Domestic demand for logs and sawn timber remains strong as wood processors around the country struggle to keep up with demand for sawn timber. Most log processors received price increases for domestic sawn timber products in February.

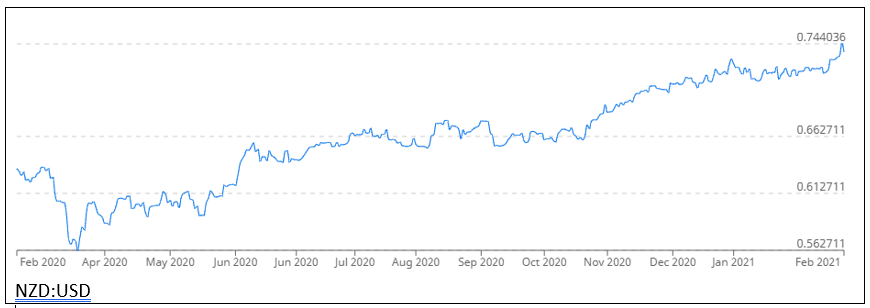

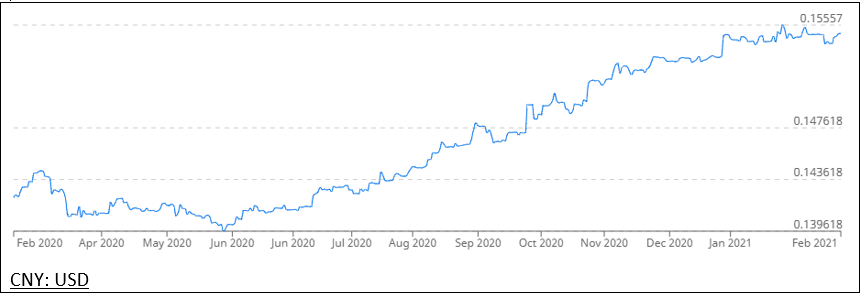

Log demand in China is strong due to a busy construction season, while supply has been constrained. Since December there has been a 15% increase in CFR sale prices for logs in China. Increases in ocean freight costs of up to 40% in this same time and the strengthening NZD against the USD has partially offset the benefit of the higher log sale prices for forest owners in New Zealand. The AWG prices for export grade logs increased by $5-$8 per JASm3 in January and by $5 per JASm3 in February.

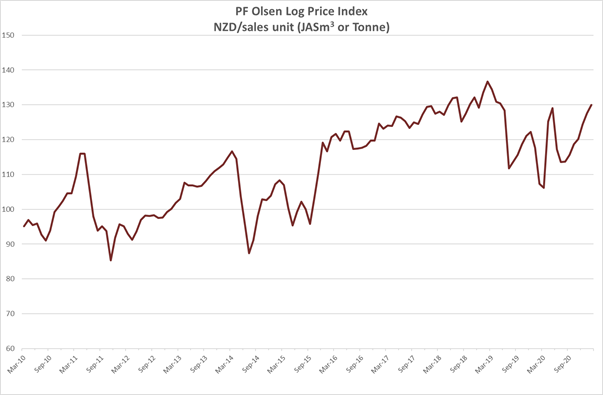

Due to the increase in AWG export log prices the PF Olsen Log Price Index increased by $4 in January and $2 in February to $130. The index is currently $9 above the two-year average, $6 above the three-year average, and $6 above the five-year average.

Domestic Log Market

Log Supply and Pricing

Prices for domestic logs have increased by $2-$6 per tonne for structural and industrial grade logs. Pruned log prices have remained relatively stable. Harvest levels are high in New Zealand and mills are well supplied. Some mills are now targeting more FSC certified logs.

Sawn Timber Markets

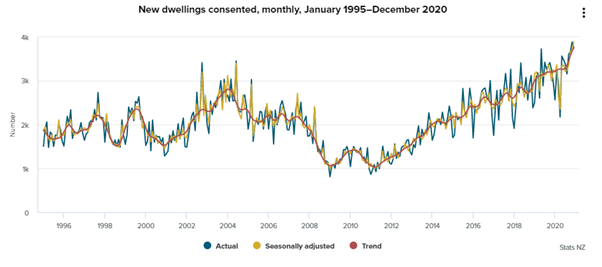

The domestic market for sawn timber across all product ranges continues to be very strong. Most mills report they are struggling to supply all the orders requested, and many report sales books are full for the next two to three months. This demand is mainly driven by the residential housing market. Consents for new dwellings in New Zealand was up 4.8% from December 2019. The annual value of non-residential building work consented was down 5.5% from the 2019 year.

Mills received a 2-5% increase for sawn timber from the retailers in February. The price increase was generally highest in the clearwood grades.

The Australian and US housing and construction markets are also booming with the US housing starts hitting a 14-year high in December 2020. Sawn timber is in demand around the world. China reduced tariffs on over 100 timber and board products in January.

Export Log Market

China

The CFR prices for New Zealand pine logs in China has continued to increase. The range for A grade logs was 130USD per JASm3 for early December shipments but is now 152-154USD per JASm3 for late February shipments.

Softwood log inventory in China has increased as expected over the Chinese New Year period to 4.5m m3. The percentage of spruce within the total softwood inventory levels has increased. Approximately 1.5m m3 of spruce arrived in January, but the China log buyers expect spruce supply to be constrained for the next few months due to a lack of containers, and heavy snowfalls in Europe.

There is also no indication the ban on Australian logs will be lifted. The increase in log supply from South America has filled the gap left by the Australian log volume. Suppliers of this volume, however, will suffer from the increase in ocean freight costs more than the New Zealand suppliers.

Daily log use in China had dropped to just over 60k prior to the Chinese New Year. Many Chinese were unable to travel for the Chinese New Year, so the disruption to productivity is likely to be less than normal, and we expect productivity to increase faster than usual after the Chinese New Year period.

The Bank of China’s Economic and Financial Outlook annual report bodes well for log demand in China. “Looking into 2021, infrastructure and real estate investment will keep growing fast to drive a continuous economic recovery. Driven by infrastructure and real estate investment, investment will continue to accelerate in 2021 and become the main engine of economic growth for the year”.

Log demand in China is expected to remain strong until productivity drops in their very hot summer period.

India

India continues to be oversupplied with logs from Australia. Many containers are being sold from Australian ports to Mundra and Tuticorin. These are mostly fire burnt logs with low sale prices of CIF USD 108, 100, 85/m3 for A, K, and MP grades respectively.

The sentiment of the Indian log buyers is now turning negative due to winter and farmers agitation in the Punjab region.

Exchange rates

The NZD has strengthened against the USD since November, while the CNY has strengthened against the USD since June.

Ocean Freight

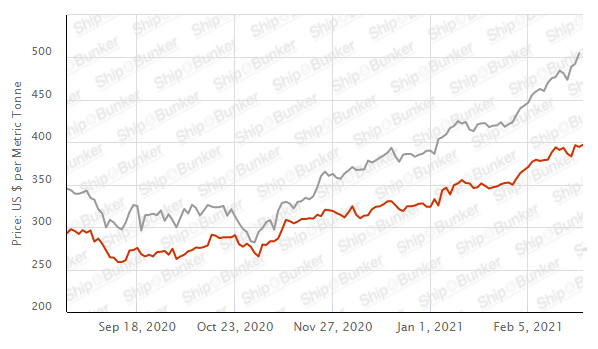

Ocean freight rates for bulk cargo were sitting in the mid-high 20’s in December. Freight rates to China from New Zealand are now reportedly hitting 40 USD per JASm3. There is very high demand as well as a bullish sentiment for dry bulk tonnage due to several reasons.

- Good grain seasons in Australia and South America.

- Strong demand for all commodity (China reduced tariffs on 882 commodities in January).

- The China ban on Australian coal has led to China importing coal from further afield and Australia shipping their coal to more distant markets.

Pent-up demand for furniture and household appliances, work-from-home goods, exercise equipment, medical supplies, and personal protective equipment has driven the demand for containers. Log exporters who use containers (especially European log suppliers) are struggling to source them. The spike in airfreight has also contributed to a surge in container demand. Port congestion has led to berthing delays which has reduced container capacity.

The Baltic Dry Index was sitting at 1200 in November and is now at 1709.

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capesize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in handy size vessels, this segment is strongly influenced by the BDI.

Singapore Bunker Price (IFO380) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index – February 2021

Due to the increase in export log prices the PF Olsen Log Price Index increased by $4 in January and $2 in February to $130. The index is currently $9 above the two-year average, $6 above the three-year average, and $6 above the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – February 2021

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Feb-21 | Dec-20 | Nov-20 | Oct-20 | Sep-20 | Aug-20 | Feb-21 | Dec-20 | Nov-20 | Oct-20 | Sep-20 | Aug-20 | |

| Pruned (P40) | 170-195 | 170-195 | 170-195 | 170-195 | 170-200 | 170-200 | 180-190 | 170-185 | 170-185 | 165-175 | 155-165 | 162 |

| Structural (S30) | 118-132 | 115-130 | 115-130 | 115-130 | 110-120 | 110-120 | ||||||

| Structural (S20) | 108 | 105 | 105 | 105 | 105 | 105 | ||||||

| Export A | 148 | 138 | 130 | 128 | 123 | 119 | ||||||

| Export K | 140 | 131 | 122 | 120 | 115 | 111 | ||||||

| Export KI | 134 | 120 | 113 | 112 | 106 | 102 | ||||||

| Export KIS | 125 | 115 | 105 | 104 | 97 | 95 | ||||||

| Pulp | 46 | 46 | 46 | 46 | 46 | 46 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

2 Comments

Wood is in demand and always will be. No difference to any other primary produce.

Lumber prices have hit ...... an all-time high, .......... That's double the price from three months ago.

https://www.woodworkingnetwork.com/news/woodworking-industry-news/lumbe…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.