Too slow.

Commerce Commission chairman John Small says New Zealand banks have taken too long to innovate and introduce lower cost in-person bank-to-bank payments, while industry experts say these measures would also help to fight devastating financial scams.

The competition watchdog, the Commerce Commission, is currently consulting on the retail payments system. It has warned it may regulate the bank transfer network to speed up adoption of in-person bank-to-bank payments.

Small said “everyone would agree” New Zealand’s banks had been too slow to allow new types of payments, and to do the work needed to bring in open banking which would also open up new payment types.

“We want to make this better, we want to take the pain out of [payments]. As much as possible, we want to promote innovation,” Small said.

He said the bank-owned payments system operator, Payments NZ, had "done its bit", setting the standards needed for open banking.

But not all banks had built their own application programme interfaces (APIs), or software applications, that would allow external access to customer data or to make payments.

Payments NZ launched its API centre in 2019.

Small said if you look at the slow development of APIs by banks, "that tells the whole story".

"You need all of [the banks]. It's obvious why they haven't. And that's the point of our consultation on that in that new paper, is to see whether it makes sense for us to essentially force them to do that."

Industry critics have pointed out in the Asia-Pacific region, New Zealand is in the company of North Korea, Laos and Papua New Guinea in failing to roll-out real-time account-to-account payments.

Wordline Head of Public Affairs, Julia Nicol, said the payment platform was working on new products to allow account-to-account transactions, and widespread adoption of open banking would make this possible.

Worldline used to be known as Paymark in New Zealand and launched Eftpos in 1989. It says it processes about 70% of all payment transactions in New Zealand.

Nicol said Worldline had sold its first open banking API to a New Zealand bank in 2016, and another new API had been sold to the big four banks — ANZ, Westpac, ASB and BNZ — last year for online Eftpos e-commerce payments.

However, she said all banks needed to sign up to use those APIs to make it attractive for merchants to allow new payment options. Kiwibank, which has many customers, was yet to sign up for example, Nicol said.

There were merchants who were using Wordline's online Eftpos payment technology, which allowed fast and secure payments via mobile phone.

"It's a chicken and egg situation with payments. If you can't use it, a merchant doesn't want to accept it. They want everyone to use a product. And for all Kiwis to benefit, it shouldn't matter which bank they are with. They should be able to benefit from the new technology."

Wordline supported the work the Commerce Commission was doing on payments.

"It would be good to get some movement," Nicol said.

Nicol said the Commission could tell banks they had to adopt a certain API and give them a deadline. There needed to be an enforcement regime which moved the banking industry to get moving in the same direction, at the same time.

"I think the ComCom could use some of its powers to provide certainty in that area."

Why the banks love electronic card payments

Small said Visa and Mastercard had taken the lion’s share of the electronic payments market.

A Reserve Bank of New Zealand report from 2022 found banks were earning more than $400 million annually from debit and credit card payments made through the Visa and Mastercard networks.

The central bank said while other fees income for banks had dropped, banks’ income from card payment fees through Visa and Mastercard had grown in recent years.

Banks earn interchange fees on Visa and Mastercard contactless payments, with the merchant’s bank paying fees to a cardholder’s bank for accepting tap-and-go electronic card payments.

Concern bank interchange fees for Visa and Mastercard payments were too high, and had become untethered from the cost of providing the service and a profit centre, saw the Commission introduce an initial pricing standard to limit bank charges for card payments through the two networks. This followed the government passing the Retail Payment System Act to regulate merchant service fees.

Small said he had now signed off on compulsory notices requesting information from Visa and Mastercard about interchange fees to ensure compliance with the new standard.

"We need to go to them to verify compliance to make sure the correct interchange rate has been paid and not something too high," Small said.

The Government estimated capping bank interchange fees on Visa and Mastercard transactions would save New Zealand businesses around $74 million a year.

Consumers were often faced with 2% surcharges on purchases to make contactless payments through the Visa and Mastercard network.

Small said the regulator expected businesses should offer one fee-free payment type. That was usually an in-person payment. Online was harder to achieve, he said.

As part of its work on retail payments the Commission wrote to large businesses including Air New Zealand, One NZ (formerly Vodafone), 2degrees and councils, asking them to lower online payment surcharges.

New act, new rules, new regulation?

The Commission said in July it had observed a lack of innovation in payments.

It said bank transfers were one of the lowest-cost payments options for consumers and businesses, and could be a cheap, safe and easy way for New Zealanders to pay.

Eftpos use has been falling as more people use tap-and-go payments through the Visa and Mastercard payments networks. While Eftpos was a low-cost option, contactless payments are an income stream for banks.

Small said banks didn't earn fees on Eftpos payments, and therefore there had been a failure to invest in the Eftpos system.

The Commerce Commission has categorised Visa and Mastercard as designated networks under the Retail Payment System Act, meaning it can determine how prices are set, cap charges, and ask for information from the two card networks.

Payments NZ could be next to receive designation, the Commission has said.

New Zealand's payments systems are lagging our peers, critics say, including Australia.

New Zealand’s banks — of which the four largest have Australian parents — and Payments NZ, are also under pressure for failing to bring in anti-scam measures to protect consumers.

One of those measures, confirmation of payee, or name and account number checking, could be implemented along with making it easier for people to make in-person bank-to-bank payments, cutting out the more costly option for consumers of paying through Visa or Mastercard’s systems.

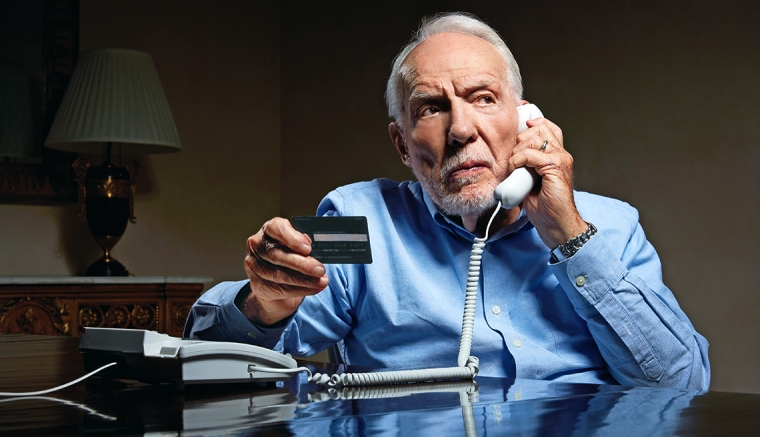

Nicol said new account-to-account payments were safe, and introduced checks such as confirmation of payee to let people see exactly who they were paying which would be useful to combat scams, such as the Waka Kotahi toll scam.

The new payments also allowed consumers to hold things like discounts or loyalty cards in a more secure way, Nicol said.

In Australia, the Reserve Bank has oversight of payments.

In 2018 Australia launched the New Payments Platform (NPP), which allows near real-time account-to-account payments and confirmation of payee.

The Reserve Bank of Australia is a shareholder of the company which runs the platform, and built the settlement technology underpinning the system known as the Fast Settlement Service, which allows transactions to be settled individually on a 24/7 basis, in close to real time.

In contrast, New Zealand banks only started processing bank payments on the weekends in May. New Zealand banks don't process payments in real-time.

The Reserve Bank of New Zealand has criticised the industry's slow move to real-time payments.

On September 15, industry lobbyist the New Zealand Banking Association announced it would "instigate" confirmation of payee as part of a suite of changes the industry says will help to combat bank scams.

A recent report from the Banking Ombudsman found almost a third of its annual investigations related to scams, in which victims' average losses were $57,000.

NZ banks maintain they are doing all they can to protect their customers.

2 Comments

While our banking cartel f's around, the rest of the world is going to QR code payment scanning apps, linked to a bank account or transferred directly to other peoples apps.

Where's the goddamn leadership? That's where we should be headed, an NZ payments app with QR code scanning that has interchange to the other big apps world wide (Alipay, for instance). Then the app is used for everything, public transport, food deliveries, online shopping, in shop payments. Would make it easier for almost everyone and isn't that hard to setup. Kiwibank and the NZ govt should be getting in on this, setting up its own independent shop for doing it. They can keep the control under good oversight and profit from being the NZ payments app.

Would love to see ComCom do things.

But it prefers to just contemplate.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.