The At Wharf Gate (AWG) prices for export logs remained unchanged in December, although we did receive price increases in a couple of ports where exporters managed to secure favourable spot deals for shipping. The CFR sale price in China has bottomed at US$130-135 per JASm3 for A grade. Shipping congestion has cleared in China and the backlog of log vessels have been discharged without log inventory increasing. Reduced supply in December and January should lead to reduced inventory levels heading into the Chinese Lunar New Year at the start of February. However, log demand in 2022 is still uncertain.

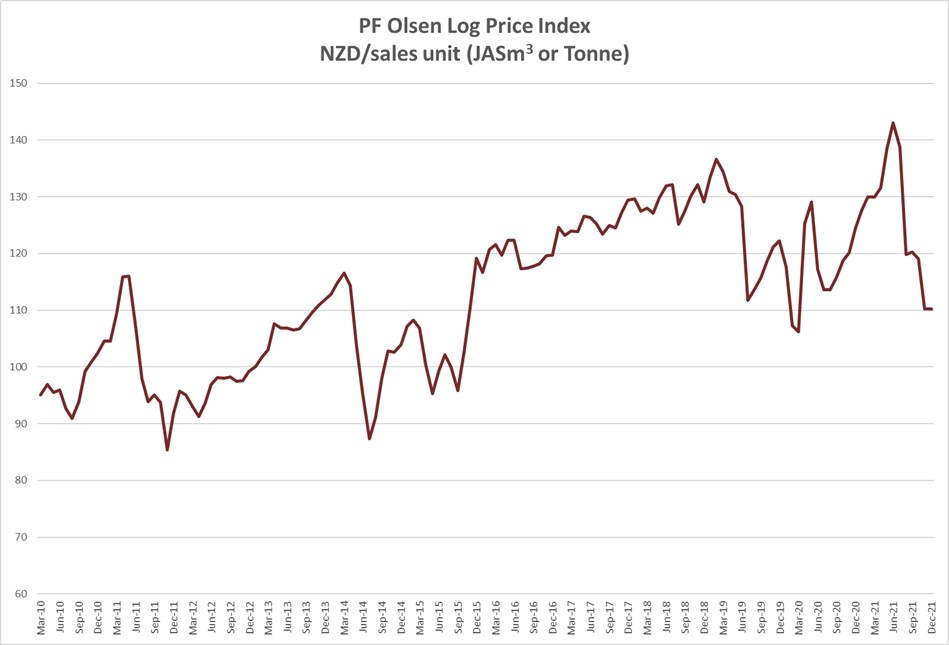

The PF Olsen Log Price Index remained at $110 for December. The index is currently $12 below the two-year average, $13 below the three year-average and $14 below the five-year average.

Domestic Log Market

Log Supply and Pricing

Log pricing has generally remained flat as we come to the end of Quarter 4. Many harvesting crews are taking a three-to-four-week break over the festive season. Many sawmills are taking this time to catch up on maintenance etc, so builders expecting a surge of stock to greet them in the new year will be disappointed.

Sawn Timber Markets

You don’t have to read too many papers in New Zealand to understand there is a shortage of building materials and builders, developers and homeowners are grappling with rising costs. Sawmillers continue to report demand exceeds supply for sawntimber. There is plenty of demand from clearwood and structural to post and poles for infrastructure demands.

On the export side, the Asia markets that buy the fall-down grades from framing production are oversupplied. The core larger size dimension sawn timber grades have held prices better.

Export Log Market

AWG Prices

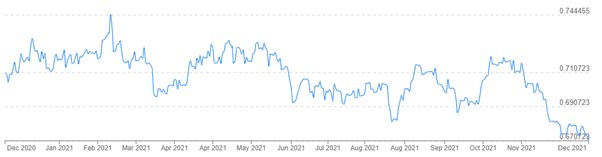

While the AWG price range between exporters and ports remains varied there was some reduction in the range as exporters that had better shipping deals have seen those deals end and there is a more level playing field. A couple of exporters also managed to secure good spot deals on vessels which allowed them to increase AWG prices at certain ports. The drop in sales price in China was countered by the fall in freight costs and the NZD weakening against the USD.

China

The price for logs in China seems to have bottomed at US$130-135 per JAS m3 for A grade logs.

Softwood inventory levels have dropped slightly to 4.5mln m3 and daily offtake remains steady at 75k per day. This inventory level is about 40% higher than normal for this time of the year.

There will be reduced log supply in December and into Quarter 1 due to:

- The New Zealand Forest Industry Contractors Association said that in a recent survey of members only about 35% were operating at normal capacity.

- Many harvesting crews will stop work for three to four weeks over the Christmas/New Year period.

- Germany’s logging of bark beetle damaged wood is forecast to decrease from 60mln m3 in 2021 to 43mln m3 in 2022. Increasing domestic demand will further reduce the volume available for export to China.

Log demand usually reduces heading into the Chinese Lunar New Year, then increases rapidly until construction activity is at full production until the hot sticky weather arrives in China in June and July.

While we know log supply will reduce we don’t know how much construction productivity and log demand will increase after Chinese New Year. This will depend on how successfully the Chinese Government restructures the property development sector while avoiding large scale sustained disruption to an industry that contributes a quarter of its GDP. The Chinese Government wants to see property development, but reduced speculation and President Xi is personally involved in real estate policies, so ministers won’t consider easing policies without his approval.

Most economists predict a 10% decline in new housing starts in 2022 in China. This is a combination of falling house prices reducing demand, reduced credit, and the introduction of new taxes introduced to curb speculation. Beijing is concerned about social stability if developers are unable to complete pre-sold projects (common in China) so officials will try to ensure existing projects are finished. In many of these projects the local government made significant sums of money by acquiring land to then on-sell the user rights to developers at a healthy margin, so they are motivated to see projects completed.

India

The South American logs sitting unsold at port, bonded warehouses, and on inbound vessels to Kandla has fallen from over 400,000m3 to an estimated 250,000 m3. Sentiment remains subdued in Gandhidham with lukewarm demand. The price of sawn timber from Uruguay logs is flat at INR 521 per CFT. The price for radiata sawn timber has fallen from INR 571 to INR 561 per CFT. Market sentiment is likely to remain subdued over the next couple of months as the unsold South American volume is sold off. Indian export remains constrained due to a lack of containers.

Tuticorin had a good rainy season and log demand is limping back to normalcy. The local pine sawn timber price is about INR 651 per CFT.

From January 1st, 2022, the use of methyl bromide for fumigation in ship holds will require a buffer zone of 900m and log exporters have said this is operationally impossible to ship logs from New Zealand to India. The Indian Phytosanitary Authority is likely to permit Ethanedinitrile and Sulfuryl Fluoride to fumigate logs and lumber. But given the regulatory procedures involved, it may take months, or even years, to get the necessary regulatory approvals at both ends.

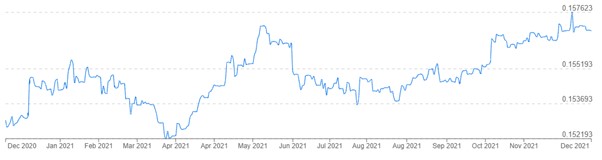

Exchange rates

The NZD weakened against the USD over November, and this assisted the AWG pricing in New Zealand by about NZ$6-7 per JAS m3. The CNY continues to strengthen against the USD.

NZD: USD

CNY: USD

Ocean Freight

The daily cost to hire a vessel has increased this month for log exporters, but the total freight cost has reduced as shipping congestion has cleared in China. Vessel waiting times have reduced from over twenty days to one to three days in the main log ports in China.

Source: TradingEconomics.com

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capesize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in handy size vessels, this segment is strongly influenced by the BDI.

The Singapore Bunker Price continues a downward trend.

Singapore Bunker Price (IFO380) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index – December 2021

The index is currently $12 below the two-year average, $13 below the three year-average and $14 below the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – December 2021

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Dec-21 | Nov-21 | Oct-21 | Sep-21 | Aug-21 | Jul-21 | Dec-21 | Nov-21 | Oct-21 | Sep-21 | Aug-21 | Jul-21 | |

| Pruned (P40) | 180-200 | 180-200 | 180-200 | 180-200 | 180-200 | 180-200 | 150-160 | 150-160 | 194-200 | 194-200 | 194-200 | 194-200 |

| Structural (S30) | 120-155 | 120-155 | 120-155 | 125-160 | 125-160 | 125-160 | ||||||

| Structural (S20) | 100-105 | 100-105 | 100-105 | 105-110 | 109 | 109 | ||||||

| Export A | 108 | 108 | 126 | 128 | 128 | 163 | ||||||

| Export K | 99 | 99 | 118 | 120 | 120 | 156 | ||||||

| Export KI | 90 | 90 | 114 | 113 | 113 | 147 | ||||||

| Export KIS | 82 | 82 | 105 | 104 | 104 | 137 | ||||||

| Pulp | 46 | 46 | 46 | 46 | 46 | 46 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.