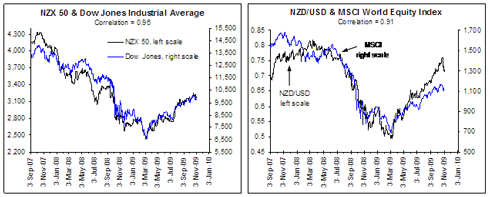

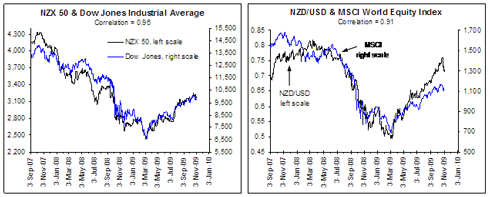

By Rodney Dickens Since the international financial crisis started in 2007, and especially since it escalated post the bankruptcy of Lehman Brothers in September 2008, the overnight performance of the overseas markets has largely dictated what happens in the NZ share market and with the NZD/USD the next day. If the overseas markets have a good night it is almost a sure bet that the NZ share market will gain ground and the NZD/USD will appreciate, and vice versa if the overseas markets have a bad night. This linkage is reflected in the extremely high correlations between the NZX 50 share market index and the Dow Jones (left chart below) and between the world equity market and the NZD/USD (right chart below).

By Rodney Dickens Since the international financial crisis started in 2007, and especially since it escalated post the bankruptcy of Lehman Brothers in September 2008, the overnight performance of the overseas markets has largely dictated what happens in the NZ share market and with the NZD/USD the next day. If the overseas markets have a good night it is almost a sure bet that the NZ share market will gain ground and the NZD/USD will appreciate, and vice versa if the overseas markets have a bad night. This linkage is reflected in the extremely high correlations between the NZX 50 share market index and the Dow Jones (left chart below) and between the world equity market and the NZD/USD (right chart below).

It is common for people to form expectations about the future based on recent experience even though recent experience can at times be a poor guide to future behaviour. The NZ share market won't necessarily remain linked to the fortunes of the US share market, with the left chart below showing both the recent close relationship and a major difference in performance between 1995 and 2002. Similarly, the right chart below shows that in the relationship between the NZD/USD and the world equity market has for extended periods been totally different to the recent cosy one.

It is common for people to form expectations about the future based on recent experience even though recent experience can at times be a poor guide to future behaviour. The NZ share market won't necessarily remain linked to the fortunes of the US share market, with the left chart below showing both the recent close relationship and a major difference in performance between 1995 and 2002. Similarly, the right chart below shows that in the relationship between the NZD/USD and the world equity market has for extended periods been totally different to the recent cosy one.  Could the linkages breakdown? This Raving doesn't supply conclusive answers. Rather, it encourages people to keep an open mind and most importantly to keep doing homework on what really matters to markets rather than falling back on rules of thumb like the rule that what happens overseas will be the key to NZ market behaviour. If there are fundamental differences in the key drivers of markets then ultimately the fundamentals will out. In that context, there is an interesting divergence in monetary policy emerging between New Zealand and Australia. This was discussed in the recent Raving titled "Should Australia take over NZ monetary policy". As discussed in the recent Raving, the key leading indicators are pointing to NZ and Australia both experiencing strong rebounds in economic growth, while both countries are facing a high exchange rate and leading indicators of inflation are similarish in both countries. These similarities suggest that similar monetary policy decisions should be unfolding in the two countries. On 29 October Governor Bollard stuck to the view that "a very gradual increase in household spending appears to be taking place" and that "The forecast recovery in economic activity is based on fiscal and monetary policy continuing to provide substantial support to the economy. We think such support remains appropriate." While Bollard continues to largely dig his toes in over when OCR hikes will begin: "In contrast to current market pricing, we see no urgency to begin withdrawing monetary policy stimulus, and we expect to keep the OCR at the current level until the second half of 2010." However, his thinking has evolved with "the second half of 2010" replacing the previous "late 2010". There was also the comment: "Further ahead, removing some of the current fiscal stimulus is likely to reduce the work that monetary policy will otherwise need to do." See here for the Governor's pearls of wisdom. By contrast, the Reserve Bank of Australia (RBA) followed up the 0.25% hike in the Aussie cash rate delivered on 7 October with another 0.25% hike to 3.5% effective 4 November. The RBA's media statement concluded with the following comments:

Could the linkages breakdown? This Raving doesn't supply conclusive answers. Rather, it encourages people to keep an open mind and most importantly to keep doing homework on what really matters to markets rather than falling back on rules of thumb like the rule that what happens overseas will be the key to NZ market behaviour. If there are fundamental differences in the key drivers of markets then ultimately the fundamentals will out. In that context, there is an interesting divergence in monetary policy emerging between New Zealand and Australia. This was discussed in the recent Raving titled "Should Australia take over NZ monetary policy". As discussed in the recent Raving, the key leading indicators are pointing to NZ and Australia both experiencing strong rebounds in economic growth, while both countries are facing a high exchange rate and leading indicators of inflation are similarish in both countries. These similarities suggest that similar monetary policy decisions should be unfolding in the two countries. On 29 October Governor Bollard stuck to the view that "a very gradual increase in household spending appears to be taking place" and that "The forecast recovery in economic activity is based on fiscal and monetary policy continuing to provide substantial support to the economy. We think such support remains appropriate." While Bollard continues to largely dig his toes in over when OCR hikes will begin: "In contrast to current market pricing, we see no urgency to begin withdrawing monetary policy stimulus, and we expect to keep the OCR at the current level until the second half of 2010." However, his thinking has evolved with "the second half of 2010" replacing the previous "late 2010". There was also the comment: "Further ahead, removing some of the current fiscal stimulus is likely to reduce the work that monetary policy will otherwise need to do." See here for the Governor's pearls of wisdom. By contrast, the Reserve Bank of Australia (RBA) followed up the 0.25% hike in the Aussie cash rate delivered on 7 October with another 0.25% hike to 3.5% effective 4 November. The RBA's media statement concluded with the following comments:

With the risk of serious economic contraction in Australia now having passed, the Board's view is that it is prudent to lessen gradually the degree of monetary stimulus that was put in place when the outlook appeared to be much weaker. The adjustments at the October and November meetings will work to increase the sustainability of growth in economic activity and keep inflation consistent with the target over the years ahead.

See here for the full statement if you want to read some quality comments by a central bank governor with an eye for trying to stabilize economic growth rather than promote boom-bust cycles. NZ has a proud history of being a trend-setter and forging its own destiny (e.g. women's suffrage and nuclear free vegemite sandwiches). However, NZ has also been a trend setter in trying silly monetary policy experiments that have caused more pain than good, like the monetary conditions index (MCI) that put too much emphasis on the level of the exchange rate. Unfortunately, in my considered opinion, Governor Bollard's current attempt to try a new approach to monetary policy is just a repeat of his misplaced "go for growth" approach first adopted in 2003 that merely resulted in the economy being subjected to a damaging boom-bust cycle. This is one case in which following the lead of the Australians, who have a much better track record at running monetary policy than the RBNZ, is a good idea. Even some of the bank economists are starting to wake up to the implications of Governor Bollard's stubbornness to start gradually removing the massive monetary policy stimulus, as evidenced by the following extract from an article on 2 November:

"Late and hard" rather than "early and gradual" is the prediction on how the Reserve Bank will move when it eventually hikes cash rates, this week's economic commentaries suggest. by Sonia Speedy The Westpac Weekly Commentary says recent comments from the RBNZ strongly hint that it is leaning towards moving "late and hard". This would put it at odds with other central banks favouring a more pre-emptive approach, particularly with policy rates still at "emergency settings". "The Reserve Bank of Australia (RBA) and Norges Bank have begun raising rates on this basis, European Central Bank officials have commented on the need to act early, and there's even speculation that the Fed will look at rewording its commitment to low rates at this week's review," it says. Westpac believes that the RBNZ will have started moving rates by March and also comments that with six-month fixed mortgage rates having now risen, there is now no point on the mortgage curve that appears to be "safe".

Boys with toys will be boys with toys and all that, but it is a pity when the toy in question is something as important as the OCR. However, if history has taught me anything it is that my long-standing campaign for more stable interest rates (and by implication more stable economic growth and a more stable exchange rate) has no impact on NZ monetary policy decisions. So rather than lose sleep over dubious monetary policy decisions by the RBNZ my focus is on helping clients of our regular pay-to-view reports take advantage of the folly. Most importantly at the moment I am advising clients to gear up for the good times that are starting to unfold, but equally to store up lots of acorns during the period of strong growth because Bollard's "go for growth" approach will continue to mean famines follow feasts. _________________ * Rodney Dickens is the Managing Director and Chief Research Officer for Strategic Risk Analysis (SRA), which is a boutique economic, industry and property research company. Rodney produces regular free reports on topical issues and on specific property markets. Find out more about SRA here and sign up to SRA's free reports here.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.