At Wharf Gate (AWG) prices for export logs reduced an average of -NZ$2 per JASm3 across ports in New Zealand in December. Market prices have stabilised in China, but the strengthening NZD against the USD caused AWG prices to drop. Log inventory in China remains stable. While there will still be market volatility in China due to Covid and Chinese New Year, log consumption is expected to lift through the first half of 2023.

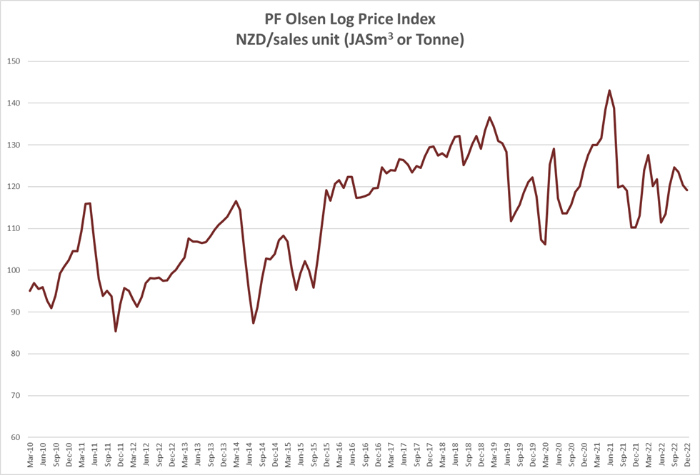

The PF Olsen Log Price Index decreased -$1 in December to $119 which is -$4 below the two-year and five-year averages.

Domestic Log Market

Many mills in New Zealand are taking longer end of year breaks than they have in the last couple of years. Most forest owners are coinciding harvest production with these dates. This means harvest volumes in New Zealand will be lower than normal.

Export Log Market

China

China softwood log inventory is stable at about 3.4 m3 and port off-take is still stubbornly sitting at about 60k per day. Most economies around the world have experienced a spike in consumption and activity after a Covid induced slowdown. While the China economy is not like most economies, I think it will also experience a similar upswing in consumption and activity.

The Chinese government has announced a loosening of monetary policy and business friendly laws, (some of which are directly targeted at the real estate industry), as they look to revive the economy after the Covid induced economic downturn. The actual stimulus packages are likely to be less than 2022, so China is relying on creating the environment for business and increasing domestic demand.

India

Demand for sawn timber in Kandla remains weak. South American sawn timber sells for 501 INR per CFT, Australian green sawn timber at 561 INR per CFT. European spruce kiln dried sawn timber sells for 601 INR per CFT.

During January 2023, three log vessels will arrive at Kandla, two from South America and one from Australia.

The market still awaits confirmation from the Indian Plant Quarantine Authority on the treatment requirements and cost charges of unfumigated logs from New Zealand.

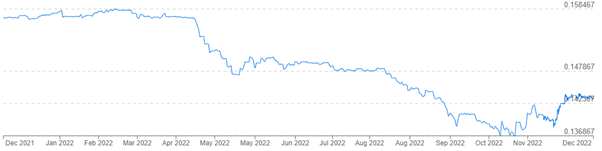

Exchange rates

The NZD strengthened considerably during November and this affected December AWG log prices in New Zealand. The NZD is still volatile against the USD, but the underlying upward trend has stopped in the last couple of weeks. The CNY has stabilised against the USD in the last couple of weeks.

NZD:USD

CNY:USD

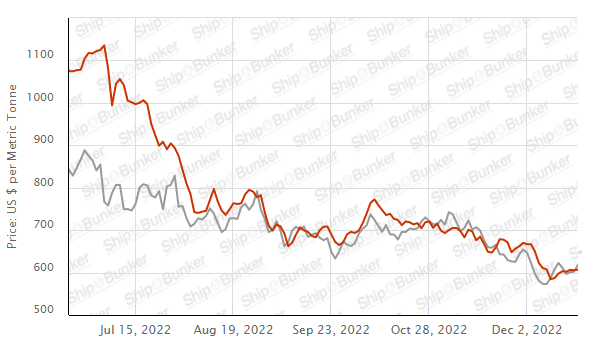

Ocean freight

Shipping costs have continued to drop and the average shipping rate from the North Island of New Zealand to China is now just over 30 USD.

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capsize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in Handysize vessels, this segment is strongly influenced by the BDI.

Source: TradingEconomics.com

Singapore Bunker Price (VLSO) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index - December 2022

The PF Olsen Log Price Index decreased $1 in December to $119 which is $4 below the two-year and five-year averages.

Please note these are AWG prices at North Island ports and that South Island prices are commonly lower due to higher port and shipping costs.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – December 2022

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Dec-22 | Nov-22 | Oct-22 | Sep-22 | Aug-22 | Jul-22 | Dec-22 | Nov-22 | Oct-22 | Sep-22 | Aug-22 | Jul-22 | |

| Pruned (P40) | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 175-190 | 190-200 | 190-200 | 190-200 | 150-170 | 150-170 |

| Structural (S30) | 120-150 | 120-150 | 120-150 | 120-150 | 120-150 | 120-150 | ||||||

| Structural (S20) | 98-105 | 98-105 | 98-105 | 98-105 | 98-105 | 98-105 | ||||||

| Export A | 125 | 126 | 133 | 135 | 128 | 115 | ||||||

| Export K | 115 | 117 | 124 | 126 | 119 | 107 | ||||||

| Export KI | 106 | 109 | 116 | 118 | 110 | 100 | ||||||

| Export KIS | 100 | 101 | 110 | 112 | 101 | 93 | ||||||

| Pulp | 46 | 46 | 46 | 46 | 46 | 46 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

5 Comments

Wood matters ! ... what would Christmas be without the log report ...

... looks like freight costs are declining , sawn timber prices off slightly ... steady as she goes ...

Fantastic , festive forest season , team 🎄😊🍺

Totally agree with you there Gummy, forestry like dairying is a total commitment. Nothing comes easy. All the best to the hard working forest industry people.

Forestry is great exercise, too. I am just starting to harvest, myself, the blackwoods i planted in the 1990s using a portable sawmill. It is a long patient end to end process. Next thing to learn is how to use a planer/thicknesses on the boards I cut last summer.

That would be very satisfying. Did you prune the blackwood s?

Our plot (of trees) is due 2024 according to our Roger Dickie updates. Got a sample payment recently due to the cut in (the making of roadways within the forest) so hoping things hang together for another couple of years. If not, might pick up my share & do something with it myself.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.