The At Wharf Gate (AWG) prices paid by log exporters in May increased +NZ$50-56 per JASm3 from the prices received by forest owners in March prior to the COVID-19 lockdown. This is an increase in sale prices of +50-56% depending upon the grade and length.

This AWG increase in NZ was driven by increased log prices paid by Chinese log buyers concerned about log supply, as well as a weakening NZD, and relatively cheap ocean freight costs. There was however, no substantial increase in demand to sustain this price increase and the CFR sale price which peaked in China at US$128-130 per JASm3 for A grade logs mid-May has now fallen over US$15 per JASm3 in the last week.

Many domestic mills which had reported near record domestic sales of structural sawntimber prior to the COVID-19 lockdown are now uncertain about domestic demand, while their export sales of sawn timber have been referred to as ‘fire sales’.

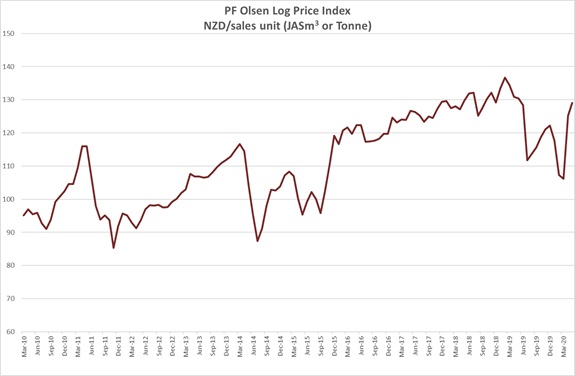

Due to the increases in AWG log prices, the PF Olsen Log Price Index increased $23 from March to $126. The index is currently $4 above the two-year average, $4 above the three-year average, and $7 above the five-year average.

Domestic Log Market

Log Supply and Pricing

With the increased harvest volumes in New Zealand there has been sufficent supply for most mills in New Zealand.

Sawn timber markets

Builders in New Zealand report clients deferring or cancelling booked jobs as people take a cautious approach to the current economic situation. Many sawmills report a ‘wait and see’ approach for domestic demand.

While many people naturally do not want to spend money now, others may be motivated by low interest rates and the New Zealand Reserve Bank’s removal of mortgage loan to value ratio (LVR) restrictions. Sawmillers have previously noted changes in demand when the LVR restrictions are changed.

While the New Zealand government has signalled an intent to undertake infrastructure projects to kick start the economy, the industry is not holding its breath waiting for this to happen. The New Zealand Government’s recent announcement to remove the requirement for consents for low-risk building work like sleep-outs, sheds and car ports, is an effort to stimulate the construction sector, and deflect its own inability to deliver construction projects.

Many export markets have seen sawn timber from various parts of the world dumped at very low prices in their Asian markets. One sector that held up a little better for some New Zealand mills was selling sawn timber to manufacturers in China who make speciality products like edge glued panels etc.

Export Log Market

China

In March I reported the CFR sale price in China had lifted from the US$100 for A grade to the US$105-109 range despite total log inventory still building to over 8 million m3 when including the significant volume also on vessels. These price increases defied economic sense as inventory was still high, and demand was uncertain. It appears this demand was driven purely by concerns about global log and sawn timber supply, as manufacturing and construction recommenced in China.

The same day the Covid-19 lockdown was announced in NZ, market prices for logs in China increased by +RMB150.

Russia usually harvests forests on the permafrost, but due to unseasonably warm weather has not been able to send machinery into forests. This has significantly reduced the supply of sawn lumber into China.

China was also receiving an increasing volume of spruce from European forests that had been damaged by storms and bark beetle. This volume was back-loaded in containers on rail. Due to a lack of consumer demand in Europe for Chinese products, there are very few back-loads of containers for this supply. This supply will likely recommence when consumer demand increases in Europe for Chinese products and back-loads are again available.

Log supply from South America had stopped when log prices in China fell to low levels and there was no indication of when supply could restart due to Covid restrictions.

During the first three months of the year (Q1 2020), China import volume of logs was just short of 12 mln m3 which was down about 20% from last quarter of 2019 (Q4 2019) and down around 15% in comparison with the first quarter of 2019 (Q1 2019).

During May the CFR price for A grade radiata pine jumped to US$128-130 per JASm3 on the back of concerns about global log and sawn-timber supply. As the log prices increased, some sawmills in China slowed down or stopped production as they could not operate profitably with the high cost of logs. The increase in the log price has exceeded any price increases in their finished products. Daily port offtake of log volume was deceptive as many mills were buying increased log volume at lower price levels to avoid the expected price increases.

Due to the lack of demand the CFR price for A grade radiata pine has fallen to US$115-120 per JASm3. This decrease happened virtually within one week. The softwood log inventory in China ports is 4.5-4.8m m3. Daily port off-take of logs is in the 50-60,000 m3 range. While this does show considerable activity is happening in China, these volumes are well down on the same time last year when daily port off take was 80-90,000 m3.

There are some concerns about the China log market in the medium term. China’s finance minister Liu Kun said in early May that China will increase fiscal spending in 2020 to help offset the damage to economy caused by the Covid-19 outbreak, but we have yet to see any stimulus package from the China government have a material effect on log demand. At the National People’s Congress in Beijing (May 22, 2020), Premier Li Keqiang did not announce a growth target for the Chinese economy due to factors that are difficult to predict. Because the Chinese government plays a significant role in the economy, the GDP growth target it sets and strives to achieve is not just a predictor of growth output but can also signal government intent for credit and spending policies. It may also be a signal that the government is prepared to accept a lower level of growth in 2020.

Li announced a fiscal stimulus package of almost RMB 3.6 trillion (US$506 billion) to lead China’s economy recovery following the COVID-19 disruption. As part of this package, the government will issue RMB 1 trillion (US$140 billion) worth of special treasury bonds and increase the local government special bond quota to RMB 3.75 trillion (US$527 billion) These bonds, in particular, are a key source for infrastructure funding, which is a method the Chinese government often employs to stimulate growth, such as it did after the 2008 global financial crisis. However, this infrastructure spend is targeted at “new infrastructure,” such as 5G networks and new energy vehicles (NEV) charging stations. Many of these projects will not create the same log demand as the stimulus spend the Chinese government implemented after the global financial crisis that targeted traditional infrastructure.

One good sign is that China’s Construction and Machinery Association showed total excavator sales jumped +60% in April for year on year data comparison. Excavator sales have previously proved to be a good leading indicator of construction activity, so many Chinese predict construction activity to increase.

It is estimated that approximately 70-75% of the logs China imports is used for domestic consumption. The remaining 25-30% of log imports is manufactured into export products. Global demand for timber products is likely to take longer to recover than China’s domestic demand. If there is no substantial increase in Chinese domestic demand then inventory levels will rise quickly, as global log supply increases. There is increased log supply from New Zealand due to the high prices and the usual rush to harvest forests before the winter weather. Log supply has also recommenced from South America. One exporting company has just celebrated loading three logs vessels in South America simultaneously for the first time. Log exporters in Uruguay are currently loading weekly about 65,000 JASm3 from Fray Bentos and Montevideo ports bound for China, at an average sale price of US$118-120 per JASm3. Log exporters that had supplied logs and sawn timber to India have switched supply to China, with many Chinese log and sawn timber wholesalers saying they have been contacted by new suppliers or suppliers they have not heard from for several years.

As countries around the world emerge from their respective lockdowns and economies restart, we will keenly observe the increase in global log supply relative to the demand for timber products. At the moment global log supply seems to be increasing faster than demand, but this can quickly change.

India

India has been in lockdown with strict curfews in place. Approximately 70% of the log and timber processing facilities in Gujarat are still closed even after getting permission from the Indian government to restart activities. It is predicted that the processing hub of Gujarat near the port of Kandla may take a year to function normally again. Not only is there very little demand for timber products, but over 50% of the migrant labour utilised in these facilities had returned home due to the COVID lockdown uncertainties.

The INR is also weakening against the USD and this has reduced the buying power of the Indian log buyers.

Exchange rates

The NZD weakened against the USD through March and this alone caused an increase in AWG prices of about 14 NZD per JASm3. The CNY has weakened against the USD reducing the buyer power of Chinese log buyers.

NZD:USD

CNY:USD

Ocean Freight

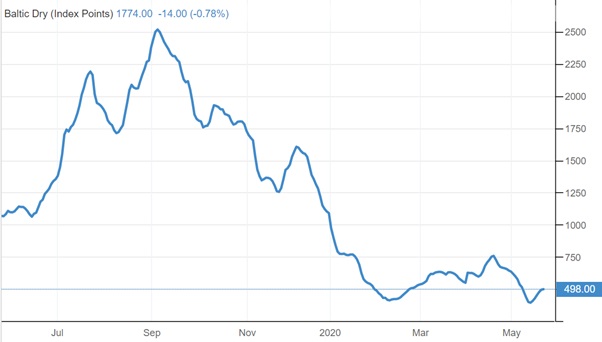

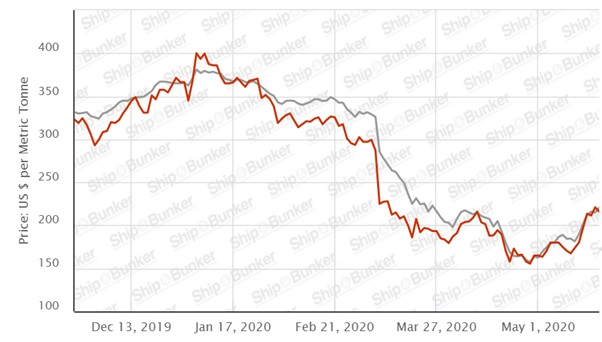

Ocean freight rates dropped in April and early May due to an oversupply of bulk vessels. In the second half of May ocean freight rates to China have increased by approximately 3 USD per JASm3.

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capesize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in handy size vessels, this segment is strongly influenced by the BDI.

Source: TradingEconomics.com

Singapore Bunker Price (IFO380) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index – May 2020

Due to the increases in export log prices, the PF Olsen Log Price Index increased $23 from March to $126. The index is currently $4 above the two-year average, $4 above the three-year average, and $7 above the five-year average. There were no AWG prices offered at the start of April as no logs were being produced. Any AWG prices at the start of April would have been similar to March prices. April Log exporters posted AWG prices in the last week of April and by then the scramble for log supply had begun.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – May 2020

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| May-20 | Mar-20 | Feb-20 | Dec-19 | Nov-19 | Oct-19 | May-20 | Mar-20 | Feb-20 | Dec-19 | Nov-19 | Oct-19 | |

| Pruned (P40) | 160-180 | 170-190 | 170-190 | 170-190 | 170-190 | 170-190 | 180-190 | 140-145 | 140-145 | 160-175 | 160-175 | 160-175 |

| Structural (S30) | 110-120 | 115-125 | 115-125 | 120-130 | 120-130 | 120-130 | ||||||

| Structural (S20) | 105 | 108 | 110 | 110 | 110 | 110 | ||||||

| Export A | 154 | 103 | 103 | 131 | 129 | 124 | ||||||

| Export K | 146 | 95 | 95 | 124 | 121 | 116 | ||||||

| Export KI | 138 | 83 | 83 | 116 | 114 | 108 | ||||||

| Export KIS | 130 | 80 | 80 | 107 | 105 | 105 | ||||||

| Pulp | 46 | 46 | 48 | 51 | 51 | 51 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only. There was no September 2019 report.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

15 Comments

"All eyes on China's domestic recovery." No eyes on Shane Jones dodgy Log Traders Bill and his vested interests.

OK to hand pick grapes and apples but unsafe to mechanically harvest trees - NZ First thumb on the scale to support their sawmill business. Under Adern we are fast becoming a banana republic.

"The Government's decision to deem forestry "non-essential" in the Covid-19 response cost the sector around $500 million in lost or delayed sales, say the chief executives of New Zealand export ports."

https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=12…

"A powerful New Zealand First figure helped establish a forestry company that then pushed for money from two key funding streams controlled by a New Zealand First Minister.

...On 29 August it announced it had entered into an agreement to acquire Claymark Group Holdings, a New Zealand-US wood product manufacturer.

And just last week, the company said it had entered into a "strategic transaction" to purchase a 25 percent stake in Northland lumber company North Sawn Lumber and help it build a sawmill in Ruakaka."

https://www.msn.com/en-nz/news/national/nz-first-linked-forestry-compan…

Why are so many sawmills in NZ closing.

Log suppliers always wanting top export dollar and no long term consistant supply to locals.

Good job.?

It is a very, very tough business. For instance Prime in Gisborne has had eight odd owners and lost at least $50 million over the last 30 years. $10's of millions of rate and tax payer money has been thrown at it. No shortage of wood or labour in Gisborne - it is just a very low margin business. The sort of business that business titans like NZ First would get into.

China buy logs, not sawn timber. So even though demand for logs has remained steady, the market for sawn timber has fallen by the wayside.

China is a huge importer of lumber. "China continued to increase importation of softwood lumber in 2019 when 28 million m3 was unloaded at the country’s ports, 15% more than in 2018."

https://www.lesprom.com/en/news/China_increase_softwood_lumber_imports_…

Many factors. Largest one being globalised economy requires most efficient manufacture will survive. The other and by far most salient is China driving (pre covid) economy with a command planning government not driven necessarily by rational economics which leads to large infrastructure and construction running so hot other nations feed off at the margins.

"IMHO, this has to be amongst the leading contenders for the worst piece of emergency legislation promulgated by the Government.

A glance at the regulatory impact statement elicits some truly worrying signs, in terms of both:

strained application (or disregard – depending on your point of view) of the most basic of economic concepts; and

a fundamental misunderstanding of the economics of domestic wood processing – and the nature of the NZ wood resource and its uses."

https://offsettingbehaviour.blogspot.com/2020/05/reader-mailbag-propose…

He (Shane) doesn’t care. It’s a Trumpian headline and vote he’s after

Although I haven't had any dealings on the ground in India I am told their productivity rates are terrible, I'd hate to think what they will be like with social distancing in effect post lockdown.

On our timber industry in general; so many NZ businesses in the primary sector take the easy way out and export raw product and the forestry sectir is no less guilty. While that suits the sole exporter it virtually eliminates the opportunity for another business to be created downstream and develop the raw product further and for further profit and employment of NZers subsequently. Its very disappointing and utterly greedy.

You fail to see manufacturing ( downstream) is just not competitive in NZ. Lack of scale and investment in efficient production along with distance to market.

NZ is so small on world market we bring little else in o the negotiation table.

We need to create niche demand for high end products. This requires entrepreneurs - not government picking winners and losers with your money

With outdated equipment, little in the way of venture capital and no cohesive national strategy then yes, manufacturing in NZ won't ever realise its full potential mainly because competing Nations have the 3 components of technology, capital and national strategy in place and enjoy the success we sorely miss.

The pines are owned by foreign investment funds, so no motivation to process trees.

Thats not true. Many forests are owned by nz farmers and small forest owners. To demand foresters to subsidise inefficient processors is a step to far. Establishing forest is high risk and cost. Until demand for processed timber beyond our borders increases log exports must continue.

I was talking to a guy who used to work for Juken and they are moving to Eucalypts where possible. I think it was to do with limited uses for pine in Asia. He said where they can grow eucalypts they will. I worry about companies like Juken, I wonder if they will hang about in a country with such high cost structure.

Love to see small mills in rural towns again.

Yes I agree and we are experimenting with E fastigata and redwoods. Small on farm mills will probably be the way to go for family farm diversity. But mainstay forestry will remain radiata for commercial reasons.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.