ANZ chief economist Sharon Zollner says business optimism is continuing to rise and steady falls in interest rates are injecting “new optimism” into businesses.

The ANZ Business Outlook Survey (ANZBO) for October shows forward-looking activity indicators are higher again and there's been a decent lift in reported past activity and employment.

However, Zollner said both past activity and employment remain in negative territory for every sector except agriculture which is an indication that more firms are reporting they are lower than are saying they are higher, compared to a year earlier.

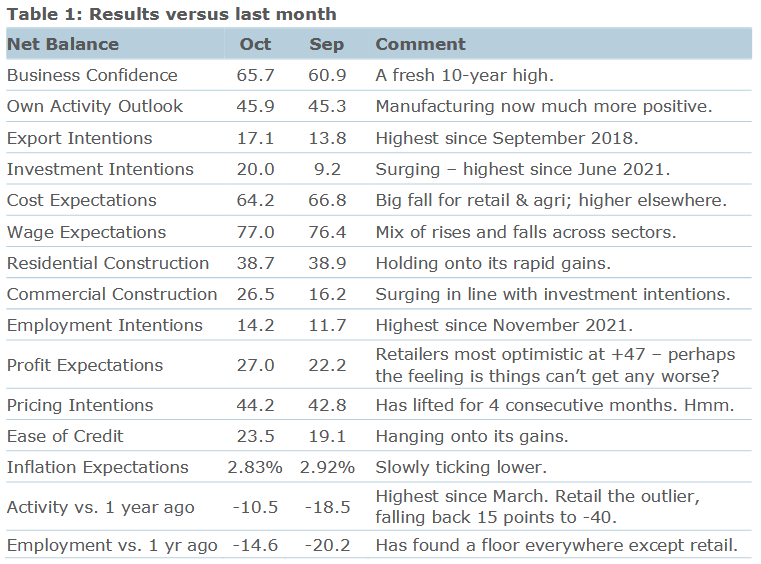

The latest ANZBO survey showed business confidence was up 5 points to +66 in October, while expected own activity lifted just 1 point to +46.

Experienced own activity rose 8 points to -11 which was its highest level since March but Zollner said retail “bucked the trend” and had given up its recent gains.

“That may be related to the fall in consumer confidence seen this month,” she said.

Meanwhile inflation expectations eased 0.1% to 2.8% which Zollner said was still much closer to the top of the RBNZ’s target band (3%) than the middle (2%).

The Reserve Bank’s Monetary Policy Committee trimmed the Official Cash Rate (OCR) from 5.25% to 4.75% in its latest review of the benchmark interest rate in early October.

The central bank says annual inflation is within the target range and “converging on the 2% midpoint”.

Zollner said that the average amount by which firms intend to raise prices drifted up to 1.7% in the latest ANZBO survey.

“The net proportion of firms expecting higher costs over the next three months fell from 67% to 64%, but the net proportion intending to raise their prices over the same timeframe ticked up slightly from 43% to 44%. Both remain above pre-Covid levels.” she said.

Reported wage increases compared to a year earlier were still steady at 3% in aggregate and mixed by sector like they had in the September ANZBO survey, while expectations for firms’ own wage increases over the next 12 months “eased a touch” to 2.6%, Zollner said.

She added that wage increases are “right where the RBNZ would like them to be” in terms of being consistent with Consumer Price Inflation (CPI) inflation of 2%.

The headline inflation rate fell to 2.2% in the September quarter, the first time it’s been in the Reserve Bank's inflation target range since March 2021.

“The October ANZ Business Outlook survey again showed that steady falls in interest rates are injecting new optimism into businesses. And it’s not just unsubstantiated hope–a smaller net proportion of firms are now reporting that activity is lower than a year earlier, with the sharpest lift for respondents in the construction sector. That said, both past activity and employment are still in negative territory economy-wide (ie there are still more firms saying activity and employment in the last month was lower than a year earlier than are saying it was higher). So the pressure remains on,” Zollner said.

“The Business Outlook survey suggests the labour market will turn upwards too, but given the labour market lags activity considerably, there are still some hard yards to traverse before then.”

10 Comments

Much of this optimism will be animal spirits and wishful thinking

Employment "Has found a floor everywhere except retail"

Apart from the 30% of small businesses currently cutting staff. Maybe they don't count.

Yeah it’s a bullshit spruiking comment. I can safely say that more job cuts are coming in construction

Weeding out underperforming or redundant industries and business processes is part of the capitalist cycle.

Creative destruction is progress and should be welcomed!

Kodak, MySpace anyone? 🥂

Creative destruction is progress and should be welcomed!

Except when it's your job.

Insensitive pr-ck.

@ Retired Poppy - Nothing is guaranteed, not even job security. Gone are the days of giving 20+ years to a company & receiving a gold watch at the end of it. There's no loyalty in business anymore.

Unemployment rocketing up

Purchasing power disappearing overseas

Public sector getting destroyed

Cannot find anybody to rent your house out to

Housing stock for sale increasing

China throwing money at an economy that is basically collapsing into itself

Businesses: Dunno, might feel confident tonite 🥂

Don't care, I'm rich and sorted

@ Toye - You have to make best of what you can out of the situation, regardless of whats going on.

Can't wait for the "right" time, or one will be waiting forever, much like the chicken little sky is falling property skeptics that have believed for decades now that the property market any day now will tank "all the way to the bottom" what ever that looks like.

Successful people find a way to make it happen regardless of what's going on around them. If the answers not obvious, then get creative with your "how".

Zollner is such a bore

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.