The Australian budget was announced last Tuesday evening and although comparisons with Australia are not always constructive, there are several points of interest, not just in terms of how the tax systems operate, but also about initiatives which could replicated here.

The Treasurer is predicting a surplus for the period to June 2025, but after that, apparently things get a bit tougher. A little bit like Aotearoa-New Zealand in that regard. The key point with an election coming up, is the “Stage Three” tax cuts take effect from 1 July. As is well known and has been the subject of some commentary over time, Australia has a tax-free threshold of A$18,200. That threshold isn't changing, but what is happening is that the tax rate for the next bracket between $18,200 and $45,000 is dropping from 19% to 16%. The big change is in the next tax bracket where the rate drops from 32.5% to 30% for income from A$45,000 all the way up to A$135,000 Australian. Quite apart from the rate change the bracket has been extended from A$120,000 to A$135,000. The 37% bracket remains in place and applies for income between A$135,000 and A$190,000. Over $190,000 the top rate of 45% kicks in.

We had record migration last year and a lot of those people are heading to Australia and no doubt these tax measures will make it more attractive. I'm in the camp that you can't ever compete on tax cuts because there's always someone better able to reduce tax rates further. Right now that’s Australia.

One of the interesting comments I've heard about the Australian budget, is that the Australian Treasury forecasts, are frequently incorrect sometimes resulting in unexpected surpluses. Apparently, the Australian Treasury consistently under-estimates forecast inflation and the iron ore price, which since Australia is such a huge minerals exporter, is quite critical. Generally, the Australian economy tends to perform better than Australian Treasury predictions.

Another strong Australian corporate tax result

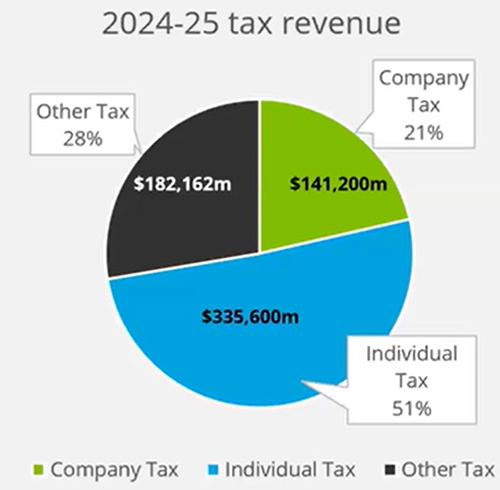

Furthermore, as the Australian economy is performing so well, the Australian company tax take is now a significant proportion of the total tax revenue. For the coming year to June 2025 it’s predicted to be A$141.2. billion or just over 21%.

(Deloitte Australia)

That's a substantial sum by world standards. For comparison, in the UK (a near comparatively sized economy) the proportion of the tax take that comes from companies is usually between 7% and 10%. We are also a country with a fairly high corporate tax take. In the year to June 2023, it was 16.1% of total tax revenue. However, one of the reasons the Government’s books are deteriorating is the decline in the company tax take which is expected to fall to 15.6% of the total tax revenue this year.

Australian cost of living initiatives

There were also a number of other direct cost of living initiatives, including a $300 energy bill rebate to all Australian households. Eligible small businesses will get a $325 rebate during the coming year to June 2025. The Australian Government will also provide A$1.9 billion Australian over five years to increase the Commonwealth Rent Assistance maximum rates by 10%. (This would appear to be the Australian equivalent of the Accommodation Supplement).

Over here we don't know whether the Budget in two weeks’ time will contain specific cost of living responses similar to these Australian initiatives but that appears highly unlikely. Based on what we've heard so far, the Government is relying on the individual tax threshold adjustments to sort of deliver cost of living relief.

Beefing up the ATO

Australia has a capital gains tax and some changes are proposed around the application of capital gains tax to non-residents. These are intended to ensure from 1 July 2025 that foreign residents are caught within the rules in relation to disposals of land. That's something people tend to forget, that non-residents are taxable on disposals of Australian property and these proposed rules are intended to strengthen that compliance.

Another thing of note, which I think we will see something similar in our budget, is increased funding for various Australian Tax Office (the ATO) compliance programmes. The ATO has currently got three such programmes on the go, covering personal income tax, the shadow economy and tax avoidance (Tax Avoidance Taskforce). The Budget announced a new initiative countering fraud. In terms of dollar returns on these programmes, they range between four to one for the funding of the personal income tax down to a little two to one for the Tax Avoidance Taskforce.

Small businesses and ABUMS

The other thing that I think people would love to see here is the Instant Asset Write Off. This is where small businesses can purchase an asset up to $20,000 in value and claim an instant write off. This programme has been extended for another year. Apparently one of the reasons it has been extended is that the legislation which would have terminated that programme hasn't yet been passed. Australian governments have a habit of announcing measures and then not getting around to passing the relevant legislation resulting in something with the delightful acronym ABUMS - Announced But Unacted Measures.

Overall, there was some interesting stuff in the Australian Budget including another measure I'm going to talk about next, which I also wonder whether we might see applied here.

Facebook’s results

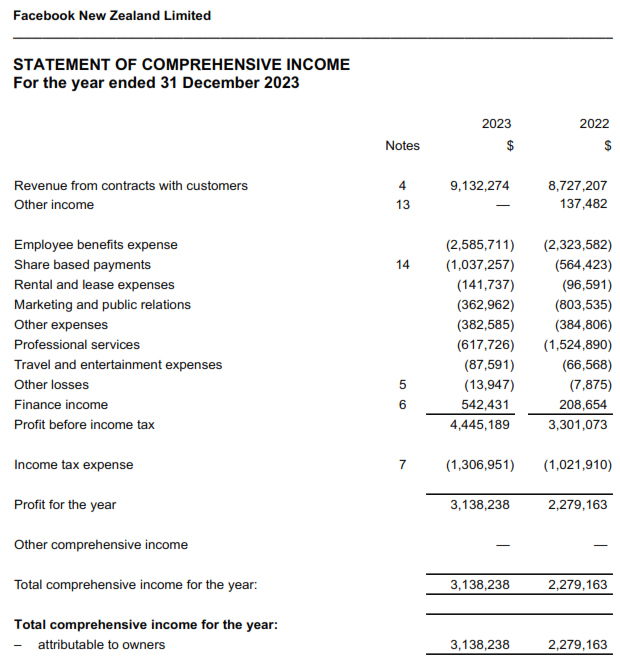

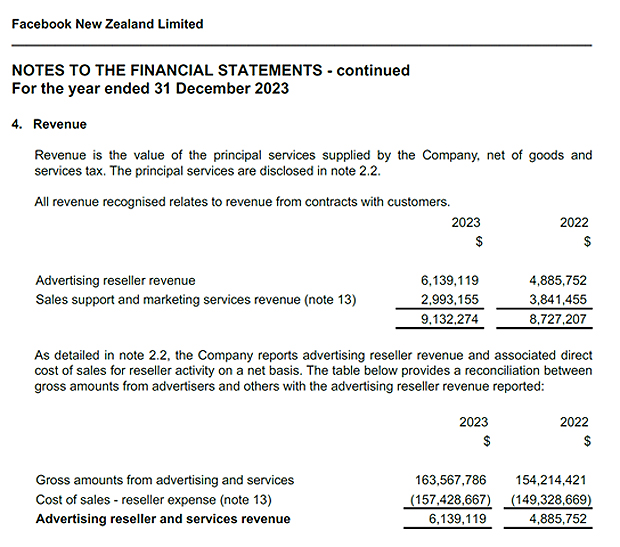

Moving on, Facebook has now released its New Zealand financial statements for the year to 31 December 2023, and these are bound to generate some controversy. The official income reported for the year was $9.1 million and the profit before tax was $4.4 million, resulting in income tax of $1.3 million.

Like Google New Zealand details of the payments to related parties is the very interesting section to look at, together with the statement of cash flows because these give you a better clue of what the scale of Facebook's activities within New Zealand are. Note 4 to the financial statements, which explains the revenue, sets out what is happening. “The company reports advertising reseller revenue and associated direct cost of sales for reseller activity on a net basis” This note explains that the gross amounts it received in the year to December 2023 from advertising and services was $163,567,786 and then a reseller expense was $157,428,667.

So, although Facebook is reporting income for income tax purposes of $9.1 million, the real scenario is that the revenue that's passing through it, is substantially higher.

Another Australian example to follow?

Now it so happens there's a case going through Australia at the moment involving what they call an embedded royalty. Basically the Australian Tax Office took a case against drinks company Coca-Cola in relation to what it perceived as an embedded royalty (and therefore subject to withholding tax) in payments for the right to brew Coca-Cola in Australia.

The Australian budget has a number of what’s termed Intangibles Integrity Measures. One of those appears is a new provision, effective from 1 July 2026, where it applies a penalty to taxpayers who are part of a group with more than $1 billion in global turnover annually, that are found to have mischaracterised or undervalued royalty payments to which royalty withholding tax would otherwise fly.

Now that's two years away from implementation, but it's clearly a shot across the bow of companies such as Facebook or Meta, and Alphabet, the owner of Google, about these reseller services expense. So that's something to watch how this develops.

And I just wonder whether we might see something similar here, because significant sums of money coming from advertising, are going overseas, and, as I've mentioned before, that has had a detrimental impact on our media landscape that it's basically been starved of cash as a consequence. So, watch this space.

Treasury’s warning on structural reform

Finally, this week there was a budget information release from Treasury of papers relating to the Government's mini budget in December. And one of the papers titled Implementing the fiscal strategy has attracted quite a great bit of interest.

In the paper Treasury sets out in fairly blunt terms that there is a requirement or need for structural reform of the tax system. The key paragraphs are 24,25 and 26. Paragraph 24 notes

“Structural reform of the tax system is the most effective way to ensure it is flexible and capable of raising additional revenue sustainably… Such reform would need to recognise that while revenue raising is the primary purpose of the tax system, its distributional and economic objectives are also important.”

Plenty of wry smiles here for those who listened to the Titans of Tax expand on this very point.

The problem with fiscal drag

Paragraph 25 then discusses the importance of fiscal drag

“Since 2010, fiscal drag…has played an important role in enabling successive governments to use the tax system to meet their revenue objectives. This has placed increased pressure on the tax system’s other objectives. If you wish to offset or end fiscal drag, through adjustment of personal income tax rates and thresholds the fiscal headroom which needs to be created will further increase”.

In other words, if you want to end fiscal drag, you really do need to rebalance and reshape the tax system,

I’ve seen some commentary that this was blunter advice than was provided to the previous government. I don't actually subscribe to that view because in my view Treasury’s 2021 long-term fiscal insights briefing He Tirohanga Mokopuna was pretty clear that a fiscal crunch was coming. I just think that because there's been a change in government, what Treasury has done here is taken the rather softly, softly approach in He Tirohanga Mokopuna and just made it very blunt so the new Government knows from the offset that there are challenges ahead. And to be fair to Finance Minister Nicola Willis and the Prime Minister, they have not denied that. But what they propose to do about it, of course, we'll have to wait and see.

And on that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.