By Patrick Watson*

Remember when inflation was going to be transitory? Good times.

Our monetary authorities are finally beginning to see the problem. Unfortunately, it’s more than a monetary problem. Their tools will thus have limited effect.

Here’s how it used to go: The Federal Reserve raises interest rates, which raises the cost of goods bought with borrowed money. This reduces demand for those goods, forcing the sellers to drop their prices. Presto, inflation gone.

That can work when the inflation occurs at the end of a long growth cycle, as confident consumers buy expensive luxuries. It is less effective when the rising prices are concentrated in non-discretionary essentials, like food and fuel.

The Fed probably can’t get us out of this mess, at least not soon. Fed officials seem to know it, too. They seem to have decided a recession is the lesser of two evils.

The problem with this thinking: The lesser of two evils is still evil. Better to find a third way.

Recently I talked about the Fed’s quandary with Michael Gayed on his Lead-Lag Live Twitter Spaces show. Michael asked me what, if anything, could give the Fed some better alternatives?

That was a really good question. Let’s think through the answers.

Demand destruction

Our current inflation is a perfect storm arising from COVID policies, central bank mistakes, geopolitical events, demographic trends, and more. Getting to the roots is hard… but rising energy prices are high on the list.

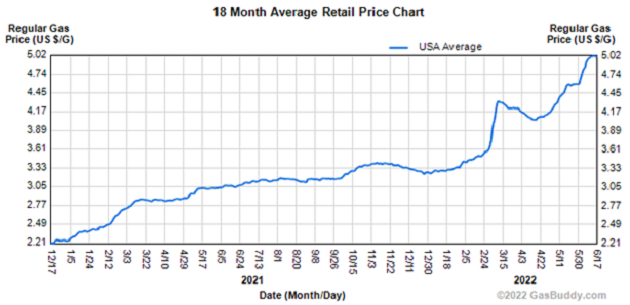

Notice the US average gasoline price had already risen about 50% in the year before Russia invaded Ukraine. So the problem isn’t just war related.

All economic activity is simply the transformation of energy from one form to another. If we want lower price inflation, energy prices must go down. There’s just no other way—and they need to drop not just a little, but a lot.

How could that happen?

Prices are the intersection of supply and demand. Raising interest rates is a way of reducing demand. It’s already happening, too, as higher mortgage rates make buying a home more expensive.

Less construction activity means fewer trucks on the roads, less fuel consumed by heavy equipment, etc. It also means lower pay—and eventually layoffs—for workers in a pretty big sector.

All that reduces energy prices, but meanwhile we also have fuel demand increasing in sectors like travel as people take COVID-delayed vacations. Hotter weather is also driving higher demand for electricity, much of which comes from natural gas and coal.

Crunch all that together and yes, Fed action can reduce fuel demand—but probably too slowly to bring energy prices down significantly this year.

Would anything else work?

A deadlier COVID variant or a new pandemic might do the trick. It would have to be scary enough to make people stay home again and avoid public places, like early 2020. That could happen even if governments don’t mandate closures. It seems unlikely, though.

Another possibility is some kind of financial crisis that induces a quick recession. We have plenty of overleveraged investors who could trigger defaults that cascade through the system. Spread broadly enough, it might greatly reduce energy demand. The cost would be enormous, though.

Asset prices—stocks, crypto, real estate, whatever—also have a “wealth effect.” People spend more freely when they feel confident, and less freely when they don’t. So even a normal bear market will affect consumer demand. But again, it will take time.

Supply-side solutions

Absent a demand crash, energy prices will stay high until supply increases. What might do it?

A peaceful end to the Ukraine war would certainly help, but only if it persuaded Western leaders to drop their sanctions on Russia. Practically speaking, I don’t see how that can happen as long as Vladimir Putin stays in power. They will still perceive a threat even if he pulls Russian forces out of Ukraine.

So, with Russian energy exports dwindling, any new supply will have to come from somewhere else.

Keep in mind, simply having oil and gas reserves isn’t enough. You also have to recover and export them. That takes infrastructure, capital, talent, and time.

With energy prices as high as they are, those who can raise production have mostly done so. The main exceptions are oil-producing countries facing international sanctions: Russia, obviously, but also Iran and Venezuela. Both could add to world supplies fairly soon, if other governments allow it.

Something may be brewing here. President Joe Biden will visit Saudi Arabia next month, and some analysts think he may finalize a deal to let Iran resume exports. It wouldn’t replace the lost Russian supply but it would help.

As for the US, producers here don’t have many more spigots to open, nor are they making the investments that would add new capacity. Why?

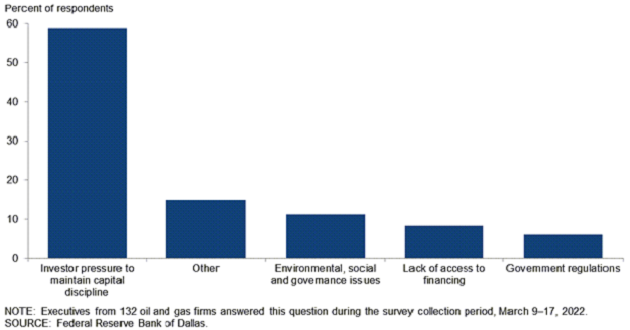

A Dallas Fed survey of energy executives last quarter asked, “Which of the following is the primary reason that publicly traded oil producers are restraining growth despite high oil prices?” Here’s how they answered.

A solid majority say the main barrier isn’t access to capital or government interference, but “investor pressure to maintain capital discipline.” That means they would rather spend their profits on dividends and share buybacks.

(An update of that survey will be out later this week. We’ll see if energy industry leaders have changed their minds. It might help bring prices down if so.)

Finally, high fuel prices are sparking more interest in renewable energy, supplies of which are growing quickly. That’s helpful, particularly for the electric grid, but doesn’t do much for gasoline, diesel, and jet fuel supplies. Solar and wind energy aren’t going to solve our near-term problems.

No magic button

Going through those possibilities, it’s hard to see any combination of lower demand or higher supply sufficient to break energy prices.

You can blame government, energy companies, environmentalists, SUV owners—whoever you think deserves it. But none of them have magic buttons they could push to bring down fuel prices. This is a complex, long-developing crisis with no easy solutions.

That being the case, energy will likely stay expensive, and inflation will remain a stubborn problem.

Maybe instead of complaining, we should try getting used to it.

*Patrick Watson is senior economic analyst at Mauldin Economics. This article is from a regular Mauldin Economics series called Connecting the Dots. It first appeared here, and is used by interest.co.nz with permission.

60 Comments

PDK coming in hot

I can see him hugging his computer right now. He's right though. Reduction of energy demand is the key way forward, but unfortunately it's also the hardest to implement/accept.

... I don't see reducing energy demand as the answer ... ramping up energy supply ought to be the goal ..

As a country NZ has incredible energy options ... we just lack the leaders with the vision & guts to go hard cracking into them ...

... Arderns decision in 2017 to halt new offshore oil & gas exploration licences was an ideological fart , a brain fade of epic proportions ...

We need to widen & deepen our energy base , to keep us immune from events offshore , be it pandemics or wars ...

GBH,

Here's some questions for you. Before the decision was made to stop further exploration, had any new oil/gas fields been found? I don't know of any, do you? If that ban were reversed, how long would it take for exploration to resume? If it did resume and a significant made, how long before it could be exploited?

There would be resource consent issues and almost certainly legal challenges. I actually agree that the decision to suspend exploration was ill advised, but we simply may not have any significant finds to exploit.

Linklater01 - You may be right there may not be any more significant finds -- but we simply wont know now -

i think the impact was less about finding new fields and viable sources -- but more about the message it sent to companies that NZ was no longer a long term prospect -- and so why invest the very significant amount of $$$ needed to maintain and upgrade the infrastructure needed to harvest the existing finds - which in turn supports further exploration.

Even if the ban is overturned by the next National led government - be it next year or in 4 years - -the damage is already done as investors will always be worried that the next Labour government will simply ban it again -- the vast amount of $$$ needed to find and then exploit finds -- mean unless you have a very long term secure operating environment you simply cant invest.

Meanwhile -- we now burn 1 million tons of imported dirty coal, and are 100% reliant on overseas shipping to bring us fuel having closed our only refinery -- incredibly short term thinking -- and very very risky to get rid of a key aspect of our self sustainability

100% reliant on overseas shipping to bring us fuel having closed our only refinery

Yeah it was so much better back in the day when we were 100% reliant on overseas shipping to bring us oil to refine into fuel.

I don't get why its hard to implement! I reckon most people in this country could easily decrease their petrol demand just by buying a bike and/or walking a bit more. It's hardly the end of the world is it? I would say 80% of people arriving at our local dairy do so by car, most of them probably live a short walk away. Why do we need a planet busting solution just so we can all be super lazy and fat?

New Zealand is a dangerous country to ride a bike with all those ute/SUV loving drivers around you.

I completely agree - implementation at a micro level is very easy, but far too many "muh freedom" people don't want to accept it. The world is hooked on a sugar rush of energy without stopping to ask if maybe there's a more efficient way of achieving their goals.

As an experiment, a few years ago we bought an early Nissan Leaf. It was down to about 80% battery health, and we'd get maybe 80km out of it in the real world before requiring a recharge. It forced us to rethink our daily travels, because we didn't want to get stranded somewhere, or have to wait an unacceptable amount of time before we could get going again. We became very good at planning each day to make sure we could get everything done on a single charge. As a bonus we won back more time in the day because we were condensing more trips into one. We became more productive.

Sadly we've had to revert to diesel since we're now kind-of-farmers, but if that Leaf had been 4WD and could tow at least 2,500kg we'd likely still be driving it. Okay, not very far by now, but you get the idea. We're even considering getting a cheap one to use for running around the flat paddocks over the dry months to cut down on diesel usage and emissions.

How many of those arriving by car are going past in the car anyway? 80% of my stops at the local diary aren't journeys that start and end at home, they are usually a case of grabbing something we need at home as I pass on my way home from further afield. About the only time I'll drive to the dairy and home again is if the weather is shitehouse and there is something I don't want to wait till the next trip out for, which is rare.

I think you will have a hard time selling that line

I'm picturing some kind of WW2 Spitfire scramble going on in PDK-HQ right now.

... I was picturing in my minds eye a wild bearded man thrashing around in his candle lit cave , spittle flying in all directions , eyes blazing with fury , smashing down hard on the keyboard with his great hairy hands ...

I was thinking more vietnam era.. sidewinder homing in on a hot afterburner.

He could star in the next Top Gun film - Maverick and PDK jetting off to demolish Marsden Point, after it has been occupied by eco-terrorists led by David Seymour looking to resurrect New Zealand's domestic oil refining capacity.

(PDK, if you're reading, I jest - I enjoy your commentary and although it is honestly a bit repetitive, you are right in the sense that increasingly expensive energy will make the cracks harder and harder to paper over).

Look at profit margins. THAT is where you'll find the savings.

A very unusual view for an economist.

What became of infinite substitution by the market?

Yeah.... that's never been a thing.

I think you have a fundamental misunderstanding of economics driven by your preconceived opinions of the field.

Julian Simon springs to mind. He published a lot of BS when he was alive claiming there was no resource limits:

The overarching thesis on why there is no resource crisis is that as a particular resource becomes more scarce, its price rises. This price rise creates an incentive for people to discover more of the resource, ration and recycle it, and eventually, develop substitutes.

An article about energy that ignores nuclear. He has it right about wind and solar.

Current wind capacity 1040MW. Current Supply 44MW. In the middle of winter. edit: Make that 3.3% of capacity as of 11.30am.

https://www.transpower.co.nz/power-system-live-data

Saudi oil demand peaks in the summer. Biden has painted himself into a corner - he can't fix anything before the mid terms. Not that he really cares about oil price.

https://nypost.com/2022/06/23/amid-record-gas-prices-biden-snubs-oil-ce…

Nuclear power is the solution to global emissions ... France has led the way since the 1970's ... you never hear from them , no accidents nor meltdowns ... why ... because they do it right , and don't shortcut or cost cut on safety ...

Nuclear power is a way of moving the problem, it will assist the emissions challenge but increase the nuclear waste problem.

France is a leader in this field but not that shiny when it comes to the whole ethics thing.

https://www.greenpeace.org/eu-unit/issues/climate-energy/45879/french-n…

Yeah, France is leading the way... at dumping it's nuclear waste where it's citizens can't see it.

Nuclear also doesn't solve the energy issues at the pump, not until we go all electric with vehicles. Which is decades away, that's addressed in the article. Nor is it an easy substitution for things like steel production, where it's carbon goes into the final product. Converting all the worlds steel mills would also be decades away.

Steel production is a funny one, the way its typically done is to throw lots of carbon into the iron, melt it, then burn off excess carbon by pumping O2 in to get the molten pig iron down to the correct carbon level (and produce a butt-ton of CO2 in the process). Seems to me there is huge room for improvement by not adding a ton more carbon than you actually need in the first place. And the source of carbon could be waste plastics that currently end up in landfill, providing there wasn't enough other crap that came along with it to mess up your steel properties.

Brazilians make negative CO2 balance pig iron and cogen electricity via purpose bred eucalyptus charcoal plantations. Anybody who believes in climate change CO2 homeopathy should buy their plantation charcoal based steel from Brazil.

You could have used Japan instead of France a few years back... All it takes is one cock-up

Nor do you hear about the US Navy.

"The United States has over 200 nuclear reactors producing power. You might be aware of the hundred or so commercial nuclear power reactors that produce just under 20% of our electricity. But there are another hundred nuclear reactors that power 86 submarines and aircraft carriers, producing electricity, heat, fresh water and propulsion.

...The Nuclear Navy has logged over 5,400 reactor years of accident-free operations and travelled over 130 million miles on nuclear energy, enough to circle the earth 3,200 times. The nuclear reactors can run for many, many years without refueling. They operate all over the world, sometimes in hostile environments, with no maintenance support except their own crew. These reactors can ramp up from zero to full power in minutes, as fast as any natural gas-fired plant.

Thousands upon thousands of people have continuously lived, worked, eaten and slept within a stone’s throw of a nuclear reactor for 60 years with no adverse effects at all. Annual radiation doses to Navy personnel have averaged only 0.005 rem/year (5 mrem/year; 0.05 mSv/year), a thousand times less than the Federal 5 rem/year allowed for radworkers."

https://www.forbes.com/sites/jamesconca/2014/10/28/americas-navy-the-un…

There's a big difference between military run reactors and those run by energy companies, for-profit. One has very strong profit motivations to overlook safety procedures, the other does not and prizes safety and reliability above all else. Until the profit motive is removed and they can be made a lot safer, nuclear powered disasters will continue. Fusion doesn't look like it's going to cut it either, until we can find a source of tritium which will reach peak supply then start declining right when it's needed the most. Pure deuterium fusion mostly ends up being energy negative.

The tech has moved on. Have a read up on pebble bed reactors and their inherent safety features. One has just been connected to the grid in China.

"...Since then, reactors have improved exponentially in terms of safety, sustainability and efficiency. Unlike the light-water reactors at Fukushima, which had liquid coolant and uranium fuel, the current generation of reactors has a variety of coolant options, including molten-salt mixtures, supercritical water and even gases like helium.

Dr. Jean Ragusa and Dr. Mauricio Eduardo Tano Retamales from the Department of Nuclear Engineering at Texas A&M University have been studying a new fourth-generation reactor, pebble-bed reactors. Pebble-bed reactors use spherical fuel elements (known as pebbles) and a fluid coolant (usually a gas).

"There are about 40,000 fuel pebbles in such a reactor," said Ragusa. "Think of the reactor as a really big bucket with 40,000 tennis balls inside."

During an accident, as the gas in the reactor core begins to heat up, the cold air from below begins to rise, a process known as natural convection cooling. Additionally, the fuel pebbles are made from pyrolytic carbon and tristructural-isotropic particles, making them resistant to temperatures as high as 3,000 degrees Fahrenheit. As a very-high-temperature reactor (VHTR), pebble-bed reactors can be cooled down by passive natural circulation, making it theoretically impossible for an accident like Fukushima to occur."

https://www.sciencedaily.com/releases/2021/05/210521131336.htm

https://www.reuters.com/markets/commodities/china-puts-pioneering-pebbl…

https://www.thechemicalengineer.com/features/energy-bringing-nuclear-ba…

Great, reactors that are "safer" which means those profit motivated companies can have even less safety measures in place. You do know that every nuclear power company in history has claimed their reactor is safe and could never have a problem due to all the safety measures they have in place? Yet here we are, 70 years into nuclear power and at least 3 major accidents.

Fission nuclear is, by nature, dangerous, because it relies on attaining sweet spot for neutron fission production. Too much and the whole shebang can runaway into a heat meltdown. Yes, even pebble bed reactors where a fault in the expulsion of spent pebbles and/or the input of new pebbles could cause runaway meltdown (jammed pebbles has actually happened too), not to mention the various other safety issues seen before (dust buildups, higher nuclear waste products).

You really should listen to the link below.

Chernobyl was run for profit?

Nuclear not a solution. Covered here:

https://www.thegreatsimplification.com/episode/19-simon-michaux

This is a fantastic piece, thanks for the link! Profile should have a listen, he will realise how wrong he is about nuclear and how right PDK is.

The people building 57 new reactors in 19 countries beg to differ.

they are fooling themselves - even if we build 25 a year we will still never get there

Have a look at France and how quickly they rolled out their nuclear fleet. Perhaps we could treat it like an emergency? I keep hear about about climate emergencies - well until covid, Ukraine and the next scare comes along.

very good discussion - everyone should listen to this to see where PDK is coming from and why people are fooling themselves

the thing ppl need to understand is why the US created this mess at the first place, then you can start to find solutions.

Is the theory since China imports 4x as much oil as the USA, this whole energy price inflation has been engineered as anti-China?

Oil prices were well North of here for over half a decade... Wayyy north inflation adjusted.

No issues.

A couple of weeks I saw an interview on Wealthion with a petroleum market analist showing graphs that the amount of diesel "on the water" (meaning being transported from regio's of a surplus refining capacity to area's which have a shortfall like Europe and the US) currently has never been that low as ever before in history. This clearly indicates more pain is coming especially for those jurisdictions who have no refining capacity at all.

The comments from the oil executives sums it up for us all: capitalism is orchistrating its own downfall!

Yes, it is. And the amazing thing is Marx's critique gets more and more relevant by the day.;

Lol, funny the government options are

1) Central banks fix their own QE mistakes by raising interest rates (pop their own bubble)

2) Use fear to dampen demand

Of course energy prices will naturally come back down if demand dries up because the economy is shrinking, disposable income is shrinking right now...

They could of course just reduce taxes on fuel which make up nearly 50% of the price and go into the general coffers in NZ?!! Crude Oil hit US$145 barrel 14 years ago and price at the pump was $2.20, its now $3.10, how much of that is just a tax take?

I see diesel is now nearly the same price as 91, um... what? this will of course hit transport costs as well....

The petrol tax money then goes to covering the costs of maintaining state highways and half the cost of local roads (the balance being funded through council rates).

Waka Kotahi NZTA have already indicated that there is not enough tax revenue through petrol tax to continue funding the car centric transport system, that's why some of the new big roading projects are being funded from general taxation.

No good having cheap gas if all the roads are crumbling to shit.

So if we want gold plated roads (and yes, by international standards they are gold plated) you either suck up higher petrol taxes or general taxes or much much higher local council rates or cut funding from things like education and healthcare.

So if we want gold plated roads (and yes, by international standards they are gold plated)

The goat track we call SH1 is gold plated? Or SH54, or any number of other single carriageway main highways?

Yes, for the population density we have our roads are gold-plated.

Then the same must be said for our rail network and cycle-lanes surely...

And of course in NZ we get:around $1.00 of tax for every litre of fuel ~30%

Tax on a tax (GST on Fuel Excise Tax) +15%

Emissions Trading Scheme (whatever that is) $0.20c./ litre

And Aucklanders get their own tax (Regional Fuel Tax) $0.10c litre

https://www.mbie.govt.nz/building-and-energy/energy-and-natural-resourc…

Surprisingly, people are still thinking once the supply side issues fixed, inflation will be gone. It's more complicated than that in my opinion. Energy price has hiked so much through last year, but I don't see much reduction in demand. In the weekend, you still can see lots of large SUVs UTEs on road. Hence high gas price seems not to effect how they drive and what cars they drive. There is definitely quite a lot of inflation is caused high demand. Even when the war is over, I don't think inflation will come down that quickly. At the moment, what we need to do is to get inflation expectations under control.

Effective Russian energy sanctions likely won't last more than 5 to 10 years. Russia will build the infrastructure to move energy east to China and it's eastern seaports which will substantially offset those sanctions. The best bet for a rapid end to the Russo-Ukranian war is Ukrainian victory.

The job openings data is simply staggering, there is no one left to hire. The situation is desperate and companies are speeding up their recruiting processes to try to stop good candidates being poached before they even get a chance to interview them. The problem is demographics guarantee this is a long term and not secular trend.

America is going to wake up one day very soon and realise they should have never got involved in the Ukrainian conflict. Ukraine cannot beat Russia end of story. The USA is just shooting itself in the foot.

I disagree.

The idea that monetary policy can do the heavy lifting to bring down (or even stabilise) energy prices is dying a fast death now - at least amongst people that look at the real world instead of their 1982 econ 101 textbook.

I think it is worth stressing a couple of things here though...

Central banks trying to kill demand to lower oil prices will make it less likely that oil companies and funders will invest in the expanded and alternate capacity that is needed to reduce prices in the next 6 - 24 months. Why would you invest in increasing capacity / supply if this will reduce your profits and returns? This is particularly the case for higher production cost oil fields (e.g. US shale) who know that OPEC could wipe them out at any stage by increasing supply and pushing oil prices down below $70 for 6 months. The $100+ price works for everyone - a happy equilibrium where everyone makes a tonne of money.

Fossil fuels are an increasingly risky investment, and we are probably entering the phase where oil companies, OPEC countries etc are working out how to squeeze maximum profits out of the next 20 years or so. The current environment where the 'market' does not conjure up extra capacity in response to higher prices is here to stay. Once we accept that this is our new reality, the solutions become more obvious. We need a planned and managed transition from fossil fuels to more renewable energy sources - and that means accepting some short-term pain, some serious Govt involvement and investment, and some short-term compromises in our living standards so that our grandkids have better lives.

The cure for inflation caused by high fuel prices is high fuel prices. Here comes recession and demand destruction. The big problem from here is that we won't be able to build demand back up to the same level again as the energy to do this won't exist. Expect standards of living to start to slowly deteriorate.

They don't need to deteriorate, just change. Many aspects of the low energy lifestyle are actually pretty good. The trick is to cut the stuff that is no good now so we can save the energy we do have for things that really add value. Yeah, yeah, I know value is subjective but the reality is that many things add little real value and are more about status signifiers. Things like SUVs are completely pointless really, you can have much smaller vehicles do the same thing an SUV does more efficiently. SUVs are about status and keeping up with the Joneses. This is the sort of stuff that will get dumped and I think it's going to be great.

I am with you on transitioning to a better lower-energy lifestyle - I have already done this. However, you are overestimating people's ability to make change. Change will be forced upon them and it will be messy. Organised retreat is only for the prepared.

People adapt, faster than we give credit. We will begin to see a visible cumulative effect from adjustments like work from home, transition to higher productivity and wage jobs, increased solar and wind generation, electric vehicles, cycling, simpler lifestyles etc etc. This is all going on now, affecting everyone I know, and high energy cost and inflation accelerate it.Aggressive interest rate increases would slow this healthy adaption, as it requires investment.

"Aggressive interest rate increases would slow this healthy adaption, as it requires investment"

Maybe, or maybe it will catalyse more efficient innovation. Seville created a while cycling network in 2 years off the back of the GFC and people now having money to pay for petrol.

https://medium.com/vision-zero-cities-journal/how-seville-became-a-city….

Once we see $5+ a litre at the pumps people might actually start making lifestyle changes. They might consider public transport (we may also see public transport improve with demand) if they can save a few hundred a month in transport costs. We will eventually have to give up convenience, but if we get it right the alternatives won't be so bad once the shift is needed.

That being the case, energy will likely stay expensive, and inflation will remain a stubborn problem.

Maybe instead of complaining, we should try getting used to it.

We should have known that the decline in central bankers' chatter of the topic of inflation was not a good sign. All the virtue signalling distracted people from the inflationary policies adopted since March 2020. Link

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.