Inflation expectations are still heading for the roof, while early business reaction to the Level 4 lockdown has been 'encouragingly robust' - though it is early days.

Those are two key take-outs from the August ANZ Business Confidence Survey results released on Tuesday.

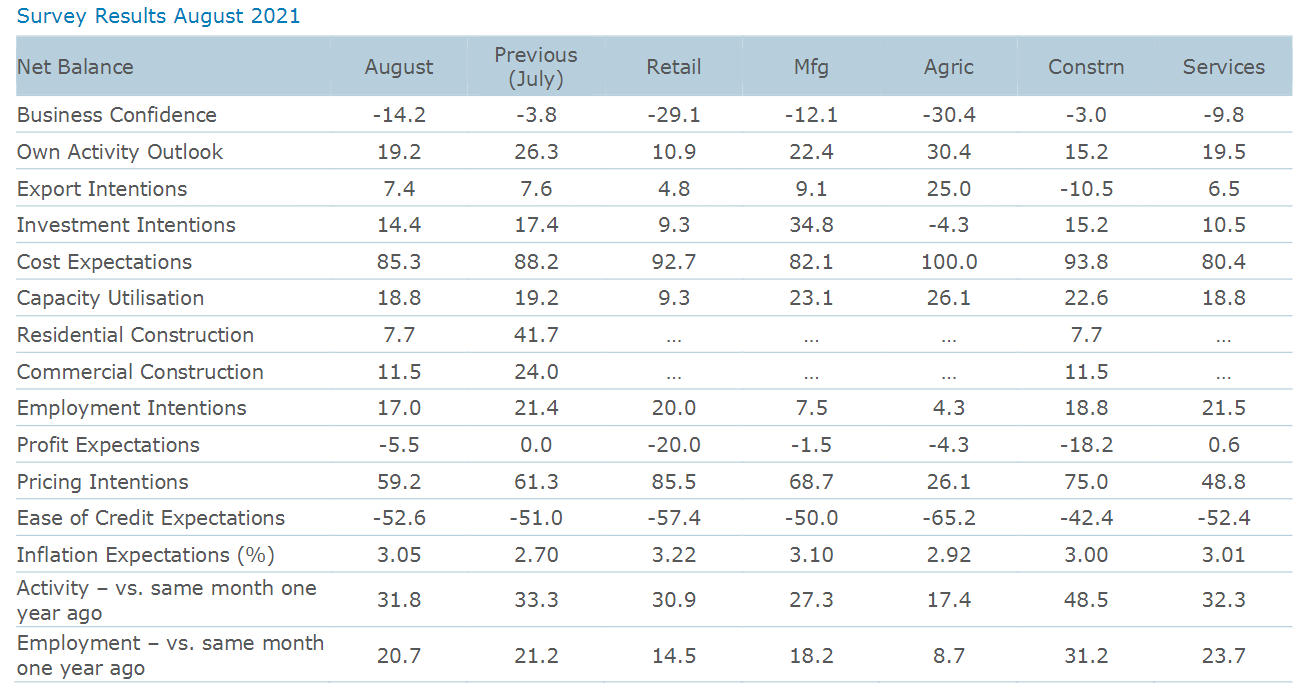

ANZ chief economist Sharon Zollner said inflation expectations at 3.05% for the month "mark the first time since late 2011 they’ve been out the top of the RBNZ’s target range of 1-3%. Pricing intentions also remain extremely high, as do expected costs."

She said headline business confidence fell 10 points; while the 'own activity' measure fell 7 points.

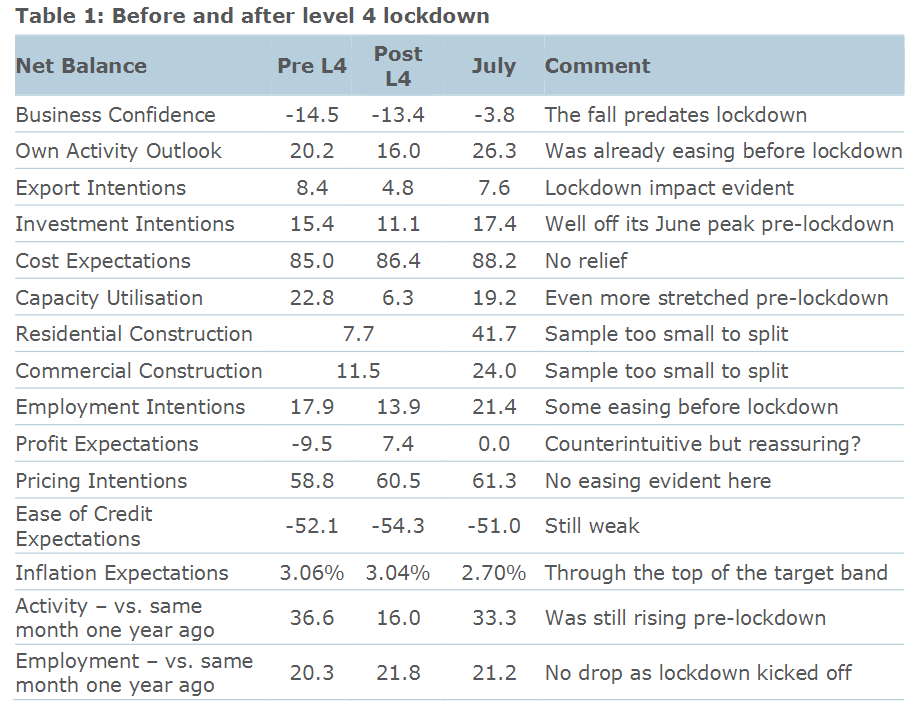

“This month we divide the survey into before and after lockdown. The two samples account for roughly 75% and 25% of the responses respectively.

"Initial responses after level 4 lockdown look encouragingly robust, but it’s early days.”

She said some key themes are evident:

- The inevitable lockdown impact is clear. But it’s worth noting that many activity indicators, including own activity and investment intentions, were easing (from high levels) before lockdown.

- Employment intentions are so far looking robust, but time will tell.

- Inflation pressures remain intense.

“The RBNZ has been keen to make the point that it does not view lockdowns (and Covid disruptions more generally) as deflationary – that the impact on supply is at least as significant, and more persistent, than the impact on demand. Our survey will help disentangle those effects over coming months.

“It’s really tough. And Delta is a formidable opponent. But there are some reasons to be glass-half-full about the situation:

- The economy had significant momentum going into this, and we know the wage subsidy works. People will be a lot more confident than last time that their job will be there for them on the other side of this.

- Evidence both here and overseas suggests that the bounce out of lockdowns tends to be vigorous.

“On the other hand, it’s too soon to be sure that level 4 restrictions will stamp out Delta in an acceptable timeframe. Also, the outlook for the housing market is tough to pick, but we are most certainly not looking at another 30% lift in house prices over the next 12 months.

“That increase has had all kinds of nasty consequences, but one thing it did unquestionably do is boost confidence and spending amongst the roughly two thirds of households who already owned a house. We’ll see what a post-lockdown bounce-back looks like without that, but we’re optimistic that strong job security this time round will provide a valuable offset.

Zollner said the RBNZ has made it clear that they expect confidence to fall, but it also anticipates a rapid bounce-back.

"During this time of turmoil, we will once more report preliminary ANZBO results. For now, the results are reassuring."

She said activity indicators "have of course" taken a hit, but employment intentions have barely budged.

"On the other hand, the data does confirm that key activity indicators were already peaking (at very strong levels) before this COVID outbreak occurred.

“Firms’ balance sheets are generally in pretty good shape to weather this storm (outside of hospitality and those exposed to international tourism), and a strong bounce-back is a good base case. But it’s not a given.

“We’ll be watching both business and consumer sentiment indicators closely for any signs that people are altering their medium-term decisions, as opposed to just hitting pause.

“Hang in there.”

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.