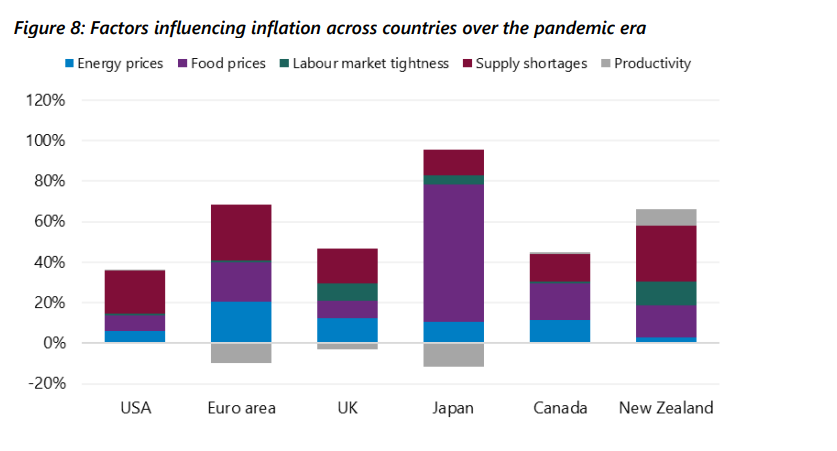

Research by the Reserve Bank (RBNZ) suggests supply and labour shortages played a much greater role in New Zealand’s inflation pressures than it did in other economies.

Paul Conway, the central bank’s chief economist, said labour market tightness and supply shortages had been the two largest contributors to the Consumer Price Index (CPI) inflation spike. The CPI peaked at 7.3% in June 2022 having been at 1.5% in March 2021. CPI was 4% for the March 2024 year.

“Compared to other countries, tightness in the labour market, brought about by the border closure and strong domestic demand, had a big impact on inflation in New Zealand,” he said.

NZ was more reliant on immigration to grow the labour force and required more workers to create the same amount of economic output, relative to many other countries.

“This tightening in labour market capacity pressure was the most important factor driving up wages over the pandemic. By late 2022, as international borders reopened and migrants returned, labour market pressures began to ease, contributing much less to wage inflation.”

Increasing food prices also contributed to inflation in New Zealand but energy cost inflation, which hit Europe and the United Kingdom after Russia invaded Ukraine, was largely avoided.

Unlike most other countries, a decline in Kiwi productivity had also worsened overall inflation over the past three years.

This analysis looked at what drove price increases over a three year period, and didn’t attempt to deny that fiscal and monetary policy played a part in sparking inflation.

The RBNZ used the New Zealand Institute of Economic Research's Quarterly Survey of Business Opinion (QSBO) as a supply shortage indicator for the net number of NZ firms reporting materials as the factor most limiting production.

Policy implications

The RBNZ released four analytical notes, alongside Conway’s speech, on Wednesday which sought to help explain why domestic inflation hasn’t fallen as fast as originally hoped.

Conway said the research didn’t cause any radical change in how the central bank was assessing the economy and inflation, but did provide extra confidence in its approach.

He endorsed the bank’s May forecasts, which showed annual inflation should narrowly squeak into the RBNZ's 1% to 3% target range in the final quarter of 2024.

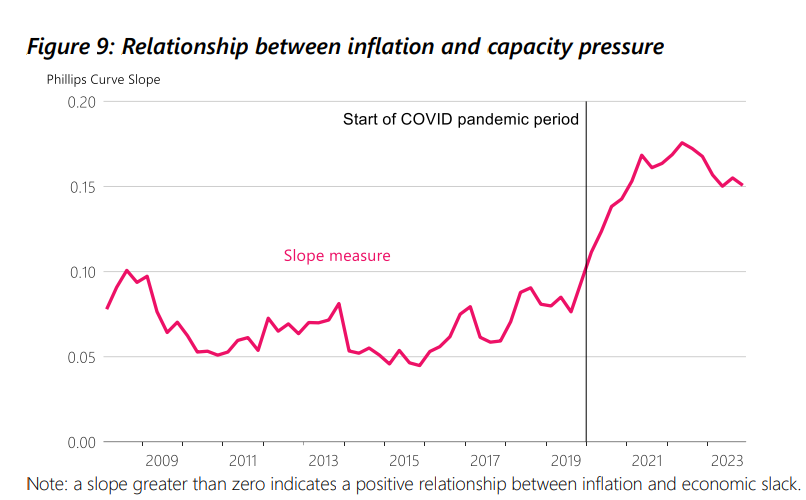

An analytical note called “The resurgence of the NZ Phillips curve” was called out as a particular confidence booster for the central bankers.

The paper looked at the Phillips curve, an economic model arguing inflation and unemployment have an inverse relationship, meaning higher inflation is associated with lower unemployment and vice versa.

“It gives us increasing confidence that what we are doing, with the economy definitely in a slow patch, is going to work — it is going to bring down inflation,” Conway said.

Unemployment was 4.3%, or 134,000 people, in the March quarter, up from 3.2% in December 2021, or 93,000 people.

This idea is central to how monetary policy works but has been called into question after long periods of low inflation and strong employment.

The RBNZ’s paper argues inflation has become more sensitive to activity during the pandemic, particularly when measured by broader employment statistics.

Conway said the stronger relationship also suggested that remaining inflation could decrease quickly as spare capacity emerges in the economy over 2024.

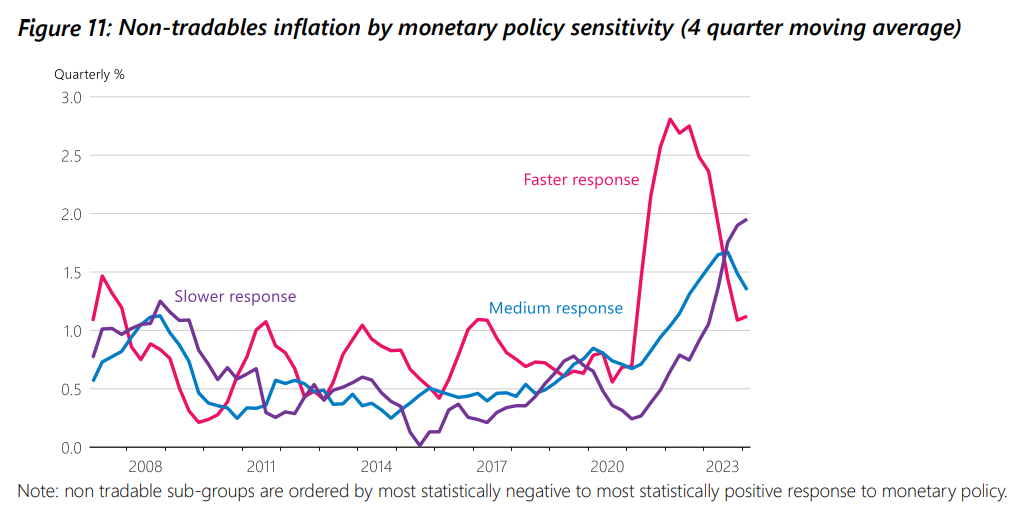

Another note observed that New Zealand’s services inflation was higher and spread more broadly than in some other economies.

This may suggest that price and wage setting behaviour in New Zealand has resulted in a longer lag time for weaker demand to flow through into lower services inflation.

But it also said disinflation elsewhere should give the central bank confidence that dampening in overall demand conditions will bring inflation back to target.

Hamish Pepper, the director of fixed interest strategy at Harbour Asset Management, said Conway’s message didn’t deviate from the May Monetary Policy Statement.

Rather, it provided some more in-depth insight into the research and thinking that had backed up recent policy decisions and economic forecasts.

Miles Workman, an economist at ANZ, agreed the speech and papers were topical and interesting, but didn’t signal anything different about future policy settings

18 Comments

"But, this whole (Phillips Curve) model — of a CPI being affected by the supply and demand of labor and actually, all things (”aggregate supply” and “aggregate demand”) blew up completely during the 1970s....Since then, the Phillips Curve has been denounced over and over again. You can’t fix a monetary problem with More Unemployment."

https://www.forbes.com/sites/nathanlewis/2023/02/08/the-phillips-curve-…

Whether it's Jfoe or RBNZ, I can't buy this supply-driven inflation theory.

Consumption data shows durables consumption spiking in line with durables inflation, all during border closures and monetary stimulus. Then services consumption spiking in line with services inflation as restrictions eased and cost of borrowing grew. This observation is the exact opposite of what we'd expect if inflation was primarily driven by supply issues, whether those be costs, shortages, labour or whatever.

Not saying that supply chain disruption and labour pressures didn't contribute at all, but the data seems pretty clear that shifts in demand were the dominant cause of inflation in 2020-2022.

Aaaaagh. The rest of the world is mourning the 'death of the Phillips Curve' and we are doubling down on it? Really?

How about RBNZ actually read the Bill Phillips 1958 paper that led to the term 'Phillips Curve' and the phrase 'wage-price spiral'. In that paper, Bill stated:

'It will be argued here, however, that cost of living adjustments will have little or no effect on the rate of change of money wage rates except at times when retail prices are forced up by a very rapid rise in import prices'

Sound familiar? How about we look at that rapid rise in import prices - and particularly the systemically important cost of petrol and diesel. What can we see? Import prices rocketed (particularly fuel), CPI followed as import prices drove up the price of other goods and services, and THEN wages started to move as they tried to catch-up with cost of living increases. This is *exactly* what Bill Phillips said would happen. He also modelled the impact of import prices subsiding and forecast exactly what we are seeing now - drop in import prices, followed by calming general prices, and wages falling into line last.

The idea that higher wages have driven inflation in NZ is an ideologically-inspired fantasy. Wages have followed not led cost of living increases (of which higher debt costs have been a big part).

What RBNZ are attempting to do here is two fold:

- Justify engineering a permanent reduction in real wages and our standard of living. That's what we are doing here - wounding our economy for the next decade while the rest of the world looks on in wonder at how determined we are to self-harm.

- Defend the ivory tower status of medieval monetary policy in NZ because the whole damn model is being increasingly questioned across the world and they will want to keep that discourse offshore.

Apologies in advance, but I don't have time today to engage in any 'but what about Cindy printing money' discussions.

It definitely feels like they have painted themselves into a corner and have no real plan to get us out of it. Possible they are simply trying to do nothing, hope inflation sorts itself and find a model to justify this strategy scientifically.

There is however an argument that we do need to reset our economy away from residential housing and immigration (which for the last 10 years have been used to deliver significant leaps in growth) and toward something more sustainable and realistic.. and to do so we do need to smash expectations and standards of living to start with,.

The issue with simply increasing immigration, and dropping rates to deliver growth is (as now) we have ended up with an economy focussed on building and selling houses/land for ever increasing amounts of money and our tax take isnt covering the maintenance let alone the renewal and expansion of infrastructure and public services. And housing is unaffordable for the very people we need to attract and retain to grow our real productive economy.

My feeling is that we may have to accept a period of economic contraction (and a reduction in wealth for many) whilst we try to stem the tide of young professional kiwis leaving us, motivate people to start and grow productive businesses and reduce immigration whilst our infrastructure catches up. Voicing that as a strategy wouldnt be popular tho - because most people want and are expecting everything to go back to 'normal' where we live on house price growth but trying to kickstart that again is quickly going to break NZ society.. itss going to take a couple of years where house building and selling drops to sustainable levels and prices for people to accept and change.

Agreed.

What you say with regards the root cause of NZ's inflation is undeniably true. It has happened before ... with exactly the same causes and much the same pattern and outcome.

When we have RBNZ economists (and many others) claiming it is a labor issue because workers are getting higher wages - they cease to be economists and become politicians.

Given the god-like powers the RBNZ has - We need a RBNZ that not only identifies the root causes with honesty and forthrightness - but also goes looking for mitigation strategies - and recommends them to government. Rolling out tired, incorrect and damaging nonsense while implementing out-of-date solutions only indicates a level of political dogma that is completely unacceptable.

It is time for a clear out at the RBNZ.

Labour is mere noise, versus fossil energy.

Those who still think in labour terms, are equivalent to flat-earthers

https://onlinelibrary.wiley.com/doi/full/10.1111/jiec.13442

Fig3 - I've put this up before, but it seems to take time for things to sink in - note the resource track; top left to bottom right. Note food falling off a cliff NOW.

Philips curve? Why do we insist on reporting tea-leaf-readers?

Great so next year we'll know the model is reliable if we see a dramatic reduction in global food production.

Logic is a useful cognitive capability.

Just saying.

Did you read that somewhere ?

The Person,

I have looked closely at the graph-BAU and Recalibration23 and it does indeed show food production falling precipitously from next year and continuing to do so. I will be watching with interest. On non-renewable resources, the graph flatlines right through to 2100 rather than continuing to fall and I think that is more realistic than the doomsday scenario often painted, but even that may be too pessimistic. It has just been announced that a major light oil discovery has been made in Namibia-quite possibly in excess of 10bn barrels, with over 8 trillion cubic feet of gas. Thus, in a short space of time, we are likely to have 2 new major suppliers, Guyana and Namibia. They are unlikely to be the last.

Well that will be great for Namibia. Nice place and not too many people so if they manage it well they could be quite wealthy. I don't see South Africa invading again to steal it.

Bla bla bla from the reserve clowns. When are they just going to own up that it was THEM and Robertson that blew our country to bits by making money way too cheap, giving it out like candy, then holding interest rates too low for too long?!!

Blame covid all you want but they cause this.

That happened world-wide. They were all trying to perpetuate the unperpetuatable.

And in that overton-window space, they all had little option; the resilient section of our society is less than 10%, probably less than 5%. So it couldn't step up - note they went for the supermarket model, not the farmers market one.

We dropped our ocr way further any anyone else and held it there for too long.

We could have targeted payments at the right people rather than ocr drop and the covid payments.

Was a foolish strategy with obvious results which are very apparent now.

There is no evidence - ever - that core prices have anything to do w/some Phillips Curve or that their stickiness is anything but usual, historical behavior. Claiming the need to hike rates because core PCE deflator is stubborn is intentional bullsh--. https://buff.ly/3JBmFz9 Link

Inflation was driven by the tidal wave of cash that RBNZ unleashed. Now the economy is being crippled by their overreaction. Despite having all the latest data, these people appear to be totally disconnected with what is going on out here.

And that tidal wave of cash being unable to be spent on normal things (due to border closures and supply restrictions) so it all got spent on the few things that were available (like houses) - unleashing a surge in demand for domestic services that did not have the capacity to increase the supply of (due to border closures). Add in the huge amount of savings from normal wages and salaries as people were unable to spend their money. So savings + cheap central bank money = inflation.

Resurgent ..?

😂

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.