Transport Minister Michael Wood is suggesting temporary fuel tax cuts won't necessarily be removed gradually, as the Government indicated they would, when it unveiled the discount last month.

Speaking to journalists on Tuesday, Wood said the Government is still figuring out what it will do once the three-month discount period ends.

However he noted officials warned it would be difficult to gradually remove the discount, aimed at alleviating cost pressures associated with rising inflation.

Asked whether this comment suggested the Government might not in fact remove the discount gradually, Wood said, "I'm just noting what the advice is - that that's potentially more challenging. We really haven't gotten to the point of having detailed discussions about that.

"At this point in time, the policy is that the reduction is in place for three months and ends at the end of that period."

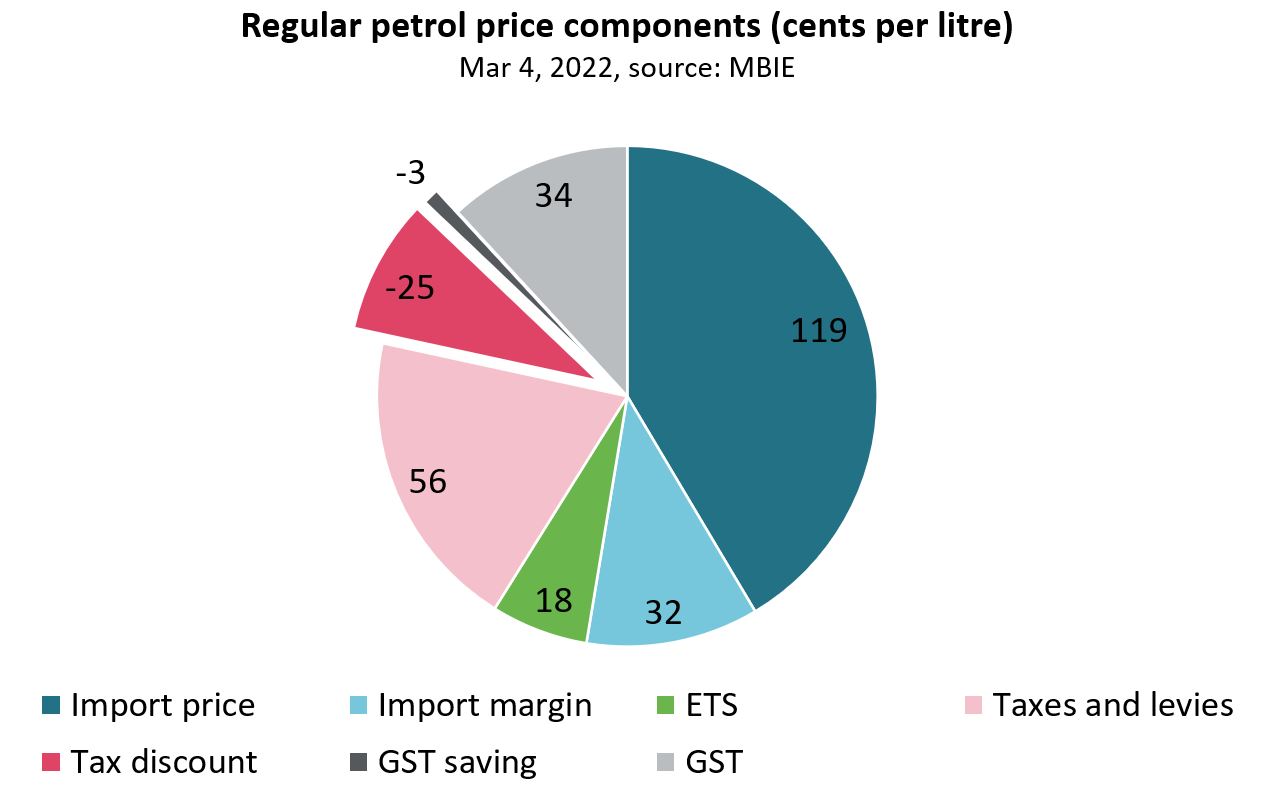

The Government on March 14 announced that as of March 15, it would cut the petrol excise duty by 25 cents per litre for three months.

It also said it would pass legislation to cut road user charges by an equivalent amount. Accordingly, as of April 21, a 36% reduction across all rates will be applied for three months.

The Government kept the door open to extending the discounts, expected to cost the Crown $350 million.

Asked whether motorists should temper their expectations around the longevity of the discount, Wood said, "What I would say to people is that we've been really clear this is a three-month policy at this point to provide relief as people are feeling the pinch, and people should set their expectations around that policy. But as we go forward, we continue to review the situation."

Wood couldn't say what sort of level fuel prices would need to be at for the Government to consider it necessary to continue to provide a tax cut.

"There's not a magic number," he said.

AA motoring policy principal advisor, Terry Collins, didn't have a sense of what the Government would do come June/July when the three-month discounts end.

"The only thing I'm sure of is that it will be a political decision," he said.

Collins noted gradually removing the petrol excise duty discount would be easier than doing the same for road user charges, as the latter requires legislative change.

But he said sanctions against Russia will only continue to put upward pressure on fuel prices.

Furthermore, he said international fuel inventories, which are being released by countries including New Zealand to try to suppress prices, are low. In fact, he said New Zealand only has 20 days' worth of petrol reserves in-country. Consultation is underway to up this minimum amount to 24 days.

Looking further down the track, Collins said fuel users' contributions towards the Emissions Trading Scheme will also need to rise.

Hence he saw the culmination of war and the need for the world to respond to climate change as creating "highly inflationary pressures".

"I'd just about guarantee my house fuel prices won't go down substantially," he said.

Oil and Petrol

Select chart tabs

Example of how the tax cut affects the petrol price

23 Comments

"There's not a magic number," he said.

Translation: "We haven't got a bloody clue ...."

Or that:

"We really haven't gotten to the point of having detailed discussions about that."

Yes there is. It starts with 3 (or rather, $2.76 + 25c). Marketing 101

the Government is still figuring out what it will do once the three-month discount period ends.

Yet another thoroughly thought through government decision, then. When will they learn to think things through properly, before acting?

Lol no words...

The lack of foresight is astonishing!

"We're behind in the polls for the first time in 4 years, let's give people a discount on fuel for 3 months, that'll make them like us! Awesome idea! Let's do this!"

"What happens after 3 months?… err……………….. hmmm……….. well……. don't know really, …but if we remove the discount, we won't be popular anymore………………………... bugger……….."

Path of least regrets, go fast and early, transitory yada yada yada

If you've been paying any attention whatsoever it's not astonishing at all.

oil is below $100 --- the discount is not being applied in reality -- the margins at every stage have just increased -- should be back under $2.50 a Litre -- 27% margin FFS not to mention well over $ 1 in taxes after teh discount

more virtue signalling -- -more failure to look after the vast majority of Kiwi's

ahhh, but here's the kicker....oil price has gone down, but refined price has increased. Turns out that Russia refined a lot of oil and recently in western nations alot of refineraries (including very recently our only one) have been shut down in the so called fight against Climate change.

So don't expect prices to do anything but go up.

Middle-Distillates Driving Refinery Margin Strength | ZeroHedge

Watching price daily we use Z share tank to hedge price and make most of pullback just like the covid bargain loaded up and happy for next 12 months.

lucky we have so much refinery capacity ...... oh wait !

NZ Oil refinery shutting down has zero to do with fighting climate chagne, and will have zero impact on fighting climate change. It was purely a commercial decision by the owners that it would be more profitable for them to import refined petrol than to import crude and refine it here.

GST will be next to be chopped from fresh fruit and vegetables and maybe meat and dairy.

In my view government will use it to boost votes in leadup to next election if National is a threat in the polls.

Unlikely. They know that would be a massive pain for businesses and IRD to account for.

GST should just be dropped to 10%. Give those that spend the highest proportion of their income (ie low income households) a tax break for once.

I've said it before, I'll say it again. They need to stop charging GST on top of excise tax, which is tax on tax. If they did that at the same time as the 3 month period ending then that solves their political problem

That would be pretty difficult to calculate for tax claims wouldn’t it? Accountants would have to know how much excise was at the time of purchase and subtract that from the amount paid to calculate how much gst was paid. And then to avoid tax on tax they would need to do that on alcohol, rates, cigarettes, etc. then also the governments income would drop so they would just need to make up for it somewhere else, probably higher excise tax!

Not that complicated really, individual tax lines can be printed on receipts at the time of purchase (like what happens in other countries). I'm sure accountants can workout an efficient way to process (noting individuals don't get the same GST exemptions as businesses do). Yes to doing the same for rates, ciggies and alcohol as well, same principle applies. If Govt wants to increase other taxes to make up for lost revenue, that's fine, they can do so in an honest way. But tax on tax is wrong in principle and a hidden tax

This govt will find that when you reduce peoples tax (or increase benefits), to take them away is a really really difficult thing politically!!!!

And unintended consequences abound. eg If I knew that the tax cut would not be extended, I would go for a really long drive just before the tax reintroduction. Does the govt want me to do that? Nope! But I'll do it!

Can you imagine the queues at the gas station the day before it gets taken away?

Smarter people might just sit on the sofa and top up their Z share tank the day before the discount is reversed.

why is it hard to phase the reintroduction of the 25c tax, given that just about every government of the last decade or two has gradually phased in their fuel tax raises?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.