Wholesale interest rate changes are still moving fast, even if the direction is the same - down.

This is an update, four working days ahead of the upcoming Official Cash Rate (OCR) review from the Reserve Bank next Wednesday, October 9.

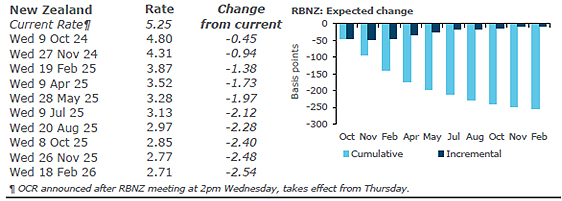

Wholesale money markets are now pricing in 45 basis points of a cut then.

And another almost 50 basis points at the November 27 OCR review and full Monetary Policy Statement.

Without these cut levels delivered, there are likely to be substantial financial market reactions for the required reassessments.

With them delivered, the current 5.25% OCR could be 4.25% by Christmas.

But there is more to financial markets than changes to the overnight indexed swap (OIS) implied rates.

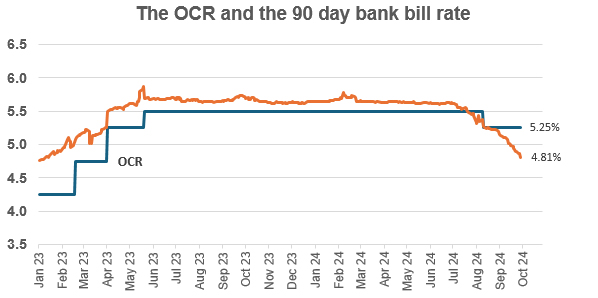

The 90 day bank bill rate, which 'usually' runs at a premium to the OCR, has now turned sharply negative.

That difference today is 44 basis points.

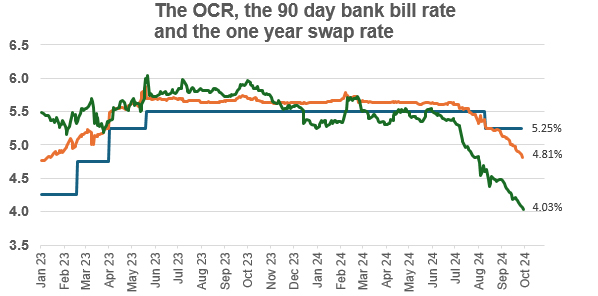

The story is largely the same if we add the one-year swap rate to the analysis, the one swap rate that is influenced by OCR expectations.

But this shows an even fiercer retreat.

Banks as receivers are finding payers willing to offer sharply lower rates in these swap markets, and that underpins their ability to fund lower retail mortgage rates. (More on the theory and practice here.)

Over the past year, the one year swap premium to the OCR has shifted from about 75 basis points, to 25 basis points, then to 0 basis points, and now to suddenly minus 125 basis points.

The Reserve Bank's Monetary Policy Committee will make its decisions based on the economic data they see for the New Zealand economy, and their judgements about the next few years, especially about inflation prospects.

The question is; will that committee read these tea-leaves the same way financial markets have interpreted them?

If they do see a similar picture, these variations will close up as the OCR falls.

If they don't, the wholesale money markets will have to recalibrate, and that could be messy. A recalibration may also involve the exchange rate.

Only the Monetary Policy Committee 'knows' what the decision will be, although to be fair they probably haven't yet started the key parts of making that decision yet.

Everyone else - traders, money market participants, bank treasurers, bank bosses, economists, you and me - we are only guessing (ie betting). And important stuff can emerge between now and Wednesday that could affect the OCR call.

'Certainties' now could be dangerous. If your current guess works out, your confirmation bias could be doubly dangerous for the November decision. Just saying ...

26 Comments

10% by Christmas guaranteed!

Cheap jabs easily said now we're on the ride down. On the ride up, I cannot recall you ever guaranteeing they wouldn't. Please feel free to regurgitate an historic and insightful post proving otherwise :)

Not cheap jabs, just smart enough to know the economy was already flogging at the time and end of the tunnel for high rates was nigh.

Not shorted by you lot then, who jumped up and down at every news article without seeing the bigger picture and recognising the stage in the cycle. But I understand now why you behaved that way then as you are renting and have term deposits as investments.

But I understand now why you behaved that way then as you are renting and have term deposits as investments

Wrong, we haven't paid rent in 27 years :) It would seem you struggle with any home owner who isn't obsessed with their house valuation. To cope, you suggest they're all renters. Why is that I wonder....

You acknowledged you were renting and also your only investments were term deposits. Someone is lying here.

I'm not lying. We purchased in 97. I challenge you to put up my post that said we are renting.

In any case, why do you look down on renters?

I never look down on renters.

It’s just a fact that most DGMs on here who talk a lot of nonsense happen to be renting.

You acknowledged you were renting - Someone is lying here.

Having failed the challenge, you're admitting you're a liar then?

Please provide evidence of this 'fact'.

Hahahahahhahhahahhahhahhahahhah

youre such a sore loser.

Where have all the DGM gone today?

The DGM are usually here in droves by this time of the day.

Could it be, perhaps, that they're going into hiding with the looming threat of lower interest rates and increasing house prices??

TTP

looming threat of lower interest rates and increasing house prices??

Why are lower interest rates a threat? They're a relief - surely. Anyway, house prices are still falling.

Threat because your term deposits won’t even be keeping up with inflation soon once you’ve paid tax on the “profits” from them.

Truth hurts.

I'm totally devastated - "apparently"

Clearly, Retired-Poppy, falling interest rates are not part of your property-crash fantasy.......

Or your fantasy that term deposits will make you rich.

You're a bit of a plonker, we reckon.

TTP

"we reckon"

Are you okay? Hearing voices? Try and have a nice day 😂🤣

I am to refix 50% of mortgage by end of this month. 1 year or 6 months? I think 6 month but even if we lose 100 basis points on 6 month rate between Nov and March, I'd only come out even. Probably not really worth fussing about.

I would still go 6 months.

Yeah 100 is almost guaranteed, 150-200 isn't out of the question. Economies in a shambles.

The fed has signalled it’ll be going back to 25 basis point moves. If they follow though on this it may slow down RBNZ’s OCR cuts

They’ve said their neutral rate is 2.75 so logically (take them at their word 🤷🏻♂️) we should see another 2.5% in cuts over the next however long it takes…that’s assuming they don’t need to stimulate then they’ll cut harder eh…but surely they haven’t screwed the pooch 😬

Interest rates plunging...as predicted.

Where's resident economic 'expert' ITGuy?

Where's resident economic 'expert' ITGuy?

Do you need financial advice?

No, it's all cool here.

He's been telling us all about the great economic meltdown...where is it? In his imagination.

Keep your tin hat on

What happens to the currency though?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.