With the latest GDT auction results this week farmers will be feeling a little relieved that the steady decline in prices being experienced since March (small June exception) has finally been reversed. This reversal has been reasonably significant with a +4.9% lift overall and WMP up +5.1% A summary of the specific prices is below:

- Butter index up +3.3%, average price US$5,369/MT

- Cheddar index up +1.0%, average price US$5,046/MT

- SMP index up +1.5%, average price US$3,575/MT

- WMP index up +5.1%, average price US$3,610/MT

The banks should be feeling a little smug having held to their belief that the prices would return to levels which would justify their mostly somewhat bullish predictions. The reason for the turn around is largely laid at production weaknesses, mostly in New Zealand with July production down -6% and the trend continuing into August likely to show a -4% drop.

- Rabobank $9.00

- Westpac $9.25

- ASB $10.00

- ANZ $8.50

Higher prices undermined by much higher costs

The high input costs experienced by all farmers, but particularly Northern Hemisphere farmers, mean that they are not likely to be able to crank up their production quickly to take up the opportunity provided. Fonterra says production will be down -1% for the season. ASB are going further in predicting that New Zealand’s seasonal supply will be down by about -1% to -3% on last season which also had experienced a drop on the previous year. They also predict the NZ$ is not likely to do major turn arounds and climb against the US$ to a level which undermines the value of farmgate prices meaning the high predictions are ‘locked in’.

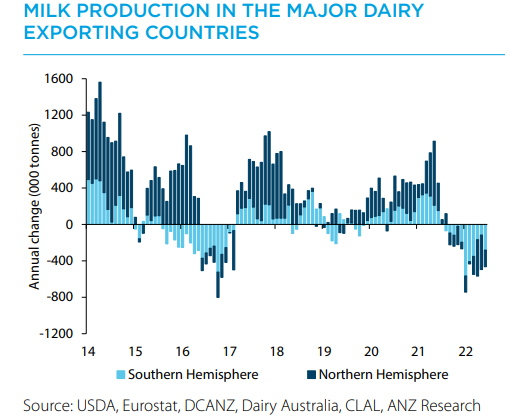

Rabobank in their last report which was pre the latest GDT are still wary of the China influence which maybe why they have a adopted a more cautious MS price prediction. ANZ, again pre last GDT result, are the most cautious of the major banks and still holding to their $8.50 forecast. The graph they included in their last AgriFocus update clearly shows the fall in dairy production globally.

Increasing costs and climate constraints likely to be the major cause and neither showing any likelihood to abate in the foreseeable future.

Forestry's march masked

Going onto a different track, REINZ released an update of rural farm sales recently. In the 3 months leading up to the end of July 2022 there were 127 fewer farm sales than for the same period last year. Going back the full year 289 fewer farms were sold with 1,590 farms sold. Dairy, perhaps surprisingly, bucked the trend with 3% more sales being made although Dairy support were down 31% Grazing farms down 25% Finishing Farms down 13.5% and Arable farms down 19.4%.

Dairy farms prices paid per MS for the quarter ending July 2022 was $36.94 up +10.9% up on the same period last year. Despite this when sales are adjusted for location and differences in farm size (REINZ Dairy Farm Price Index) the index only increased by 1.8%. For the last three months ending July the median price per hectare was $38,880 up from $35,740 for the same period last year. A summary of prices is below with Horticulture being the big mover.

One thing the numbers do not appear to have captured is the number of pastoral farms being converted to Forestry, as the anecdotal reports are that there are plenty.

Grazing farms have increased in value but with the combined Bay of Plenty and Gisborne/Hawke’s Bay (-18 sales) region recording the biggest decreases in sales, mass conversions are not (yet?) being seen in the numbers. It also appeared that the recent sales which were approved by the OIO were included in the sales with “Two sales of larger grazing properties on the East Coast portion of the Gisborne district”. It is quite possible that the way the data is collected, planned conversion to forestry do not get shown and sales remain as grazing until sold as forestry sometime in the future.

14 Comments

My understanding is that if a farm is marketed/listed as a finishing or grazing farm the statistics show that, not what the buyer intends doing with the property so forestry will only show if sold after being planted in trees or previously harvested and ready for replanting. The local agents use their knowledge to separate out sales to pine trees.

There is no hard and fast rule separating the definition of finishing and grazing farms. There are regional differences as well as by agent. Finishing farms can be anything from a large lifestyle block to hundreds of ha if the contour is flat to rolling.

The grazing per ha price is the more relevant to economic faming although recently more influenced by forestry buyers rather than farmers. The last 10 grazing sales up here that I am aware of have all gone to forestry. The last one bought to continue farming was nearly two years ago. More recently several dairy farms are to be planted and several more in negotiations.

As a matter of interest which area do you live in Wilco?

Northland.

Beef and sheep sales to forestry have moved into the mid Northland. Originally the sales were for more isolated areas but as pricing has become more aggressive have been less than 15-20km to the nearest town. The dairy farms I mention are all operating dairy farms but 2nd class quality or location.

Thanks Wilco. Forestry must be paying good money if they are moving closer to town.I can only see it getting bad for locals.The Govt do not care as getting rid of livestock.

It wasn't that many years ago when they were pulling out the trees & opening up the land for dairying. Now it's reversed. Funny ol world isn't it?

It just markets responding to government incentives, previous governments wanted more dairy exports receipts and had legislation allowing it to happen and now the current government don’t want export income they just want carbon reducing trees and have legislated to make that happen.

Good grazing land going into forestry because of subsidies is a disaster. Will end in tears.

There is no subsidy to move to forestry. Only our obligations to cover our cow emissions. We would have to import credits if we don't plant trees.

Can we use trees to cover cow emissions? I thought that was only for FF.

No, and we are unlikely to have enough to cover fossil fuels. I don't think people are understanding what this could cost us in the future , if we don't plant enough trees. Or significantly reduce our carbon emissions. That won't happen while we have some parties ignoring the liklihood we wont be able to export anything , if we don't meet our obligations.

Sorry ,i see now . I wrote cow emissions , when i mean't carbon.

Cows (calves)on the brain !

Remember that these trees are being planted to offset European mega corporation (Ikea etc) carbon liabilities , we've not even touched ours yet , so pretty sure we won't be exporting anything in the future anyway. Should work out well.

solardb - I understand the rationale for planting trees. The rationale being we don't have the political will power to encourage/force people to reduce their carbon emissions. Carbon pricing was SUPPOSED to push up the price of fossil fuels thereby reducing demand. At the first public resistance the gov't caved in and reduced the taxes on petrol defeating the purpose of encouraging people into alternative means of transport.

Using carbon offsets by planting trees is the political soft option by unsettling only a handful of people (farmers) but has a very limited lifespan, being one rotation of pine trees before this option is all used up. Then what?

Agreed.

We eventually have to reduce our fossil fuel carbon emissions. The technology is there , and the up take is starting to grow.

I think we will also fine tune carbon farming , and go to measuring individual trees , and maximise the amount of carbon per tree. Also allow for wood been locked up in construction for 50 years .

I think a version of farm forestry will become the only way many farms (including dairy)) will survive. The shelter belts expanded and fertilised to be similar hig carbon sinks.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.