By Fabio Cortes, Glenn Gottselig, Shoko Ikarashi and Aki Yokoyama*

Liquidity is a key measure of how well financial markets are working. It refers to how easily assets can be bought or sold - and when it dries up, it can be disruptive.

After more than a decade of abundant liquidity and relative calm in markets, central bank interest-rate increases to contain inflation have been accompanied by elevated market volatility.

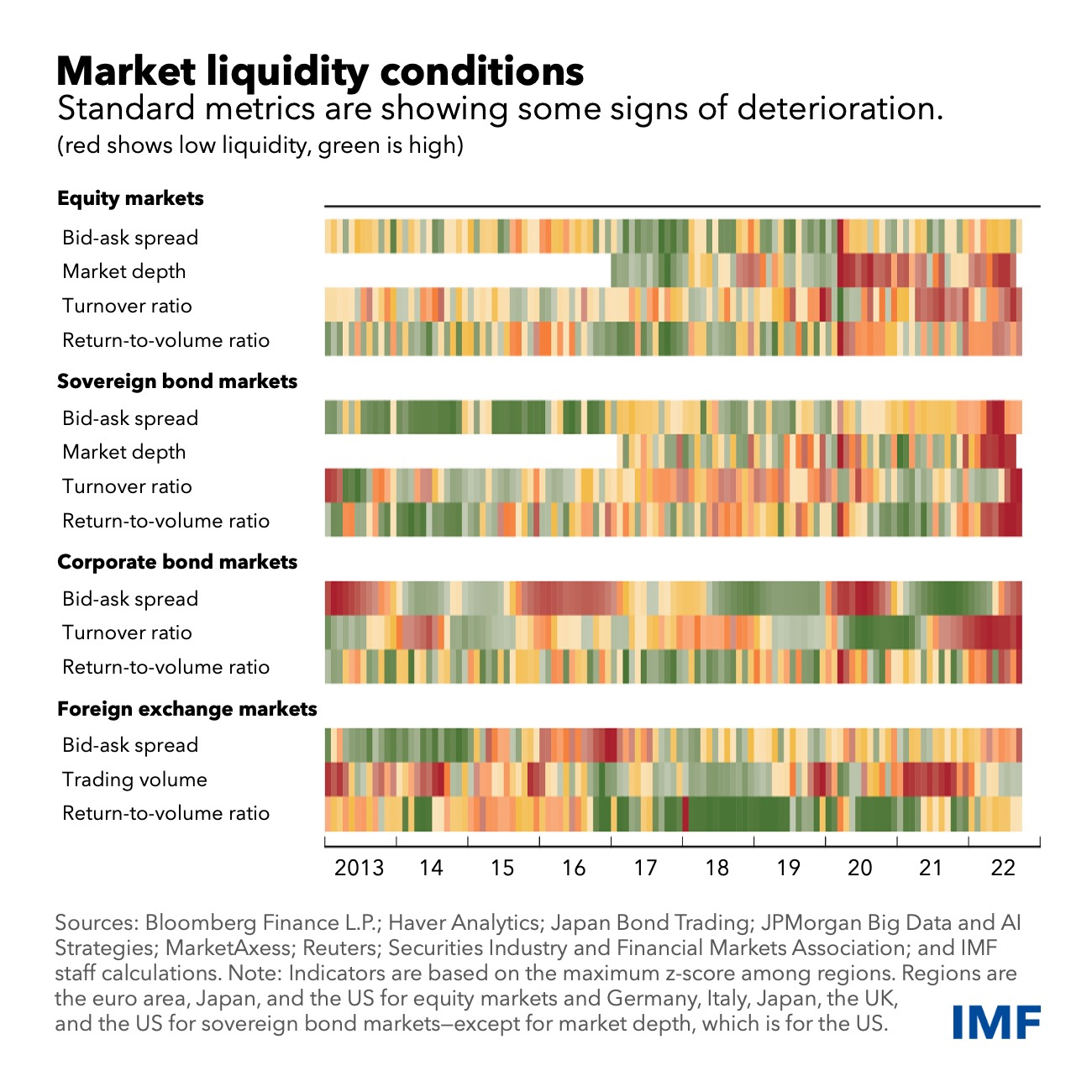

As the Chart of the Week shows, measures of market liquidity have worsened across asset classes, especially in recent weeks, as heightened uncertainty about the economic outlook and monetary policy left investors with much less risk appetite.

This may pose risks to financial stability, as our Global Financial Stability Report outlined earlier this month. This was recently underscored by the stress in the United Kingdom’s government bond market, which required the Bank of England to intervene. This episode showed how sudden price moves combined with forced selling and deleveraging can lead to disorderly conditions in asset markets that could threaten broader market functioning and stability. Spillovers from disorderly asset markets could also increase borrowing costs for governments and corporations, worsening financial conditions.

Fabio Cortes is a Senior Economist in the IMF’s Monetary and Capital Markets Department., Glenn Gottselig, Shoko Ikarashi, and Aki Yokoyama are also IMF staff. This is a re-post of an article that ran on the IMF blog.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.