Governor Adrian Orr says the Reserve Bank (RBNZ) will probe the impact of loose monetary policy on wealth and income inequality.

Orr made the comment on Wednesday evening in a wide ranging speech delivered via video conference to Australia National University in Canberra.

"Empirical studies globally looking at the overall net effects of looser monetary policy on wealth and income inequality have produced mixed results. While the necessary data is limited for New Zealand, we intend to push forward on this work in our research agenda...Issues arising from wealth and income inequality need to be understood and, if necessary, managed with the appropriate interventions," Orr said.

He noted that the impact of monetary policy decisions on wealth and income equality is "an important topic for considering overall economic wellbeing."

"As Janet Yellen recently noted, despite the fact that the tools of monetary policy are generally not well-suited to achieve distributional objectives, it is nevertheless important that policymakers understand and monitor the effects of macroeconomic developments on different groups within society."

"Here at the [Reserve] Bank we have undertaken an assessment of the international literature on the distributional impacts of monetary policy on wealth and income. Our work highlights that it is unclear whether looser monetary conditions (i.e., lower real interest rates) increase or decrease income and wealth inequality, on net. In theory, lower interest rates are capable of both, and empirical studies on this issue are inconclusive," Orr said.

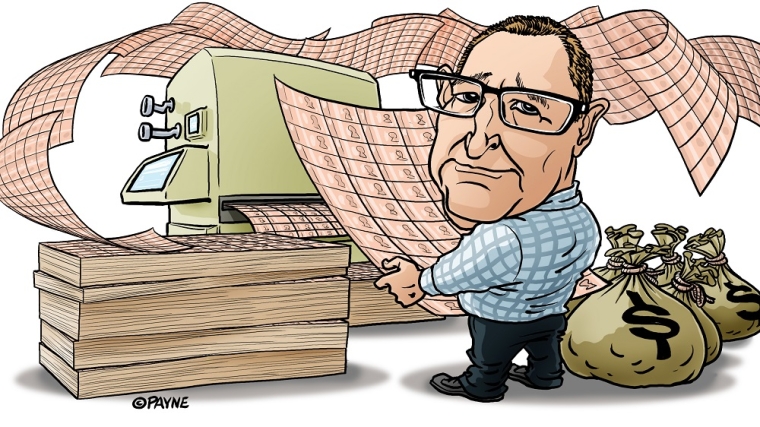

Orr's comments come after Finance Minister Grant Robertson last week wrote to Orr proposing to require the RBNZ to “avoid unnecessary instability” in house prices, as it works to meet its inflation and employment targets. This comes with the RBNZ's moves to stimulate the economy and achieve its inflation and employment targets in the face of Covid-19 being widely seen as contributing to soaring house prices, and asset price inflation more broadly.

Additionally Orr said the RBNZ's dual monetary policy mandate of price stability and maximum sustainable employment, has ensured it remains cognisant of the impacts of its activities, and that its dual mandate is proving "welfare enhancing."

"Furthermore, Bank of England research shows that easier monetary policy after the Global Financial Crisis in 2009 had significant welfare benefits, making the majority of households better off," Orr said.

On unemployment Orr said "preliminary research" indicates employment downturns last a lot longer than economic output downturns. Thus even if economic activity picks up over 2021, "unemployment will remain elevated for quite some time."

He argued the RBNZ's easing of monetary conditions by lowering the Official Cash Rate to a record low of 0.25% and embarking on up to $100 billion of government and local government bond buying, has played a significant role in retaining jobs.

"When setting monetary conditions, the Monetary Policy Committee was kept aware of the Government’s fiscal policies’ purposes and desired impacts. We were thus able to calibrate our response appropriately. Coordination worked well," said Orr.

"The most recent New Zealand data shows annual consumer price inflation currently at 1.4% (compared to our 1-3% target range) and the unemployment rate is at 5.3% (above our estimate consistent with maximum sustainable employment). We estimate that in the absence of our recent monetary policy actions, unemployment would be higher still (nearer 6.0%), inflation expectations would have continued to decline, and the New Zealand dollar trade-weighted exchange rate would have risen by around 7%. In other words, monetary policy has been effective to date in supporting both inflation and employment as intended – at least at the aggregate level."

Separately Orr said RBNZ research suggests the Government’s wage subsidy scheme improved job retention by about 2.5% of the total labour force. However, he warned that the full impact of closed borders is yet to be felt.

"The implications of closed international borders have meant that service export industries, such as tourism, will operate well below capacity for a prolonged period. This is despite what we are witnessing in New Zealand at present, with Kiwis enjoying ‘staycations’ as a substitute for international travel; relaxing in our own backyard."

"Demand for New Zealand’s education and tourism services is being significantly suppressed by fewer international arrivals. Prior to the COVID-19 outbreak, international tourism and education accounted for around 6% of nominal GDP. Receipts from these and other services fell 40% in the June quarter 2020, and are only being partially offset by increased local spending. This spending weakness will affect incomes in the wider economy for years to come. An early taste of this will occur in early 2021, when the seasonal influx of international tourists fails to show up at our doorstep," said Orr.

He concluded by saying it's important to have clarity and collaboration on government fiscal, RBNZ monetary and financial policy when considering equity and distributional aspects within an economy.

"Monetary policy decisions appropriately target aggregate measures – inflation and maximum sustainable employment – while being attuned to equity considerations of our policy actions. However, we do not have the tools to manage any desired equity implications of our actions. There are additional decision-makers and tools for such tasks. That said, these are complex and ambiguous issues, and at the Reserve Bank a lot of work is ongoing to understand the transmission mechanisms for, and the wider implications of, monetary policy, particularly in relation to the new suite of tools."

97 Comments

A bit like when you google for reviews *after* buying something.

Comment of the year!

Every kiwi bloke reads the manual after, part of our psyche

I must be unusual then. Always start with the instructions. Rework sucks!!

Brilliant comment. I don't know if Orr is incompetent, disingenuous or both. It is high time to put somebody who knows what he is doing at the helm of the RBNZ.

Orr's comments are ridiculous. He was just showboating for his Australian audience.

QE in it's various forms AIMS to increase asset prices. Pretty sure Orr knows the majority of asset's are held by the wealthy.

Like I said yesterday, Jacinda's house has probably increased in value this year .. MORE than her PM salary.

Did Jacinda send Orr a gift basket and a thank you card alongside Grant's wee love letter?

How many Labour MP's have brought houses in the past 3 years?

It must have been predicted that the money would move into housing. Tax free housing investment is more attractive than dangerously overpriced shares, and you can sleep at night. They must have known. But he STILL bangs on about even lower rates.

Research..setting up a comittee.... is all tool play with time.

When one knows that is emergency as is burning hot topic which has to be acted upon But as has no intent and do not want to act as in favour of the ponzi, best is to either set up a commitee or research team to play with time to avoid taking action.

...also quickly change the subject, making a song and dance about it 'Climate emergency declaration' comes to mind.

Why do they need to research when the effects are clear from what has happened in the USA, UK and the EU?

Exactly, he even mentions that data from the Bank of England clearly showed the welfare benefits associated with cutting interest rates after the GFC. It is almost like a politician has told him that lower rates are bad for welfare so now he has no choice but to go research what he already knows the answer to.

We diffrunt

By saying '...............but it's not clear if lower interest rates increase or decrease income & wealth inequality'

Either Mr Orr is Stupid or thinks that people are Stupid to say such a thing and media /experts do not question such a question.

He knows the answer, he is just being made to “research” it again by a politician.

"Furthermore, Bank of England research shows that easier monetary policy after the Global Financial Crisis in 2009 had significant welfare benefits, making the majority of households better off," Orr said.

The non asset (house) population in theory should be compensated each time the NZRB decreases interest rates or applies policy to increase asset values. Otherwise Mr Orr is knowingly (I'd say purposely) creating inequity. He in fact said it himself 'Higher house prices create a wealth effect'. I believe this latest trick "playing ignorant" is to protect his rear end if things get nasty. ie lawyers get involved with class action because of the obvious wealth injustice that is taking place.

The "wealth effect" looks like outdated, flawed thinking in any case. As discussed and analysed by many including Michael Reddell,

For myself, I remain very sceptical of the idea of any material housing wealth effect at all. The Bank has been running this line for the last 15 or so years – really since the 00s boom got into full swing – but its case has never been very persuasive, and it remains a story one hears much more vocally from our central bank than from others operating in countries with high/rising house prices.

My scepticism on this count is now of long standing, and has both a conceptual and empirical strand. At a conceptual level, higher house prices do not represent greater wealth for the population as a whole (that makes them quite different from, notably, higher stock market valuations, especially those resting on business innovations and rising profit opportunities etc). There is, of course, a distributional effect affecting some people (although not generally owner-occupiers, who have a natural position owning one house and wish to consume housing services for the rest of their lives). Those holding rental properties, who can reallocate their portfolio are certainly better off when prices rise (and worse off when they fall). But their gain is exactly offset by losses to the renters, and to those in a demographic wanting to shift into home ownership.

Surely the RBNZ must be aware of the highly dubious nature of any "wealth effect"?

They've been busy running policy settings that haven't worked elsewhere, have not worked to produce inflation or growth, and lack a sound basis in reality. Have we all this time simply been pumping asset portfolios based on dubious ideology and an underlying desire for living up large while kicking the cost down the road?

Exactly right. Does he think that people are stupid, or is he himself an incompetent fool ? In any case, such statement borders on the ridiculous.

RBNZ still has a research team?

I thought Orr fired them all..

Karen from accounts using Google Search is the 'research team'.

Karens have a reputation for being loud and demanding. Maybe a few more Karens with Google and who can search for "Asset inflation" is exactly what the RBNZ needs.

Such a shame considering the RBNZ once had probably one of the best macro research teams in the world.

Orr is the one who should be fired. Immediately.

nymad... the research team all resigned. They were all offered over paid jobs; one went to the ANZ, another to the ASB, the third to the BNZ and the last one to Westpac.

IF RBNZ did not know what was obviously clear and need to research, what the heck were they doing all this while ?

Experimenting at the expense of NZ financial stability and social cohesion, while playing with toys that have already failed overseas.

If any further proof of Orr's unfitness for the position he holds was needed, this surely provides it.

He has clearly never heard of Hyman Minsky. Decades ago, he spelled it out. The more successful a central bank is in mitigating one type of risk by achieving low and stable inflation, the more confident investors will become and the more they will willingly assume other types of risk by investing in uncertain and illiquid securities. Squeezing the balloon in one place-eliminating high and volitile inflation-will simply reinflate it in another-causing catastrophic instability in asset markets. Monetary stability will actually breed financial instability.

Orr's job is to know the cause and effect of the RBNZ actions. It's simply not good enough to say after the fact of intensive QE & FLP that research needs to be done on the effects to wealth and income equality... Is this just one big experiment where we're hoping for the best?

It’s a long winded way of saying “We might have f*****d up.”

These people are not stupid , they know exactly what they are doing

Not stupid, but totally incompetent

We are catching the world's attention. Our house prices are turning heads overseas. Imagine what will happen when Covid ends. Better to buy now, with cheap rates. Buying a house now has become like buying a hot share, with easy financing. You can flip it after a year to get a great return. Retirees with savings will be getting in on the act soon in greater numbers, advised by their kids/grand kids. It is set to explode soon.

More money pumped into the system by RBNZ will end up we know where. Happy Seasons Greetings.

https://www.bloomberg.com/news/articles/2020-12-02/kiwi-housing-frenzy-…

Retirees will be getting out of the market, down sizing to Ryman's. Most suburbs have a big swag of elderly, often single in three bedroom homes. There is a ton of housing capacity coming. The plan of course was to load these homes up with waves of immigrants, but covid has reached out to save us from that.

Bide your time fhb's.

It was Mervyn King who late last year roiled the delicate sensibilities of the mainstream sense of economic things when he told the truth. Despite all statements proclaiming otherwise, the global economy hadn’t actually recovered at any point before then. King was pointing out only what the data unequivocally showed. Given 2020, it obviously isn’t doing it now, either.

What was so unusual wasn’t necessarily what he said; lots of people have been making the same argument. Rather, the shock came from was who was actually saying this out loud. King, after all, ran the Bank of England for years during and after the first global financial crisis.

No one can doubt that we are once more living through a period of political turmoil. But there has been no comparable questioning of the basic ideas underpinning economic policy. That needs to change.

…

Conventional wisdom attributes the [post-2008] stagnation largely to supply factors as the underlying growth rate of productivity appears to have fallen. But data can be interpreted only within a theory or model. And it is surprising that there has been so much resistance to the hypothesis that, not just the United States, but the world as a whole is suffering from demand-led secular stagnation. "https://meetings.imf.org/en/2019/Annual/Schedule/2019/10/19/imf-seminar…"

“In recent years, numerous major central banks announced objectives of achieving more rapid rates of inflation as strategies for fostering higher standards of living. All of them have failed to achieve their objectives.” – Jerry Jordan, former Cleveland Federal Reserve Bank President

Only rarely is there occasion for useful information.

One of those was August 2014. Stanley Fischer who was then Vice Chairman of the Federal Reserve found himself in Sweden. Because his audience was Swedish and not American or even English-speaking perhaps he felt a freer hand at being honest. Whatever the reason he told them what he would never say here.

"Year after year we have had to explain from mid-year on why the global growth rate has been lower than predicted as little as two quarters back. Indeed, research done by my colleagues at the Federal Reserve comparing previous cases of severe recessions suggests that, even conditional on the depth and duration of the Great Recession and its association with a banking and financial crisis, the recoveries in the advanced economies have been well below average."

In the aftermath of the Great “Recession” they never saw coming, the same worthless policymakers kept promising the world they’d make up for it by ensuring recovery. QE’s and whatnot, by and large populations around the globe were willing to lend officials that chance, extending a huge benefit of the doubt (given the severity of what had just happened) unearned by the crisis performance.

More than that, people stayed patient for years and that patience was repaid with over promises and lack of transparency, indeed a controversial and thoroughly corrupt enterprise intended to hide the truth. There was no recovery; Economists had been wildly over-optimistic about the ability of “stimulus” to, well, stimulate. Link

Going to research it? How come they don't know all about it already?

Isn't that what we pay the fat salaries for?

"Furthermore, Bank of England research shows that easier monetary policy after the Global Financial Crisis in 2009 had significant welfare benefits, making the majority of households better off," Orr said.

Sounds like he knows the answer but is being made to research it anyway.

Benefits over what period??? And what exactly is "welfare" meant to mean?

Imprecision rules.

This is insane! It's his actual job to know this BEFORE implementation. Give me strength.

Not at all - He is in charge of maintaining CPI within 1-3% range, and maintaining employment as close to max employment as possible. Asset stability as far as limiting any major risks of collapsing prices and their knock on effects to CPI and employment are therefore also considered.

GOVERNMENT is in charge of ensuring a fair, equal society with no extremes in wealth distribution - NOT rbnz.

Labour's lack of understanding of the whole economy as a complex, almost living system that's normally finely balanced, mean they make one-off singular 'pot shots' at trying to fix things in isolation - and every time actually make things much worse for the exact people they try to help.

In last 30+ years real estate agents can never remember the sorts of rent hikes that have been occurring in last few years. In PN, double digit gains every year in rents across the region last few years (a 3 bed for 280 a week I rented is now 350, but market rent according to bond and trademe is 450). Same period we have record, exponential growth in homeless and people on HNZ waiting lists, record numbers living in motels.

The saying 'don't let perfect get in the way of good enough' is relevant here. Landlords and in particular property managers, who are liable when renting out places, have seen risks sky rocket - half the rental stock needs specific upgrades that may not actually make any difference; A super sized heatpump is useless if never used - A range-hood in the kitchen next to an already open window adds little. Poor people will live more cramped, overcrowding being the real cause of respiratory illness not living room temperature, poor health outcomes will increase as homes still don't heat themselves and winter power payments get spent on 'other things'.

Being "charged with" a responsibility does not equate to being in charge of it.

Median wages in NZ are piss poor. This is major cause of poverty and rising inequality as productivity gains are going only to the top 20%

House prices rising at 80% every 10 years in Auckland simply adds to this and effect aggravated due to being no decent paid jobs outside of Auckland, Christchurch and Wellington.

You can see that house prices are far more of a problem OUTSIDE Auckland v easily - sales are falling except in Auckland, for last 4 months.

Because median earnings outride Auckland will not support price of $700+ median.

Does not seem to occur to Orr and Ardern that effect of rising house prices and rents is to suck demand out of the economy

This is precisely what rising inequality does: giving more to them who do not need it and do not spend it, means less is circulated.

Surely if person A pays person B more for a house then person B who sold the house now has more money to spend in the economy. Even if person B spends it on another house, who ever sold him that house now has that money to spend in the economy. Which means selling houses for more money releases more money into the economy? No matter what someone eventually spends all the extra house money on something which injects it into the economy. How does this suck demand out of the economy?

What happens if Person B sells the house and parks the money in the bank? They're not injecting that money into the economy. In fact, if that "money" was derived from mortgage lending then approximately 1 - 2% of that "money" is extracted from the economy every year.

That would mean that it is best we lower interest rates to the point that parking that money in the bank becomes unattractive. If you reckon that just means it’ll go into another house then there is still someone at the end of the chain of house sellers who needs to do something with that money. At the very least a developer will turn a portion of the house money that keeps cycling about into construction activity.

But you're really just shuffling money from those without assets to those with, and changing where that money gets spent. That's not increasing overall wealth.

Making a portion get spent on housing which the people of this forum will tell you is a basic human need that we don’t have enough of.

Geez, that's a real reach for justification...

It would appear that person A simply competes with person B and uses their previous equity to buy another house at a higher valuation - hence it looks like we're building a government and central bank backed housing ponzi.

Who ever sells that other house to them then needs to do something with that money.

Buy another house. It was profitable the first time, after all.

Given that home ownership rates are still falling would that mean many/most are just using it to buy another house?

His actions have created massive inflation, devaluing younger Kiwis' wages and savings in the process.

It's just we conveniently choose not to measure it, because we know that inflation is in housing. It would jolly inconvenient to acknowledge the reality of that massive inflation-driven transfer of wealth from younger workers and savers to older asset owners.

I do agree, although there are good reasons why house prices aren’t in the cpi. One thing though, most of the housing ‘investors’ I know personally are aged between 35-55. The older you get, the less inclined to be a landlord you become. And of course, older people have always had more assets in terms of owner occupied property and pension funds than younger people because they have had more time to accumulate them. The whole problem is ‘investment’ in existing housing. Cutting mortgage tax relief would be a big help.

Is Mr Orr in Mars...

https://i.stuff.co.nz/business/123583129/evidence-inconclusive-that-low…

He has crewed up.

Unfortunately, central bankers are typically so narrowly focused on trying to exploit the weak relationship between monetary easing and employment gains that they become blind to the very powerful relationship between monetary easing and yield-seeking speculation. As I’ve detailed before, monetary easing doesn’t reliably support the financial markets when risk-aversion is high (in which case, safe liquidity is treated as a desirable asset rather than an inferior one), but monetary easing can and does amplify financial distortion and malinvestment when investors are inclined toward speculation. Link-h/t Andrewj

Wealth effect or wealth illusion? The other therapeutic effect of lower-for-longer interest rates is the wealth effect. By driving up the value of future cash flows with lower rates of interest, all manner of assets – stock, bonds, and houses – increase in value and, thereby, can stimulate our marginal propensity to consume. More simply put, the imperative was to make rich people richer so as to encourage their consumption. It is not so hard to imagine negative side effects.

There are the obvious distributional effects between those who have assets and those who do not. Returning house prices in California to their 2005 levels may be good for those who own them, but what of those who don’t?

There are also harder-to-observe distributional consequences that flow from the impact of lower-for-longer interest rates on the value of our liabilities. This is most easily observed in pension funds.

Consider two pension funds, one with a positive funding ratio and one with a negative funding ratio. When we create a wealth effect on the asset side of their balance sheets we also drive up the value of their liabilities. Lower long-term interest rates increase the value of all future cash flows – both positive and negative. Other things being equal, each pension fund will end up approximately where they started, only more so.

The same is true for households but is much more ominous, given the inequality of wealth with which we began the experiment. Consider two households: one with savings and one without savings. Consider also not just their legally-defined liabilities, like mortgages and auto-loans, but also their future consumption expenditures, their liability to feed and clothe themselves in the future.

When the Fed engineered its experiment to promote the wealth effect, the family with savings experienced an increase in the present value of their assets and also an increase in the present value of their liabilities. Because our financial assets are traded in markets and because we receive mutual fund and retirement account statements, we promptly saw the change in the value of our assets. We are much slower to appreciate the change in the present value of our liabilities, particularly the value of our future consumption expenditures.

But just because we don’t trade our future consumption expenditures on the stock exchange does not mean that the conventions of finance do not apply. The family with savings likely ends up where they started, once we consider the necessity of revaluing their liabilities. They may more readily perceive a wealth effect but, ultimately, there is only a wealth illusion.

But what happened to the family without savings? There were no assets to go up in the value, so there is no wealth effect – real or perceived. But the value of their future consumption expenditures did go up in value. The present value of their current and expected standard of living went up but without a corresponding and offsetting increase in assets, because they don’t have any. There was no wealth effect, not even a wealth illusion, just a cruel hoax. Link-pdf

You are v informed

Where do you get this stuff and what is your position or background, academically?

I am concerned that the everything bubble has about 18m to 36 months to run before we get a massive rebalancing due to asset value decline, particularly an upsurge in inflation which most seem utterly oblivious to , in risk terms.

Bsc Hons Victoria University Wellington.

NZ Employment - Research Manager - O’Connor Grieve & Co - stockbrokers, Wellington

Various trading positions at US banking institutions in the UK.

Now retired.

Brilliant and informative postings, Audaxes. I have learned a bit from them in these last few weeks.

QE is KNOWN by all in economics, to increase ability of rich to leverage.

They, as Mauldin has pointed out repeatedly for over 10 years in his columns, have capacity to benefit more than others, due to being closer to the spigot officialdom.

if you own nothing and cannot get access to loans at daft rates, you cannot leverage

QED.

pathetic evasion by Orr and Ardern

According to Stuff, in Mr Orr's recent and latest ditty, he says not us Guv, it is supply and demand.

Errr, who ramped up demand then????

Very true.

Orr and the RBNZ have massively incentivised demand for a government subsidised and protected investment: property.

It's pretty simple:

If an economy is set up to flow the majority of income into assets, then when you add more money into that economy, more of it will flow to asset holders. In turn, those not holding assets will be less well off, causing inequality.

Almost guarantee this is what they will come up with, but in a few hundred page report, instead of 2 sentences.

Lol by the looks of it no action will be taken in the next year or two. I'll talk to a mortgage broker next week and buy a house. If interest rates go to 2% thanks to the FLP, there's literally no point in waiting. And it sure as hell doesn't look like rates will go above 5% anytime soon.

They are just trying to look like they care about inequality while the opposite is obvious given their recent actions.

Metric news: RE NZ yesterday had 111 new house and townhouse listings

Thus far today: 60

A week ago it was averaging 173 per day.

2 weeks ago it was 213 a day.

November 5th it peaked at 256 per day.

Xmas decline was 3 weeks ahead of schedule. Mania over, reality coming.

Isn't that going to create more mania, less supply & same/more demand?

That is what I got from those stats as well. Not sure how he got to his conclusion.

Cannot sell what is not OTM is my point.

Yes, fewer OTM might mean higher prices but did not do so in 2017-19 did it?

My conclusion is that mania of winter and spring will not continue into Summer.

Also, stats evidence of REINZ HPI and medians does not support the anecdotal approach of media in general.

That is, Auckland median price is $1m and 2.7 years ago was $900k.

That is not a huge increase.

It is 11.11% or 3% pa.

Media look solely at last 6 months and forget about the v low price increase and flat sales that preceded it.

Manias, by definition , do not last and this one is dissipating already.

It will be interesting to see what happens. My prediction is there will be a surge of properties early Jan/Feb. This will be owners trying to get in and cash up before its too late - not realizing that the peak has already hit. This will happen after all the friends/family talks over the break creating selling FOMO. This will result in a potential 'cooling' of the market with supply meeting demand.

Good stats. Thank you.

Might as well create a 'committee' to review it... So that any good idea can die slowly and expensively...

Aren't you supposed to understand the impact of policies BEFORE implementing them?

Looks to me like income inequality has been a result of the war against inflation circa 1980's.

https://ei.marketwatch.com/Multimedia/2016/06/28/Photos/ZQ/MW-EQ301_ine…

Notice how inequality is similar now to where it was in the 1930's in the lead up to WW2 - make you wonder if enough people get tired of the same old same old, whether a big change could be in the winds.

Orr got himself into a wrong career, he should be a politician, not a reserve bank governor.

He's most definitely going into politics after RBNZ, he will be a Labour Finance Minister.

While I support the RBNZ's monetary policy moves, be under no illusion that as an institution they only hire "the boys". No one there, or any other senior civil servant, is hired through a meritocratic and transparent process. Don't get me started on their Maori symbolism either, the only point of which is to make some privileged pakeha look "progressive".

Dunno. After this farce, I think he's done his dash and will be put out to pasture. Especially if the intergenerational wealth transfers keep getting worse.

Not sure I agree, National are even more pro-property than Labour so who are you going to vote for? Orr is 100% on message with Labour's policies.

Complex Yes, ambiguous - only if you dumb it down. I suggest it is clear that looser monetary policy inequitably benefits the wealthier, investor class of society while disproportionately penalises the lower stratas in society. As a few have commented here those investors expect a return, usually disproportionately, and the looser policies have sent them into housing with the lower socio-economic classes being roundly fleeced. I suggest tighter policies, which include targeted directions to achieve better living standards and reduced welfare (i.e. more, real jobs) will have a much better outcome.

Intuitively low interest rates would generate both welfare / inequality benefits and disbenefits.

However, also intuitively, and depending on context, one could surmise that the equality disbenefits would typically be greater.

Typically middle and higher income households will be uplifted, lower income households will stagnate or go backwards.

Lower interest rates skew the relative income away from capital and towards labour. Ie. you now need much more money in the bank to achieve the same income, but the person trading labour for an income continues to make the same income regardless.

With 10% interest $500,000 in the bank pays 50k a year, when interest rates drop to 0.2% you need $25,000,000 to get 50k a year. The person trading labour for income trades about 2,000 hours for 50k regardless.

Poorer people tend to trade labour for more of their income than the wealthy. This means that lower interest rates cause the wealthy to loose income without much impact on the incomes of the poor, thus reducing inequality.

Theoretically... But that ignores asset inflation in forms other than interest rates, and that inflation is in practice *driven* by interest rate falls, as we see now. If low interest rates drive up stocks or property --> that increased value can be exchanged for *real* money, so holders of those assets still have a claim on real production that has grown relative to labour earnings.

Despite the ocr falling from about 10% to 0.2% over the last dozen years asset prices have not increased by the 50x necessary to maintain the yields described above.

Furthermore asset price inflation due to a reduction in interest rates is a one off event, whilst the lower yields are an ongoing issue. This means that over the long term, sellers of labour win.

Introducing a capital gains tax when rates are at the bottom and likely to go up (taking asset prices back down with them- or at least exerting negative pressure on asset prices) would in effect be discounting future non interest rate related asset inflation.

The RBNZ cut interest rates in half five times since July 2008 and has proposed to do so again. When interest rates are cut in half the present values of future cash flows are doubled for both assets and liabilities. This assumes variable cash flows maintain their historical values as time passes, which is not always the case in low interest rate environments. Bank leveraged speculators can over capitalise the higher discounted net present value cash flows associated with residential property, or not.

What a load of nonsense....... "When interest rates are cut in half the present values of future cash flows are doubled for both assets"

If I am due $100 in a years time and the interest rate is 5%, the present value is $95 (give or take a few cents), if interest rates are halved to 2.5% then the present value rises to $97.5. Now the last time I checked, $97.5 wasn't the double of $95.

Now, if you were referring to an annuity...

I have a recurring annual $10,000.00 liability in need of funding.

I deposit $100,000.00 in a one year bank deposit account paying 10% annually.

Annual interest rates are cut in half to 5% during the deposit term.

How much do I have to deposit for one year next year to be in receipt of $10,000 to liquidate the same value annual liability?

Exactly my point. It needs to double. Asset prices have not however doubled 5x since 2008 whilst the ocr has been halved 5x since 2008, this means that asset owners have lost out.

So have those funding the wage pool - the rising discounted present value costs to employers are enormous, hence employees remain under rewarded and underemployed, if not unemployed.

Elderly bank depositors face the same.

The example you are giving isn't present value though, you need a larger deposit to generate the same income, very different to PV.

Look at a bond price, if the bond coupon halves the price doesn't go to 200.

The adjusted PV discount factor for the original $10,000 cash flow @ 10% for the cut in half 5% rate is 0.95 x 2 = 1.9 x $100,000 = $190,000.

Every time your rate of return ( interest rate ) is halved you asset value needs to double in order for the same asset to produce the same income at the same yield.

The halving of interest rates 5x would require that asset prices double 5x ( that means grow to 32x their 2008 value ) for them to return the same income at the same yield.

Leverage in the form of debt is available to almost all New Zealanders with a wage income ( you can even get a credit card whilst on the dole ) often on VERY favorable terms. In fact the leverage ratio of a credit card holder with little to no assets can be many many times greater than that of someone who is leveraging shares / real estate. This means that when it comes to benefiting from a change in the temporally adjusted value of cash flow, non asset owners stand to benefit the most as a percentage of their current wealth because they can leverage at ratios that asset owners can only dream of.

On top of this wage inflation (6.3% p.a. average minimum wage inflation over the last 3 years ) generally outpaces the price inflation of consumables (Hence the dole now being indexed to wage inflation instead of the CPI), which means that asset income has to actually increase just to keep up with the purchasing power of wage income despite income per asset dollar dropping when interest rates fall.

I understand that you are something of an academic who has studied this field, whilst I am simply a generic child of the 90s. It is conceivable that you may be privy to logical reasoning that is beyond my comprehension, but this does not appear to be it. Is there perhaps other reasoning (perhaps logic not easily conveyed in this forum?) you could point me to?

(b) the rate cut makes labor’s terms of trade deteriorate

No less, the present value of the cash flow of wages is increased by the rate cut, penalizing wage earners indiscriminately. In our conception the cash flow of wages

comes about as a result of bargaining whereby the wage earner purchases the cash flow of wages against the delivery of his labor. The purchase price of the cash flow has just been increased by the cut in interest rates. There is no adjustment on labor's side of the bargain: the wage earner is supposed to deliver as before. This means that labor's terms of trade has deteriorated as a result of the rate cut by the Fed. Lowering interest rates is a clear setback for labor.A simile may clarify this. Let us visualize the wage earner running on a treadmill the speed of which has just been stepped up. The increased speed of the treadmill

is equivalent to increasing the present value of cash flows in the wake of the rate cut. The wage earner has to run faster just to keep abreast. The Fed is making unemployment grow indiscriminately through the rate cut. Marginal wage earners are laid off. Machinery financed at a lower rate, peddled by the central bank, replaces human labor for no better reason then the prolongation of the moribund regime of irredeemable currency. The bargaining power of labor is grievously undermined. Link

The RBA calls it correctly.

"Speaking at a parliamentary economics committee meeting in Canberra, Dr Lowe said the aim of the bank in lowering borrowing cost was to “free up cashflow” for households to spend. “It would be inappropriate for us to target asset prices,” Dr Lowe said. “That’s not our job and shouldn’t be our job. What the monetary system can do is influence the average level of prices of goods and services.”

Dr Lowe said it was clear property prices would rise on the back of record low rates. “That shouldn’t surprise us. Lower interest rates do mean higher house prices, that’s part of the transmission mechanism,” he said."

So anyone that thinks a CGT or rent control is going to fix house prices, really has no clue as to how the monetary system works. Higher house prices is not a bug in the system, its a design feature.

...What the monetary system can do is influence the average level of prices of goods and services.”

Lower in the case of Europe> and Japan.

Higher residential property prices are the collateral damage caused by lower interest rates raising the discounted present value of future cash flows associated with assets.

NZ banks extend ~60 % of their lending to one third of already wealthy households to speculate and capitalise these higher cash flows in the residential property market, because the RBNZ offers them a RWA capital reduction incentive, to do so.

by Audaxes | 23rd Sep 20, 3:27pm

However, on Wednesday the Committee agreed it could try to speed up the process of lowering interest rates even further by deploying the FLP first.

“Members noted staff advice that deploying an FLP before the forward guidance period for holding the OCR ends could provide additional stimulus to the economy sooner,” it said.Low rates do not signify stimulus nor abundant liquidity, they often describe just this sort of monetary tightness and chaos. Abundant liquidity means everyone gets funding; lack of liquidity, which does show up in low rates, means that money dealers are being prohibitively discriminating.

Low rates are not, repeat, NOT STIMULUS. They are the signal that "stimulus" doesn't work. If you have to keep doing something over and over, year after year, is that a sign of success? Nope. Bonds are kind enough to identify the cause, too. Tight money.

Low interest rates aren’t a central bank providing accommodation, they are instead its worst nightmare being shoved right back in their face. Well, our worst nightmare because for one thing despite repeated failures, rates that never rise testifying to that failure, central bankers are never held to account.

To correct this view, Friedman pointed out the basic, non-trivial distinction between a liquidity effect and an income effect. Low rates can be stimulative in the short run (the liquidity effect), but over the long run their persistence means something far different. A yield curve is supposed to be upward sloping given the core time value of money and investing. That arises from opportunity cost, meaning the more plentiful the opportunities the greater the time value and the steeper the curve (the income effect). Yield and/or money curves (the eurodollar curve and even the history of the OIS curve) that collapse and remain that way unambiguously demonstrate that "stimulus" deserves only the quotation marks.

"it's not clear if lower interest rates increase or decrease income & wealth inequality"

I can help with that one, YES IT DOES. I own 3 businesses and real estate, the lowering of the interest rates has not really helped us for the businesses but heck it has helped hugely with the real estate!

Don't you have business loans secured against residential property? Seems like it helped your business hugely.

I wish I still had loans but the bank forced me to repay all loans when I sold my house this year

Investors are coming it on paper and that makes people mad. We the people want some kind of revenge where they are punished in a way that helps every other aspect of the economy please.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.