ATO

The New Zealand Tax Podcast – tax policy changes around the world. A happy 40th birthday to Australia's Capital Gains Tax. And an international expert gives his views on the challenges facing our tax system

13th Oct 25, 9:23am

16

The New Zealand Tax Podcast – tax policy changes around the world. A happy 40th birthday to Australia's Capital Gains Tax. And an international expert gives his views on the challenges facing our tax system

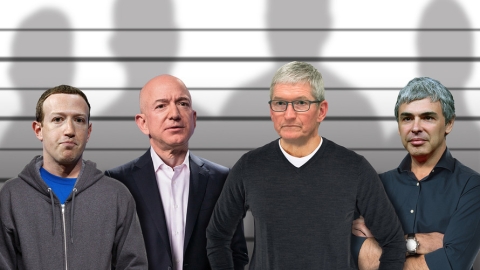

The New Zealand Tax Podcast - an overlooked but welcome change in the new tax bill; and tax minimisation in the technology sector highlights the low income tax bills of companies such as Amazon and Google

1st Oct 25, 11:50am

3

The New Zealand Tax Podcast - an overlooked but welcome change in the new tax bill; and tax minimisation in the technology sector highlights the low income tax bills of companies such as Amazon and Google

New laws to make it harder for large Australian and foreign companies to avoid paying tax

4th Jul 25, 11:30am

New laws to make it harder for large Australian and foreign companies to avoid paying tax

The New Zealand Tax Podcast – Inland Revenue on when subdivisions are GST taxable activities, and the G20’s blueprint for taxing billionaires

1st Jul 24, 10:17am

5

The New Zealand Tax Podcast – Inland Revenue on when subdivisions are GST taxable activities, and the G20’s blueprint for taxing billionaires

The New Zealand Tax Podcast – The Minister of Finance hints at review of charitable tax exemption; Inland Revenue targets smaller liquor outlets; How effective marginal tax rates act as disincentives

23rd Jun 24, 3:54pm

18

The New Zealand Tax Podcast – The Minister of Finance hints at review of charitable tax exemption; Inland Revenue targets smaller liquor outlets; How effective marginal tax rates act as disincentives

The New Zealand Tax Podcast - the awkward discussion we’re not having. And Budget papers reveal how some could now have an effective tax rate of 128% - or even more

16th Jun 24, 5:13pm

33

The New Zealand Tax Podcast - the awkward discussion we’re not having. And Budget papers reveal how some could now have an effective tax rate of 128% - or even more

[updated]

The New Zealand Tax Podcast – Budget preview: What might Inland Revenue get funding for and how Nicola Willis could raise $400 million

26th May 24, 7:24pm

113

The New Zealand Tax Podcast – Budget preview: What might Inland Revenue get funding for and how Nicola Willis could raise $400 million

The New Zealand Tax Podcast: Major tax cuts in the Australian Budget; the problem with Facebook; and Treasury suggests a capital gains tax as part of 'structural reform'

21st May 24, 11:55am

1

The New Zealand Tax Podcast: Major tax cuts in the Australian Budget; the problem with Facebook; and Treasury suggests a capital gains tax as part of 'structural reform'

Aussie Treasurer Jim Chalmers 'bitten by the giveaway bug' in a budget that contains good news for almost everyone, Stephen Bartos says

15th May 24, 10:56am

11

Aussie Treasurer Jim Chalmers 'bitten by the giveaway bug' in a budget that contains good news for almost everyone, Stephen Bartos says

The New Zealand Tax Podcast: The religious organisation charitable exemption in line for a review. And FBT to get new focus from the IRD

21st Apr 24, 5:20pm

16

The New Zealand Tax Podcast: The religious organisation charitable exemption in line for a review. And FBT to get new focus from the IRD

The New Zealand Tax Podcast: Inland Revenue gets tough with construction industry bad debtors as they roll out a range of actions targeting tax evaders

14th Apr 24, 5:02pm

18

The New Zealand Tax Podcast: Inland Revenue gets tough with construction industry bad debtors as they roll out a range of actions targeting tax evaders

The New Zealand Tax Podcast: Confusion over new Apps Tax; Treasury analyses the effects of taxes and benefits; and are the Australian raids on the business operations of the Exclusive Brethren an example for Inland Revenue?

8th Apr 24, 10:18am

2

The New Zealand Tax Podcast: Confusion over new Apps Tax; Treasury analyses the effects of taxes and benefits; and are the Australian raids on the business operations of the Exclusive Brethren an example for Inland Revenue?

Terry Baucher on how the IRD is updating its investigations, merits of waste levies as a behavioural tax, and how being six minutes late could cost the ATO nearly $100 mln

2nd Dec 19, 10:32am

4

Terry Baucher on how the IRD is updating its investigations, merits of waste levies as a behavioural tax, and how being six minutes late could cost the ATO nearly $100 mln

UBS argues APRA move on debt-to-income limits could hit Australian investors who have an owner-occupier mortgage and geared investments hard

20th Jun 18, 9:37am

UBS argues APRA move on debt-to-income limits could hit Australian investors who have an owner-occupier mortgage and geared investments hard

ASB's Aussie parent details another PERLS debt issue by its NZ branch giving the trifecta of Tier 1 Capital, NZ tax deductibility & Australian franking credits

21st Feb 17, 9:50pm

ASB's Aussie parent details another PERLS debt issue by its NZ branch giving the trifecta of Tier 1 Capital, NZ tax deductibility & Australian franking credits