion.

But another possibility is they have an entirely different strategy than we think. Some of my contacts believe the real goal is to make US businesses pull back from operating in China at all. If that’s the goal, they are off to a good start. But that is not good for US businesses or for the US.

For the moment, the US side is negotiating from a marginally stronger position. Our economy is growing nicely and can withstand some tariff pain—though it will hurt certain sectors. This is already happening, in fact. But in the long run we are playing a very dangerous game.

International trade is like plumbing. Goods and money flow around through pipes and you can only squeeze so much through them. When the US imports goods from China, we simultaneously export dollars to China. We can do that because our currency is what everything else is settled in. Reducing imports would mean we also reduce dollar exports, leaving the rest of the world with less water in its pipes. That’s not good at all, if we want to maintain our position on top of the food chain.

In researching this letter, I ran across a nice, short explanation of the threat by currency expert Taggart Murphy. I can’t say it better myself so I’ll just quote him (emphasis mine).

Trump is doing everything he can to bring on the end of the days when the US can borrow whatever it wants in whatever amounts it wants. To be sure, there is no recipe book. The dollar is now so entrenched as the world’s money that if your assignment were to bring the curtain down on that—and thus the ability of the US to borrow whatever it wants whenever it wants—it’s not at all clear what you would do.

But you’d start by doing everything that Trump is doing—pick fights with all your allies, blow the government deficit wide open at the peak of an economic recovery, abandon any notion of fiscal responsibility, threaten sanctions on anyone and everyone who seeks to honor the deal Obama struck with Iran (thereby almost begging everyone to figure out some way to bypass the US banking system in order to do business), [Which they are openly doing –JFM] throw spanners into the works of global trade without any clear indication of what it is precisely you want for a country that structurally consumes more than it produces and thus by the laws of accounting MUST run trade and current account deficits.

That’s strong language but exactly right, especially the last part. Trade deficits are President Trump’s bugaboo, yet he might as well complain about the weather. It is what it is. The US will run a trade deficit unless we accept some combination of higher savings and lower consumption. That’s not my opinion; it’s math. Threatening China will not change it.

Trying to wean the US public off of consumption and force higher savings is just not going to work, either, which means we are going to run trade deficits.

But that is just fine. As long as we have the world’s reserve currency, we can run trade deficits with essentially no consequences. We aren’t comparable to Argentina or other countries that get into trouble because of their trade deficits. Nobody, not even their citizens, wants to hold the Argentine dollar or the Venezuelan bolivar.

This brewing trade war, if it continues, will initially favor the US but we will gradually lose the advantage as the rest of the world builds new pipes to bypass us. Something similar happened to the United Kingdom, our predecessor hegemon. We don’t know what a new world financial order would look like but the US dollar would not be on top of it.

This might be an interesting parlor game if it weren’t happening against the backdrop of populist politics, enormous debt, mass refugee migrations, and rapid technological change that could put millions out of work. Talk about “who wins” is really misleading.

Think about a boxing match. Who’s “winning” in the early rounds? Whoever threw the last punch is ahead for a moment. But then they take a punch and the lead changes. It’s only later in the match that you see which fighter has staying power.

I think the US-China trade war will be something like that. It will take a long time to see how it shakes out, and meantime we’ll see both sides alternately throwing and absorbing punches. The lead will change often and the winner could even be a third party that may not exist yet.

It is my fervent hope that China makes a genuine effort to reduce their most abusive practices, and that President Trump takes that for a “W” and calls off the tariffs. I think that is the most likely outcome. One of my most inside sources in China, whom I spoke with this week while he was in Shanghai, believes that to be the case, and most Chinese do, too. Which is why the markets are being rather sanguine about the whole process. We should learn more in the coming months.

*This is an article from Thoughts from the Frontline, John Mauldin's free weekly investment and economic newsletter. This article first appeared here and is used by interest.co.nz with permission.

33 Comments

China has 1.4 billion people behind the war while the US has 0.3 billion.

I know who is going to win.

1.2 billion of those people are below the poverty line so wouldn't have any energy to fight.

Amazing stats that you provided. Are your stats from 1900?

More interesting than wealth alone is the aging demographic. It will be very interesting to watch and see whether as some put it, "China will get old before it gets rich".

https://www.scmp.com/news/china/economy/article/2130737/why-china-must-…

https://www.forbes.com/sites/salvatorebabones/2017/12/31/china-max-how-…

Good point.

The recent change from one child policy to two children policy came a little late than most demographers expected in China. But it's done.

Let's see how the US would deal with this (https://thesocietypages.org/socimages/2013/05/08/changing-u-s-racial-de…). By 2050, the share of white population would drop to 47%. The United-SA would be more likely a Divided-SA.

What will be an intriguing prospect too is whether China decides to look to immigration to address its demographic issues. Population increase via immigration will be propping up the USA...but could China attract inward migration, and would the local population accept it any better?

You are kidding me. China, in foreseeable future, will only be an emigrating country.

Do you know how hard it is to get a permanent residency in China?

To qualify for the Green card, you need to fulfill at least one of the following criteria:

I Be a high-level foreign expert holding a post in a business that promote China's economic, scientific and technological development, or social progress.

II Have made outstanding contributions, or are of special importance to China.

III Have made large direct investment of over 500 thousand US dollars in China.

IV Come to China to be with your family, such as husband or wife, minors dependent on their parents, and senior citizens dependent on their relatives.

Yeah, but that's not so much a good thing when the country is facing demographic issues, eh? That's the issue.

They'd need to turn around that difficulty even before getting to the task of trying to attract younger people in to China, rather than having them flow out. How many of those currently flowing out are doing so to push money back to and prop up the mainland, vs building their own life abroad?

(Notwithstanding any possibility with Jian Yang.)

I am pretty sure your sense of young Chinese ppl flowing out is more or less equivalent to young Kiwis flowing out to AUS, Singapore etc. But they are completely different.

1. Young Chinese with oversea experience do flow back

2. Super good ones are rewarded heavily to flow back

It is a circular system in China where young ones flow out, get educated, get experience, get improved then flow back to get a significantly better life. By contrary, for NZ, it is like a one direction flow -- young ones get education here, flow out to AUS/Singapore/Eng to have a busier life, most do not turn their head back.

Do you have any numbers on that?

http://en.moe.gov.cn/News/Top_News/201804/t20180404_332354.html

the first link pops up after google "number of Chinese international student back to china".

Ah, pure coincidence it's a Chinese government source, phew ;-) (related to your tit for tat below)

So while 600,000 students went out, and 500,000 returned (in the last year), emigration still seems to be a major source elsewhere (9 million in 2013):

http://www.chinafile.com/multimedia/infographics/wealthy-chinese-are-fl…

https://www.migrationpolicy.org/research/emigration-trends-and-policies…

Would be interesting to know how many middle class or wealthy Chinese move back to mainland China after emigrating. Suspect it's not that high...and a big driver for why the CCP clamped down on capital outflows.

I doubt the emigrated family will move back to China.

BUT, If you think beyond one generation, you probably will see the children of the first generation emigrants with a perfect command of two to three internationally used languages, equipped with nuanced awareness of two to three completely different cultures, confident and well educated flowing in and out among major international players and really bridge this increasingly aparted world.

This is called "天下观" -- the view of an integrated world.

That's quite possible...but whether they'll feel loyalty to the mainland and want to put their money back in the reach of the CCP is another matter...and surely that's where the demographic timebomb is at play. Especially if they intermarry and have kids in their country of birth.

I've read sad and angry commentary online from NZ born ethnic Chinese Kiwis, at the way migrants from the mainland talk about them and say they're "not real Chinese", or too local. That's quite a gulf between migrants and first gen locals.

Please move your CCP propaganda rubbish to stuff where it will be more welcome.

Thanks for the list of requirements to obtain permanent residency in China. Could you send it to our NZ ministry of immigration?

dp

You meant 'trade war' I hope. it's going to be interesting for sure.

1.4 billion to feed is a lot of people and even NZ's land sales to the Chinese won't be able to feed all of them. They are exporting people quite well though, so that could help and I'm sure Uncle John and the Nats would happily take another 20 million or so. What do they do with those two generations where there are far more men than women? That one-child policy did seem to discriminate against having girls for some reason, good job there is a loose interpretation of human rights I guess? But it has produced a lot of grumpy men who will have no chance of finding a partner in China, but would make substantial cannon fodder for Imperialist ambitions.

What do you think xingmowng, Give it to us plain and simple...

I recommend you download some apps called "Hu Ya" or "BiliBili". They are real time online streaming broadcasting platforms in China.

There are various popular channels where guys broadcast their daily lives together with their local girl friends from far east of Russia, Ukraine, Belarus, Turkey, and Ethiopia etc.

Just one of the many "Happy Accidents" from the Belt and Road Initiative.

You scratch my back and I'll scratch yours.... makes perfect sense.

The modern wage slavery?...ah wait there are no wages as one of these wives, just second-class citizen status and a victim of exploitation for the rest of their lives...

Does the CCP give you social credit points every time you post here?

Does CIA give you any every time you post here?

I have the same answer as yours.

The difference is bilbo doesn't constantly post pro US talking points but you consistently post pro-chinese communist party ones.

I've met people like you, you're a dime a dozen. Probably get bitter and angry every time you see a white male/asian female couple, so you make yourself feel better by drinking CCP kool aid.

I should have a bigger heart and brain than you do.

I will make sure my "yellow and white" mixed children will grow into someone to make the world a better place.

No, I'm doing that. People like you are actually enabling a broken system and holding back China from progression. I'm sure many of your younger fellow country man have radically different ideas from you. You and your mindless propaganda and becoming more obsolete by the minute.

China has a rapidly ageing population, is surrounded by enemies, has a looming debt crisis, fabricated economic figures and spends more on internal 'security' than defense. The communist party has an expiry date - same as every communist party ever.

The US has accurate figures, a growing population, and is still the premier destination for top level talent across the world.

We're at peak China already. There's no way they can win. The lost generation there is going to be a lot uglier than it was in Japan.

There may well be an 'Asian century' - but it will be a south asian one. The far east is doomed demographically.

My dad is bigger than your dad and would beat your dad up. That was an argument I used to have in the school yard at ten years old. Why don't you grow up.

I'd rather bet on quality over quantity , sorry.

China will play the USA out, they have lots of TIME on their sde

The United States of America has been a country much longer than the Peoples Republic of China.

Time is on Americas side.

This is the big question of our time, isn't it? Who will out think, out play & out last the other.

These are the two global bulls going at it, head-to-head, very civilly at first, but as the article explains, each phase will play out slightly different to the last. This is a fight to the finish, with control of the planet's riches & resources for the next generation (or two) up for grabs. Trump has the disadvantage of half of the American people wanting to impeach or kill him, which is not ideal, while over at the Han, the brutality of the treatment of its own people is ready to haunt them at any time. Don't underestimate the possibility of the Chinese people turning on their own government either. A civil war in China is in my top ten picks and running out of money could be the perfect flash point. Communism can be quite cruel remember.

Another angle on the trade maneuverings from the ever-connected David Goldman over at Asia Times: US auto industry Trumped?

The whole thing is worth a look: Goldman dates the switch from 9 July, when Volkswagen, BMW, Daimler, BASF and Siemens pivoted to China.

China also holds the keys to the future of self-driving cars. Rather than attempt to design autonomous vehicles to negotiate the poor infrastructure of American cities, China is designing cities around the concept of autonomous vehicles, with roads fenced off from pedestrians and 5th-generation mobile broadband.

China is not only the largest auto market in the world, and likely to grow as a percentage of the world auto market, but it is the center of auto industry innovation.

The other aspect, German manufacturers aside, is the line-up of other countries with China, at least partly because they can see the opportunities for trade, partly because China and Russia play chess, not checkers, and the BRI provides the logistics which will tie the whole shebang together.

Interesting times....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.