The February At Wharf Gate (AWG) prices for logs at New Zealand ports were predominantly rolled over for March. During March there have been gradual increases in the CFR sale price for radiata pine logs in China as productivity in China ramped up. A grade was selling in the 108-111 USD per JASm3 range prior to the news about the NZ COVID-19 lockdown.

The Chinese market reacted immediately to the New Zealand lockdown with wholesalers increasing their selling prices overnight by an average of 150 CNY per m3.

The combination of increased sale prices in China and the NZD weakening against the USD will see a significant increase in AWG prices when harvesting resumes.

Many domestic mills reported near record domestic sales of structural sawn-timber during Quarter 1. Of course, this has all come to a halt with the NZ COVID-19 lockdown.

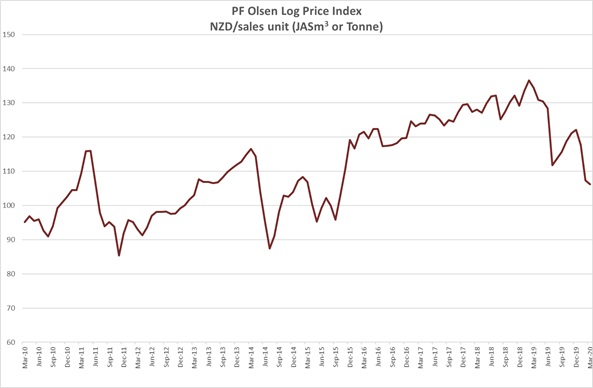

Due to some lower domestic log prices, the PF Olsen Log Price Index decreased $1 in March to $106, The index is currently $18 below the two-year average, $19 below the three-year average, and $14 lower than the five-year average.

Domestic Log Market

Log Supply and Pricing

Log pricing has been variable from region to region with some mills initially receiving increased offers of supply, then becoming short of supply as many forest owners suspended harvesting operations.

Sawn timber markets

Domestic demand for structural grade sawntimber has been very strong, driven by construction in the upper North Island. Many mills reported record sales. Export sales started to be affected by supply chain issues and demand due to COVID-19 restrictions in various countries.

Export Log Market

China

In the first week of March the CFR sale price for A grade radiata in China was in the low 100-104 USD per JASm3. Daily port off-take was still in the 35-50,000 m3 range. In the following week sales were confirmed at the 105-109 USD mark. This defied economic sense as stock was still building to over 8 million m3, with significant volume also on vessels. It appears the Chinese log buyers had noticed the reduced supply from both NZ and spruce from Europe. Indication of daily port off-take in China ranged from 80,000-100,000.

The daily port off take is now variable and dropping to 20,000 some days as log wholesalers are holding volume back to take advantage of higher prices as China log buyers react to reduced supply.

The supply of spruce from Europe has ceased as well due to the lack of containers. This combined with the reduction of logs from New Zealand will see the Chinese deplete their log inventory. This bodes well for demand of New Zealand logs when harvesting restrictions are lifted.

India

India is in lockdown with strict curfews in place. The INR is also weakening against the USD and this will reduce the buying power of the Indian log buyers when they return to work. The demand and supply balance will be dictated by the various timings of harvesting and production restrictions by various governments around the world.

Exchange rates

The NZD weakened against the USD through March and this alone should lead to an increase in AWG prices by about 14 NZD per JASm3. The actual impact will depend upon where the exchange rate is closer to when AWG pries are posted. The CNY was relatively stable against the USD.

NZD:USD

CNY:USD

Ocean Freight

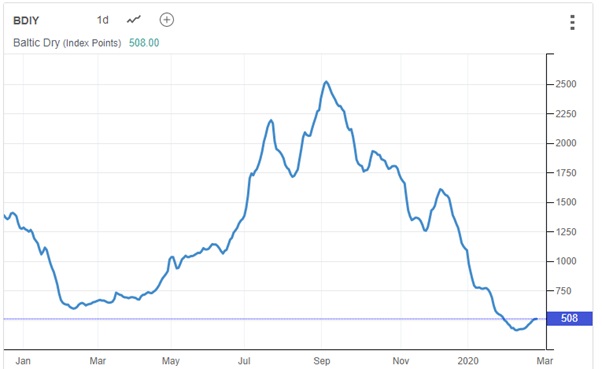

The graph below shows the quiet China effect on ocean freight rates. There is a shortage of demand for bulk vessels so the ocean freight rates have dropped considerably and there is a wide variation in the market. Shipping times have actually increased due to the slower discharge in China ports. There are also issues such as ex China vessels becoming quarantined, and specific personnel having to be dropped off at another port before reaching China to avoid quarantine.

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capesize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in handy size vessels, this segment is strongly influenced by the BDI.

Source: TradingEconomics.com

Singapore Bunker Price (IFO380) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index – March 2020

The PF Olsen Log Price Index decreased $1 in March to $106, due to some lower domestic log prices. The index is currently $18 below the two-year average, $19 below the three-year average, and $14 lower than the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – March 2020

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Mar-20 | Feb-20 | Dec-19 | Nov-19 | Oct-19 | Aug-19 | Mar-20 | Feb-20 | Dec-19 | Nov-19 | Oct-19 | Aug-19 | |

| Pruned (P40) | 170-190 | 170-190 | 170-190 | 170-190 | 170-190 | 170-190 | 140-145 | 140-145 | 160-175 | 160-175 | 160-175 | 140-155 |

| Structural (S30) | 115-125 | 115-125 | 120-130 | 120-130 | 120-130 | 125 | ||||||

| Structural (S20) | 108 | 110 | 110 | 110 | 110 | 110 | ||||||

| Export A | 103 | 103 | 131 | 129 | 124 | 107 | ||||||

| Export K | 95 | 95 | 124 | 121 | 116 | 101 | ||||||

| Export KI | 83 | 83 | 116 | 114 | 108 | 92 | ||||||

| Export KIS | 80 | 80 | 107 | 105 | 105 | 85 | ||||||

| Pulp | 46 | 48 | 51 | 51 | 51 | 51 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only. There was no September 2019 report.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

3 Comments

If its so rosy on the domestic milled timber front, why are there so many closures of mills due to inability to source locally cut trees?

Many of the mills that have closed used pruned logs - these are the bottom logs that used to be pruned(branches loped off). As the price for these stagnated plus the cost of labour increased it didn't work financially so pruning stopped. As a result the decisions made 20 years ago are are now affecting supply of this log type - there is very low volumes available and it will get worse. In some regions like Northland we are now entering a harvest period where there was a massive decrease in planting 20 to 25 years ago - there is a huge hole in supply for anyone plus increased demand. This shortage will affect the whole industry in about 5 years and we have gap from 2025 to about 2035 (roughly) were log supply will fall before it comes back up. This isn't the "Chinese" or anyone its simply we stopped planting new land plus ripped out huge areas of forest to milk cows. You can't wish up mature forest they take 20 to 28 years to grow and what you do now affects the market in the future.

Do it soon, before the windows closing again for the next wave upon wave of world wide countries take musical chair turn for the lock-down.. and before 2021-2022 onward period of reckoning.. try to digest who to blame that causes all of this animal viruses to jump to human, keep on adapting, evolving, circulating & being spread world over again by the strong youth generation carrier. Try to tell them to stop vaping out those Covids germ droplets everywhere, fall on deaf ear. You young generation, you have no idea...

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.