This article is a repost of the Westpac publication Monthly Meat Matters here. It is used with permission.

By Nathan Penny

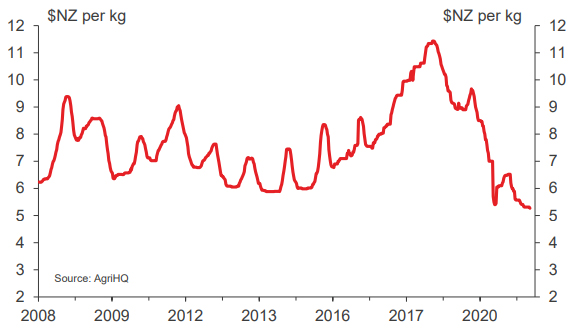

We have again upgraded our farmgate meat price forecasts. We expect farmgate lamb prices to surge over the remainder of 2021, lifting comfortably above $8.00/kg, if not surpassing $9.00/kg. Similarly, we expect farmgate beef prices to lift to $5.50/kg, although the weak US dollar (strong New Zealand dollar) will temper this lift.

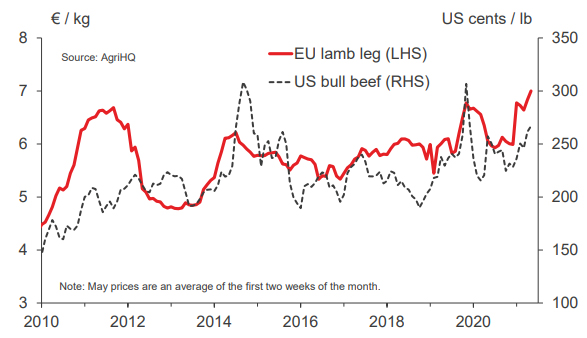

Selected global meat prices

The key catalyst is stronger demand in key markets, including the US, the EU and the UK. These economies are rebounding as the rollout of Covid vaccines progresses, with the added impetus for demand as people head out more to restaurants and other food service outlets. This boost adds to the demand strength already present in China.

The broad strength in our key export markets will translate into broad strength across all meat sectors. That means venison prices, which have been hardest hit by Covid, are also likely to turn the corner as European (German) meat demand returns. Similarly, fine and mid micron wool prices are likely to lift as strength eventually returns to Northern Hemisphere apparel markets.

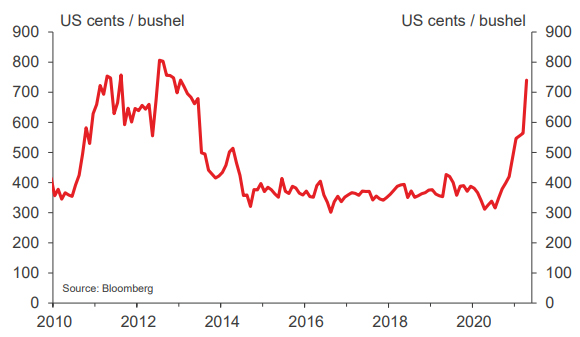

On the supply side, very high feed grain prices (see corn price chart) will constrain global beef production this year. This dynamic should support beef prices through 2021 and into 2022 and will help support other meat prices too.

Looking at sheepmeat supply, the New Zealand flock has shrunk following last year’s drought. With Australian sheepmeat supply also relatively weak, tight supply should also underpin sheepmeat prices.

Corn prices

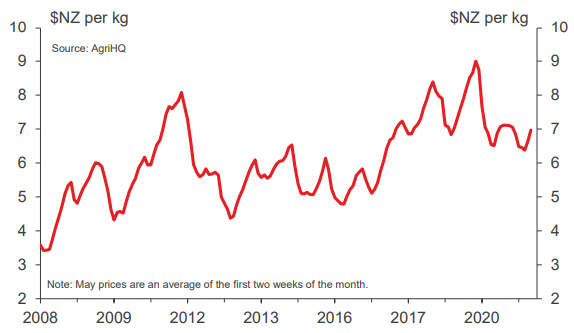

Lamb

Farmgate lamb prices have turned the corner. Prices firmed over April and have jumped to over $7.00/kg already in May. Importantly, these lifts are occurring at a time when prices usually fall. That’s consistent with a firming in underlying demand.

From here, we’re picking a surge in lamb prices over the remainder of the year. As mentioned above, we expect key the US, EU and UK markets to progressively strengthen over the year. That strength will come on top of already robust Chinese demand. Meanwhile, farmgate mutton prices are likely hold at current healthy levels. However, given that mutton largely heads to China, mutton prices won’t get the same boost as lamb from the rebound in other markets.

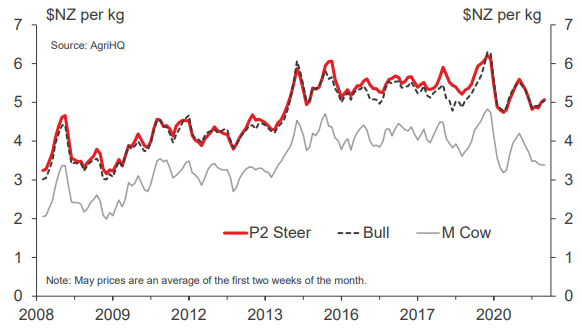

Beef

Farmgate beef prices have risen gradually over recent months. However, the lift in the NZD/USD has masked a more noticeable price lift offshore. US beef prices (for imported bull beef) have jumped by around 17% so far this year.

Over the coming six months or so, we expect farmgate prices to come to the party. In the key US market, the vaccine rollout is going well, and this should boost the economy and in turn meat demand. Meanwhile, the Chinese economy remains strong, further underpinning beef demand. On the supply side, grain feed prices are high which will constrain the supply response to higher prices. All up and while the New Zealand dollar will cap returns to a degree, we still expect P2 steer and M bull prices to reach around $5.50/kg by spring.

Venison

Venison prices have remained very weak so far over 2021. Prices have slid over 5% so far this year, and the early readings for May hint that prices haven’t yet bottomed.

However, we see light at the end of the tunnel for venison producers. In the key German market, the Covid vaccine rollout will help boost demand and venison prices over the year. Mind you, the pickup will be gradual, reflecting the relatively slow pace of growth in Germany. With that in mind, we expect the farmgate price pickup to materialise in the second half of the year.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.