Content supplied by Rabobank

Recent structural and cyclical changes are ushering in a new era of animal protein consumption in China, according to a new report from food and agribusiness banking specialist Rabobank. And companies throughout the global animal proteins supply chain will need to adjust their strategies to meet the sophisticated demands of modern Chinese consumers.

In the recently-released report, New consumption trends in China offer opportunities for animal protein, Rabobank says consumption trends are evolving in China’s animal protein market due to cyclical factors such as market oversupply and economic slowdown, and structural factors such as demographic shifts and changing consumer values.

“Across recent decades, China’s animal proteins market has seen plenty of change due to rapid economic growth, the opening of its markets, and digitisation trends triggering the fast evolution of the country’s consumer market,” report author, RaboResearch senior animal protein analyst Chenjun Pan said.

“These developments saw Chinese consumers double their consumption of meat in less than 30 years, from 35 kilograms per capita in the mid-1990s to 72 kilograms in 2023, demonstrating a growth story that has attracted a lot of investment.”

However, the report says, in recent years China’s economy has changed gears, with GDP growth slowing significantly.

“In parallel, middle-class wealth has increased substantially, supporting a resilient spending power, albeit with income growth slowing. We’ve also seen the Chinese animal protein market oversupplied across the last year, resulting in sluggish prices and a supply chain that is struggling to manage supply.” Ms Pan said.

Despite these changes, Ms Pan said, in general, China’s animal protein consumption remains resilient.

“Statistics show that consumers have lowered spending in other categories but maintained spending on food. Taking a deeper look however, we observe that China’s animal protein consumption is developing new patterns,” she said.

“The days of one-size-fits-all products in China’s animal protein market are over. Today’s consumers expect more than just a product, they seek a comprehensive value proposition that includes good service and valued experiences.”

Demographic changes reshaping preferences

The report says China’s total population reached an inflection point in 2021, with reductions following in 2022 and 2023, and the birth rate declining since 2017.

“Forecasts indicate that the population will decline from the current 1.4 billion to 1.3 billion by 2050, and experts estimate that the population aged 65 and above may exceed 20%,” the report says.

Ms Pan said China’s aging population and smaller household sizes are leading to a nuanced impact on animal protein consumption.

“The market is gradually moving away from pork, traditionally the dominant choice, toward poultry, beef and seafood, which are favoured for their perceived health benefits,” Ms Pan says.

“Additionally, the older generation’s adoption of e-commerce, food delivery and convenience foods mark the end of past consumption behaviours.”

Four key trends influencing the future

Among all the changes, the report says, four major trends stand out in shaping future animal protein consumption in China: value for money, the ‘experience economy’, a focus on nutrition and health, and a changing channel mix for purchases.

“Consumption of beef and seafood has increased strongly over the last decade despite slower income growth, illustrating that consumers continue to seek higher value but at reasonable prices,” Ms Pan said.

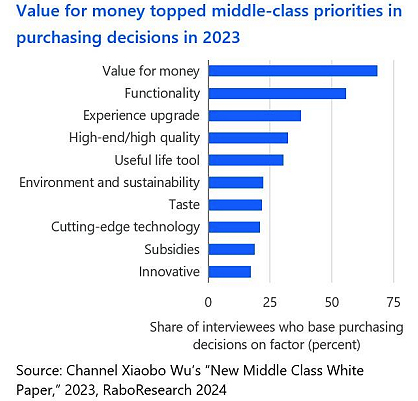

“This trend is supported by the recent ‘New middle Class White Paper’ survey which found ‘value for money’ was the top consideration in purchasing decisions.

“In our view, consumers’ perception of value includes not only the product value, but also services, such as convenience and time saved. Ready-to-eat/cook products are fast growing product categories, as they enable consumers to shorten the time spent preparing food and making home cooking more convenient.”

Ms Pan said the second identified trend, the ‘experience economy’, relates to a growing preference for spending on services over goods, reflecting a desire for valued experiences.

“Expenditure on services has grown faster than overall expenditure on goods and increased its share from 39.7% in 2013 to 45.2% in 2023. However, this is still lower than spending on experiences in more developed economies, where around 70 to 75% of consumer expenditure is on services,” she said.

“China’s total foodservice sales have delivered a steady recovery upon reopening postpandemic with sales up by 8.4% year-on-year for the first five months of 2024, and we expect consumers’ expenditure on services will also rise in the coming years.”

The report says the third trend, a focus on health and nutrition, is increasingly influencing purchasing decisions in China. “With consumers increasingly aware of health and nutrition post-pandemic, their perceptions of various proteins have evolved, and these changing perceptions are influencing the market acceptance of each protein,” Ms Pan said.

“Pork remains the staple for Chinese consumers, but its share is down from 85% in the 1990s to 58% in 2023, with poultry and beef gaining share. An aging population might further reinforce this trend as older people turn to proteins perceived as lower in fat, more digestible, and higher in nutrition, like poultry and seafood.”

The final trend, Ms Pan said, was the changing channel mix for purchases.

“Distribution channels have experienced great changes in recent decades, with the rapid growth of e-commerce, the restructuring of traditional wet markets, the ups and downs of supermarkets and hypermarkets, and the emergence of convenience stores,” Ms Pan said.

“The latest emerging distribution channel we are seeing is live streaming. For example, Pinduoduo, ByteDance and WeChat are rapidly growing their sales through this channel.

“Consumers learn how to cook, for example, a piece of steak online, and can then order the products on the streaming platform at a cheaper price than offered by supermarkets. Some food companies were reluctant to sell through this channel two years ago, but now almost all companies have developed live streaming distribution.”

Implications for New Zealand

Commenting on the implications of the changes in China for New Zealand’s red meat sector, New Zealand-based RaboResearch senior animal proteins analyst Jen Corkran said, it was encouraging to see Chinese beef consumption continuing to grow in a broad sense.

“China is New Zealand’s second largest market for beef exports accounting for about a third of total exports over the 2023/24 season (October to September). So it’s really positive to see beef consumption continuing to rise despite the recent challenges facing the Chinese economy,” she said.

“From 2013 to 2023, Chinese beef consumption grew by a compound annual growth rate (CAGR) of 3.2%, and there is scope for this to growth to continue as long as companies within the beef supply chain can successfully adapt to the changes in consumer trends within the Chinese market.”

In order to adapt to these changes, the report says, animal protein companies in New Zealand and other regions around the globe must pivot from a volume-centric to a consumer-centric approach.

“This involves focusing on value growth, with an emphasis on poultry, beef and high-value seafood,” the report says.

“Animal protein companies should also look at ‘downstream extension’ and closer integration with foodservice and retailers which will help them secure margin and meet consumer needs more effectively.”

Ms Corkran said the changes in China’s animal protein market present a unique set of challenges and opportunities and companies that adapt to these new consumption trends with agility and consumer focus are set to thrive in this dynamic environment.

“Given the vast majority of red meat produced in New Zealand is exported, it’s essential we have a deep understanding of our consumers across all of our key markets. And with China such a key destination for New Zealand beef and sheepmeat, it’s pivotal we stay closely connected to developments in this market to give ourselves the best chance of growing our market share into the future,” she said.

27 Comments

If we can convince even a small percentage of the Chinese population about the health benefits of consuming grass fed red meat we should be able to greatly lift exports.

We can remind them that the Mongol army under Genghis Khan primarily ate meat. Hmmm, maybe I need to think about this a bit more.

100% Zach, we should be doing some serious studies demonstrating how to fix diabetes etc with diet changes (meat as you say and knocking out the processed/carb/sugar).

I'd support subsided meat for this purpose too as it could be a marketing exercise to the rest of the world. Youtube is doing its thing. Still, it would be nice to get some decent studies using NZ grass fed meat (with fat left on), specifically beef, even though I was raised on a sheep farm.

Great idea about subsidies. Like how we used to subsidise milk in the old days. Free school lunches that are primarily meat would be immeasurably beneficial for physical and mental health.

Like listening to Staler and Waldorf you two? Subsidies....?

Nothing like them at all. Healthcare and education is subsidised, why not nutrition?

Christ, you're like a broken record. And you're spouting bro science bs. High consumption of red meat is linked to increased cancer risk. The American Institute for Cancer Research says "eating more than 18 oz. of red meat weekly can increase your cancer risk. If you eat red meat, limit the consumption to no more than 3 portions a week."

This is an article about meat exports to China. There is a growing awareness of the health benefits of grass fed meat however it is necessary to closely examine the consumption of other foods as well. A high meat diet works best with an extremely low carbohydrate intake, adequate exercise and sun exposure. I'd also recommend closely monitoring blood pressure, heart rate, hba1c and triglyceride level. I am always experimenting on myself. Last week I fasted for 40 hours and did a 15km walk before breaking the fast. A fat adapted body should have no trouble with this and mine managed it effortlessly. I was very tempted after the walk to push on to 48 hours of fasting.

Many health issues are cropping up amongst friends and family as we all age while my own heath indicators have all improved and at the age of 64 I take no medication. I once was edging toward being pre-diabetic and have now reduced this danger considerably. This doesn't stop them from often suggesting I should change my diet regime. The only drawback has been my employers and colleagues insisting I am too young to give up work.

You could call it "bro science" yet it appears to work miracles for many people. In my case it is possibly just robust genetics or slow aging. Everyone should seek professional advice and follow their own path and intuition. I interpret my own health metrics taking advantage of the huge amount of information online. There aren't any studies currently that focus on people who eat a health focused ,clean, red meat, diet. We are very keen to get these studies underway.

.

Z pork accounts for 60% of China's total meat consumption largely due to its cultural significance and versatility in Chinese cuisine, where it is featured in numerous dishes and consumed frequently—about 60% of consumers reported using pork in three to five meals per week.

Historically, beef consumption has been limited in China due to cultural taboos. For centuries, particularly during the Tang dynasty (618-907 AD), there were strict prohibitions against slaughtering cattle, which were primarily valued for their work in agriculture. This reverence for cattle as vital agricultural assets contributed to a long-standing aversion to eating beef.

Not sure of the figures these days but for years the most highly consumed meat globally used to be goat meat. That of course includes what you might describe as “home kill.” NZ has traditionally had a problem with resistance to its grass fed meat in Asia. The cooked odour of it is sufficiently alien to attract aversion if not rejection. That is part of why, as per my first post to this article, I am interested in the status and consumption of ground beef. That interest in turn arises from the extent of the popularity in China of such as Burger King/Mac Donalds in so much as you do not read much about pork burgers and therefore here, beef must have worked its way into general consumption, reasonably productively accordingly.

We can also sell them lamb and venison. Funnily enough, I am eating some delicious pork slices as I type this.

There are regional differences in China when it comes to beef consumption. The North, perhaps because of the closer proximity to Mongolia, consume more beef. When I spent a bit of time in Beijing I found beef dishes were quite common and in New Zealand Chinese restaurants offer a wide range of beef dishes. China also has the second largest number of McDonalds restaurants after the US.

According to Copilot 140 million Chinese people have diabetes. If diabetes and other metabolic maladies can be addressed through adopting a diet based on grass fed beef and even if only a fraction of the Chinese people adopt it there could still be significant market uptick for NZ beef.

NZ lamb and venison are available in China. Grass-fed beef is also available. It's an important market for SFF but the buyer segment is targeted more towards the food service channel. Because wallets are currently closed, it's difficult to increase volume and value share. Japan is more partial to beef, but they are price setters, not takers. To some extent, China is too.

Converting to a beef diet doesn't necessarily prevent diabetes.

The key to preventing type 2 diabetes is controlling blood sugar levels. A beef diet facilitates this. You could also do it on chicken and pork however the grass fed meats are considered healthier due to industrial animal feeds.

Anyway, grass fed beef is an ideal nutrition source for maintaining the health of humans of all ages.

The key to preventing type 2 diabetes is controlling blood sugar levels.

Correct. But not eating beef is not the reason why China has increased prevalence of diabetes. Nor does it reduce the incidence of diabetes.

There are many ways to control blood sugar levels. Meat eating is the easiest and best way because of its high satiety and nutritional profile. The advantage of beef, lamb and venison is that these meats are grown from animals that eat a fairly natural diet unlike chicken and pork. Replacing a calorie intake comprised largely of carbohydrates with one that is mostly animal fat and protein will reduce HbA1c readings. If someone is eating mostly meat because of its perceived health benefits, wouldn't it make sense to consume the best of the meats in their unprocessed form? Improved diabetic profiles are just one benefit of a meat-based diet, there are many more.

What we are really looking at here is taking advantage of China's changing attitude toward the health benefits of different meats. There is already a growing perception that pork is not the healthiest resulting in increased consumption of poultry, beef and fish. If they can be shown that poultry and fish is also problematic, then beef consumption can be promoted instead.

McDonalds aiming to open 1,000 new outlets in China during 2024 with a total of 10,000 in operation by 2028. Yep any great doubts about Chinese consumption of beef growing is more or less answered right there. Of course that is the fast food/take out sector but nonetheless it cannot but assist overall consumer interest in beef cuts etc generally.

KFC is already far ahead of Maccas in China in terms of footprint. One of the reasons being is that they offer localized food products over Western style hamburgers.

Similarly in Vietnam, McDs is closing stores and KFC is far ahead in terms of market penetration. McDs Vietnam is even offering fried chicken in an attempt to attract consumers.

https://kr-asia.com/after-33-years-mcdonalds-is-finally-accelerating-it…

True but in terms of China specifically, Mac Donald’s is showing growth, and optimism for more. Have no idea as to where their relative manufacturing is operated but from NZ’s point of interest the traditional & longstanding trade of our lean beef grinding meat to the Nth American burger product can only benefit from such developments especially as dairying is still increasing and so too with that, the culling.

True but in terms of China specifically, Mac Donald’s is showing growth

OK. What is your benchmark and evidence for that growth? And why does that growth depend on hamburgers?

The evidence of growth, eg as above 1000 new outlets opening in 2024, is provided easily enough by Mr Google. Could I also refer you to my initial post 24/10, which has been shuffled down the order here but has some relevance to this comment. If there is traditional dislike of a meat product in any market it is best addressed by approaching first the likeliest favourable sector. For example in Germany up until the eighties sheepmeat consumption was minimal due to the overhang of rationing and the “mutton” type tinned product suffered by the population WW2 and aftermath However NZ exporters steadily developed high end quality lamb cuts for the H & R and ready retail and once a chilled supply was possible Germany became the largest market in the EU. A similar progression was made with venison with farmed product gradually being accepted over game. In China though I am suggesting it may be the other way round with the commodity of beef burgers expanding as the Chinese encounter and avail themselves of this style of western cuisine. For instance it is suggestible that a family that enjoys eating at MacDonalds might in turn progress to buying beef patties, cooking and eating them at home, especially if the price is right. That in turn may lead to steak cuts at home or in restaurants. Therefore in terms of triangle concept as depicted, this is the ideal situation of the lower bracket moving up into the higher priced product. Every pathway has a beginning.

Let's hope they don't do what we did and blame the beef patty instead of the chips, bun and sugary drink for the poor health outcomes that result from eating too much fast food.

I'm not sure that J.C. is really trying to be helpful. He doesn't appear to have even read the article that prompted our comments.

It’s a long weekend I suppose.

'Opening stores' is market expansion. Not growth. KFC already operates over 10,000 restaurants across more than 2,100 cities in China.

Maccas has 5,900.

Why do you assume that Chinese people want to flock to McDs?

Starbucks has 7,300 stores+ in mainland China. They've opened 700 new stores in 2024.

But same-store sales are declining and revenue dropped 11% yoy in the second quarter of 2024.

Does that represent 'growth'?

Apart from the data in this column itself identifying growth in beef consumption as above, and some of which repeated by Mr Gray NZH 27 Oct concerning Chinese meat consumption trends. “”Consumption of beef and seafood has increased strongly over the last decade ………” and “from 2013 to 2023 Chinese beef consumption grew by a compounding annual growth rate of 3.2%” My comments relate to beef with no comparison to the status other meat consumption such as poultry or pork and nothing is being claimed as you assert, except to say beef consumption is growing. These are therefore simply thoughts on possible market trends and development which is why right at the outset I remarked that differentiating the growth vis a vis commodity and H & R etc would be interesting and that progressed , with relativity to the former, to the ongoing performance of such as MacDonalds.

Right. But good to understand context. For ex, the Rabo research shows that value for money is the most important factor for Chinese consumers. Beef is still considered 'expensive ' in China.

Similarly in Vietnam. We also see beef consumption growth slowing, similar to China. Maccas opening new stores is not a great indicator of beef consumption growth.

And look at McDs Japan menus. Far different to what you see in Aotearoa.

They may say what they like - were the people being researched only eating red meat? A Big Mac or similar aren't on my recommendation list if you want to avert cancer (too many processed carbs).

Call it what you like, my body feels so much better with lower carbs, if I had cancer, I'd be zero carb. We have been 'fed' so much nonsense about diet over the decades that anything should be taken with a grain of salt - especially a fatty beef scotch fillet!

Imagine if China decided NZ grass fed red meat was in the same category as fish maw, deer velvet or Manuka honey.

Would like to see the ratio of NZ beef exports between manufacturing/grinding meat, the burger market etc, and premium steer cuts, steak cuisine etc. The former being basic commodity the latter ready retail/restaurant, high end if you like. It is important not to lose sight of the difference. If you regard the trade, their respective consumption, as being within a triangle the latter is at the apex the former the base. In tough times, when spending is tight, the bottom of the apex, in terms of high end consumers, will inevitably commence dropping into the commodity base and that then becomes a real problem if it starts dragging some of its product and its pricing with it.

If you’re worried the pension won’t be there for you in your senior years, then it’s important to get rid of all your debt and build up a balanced portfolio of investments prior to retiring.

TTP

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.