The shareholders of giant dairy co-operative Fonterra might reap as much as $3 billion - about $2 per share - from a successful sale of its global consumer businesses, including household name brands such as Anchor and Mainland.

This is according to corporate advisers Northington Partners in an independent review of Fonterra's annual performance conducted for Fonterra shareholders and unit holders.

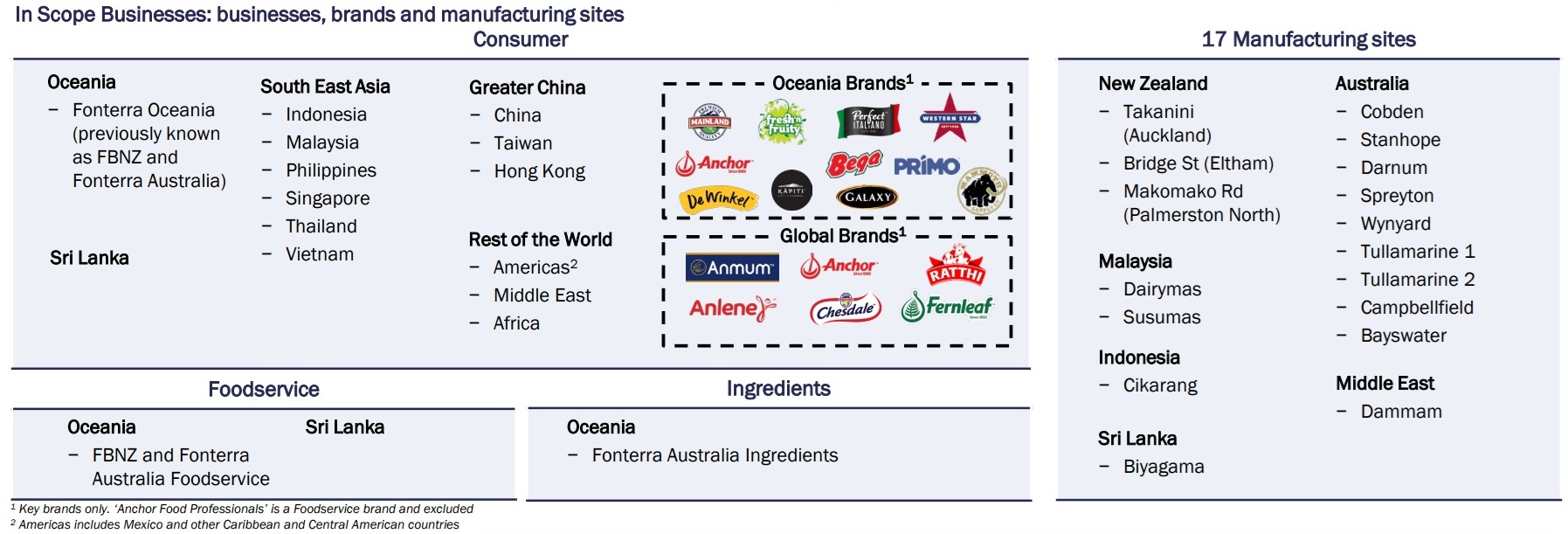

Fonterra announced back in May that the consumer businesses - which include Fonterra Oceania and Fonterra Sri Lanka - were being put on the block and said it was looking at a timeframe of 12-18 months to achieve a sale.

In a strategy update issued by Fonterra in late September, the co-op pledged a "significant capital return" if it achieves the planned asset sale. However, it has not quantified in dollar terms what the return might be.

But Northington Partners, in its review, has given some clear indications.

Given the value of the businesses potentially for sale, the implications of the divestment for Fonterra and its shareholders "are significant", Northington Partners says.

"We estimate that Fonterra could return up to $3 billion of capital to shareholders assuming a full exit."

The advisers say that they think that the majority of any sale proceeds could be returned to shareholders while still allowing Fonterra to maintain its “A” band credit rating.

"A value of $3 billion-$3.4 billion for 100% of the 'In Scope' businesses represents approximately $2.00 per share. While the level of capital that will be returned to shareholders following a successful divestment process will be influenced by a wide range of factors (including seasonal working capital requirements and expected capital expenditure), it could be material relative to the current share price," Northington Partners says.

The farmer-only shares in Fonterra are currently trading at $4.16, while units in the Fonterra Shareholders Fund (open to non-farmer investors), are trading at $4.88.

Northington Partners say the potential sale of the businesses may result in an upward “re-rating” of the Fonterra share price depending on the price achieved and level of capital returned to shareholders.

"This is largely due to the potential scale of the capital return compared to the current share price (~50% of the farmers-only market price) while a sale would have less impact on earnings, only reducing by ~20% (based on FY24 pro-forma estimates)."

The advisers' report says some of the potential benefits of divestment may include:

• Concentrates Fonterra’s effort on its core business of collecting and processing milk while stabilising supply and improving processing efficiency.

• Creates a simplified co-operative with a focus on maximising returns from its core operations.

• Allows for an exit of the Australian business which has required significant investment at return levels lower than what have been achieved in Fonterra’s other channels and markets.

• Prioritises investment in the Ingredients and Foodservice channels while releasing capital from the In Scope Businesses which would generate more value for shareholders.

• Provides the potential to achieve better return on capital in the remaining businesses.

However, there may be some potential downsides from the divestment "which need to be more fully addressed". These include:

• Less exposure to “value-add” consumer brands and their growth potential. However, historic growth has been limited which may be due to the brands not living up to their potential under Fonterra ownership. We also note that a value-add strategy can readily be pursued through the Ingredients and Foodservice channels on a B2B basis;

• Less diversified earnings streams and a reduced milk pool due to the divestment of Australia; and

• The potential loss of milk sales volumes if the potential divestment does not include milk supply arrangements with Fonterra or the buyer(s) subsequently moves away from Fonterra supply.

Northington Partners notes that Fonterra has committed to engage in further consultation with shareholders in relation to any potential divestment.

"We therefore expect that more information will be provided in due course including details on transaction structure, transaction value, use of sale proceeds (including the level of capital return to shareholders), implications for the brands, manufacturing and people and the ongoing relationship between Fonterra and the purchaser (e.g. milk supply arrangements).

"We expect that more information will become available over the course of the remainder of FY25. We also note that both the sale of the In Scope businesses and any associated capital return are expected to require shareholder approval."

This is the dairy industry payout history.

Dairy prices

Select chart tabs

10 Comments

Noticed Yili is going gangbusters with its Joyday ice cream products across Asia. Fantastic products that consumers like and are affordable. Nestle and Unilever could be under the pump. Fonterra never really showed up. The two-liter tubs of Tip Top in the Japan market was completely wrong-headed.

Is that an issue?

Most brand manager companies tend to to 'go big' in some markets but not in others. This is to ensure they get the biggest penetration from their marketing budgets which needs to be at near saturation level. I guess both Nestle and Unilever may be big enough to 'go big' in most places at the same time but they usually don't.

It means Yili is achieving more than Fonterra has with brands in the ice cream category outside their domestic mkt. Making a dent against Nestlé and Unilever is admirable.

In fact, Yili has done more with a NZ-sourced butter brand (Westgold) than under NZ ownership. And outperformed Fonterra. Westgold became the #1 foreeign butter brand in Japan when under Chinese control.

Has been signalled by the withdrawal from Chile following that of the disastrous Venezuelan venture. It is not completely necessary to have your own representation in the actual market as each market is different, has its own particular attributes and complications and having a good working relationship and communication with concerns with the relative know how is more often than not, all that is needed. To put it another way, farmers and processors would not be welcoming of overseas market people coming to NZ and calling the shots of running their businesses, but at the same time they should always be open to advice concerning what the markets are looking for.

Fonterra may get $3 billion bonanza from sale of household-name brands

Um, no they won't. There was nothing sudden or out of thin air about the $3 billion - it was built up over many years. They will turn one asset into another.

They may be looking to sell a goose. Whether or not that's a good decision going forward I'm not sure. What I am sure of, is that it is not a bonanza for shareholders as the title misleadingly states.

Typical NZ attitude, create a great brand then flog it off rather than keep it long term

very short-term thinking by fonterra, by the time farmers realise what they have sold, these managers will be long gone no doubt with a nice hefty payout

Dumb decision.

They need to find good brand managers and come up with plan to hit one market, gaining significant / sufficient market share, then move onto another market, leaving behind a 'maintenance team' to hold the market share they've won. Rinse and repeat. NZ managers are far too insular. Ho hum.

Just a reminder that this is Shareholders money that was demanded by Fonterra when farmers increased milk production accrued in the 2001-2015 period, as has been well canvassed a lot of this money was lost by previous managers. Let the shareholders decide what should happen with there own assets.

Selling brands means that new brands will have to be rebuilt from the ground up, when executive management changes it's mind. Again.

It looks a bit like an admission of defeat by short-term thinking and the apparent inability to manage ongoing market change.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.